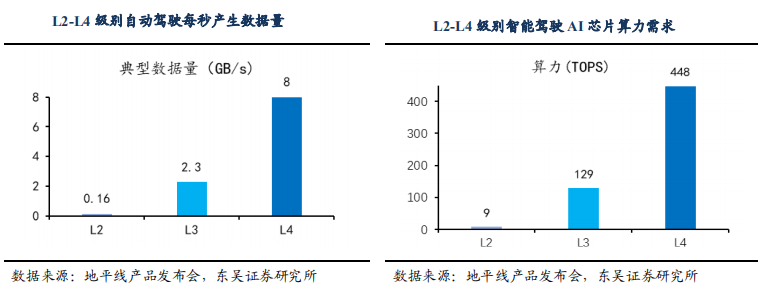

With the arrival of high-level intelligent driving, smarter cars need to process larger amounts of images, videos, and other unstructured data. Traditional MCU chips cannot meet the computational demands, while AI chips can achieve fast, accurate, and efficient calculations. We focus on data from Horizon, where L3 level autonomous driving generates a data volume of 2.3GB/s, requiring computational power above 129TOPS; L4 level autonomous driving reaches 8GB/s, with a computational power requirement of over 448TOPS. If redundancy for functional safety is considered, the computational power requirement doubles.

Due to the demand for computational power in intelligent driving, the automotive industry has regarded peak computational power as the main metric for evaluating AI chips, sparking an arms race for computational power. NIO’s new flagship model ET7 is equipped with over 1016TOPS of computational power, while SAIC’s newly released model also reaches 500 to 1000TOPS.

It is expected that by 2025, China’s automotive AI chip market will exceed $9.2 billion, with a CAGR of 45.0% over the next five years. Integrating more AI units is a major trend in the development of intelligent chip technology.

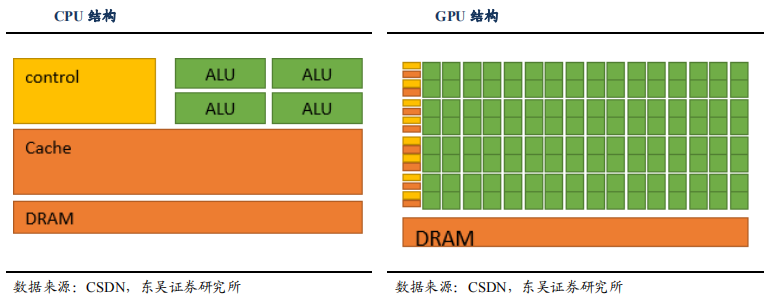

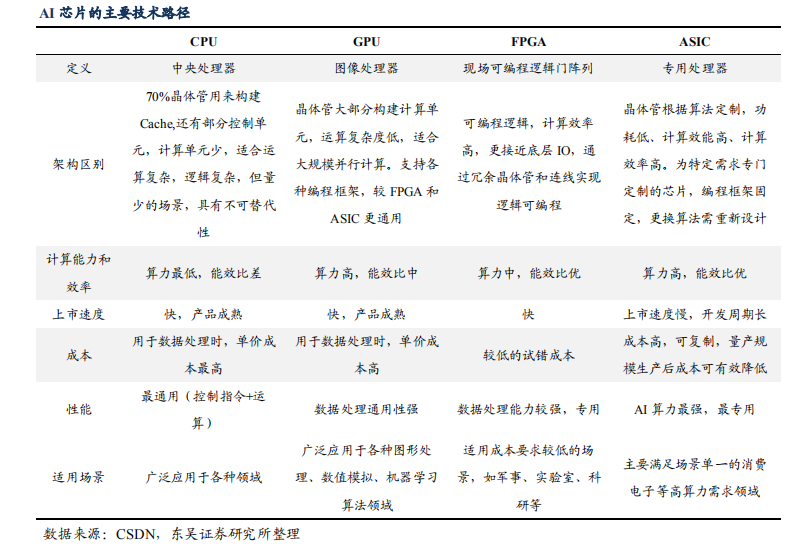

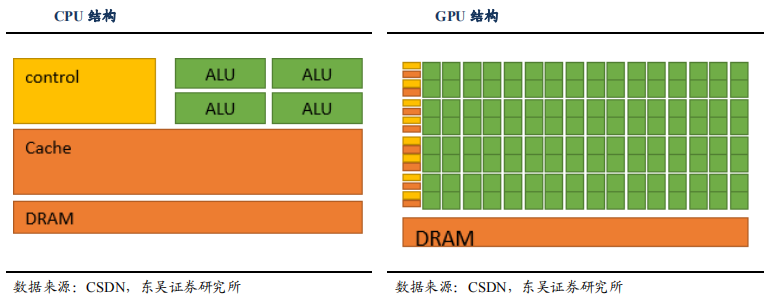

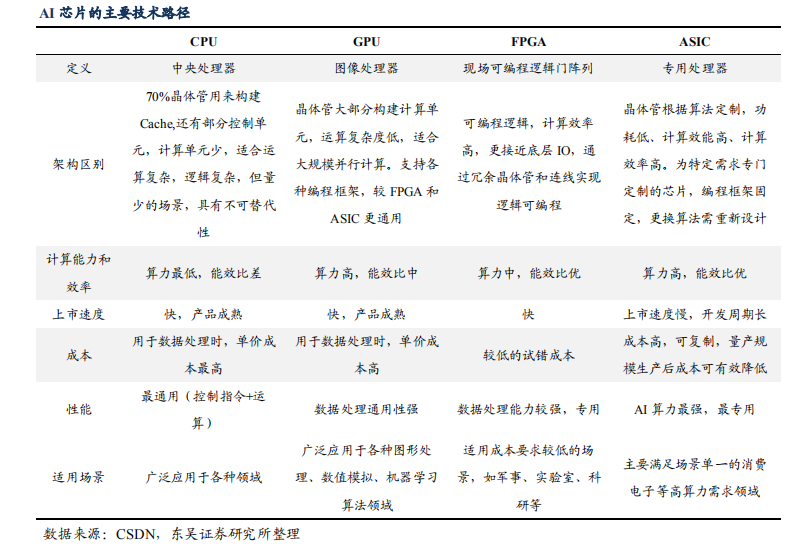

CPU, also known as Central Processing Unit, excels in logical control and general data processing, making it irreplaceable. CPUs have strong versatility, capable of handling different data types, and are primarily responsible for sequential control, operational control, timing control, and data processing. Therefore, every computer or embedded system contains a CPU or its trimmed version. A CPU consists of a controller (Control), registers (Cache, DRAM), and a logic unit (ALU), where the controller and registers take up a larger proportion, while the logic unit responsible for data processing occupies a smaller proportion, hence having weaker data processing capabilities for specialized fields. Representative manufacturers include Intel for X86 processors and ARM for embedded processors.

GPU, also known as Graphics Processing Unit, commonly referred to as a graphics card, excels in large-scale parallel computing. GPUs have numerous computational units and long pipelines, processing highly uniform, independent data types, eliminating many unnecessary control instruction computation modules from CPUs, and offering stronger parallel computing capabilities. With the development of artificial intelligence, GPUs are increasingly applied in numerical simulation, machine learning, visual processing, speech recognition, etc., with NVIDIA as a representative supplier.

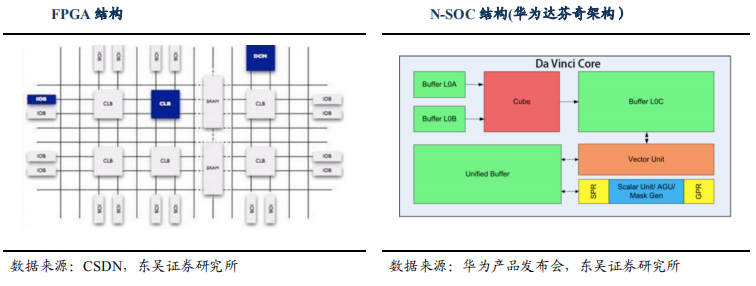

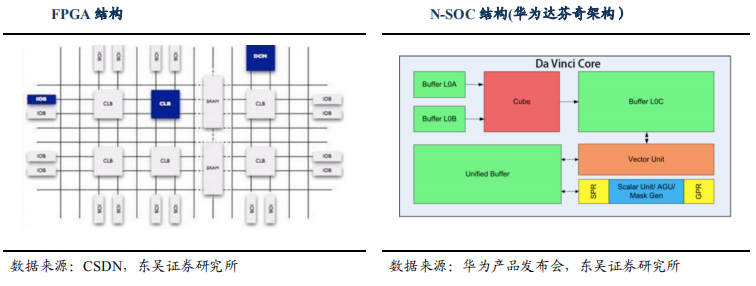

FPGA, short for Field Programmable Gate Array: also known as Programmable Logic Gate Array, has high computational power and is suitable for small-scale customized development and testing. Users can define the internal structure’s wiring by burning in configuration files to achieve custom circuits. FPGA chips have high production costs and poorer energy efficiency compared to ASIC chips. They are suitable for research and enterprise development stages; once a solution is determined, their cost advantages diminish. Representative manufacturers include Xilinx, Altera (acquired by Intel), and Deep Vision Technology.

ASIC, short for Application-Specific Integrated Circuit: is an integrated circuit designed for specific purposes, featuring the highest computational power and superior energy efficiency. ASICs cater to specific user needs, suitable for relatively singular large-scale application scenarios, operating faster than FPGAs under the same conditions. However, they harden support for specific intelligent algorithms at the architectural level, with simple or completely fixed instruction sets. If the scenario changes, these AI chips become unsuitable and need to be updated. Given the rapid evolution of AI algorithms, with numerous algorithms developed each year, their applicability in autonomous driving is currently weak. Therefore, there are no truly meaningful ASIC chips at this stage.

N-SOC, or System-on-Chip with Neural Network Units, refers to chips that integrate more neural network units to achieve fast CNN (Convolutional Neural Network) computations. N-SOC is a new term in the market, primarily due to the development of AI chips, where traditional definitions are not entirely applicable. N-SOC differs from ASIC in that its intelligent algorithms are not hardened, but it is not a completely general-purpose chip, supporting only a limited number of algorithms. Typical representative companies include Intel’s Mobileye, Huawei (Da Vinci architecture Ascend series), Cambricon (MLU series), Baidu (Kunlun Cloud), Alibaba’s T-Head, and Google (TPU).

FPGA, short for Field Programmable Gate Array: also known as Programmable Logic Gate Array, has high computational power and is suitable for small-scale customized development and testing. Users can define the internal structure’s wiring by burning in configuration files to achieve custom circuits. FPGA chips have high production costs and poorer energy efficiency compared to ASIC chips. They are suitable for research and enterprise development stages; once a solution is determined, their cost advantages diminish. Representative manufacturers include Xilinx, Altera (acquired by Intel), and Deep Vision Technology.

ASIC, short for Application-Specific Integrated Circuit: is an integrated circuit designed for specific purposes, featuring the highest computational power and superior energy efficiency. ASICs cater to specific user needs, suitable for relatively singular large-scale application scenarios, operating faster than FPGAs under the same conditions. However, they harden support for specific intelligent algorithms at the architectural level, with simple or completely fixed instruction sets. If the scenario changes, these AI chips become unsuitable and need to be updated. Given the rapid evolution of AI algorithms, with numerous algorithms developed each year, their applicability in autonomous driving is currently weak. Therefore, there are no truly meaningful ASIC chips at this stage.

N-SOC, or System-on-Chip with Neural Network Units, refers to chips that integrate more neural network units to achieve fast CNN (Convolutional Neural Network) computations. N-SOC is a new term in the market, primarily due to the development of AI chips, where traditional definitions are not entirely applicable. N-SOC differs from ASIC in that its intelligent algorithms are not hardened, but it is not a completely general-purpose chip, supporting only a limited number of algorithms. Typical representative companies include Intel’s Mobileye, Huawei (Da Vinci architecture Ascend series), Cambricon (MLU series), Baidu (Kunlun Cloud), Alibaba’s T-Head, and Google (TPU).

Ranking from general to specialized: CPU, GPU, FPGA, ASIC; data processing cost-effectiveness (from best to worst): ASIC, FPGA, GPU, CPU. 1) CPU is the most general, with poor computational power and the worst energy efficiency, but it includes control instructions aside from computation, making it irreplaceable; 2) GPU is a relatively general chip with high computational power and a relatively open architecture, allowing manufacturers to develop their specialized algorithms based on the underlying hardware architecture, but it has poorer energy efficiency; 3) FPGA has average computational power and can change the chip structure’s wiring per customer needs through configuration files, making it suitable for laboratory research, early development, and small-batch applications; 4) ASIC is a specialized chip with high computational power and excellent energy efficiency, saving unnecessary development resources and having the lowest mass production costs, but the supported algorithms are inflexible.

Ranking from general to specialized: CPU, GPU, FPGA, ASIC; data processing cost-effectiveness (from best to worst): ASIC, FPGA, GPU, CPU. 1) CPU is the most general, with poor computational power and the worst energy efficiency, but it includes control instructions aside from computation, making it irreplaceable; 2) GPU is a relatively general chip with high computational power and a relatively open architecture, allowing manufacturers to develop their specialized algorithms based on the underlying hardware architecture, but it has poorer energy efficiency; 3) FPGA has average computational power and can change the chip structure’s wiring per customer needs through configuration files, making it suitable for laboratory research, early development, and small-batch applications; 4) ASIC is a specialized chip with high computational power and excellent energy efficiency, saving unnecessary development resources and having the lowest mass production costs, but the supported algorithms are inflexible.

AI chips achieve higher efficiency in AI computations by adding neural network units. Currently, there is significant debate in the market regarding the future automotive AI chip solutions, whether to use general GPU, FPGA, or ASIC chips. We believe that automotive data processing chips are increasingly becoming heterogeneous, with the main direction of future development being the continuous addition of neural network units for AI computations. Besides companies like Huawei, Horizon, and Cambricon continuously adding neural network units, NVIDIA, as a representative supplier of general GPUs, is also adding neural network units in its autonomous driving series chips to achieve increasingly efficient AI processing. However, overall, GPUs still have high power consumption, and their rich general modules can adapt to various scenarios, but they also bring high costs and power consumption issues. The newly emerged N-SOC, while not fixed algorithms like ASICs, has advantages such as lower cost and power consumption, but its adaptability to various scenarios remains weak. In the automotive field, both will tend to converge in terms of performance and cost in the future.

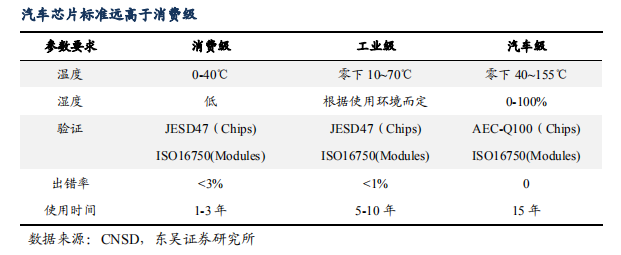

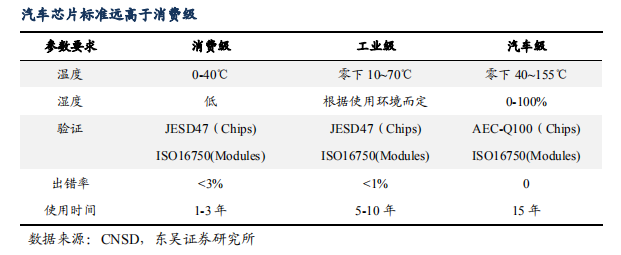

The standards for automotive-grade chips are far higher than those for consumer-grade, with long certification processes.

1) Working environments are harsher: Compared to consumer chips and general industrial chips, automotive chips operate in a wider temperature range (-40 to 155 degrees Celsius), high vibration, dust, and electromagnetic interference.

2) High reliability and safety requirements: The typical design life of a car is around 15 years or 200,000 kilometers, much longer than consumer electronics. With the same reliability requirements, the more components and links that make up the system, the higher the reliability requirements for its components.

3) The certification process for automotive-grade chips is long: typically, a chip requires around 2 years to complete automotive-grade certification, and once it enters the automotive supply chain, it generally has a supply cycle of 5-10 years.

AI chips achieve higher efficiency in AI computations by adding neural network units. Currently, there is significant debate in the market regarding the future automotive AI chip solutions, whether to use general GPU, FPGA, or ASIC chips. We believe that automotive data processing chips are increasingly becoming heterogeneous, with the main direction of future development being the continuous addition of neural network units for AI computations. Besides companies like Huawei, Horizon, and Cambricon continuously adding neural network units, NVIDIA, as a representative supplier of general GPUs, is also adding neural network units in its autonomous driving series chips to achieve increasingly efficient AI processing. However, overall, GPUs still have high power consumption, and their rich general modules can adapt to various scenarios, but they also bring high costs and power consumption issues. The newly emerged N-SOC, while not fixed algorithms like ASICs, has advantages such as lower cost and power consumption, but its adaptability to various scenarios remains weak. In the automotive field, both will tend to converge in terms of performance and cost in the future.

The standards for automotive-grade chips are far higher than those for consumer-grade, with long certification processes.

1) Working environments are harsher: Compared to consumer chips and general industrial chips, automotive chips operate in a wider temperature range (-40 to 155 degrees Celsius), high vibration, dust, and electromagnetic interference.

2) High reliability and safety requirements: The typical design life of a car is around 15 years or 200,000 kilometers, much longer than consumer electronics. With the same reliability requirements, the more components and links that make up the system, the higher the reliability requirements for its components.

3) The certification process for automotive-grade chips is long: typically, a chip requires around 2 years to complete automotive-grade certification, and once it enters the automotive supply chain, it generally has a supply cycle of 5-10 years.

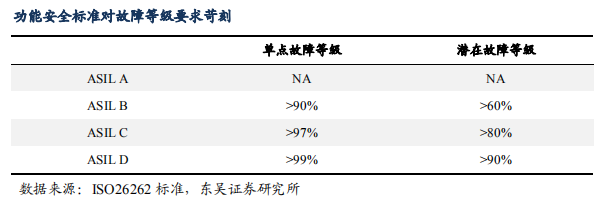

Automotive standards require certification for reliability standards such as AEC-Q series, quality management standards ISO/TS16949, among others. Additionally, they must meet functional safety standards ISO 26262 ASIL B(D). ISO 26262 was officially released on November 15, 2011, and includes four levels: ASIL A/B/C/D. ISO 26262 safety is one of the criteria for evaluating the stability of automotive electronic components. A higher level indicates that the product’s stability is qualified and durable, but it does not imply high computational power or energy efficiency. Furthermore, they must pass the zero-failure supply chain quality management standards TS16949/ISO 9000 international certification system; another is AEC-Q certification, which is a safety testing standard for automotive electronic components established by Chrysler, GM, and Ford.

The automotive AI chip market structure is clear, with industry oligopoly.

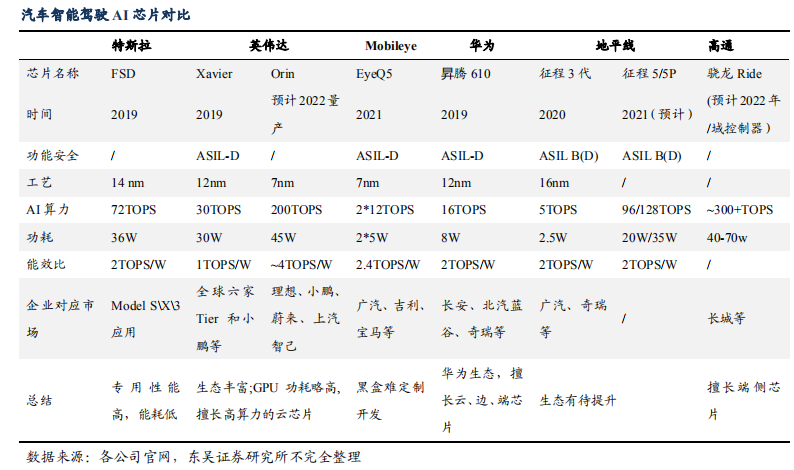

As of 2020, according to Mobileye data, it occupies about 70% of the mass production vehicle market. As L1/L2 level assisted driving gradually evolves to L3 level intelligent driving, suppliers from the consumer electronics/communications field such as NVIDIA, Huawei, Qualcomm, and domestic startups like Horizon and Black Sesame are accelerating their entry to seize market share in automotive AI chips. Computational power, power consumption, and ecosystem have become the core competitiveness for various chip manufacturers vying for the market. Tesla’s FSD chip is self-developed and used, leading industry development, belonging to an independent tier.

The chips used in Tesla have gone through Mobileye EyeQ3 and NVIDIA DRIVE PX2, later opting for self-development. The main advantages are: due to self-development and use, they can develop dedicated chips based on demand, reducing unnecessary software and hardware modules.

1) Shortening the R&D cycle and reducing design workload;

2) Improving energy efficiency;

3) User data-driven R&D optimization.

1) The ecosystem is relatively closed, with only internal development and use, unable to establish a complete ecosystem.

2) If usage is limited, chip development requires substantial investment, and the costs of software and hardware development are difficult to amortize through large-scale use.

NVIDIA, the AI leader in the global GPU field, and Mobileye, the automotive AI chip leader backed by Intel, belong to the first tier. NVIDIA, as the leader in general AI chips, provides chip-level products externally, possessing the most complete software toolchain and application ecosystem. Mobileye, backed by Intel, offers a chip + algorithm binding integrated solution, with the richest customer resources and has achieved mass production validation, but the black-box bundling sales model somewhat limits user innovation. In the short term, Mobileye targets the L3 level and below market, with more mature products. In the medium to long term, NVIDIA, targeting the L3 level and above market, has strong capabilities in AI, with a powerful latecomer advantage that will become more pronounced.

Qualcomm and Huawei belong to the 1.5 tier, with the potential to quickly break into the first tier. Qualcomm has significant advantages in communications and consumer electronics, and based on the successful experience of smartphone chips, has become the leader in smart cockpit domain chips. In the intelligent driving field, Qualcomm launched the Snapdragon Ride platform in January 2020, which is accelerating its application. Huawei’s AI chips cover all areas of cloud, edge, and terminal, with strong technical capabilities. In the intelligent driving field, Huawei’s corresponding products are Ascend 310 (for all edge sides), Ascend 610 (specifically for automotive), Ascend 320, etc. Additionally, in September 2020, Huawei released the new generation automotive-grade MDC computing platform (including MDC600, MDC300, MDC610, MDC210).

Horizon belongs to the strong second tier, providing solution-type products (chip + algorithm) externally, and can also supply separately. As a neutral third party, chips and algorithms can be sold separately or as an integrated solution, gaining customer trust and is expected to gradually realize domestic substitution.

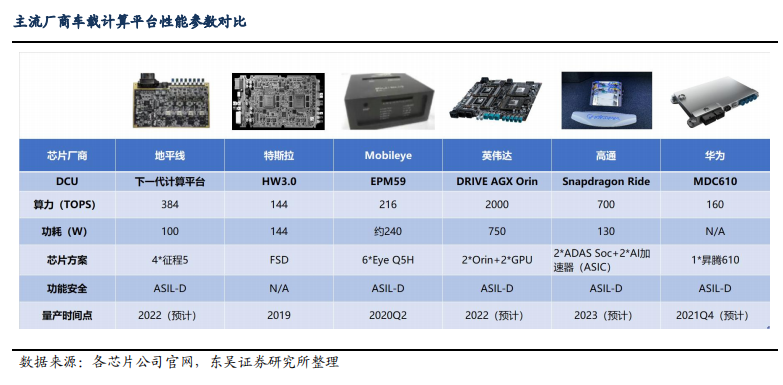

Each computing platform’s computational power exceeds 100 TOPS. In terms of the competitive landscape of onboard computing platforms among manufacturers, NVIDIA’s computational power is relatively leading, but its computational utilization rate is relatively low; while Tesla, Mobileye, and others, although their computational power is not outstanding, have higher computational utilization rates due to self-developed chips + algorithms.

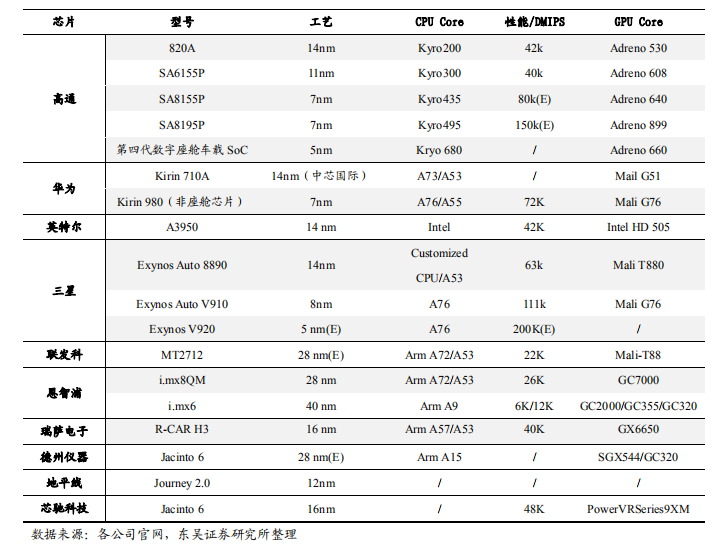

In terms of the layout of high-end cockpit domain chips, Qualcomm leads, followed by Intel, Renesas, and Samsung, while mid-to-low-end players like NXP, Texas Instruments, and domestic companies like Huawei, Horizon, MediaTek, and Chipscreen Technology are accelerating their entry.

The Qualcomm Snapdragon 820A digital cockpit platform supports computer vision and machine learning, providing rich graphics and multimedia capabilities, a wide range of visualization and operating system option combinations, and a neural processing engine. Many new models launched in 2020 are equipped with Snapdragon 820A, including Lynk & Co 05, Audi A4L, Xpeng P7, and 2020 Xpeng G3 models.

The Qualcomm Snapdragon SA8155P, which was mass-produced in 2020, is the first automotive-grade digital cockpit SoC built on TSMC’s first-generation 7nm process, with performance three times that of the original Qualcomm 820 platform. SA8155P also supports the new generation of networking technologies, including WiFi6 and Bluetooth 5.0, with better stability and speed during OTA processes. Many domestic automakers’ next-generation models, including NIO ET7, SAIC Zhiji, Great Wall WEY brand VV7 and Mocha, WM Motor EVOLVE and EX7, Leap Motor C11, BYD D1, Chery Jetour X70 PLUS, and GAC AION LX, will all be equipped with the SA8155P chip, further consolidating Qualcomm’s leading position in this field.

Automotive standards require certification for reliability standards such as AEC-Q series, quality management standards ISO/TS16949, among others. Additionally, they must meet functional safety standards ISO 26262 ASIL B(D). ISO 26262 was officially released on November 15, 2011, and includes four levels: ASIL A/B/C/D. ISO 26262 safety is one of the criteria for evaluating the stability of automotive electronic components. A higher level indicates that the product’s stability is qualified and durable, but it does not imply high computational power or energy efficiency. Furthermore, they must pass the zero-failure supply chain quality management standards TS16949/ISO 9000 international certification system; another is AEC-Q certification, which is a safety testing standard for automotive electronic components established by Chrysler, GM, and Ford.

The automotive AI chip market structure is clear, with industry oligopoly.

As of 2020, according to Mobileye data, it occupies about 70% of the mass production vehicle market. As L1/L2 level assisted driving gradually evolves to L3 level intelligent driving, suppliers from the consumer electronics/communications field such as NVIDIA, Huawei, Qualcomm, and domestic startups like Horizon and Black Sesame are accelerating their entry to seize market share in automotive AI chips. Computational power, power consumption, and ecosystem have become the core competitiveness for various chip manufacturers vying for the market. Tesla’s FSD chip is self-developed and used, leading industry development, belonging to an independent tier.

The chips used in Tesla have gone through Mobileye EyeQ3 and NVIDIA DRIVE PX2, later opting for self-development. The main advantages are: due to self-development and use, they can develop dedicated chips based on demand, reducing unnecessary software and hardware modules.

1) Shortening the R&D cycle and reducing design workload;

2) Improving energy efficiency;

3) User data-driven R&D optimization.

1) The ecosystem is relatively closed, with only internal development and use, unable to establish a complete ecosystem.

2) If usage is limited, chip development requires substantial investment, and the costs of software and hardware development are difficult to amortize through large-scale use.

NVIDIA, the AI leader in the global GPU field, and Mobileye, the automotive AI chip leader backed by Intel, belong to the first tier. NVIDIA, as the leader in general AI chips, provides chip-level products externally, possessing the most complete software toolchain and application ecosystem. Mobileye, backed by Intel, offers a chip + algorithm binding integrated solution, with the richest customer resources and has achieved mass production validation, but the black-box bundling sales model somewhat limits user innovation. In the short term, Mobileye targets the L3 level and below market, with more mature products. In the medium to long term, NVIDIA, targeting the L3 level and above market, has strong capabilities in AI, with a powerful latecomer advantage that will become more pronounced.

Qualcomm and Huawei belong to the 1.5 tier, with the potential to quickly break into the first tier. Qualcomm has significant advantages in communications and consumer electronics, and based on the successful experience of smartphone chips, has become the leader in smart cockpit domain chips. In the intelligent driving field, Qualcomm launched the Snapdragon Ride platform in January 2020, which is accelerating its application. Huawei’s AI chips cover all areas of cloud, edge, and terminal, with strong technical capabilities. In the intelligent driving field, Huawei’s corresponding products are Ascend 310 (for all edge sides), Ascend 610 (specifically for automotive), Ascend 320, etc. Additionally, in September 2020, Huawei released the new generation automotive-grade MDC computing platform (including MDC600, MDC300, MDC610, MDC210).

Horizon belongs to the strong second tier, providing solution-type products (chip + algorithm) externally, and can also supply separately. As a neutral third party, chips and algorithms can be sold separately or as an integrated solution, gaining customer trust and is expected to gradually realize domestic substitution.

Each computing platform’s computational power exceeds 100 TOPS. In terms of the competitive landscape of onboard computing platforms among manufacturers, NVIDIA’s computational power is relatively leading, but its computational utilization rate is relatively low; while Tesla, Mobileye, and others, although their computational power is not outstanding, have higher computational utilization rates due to self-developed chips + algorithms.

In terms of the layout of high-end cockpit domain chips, Qualcomm leads, followed by Intel, Renesas, and Samsung, while mid-to-low-end players like NXP, Texas Instruments, and domestic companies like Huawei, Horizon, MediaTek, and Chipscreen Technology are accelerating their entry.

The Qualcomm Snapdragon 820A digital cockpit platform supports computer vision and machine learning, providing rich graphics and multimedia capabilities, a wide range of visualization and operating system option combinations, and a neural processing engine. Many new models launched in 2020 are equipped with Snapdragon 820A, including Lynk & Co 05, Audi A4L, Xpeng P7, and 2020 Xpeng G3 models.

The Qualcomm Snapdragon SA8155P, which was mass-produced in 2020, is the first automotive-grade digital cockpit SoC built on TSMC’s first-generation 7nm process, with performance three times that of the original Qualcomm 820 platform. SA8155P also supports the new generation of networking technologies, including WiFi6 and Bluetooth 5.0, with better stability and speed during OTA processes. Many domestic automakers’ next-generation models, including NIO ET7, SAIC Zhiji, Great Wall WEY brand VV7 and Mocha, WM Motor EVOLVE and EX7, Leap Motor C11, BYD D1, Chery Jetour X70 PLUS, and GAC AION LX, will all be equipped with the SA8155P chip, further consolidating Qualcomm’s leading position in this field.

Source: Global Government and Enterprise Solutions

Gold Powder Mall Popular Book Rankings

☞ Gold Powder’s Favorite Book Rankings

☞ Mechanical Book Rankings

☞ Production Management Rankings

☞ Design Software Rankings

-

Index of Contents for the 2020 Issue of Automotive Craftsman Magazine

-

In 2021, many factories reduced or halted production, causing headaches for the global automotive industry.

-

Like China! The German automotive industry saw a significant decline in sales in July.

-

The implementation of Geely Automobile’s intelligent manufacturing strategy.

-

Research on the application of various RFID hybrid tracking systems for smart factories.

-

The necessity and goals of constructing digital factories for new energy batteries.

-

Matching of pure electric vehicle power systems and simulation of cruising range.

-

The best solution for transitioning from fuel vehicles to pure electric vehicles.

-

What is the lightest in automotive lightweight applications?

-

5G empowerment recommended by Ren Zhengfei has been published! This ppt lets you know everything.

-

Exploring aluminum body connection technology.

-

Xushui Intelligent Factory: 286 robots create luxury and safety for VV5s.