(Report Producer/Author: Dongfang Securities, Pu Junyi)

1. In the Era of Software-Defined Vehicles, the Architecture of Intelligent Automotive Software is Gradually Advancing Towards SOA

1.1 Software Becomes the Core of Differentiation for Intelligent Vehicles

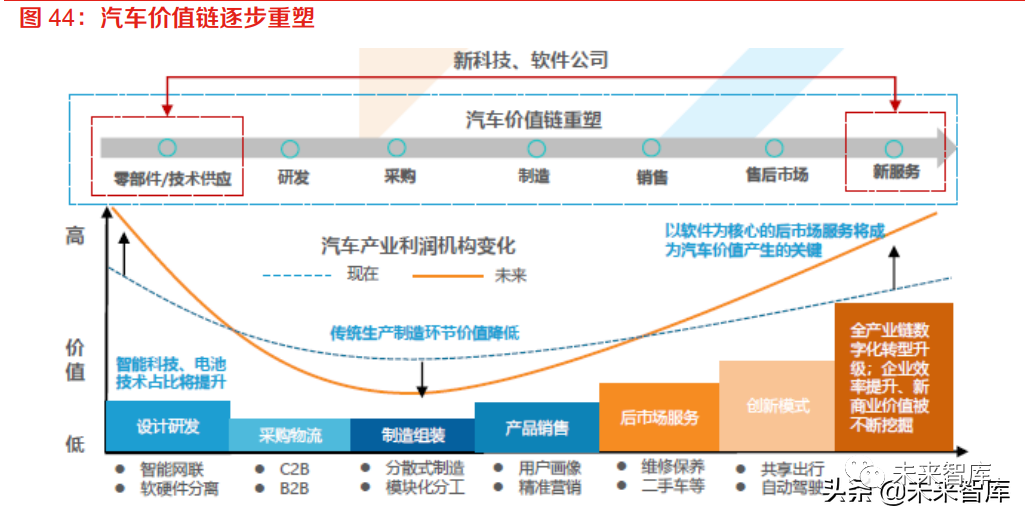

In the trend of automotive intelligence, “Software Defined Vehicles” (SDV) has become an industry consensus. Simply put, SDV means that software will deeply participate in the definition, development, verification, sales, and service processes of vehicles, continuously changing and optimizing each process to achieve ongoing improvement in experience, process, and value creation. Currently, different vehicle models are gradually converging in terms of hardware configuration, as major automakers have undergone a long competition in the hardware field, with limited room for continuous improvement in hardware and its costs. Compared to traditional vehicles, intelligent vehicles can create rich, perceptible value and a new driving experience for owners, which is key to differentiating various cars today. Therefore, software and algorithms have gradually become the core competitive elements for automakers, with the barriers to building vehicles evolving from the ability to assemble tens of thousands of components to the ability to integrate and run billions of lines of code.

The value of software is continuously increasing, and the global automotive software market is expected to grow rapidly. According to McKinsey, the structure of global automotive software and hardware product content is undergoing significant changes. The share of software-driven products increased from 7% in 2010 to 10% in 2016, and it is expected to reach 30% by 2030. In terms of scale, the global automotive software market size is projected to grow from $35 billion in 2020 to $84 billion, indicating vast potential for the future.

In the competition for the second half of intelligence, software and computing power have become the core of vehicles in the new era. Intelligence, connectivity, electrification, and sharing have become the inevitable trends in the transformation of the automotive industry, with automotive products gradually shifting from traditional mechanical tools for transportation to a new generation of intelligent terminals equipped with perception and decision-making capabilities.

In the wave of the “new four modernizations” of automobiles, Wang Chuanfu, Chairman and President of BYD, stated at the 2021 Lenovo Innovation Technology Conference: “Electrification is the first half, and intelligence is the second half. Intelligence is a greater transformation, creating an ecosystem beyond imagination.” In the era of electric vehicles, core technologies like batteries and electric drives form BYD’s moat, and Wang believes that in the next era of automobiles, software will determine automotive competitiveness.

At the 2021 Huawei Intelligent Automotive Solutions Ecosystem Forum, Yu Chengdong, CEO of Huawei’s Intelligent Automotive Solutions BU, also stated that the era of electrification, connectivity, and intelligence has arrived. Compared to traditional vehicles, the essence of intelligent vehicles has changed, with computing and software becoming the core.

It is foreseeable that in the future, automotive intelligence will become the focus of competition among major manufacturers, and software capabilities will be key to defining the functions of entire vehicles.

“Hardware pre-installed, software upgraded” has become the mainstream strategy for automakers, and there is significant room for optimization of automotive software and algorithms in the future. Currently, intelligent driving systems for mass-produced passenger vehicles are generally at L3 or below, and intelligent driving technology is still undergoing continuous iterations and upgrades. Automotive products have a long lifecycle, typically 5-10 years, and the computational power limit of onboard computing platforms determines the upper limit of software service upgrades that can be supported throughout the vehicle’s lifecycle. In contrast, software iterations occur more rapidly, leading to a mismatch between the iteration cycle of intelligent driving software and the hardware replacement cycle. To ensure continuous software upgrade capabilities throughout the vehicle’s lifecycle, manufacturers adopt a strategy of “hardware pre-installed, software upgraded” for intelligent driving, providing ample development space for subsequent software and algorithm upgrades by pre-installing high-performance chips. Automakers like NIO, Zhiji, WM Motor, and XPeng have all upgraded the intelligent driving computing power of their new generation models to the 500-1000 Tops level.

China’s intelligent automotive industry is developing at a speed that leads the world, and the realization of L3 and above autonomous driving is expected to bring greater opportunities for the industry. Driven by tremendous consumer demand, companies in China’s automotive industry chain are closely cooperating, not only building a virtuous interactive ecosystem but also rapidly improving industry standards.

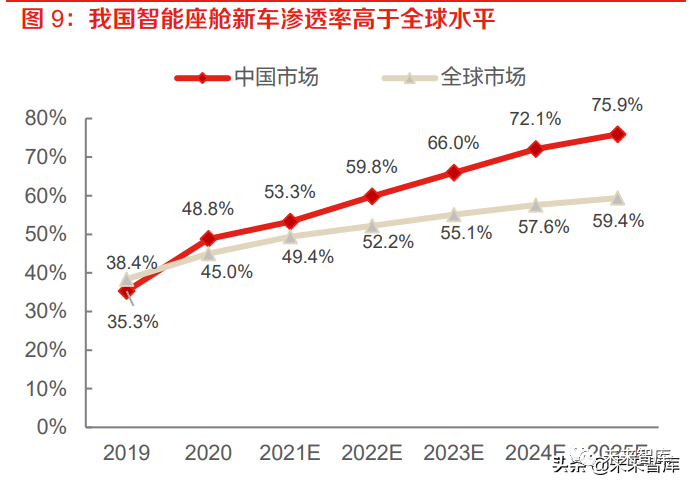

According to IHS Markit data, the penetration rate of intelligent cockpits in new vehicles in China reached 48.8% in 2020, and it is expected to exceed 75% by 2025, with both the penetration rate and the speed of increase surpassing the global average.

Ms. Zhou Xiaoying, CEO of Gaishi Automotive, also pointed out that China’s autonomous driving industry is currently at the world’s leading level. From the cockpit domain to the driving domain, the emergence of high-performance chips in recent years has accelerated the evolution of intelligent vehicles towards higher levels of autonomous driving. For example, NVIDIA launched Xavier (30 TOPS), DRIVE Orin (254 TOPS), and DRIVE Atlan (1000 TOPS). According to Horizon data, achieving L3 autonomous driving requires a computing power of 20-30 TOPS, while L4 requires over 200 TOPS. It is evident that the current chip computing power has already “prepared” for L3 and higher levels of autonomous driving.

According to iResearch, with the continuous improvement of regulations related to intelligent driving, L3 conditional autonomous driving passenger vehicles are expected to gradually land in 2023. Considering the high computing power pre-installed in new models of China’s new force car manufacturers, we believe that 2022-2023 will become a critical node for the development of L3 and higher levels of autonomous driving, with automakers and software suppliers possessing leading software and algorithm capabilities likely to seize significant opportunities.

1.2 Decoupling of Software and Hardware Drives the Evolution of Automotive Software Architecture Towards SOA

Traditional distributed EE architecture struggles to meet the demands of the software-defined vehicle era:

1> In traditional EE architecture, software and hardware are highly embedded, making the realization of software functions heavily reliant on hardware. To add a single function, all related ECU software must be modified, along with changes to the wiring and harness layout inside the vehicle. The complexity of function or system upgrades is greatly increased, making integration and validation by automakers more difficult. To implement more complex functions, multiple controllers must be developed simultaneously for validation; if any one of them has an issue, it may cause the entire function to fail;

2> Under the traditional distributed EE architecture, ECUs are developed by different suppliers, making the framework non-reusable and non-unified. Additionally, external developers cannot program ECUs or define new functions through software for hardware upgrades;

3> Based on the traditional distributed EE architecture, automakers are merely the definers of the architecture, with core functions completed by various ECUs, and software development primarily carried out by Tier 1 suppliers. This has led to the past majority of automakers having relatively weak software development capabilities.

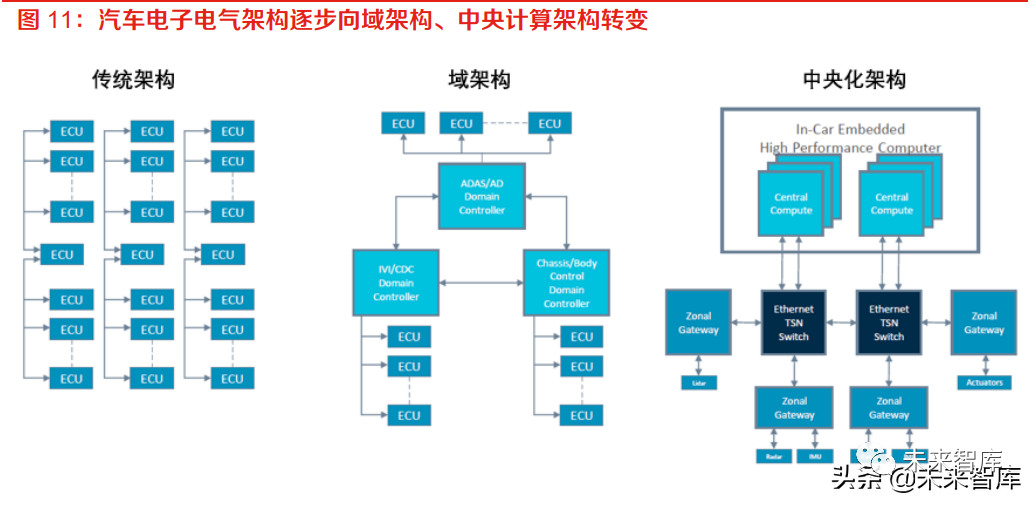

As vehicles continue to evolve towards intelligence and connectivity, the traditional distributed electronic and electrical architecture centered around microcontrollers has become increasingly inadequate to meet the development needs of future intelligent automotive products. It also faces computational power constraints, communication efficiency defects, and uncontrolled wiring costs. Therefore, the automotive electronic and electrical architecture is transitioning from a traditional distributed architecture to a domain architecture and centralized computing architecture, with centralized EE architecture being a crucial hardware foundation for realizing software-defined vehicles.

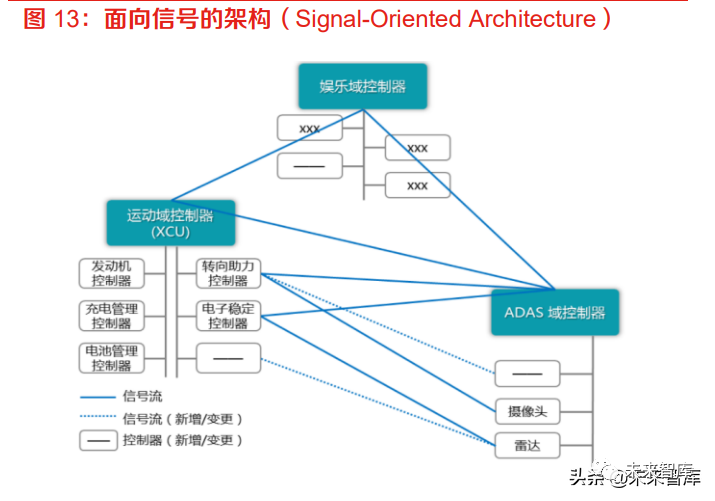

Under centralized EE architecture, software and hardware are decoupled, leading to the gradual generalization and platformization of software development. Distributed software architecture is signal-oriented, where controllers communicate via signals, and the entire system is closed and static, defined at the compilation stage. Therefore, if the automaker wants to modify or add a function definition for a controller, and that instruction must also call a function on another controller, all necessary controllers must be upgraded, significantly extending development cycles and increasing development costs.

At this point, software and hardware are highly embedded, making it difficult for hardware to form strong synergy, and the overall reusability and OTA upgrade capabilities of automotive software are weak. As the automotive EE architecture gradually centralizes, domain controllers or centralized computing platforms are deployed in a layered or service-oriented architecture, significantly reducing the number of ECUs. The underlying hardware platform of the vehicle needs to provide more powerful computational support, and software is no longer developed based on specific hardware but must possess portability, iterability, and scalability.

The original R&D organization based on ECUs will undergo transformation, forming a new type of R&D organization consisting of general hardware platforms, basic software platforms, and various application software.

To realize software-defined vehicles, the architecture of intelligent automotive software must transition to SOA. In the past, automotive software architecture was more signal-oriented, where the functions of ECUs were fixed, and software was pre-written in controllers. However, with the development of intelligent vehicles, the number of ECUs onboard has rapidly increased, making point-to-point communication between ECUs very complex and lacking flexibility and scalability. Even minor changes in function can lead to changes in the entire vehicle communication matrix and the software of each ECU. SOA (Service-Oriented Architecture) is a software architecture and design methodology characterized by standardized interfaces, loose coupling, and flexibility:

1> In SOA architecture, each service has a unique and independent identifier (ID), defining a clear functional scope and completing its publishing, subscription to other services, and communication via service middleware. Therefore, SOA architecture resolves the issue in traditional architectures where changes in individual functions lead to changes in the entire communication and routing matrix. Additionally, every service component interface in the SOA architecture is “standard accessible,” meaning that the design and deployment of service components no longer depend on specific hardware platforms, operating systems, or programming languages, allowing the same components/functions to be reused across different vehicle models, achieving “software-hardware separation.”

2> In the era of intelligent vehicles, the iteration cycle of software is becoming shorter, and independent software upgrades from hardware are key to continuously providing value to customers.Due to the “loose coupling” characteristic of SOA architecture, service components and hardware can be standardized for access and utilization. To add a function, it is sufficient to add the corresponding service component and enable it to call different hardware functions.Thus, under SOA architecture, developers can focus more on developing upper-layer applications without needing to recompile underlying algorithms or software in each ECU, solving the pain point of redundant development of the same application across different vehicle models and hardware environments, making the automotive software architecture very flexible and easy to expand.

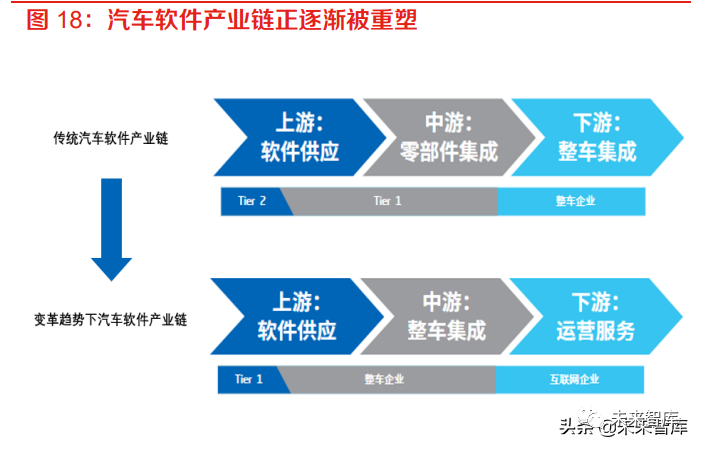

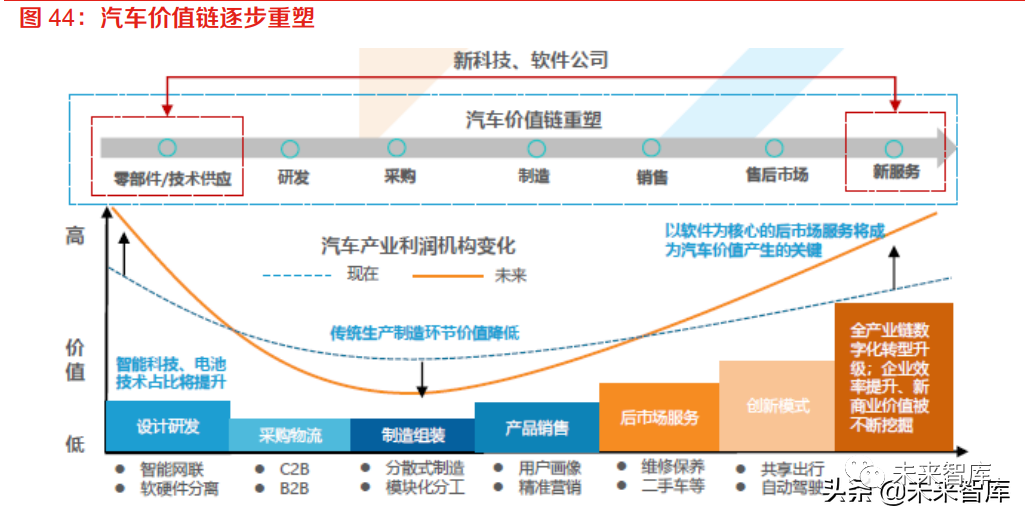

In the context of decoupling of software and hardware and the transition of automotive software architecture towards SOA, the automotive software industry chain is gradually being reshaped:

1> Automakers are beginning to emphasize the building of software capabilities, enhancing software self-research capabilities, system architecture capabilities, and SOA architecture capabilities to strengthen software-hardware decoupling. Currently, most automakers have completed the supplementation or upgrading of software self-research capabilities, establishing platform architecture systems, and their traditional development models are transitioning to development models focused on software-defined vehicles.

2> Software suppliers are leaping to become Tier 1 suppliers. As the difficulty of automotive software development increases, the R&D capabilities of traditional automotive component suppliers can no longer meet the demands. As a result, automakers are beginning to bypass traditional Tier 1 suppliers and directly collaborate with existing Tier 2 suppliers (chip manufacturers, software algorithm vendors, etc.). In the era of software-defined vehicles, the importance of software is evident, and to gain control and reduce high R&D costs, automakers often choose to directly cooperate with software suppliers that possess strong independent algorithm R&D capabilities, thus these software suppliers become Tier 1 manufacturers. In the future, the profit model for software suppliers is expected to shift, with licensing fees for developing base platforms, royalty charges for supplying functional modules, and customized secondary development becoming mainstream strategies.

Automakers are actively developing SOA software architecture, and the next few years may see a peak in SOA mass production. Currently, most OEM automakers are still in the hardware architecture upgrade stage, with only Tesla and Volkswagen having completed the development and construction of customized OS kernels and scaled applications. The decoupling of automotive software and hardware is also in its early stages, with automakers focusing on developing foundational software (system software layer) as a priority.In the long term, SOA will restructure the automotive ecosystem, and the automotive industry is likely to replicate the software division of labor model seen in PCs and smartphones.Automakers can build operating systems and SOA platforms either independently or in collaboration with suppliers, introducing a large number of algorithm suppliers and ecosystem partners to form a developer ecosystem. In this context, automakers are actively developing SOA software architecture, and the next few years are expected to usher in a peak in SOA mass production.(Source of the report: Future Think Tank)

2. Overview of Intelligent Automotive Software Architecture

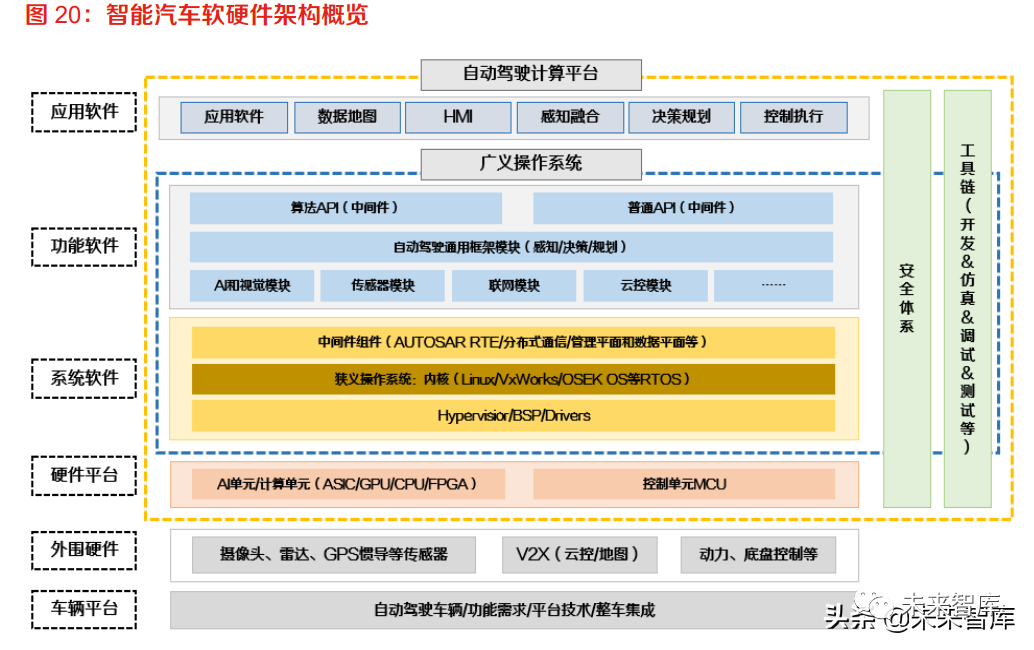

Looking at the hardware and software architecture of intelligent vehicles, the lowest level consists of the vehicle platform and peripheral hardware (sensors, V2X, power and chassis control, etc.), above which is the autonomous driving computing platform, which is also the core of achieving automotive intelligence. Further, the autonomous driving computing platform can be divided into two main parts: hardware platform and software, where the software layer from bottom to top is:

1> System software: Composed of hardware abstraction layer, OS kernel (narrowly defined operating system), and middleware components, it is the core part of the broad definition of operating systems;

2> Functional software: Mainly consists of core common functional modules for autonomous driving, including general frameworks for autonomous driving, AI and vision modules, sensor modules, and related middleware. System software and functional software together form the broad definition of the operating system.

3> Application software: Mainly includes scenario algorithms and applications, forming the core of differentiation for intelligent cockpits (HMI, application software, etc.) and autonomous driving (perception fusion, decision planning, control execution, etc.).

2.1 System Software:Provides basic functionality and underlying environment support, being the core of the operating system

System software is the foundation of onboard operating systems, providing efficient and stable environment support for upper-layer applications and functions, and acting as a bridge for scheduling various applications to access underlying hardware resources. Generally, system software comprises hardware abstraction layer, OS kernel (narrowly defined operating system), and middleware components.

2.1.1 Hardware Abstraction Layer: Hypervisor and BSP Build the “Bridge” Between Software and Hardware

In automotive electronic and electrical systems, different ECUs provide different services, and the requirements for the underlying operating system also differ. According to ISO 26262 standards, automotive instrument systems and entertainment information systems belong to different safety levels, with different processing priorities. The automotive instrument system is closely related to the power system, requiring high real-time performance, reliability, and safety, primarily based on the QNX operating system; while the infotainment system mainly provides a control platform for human-machine interaction inside the vehicle, pursuing diverse applications and services, primarily based on Linux and Android.

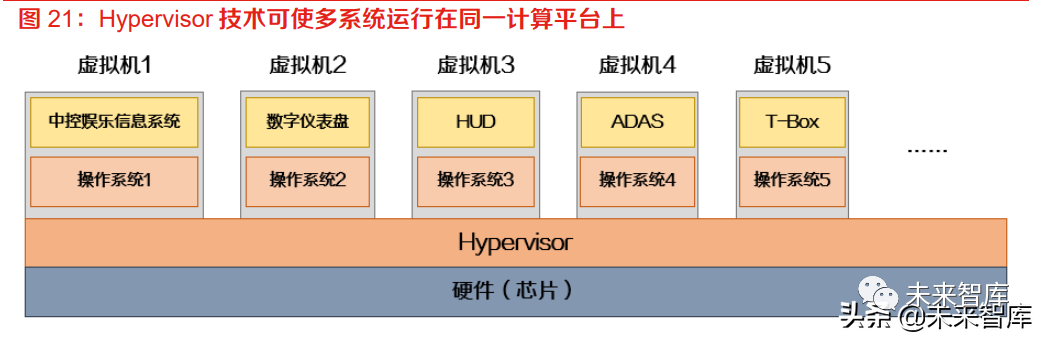

As the EE architecture trends towards centralization, the emergence of virtualization (Hypervisor) technology has made “multi-system” a reality. In the context of the evolution of electronic and electrical system architecture from distributed to domain-centric, various functional modules are centralized in a few powerful domain controllers. At this point, applications of different safety levels need to share the same computing platform, breaking traditional physical safety isolation. Virtualization (Hypervisor) technology can simulate a computer system running in a completely isolated environment with complete hardware system functionality, meaning that suppliers no longer need to design multiple hardware systems to meet different functional requirements; instead, they only need to perform virtualization software configuration on the vehicle’s main chip, forming multiple virtual machines, running the corresponding software in each virtual machine to meet the requirements. The Hypervisor provides flexibility for carrying heterogeneous operating systems on the same hardware platform while achieving good reliability and fault control mechanisms to ensure safety isolation between critical tasks, hard real-time applications, and general-purpose, untrusted applications, achieving the integration of automotive computing units and sharing of computational power.

In the field of onboard virtualization, mainstream Hypervisor technology providers include BlackBerry QNX Hypervisor (closed source) and ACRN (open source) led by Intel and the Linux Foundation. Currently, only QNX Hypervisor has been applied to mass production vehicles, and it is the only virtualization operating system on the market recognized for achieving ASIL D level functional safety.Domestic manufacturers are also joining the two mainstream virtualization technology ecosystems:In 2017, Zhongke Chuangda and Chengmai Technology were selected for BlackBerry’s VAI program (which aims to establish a global expert network based on BlackBerry’s embedded technology and Certicom security technology to expand the embedded software market), allowing the company to develop integrated services and safety-critical solutions based on BlackBerry’s embedded technology;Neusoft Group became a member of the ACRN project early on;In 2019, ACRN established a strategic partnership with Runhe Software.

BSP supports the operating system’s better operation on hardware motherboards. BSP (Board Support Package) refers to the board-level support package. For general embedded systems, the hardware part needs to be designed by embedded hardware engineers, while newly manufactured circuit boards require BSP to ensure stable operation, after which software development can proceed. BSP is one of the system software that lies between the motherboard hardware and the operating system. Its main purpose is to support the operating system to run better on the hardware motherboard. BSP is defined in relation to the operating system, and different operating systems correspond to different definitions of BSP. For example, the BSP for VxWorks and the BSP for Linux may implement the same functions for a given CPU, but their writing methods and interface definitions are completely different, so writing a BSP must adhere to the definition form of that system’s BSP to maintain the correct interface with the upper OS. Since BSP lies between the hardware and the operating system, as well as upper application programs, BSP programmers need to have a certain understanding of hardware, software, and operating systems.

2.1.2 OS Kernel:QNX, Linux, and VxWorks are the mainstream

Automotive operating systems can be divided into narrow OS and broad OS, with the OS kernel belonging to the narrow OS. As mentioned earlier, the autonomous driving computing platform is divided into four layers from bottom to top: hardware layer, system software layer, functional software layer, and application software layer. Broad OS refers to the software collection formed by the system software layer (including hardware abstraction layer, OS kernel, middleware components) and functional software, while narrow OS refers only to the OS kernel. Specifically, the OS kernel, also known as the “bottom layer OS,” provides the most basic functions of an operating system, managing system processes, memory, device drivers, files, and network systems, determining the system’s performance and stability, and is the core of the system software layer.

Currently, the narrow OS kernel is dominated by QNX, Linux, and VxWorks. The landscape for autonomous driving OS kernels is relatively stable, with the main players being QNX (Blackberry), Linux (open-source foundation), and VxWorks (Wind River). Since creating a brand-new OS requires significant manpower and resources, there are currently no companies developing entirely new OS kernels. Whether it is Waymo, Baidu, Tesla, Mobileye, or some autonomous driving startups and automakers, so-called self-developed autonomous driving OS refers to the development of middleware and application software based on existing kernels.

QNX, Linux, and VxWorks have the following distinctions:

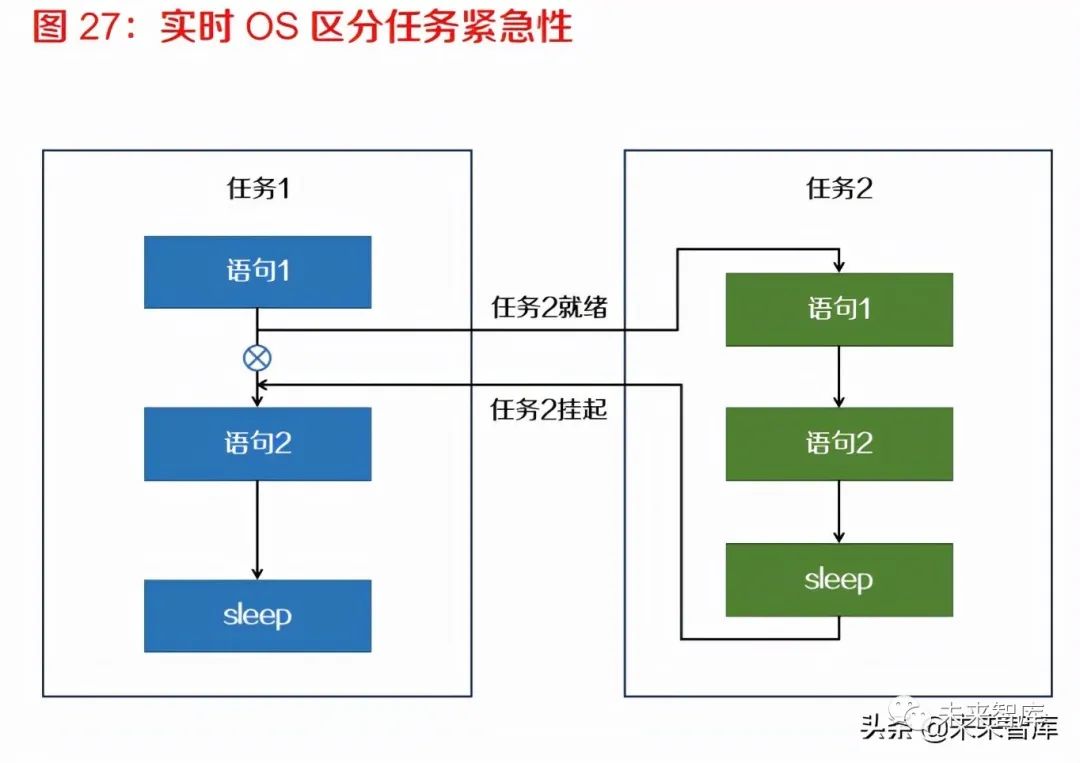

1> Real-time performance: OS kernels can be divided into time-sharing OS and real-time OS based on whether they prioritize tasks to be executed. The former treats all users/jobs fairly, without distinguishing the urgency of tasks; the latter refers to the ability to switch to a high-priority urgent task within a strict time limit when it needs to be executed. Real-time OS can further be divided into hard real-time and soft real-time: hard real-time systems have rigid, unchangeable time limits and do not allow any errors beyond the deadline; soft real-time systems have flexible time limits and can tolerate occasional timeout errors. Both QNX and VxWorks are real-time OS and belong to hard real-time OS. Initially, Linux was a time-sharing OS, but its improvements in real-time performance have never ceased. After optimization, the Linux kernel is also divided into preemptive and non-preemptive kernels, with the preemptive kernel’s real-time performance sufficient to meet the demands of autonomous driving. Therefore, the significantly improved RT Linux has effectively become a hard real-time operating system.

2> Openness: QNX is a semi-closed system, while both Linux and VxWorks are open-source systems. The term “semi-closed” means that the kernel of QNX cannot be modified by customers, but customers can write their own middleware and application software; open-source means that all kernel source code is open to customers, who can customize it according to their actual needs, offering high configurability.Compared to QNX, Linux’s larger advantage lies in its open-source nature, allowing it to run on various CPU architectures, adapting to more application scenarios, and offering a richer software library to choose from, thus having strong flexibility for customized development. VxWorks is also open-source, and VxWorks RTOS consists of over 400 relatively independent, compact target modules, allowing users to obtain all source code and customize and configure the OS kernel at the source code level as needed.

3> Kernel architecture: QNX and VxWorks are microkernels, meaning that the kernel contains only the most basic scheduling and memory management, with drivers and file systems implemented by user-mode daemons. The advantages of microkernels include stability, fewer vulnerabilities, and the fact that errors in drivers only cause bugs in the respective processes without crashing the entire system, while also being highly flexible and easy to expand, allowing for convenient addition and removal of functions in the operating system. The downside is that frequent system calls and information transfer reduce the OS’s operational efficiency. Linux is a monolithic kernel, meaning that besides basic process, thread, and memory management, file systems, drivers, and network protocols are all included in the kernel, which has the advantage of high efficiency, fully utilizing hardware performance. However, the complexity of the kernel structure and its instability means that bugs during development can crash the entire system, making the development threshold for Linux quite high.

4> Licensing: QNX occupies the top position in the automotive embedded operating system market due to its safety, stability, and real-time performance, but it requires commercial licensing fees. While both VxWorks and Linux are open-source systems, the difference lies in that Linux is free, while VxWorks is paid. Both QNX and VxWorks require high licensing fees, and the cost of developing custom solutions is also high, which may hinder their market share growth to some extent; in contrast, Linux’s free nature provides a strong attraction for automakers.

In summary, when choosing an OS kernel, automakers primarily consider factors such as openness, scalability, ease of use, safety, reliability, and cost, balancing these with their own needs and capabilities.

2.1.3 Middleware:AUTOSAR Standard is Widely Applied

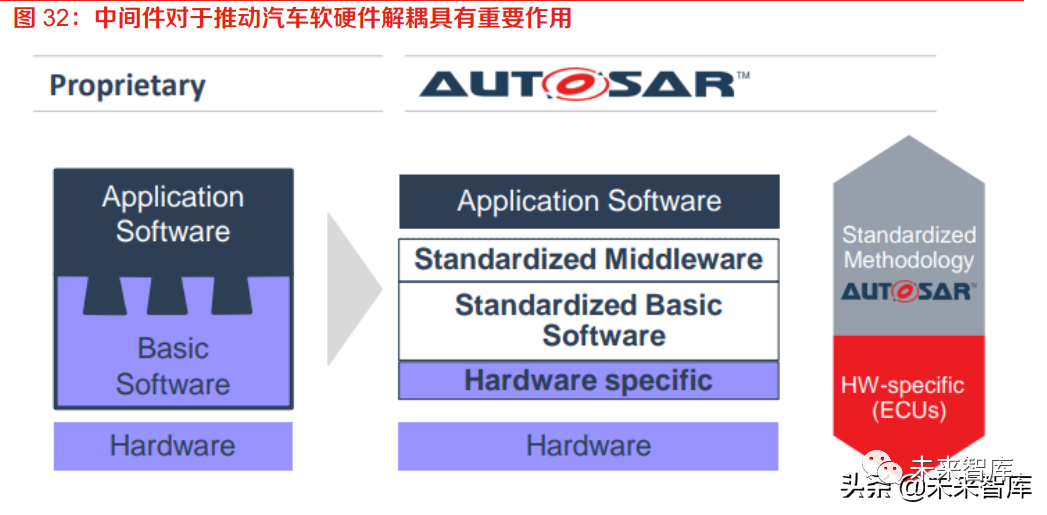

Middleware is an important category of foundational software located above hardware and operating systems, below application software. Middleware serves as a significant type of foundational software in automotive software architecture, positioned above hardware and operating systems, and below application software. Its overall function is to provide an operating and development environment for the application software above it, helping users flexibly and efficiently develop and integrate complex application software, while also managing computing resources and network communication between different technologies.

In the era of software-defined vehicles, the role of middleware is becoming increasingly important. As the EE architecture gradually centralizes, the automotive software system has seen the emergence of multiple operating systems coexisting, leading to increased system complexity and development costs. To improve software manageability, portability, configurability, and quality, it is necessary to define a set of architecture, methodology, and application interfaces to achieve standardized interfaces, high-quality seamless integration, efficient development, and management of complex systems through new models. The core idea of middleware is “unified standards, decentralized implementation, centralized configuration”: only with unified standards can various vendors provide a common open platform; decentralized implementation requires the software system to be hierarchical and modular, reducing coupling between applications and platforms; since different modules come from different vendors and have complex interrelations, integrating them into a complete system necessitates the centralized management of all module configuration information in a unified format. With automotive software middleware in place, all software and applications have standardized interfaces, and hardware functions are abstracted into services that can be called by upper-layer applications at any time; software development can adapt across configurations, vehicle models, platforms, and hardware; software developers can focus more on the differentiation of software functions; software certification can rely on established standards. Therefore, it can be said that middleware plays a crucial role in the trend of decoupling automotive software and hardware.

Among all middleware solutions, AUTOSAR is currently the most widely applied standard specification for automotive electronic systems.AUTOSAR (Automotive Open System Architecture) refers to an automotive open architecture, a collaborative development framework for automotive electronic systems jointly established by global automotive manufacturers, component suppliers, and various research and service institutions, establishing an open standard software architecture for automotive controllers (ECUs) and defining standards for vehicle operating systems and API interfaces.In July 2003, nine automotive industry giants, including BMW, Bosch, Continental, Daimler, Ford, General Motors, PSA, Toyota, and Volkswagen, initiated the establishment of the AUTOSAR alliance, which later became the core members of the AUTOSAR alliance.As of July 2021, the AUTOSAR alliance has over 300 partners, including major global automakers, Tier 1 suppliers, standard software suppliers, development tools and service providers, semiconductor suppliers, universities, and research institutions, including domestic manufacturers such as Huawei, Baidu, Great Wall, Dongfeng, FAW, SAIC, Geely, NIO, Byton, and CATL.

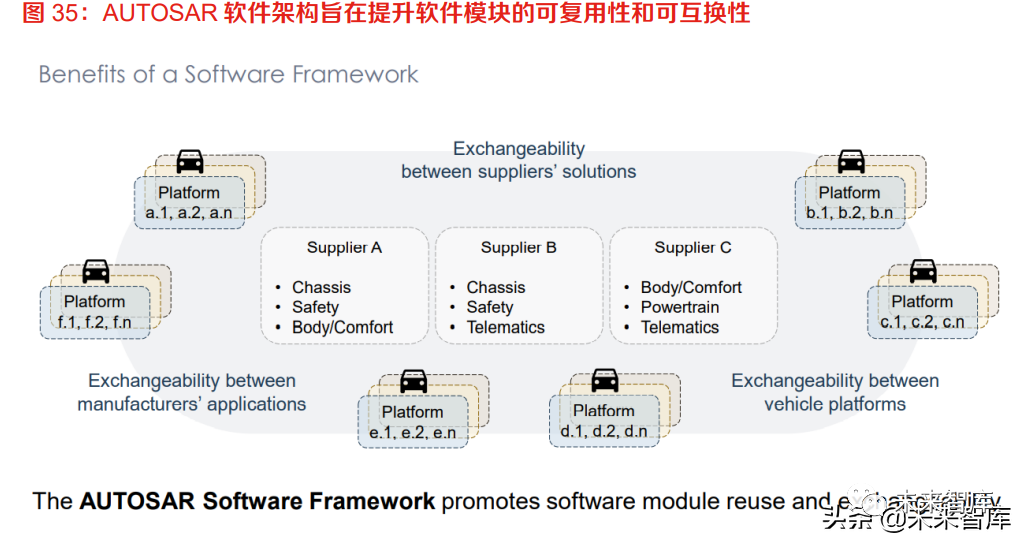

AUTOSAR aims to improve the management of complex automotive electronic and electrical architectures by enhancing the reusability and interchangeability of software modules between OEMs and suppliers. The automotive industry has numerous automakers and suppliers, each OEM having different suppliers and models, with each supplier supplying to multiple OEMs. If similar products can be reused across different models or if products from different suppliers can be made compatible, development costs can be significantly reduced. To this end, the AUTOSAR alliance has established a layered software architecture independent of hardware; methodologies for implementing applications, including seamless software architecture stacking processes and integrating application software into ECUs; and various vehicle application interface specifications as integration standards for application software to be reused across different automotive platforms. With standardized interfaces between application software and underlying software, developers can focus on functionality development without worrying about the target hardware platform.

Currently, AUTOSAR has two major platforms: Classic Platform and Adaptive Platform, corresponding to traditional control-type vehicle electronic systems and high-performance vehicle electronic systems for autonomous driving:

1> Classic Platform (CP): Classic Platform is AUTOSAR’s solution for traditional vehicle control embedded systems, with strict real-time and safety requirements. From an architectural perspective, the Classic Platform can be roughly divided from bottom to top into microcontrollers, basic software layer, runtime environment layer, and application software layer. The Classic platform software architecture achieves the layering and modularization of automotive software, encapsulating hardware-dependent and non-hardware-dependent software. Additionally, if using a toolchain for development, the basic software can achieve functional trimming and algorithm logic through configuration parameters, facilitating the development of basic software. Furthermore, standardized interfaces facilitate the integration of basic software with hardware abstraction layer software, shortening the development cycle and providing OEMs with more options.

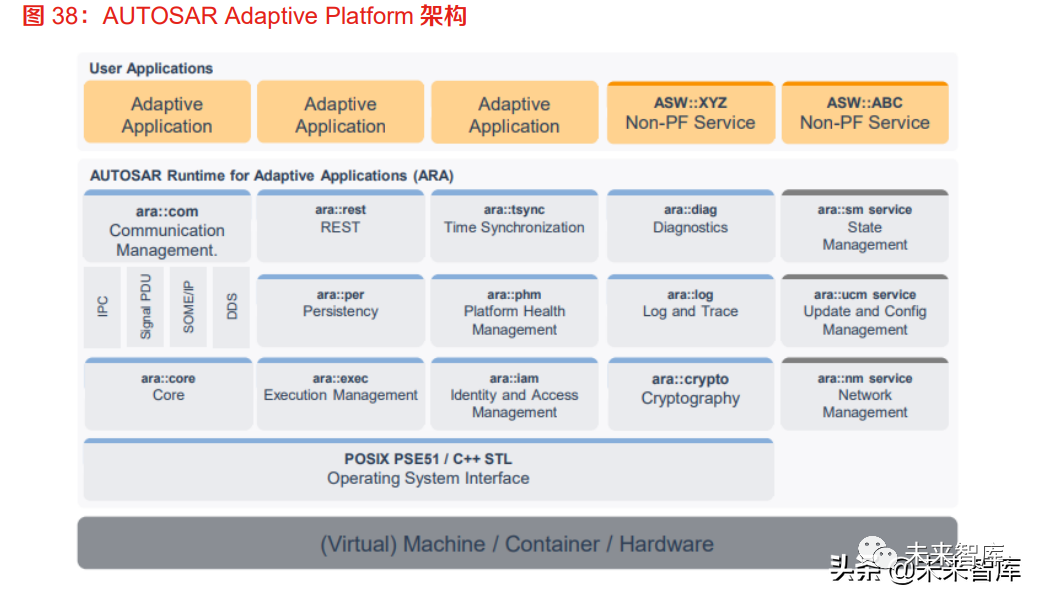

2> Adaptive Platform (AP): Adaptive Platform is a new type of software architecture standard for automotive electronic systems proposed by AUTOSAR, aimed at future autonomous driving, vehicle networking, and other complex scenarios. The Adaptive platform has modified many contents of the Classic platform standard, adopting an operating system based on the POSIX standard and developed with an object-oriented approach, making all standard POSIX APIs available, primarily to meet the needs of current automotive trends in autonomous driving, electrification, and connectivity. The Adaptive Platform can be divided into three layers from bottom to top: (1) Hardware layer: AP can view the running hardware as a Machine, meaning that hardware can be virtualized through various management program-related technologies, achieving a consistent platform view; (2) Real-time runtime environment layer (ARA): composed of a series of application interfaces provided by functional clusters, divided into API and service interface types; (3) Application layer: a series of applications running on the AP.

Compared to the Classic Platform, the Adaptive Platform is more suited to the current trend of automotive architecture transitioning towards SOA.As mentioned earlier, the current automotive architecture may integrate multiple systems on the same hardware platform, for example, ECUs related to in-vehicle infotainment typically use Linux, QNX, or other general-purpose operating systems.Although the Classic Platform supports AUTOSAR OS (OSEK OS), the Adaptive Platform supports virtualization technology and a multi-system coexistence architecture, allowing the use of any POSIX OS, including those achieving ASIL-D level operating systems, offering broad compatibility and high portability, thus AP has advantages over CP.Moreover, CP primarily supports signal-oriented architecture (Signal-Oriented Architecture), mainly based on static configuration communication methods (CAN, LIN), making post-development functional upgrades difficult; AP primarily supports service-oriented architecture (SOA), mainly based on service-based SOA dynamic communication methods (SOME/IP), virtualizing the connection relationships between hardware resources, not limited to the wiring harness connections, allowing for flexible online upgrades of software.Therefore, AP focuses more on providing high-performance computing and communication mechanisms, offering flexible software configuration methods, making it more suitable for the rapidly developing era of intelligent vehicles.

For intelligent vehicles with a new E/E architecture, AUTOSAR and middleware OS will be key focus areas for many Tier 1 suppliers. Currently, globally known AUTOSAR solution providers include ETAS (Bosch), EB (Continental), Mentor Graphics (Siemens), Wind River (TPG Capital), Vector, KPIT (a joint venture between the US and India), etc. In China, the development toolchains and basic software under the Classic AUTOSAR standard are dominated by overseas suppliers, including EB, ETAS, Vector, etc., while domestic manufacturers mainly include Neusoft Ruichi, Huawei, and Jingwei Hengrun; domestic Adaptive AUTOSAR is still in its early stages, with Continental EB collaborating with Volkswagen to apply the AP AUTOSAR and SOA platform to Volkswagen’s MEB platform ID series of pure electric vehicles. Previously, the overall standard and industrial ecology of automotive basic software architecture in China lagged behind, but under the trend of intelligent transformation and upgrading, domestic manufacturers are increasingly focusing on AP AUTOSAR, launching corresponding middleware and toolchain products to seize market opportunities.

2.2 Functional Software:Provides core common modules for autonomous driving, supporting the realization of autonomous driving technology

In the automotive software architecture, the functional software layer mainly includes core common functional modules for autonomous driving and related middleware. Based on SOA architectural design principles, by extracting the core common needs of autonomous driving, common functional modules for autonomous driving have been formed, including general framework modules for autonomous driving, networking modules, cloud control modules, AI and vision modules, sensor modules, etc. Utilizing these common functional modules, developers can conduct R&D at the business level of autonomous driving more efficiently, shortening the development cycle of intelligent driving systems; based on their own strategies, automakers can choose different functional modules and algorithm components when designing and developing functional software, achieving a modular combination of functions and flexibly constructing intelligent driving system-level solutions, thereby reducing system integration costs. The functional software layer, along with system software, collectively constitutes the broad definition of the autonomous driving operating system, supporting the realization of autonomous driving technology.

1> General Framework Module for Autonomous Driving: The general framework module for autonomous driving is the core and driving part of functional software. L3 and higher-level autonomous driving systems possess general, common framework modules such as perception, planning, and control, along with their sub-modules. On one hand, autonomous driving generates common needs for safety and productization, and designing and implementing general framework modules to meet these common needs is fundamental to ensuring that autonomous driving systems are real-time, safe, scalable, and customizable. On the other hand, key algorithms (especially AI algorithms) are continuously evolving, such as deep learning perception algorithms based on CNN frameworks, multi-source information fusion positioning algorithms based on high-precision maps, decision planning algorithms based on general AI, and control algorithms based on vehicle dynamics models. The general framework module defines the core, common functions and data flows of autonomous driving, including the implementation of common modules; it provides external API interfaces and services to integrate non-common or evolving algorithms, HMI, etc.; the design and implementation of the general framework module can fully utilize the increasingly mature sub-modules of algorithms from different fields in the market, facilitating high-quality and efficient rapid iteration of products.

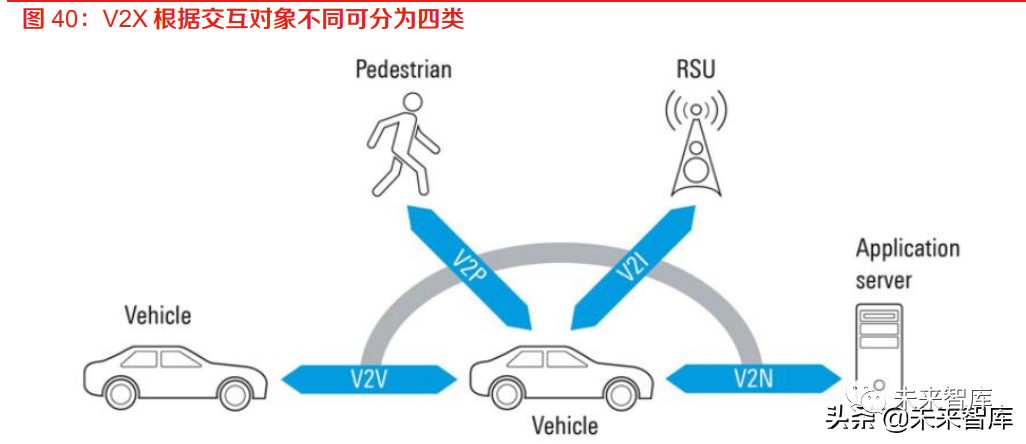

2> Networking Module: The networking module is a functional sub-module in the autonomous driving operating system that implements network communication and processes network data. In addition to meeting the requirements of conventional networking service scenarios, this sub-module achieves collaborative perception, planning, and control in networked autonomous driving through improved design of the general framework module. Network data is obtained through V2X (vehicle-to-everything wireless communication technology), including road test data, camera data, intelligent traffic lights, road traffic alerts, and other vehicle information, which, combined with various detection methods from the single vehicle sensor system, can effectively extend the perception range of a single vehicle to hundreds of meters, enabling collision avoidance between vehicles and directly controlling vehicle start and stop based on alerts.The organic combination of single-vehicle intelligence and V2X networking capabilities enhances the overall perception, decision-making, and control capabilities of the autonomous driving system, reduces autonomous driving costs, and ultimately realizes driverless operation. This sub-module is a typical feature of intelligent connected vehicles and one of the core functions of the autonomous driving operating system.

3> Cloud Control Module: The cloud control module is a functional sub-module that interacts with the cloud control infrastructure. The cloud control infrastructure provides dynamic foundational data on vehicle operations, infrastructure, and traffic environments for intelligent connected vehicles and their users, management, and service institutions. The cloud control infrastructure features high-performance information sharing, high real-time cloud computing, and multi-industry application big data analysis as foundational service mechanisms. The cloud control module, supported by the general framework module for autonomous driving, provides the data support required by the cloud control infrastructure while achieving real-time synchronization of cloud-end perception, planning, and control data through high-speed communication with central cloud/edge cloud, realizing collaborative division of labor between cloud and edge, such as cloud perception based on extensive multi-vehicle perception, cloud multi-vehicle perception fusion, and cloud final decision-making.

4> AI and Vision Module: Functional software needs to support deep learning embedded inference frameworks to facilitate the migration and adaptation of mature algorithms. Autonomous driving is a significant application scenario for deep learning algorithms, especially in vision, lidar, and decision-making planning. Algorithm companies and research institutions have conducted long-term and fruitful research and productization work in this area. The functional software in the autonomous driving operating system needs to support deep learning embedded inference frameworks (such as TensorRT) and be compatible with mainstream training and development frameworks like TensorFlow and Caffe, facilitating the migration and adaptation of existing mature algorithms and development ecosystems.

5> Sensor Module: The sensor module standardizes and modularizes various autonomous driving sensors to provide a foundation for sensor data fusion. L3 and higher-level autonomous driving technology solutions rely on different types of sensors, such as lidar, cameras, and millimeter-wave radar, which have different hardware interfaces, data formats, spatial-temporal ratios, and calibration methods. To address the diversity, differences, and common needs of sensors, the autonomous driving operating system functional software pre-installs sensor modules to standardize and modularize various autonomous driving sensors, providing a foundation for heterogeneous sensor information fusion processing.

Functional software development involves collaboration among multiple parties, with Tier 1 suppliers and software algorithm vendors providing corresponding advantageous solutions for automakers. The design specifications for the autonomous driving functional software platform standardize and platformize decoupled functional software, clarifying the interface definitions between various functional modules. Based on standard specifications and open interfaces, the production of functional software components can become similar to traditional automotive component production methods, allowing Tier 1 suppliers, software algorithm vendors, and automakers to leverage their advantages to provide solutions. For instance, algorithm vendors with strengths in AI and vision can focus on developing AI and vision modules in functional software, while sensor vendors (Tier 1) can collaborate with automakers to develop sensor modules in functional software. Therefore, the establishment of design specifications for the autonomous driving functional software platform creates an orderly, efficient, and agile automotive software supply chain system, achieving more effective division of labor and cooperation, providing more application demands for autonomous driving solution providers, and offering automakers more flexible choices, significantly promoting the landing and industrial development of autonomous driving.

2.3 Application Software: The Core of Differentiation for Intelligent Vehicles

The application software layer mainly includes scenario algorithms for intelligent vehicles, cockpit functions, and data maps, forming the core of differentiation for intelligent cockpits (HMI, applications, etc.) and autonomous driving (perception fusion, decision planning, control execution, etc.), situated at the top of the automotive software architecture. In the past, the automotive supply chain was generally provided by strong Tier 1 suppliers offering integrated “black box” products, making decoupling of software and hardware very challenging. In the era of software-defined vehicles, automotive electronic components will accelerate “white labeling” like traditional mechanical and body components, making hardware differentiation increasingly minimal, and profits more transparent, making the possibility of selling vehicles at “hardware cost” a reality, while software will become the soul of the vehicle and a new profit center for OEMs. The differentiation and profitability of vehicles will shift towards technology and relevant software stacks, mainly including intelligent cockpits, autonomous driving, data maps/vehicle-road collaboration, and other aspects.

Compared to the challenges of implementing autonomous driving technology, intelligent cockpits can achieve differentiation in product competitiveness more quickly. Since the development and testing of autonomous driving software and algorithms are complex and challenging, and current policies and regulations are not yet fully developed, the overall market maturity for autonomous driving remains low. Currently, in the era of transforming entire vehicles towards intelligence, intelligent cockpits can integrate more information and functions, providing users with a more intuitive and personalized experience, thus becoming the pioneers of overall vehicle intelligence.

According to IHS Markit, although consumer habits related to the demand for intelligent cockpit technology configurations are still in the cultivation stage, over 60% of users recognize the value of cockpit configurations and expect to convert their demand, reflecting a significant upward potential for intelligent cockpit configuration demands at the user level.In the future, the penetration rate of new intelligent cockpits in China is expected to rise rapidly, exceeding 75% by 2025, higher than the global market assembly level.

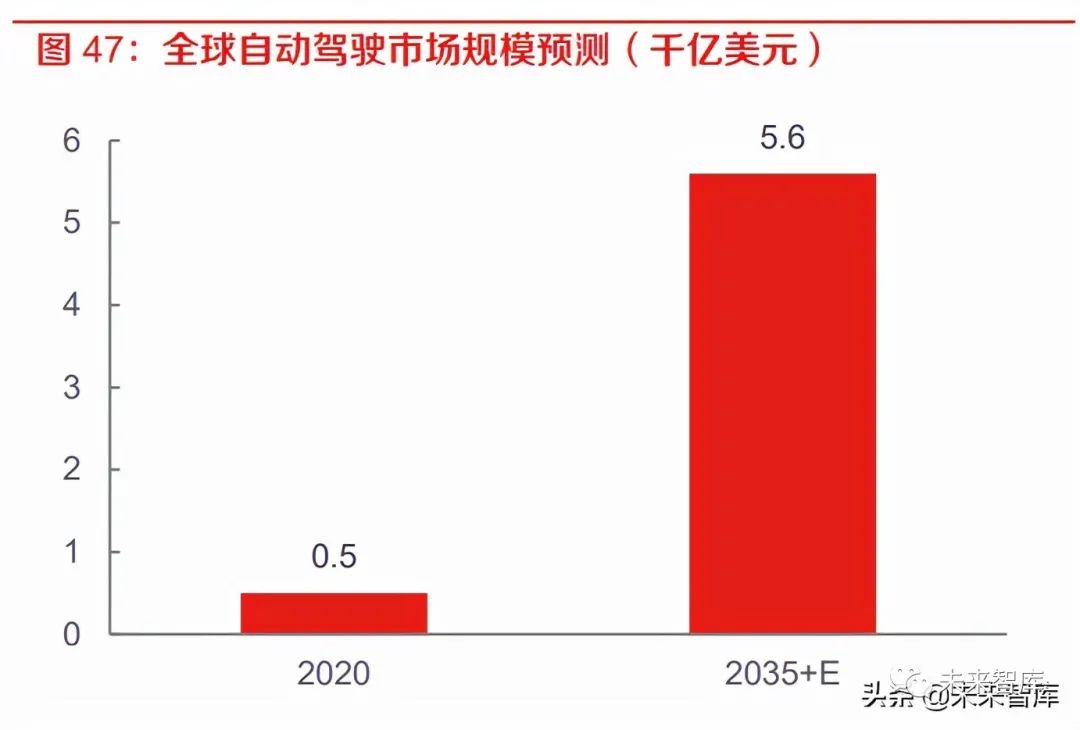

The evolution of autonomous driving from low-speed to high-speed requires long-term training and algorithm accumulation, with vast future potential. Currently, L3 and higher levels of autonomous driving are expected to be first applied in closed, semi-closed, and low-speed scenarios, with autonomous parking serving as a low-speed complex scenario that will provide low-speed domain data training and accumulation for the evolution of autonomous driving technology. Although the commercialization of high-speed autonomous driving scenarios is still some distance away, companies such as Tesla, Google, and Baidu continue to focus on high-level autonomous driving to gain an advantage before the industry reaches a turning point. According to IHS predictions, autonomous vehicles will experience explosive growth around 2025. By 2035, half of the vehicles on the road will achieve autonomous driving, with total revenue from autonomous vehicles and related devices and applications exceeding $500 billion. According to CIC forecasts, China’s autonomous driving market space is expected to approach 400 billion yuan by 2025, with a CAGR of nearly 107% from 2020 to 2025, far exceeding the global market growth rate.

The realization of high-level autonomous driving requires support from high-precision positioning and maps.Vehicle-road collaboration is one of the key pathways currently recognized in the industry for achieving intelligent driving, as intelligent vehicles will gradually transition from single-vehicle intelligence to vehicle-road collaboration.Similar to intelligent cameras, millimeter-wave radar, and lidar, C-V2X is another information exchange method that obtains the movement status of other vehicles and pedestrians through collaboration among vehicles, roads, and clouds.As high-speed autonomous driving requires real-time judgment of the movement status of farther pedestrians and vehicles, along with potential impacts from weather and obstacles, relying solely on the sensors of a single vehicle is insufficient for real-time judgment of road conditions, necessitating information from the roadside to supplement the driving decisions of intelligent vehicles.Vehicle networking combines advanced technologies such as positioning technology, sensor technology, communication technology, and internet technology, where high-level autonomous driving relies on vehicle networking support, with positioning technology (including high-precision maps) being one of the keys, ensuring safe driving of vehicles at high speeds.

Under the trend of SOA and layered decoupling, OEMs, traditional Tier 1 suppliers, and software suppliers have adopted different strategies to integrate into the application software development ecosystem:

(1) OEMs have three main paths to transform towards software:

1> Establishing software subsidiaries: Achieving a full-stack technology self-research layout, OEMs gradually master self-research capabilities across software, algorithms, chips, etc., to a certain extent bypassing traditional Tier 1 suppliers and collaborating with past Tier 2 software suppliers to co-develop subsystems, such as SAIC Zhizhi Software, Changan Automobile Software Technology Company, etc.;

2> Establishing software R&D departments: Collaborating directly with core technology manufacturers through cooperation and investment schemes to achieve maximum self-control, mainly establishing in-house R&D capabilities in one or more strategically differentiated fields, outsourcing some common software. For instance, startups like NIO and XPeng, due to their smaller size, are more flexible and do not need to cover all aspects, focusing on the development of intelligent cockpit and core application software for autonomous driving, forming large self-research teams.

3> Strategic cooperation with software companies: While expanding their internal R&D teams, OEMs establish strategic alliances with software companies to advance the construction of software ecosystems, with execution realized by software Tier 1 suppliers. For example, GAC Research Institute collaborates with Neusoft Ruichi, Zhongke Chuangda, and others to establish joint innovation centers.

(2) Traditional Tier 1 suppliers need to build integrated software and hardware capabilities. For traditional Tier 1 suppliers, the recovery of some system function development rights by OEMs is an inevitable trend, thus they urgently need to transform and seek new paths to avoid becoming mere hardware manufacturers.Currently, building full-stack capabilities in software and hardware is key to seizing the next market share high ground, which traditional Tier 1 giants are well aware of.More Tier 1 suppliers are committed to developing “hardware + underlying software + middleware + application software algorithms + system integration” full-stack technical capabilities, with typical representatives being Bosch, Huawei, Desay SV, etc., who can provide customers with hardware, software, and integrated solutions.

(3) Software suppliers need to continuously enrich their product matrix and gradually enhance their hardware capabilities. As OEMs strengthen their autonomy and self-research capabilities in software, they begin to seek direct cooperation with software suppliers. For example, OEM manufacturers first seek to reclaim functions of cockpit HMI interaction systems, while application software such as UI/UX design tools, voice recognition modules, sound effect modules, and facial recognition modules are directly purchased from software suppliers, thereby bypassing traditional Tier 1 suppliers to achieve independent development. For software suppliers, the more software IP product combinations they can offer, the higher the potential single-vehicle value they may obtain. Meanwhile, software suppliers are also seeking to enter the hardware design and manufacturing sectors traditionally dominated by Tier 1 suppliers, such as domain controllers and TBOX, to provide diversified solutions.

3. Company Introductions

3.1 Zhongke Chuangda: Leading Automotive Operating System Vendor, Opening Growth Space from Cockpit Domain to Driving Domain

Based on years of experience in secondary development of embedded operating systems in the mobile terminal field, the company has entered the intelligent connected vehicle sector. Since 2013, the company has provided overall intelligent cockpit software solutions and services, including automotive entertainment systems, intelligent dashboards, integrated cockpits, ADAS, and audio products, based on years of accumulated operating system optimization technology, excellent 3D engine, machine vision, and voice and audio technologies, providing rich and advanced intelligent driving experiences for drivers and passengers. Currently, over 100 companies globally utilize the company’s intelligent cockpit products and solutions.

Based on the SOA architecture, the company’s intelligent cockpit products have developed into a cross-system integrated intelligent cockpit 4.5 solution, providing customers with a full-stack solution from underlying system software, middleware to upper-layer applications.From the company’s TurboX Auto 4.5 intelligent cockpit platform architecture perspective:In terms of system software, the company possesses BSP development capabilities, and the solution supports multiple mainstream chip platforms (Qualcomm, Renesas, NXP, etc.), based on Hypervisor technology platforms that can support QNX, Linux, Android, etc. OS kernels, and can optimize OS performance;In terms of functional software, the platform has the capability to provide audio and image processing, sensor fusion, and in-vehicle networking modules;In terms of upper-layer applications, based on Kanzi, the platform provides infotainment systems, intelligent dashboards, ADAS, and audio-video integration products, offering 5G, cloud services, and supporting FOTA upgrades;The middleware solutions provided by the platform can achieve the standardization of software-hardware interfaces, thus supporting the continuous iterative upgrades of SOA architecture vehicles.In summary, the company’s intelligent cockpit solutions realize the decoupling of scenarios and services, allowing for rapid development changes and iterative upgrades of scenario services.

The company acquired Fuyihang to enter the driving domain through low-speed parking scenarios. In December 2020, the company acquired Fuyihang, which has five core products: low-speed perception systems, parking assistance systems, intelligent parking systems, fully automated parking systems, and autonomous driving, providing integrated solutions. This acquisition enhances the company’s technical accumulation in low-speed scenarios of ADAS, millimeter-wave radar, and autonomous driving, indicating that the company is beginning to enter the driving domain through low-speed parking scenarios. Currently, the company’s cockpit domain algorithms already support low-speed driving capabilities, enabling the integration of cockpit and low-speed driving domains, reusing the computing power of cockpit chips, achieving a safe and cost-effective automated parking solution. The commercialization of high-speed autonomous driving scenarios is still some distance away, and the industry’s turning point has not yet arrived, but the company’s accumulation in low-speed scenarios will benefit when the policies for high-speed autonomous driving are implemented and technology matures, providing leading and mature products or solutions for automakers.

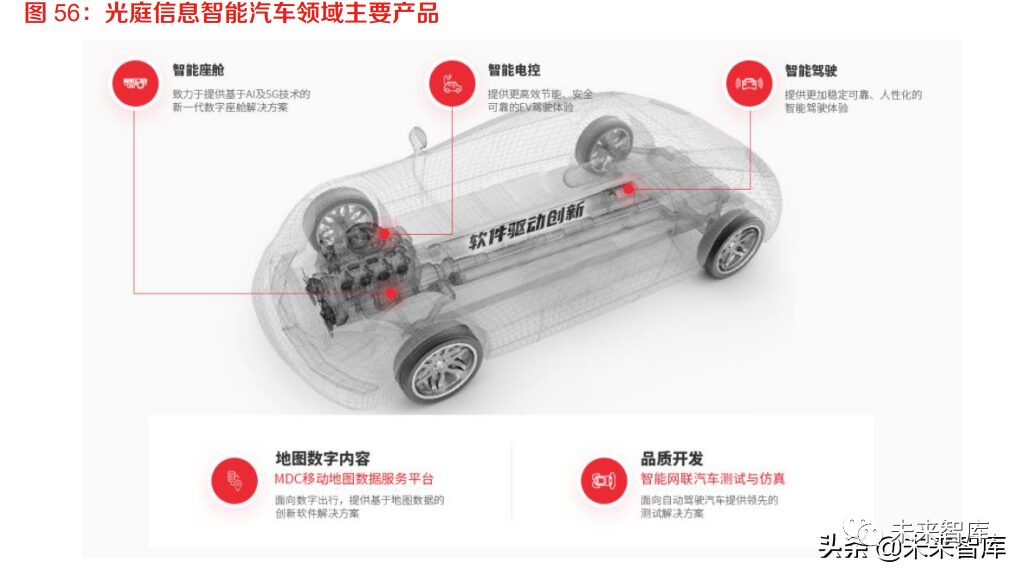

3.2 Guangting Information:Leading domestic provider of automotive software and solutions

The company possesses full-stack software development capabilities for intelligent connected vehicles. Since its establishment in 2011, the company has focused on the R&D and innovation of cutting-edge automotive electronic software technologies. With the evolution of automotive electronic and electrical architecture and the rise of the “software-defined vehicle” concept, the company closely follows the trends of automotive intelligence, connectivity, and electrification, aiming to build a foundational software platform centered on onboard operating systems, driving the digital transformation of vehicles through software, and providing users with new driving experiences and services. Currently, the company’s products and technical services cover the core areas of intelligent connected vehicles, including intelligent cockpits, intelligent electronic control, and intelligent driving, and it has established two supporting systems: intelligent connected vehicle testing service system and mobile map data service platform. Currently, the company’s full-stack product system is capable of providing software development and technical services for the new generation of intelligent connected vehicles.

The company’s intelligent connected vehicle business encompasses five product lines:

1> Intelligent Cockpit: The company’s intelligent cockpit solutions mainly include user experience (UX) design and human-machine interface (HMI) software development services, instrument platform software solutions, software-hardware decoupling solutions, overall virtualization cockpit solutions, and T-BOX software solutions. Major clients include Nidec, Yanfeng Visteon, Faurecia, Denso, MSE, Marelli, and automotive manufacturers such as Nissan and NIO.

2> Intelligent Electronic Control: The company’s intelligent electronic control business primarily provides customers with solutions for new energy motor controllers, electronic power steering system application software development services, and electronic servo braking system application software development services. The main customer is Nidec, with whom the company established a strategic partnership early on, making it an important strategic partner in the Chinese market.

3> Intelligent Connected Vehicle Testing: The company’s intelligent connected vehicle testing business mainly provides testing evaluation, data products, and technical platforms for automotive manufacturers, automotive component suppliers, and autonomous driving algorithm companies in the fields of intelligent cockpits and autonomous driving. Major clients include Nissan, Renault Samsung, Dongfeng Motor, and other automotive manufacturers, as well as Toyota Tsusho and other automotive electronic component suppliers.

4> Mobile Map Data Services: The company’s map data services mainly provide customers with deep customization development and mobile big data value-added services based on maps for various mobile travel and application scenarios. The company’s current major products include global navigation electronic map compilation systems and L2+ autonomous driving map update service platforms. Major clients include Hitachi, Huawei, and Nissan.

5> Intelligent Driving: The company’s intelligent driving business mainly provides customers with passenger vehicle ADAS application software development services and is involved in the development of cutting-edge technologies related to the next generation of integrated parking solutions (APA). Currently, the revenue scale of the company’s intelligent driving business is relatively small, but it is a strategic business direction for the company’s future layout.

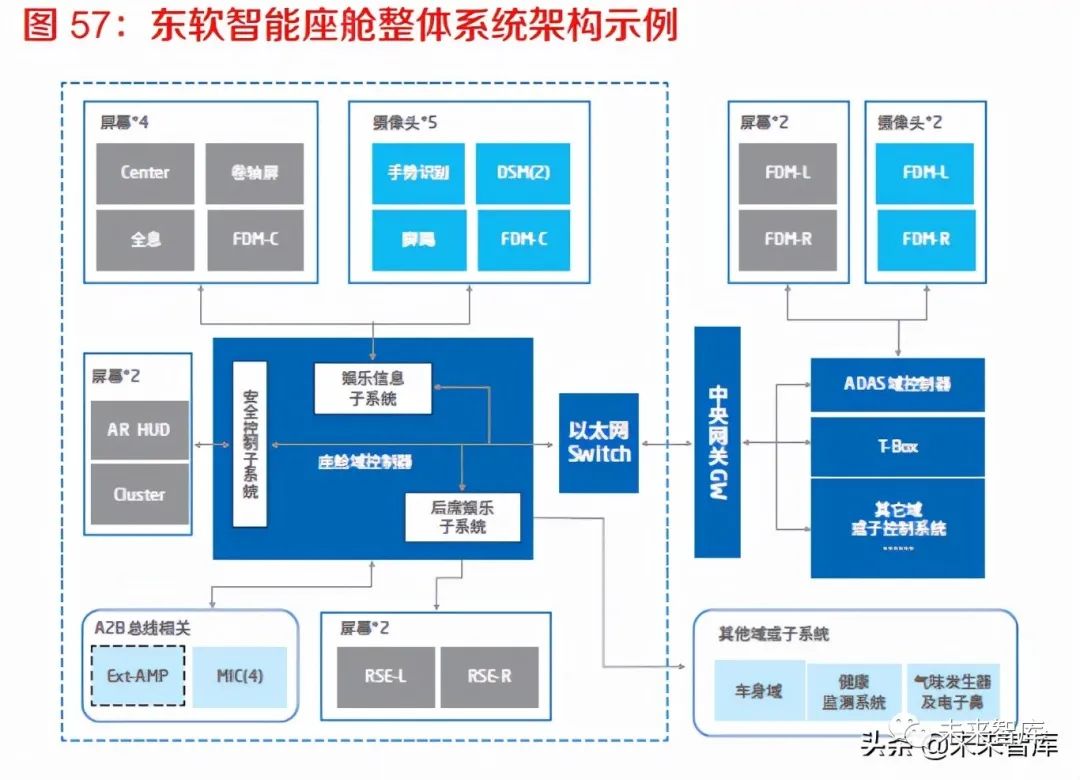

3.3 Neusoft Group: A Global Leader in Automotive Electronic Products and Services

The company is a global leader in automotive electronic products and services. In the automotive electronics business field, after thirty years of accumulation and development, both technology and market share are at the forefront. The company has established long-term collaborations with numerous domestic and international vehicle manufacturers and international automotive electronic manufacturers, with 85% of the top 30 global automotive manufacturers using Neusoft’s software and services. Currently, the company has comprehensive products and solutions in intelligent cockpits and vehicle networking, while its subsidiary Neusoft Ruichi is dedicated to providing the next generation of automotive platforms and key technologies, offering intelligent products, technologies, services, and overall solutions for automakers in the fields of automotive foundational software platforms, new energy vehicle EV power systems, advanced driver-assistance systems, and autonomous driving.

The company has comprehensive products and solutions in intelligent cockpits and vehicle networking:

1> Intelligent Cockpit: The company’s intelligent cockpit series products mainly include IVI in-vehicle infotainment systems, fully digital dashboards, intelligent cockpit domain controllers, intelligent networking modules, and global online navigation systems, achieving human-vehicle interaction through multi-screen integration. Currently, the company’s new generation intelligent cockpit products are applied in multiple models including Hongqi, Geely, and Chery, and are continuously mass-produced and delivered. BOX products are used in models from Volvo, Audi, and others, while the global online navigation system is applied in models from Nissan, Jaguar, and Land Rover. Neusoft’s ARHUD products have won bids for projects from automakers such as Changan and BAIC.

2> Intelligent Networking: In the intelligent networking field, the company actively participates in and promotes discussions and definitions of standards related to intelligent connected vehicles, integrating vehicle networking, IoT, and the internet to provide users with seamless travel services in various scenarios. The vehicle-road collaboration system developed by the company has been widely applied among major domestic manufacturers and intelligent connected vehicle demonstration zones.In terms of mass production, the company has validated various scenarios based on LTE-V2X communication, supporting centimeter-level high-precision positioning, which has been mass-produced and launched in high-end models from Hongqi, while also obtaining domestic leading manufacturers’ orders for 5G V2X mass production, which have begun implementation and delivery.

Neusoft Ruichi is dedicated to providing the next generation of automotive platforms and key technologies. Established in October 2015, Neusoft Ruichi is a subsidiary of Neusoft Group. After the investment of 650 million by Guotou Investment and Dezhaihou in 2021, Neusoft Group holds 32.26% of Neusoft Ruichi’s shares. Neusoft Ruichi’s business primarily covers automotive foundational software platforms, new energy vehicle EV power systems, advanced driver-assistance systems, and autonomous driving:

1> Automotive Foundational Software Platform: Neusoft Ruichi continuously explores future autonomous driving business models through an open SOA software architecture and integrated software platform, achieving self-evolution and upgrades of future intelligent scenarios and systems. The foundational software product NeuSAR has been awarded the ISO26262 product certification, marking that Neusoft Ruichi has established a product development process system that meets the highest ASIL-D level of functional safety, with products already reaching international advanced levels.

2> New Energy Vehicle Sector: Neusoft Ruichi continues to optimize and improve products such as power battery packs (PACK) and battery management systems (BMS), while strengthening the construction of the industrial ecosystem. Neusoft Ruichi enhances interaction and cooperation with major vehicle manufacturers in the form of “intelligent hardware + big data,” deepening business cooperation with vehicle manufacturers such as Geely and GAC based on battery management systems (BMS).

3> Advanced Driver-Assistance and Autonomous Driving Sector: Neusoft Ruichi continues to enhance its product lines for ADAS advanced driver-assistance systems, having completed the mass production and launch of L0-L2 level ADAS products. Targeting the passenger and commercial vehicle segments, Neusoft Ruichi’s ADAS products are applied in models from Dongfeng Lantu, FAW Hongqi, and others, while its collaboration with major domestic commercial vehicle groups to develop L3 domain control products is set to enter mass production stage soon. During the reporting period, Neusoft Ruichi launched a new generation of central computing platforms for autonomous driving, laying a solid foundation for the mass production of higher-level autonomous driving products.

3.4 Jingwei Hengrun:Leading domestic automotive electronics enterprise, capable of providing SOA architecture-based solutions and overall solutions for high-level intelligent driving

The company is one of the few domestic enterprises capable of providing solutions covering intelligent driving electronic products, R&D services, and overall solutions for high-level intelligent driving. Established in 2003, the company focuses on electronic systems, providing electronic products to customers in the automotive and unmanned transport fields. Currently, the company’s business spans electronic system R&D, manufacturing, and operational services, forming a “three-in-one” business layout of electronic products, R&D services, and overall solutions for high-level intelligent driving, achieving mutual support and collaborative development across core technologies, application scenarios, and industry customer groups. Through long-term business accumulation, the company has formed a customer base in the automotive sector centered around major domestic and international manufacturers such as FAW Group, China National Heavy Duty Truck Group, SAIC Group, GAC Group, and international Tier 1 suppliers such as Infineon, Antolin, and BorgWarner.

The company is capable of providing SOA architecture-based solutions and overall solutions for high-level intelligent driving:

1> Whole Vehicle Electronic and Electrical Architecture Consulting Services: Based on the service-oriented architecture (SOA) design concept, the company provides consulting services including methodology training, service scenario definitions, service extraction, service interface definitions, and software-hardware solution designs, helping customers build sustainable integration, upgradeability, and flexible configuration for whole vehicle electronic and electrical architectures. Currently, the company has provided consulting services for whole vehicle electronic and electrical architecture development to several vehicle manufacturers, including BAIC Group, Huaren Transportation, Geely, SAIC Group, FAW Group, and China National Heavy Duty Truck Group.

2> Automotive Foundational Software Development Services: The company began its self-research of automotive electronic foundational software products gradually since 2010. Currently, the company’s AUTOSAR Classic platform software is designed to build a high-real-time streamlined operating system for microcontrollers, meeting the high real-time requirements of automotive applications. The company’s AUTOSAR Adaptive platform software is designed for high-performance computing platforms (HPC) for in-vehicle applications, meeting the needs of automotive connectivity and autonomous driving. The company has provided automotive embedded software development services to several clients, including Geely, NIO, Aptiv, Bosch, and Magna.

3> Overall Solutions for High-Level Intelligent Driving: The company entered the high-level intelligent driving business field in 2015. To commercialize the MaaS (Mobility as a Service) solutions for high-level intelligent driving systems, the company has developed single-vehicle intelligent solutions, intelligent fleet operation management solutions, and vehicle-cloud data center solutions. The company’s high-level intelligent driving business has collaborated with multiple vehicle manufacturers, covering various scenarios, including intelligent port logistics, intelligent sanitation vehicles, intelligent campus logistics vehicles, and intelligent shuttle buses.

Welcome all angel round and A round enterprises in the entire automotive industry chain (including the electrification industry chain) to join the group (Friendship connections with 500 automotive investment institutions including top institutions; some quality projects will be selected for themed roadshows to existing institutions);There is a communication group for leaders of sci-tech innovation companies,the automotive industry whole vehicles, automotive semiconductors, key components, new energy vehicles, intelligent connected vehicles, aftermarket, automotive investment, autonomous driving, vehicle networking, and dozens of other groups. Please scan the administrator’s WeChat to join the group (Please indicate your company name)