Click the blue text to follow us

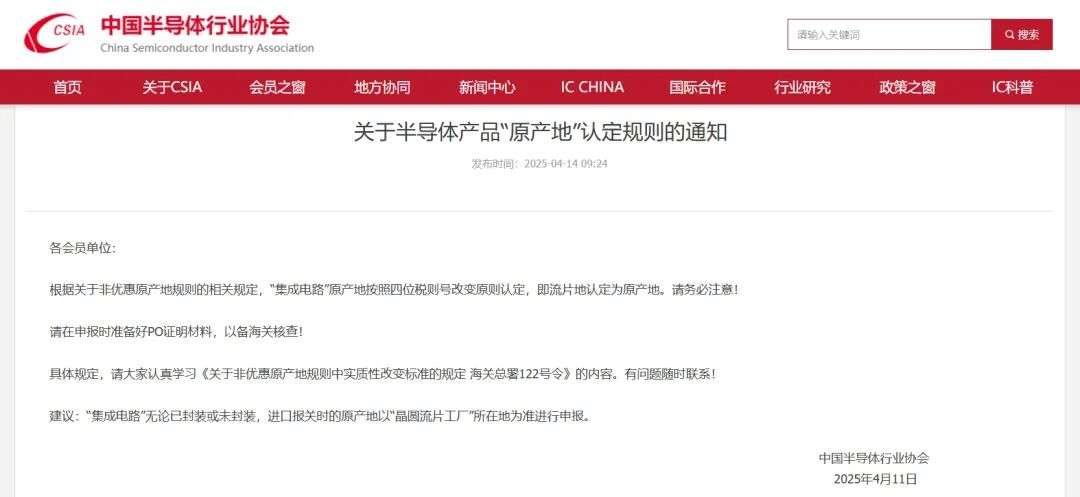

On April 11, the China Semiconductor Industry Association issued an “Emergency Notice on the Identification Rules for the ‘Origin’ of Semiconductor Products,” clearly defining the origin of integrated circuits as the “wafer fabrication location”. This policy adjustment is seen as a key measure for China to strengthen the autonomy and controllability of its industrial chain amid the backdrop of Sino-US trade friction.

The new regulations, through the principle of changing four tariff codes (i.e., recognizing the wafer fabrication location as the origin), directly impact the export costs of US IDM (Integrated Device Manufacturer) companies and manufacturers relying on US wafer foundries to China, thereby reshaping the global semiconductor supply chain landscape.

As Sino-US trade friction continues to escalate, the US will increase the semiconductor tariff rate on China to 125% starting from April 2025, while China will simultaneously raise tariffs on US imports to 125%. The new regulations aim to strictly define the origin to prevent US companies from circumventing tariffs through third-party foundries, thereby strengthening China’s control over key links in the supply chain. For example, if the chip fabrication is completed in the US, even if subsequent packaging and testing are conducted in a third country, it will still be subject to high tariffs as per US origin.

As the world’s largest integrated circuit consumer market, accounting for over 50% of global demand, China has long relied on imported chips, with a self-sufficiency rate of only 16% for analog chips in 2024.The new regulations will increase import costs, forcing downstream manufacturers to turn to domestic supply chains and accelerate the realization of “self-controllability”.

Wafer fabrication location is the origin,

Which companies will be directly affected?

1. Impact on US IDM companies: Cost surges and market share losses

US IDM companies such as Texas Instruments (TI), Intel, Analog Devices (ADI), and Micron primarily manufacture wafers in the US. For instance, Texas Instruments has its 12-inch wafer fabs located in Texas and Utah, and the analog chips exported to China will face a 125% tariff, significantly reducing their price competitiveness.

US RF manufacturers Qorvo, Skyworks, and Broadcom, which produce high-value non-silicon process chips (such as BAW filters) in the US, also face the risk of market share shrinkage due to increased tariff costs.

2. Companies relying on US wafer foundries: Order losses and additional tariff burdens

The domestic capacity of US wafer foundry GlobalFoundries (GF) is mainly used for producing automotive and industrial-grade chips, and its customers will have to bear additional tariffs if they export products to China. This will lead to orders shifting to Asian foundries (such as TSMC, UMC) or local Chinese foundries like SMIC and Hua Hong Semiconductor.

3. Forcing Chinese “customers” to choose domestic product substitutes

In the analog chip sector, order customers will have to opt for domestic products as substitutes. For example, domestic companies like Sanan Optoelectronics and Sireen are expected to accelerate the replacement of TI and ADI products in the industrial and automotive electronics markets.

In terms of wafer foundry and equipment localization, SMIC and Hua Hong Semiconductor will benefit from the return of orders, while domestic equipment manufacturers like North Huachuang and Zhongwei will also accelerate their localization processes.

Wafer fabrication location is the origin,

What direct impacts will it have on the industry?

International manufacturers may accelerate their “Local for Local” strategy to avoid tariffs. For example, although TI has a packaging plant in Chengdu, China, its wafer fabrication still relies on US factories, making it difficult to transfer capacity in the short term. In the long run, the demand for building domestic wafer fabs in China will significantly increase.

The rising import costs of US semiconductor equipment (such as Applied Materials and KLA) and materials (like DuPont) will drive domestic wafer fabs to prioritize the procurement of domestic equipment and materials. For instance, there is significant potential for domestic substitution in niche areas such as measurement equipment and photoresists.

The new regulations may trigger further countermeasures from the US, such as expanding export restrictions on semiconductor equipment to China. On the other hand, the EU recently announced it might lift tariffs on Chinese electric vehicles, indicating China’s strategy to seek balance amid multiple negotiations.

In conclusion,

The introduction of the new origin regulations for China’s integrated circuits is both a defensive measure against US tariff pressures and a proactive strategy to promote the autonomy of the industrial chain.In the short term, US IDM companies will face market share losses and cost pressures, while domestic manufacturers will welcome a window for substitution; in the long term, the global semiconductor supply chain will accelerate its restructuring, with localized production and technological innovation becoming core competitive factors.

Images and content are sourced from public materials; for inquiries, please contact the assistant.

Add the WeChat of the operations partner to join the group and discuss cutting-edge innovative technologies together.

Spring Equinox

The rains

Recommended Reading

ADATA enters the enterprise storage market, collaborating with Korean controller manufacturer FADU to launch the first batch of SSD products at COMPUTEX 2025

Performance exceeds the world’s fastest supercomputer by 24 times! Google launches the seventh-generation TPU Ironwood AI chip, reshaping the new landscape of AI inference

Official WeChat account ceases updates, labor arbitration for rights protection, restrictions on corporate consumption… How does Core Chip Technology’s transition from a “quasi-unicorn” to a broken capital chain warn domestic chip companies?

Ranking third globally! Affected by capital expenditures, SMIC’s net profit in 2024 is 3.699 billion yuan, a year-on-year decrease of 23.3%

See how DeepSeek uses innovative technology to break through NVIDIA chip restrictions? MoE, DeepSeek MLA, FP8, PTX…