On June 2, according to EEnews Europe, the latest financial documents disclosed by the UK semiconductor IP giant Arm reveal a product brand restructuring strategy, planning to provide self-designed chips to customers, while also mentioning its reliance on the Chinese market and the competitive risks posed by RISC-V. Previously, the company achieved a milestone of over $1 billion in revenue for the first quarter (the fourth fiscal quarter of the 2025 fiscal year ending March 31, 2025), with total revenue for the 2025 fiscal year expected to exceed $4 billion.

Abandoning the Cortex Brand, Launching Five New Brands

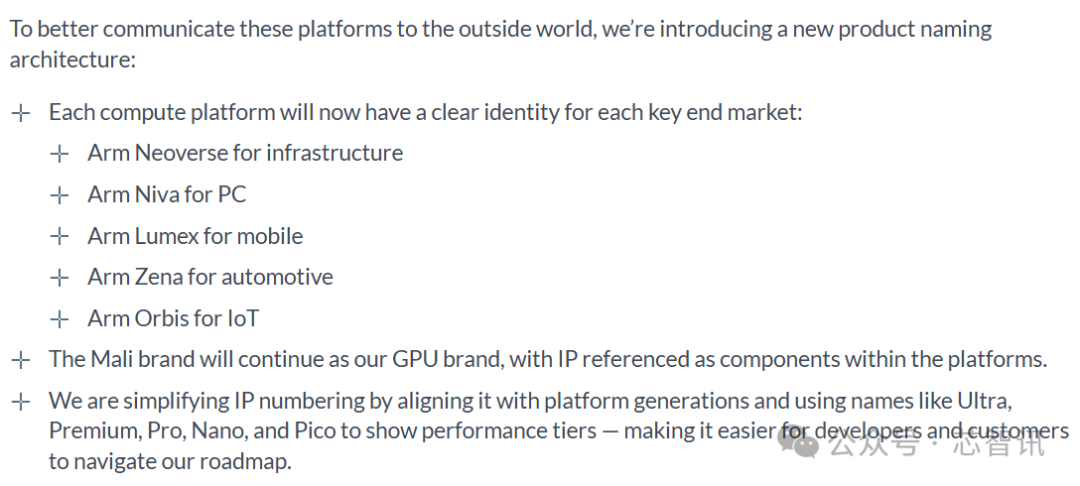

Arm has decided to abandon the Cortex brand, which has been in use for nearly 20 years, and adopt a new product naming system, introducing five major brands: Neoverse for the infrastructure market, Niva for the PC market, Lumex for the mobile market, Zena for the automotive market, and Orbis for the IoT market, all of which incorporate the Arm Computing Subsystem (CSS). Mali will continue as the GPU brand, with this series of IP referenced as components within the platform.

Arm will also use names like Ultra, Premium, Pro, Nano, and Pico to indicate performance levels (for example, the successor to Cortex-X925 may be called Lumex Ultra 1), which is said to make it easier for developers and customers to understand its roadmap, meaning that Cortex and Corstone will no longer be used for future cores and computing subsystems (CSS).

△This news was also disclosed in an official press release from Arm in mid-May this year.

“This platform-first approach reflects a rapid transition to the Arm computing platform at the system level, not just core IP. It enables our partners to integrate our technology faster, more confidently, and more systematically, especially as they scale to meet AI demands,” said Arm CEO Rene Haas.

However, Arm also acknowledges that these new brands may not generate the expected benefits, as the initially renamed brands will not have the brand recognition of the previous names, which may lead to buyer confusion.

Arm also stated that it has checked that the brand restructuring does not infringe on others’ intellectual property rights, but it may inadvertently infringe on others’ intellectual property rights, and the company may not obtain sufficient intellectual property protection (for example, some brand trademarks may have already been registered by other companies in certain countries and regions).

Future Plans to Provide Chips to Customers

As previously rumored, Arm seems to be planning to change its business model and enter the chip design market, providing chips designed by Arm itself to its major customers.

In December 2024, during the court hearing regarding the technology licensing issue between Arm and Qualcomm, Qualcomm accused Arm of providing Arm Computing Subsystem (CSS) for client and data center processors and other use cases, raising suspicions of competing with customers. At the same time, Qualcomm’s legal team presented a document prepared by Arm CEO René Haas for the Arm board, indicating that Arm is also considering designing its own chips to be directly provided to customers, which would make it a major competitor to its customers, including Qualcomm.

René Haas refuted these claims at the time, stating that while Arm is exploring various business opportunities, it does not manufacture chips and has never been involved in this industry.

In December 2024, Qualcomm also modified its counterclaims against Arm, adding more allegations regarding Arm’s violation of licensing agreements and accusing Arm of intentionally producing competitive chips, thereby “distorting” the relationship between the two parties.

Qualcomm claimed in court documents that Arm “attempted to recruit executives from its customers as early as November 2024,” and recruiters specifically told one of the executives that the new position would help Arm “transition from merely designing processor architectures (IP) to selling its own chips.”

In February of this year, the Financial Times reported that Arm is developing its own chips, with the first self-designed chip expected to be launched as early as this summer, to be manufactured by TSMC, and Meta may become one of the first customers.

EEnews Europe reported that Arm has also acknowledged for the first time that it is planning to provide self-designed chips to customers, but this move may compete with some of its existing major customers. Data shows that currently about 56% of Arm’s revenue comes from its top five customers.

“In the future, we may provide chip consulting or design for certain existing customers and other third parties (including subsidiaries of SoftBank Group) for various use cases and end markets,” Arm stated. “Like any company entering a new market or offering new products or solutions, we will compete with companies that have more mature businesses, long-term customer relationships, and established brand recognition. Since our resources must be allocated to developing and maintaining our existing IP portfolio, as well as developing and commercializing any new, more integrated computing products or solutions, companies that focus their efforts on a single product or solution or a limited number of products or solutions may have more financial, technical, manufacturing, marketing, sales, and distribution resources dedicated to such markets and solutions than we do.”

Based on this, Rene Haas pointed out: “Customers or partners may terminate or significantly reduce their relationships with us and seek alternative architectures or products from competitors. Therefore, within the scope of our efforts to enter any new market or offer any new products or solutions, we may not achieve the expected amounts, timelines, or the anticipated financial benefits of such changes.”

It is worth noting that Arm’s parent company, SoftBank Group, also announced in March this year that it would acquire Arm server chip design firm Ampere for $6.5 billion. Whether SoftBank Group will integrate Arm’s self-designed chip business with Ampere remains to be seen.

Risks in the Chinese Market

In recent years, as the US-China trade war has escalated, US export control policies have restricted Arm’s export of certain IPs to China. For example, the Neoverse V series high-performance cores used for AI data center chips and some small chip IPs. Earlier this month, the UK government updated its export controls to align with the US export controls on high-performance computing cores. This will directly impact Arm’s revenue in the Chinese market.

(Note: In September 2020, Arm divided its infrastructure-oriented Neoverse series CPU core designs into three series: the V series high-performance cores (with double vector engines), the N series cores (focusing on integer performance), and the E series cores (entry-level, focusing on energy efficiency and edge chips). Currently, Arm has authorized the E series and N series to domestic manufacturers, but the highest performance V series has not been authorized to Chinese customers due to export control issues. Currently, the Neoverse V3 core (now Zena) is also becoming increasingly popular in autonomous driving.)

Nevertheless, Arm China remains Arm’s largest customer, contributing about 17% of Arm’s revenue (this percentage was as high as 24% in the 2023 fiscal year, when the total revenue contribution from the Chinese market was 25%) and nearly half of the royalties.

“In the fiscal year ending March 31, 2025, patent royalty revenue from mobile application processors accounted for approximately 46% of our patent licensing revenue. A significant portion of this revenue comes from the Chinese market, making us particularly vulnerable to the economic and political risks in China, such as the potential escalation of tensions between the US or UK and China regarding trade and national security.”

The report also pointed out that due to the uncertain impact of trade and national security policies, as well as the high debt levels of private and state-owned enterprises, the near-term growth prospects for the Chinese semiconductor industry remain unclear.

Currently, a few years ago, to facilitate Arm’s smooth listing, Arm’s parent company SoftBank Group has transferred its equity in Arm China to a subsidiary specifically established for this purpose, Acetone, so Arm China is now a joint venture under SoftBank Group, rather than a joint subsidiary of Arm. Arm CEO Rene Haas is the designated head of Acetone.

Competitive Risks Posed by RISC-V

Arm also specifically emphasized the competitive risks posed by the European chip joint venture Quintauris GmbH, established by several major chip manufacturers based on the open-source RISC-V instruction set architecture.

In August 2023, the world’s five major semiconductor manufacturers Qualcomm, NXP, Bosch, Infineon, and Nordic announced the establishment of a company aimed at promoting the global application of RISC-V by supporting the development of next-generation hardware. Subsequently, Quintauris was officially established in December 2023. In September 2024, European chip giant STMicroelectronics NV also officially announced its joining of Quintauris, becoming its sixth major shareholder.

Quintauris will serve as a single source to support RISC-V compatible products (avoiding fragmentation), provide reference architectures, and help establish industry-wide solutions. Although the company’s initial application focus will be on the automotive sector, it will eventually expand to mobile and IoT fields. This undoubtedly poses a strong competitive threat to Arm.

“Our current and potential competitors may also be subject to more favorable regulatory regimes or establish partnerships,” Arm stated. “For example, in August 2023, a group of our customers and other competitors announced the establishment of a joint venture aimed at accelerating the adoption of RISC-V. If our competitors establish partnerships or integrate with each other or with third parties, such as the aforementioned joint venture focused on RISC-V, they may have additional resources that enable them to develop architectures and other technologies that directly compete with our products more quickly.”

It is worth mentioning that Qualcomm is also one of the main initiators and shareholders of Quintauris. Last year, Qualcomm launched its self-developed Oryon CPU core based on Arm instruction set licensing and applied it to its PC-targeted Snapdragon X series processors, mobile Snapdragon 8 Gen 2 processors, and automotive Snapdragon Cockpit Elite and Snapdragon Ride Elite platforms. This also means that Qualcomm’s future demand for new IP core licensing from Arm will decrease.

To prevent Qualcomm from breaking away from control, Arm also sued Qualcomm last year, claiming that Qualcomm’s acquisition of architecture license agreements (ALA) from the acquired Nuvia company was a breach of contract and needed to be re-licensed. However, in December last year, a US court ruled that Qualcomm did not violate its licensing agreement with Arm. Subsequently, in February of this year, Arm withdrew its breach of contract allegations against Qualcomm.

Qualcomm also filed a counterclaim against Arm in December last year, accusing Arm of “refusing to provide licenses for off-the-shelf cores at commercially reasonable prices,” failing to fulfill obligations stipulated in the separate technology licensing agreement (TLA) between the two companies, claiming this violated the negotiated licensing terms between the two companies.

Qualcomm cited that it submitted a request to renew the off-the-shelf core licenses for Cortex-A720 and Cortex-A520 in April 2024, but despite repeated follow-ups in the following months, Arm still refused to license these two cores.

According to Bloomberg, in March of this year, Qualcomm also initiated an antitrust lawsuit against Arm globally, accusing Arm of harming competition by restricting access to its technology after operating an open network for over 20 years.

In response, Arm stated, “Any allegations of anti-competitive behavior are merely Qualcomm’s attempts to distort the truth and escalate the ongoing commercial dispute between the two parties to seek its own competitive advantage.”

Editor: Chip Intelligence – Wandering Sword

Previous Exciting ArticlesWolfspeed Plans to File for Bankruptcy, Renesas Dissolves Silicon Carbide Team!Synopsys CEO Sends Internal Letter: New US Regulations Will Affect All Customers in China!Zhongwei Company’s Yin Zhiyao: Will Continue to Focus on High-End, Fill Weak Links, Not Afraid of Competitor Competition!The US Has Requested to Cut Off EDA Supply to China? Synopsys and Cadence Stocks PlummetTest Results Released: Qualcomm’s 5G Modem Performance Outperforms Apple’s C1The US Requests Three Major EDA Companies to Cut Off Supply to China? No Notification Received in ChinaOver 800 Million Losses in Three Years! Silicon Carbide IDM Giant Basic Semiconductor Files for Hong Kong Stock ExchangeBenchmarking RTX4060! Lishan Technology’s 6nm High-Performance GPU Successfully Lights Up: Has Secured 100 Million Yuan Pre-Orders!Not Customized for Arm CSS! What Exactly Did Xiaomi’s Xuanjie O1 Self-Develop?Huawei and MediaTek Patent Litigation Jurisdiction Dispute, Supreme Court Makes Final Decision!Xiaomi’s 13.5 Billion Burned “Xuanjie” Dual Chip, Is It Hard Enough?Jensen Huang Criticizes US AI Chip Restriction Policies, NVIDIA’s Market Share in China Has Dropped to 50%!Wolfspeed to File for Bankruptcy, Stock Price Plummets Over 70%!The US Globally Bans Chinese AI Chips! China Responds: Enforcers Will Violate the “Anti-Foreign Sanctions Law”Malaysia’s Sovereign AI Project Launched: Chinese AI Chips + DeepSeek as Core Support!

For industry communication and cooperation, please add WeChat: icsmart01

Chip Intelligence Official Communication Group: 221807116