Click the above“blue text”to follow us!

Click the above“blue text”to follow us!

According to research from TrendForce’s DRAMeXchange, a global market research organization, the NAND Flash industry is experiencing a significant oversupply this year. SSD manufacturers are engaged in a price war, leading to a sharp decline in prices for PC OEM SSDs. It is expected that the contract average price for both 512GB and 1TB SSDs will drop below $0.1 per GB by the end of the year, making the 512GB SSD the second most mainstream specification after the 256GB SSD, replacing the 128GB SSD.

The market penetration rate of PCIe SSDs is benefiting from their nearly identical pricing to SATA SSDs, with a chance to challenge the 50% mark.

Chen Jiewei, a research associate at TrendForce, pointed out that the adoption rate of NB SSDs has surpassed 50% for the first time in 2018. Since the average contract prices for mainstream capacities of 128/256/512GB SSDs have dropped over 50% from their peak in 2017, and with the average contract prices for 512GB and 1TB SSDs expected to fall below $0.1 per GB by the end of the year, this will stimulate significant demand to replace 500GB and 1TB HDDs. It is anticipated that the SSD adoption rate will reach 60-65% in 2019.

Second Quarter SSD Contract Prices Drop by Double Digits, Third Quarter Decline Expected to Moderate

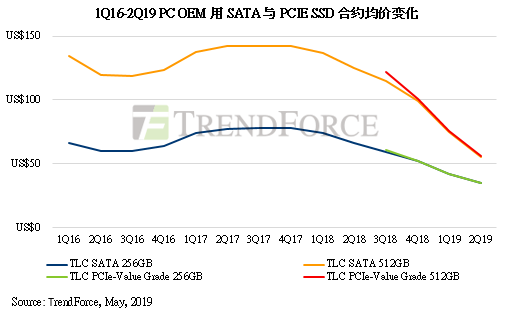

Regarding SSD prices, the latest survey from TrendForce shows that the average contract price for mainstream capacity PC-Client OEM SSDs has fallen for six consecutive quarters in the second quarter of 2019. The average contract price for SATA SSDs dropped by 15-26% compared to the previous quarter, while PCIe SSDs saw a decline of 16-37%.

The reasons for the continued price drop in the second quarter include: conservative sales outlook from customers in the PC, smartphone, and server/data center OEM sectors, leading to high inventory levels and weak stocking momentum, resulting in a severe oversupply in the NAND Flash market; leading SSD manufacturers engaging in aggressive price wars to clear their 64/72-layer inventory; and the price comparison effect brought by Intel’s 3D QLC SSDs.

Looking ahead to the third quarter, despite the traditional peak sales season and demand from new Apple device stockpiling, which may improve demand compared to the first half of the year, and most NAND Flash manufacturers slowing down their expansion plans and announcing production cuts to curb supply, Chen Jiewei expects that the average contract prices for mainstream capacity SSDs will continue to decline in the third quarter, although the rate of decline is expected to moderate.

Price Gap Significantly Narrowed, PCIe Expected to Replace SATA as Market Mainstream This Year

From the product progress of various SSD manufacturers, all mainstream product lines have now switched to 64/72-layer SSDs with 256/512GB capacities and PCIe interfaces as their main products, with the latest 96-layer SSDs gradually ramping up production since the first quarter of this year.

Additionally, based on the average contract prices in the second quarter, the price gap between premium PCIe SSDs and SATA SSDs is now less than 6%, while the price gap between value-grade PCIe SSDs and SATA SSDs is nearly zero. With the support of value-grade PCIe SSDs, the PCIe interface is expected to replace the SATA interface as the market mainstream this year.

For more pricing information, you can download the Global Semiconductor Observation APP for viewing.

Note: The above content is original from TrendForce and is prohibited from being reproduced, excerpted, copied, or mirrored. For reprint requests, please leave a message in the background to obtain authorization.

Image Statement: Cover image sourced from a legitimate image library, Pai Xin Wang.

Extra:Dear friends of Global Semiconductor Observation, to avoid missing semiconductor industry news due to WeChat updates, please take a moment to set us as a star mark! The specific method is as follows: 1. Click “Global Semiconductor Observation”; 2. Click the top right corner of the public account “…”; 3. Set the public account as a star mark.

PS: If you are using an old version, you can also do this, just click “Top Public Account” in the third step!

Recent Hot Topics

-

Official Announcement: Former SMIC CEO Qiu Ciyun Appointed CEO of Shanghai Xinsheng

-

Significant Progress: Unisoc’s Acquisition of Nexperia Passes Antitrust Review

-

Total Investment of 365 Million Yuan! An Integrated Circuit Material Project in Yichang Commences

-

Antenna Packaging Technology Evolution, LCP Becomes Key Material for AiP Technology