1. The Operating System is the Soul of Software-Defined Automotive Ecosystem Development

From the consumer’s perspective, the intelligent connected vehicle is rapidly developing. With the rapid development of smart cars, both the intelligent cockpit and ADAS functions are constantly upgrading. Whether it is the number of sensors, chip computing power, or the value of a single vehicle, all have achieved rapid improvement. Referring to our earlier reports “Software-Defined Vehicles: Intelligent Cockpit First” and “Software-Defined Vehicles: ADAS is Accelerating”, this report focuses on the upgrade paths of the cockpit and ADAS, the competitive landscape of the upstream and downstream industrial chains, and calculates the market size based on our self-built sample database. In terms of the intelligent cockpit, China’s intelligent cockpit market size is expected to increase from 56.7 billion yuan in 2020 to 103 billion yuan in 2025, with a CAGR exceeding +15.2%; in terms of ADAS, China’s autonomous driving market size is expected to increase from 84.4 billion yuan in 2020 to 225 billion yuan in 2025, with a CAGR exceeding +21.3%.

Under the trend of software-defined vehicles, chips + operating systems + middleware + application algorithm software + data are the keys to realizing intelligent vehicles. In the context of a major transformation in the intelligent connected vehicle industry, the concept of software-defined vehicles has become a consensus. The distributed electronic and electrical (E/E) architecture used in traditional vehicles cannot meet the current automotive development needs due to bottlenecks such as insufficient computing power, inadequate communication bandwidth, and inconvenience for software OTA online upgrades. Therefore, upgrading the E/E architecture has become key to the development of intelligent connected vehicles. Referring to our previous report “Software-Defined Vehicles: E/E Architecture is Key”, this paper focuses on the upgrades of E/E architecture, including hardware, software, and communication architecture, and constructing a core technology closed loop with chips + operating systems + middleware + application algorithm software + data. In the future, whoever can grasp one of these links may achieve an upgrade in the automotive industry chain position.

Traditional automakers’ operating systems will develop from multiple independent operating systems/system programs to a few or a single operating system. Referring to our earlier report “Software-Defined Vehicles: AI Chips are the Source of the Ecosystem”, this paper discusses how the hardware of automotive E/E architecture is continuously upgraded from distributed to domain control-centralized, highlighting the importance of domain controllers, while AI chips are at the core of autonomous driving domain controllers/central computing platforms. The main AI chip players in the cockpit domain are Qualcomm, Intel, Huawei (Kirin), and Renesas, which require low AI computing power and low safety levels, while the autonomous driving domain requires much higher AI computing power and functional safety than cockpit chips, thus the main AI chip players are Tesla (self-developed), Mobileye, NVIDIA, Huawei, and Horizon. Due to the different real-time, safety, and communication bandwidth requirements between domains, traditional car manufacturers/Tier 1 suppliers cannot achieve a one-step solution, thus often adopting cross-domain integration solutions (i.e., 3 domains or 5 domains, etc.). Therefore, with the gradual formation of domains, domain operating systems will gradually take shape, and this paper will focus on how automotive operating systems are the soul of achieving software-defined vehicles.

2. Operating Systems Bridge and Lead Intelligent Vehicle Development

The operating system (Operating System, OS) refers to a collection of programs that control and manage the hardware and software resources of the entire computing system, reasonably organizing and scheduling the work and resources of the computer to provide users and other software with convenient interfaces and environments. Once intelligent devices reach a certain level of development, they generally require a dedicated OS, such as the Microsoft Windows system for PCs, Google Android system for smartphones, and Apple iOS system. Under the trend of software-defined vehicles, automotive OS is key to upgrading traditional vehicles to intelligent vehicles. The automotive operating system has evolved from traditional automotive electronic basic software, which can be divided into two categories:

1) Automotive Electronic Control Devices: Systems that directly send commands to actuators (such as electronic valves, relay switches, motors, etc.) to control the coordinated operation of the engine, transmission, power battery, etc., collectively referred to as ECUs (Electronic Control Units). Common ECUs include Engine Control System (EMS), Transmission Control Unit (TCU), Electronic Stability Program (ESP), Battery Management System (BMS), etc. This type of system involves safety and driving performance.

2) In-Vehicle Electronic Devices: Such as instrument panels, central controls, heads-up displays (HUD), and streaming media rearview mirrors. These systems are often related to user experience and do not directly participate in the control decisions of vehicle driving, thus having a minor impact on vehicle driving performance and safety.

In the future, automotive operating systems will mainly be divided into two categories: autonomous driving OS and intelligent cockpit OS. Different automakers/Tier 1 suppliers have different plans for the number of domain divisions. For example, Bosch divides into 5 domains (power domain, chassis domain, cockpit domain, autonomous driving domain, body domain), while Volkswagen’s MEB platform models are divided into 3 domains (autonomous driving domain, intelligent cockpit domain, body control domain), and Huawei also divides into 3 domains (autonomous driving domain, intelligent cockpit domain, vehicle control domain). Although there are multiple domains, they are generally mainly divided into intelligent cockpit domain operating systems that focus on openness, compatibility, and ecology, and autonomous driving domain operating systems that emphasize real-time, safety, and stability.

2.1. Automotive General OS Includes Two Parts: System and Functional Software

The narrow definition of an operating system only includes the system kernel part, while the broad definition includes both system software and functional software. The in-vehicle intelligent computing platform can roughly be divided into four parts from the bottom up: hardware platform, system software (hardware abstraction layer + OS kernel + middleware), functional software (library components + middleware), and application algorithm software.

1) Hardware Platform: Based on a heterogeneous distributed hardware architecture, including AI units and computing control units, it should support flexible chip selection, configurable expansion, and stacking computing power.

2) System Software: A complex large-scale embedded system operating environment customized for automotive scenarios, mainly includes three layers: a) Hardware Abstraction Layer: Includes BSP (Board Support Package), Hypervisor (hardware virtualization technology, providing virtual platform support for multiple operating systems), etc. BSP includes Bootloader (the basic support code that loads the operating system’s boot program), HAL (Hardware Abstraction Layer) code, drivers, configuration documents, etc., serving as the interface layer between the kernel and hardware, aiming to provide a virtual hardware platform for the operating system, enabling hardware independence and portability across multiple platforms. b) Operating System Kernel (Kernel): This is the narrow definition of an operating system, such as OSEK OS, VxWorks, RTLinux, etc. The kernel provides the most basic functions of the operating system, responsible for managing system processes, memory, device drivers, files, and network systems, determining the performance and stability of the system. c) Middleware: Software that sits between applications and the operating system, addressing common issues of software interconnectivity and interoperability in heterogeneous network environments, providing standard interfaces and protocols, and featuring high portability, such as POSIX/ARA (Adaptive AutoSAR Runtime Environment, i.e., middleware API interface) and DDS (Data Distribution Service).

3) Functional Software: Includes core common functional modules for autonomous driving, such as programming frameworks for related algorithms (like TensorFlow, Caffe, PaddlePaddle, etc.). Core common functional modules include general frameworks for autonomous driving, connectivity, cloud control, etc., which, together with system software, form a complete autonomous driving operating system that supports the realization of autonomous driving technology.

4) Application Algorithm Software: Software that implements specific autonomous driving functions, HMI interactions, etc.

2.2. Typical Levels of Automotive Operating System Transformation

Automotive operating systems can be mainly divided into the following types based on the degree of transformation of the underlying operating system:

1) Basic Operating System: Develop a completely new underlying operating system and all system components, such as the system kernel, low-level drivers, etc. Some may also include virtual machines, such as QNX, Linux, WinCE, etc. Due to the high manpower and material costs required to develop a new operating system, there are currently basically no companies that will fully develop a new underlying operating system.

2) Customized Operating System: Deeply customize and develop on top of the basic operating system, such as modifying the kernel, hardware drivers, runtime environment, application framework, etc. Typical representatives include Volkswagen’s VW.OS, Tesla’s Version, Google’s Android for vehicles, Huawei’s Harmony OS, AliOS, etc., which have become independently developed operating systems.

3) ROM-type Automotive Operating System: Conduct limited customization development based on basic operating systems like Linux or Android, without involving changes to the system kernel, generally only modifying the built-in applications of the operating system, etc. Most OEMs generally choose to develop ROM-type operating systems, with foreign OEMs mostly using Linux as the underlying operating system. Due to the better application ecology of Android in China, most domestic independent brands and new automotive forces mainly customize automotive operating systems based on Android, such as BYD DiLink, Chery GKUI, NIO OS, XPeng Xmart OS, etc.

Super Car Apps (also known as car-machine interconnection or phone mapping systems) are not complete automotive OS. They simply mirror the content of the mobile phone screen onto the vehicle’s central control, integrating functions such as maps, music, and social media to meet the needs of car owners, such as Apple CarPlay, Google Android Auto, Baidu CarLife, Huawei HiCar, etc. This is mainly because the vehicle cockpit must sacrifice performance to ensure system stability and high safety, leading to mobile phones, whether in terms of chips or operating system processing capabilities, outperforming the vehicle cockpit. Therefore, the rich functions of mobile phones are mirrored onto the vehicle’s central control to meet car owners’ entertainment needs. Due to ease of implementation and low cost, this remains the mainstream choice for car owners at this stage.

2.3. The Global Automotive General Operating System Market Reached $20 Billion in 2020

The global automotive general operating system market size reached $20 billion in 2020, with a projected CAGR of +13.1% over the next five years. We have referred to analysis data from McKinsey, which indicates that the global automotive general operating system (functional software, narrow operating systems, middleware) market size reached $20 billion in 2020, expected to reach $37 billion by 2025, with a CAGR of +13.1%; and reach $50 billion by 2030, with a ten-year CAGR of +9%.

3. QNX, Linux, and Android are the Three Major Underlying Operating Systems

The automotive OS is continuously upgraded from basic software programs to simple embedded systems to complex OS. Early embedded development was done directly on bare metal without an OS. As software became increasingly complex, to achieve multi-task execution, bare metal programs had to introduce interrupts, making program structures complex and difficult to read and maintain; thus, embedded OS gradually formed. However, due to the relatively single functionality executed by ordinary 8-bit or 16-bit ECUs and limited hardware resources, they cannot run complex OS like QNX or Linux, often using some basic software programs or simple embedded real-time OS like UCOS, FreeRTOS, etc. As IVI applications and interfaces gradually became complex, the cockpit was the first to adopt more complex OS. Linux and QNX integrate only the academically defined OS and communication protocol stacks; Ubuntu adds middleware and desktop environments on top of Linux; Android and AliOS integrate middleware, desktop environments, and some application software on top of Linux.

Global Automotive Cockpit Underlying OS is Highly Concentrated. Safety and performance are two contradictory aspects; due to the lower safety level of the cockpit domain, it currently requires a relatively complex OS to support a large number of applications and interfaces. According to statistics from ICVTank, in 2019, the top three underlying OS in the global automotive cockpit market had the following shares: QNX (43%), Linux (including Android) (35%), WinCE (10%). As the autonomous driving domain has not yet truly formed, the OS landscape for autonomous driving remains unclear. Considering the high costs of redeveloping underlying OS, autonomous driving OS may develop based on Linux/QNX kernels.

3.1. QNX: Non-Open Source & Safe Real-Time

QNX is a microkernel, embedded, non-open-source, safe real-time operating system. The QNX system was developed by Canadian QSSL; in 2004, Harman International acquired QNX; in 2010, BlackBerry’s parent company RIM acquired QNX from Harman International. QNX has a microkernel architecture, where the kernel is generally only a few tens of KB, while drivers, protocol stacks, file systems, and application programs run in memory-protected spaces outside the microkernel, allowing components to operate independently and avoiding kernel failures caused by program pointer errors. Due to its small kernel, fast operation speed, unique microkernel architecture, high safety and stability, and resistance to virus damage, QNX is the world’s first real-time operating system to pass ISO26262 ASIL-D safety certification. Therefore, QNX is often used in digital instruments that require high safety and stability.

BlackBerry has developed different domain system platforms for the automotive industry based on QNX. BlackBerry has developed in-vehicle infotainment systems (QNX CAR Platform for Infotainment), digital cockpit systems (QNX Platform for Digital Cockpits), and advanced driver assistance systems platforms (QNX Platform for ADAS) for the automotive industry, providing developers with flexible tool choices and good human-computer interaction interfaces. Taking the QNX ADAS platform as an example, its hardware supports chips from Renesas (H3, V3M), Intel (Denverton, Apollo Lake), NVIDIA Drive systems, and also supports sensors like millimeter-wave radar, lidar, cameras, and GPS.

QNX occupies a high market share due to its safety and stability advantages. QNX is a non-open-source system with characteristics of high development difficulty and weak application ecology, and it requires commercial fees. However, due to the very stringent requirements for safety, stability, and real-time performance in automotive embedded operating systems, QNX still firmly holds the top position in the market share of automotive embedded operating systems. According to its official website, QNX has cooperated with more than 45 OEMs, with over 175 million vehicles using QNX systems.

3.2. Linux: Open Source & Powerful Functionality

Linux is an open-source, more powerful operating system. Linux features a compact and efficient kernel that can fully leverage hardware performance. Its greatest advantage compared to QNX is its open-source nature, which allows for strong customization and development flexibility. When we mention developing new operating systems based on Linux, we refer to further integrating middleware, desktop environments, and some application software based on the Linux kernel. Linux has more powerful functionality than QNX and more complex components, thus it is often used in infotainment systems that support more applications and interfaces. Associations or alliances are dedicated to promoting open-source Linux operating systems in the automotive field, with typical representatives being AGL and GENIVI.

The AGL open-source project aims to establish an open platform for connected vehicles based on Linux. In 2014, the Linux Foundation released the first version of the open-source AGL (Automotive Grade Linux) specification 1.0, which is the first open IVI software specification. About 70% of the code (including the operating system, middleware, and application frameworks) has been completed, allowing automakers to focus on the remaining 30% for personalized customization to ensure brand differentiation, and AGL does not charge any licensing fees. With the development of autonomous driving, AGL is no longer limited to the IVI field and will extend to dashboard, cockpit, and autonomous driving fields in the future, although it has not yet passed the ISO 26262 standard. From the perspective of its member automotive enterprises, AGL’s early members were mainly Japanese manufacturers like Toyota, Honda, and Nissan. With the addition of Volkswagen and Hyundai in 2019, AGL’s influence has gradually expanded. As of March 2020, over 150 companies, including China Mobile, SAIC Group, Desay SV, and Zhongke Chuangda, have joined AGL.

GENIVI’s mission is to achieve widespread adoption of open-source development platforms for in-vehicle infotainment systems. Established in 2009, the GENIVI Alliance has been committed to providing various open-source technology solutions for in-vehicle infotainment systems in the automotive industry. GENIVI provides open-source software based on Linux, allowing automakers to select and integrate different applications and middleware to achieve differentiated in-vehicle infotainment products, shortening the development cycle and reducing costs for automotive manufacturers. About 80% of the software has already been developed in the consumer electronics/communication industry and can be applied without modification, only 15% need adjustments to fit special automotive parameters, and only 5% need to be developed from scratch. GENIVI will continue to develop the remaining 5% of the code and make it open to all automotive manufacturers. Currently, the alliance includes over 170 automotive manufacturers and suppliers.

3.3. Android: A Distribution Version of Linux

Android is a distribution version of Linux, with a complex system and powerful functionality. Android is an operating system developed by Google and the Open Handset Alliance based on Linux. Android is considered one of the most successful products based on Linux, with the richest application ecology, primarily applied to mobile devices. Therefore, in domestic vehicle IVI systems, it is often based on Android development. The main advantages of Android include: 1) open-source nature, which is very attractive to mid-to-low-end OS developers; 2) flexibility, allowing for customized modifications of native Android according to specific needs; 3) strong portability, allowing applications from Android phones to be used in vehicle systems with minimal modifications, facilitating domestic Internet companies to enter the automotive field and quickly establish an in-vehicle software ecology.

The main disadvantages of Android are: 1) poor security and stability, with system vulnerabilities posing high risks and high technical maintenance costs; 2) excessive reliance on Google. Android has entered the automotive IVI system field due to its rich application ecology in China. Although it lacks security and stability, Android still occupies a mainstream position in the domestic in-vehicle infotainment system field due to its aforementioned advantages. In particular, various Internet giants, independent brands, and new automotive forces have customized modifications based on Android, launching their own automotive operating systems, such as AliOS, Baidu’s Xiaodu Vehicle OS, BYD DiLink, NIO OS, XPeng Xmart OS, etc.

3.4. WinCE: Gradually Phasing Out of the Market

WinCE is an embedded operating system released by Microsoft in 1996, primarily applied in vehicle hosts, navigation systems, and entertainment systems. However, with the impact of Linux and Android, the number of developers and users has significantly decreased, and Microsoft plans to terminate its services by March 2021, gradually exiting the automotive operating system market.

4. Automakers & Internet & Technology Companies Release Operating Systems

4.1. Tesla Takes the Lead in Creating OS, Setting Industry Standards

Summary: In terms of underlying chips, Tesla uses Intel Atom E3950 CPU, self-developed FSD AI chips (continuously optimizing the underlying toolchain and operator library based on algorithm software requirements), etc.; in terms of the operating system, it is self-developed based on the underlying Linux; in terms of functional software, it supports the PyTorch deep learning programming framework (self-developed algorithms, not requiring support for all programming frameworks); the core algorithms for autonomous driving are self-developed; and data generated by users is collected to continuously optimize algorithm software, forming a closed-loop development model similar to Apple.

Tesla’s operating system Version is deeply modified based on the Linux kernel. Tesla’s system platform adopts the Linux 4.4 open-source operating system, supporting the PyTorch deep learning programming framework and based on the Kafka open-source stream real-time data processing platform, capable of supporting infotainment systems (IVI) and advanced driver assistance systems (ADAS), etc. Tesla chose Linux partly due to the advantages of Linux’s open-source nature, avoiding dependence on operating system vendors; on the other hand, it takes advantage of its compact and efficient kernel to fully leverage hardware performance, meeting Tesla’s performance requirements for vehicles.

Through access control, Tesla avoids attacks on the core areas of the operating system. For information security issues, Tesla uses kernel modules in the Linux system: Security-Enhanced Linux (SELinux), which enhances the information security of the operating system through “access control.” Access control refers to understanding all hardware resources and device interfaces in the system, clearly defining the allowed access range and hardware interfaces. In simple terms, it divides accessible and prohibited areas for third-party software, maximizing safety. Through access control, even if third-party programs attack the operating system, Tesla can ensure that the core area remains intact.

Based on Linux, the independently developed OS continuously achieves OTA online upgrades. By using open-source Linux, Tesla no longer relies on software vendors but fully controls the stack. Once a problem is discovered, it can be quickly corrected and upgraded through OTA, enhancing user experience. Since first using Version 5 on Model S in 2014, Tesla has made several significant upgrades to its operating system through OTA technology.

4.2. Volkswagen Develops VW.OS Platform to Accelerate Digital Transformation

Summary: Volkswagen pays more attention to functional safety and standardized frameworks, using multiple underlying operating systems such as Linux, QNX, and VxWorks to create an integrated platform that simplifies interactions between intelligent cockpits, autonomous driving, and body control. Advantages: It can fully utilize the existing technological advantages of various suppliers for rapid transformation. Disadvantages: The standard interfaces and protocols of various suppliers are not unified, resulting in overly complex systems that still rely heavily on suppliers. Volkswagen places more emphasis on functional safety and standardized frameworks, using multiple underlying operating systems to build an integrated platform.

Volkswagen simplifies the interaction technology between the cockpit and autonomous driving by building a VW.OS platform that can run multiple underlying systems (such as Linux, QNX, VxWorks). Due to the differing standard interfaces and protocols of various suppliers, there is a heavy reliance on AutoSAR to achieve middleware standardization, resulting in a large number of complex modules and components to support software from different suppliers. In addition, Volkswagen will establish Volkswagen Automotive Cloud, a global exclusive cloud service backend, to transform traditional Volkswagen vehicles into new intelligent software products.

Under the trend of software-defined vehicles, Volkswagen’s software department is undergoing significant changes. In February 2019, Volkswagen established a new software department, “Digital Car & Service,” dedicated to intelligent vehicle cloud services, appointing Christian Senger, who successfully led the team to develop Volkswagen’s MEB platform, as the head of the department. In April 2019, Volkswagen joined the open-source operating system AGL alliance to create a universal operating system in an open-source manner. In June of the same year, Volkswagen prepared to unite 5,000 digital experts to form the Car.Software department, focusing on the research and development of the software operating system “VW.OS” to accelerate digital transformation. Volkswagen claims that the ID.3 will be the first mass-produced model equipped with VW.OS, and models based on the self-developed operating system VW.OS will have L3 autonomous driving capabilities, allowing for autonomous driving on highways and congested urban roads. Starting in 2025, all new models under Volkswagen will be equipped with VW.OS and connected to the Volkswagen Automotive Cloud (developed in cooperation with Microsoft).

The goal of Volkswagen VW.OS is to achieve a unified digital platform for vehicles, customers, and services. VW.OS is born out of Volkswagen’s digital transformation strategy, and its existence also helps establish Volkswagen’s digital brand ecosystem. New models equipped with Volkswagen VW.OS will use the system platform to achieve resource allocation of underlying hardware, communication interaction between software and hardware, and sharing of underlying function library component resources, significantly reducing code volume while integrating ECU functions. This ecosystem relies on a cloud-based technology platform that tightly connects vehicles, customers, and services (ODP, One Digital Platform). The ODP platform effectively ensures that Volkswagen’s external partners and services are closely connected with Volkswagen’s IT architecture, facilitating comprehensive cooperation.

4.3. Google’s Involvement with Automotive Android, Expected to Replicate the Path of Mobile Android

Google has entered the automotive OS field through the in-vehicle app Android Auto and Android Automotive OS. Google began laying out the automotive field as early as 2014, releasing the in-vehicle system Android Auto (which is essentially an app) that allows users to project messages, calls, media, navigation, and other applications from their phones onto connected vehicle systems, similar to Apple CarPlay and Huawei HiCar. In 2019, Google released Android Automotive OS, an open-source operating system that can run directly on automotive IVI systems, allowing users to download applications like Google Assistant and Google Maps from Google Play to run on their vehicles without using an Android phone. Android Automotive is similar to mobile Android in that its source code library is free and open-source, providing basic infotainment functions, and OEMs can use Android’s generic framework and API to implement the desired functions.

Android Automotive replaces the original mobile Android system architecture with vehicle-related modules. These primarily include: 1) Car App: Apps developed by OEMs and third parties; 2) Car API: Interfaces unique to automotive apps; 3) Car Service: Services related to vehicles within the system; 4) Vehicle Network Service: Automotive network services; 5) Vehicle HAL: Describes the hardware abstraction layer of vehicles. Unlike previous open-source Android systems, the flexibility and modifiability of the in-vehicle Android system are greatly reduced, and its applications may be limited. Volvo’s electric vehicle brand Polestar will be the first model equipped with the in-vehicle Android system.

4.4. Huawei Harmony OS Aims at All Scenarios, Creating an Independent Third-Party Platform

Huawei Harmony is a distributed OS based on a microkernel aimed at all scenarios, originally intended to achieve cross-platform collaboration capabilities. Harmony is the world’s first distributed OS based on a microkernel for all scenarios, developed to enhance the cross-platform capabilities of the operating system, including support for all scenarios, across multiple devices and platforms, and addressing low latency and high security challenges. Harmony OS has four major characteristics: distributed architecture, inherently smooth performance, kernel security, and ecological sharing; it has a three-layer architecture: the first layer is the kernel, the second layer is basic services, and the third layer is the program framework. In 2019, Harmony OS 1.0 was first used in smart screen products, and plans to gradually apply it to smartphones, tablets, vehicles, and more smart devices starting in 2020.

The Harmony autonomous driving OS microkernel became the first OS kernel in China to obtain ASIL-D certification. In 2020, Huawei’s autonomous driving operating system kernel obtained the industry’s highest level of functional safety certification (ISO 26262 ASIL-D), becoming the first OS kernel in China to obtain ASIL-D certification; at the same time, this kernel received high-level information security certification (CC EAL 5+) in September 2019, marking it as the first commercial OS kernel in the industry with both Security & Safety dual high certifications.

According to Huawei’s plan, its E/E architecture solution consists of three domains: intelligent cockpit, intelligent driving, and vehicle control. The CDC intelligent cockpit platform: 1) Achieves sharing of the industrial chain between vehicles and smartphones in software and hardware, application ecology, etc.; 2) Constructs IVI modules based on Kirin chips to reduce hardware costs through industrial collaboration; 3) Achieves Huawei’s “1+8” ecology based on Harmony OS, enabling seamless interconnection across terminals. The MDC intelligent driving platform: 1) Leverages Huawei Cloud (Octopus Cloud Services) + AI advantages to create a platform for vehicle-cloud collaboration; 2) Establishes standards and protocols, opens up the sensor ecology; 3) Supports partners in developing algorithms to create differentiated solution algorithms; 4) Establishes docking specifications to build an actuator ecology with mainstream manufacturers. The VDC intelligent electric platform: Aims to create differentiated user experiences based on different user preferences, introducing network energy industrial chain and technical advantages to create mPower multi-form electric drive and efficient in-vehicle charging products.

The intelligent driving MDC platform covers an open software stack from operating systems to cloud services. According to Huawei’s plan, the MDC system platform will follow AutoSAR specifications, be compatible with third-party algorithm dependency libraries like OpenCV, OpenCL, etc., and support POSIX PSE52 API, mainstream AI frameworks like TensorFlow and Caffe. In addition, the system platform will provide rich services, such as image data preprocessing services, vehicle control data parsing services, etc., with system kernel latency below 10us and communication latency below 1ms.

4.5. Baidu Apollo Cultivates for Years, Awaiting Results

Baidu is a leading internet company in China that was one of the earliest to layout intelligent driving. In 2013, Baidu established an autonomous driving research team based on its deep learning institute, beginning its layout in the automotive intelligent driving field. In 2017, Baidu officially released Apollo 1.0 for the first time, and in the same year, it released the conversational AI operating system DuerOS customized based on Android. In September 2019, Baidu’s L4-level mass-produced autonomous driving taxi fleet Robotaxi officially began operation in Changsha in cooperation with FAW. At Baidu’s first Apollo ecosystem conference in December of the same year, it launched Apollo 5.5 version, supporting point-to-point city autonomous driving, and released two open-source platforms: vehicle-road cooperation and intelligent vehicle networking. As of 2020, Baidu Apollo is the only company listed as a leader in autonomous driving in the NR report. As of October 2019, Baidu’s Apollo open platform has over 36,000 developers from more than 90 countries and over 170 ecological partners, open-sourcing 560,000 lines of code.

Apollo has formed three open platforms: autonomous driving, vehicle-road cooperation, and intelligent vehicle networking. In terms of the intelligent vehicle networking platform, Baidu’s solution is the Xiaodu Vehicle OS, which is a customized intelligent voice solution designed for in-vehicle devices, navigation systems, rearview mirrors, etc. In terms of the autonomous driving platform, Baidu Apollo is an open-source autonomous driving platform based on the QNX kernel, aimed at providing the automotive industry with an open, complete, and secure software platform to help them quickly build their own complete autonomous driving systems by combining vehicle and hardware systems. Baidu will develop environmental perception algorithms, path planning algorithms, vehicle control algorithms, and source code for the in-vehicle operating system, providing complete development testing tools, and partnering with mature sensor field partners to reduce the R&D threshold for unmanned vehicles. Among the automotive companies Baidu collaborates with, brands cooperating at the underlying OS level include Chery Exeed, Great Wall, and Ford, while brands integrating Baidu’s services and ecology include Kia, Geely, Chery, WM Motor, and Hongqi.

4.6. Ali AliOS Enters from the Cockpit, Seizing Application Ecology Entry Points

Alibaba has long been involved in the mobile operating system field. Alibaba began laying out mobile operating systems as early as 2010, launching the mobile terminal operating system YunOS in 2013. With the development of 5G and IoT technologies, Alibaba has expanded from mobile operating systems to a broader IoT field. In terms of intelligent vehicles, in July 2015, Alibaba and SAIC Group jointly established Zebra Smart Travel, later restructuring their strategy in 2019 to expand their cooperation areas to automotive travel services, autonomous driving, and automotive industry cloud services. Currently, nearly one million internet vehicles equipped with the Zebra system are driving on the road, including brands such as Roewe, MG, MAXUS, Dongfeng Citroen, Changan Ford, Qoros, Baojun, and Skoda.

AliOS has a wide layout and clear positioning. Unlike Baidu Apollo, Alibaba positions AliOS as an IoT operating system for multiple terminals, not limited to the automotive market; in the field of intelligent connected vehicles, AliOS is positioned specifically for the IVI field (in-vehicle infotainment system). Its predecessor YunOS is based on the Linux Kernel, with an architecture similar to Android. The system is equipped with a core virtual machine designed, architected, and developed independently, adding cloud service-related modules, providing a runtime environment compatible with the Android Dalvik virtual machine. The upgraded AliOS adheres to an open-source and free technical route, and after the strategic restructuring of Zebra, Alibaba transferred the overall intellectual property and business of YunOS to Zebra. The latter has complete ownership and usage rights of the underlying architecture code of YunOS and can authorize automotive brands or their designated partners to use it. Meanwhile, Zebra Network will further open to the entire automotive industry, combining core basic technologies of the YunOS operating system to allow the Zebra system to enter more automotive brands.

4.7. Tencent Car Connection TAI Enters Late, with Clear Ecological Advantages in the Cockpit

Tencent entered late but has significant software ecological advantages. In November 2017, Tencent launched the Tencent Car Connection AI in Car system at the global partner conference, and later that year, it was implemented in the GAC Group’s iSPACE smart electric concept car. A year later, AI in Car was upgraded to Tencent Car Connection TAI (Tencent Auto Intelligence) system. In June 2020, Tencent Smart Travel released TAI 3.0, a new generation of autonomous driving virtual simulation platform TAD Sim 2.0, as well as automotive cloud digital marketing solutions and smart transportation solutions. Currently, Tencent Car Connection has established deep strategic cooperation with automakers such as BMW, Audi, Mercedes-Benz, GAC, Changan, FAW, Geely, Dongfeng, and has implemented several mass-produced models such as GAC GS4 and Dongfeng Liuzhou T5.

Tencent’s ecological advantages are significant. The Tencent Car Connection “AI in Car” system is a vehicle networking solution specifically designed for the next generation of smart connected vehicles, integrating Tencent’s security, content, big data, cloud computing, and artificial intelligence platform capabilities. The upgraded Tencent Car Connection TAI (Tencent Auto Intelligence) system builds an ecological vehicle networking system through lightweight, ecological, cross-platform, and cross-terminal toolchains. Specifically, it is constructed through the vehicle system, cloud platform, and ecology. The vehicle system is divided into: in-vehicle scene services, in-vehicle applications, and scene engines, closely integrating with Tencent’s small scene; the cloud platform includes Tencent Car Connection Super ID, WeChat payment platform, AI scene management platform, content management platform, service management platform; the ecology includes Tencent’s internal and external ecosystems such as QQ Music, Dianping, etc.

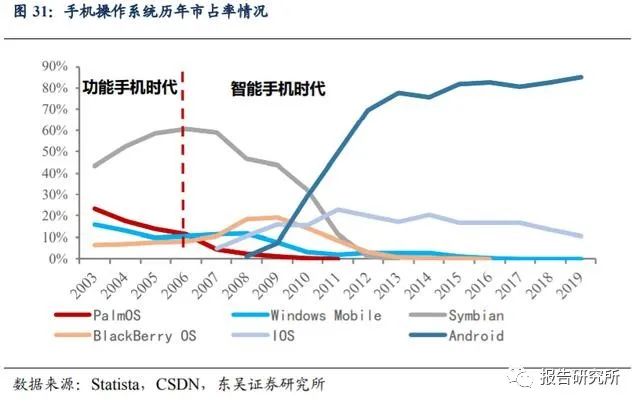

5. Using the Stone of Smartphones to Attack the Jade of Intelligent Vehicles

Symbian failed to follow the changes of the smartphone era and quickly fell. Symbian was jointly established by Psion, Nokia, Ericsson, and Motorola. Early on, the Symbian system positioned itself as an open platform, allowing any developer to develop software for devices supporting Symbian. Its platinum partnership program also attracted ARM, Texas Instruments, Panasonic, Siemens, Samsung, Lenovo, and other manufacturers to join. The Symbian Alliance launched the Symbian series OS, which received widespread user praise, and it had a market share exceeding 60% during the feature phone era. However, with the advent of the smartphone era, the Symbian operating system, developed specifically for feature phones, could not adapt to the era’s changes due to high development difficulty and the later Symbian signing system (installation programs required certificate signing, meaning developers had to pay for Symbian), leading to a significant decrease in the developer ecology and the withdrawal of Motorola and Psion from the alliance. Within just five years, its market share plummeted from nearly 60% in 2007 to less than 2% in 2012.

iOS adopts a closed-loop development model (chip-operating system-phone), and its market share rapidly increased and stabilized after the release of the first-generation iPhone in 2007. Android quickly increased its market share and surpassed iOS after releasing Android 1.0 in 2008.

5.1. Android as a Representative of Open Source Route

Android is an open-source OS developed by Google based on Linux, consisting of open-source AOSP and closed-source GMS. Android is led and developed by Google and the Open Handset Alliance, a free and open-source operating system based on the Linux kernel. Android occupies a large share of the mobile device OS market due to its open-source, strong compatibility, and rich application ecology. According to IDC’s estimates, the market share of Android phones is expected to reach 87% in 2019. Android consists of open-source AOSP (also known as the Android Open Source Project) and closed-source GMS (Google Mobile Services). Other manufacturers can freely use and modify AOSP and customize it based on their needs. GMS includes Google’s app store, search engine, browser, maps, email, voice services, and other key services, and the entire suite’s source code is not open to the public.

The overseas market is highly dependent on GMS, while the domestic market is the opposite. In the overseas market, without support from Google GMS, most apps cannot run, nor can they use Google-developed applications such as Google Play, Google Search Engine, Chrome Browser, Google Earth Maps, Gmail, etc. In the domestic market, the situation is completely different. Due to the inability to use Google’s network services, domestic phone manufacturers usually customize the native Android system by deleting unnecessary GMS components, optimizing the UI, and providing features that better fit local usage habits, improving software services, and promoting their brands. Examples include Xiaomi MIUI, Huawei EMUI, and OPPO ColorOS. They are essentially UI or ROM modifications based on Android. UI refers to the overall design of the software’s human-computer interaction, operational logic, and interface aesthetics. ROM refers to the phone system firmware, which is solidified software written into Flash-ROM.

In summary, the main reasons for Android’s success are as follows:

1) Open-source and free strategies have formed a rich software ecology. Android’s open-source nature allows phone manufacturers to personalize Android according to their needs. Google utilizes typical internet thinking, attracting a large number of third-party developers to create apps through free and open services, thus building a complete software ecology and generating advertising revenue from massive traffic. This forms a virtuous cycle: open-source -> numerous developers -> diverse application software choices -> excellent user experience -> large user base -> numerous developers.

2) Strong software development capabilities and bundling strategies enhance user stickiness. Google, with its strong software development capabilities, has developed many excellent apps, such as app stores, search engines, maps, email, etc. Google also enhances user stickiness by bundling these foundational apps with the Android system, and most apps remain open to third-party companies.

3) Neutral third-party alliances led by ARM + Android giants drive industry development. Google is sufficiently independent, and its deep cooperation with ARM allows the Android system to be highly optimized for ARM architecture processors, constructing a unified CPU instruction set and OS kernel standard alliance through hardware openness and software open-source strategies, leading industry development.

4) A unified standard interface has been formed, making software and hardware portability strong.

Of course, open-source is a double-edged sword. While Android opens more permissions to third-party developers, it also leaves many security vulnerabilities, resulting in relatively poor system security and stability.

5.2. iOS as a Representative of Integrated Closed-Loop Model

Apple’s iOS adopts an integrated model of chip-operating system-phone, using a non-open-source route for its operating system. iOS is only used in Apple’s products, with limited authorization for third-party manufacturers for software development. Apple has always adhered to its philosophy of combining software and hardware, insisting on self-developing software to maximize hardware performance and achieve the best user experience.

In summary, the success of iOS is mainly due to the following points:

1) Superior security and stability. Apple adheres to a strict management system, with the Apple Store having a comprehensive developer certification and application software review mechanism to effectively prevent system vulnerabilities, malicious plugins, and viruses; it strictly manages permissions related to user privacy information such as messages, addresses, and voice; and restricts users to download apps only from the Apple Store; its unique sandbox mechanism protects user data and isolates different programs. The non-open-source strategy allows iOS to operate stably while emphasizing user privacy protection.

2) Adhering to the closed-loop integrated route of combining software and hardware, focusing on system smoothness and user experience. iOS does not consider portability, thus does not need to run on virtual machines, and it uses the highly efficient Objective-C language, with execution efficiency far exceeding that of Android; iOS focuses on optimizing apps for its hardware platform, without needing to ensure smooth operation across different models and system versions like Android; iOS does not allow applications to run in the background, occupying less CPU and memory, ensuring smooth system operation; unlike Android, where data processing instruction permissions are highest, iOS prioritizes UI instruction permissions to ensure the smoothness of human-computer interaction in the system.

5.3. Development Insights for Intelligent Vehicle OS

The traditional automotive industry chain may build a basic platform through an Android-like model, creating dedicated platforms through Tier 1 suppliers. Due to the low sales and replacement rates of vehicles, developing a completely new OS kernel (narrow definition of operating system) is too costly, and it is also difficult to build an ecology. In terms of cockpit OS, most automakers and Tier 1 suppliers choose to build dedicated operating systems (ROM-type) based on open-source underlying OS (Android/Linux), quickly establishing a rich software ecology. Domestic internet companies will quickly enter the automotive field based on their application ecology, constructing a large ecological system. In terms of autonomous driving OS, considering the high safety and stability requirements of vehicles, automakers and Tier 1 suppliers will choose more basic OS (Linux/QNX) to build a basic platform for autonomous driving, and then Tier 1 will customize differentiated products based on individual needs.

Apple-like integrated closed-loop technology routes have distinct advantages in the early stages of autonomous driving development, with high barriers. Tesla’s development model, similar to Apple’s, integrates chips, operating systems, and vehicles in a closed-loop R&D process, providing distinct advantages in the early stages of autonomous driving development. We believe that in the short term, Tesla’s advantages in autonomous driving will continue to expand compared to traditional automotive industry chains. The traditional automotive industry chain cannot quickly establish a closed loop of core technologies such as AI chips, operating systems, middleware, core algorithms, and data.