In today’s world where automobiles are continuously evolving towards intelligence, the value of chips is becoming increasingly apparent. According to McKinsey data, it is estimated that by 2030, the semiconductor market for high-level autonomous vehicles (L3 and above) in China alone could reach $13 billion.

However, according to data from the China Automotive Technology and Research Center, the scale of domestic automotive chips in China only accounts for 4.5% of the global market, with a staggering 90% dependence on foreign sources.

From the perspective of complete vehicles, automotive chips can be roughly divided into ten categories, including control chips, computing chips, sensor chips, storage chips, communication chips, safety chips, power chips, driver chips, power supply chips, and analog chips.

“We have sorted out the automotive chips; excluding diodes and transistors, pure electric vehicles average 437 chips, while hybrid vehicles average 511 chips.” At the 20th China Automotive Industry Development (Teda) International Forum at the end of August, Zou Guangcai, deputy secretary-general of the China Automotive Chip Industry Innovation Strategic Alliance, stated that our country has the best foundation in power analog chips. These chips are widely used in vehicles, but due to their low cost, some even as low as a few cents, their value proportion is not very high.

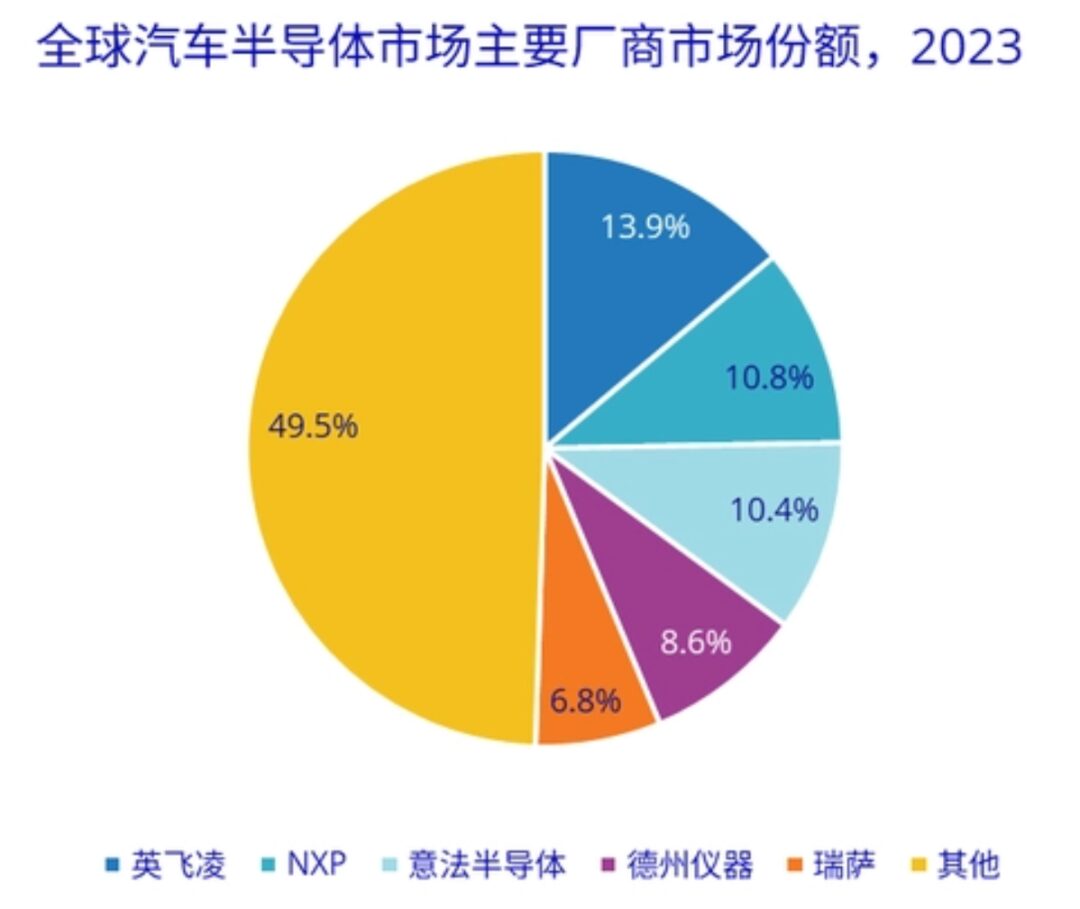

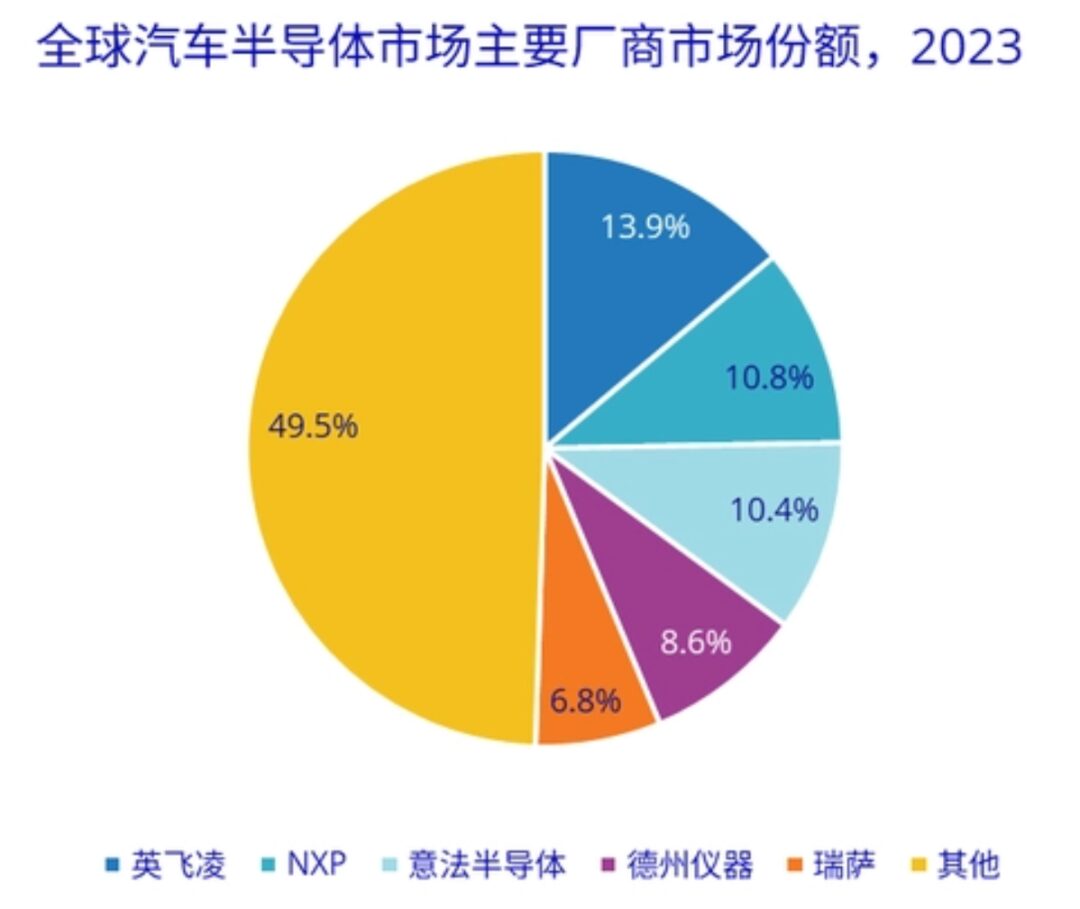

From a global perspective, the automotive chip market share is mainly dominated by a few leading manufacturers, with the top ten accounting for over 70% of the global market, primarily from developed countries. In addition to their high market share, each of these companies also develops multiple categories of automotive chip products.

“This gives us a clue that for our country to have leading automotive chip manufacturers, it is difficult to survive internationally by focusing solely on one type of chip; corresponding category expansion is essential.”

Safety Chips Have the Highest Share, China Faces “Bottleneck” Issues

Previously, Zou Guangcai conducted a round of research on the state of our country’s chip industry.

In terms of market share, the domestic rate of control chips with high safety performance for MCUs is relatively low; however, there are many domestic substitutes in other fields, with an overall vehicle installation rate reaching 10%.

In the computing chip sector, there are some mid-to-low power products installed in vehicles, but high-power products are still relatively absent, with an overall application rate exceeding 20%.

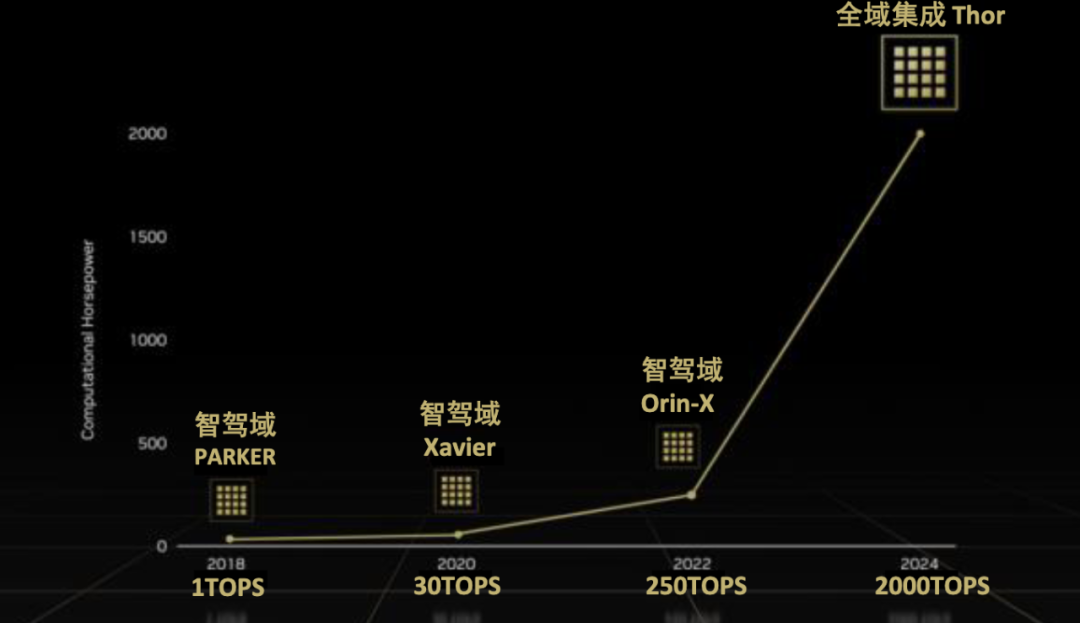

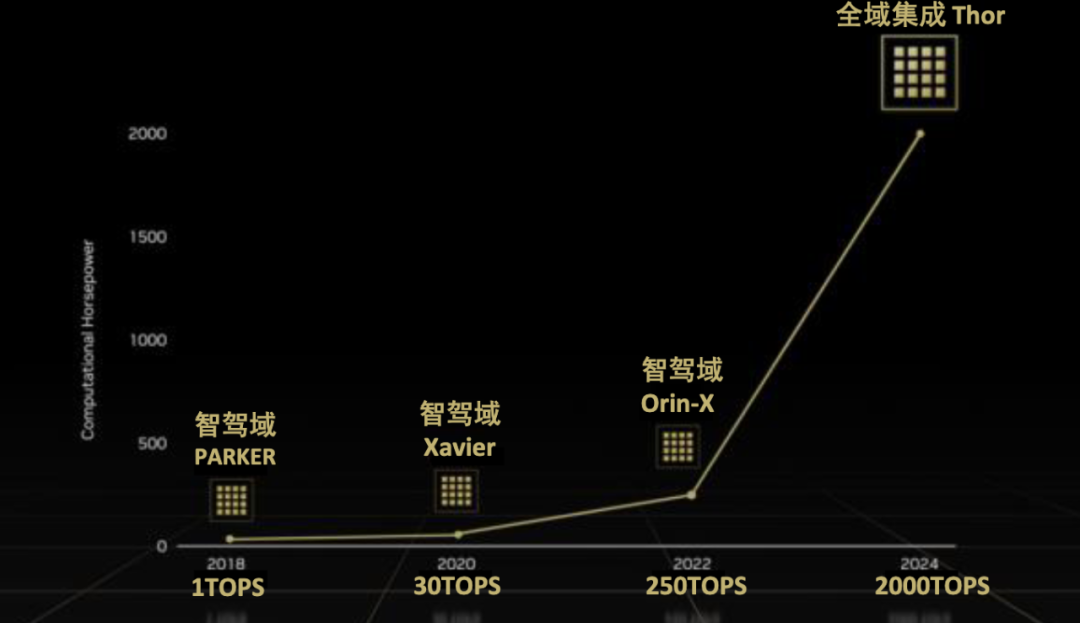

NVIDIA’s smart driving chip computing power is continuously improving.

In the storage chip domain, due to a solid foundation previously, the overall installation rate has reached 25%.

Communication chips, including 4G and 5G communication, navigation chips, CAN/LIN/TSN, have an installation rate between 5% and 10%.

Power devices were laid out domestically relatively early, with an overall mass production rate of 15%. He stated that our IGBT products are quite mature and suggested that more attention be paid to silicon carbide in the next steps.

Power supply chips have many products available, accounting for 10%; driver chips are slightly less than power supply chips since there are relatively fewer domestic products that can replace foreign ones.

Sensor chips have a relatively high share, ranging from 15% to 20%; information security chips have the largest quantity, reaching up to 50%.

“Our country has a characteristic where leading automotive companies are broadly laying out the automotive chip industry, using various approaches. Some are self-research, some are investments, and some are joint ventures,” Zou Guangcai said. Overall, everyone is very focused on the three tracks of control, computing, and power.

Regarding the widely focused tracks, Zou Guangcai further analyzed.

NVIDIA’s smart driving chip computing power is continuously improving.

In the storage chip domain, due to a solid foundation previously, the overall installation rate has reached 25%.

Communication chips, including 4G and 5G communication, navigation chips, CAN/LIN/TSN, have an installation rate between 5% and 10%.

Power devices were laid out domestically relatively early, with an overall mass production rate of 15%. He stated that our IGBT products are quite mature and suggested that more attention be paid to silicon carbide in the next steps.

Power supply chips have many products available, accounting for 10%; driver chips are slightly less than power supply chips since there are relatively fewer domestic products that can replace foreign ones.

Sensor chips have a relatively high share, ranging from 15% to 20%; information security chips have the largest quantity, reaching up to 50%.

“Our country has a characteristic where leading automotive companies are broadly laying out the automotive chip industry, using various approaches. Some are self-research, some are investments, and some are joint ventures,” Zou Guangcai said. Overall, everyone is very focused on the three tracks of control, computing, and power.

Regarding the widely focused tracks, Zou Guangcai further analyzed.

Data Source: IDC

He pointed out that in the MCU aspect, there is still a monopoly situation dominated by international giants, especially Infineon. Domestic mid-to-low-end chips have already been widely installed in body and cockpit fields, but in the power chassis and intelligent driving fields, domestic manufacturers are relatively hesitant in mass production, despite conducting extensive testing and validation, there is still a gap compared to foreign products.

SOCs are divided into two categories: one for intelligent driving, where Tesla and NVIDIA are relatively advanced and widely applied; the other for intelligent cockpit, where Qualcomm is leading. Although there are many mid-to-low power products in our country, high-power products are quite lacking, which is a direction for future development.

In the communication chip sector, TSN (Time-Sensitive Networking) chips have gradually been adopted, and many domestic automotive companies are investing in TSN chip enterprises; SerDes has progressed relatively faster than TSN, with domestic SerDes companies’ technical specifications already matching those of foreign counterparts. “These two types of products are developing very quickly in the domestic market, and everyone should pay attention to them.”

Silicon carbide is also a highly regarded field. “People always say that the cost of silicon carbide is too high, and the yield is low.” Zou Guangcai stated that our country has entered a period of reduced silicon carbide costs, though this cycle is slightly slower compared to Moore’s Law, with the main issues concentrated on epitaxial wafers, which determine most of the cost and also affect yield.

In Zou Guangcai’s view, IDM companies, which can design and produce their chips, will definitely have significant advantages in the industry.

Overall, in the domestic automotive chip sector, there is a wide range of general IC and component suppliers, with relatively abundant resources that are easy to replace, short cycles, and relatively low costs; however, MCUs, intelligent power devices, power management chips, and other high-end chips are still dominated by foreign manufacturers, posing a “bottleneck” risk.

Data Source: IDC

He pointed out that in the MCU aspect, there is still a monopoly situation dominated by international giants, especially Infineon. Domestic mid-to-low-end chips have already been widely installed in body and cockpit fields, but in the power chassis and intelligent driving fields, domestic manufacturers are relatively hesitant in mass production, despite conducting extensive testing and validation, there is still a gap compared to foreign products.

SOCs are divided into two categories: one for intelligent driving, where Tesla and NVIDIA are relatively advanced and widely applied; the other for intelligent cockpit, where Qualcomm is leading. Although there are many mid-to-low power products in our country, high-power products are quite lacking, which is a direction for future development.

In the communication chip sector, TSN (Time-Sensitive Networking) chips have gradually been adopted, and many domestic automotive companies are investing in TSN chip enterprises; SerDes has progressed relatively faster than TSN, with domestic SerDes companies’ technical specifications already matching those of foreign counterparts. “These two types of products are developing very quickly in the domestic market, and everyone should pay attention to them.”

Silicon carbide is also a highly regarded field. “People always say that the cost of silicon carbide is too high, and the yield is low.” Zou Guangcai stated that our country has entered a period of reduced silicon carbide costs, though this cycle is slightly slower compared to Moore’s Law, with the main issues concentrated on epitaxial wafers, which determine most of the cost and also affect yield.

In Zou Guangcai’s view, IDM companies, which can design and produce their chips, will definitely have significant advantages in the industry.

Overall, in the domestic automotive chip sector, there is a wide range of general IC and component suppliers, with relatively abundant resources that are easy to replace, short cycles, and relatively low costs; however, MCUs, intelligent power devices, power management chips, and other high-end chips are still dominated by foreign manufacturers, posing a “bottleneck” risk.

Exploring New Technologies, The Chip Industry Aims to “Overtake on the Curve”

In light of the unsatisfactory overall share of automotive chips, our country is also exploring ways to catch up.

“Automotive chips cannot escape the influence of the integrated circuit industry’s foundation; our country’s integrated circuit industry foundation is relatively weak in the area of advanced process chip tape-outs.” Therefore, Zou Guangcai pointed out that everyone is discussing how to meet the future high-power chip requirements for intelligent driving using Chiplet technology.

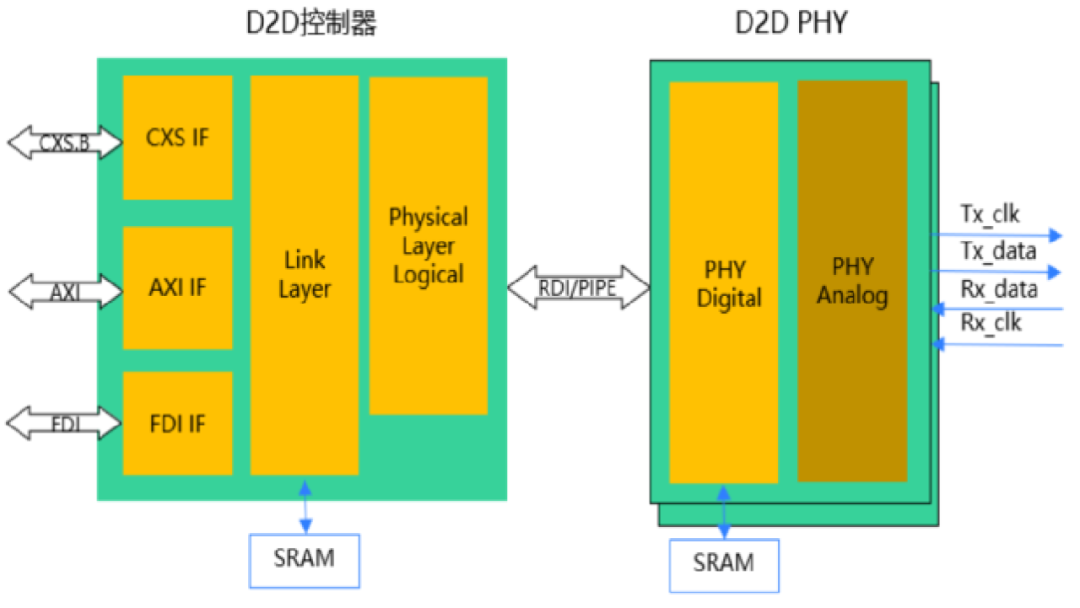

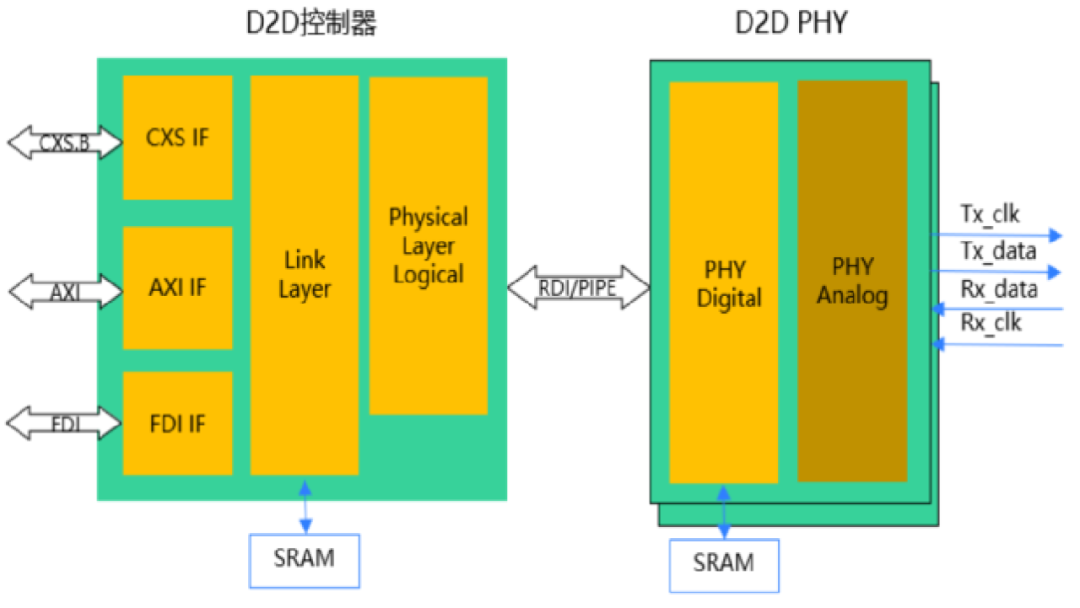

Chiplet, commonly known as a chiplet, is a type of die (bare chip) designed to meet specific functions, interconnected through die-to-die internal interconnection technology to package multiple module chips with the underlying base chip together, forming a system chip for a new form of IP reuse. It can be understood as gluing each small chip together to create a more powerful large chip.

D2D Layered Architecture

The characteristics of Chiplet include the ability to independently package some functions into separate modules, reducing the area of a single SOC, and selecting relatively mature processes for combination packaging. This method can replace product innovation and performance enhancement while controlling cycles and costs to some extent. However, Zou Guangcai also pointed out that Chiplet is a direction, but it has its own issues, namely interface protocols and reliability, which have not yet been validated for automotive applications.

Open-source architecture chips are also a technology direction and field being promoted in line with our country’s industrial characteristics.

CPUs are one of the key technologies for the development of the automotive industry, as their architecture represents the integration of the chip industry chain and chip ecosystem. Historically, the CPU market has been dominated by two architectures: X86 and ARM.

Open-source architecture is seen as a hopeful way to break the “dual oligopoly” pattern of instruction sets, characterized by its openness, particularly suitable for IoT applications, and our country is integrating it into the development of intelligent connected vehicles.

At last year’s Teda Forum, Chinese Academy of Engineering academician Ni Guangnan stated that the new open-source reduced instruction set architecture “RISC-V” provides an opportunity for our country to gain control over the development of the chip industry.

RISC-V, known in Chinese as the fifth-generation reduced instruction set (Reduced Instruction Set Computing), is an open instruction set architecture based on reduced instruction set principles.

D2D Layered Architecture

The characteristics of Chiplet include the ability to independently package some functions into separate modules, reducing the area of a single SOC, and selecting relatively mature processes for combination packaging. This method can replace product innovation and performance enhancement while controlling cycles and costs to some extent. However, Zou Guangcai also pointed out that Chiplet is a direction, but it has its own issues, namely interface protocols and reliability, which have not yet been validated for automotive applications.

Open-source architecture chips are also a technology direction and field being promoted in line with our country’s industrial characteristics.

CPUs are one of the key technologies for the development of the automotive industry, as their architecture represents the integration of the chip industry chain and chip ecosystem. Historically, the CPU market has been dominated by two architectures: X86 and ARM.

Open-source architecture is seen as a hopeful way to break the “dual oligopoly” pattern of instruction sets, characterized by its openness, particularly suitable for IoT applications, and our country is integrating it into the development of intelligent connected vehicles.

At last year’s Teda Forum, Chinese Academy of Engineering academician Ni Guangnan stated that the new open-source reduced instruction set architecture “RISC-V” provides an opportunity for our country to gain control over the development of the chip industry.

RISC-V, known in Chinese as the fifth-generation reduced instruction set (Reduced Instruction Set Computing), is an open instruction set architecture based on reduced instruction set principles.

As the name suggests, instructions are tasks given to chips. A processor is a chip, and chips do not work on their own; they need someone to tell them what operations to perform. For example, “tell the chip to perform multiplication” is an instruction, while a collection of chip instructions is called an instruction set.

As a newer instruction set, RISC-V architecture has certain advantages. For instance, it has a more advanced architecture, broader applications, more economical costs, and stronger vitality.

In Ni Guangnan’s view, our country has three unique advantages in developing RISC-V.

Firstly, it aligns with the national strategy of technological self-reliance and strengthens, while also promoting global technological innovation.Historically, the CPU market has been monopolized by X86 and ARM architectures, and the entire chip industry has been in a high monopoly state. The emergence of open-source RISC-V breaks this monopoly, providing a strong impetus for the development of the global chip industry, and the relevant ecological environment is rapidly developing and improving.

Secondly, China’s super-large-scale market is fertile ground for cultivating the next generation of information technology.

Moreover, China is the world’s largest cradle for cultivating engineers, and its talent advantage provides necessary conditions for technological development and innovation.

However, Zou Guangcai also indicated that “RISC-V has fragmentation characteristics in the development process, and recently RISC-V automotive chip products have emerged, but vehicle validation still requires a process.”

Chip Enterprises Must Prepare for Long-term Combat

Despite facing numerous uncertainties, Zou Guangcai believes that our automotive chip industry has a long-term positive outlook. However, just like the development of the new energy industry, there will inevitably be shortboards and fluctuations in the situation.

For instance, there are shortcomings in product development levels, IP/EDA, automotive-grade tape-out processes (yield + advanced processes), and high-safety scenario applications. At the same time, there are many automotive chip companies in our country, and the market capacity makes it difficult to ensure that all these companies can develop healthily; there will be a process of elimination in the next three years, and each company must have the determination to persist for over ten years in the automotive chip sector.

Market share situation of various companies in the EDA field in 2023

Market share situation of various companies in the EDA field in 2023

At the same time, Zou Guangcai pointed out that the trend of integration between automobiles and chips is becoming increasingly evident, especially breaking the traditional division of labor. Traditionally, the automotive industry’s division of labor has been that vehicle manufacturers manage the whole vehicle, Tier 1 manages controllers, and chip manufacturers manage their own products. However, now many vehicle manufacturers are self-developing chips or designating Tier 1 companies to choose certain chips, which disrupts the division of labor and directly compresses the survival space of Tier 1, mainly in terms of development rights and cost control. How the new mechanism will clarify this is yet to be answered by cooperation between the upstream and downstream of the industry.

Zou Guangcai emphasized that we must recognize that the foundational elements of our automotive chip industry chain are still relatively weak, closely tied to the foundation of the integrated circuit industry. It can be understood that our country is currently developing rapidly in product design, development, integration, and testing. However, there is still a significant gap compared to foreign countries in IP/EDA and automotive-grade processes.

“Recently, many tape-out factories have been established in the country, and most of them have automotive chip industry plans in their planning, but most will only start construction in the second or third phase. Many enterprises first consider operations and use consumer electronics to revitalize their operations before considering automotive chips.” In Zou Guangcai’s view, it will take about four to five years for companies to go from construction to being able to produce products to serve the industry. “So we may have to endure for a while longer. But I believe that after four to five years, our automotive chip tape-out capacity will improve.”

In light of the above situation, he offered some suggestions to the industry.

First, we must clarify the future vision for the development of our country’s automotive chip industry.We believe that in the next 5 to 15 years, our domestically produced chip products will definitely form a series, with different applications and layouts aimed at the mid-to-high-end market. The level of high-end products must reach world advanced standards, while mid-to-low-end products should integrate into the international circulation, striving for a good development ecology.

In Zou Guangcai’s view, our automotive chip industry cannot be completely closed off; it must integrate and cooperate with the international industry chain to form cost and industrial chain advantages for some automotive chip products, while also gaining international recognition and application. This means that there is much work to be done in terms of industrial chain, industrial pattern, ecological system, and integrated development.

Second, we must return to the essence of industrial development and focus on products.When automotive manufacturers apply chips, they should first consider “price, performance, reliability,” which are the core competitive factors of the product, rather than the most advanced technology, while also valuing stable quality and supply stability, which are the core competitiveness of chip enterprises.

He hopes that chip companies can avoid homogeneous competition as much as possible; although this is difficult, he hopes everyone can find their own path, and chip enterprises should collaborate with automotive manufacturers to conduct research on product definitions, paying more attention to the development of high-end, unique, and innovative products to establish long-term competitiveness.

Finally, he suggests establishing a complete ecosystem, which is the foundation for achieving healthy and sustainable development.“Domestic chips being installed in vehicles is definitely not a simple technical issue; it is an industrial issue, especially an ecological challenge. From design, manufacturing, packaging, standards, testing and certification, electronic controller development, to vehicle certification, all these aspects require cooperation between upstream and downstream to share risks and benefits.”

Editor | Qiu Kaijun

NVIDIA’s smart driving chip computing power is continuously improving.

NVIDIA’s smart driving chip computing power is continuously improving. Data Source: IDC

Data Source: IDC D2D Layered Architecture

D2D Layered Architecture

Market share situation of various companies in the EDA field in 2023

Market share situation of various companies in the EDA field in 2023