This year, the hottest AI hardware is undoubtedly humanoid robots, but the Beijing Marathon humanoid robot competition has made it clear that large-scale commercialization of humanoid robots is unlikely in the short term. In contrast, a niche sector is set to experience a massive explosion this year, following the large-scale production of leading companies in 2024, which is the lawn mower robot industry, a category rarely seen in China.In February, ZhiMi Technology announced that its smart lawn mowers had exceeded cumulative shipments of 100,000 units;On April 12, Ninebot released its 2024 annual report, revealing that its lawn mower business achieved annual revenue of over 860 million yuan, a year-on-year increase of 284%, with expected sales surpassing 100,000 units;On April 26, Ecovacs released its 2024 annual report, showing that its lawn mower robot’s overseas revenue and sales increased by 186.7% and 271.7% year-on-year, respectively, demonstrating strong growth momentum.Leading companies have all achieved significant growth, and this article will delve into the lawn mower robot sector to help readers understand the current state of this niche category. The content of this article covers: basic knowledge of lawn mower robots, demand analysis, market prospects, industry chain, and analysis of representative companies.1. Basic KnowledgeWhen discussing lawn mower robots, we must first mention OPE tools(Outdoor Power Equipment), which are tools primarily used in outdoor applications, mainly for maintaining lawns, gardens, or yards. OPE products can be categorized based on their working methods into handheld, walk-behind, riding, and smart types. Among these, the smart type mainly refers to lawn mower robots.

| By Working Method | Main Products | Product Example Images |

| Handheld | Lawn Mower |  |

| Blower/Sucker |  |

|

| Chainsaw |  |

|

| Pruner |  |

|

| Walk-behind | Lawn Mower |  |

| Snow Blower |  |

|

| Riding | Lawn Mower |  |

| Smart | Lawn Mower Robot |  |

The development of lawn mower robots has gone through three stages, and we have now entered the era of smart lawn mower robots, with the level of intelligence continuously upgrading and evolving.

| Stage | Illustration | Characteristics | |

| 1.0 Era | Push Lawn Mower Robot |  |

Primarily powered by fuel, requires manual involvement |

| 1.5 Era | Wired Lawn Mower Robot |  |

Requires pre-buried wires, manual involvement needed |

| 2.0 Era | Smart Lawn Mower Robot |  |

Can autonomously plan routes, does not require pre-buried wires, achieves positioning through RTK or vision, and uses AI + vision for obstacle avoidance. No manual involvement is needed, freeing up human labor. |

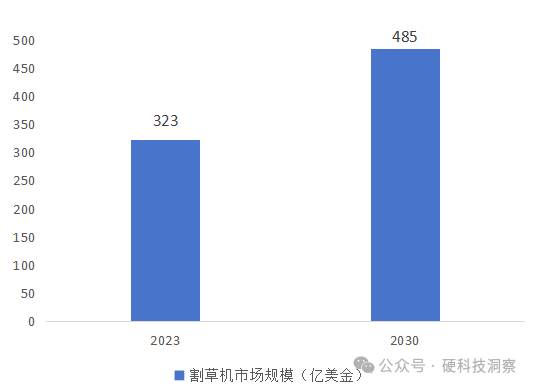

2. Demand AnalysisThere are approximately 250 million private gardens worldwide, with about 100 million in the United States and 80 million in Europe. In Europe and the U.S., failing to mow lawns can result in fines, and people often host parties on their lawns, making lawn care a necessity. For example, in Germany, lawns need to be mowed every 1-2 weeks, taking 1-2 hours each time.The current situation is that about 70%-80% of households choose to maintain their lawns themselves, while 20%-30% hire someone to do it.① Hiring Maintenance: Taking Germany as an example, hiring someone to mow the lawn costs about 100 euros per hour, resulting in a total expense of 100-200 euros every one to two weeks, which amounts to 2000-3000 euros per year. Currently, smart lawn mowers generally sell for between 1000-2000 euros, with some popular products even priced at 699 euros, making them a very cost-effective option. ② Self-Maintenance: A typical push lawn mower costs around 500 dollars and lasts about 5 years; it is generally a fuel-powered mower, requiring additional fuel costs. Currently, entry-level wired lawn mowers have dropped to 400-500 dollars, comparable to push lawn mowers. Additionally, smart lawn mowers have reached a minimum price of 699 euros, and with the advantages of freeing up human labor and being energy-efficient, they will gradually penetrate the self-maintenance market, replacing traditional push lawn mowers.3. Market SizeAccording to Grand View Research, the global lawn mower market size in 2023 is 32.31 billion dollars, corresponding to sales of about 25-30 million units. It is expected to reach 48.5 billion dollars by 2030, with a compound annual growth rate of 6%.

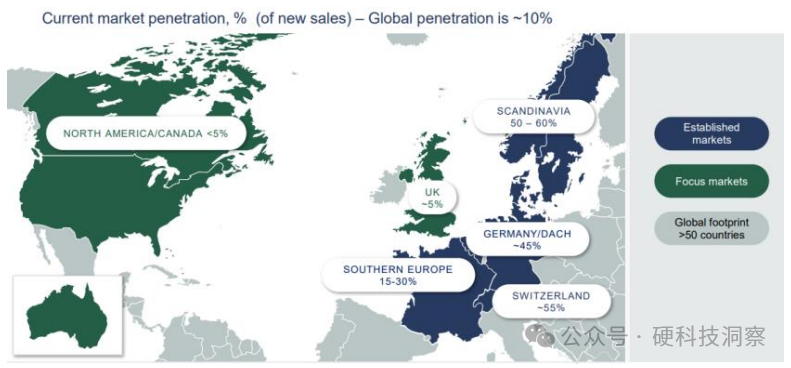

② Self-Maintenance: A typical push lawn mower costs around 500 dollars and lasts about 5 years; it is generally a fuel-powered mower, requiring additional fuel costs. Currently, entry-level wired lawn mowers have dropped to 400-500 dollars, comparable to push lawn mowers. Additionally, smart lawn mowers have reached a minimum price of 699 euros, and with the advantages of freeing up human labor and being energy-efficient, they will gradually penetrate the self-maintenance market, replacing traditional push lawn mowers.3. Market SizeAccording to Grand View Research, the global lawn mower market size in 2023 is 32.31 billion dollars, corresponding to sales of about 25-30 million units. It is expected to reach 48.5 billion dollars by 2030, with a compound annual growth rate of 6%. Market research predicts that by 2025, sales of lawn mower robots will exceed 1 million units (with a penetration rate of less than 5%), and with a unit price of 1500-2000 dollars, the lawn mower robot market size will be about 1.5-2 billion dollars. Ninebot also predicts in its annual report that the market size for lawn mower robots will exceed 15.9 billion dollars by 2030, indicating significant growth potential for lawn mower robots in the future.Currently, the lawn mower robot market is primarily in Europe, while North America is still in its infancy. The penetration rate in Europe is over 15%, while in North America, it is less than 5%, still at the starting stage. This is because European lawns are generally smaller, making them more suitable for the initial application of lawn mowers; additionally, Europe has implemented strict environmental policies earlier than other countries, promoting the phasing out of traditional fuel lawn mowers; furthermore, higher labor costs in Europe necessitate the use of lawn mower robots to reduce household expenses.

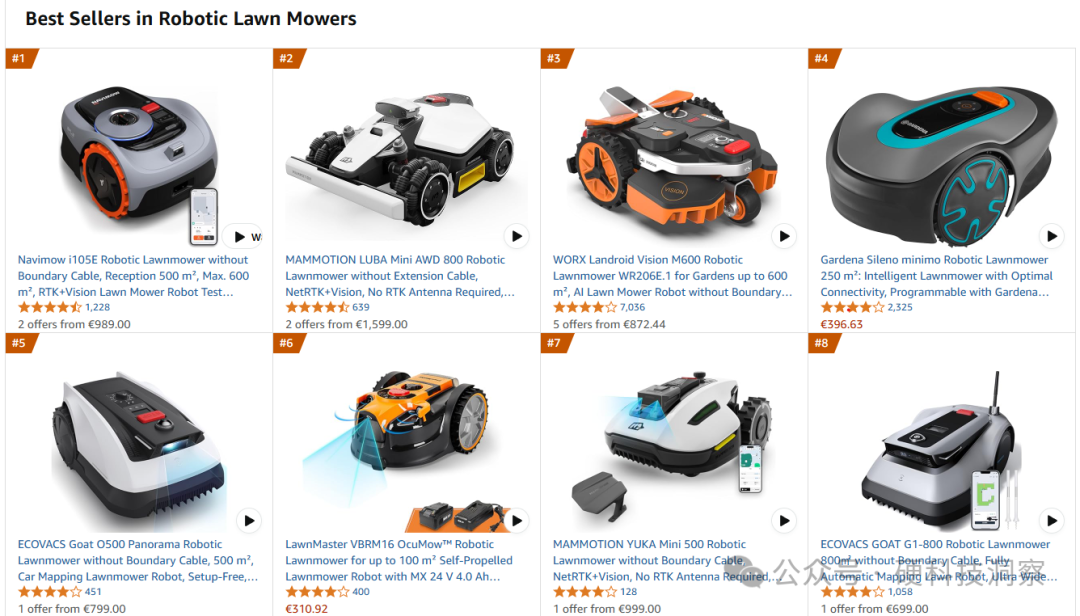

Market research predicts that by 2025, sales of lawn mower robots will exceed 1 million units (with a penetration rate of less than 5%), and with a unit price of 1500-2000 dollars, the lawn mower robot market size will be about 1.5-2 billion dollars. Ninebot also predicts in its annual report that the market size for lawn mower robots will exceed 15.9 billion dollars by 2030, indicating significant growth potential for lawn mower robots in the future.Currently, the lawn mower robot market is primarily in Europe, while North America is still in its infancy. The penetration rate in Europe is over 15%, while in North America, it is less than 5%, still at the starting stage. This is because European lawns are generally smaller, making them more suitable for the initial application of lawn mowers; additionally, Europe has implemented strict environmental policies earlier than other countries, promoting the phasing out of traditional fuel lawn mowers; furthermore, higher labor costs in Europe necessitate the use of lawn mower robots to reduce household expenses. 4. Major Players in the Industry(1) Competitive Landscape of Lawn Mower RobotsIn 2024, the total annual sales of lawn mower robots are expected to be around 1-1.2 million units, among whichHusqvarna Group (including Husqvarna and Gardena) has an annual shipment of about 500,000 units (including wired and smart lawn mower robots, mainly wired lawn mower robots), and Worx Group has an annual shipment of 300,000 units(including wired and smart lawn mower robots), accounting for 80% of the market share.According to Amazon data, Husqvarna Group and Worx Group mainly ship wired lawn mower robots, while the shipment of smart lawn mower robots is still relatively low. The companies with larger shipments of smart lawn mower robots include Ninebot, Songling, Ecovacs, and ZhiMi.

4. Major Players in the Industry(1) Competitive Landscape of Lawn Mower RobotsIn 2024, the total annual sales of lawn mower robots are expected to be around 1-1.2 million units, among whichHusqvarna Group (including Husqvarna and Gardena) has an annual shipment of about 500,000 units (including wired and smart lawn mower robots, mainly wired lawn mower robots), and Worx Group has an annual shipment of 300,000 units(including wired and smart lawn mower robots), accounting for 80% of the market share.According to Amazon data, Husqvarna Group and Worx Group mainly ship wired lawn mower robots, while the shipment of smart lawn mower robots is still relatively low. The companies with larger shipments of smart lawn mower robots include Ninebot, Songling, Ecovacs, and ZhiMi. (2) Major Players in the Lawn Mower Robot Industry(1) Husqvarna

(2) Major Players in the Lawn Mower Robot Industry(1) Husqvarna

Husqvarna, founded in 1689 and headquartered in Sweden, is a company with a long history. Its business includes forestry and garden equipment, construction and stone equipment, outdoor power tools, and motorcycle business.

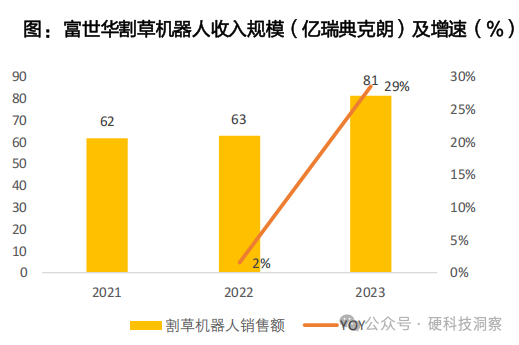

The lawn mower robot brands under Husqvarna Group are mainly Husqvarna and Gardena, with a combined annual shipment of about 500,000 units, primarily wired lawn mower robots. In 2023, Husqvarna Group’s lawn mower robot revenue was approximately 8.1 billion Swedish Krona (about 5.4 billion yuan). In the first quarter of 2025, Husqvarna Group’s lawn mower robot business grew by 16% year-on-year, continuing to maintain a rapid growth rate.

(2) Worx

Worx was founded in 1994 and has developed from a small trading company into a leading enterprise in the global power tool industry. Its business includes power tools, garden tools, and service robots.

The lawn mower robot brand under Worx is Worx, which released its first lawn mower in 2011, with cumulative sales exceeding one million units, becoming a leader in the industry. According to reports, Worx’s smart lawn mower robot achieved a 59% market share in modern channels in Germany in Q1 2024. According to industry research, Worx’s lawn mower robot shipments in 2024 are expected to be around 300,000 units, making it a leading company in the industry.

(3) Ninebot

Ninebot was founded in 2012, initially focusing on electric balance scooters and electric scooters. It went public on the Science and Technology Innovation Board in 2019. Ninebot’s lawn mower robot business began in 2021, entering the market through its brand NAVIMOW, using RTK + vision solutions.

In 2024, Ninebot’s lawn mower robot revenue reached 860 million yuan, a year-on-year increase of 284%, with shipments exceeding 100,000 units, achieving explosive growth.

(4) Songling Robotics

Songling Robotics (Agilex) was founded in 2016, incubated by Professor Li Zexiang from the Hong Kong University of Science and Technology, focusing on the development of outdoor mobile robot chassis as its core business.

Songling’s subsidiary, Kuma Power, is responsible for the lawn mower robot business, established in 2022 under the brand MAMMOTION, using RTK + vision solutions, reportedly ranking among the top tier in shipments in 2024.

(5) Ecovacs

Ecovacs was founded in 1998, starting with vacuum robots, and went public on the Shanghai Stock Exchange in 2018.

The lawn mower robot brand under Ecovacs is ECOVACS, which uses RTK + vision solutions. In 2024, Ecovacs’s lawn mower robot overseas revenue and sales increased by 186.7% and 271.7% year-on-year, respectively, showing strong growth momentum, with shipments in the tens of thousands.

(6) ZhiMi

ZhiMi was founded in 2017, focusing on vacuum cleaners, sweeping robots, floor washers, and hair dryers.

The lawn mower robot brand under ZhiMi is DREAME, launched in 2023, using laser radar + vision solutions, and its smart lawn mowers have exceeded cumulative shipments of 100,000 units.

5. Comparison of Lawn Mower Robot Technology Solutions

Currently, there is a trend of convergence in lawn mower robot technology solutions, with the mainstream approach being RTK + machine vision for positioning and obstacle avoidance. Some manufacturers also use pure vision solutions and laser radar solutions, while hybrid solutions are expected to become the mainstream technology in the future.

| Technology Solution Comparison | Advantages | Disadvantages |

| RTK + Vision |

High maturity, multiple suppliers to choose from, manufacturers can reduce investment in algorithm development; applicable to most scenarios; low cost |

In special situations, positioning may deviate, with accuracy changing from centimeter-level to meter-level, such as sunlight exposure, shadows causing misidentification; or camera obstruction, dirt, or rainy weather affecting vision functionality; RTK is relatively large, occupying some transport space, increasing transport costs; |

| Pure Vision Solution |

Suitable for small areas with distinct features and stable lighting conditions; higher accuracy compared to GPS positioning, and stable signals |

High algorithm requirements, requiring extensive training; Limited in certain usage scenarios, such as at night or in bright light conditions |

| Laser Radar + Vision | Easy to install, high positioning accuracy, does not require complex wiring or installation of RTK base stations and signal poles |

Laser radar solutions are the most expensive; detection distance is relatively limited; uneven ground can lead to poor performance; laser radar cannot perform recognition or obstacle avoidance; |

| UWB Technology | Fast data transmission, precise positioning, strong anti-interference capability, low power consumption, etc., can achieve centimeter-level positioning accuracy | Frequency band is regulated |

| Wired | Compared to traditional lawn mowers and hiring services, it saves time, effort, and money | Initial wiring process is cumbersome, and later maintenance costs are high |

6. Conclusion

① 2024 is the inaugural year for lawn mower robots, and 2025 will be a significant year for mass production. The lawn mower robot market is burgeoning, with vast penetration potential, and is expected to become a massive market worth 15 billion dollars in the future.② The technology route for smart lawn mower robots is beginning to converge, with the current RTK + vision solution maturing, and hybrid solutions are expected to become mainstream in the future.③ Currently, a number of leading companies have emerged in the smart lawn mower robot sector, achieving large-scale shipments, such as Husqvarna, Worx, Ninebot, Songling, Ecovacs, and ZhiMi. Except for Songling, almost all are large companies with established business foundations. Therefore, the opportunities for startups that have not yet achieved mass production this year are limited;④ What kind of companies can succeed in fierce competition? 1) Companies that integrate hardware and software for lawn mower robots, with capabilities in hardware, software, and algorithms; 2) Cost control capabilities; 3) Mass production capabilities; 4) Companies with brand and channel advantages are likely to gain a higher market share.Image and text references are from publicly available materials from China Merchants Securities, Tianfeng Securities, Amazon Germany, and various company websites; for sharing purposes only, do not represent my personal stance, and do not constitute investment advice.