Previous Recommendations

China-Europe Cooperation, Core Beneficiary Industry Chain Overview

Comprehensive Tariff Countermeasures, Detailed Overview of 9 Beneficial Concepts

Striking a Blow to Avoid a Hundred Blows: An Overview of Opportunities in Tariff Countermeasures!

Active Countermeasures Against Tariff Increases by Penicillin, The Most Authentic 6 Companies

In-Depth Analysis of Controlled Nuclear Fusion Expectations, The Most Authentic 7 Core Companies Overview

Trade War Escalation: China Builds a Globally Shared Market, Core Company Overview

Trade War Continues to Ferment, The Most Comprehensive Related Industry Chain Table Overview

The China Semiconductor Industry Association issued an “Emergency Notice on the Origin Certification Rules for Semiconductor Products” on April 11, 2025, clearly adjusting the origin determination standard for integrated circuits to be based on the location of the “wafer fabrication factory” (i.e., “wafer fabrication as origin”). This policy is based on the General Administration of Customs’ “Regulations on Substantial Changes Standards in Non-Preferential Origin Rules” (Customs Order No. 122), aimed at addressing international trade frictions, accelerating domestic substitution, and restructuring the global semiconductor industry chain. Below, I will analyze the policy changes, motivations, and impacts for everyone.

The core content of this policy has two points

1. Origin determination standard

The classification of chips during the wafer fabrication stage (wafer manufacturing) changes, with the wafer fabrication location being recognized as the origin, regardless of subsequent packaging or testing. Declaration requirements: The origin must be declared based on the location of the wafer fabrication factory during import customs clearance, and supporting documents such as purchase orders (PO) must be provided for reference.

2. Differences from the old rules

In the past: The origin determination standards were diverse, possibly based on the packaging location, assembly location, or value-added ratio, with some companies circumventing tariffs through Southeast Asian packaging.

New rules: Clearly define the wafer fabrication location as the sole criterion, weakening the influence of packaging and other links on the origin attribute.

II. Policy Background and Motivation

1. Responding to international trade frictions

The U.S. has increased semiconductor tariffs on China (e.g., raising tariffs on U.S. chips to 125%), and the new rules precisely target “false declaration” behaviors (e.g., U.S. companies packaging in Southeast Asia but with wafer fabrication in the U.S.), weakening their price advantage.

Countermeasures against the U.S. “CHIPS and Science Act” aim to guide global semiconductor manufacturing to shift to China, countering U.S. technology blockades.

2. Promoting domestic substitution

China’s chip import deficit is expected to reach 1.6 trillion yuan in 2024, with U.S. chips accounting for over 5%. The new rules encourage companies to move wafer fabrication to domestic locations, supporting the development of local wafer fabs.

3. Customs supervision facilitation

Unified standards reduce declaration disputes, facilitate customs verification, and enhance trade compliance.

III. Impact on the Industry Chain

1. Beneficial areas for domestic companies

Wafer foundry: Local wafer fabs such as SMIC and Hua Hong Semiconductor may undertake more international orders, especially for analog chips (e.g., TI, ADI, etc., which U.S. companies find difficult to shift manufacturing capacity).

Equipment and materials: Demand for domestic equipment (e.g., Northern Huachuang, Zhongwei Company) and materials (e.g., Shanghai Silicon Industry) will increase, as localizing the wafer fabrication stage requires supporting supply chains.

Analog chip design: High-end analog chips require a deep integration of manufacturing processes and design; U.S. companies will find it difficult to shift capacity in the short term, creating a window for domestic companies (e.g., Sanken, Naxin Micro, Fuman Micro) to replace.

2. Challenges for international companies

U.S. chip manufacturers: Chips fabricated in the U.S. by companies like Intel and Micron may be recognized as “U.S. origin,” facing high tariff pressures; if they merely shift capacity to China to avoid taxes, the cost and policy risks are high.

Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung: They need to adjust supply chain strategies and may transfer some wafer fabrication capacity to China to meet demand.

3. Changes in packaging and testing

The cost advantages of Southeast Asian packaging bases are weakened due to the irrelevance of origin, and domestic packaging companies (e.g., JCET, Tongfu Microelectronics) need to accelerate technological upgrades (e.g., 3D packaging) to break through limitations.

IV. Key Points of Policy Implementation

1. Clarification of historical standards

The General Administration of Customs Order No. 122 has long clarified that “tariff changes” are the basic principle for origin determination, but previously, companies had inconsistent declaration standards (e.g., declaring based on design or packaging location). The new rules strengthen compliance through unified interpretation.

2. Corporate response strategies

Importers: Need to verify chip wafer fabrication location information, ensuring that PO and logistics documents are consistent with declarations to avoid tariff risks due to origin misjudgment.

Manufacturers: Should prioritize choosing international partners with wafer fabs in mainland China (e.g., TSMC’s Nanjing plant) or accelerate the introduction of domestic equipment.

V. Future Trend Outlook

1. Acceleration of technological self-sufficiency

Demand for domestic equipment and materials will increase, driving breakthroughs in “bottleneck” technologies such as lithography machines and EDA, although high-end processes will still require time to overcome.

2. Global supply chain restructuring

U.S. companies face a dilemma of “shifting capacity” or “abandoning the Chinese market,” which may promote regional layouts of the semiconductor industry chain, with China potentially becoming a core manufacturing hub.

3. Adjustment of trade patterns

China uses tariff levers to weaken the competitiveness of U.S. chips while creating market space for domestic chips, potentially reshaping the global semiconductor trade landscape in the long term.

The “wafer fabrication as origin” policy is a key measure for China to respond to international trade frictions and promote self-control in the semiconductor industry. In the short term, it benefits local wafer fabs, equipment materials, and analog chip companies; in the long term, it requires technological breakthroughs (e.g., advanced processes, third-generation semiconductors) to consolidate advantages. Below, I will provide a detailed overview of the semiconductor industry chain.

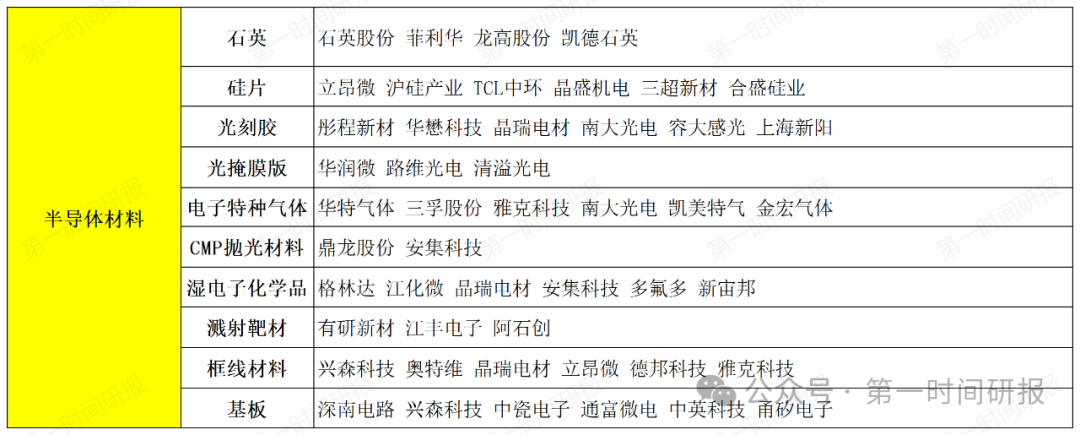

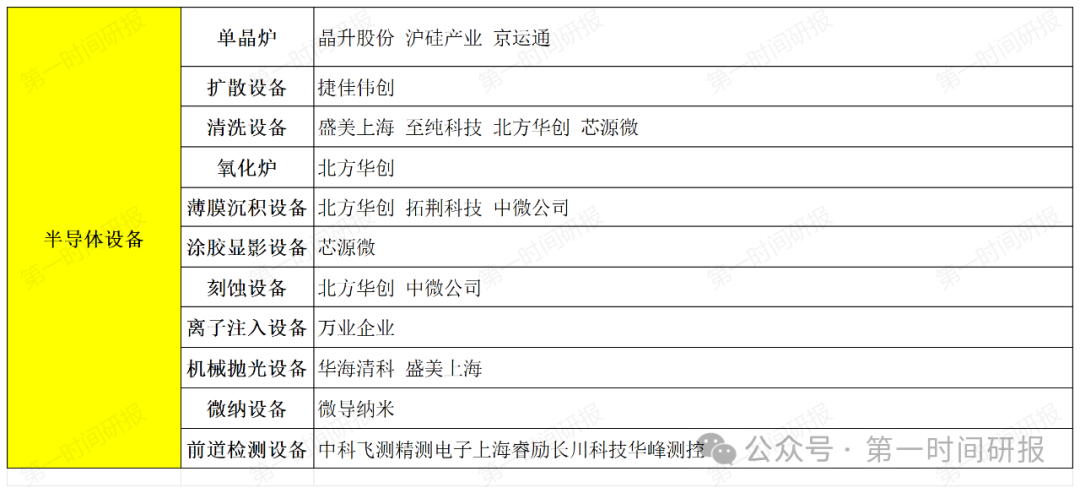

01Upstream: Semiconductor Materials and Equipment

Semiconductor Materials

Semiconductor Equipment

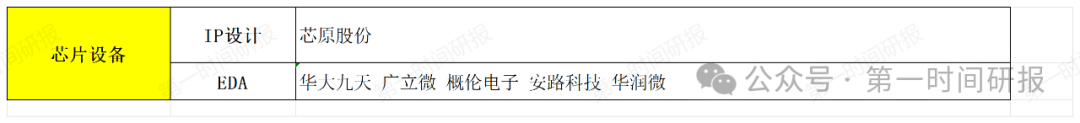

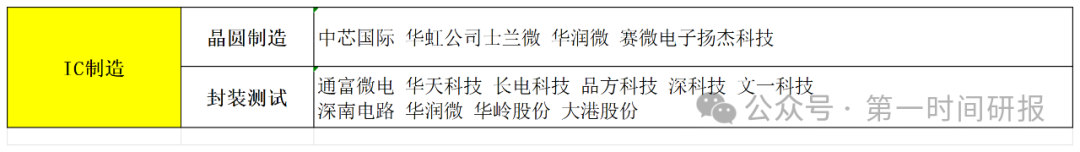

02Semiconductor Chip Design, Manufacturing, and Packaging

Chip Design

IC Manufacturing

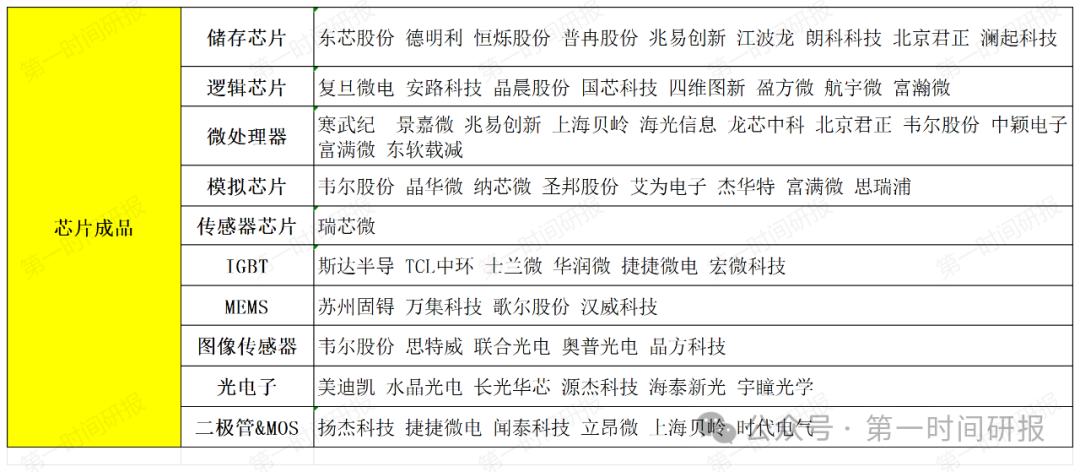

Finished Chips

For more information on market development trends, development trends, industry chains, and individual stock research materials, they have been uploaded to the knowledge community. Currently, there is a limited-time early bird price of 98/year.

For more information on market development trends, development trends, industry chains, and individual stock research materials, they have been uploaded to the knowledge community. Currently, there is a limited-time early bird price of 98/year.

Quality Cases from the Knowledge Community:

Welcome to join the knowledge community for timely research reports

Risk Warning: This article is for industry analysis reference only and does not constitute any investment advice.

Risk Warning: This article is for industry analysis reference only and does not constitute any investment advice.

Finally, your attention + likes + shares + views are the greatest motivation for timely research reports.