👆If you wish to meet regularly, feel free to star 🌟 and bookmark it~Source: This article is translated from eenews, thank you.

👆If you wish to meet regularly, feel free to star 🌟 and bookmark it~Source: This article is translated from eenews, thank you.

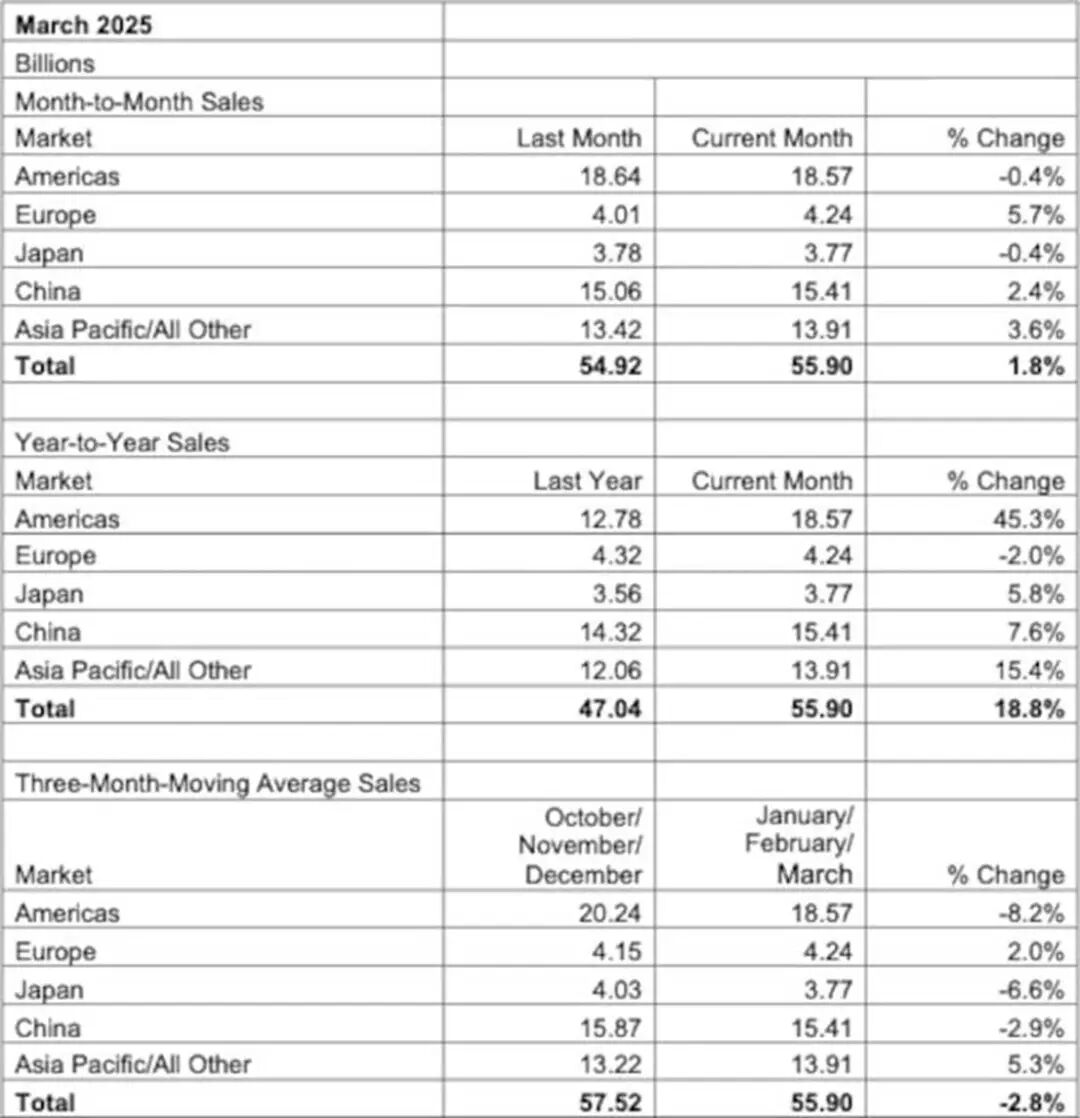

According to statistics from the Semiconductor Industry Association, the global chip market’s three-month average scale in March was $55.9 billion, a month-on-month increase of 1.8% and a year-on-year increase of 18.8%.

The three-month moving average for March can represent the chip sales for the first quarter, and the annual market growth rate has increased compared to February’s 17.1% year-on-year growth rate. This may reflect a surge in chip procurement in March, although sales in the third month of each quarter are typically the highest.

Referring to the actual monthly sales data from the World Semiconductor Trade Statistics (WSTS), the global chip market scale in March was $62.76 billion.

The European chip market continues to shrink year-on-year, but the rate of decline has slowed compared to previous months. Meanwhile, all other geographical regions tracked by WSTS have seen year-on-year growth in chip market size.

The fastest-growing region is the Americas, where the chip market size grew by 45.3% year-on-year in February. The growth rates for the chip markets in Japan and China were only in single digits, while the Asia-Pacific region, excluding Japan and China, achieved a strong growth of 15.4%.

Tariffs imposed by the U.S. on imported chips may have a chilling effect on the global chip market by 2025, but the latest data indicates that the uncertainty caused by President Trump’s statements and delays is prompting procurement orders to be placed earlier.

SIA CEO John Neuffer stated, “Global semiconductor demand remains high, with first-quarter sales significantly exceeding the same period last year.” He added, “Driven by approximately 45% year-on-year growth in the Americas, sales have increased year-on-year for 11 consecutive months by over 17%.”

Although the data source WSTS tracks sales on a monthly basis, the monthly data provided by SIA is an average of three months. SIA and other regional semiconductor industry organizations choose to use average data because it balances actual data, which typically sees a trough at the beginning of the quarter and a peak at the end of the quarter.

TechInsights: Global Semiconductor Market to Shrink by One-Third

The semiconductor supply chain is complex, with a complicated cost structure (often requiring national subsidies and clear facilitation measures), and as a common input for countless products, it holds strategic value. Therefore, it is currently at the core of a tariff game similar to the “Thucydides Trap” between the U.S. and China. However, a new analysis predicts that if the current high tariff regime becomes the norm, the global semiconductor sector will face significant impacts.

That is to say, the market research company TechInsights has now released a comprehensive analysis of the ongoing tariff-related competitive dynamics between the U.S. and China, revealing concerning signs for the broader semiconductor sector, especially in the absence of significant de-escalation.

For those who may not know, the Trump administration recently abandoned its earlier hardline stance on import tariffs and even introduced a series of de-escalation measures in the face of disorderly selling of U.S. debt, including reducing the global import tariff rate for all U.S. trading partners, except China, to 10%, while China still faces a punitive import tax of 145%.

President Trump also temporarily suspended tariffs on imported semiconductors, electronic products, and smartphones (including Apple iPhones) from China. Currently, these products still face a 20% fentanyl-related tariff.

Additionally, reports indicate that the U.S. government is also considering limited tariff exemptions for certain automotive companies to give them space to relocate their supply chains out of Mexico and Canada. It is important to note that automobiles and automotive parts imported from countries outside of China still face a 25% tariff.

China has imposed a 125% tariff on all U.S. imports. China has also banned the export of rare earth metals to the U.S. and is drafting a policy to cut off supplies to the U.S. military and its affiliates. It is worth noting that rare earth metals are used in various industries, including the production of electric motor magnets. Contrary to popular belief, the U.S. cannot easily begin extracting its abundant rare earth resources, as this endeavor requires significant funding, energy, infrastructure, and the complex interplay of vertically integrated supply chain partners.

Returning to the previous topic, assuming a global tariff rate of 10% in the U.S., TechInsights believes that by 2026, the broader semiconductor sector will form a market valued at $844 billion, compared to this year’s market size of $777 billion. This corresponds to an annual growth rate of 8.6%.

However, if the current situation persists, with the U.S. and China imposing tariffs exceeding 100%, TechInsights finds that the global semiconductor market size will shrink by 10% to $696 billion by 2025, and drop to $557 billion by 2026. In contrast, under the baseline scenario of a global tariff of 10%, the market size is expected to reach $844 billion, a decline of about 34%. It is noteworthy that this scenario would also raise the average import tariff in the U.S. to 40%.

Another scenario is that if U.S. import tariffs on China stabilize between 30% and 40%, while global tariff rates rise between 20% and 40%, the semiconductor market value this year would reach $736 billion, and next year it would reach $699 billion.

Original Link

https://www.eenewseurope.com/en/chip-market-bounce-could-reflect-pre-tariff-purchasing/

END

👇 Recommended Semiconductor Public Account 👇

▲ Click the card above to follow

Focusing on more original content in the semiconductor field

▲ Click the card above to follow

Follow global semiconductor industry trends and movements

*Disclaimer: This article is original by the author. The content of the article represents the author’s personal views, and Semiconductor Industry Observation reprints it only to convey a different perspective, which does not represent Semiconductor Industry Observation’s endorsement or support of that view. If there are any objections, please contact Semiconductor Industry Observation.

This is the 4025th issue shared by “Semiconductor Industry Observation” for you, welcome to follow.

Recommended Reading

★A Chip That Changed the World

★U.S. Secretary of Commerce: Huawei’s Chips Are Not That Advanced

★“ASML’s New Lithography Machine, Too Expensive!”

★The Quiet Rise of Nvidia’s New Competitors

★Chip Crash, All Blame Trump

★New Solutions Announced to Replace EUV Lithography

★Semiconductor Equipment Giants, Salaries Soar by 40%

★Foreign Media: The U.S. Will Propose Banning Software and Hardware Made in China for Automobiles

“The First Vertical Media in Semiconductors”

Real-time, Professional, Original, In-depth

Public Account ID: icbank

If you like our content, please click “Looking” and share it with your friends.