Unisoc has recently found itself in the spotlight again. Amid the severe global pandemic, it successfully overcame challenges and secured a substantial investment of 2.25 billion yuan from a major fund, warming up for its debut on the Science and Technology Innovation Board in 2021. However, at the same time, there are rumors that the NAND Flash team under Unisoc may be disbanded.

In response to inquiries from Voice of Chip, Unisoc stated that it has no plans to disband, but is instead focusing on implementing the overall storage strategy of the group, optimizing the product portfolio, and refocusing on related businesses by compressing certain NAND product lines. In the future, as Yangtze Memory Technologies (YMTC) steadily ramps up production of 3D NAND, related businesses will gradually transition to YMTC, while enhancing the DRAM product line.

Why did Unisoc choose this time to undergo operational transformation and refocus its product lines? According to Voice of Chip, there are two key reasons behind this.

First, the establishment of Yangtze Memory’s self-production and self-sales strategy;

Second, Unisoc will no longer enter into new contracts for NAND Flash chip supply with Intel;

Unisoc is one of the strategic layouts in the storage sector under Unisoc Group, established in 2018, focusing on the sales of various storage products including NAND Flash, SSD, UFS, eMMC, DRAM, and more, while also establishing its own domestic storage brand.

The initial purpose of establishing Unisoc Storage was twofold: to create the largest storage module brand and sales channel in China; and to establish a smooth outlet for the future mass production of 3D NAND chips by Yangtze Memory.

At the same time, Unisoc Group also established Shanghai Hongmao Microelectronics for chip backend packaging, and jointly set up Suzhou Guangjian Storage with Lite-On Technology in Suzhou for SSD assembly, with Unisoc and Lite-On holding 55% and 45% respectively. Later, Lite-On’s SSD business was sold to Kioxia (formerly Toshiba), but the Suzhou SSD assembly plant was not included in the transaction.

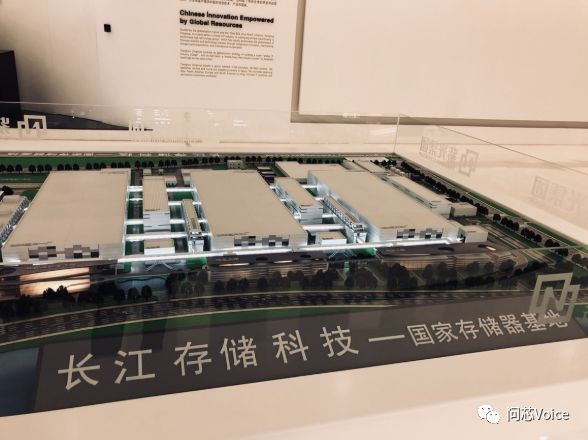

Based on this blueprint, we can clearly see that Unisoc Group has planned a comprehensive layout in the storage sector, including NAND Flash chip manufacturing (Yangtze Memory), packaging plants (Shanghai Hongmao Micro), SSD assembly (Suzhou Guangjian), and module brand channels (Unisoc Storage), forming a complete vertical integration.

This is a macro layout that is ambitious and meticulously thought out, aimed at establishing a self-sufficient production and sales system for storage in China, covering manufacturing, chip packaging, finished product assembly, and sales channels.

If we were to say that this perfect script lacks something, which has led to the current development not proceeding as planned, perhaps it is the absence of a frontline executor who is very familiar with the storage industry to fully implement this perfect script.

As developments progressed, two key reasons forced Unisoc Storage to make the decision for operational transformation today.

First, the positioning of Yangtze Memory has somewhat changed.

Originally, Yangtze Memory’s role was more factory-oriented, primarily focused on manufacturing, with no sales included. However, as Yangtze Memory’s operations have been very successful, it has gradually integrated from the manufacturing end to the sales end, leading to some overlap with Unisoc Storage’s role.

The second reason is the supply issue of 3D NAND chips for Unisoc Storage.

As mentioned earlier, the purpose of establishing Unisoc Storage was ultimately to become the outlet for Yangtze Memory’s 3D NAND chips.

However, before Yangtze Memory truly entered mass production, Unisoc Storage was established early to build the sales channels and brand reputation, so that when Yangtze Memory’s 3D NAND chips began mass production, the upstream and downstream could connect smoothly.

Therefore, to establish the sales channels in advance, Unisoc Storage’s first source of NAND Flash was through a partnership with Intel, purchasing NAND Flash chips from Intel to create end products and build brand recognition.

However, after the two-year NAND Flash chip procurement contract with Intel expired, there have been recent industry rumors that the two parties will not renew the contract, which has hinted that this development may affect Unisoc Storage’s operational direction.

Industry insiders believe that Intel’s enterprise SSD products have been selling very well in recent years, and they do not have enough NAND Flash chips for their own use, making it impossible to supply external customers, which could be one of the reasons for the lack of consensus on contract renewal.

In short, with insufficient supply of NAND Flash chips, Unisoc Storage can only start considering transformation, focusing on the development of DRAM products in the future.

Unisoc Group is currently the only semiconductor manufacturer in China that has entered mass production of storage chips, and has already garnered support from numerous specific customers for Yangtze Memory, successfully breaking the “zero self-manufacturing” milestone for storage chips in China.

The path of storage is one that has not been walked in the country.

Unisoc carries a significant mission, and throughout its development and attempts at various business models, many perfect ideals have been realized, while others have not, requiring adjustments and new beginnings.

However, the macro goal of establishing two major storage chip product chains, 3D NAND and DRAM, is an inevitable target. After the transformation, Unisoc Storage will also seek other more suitable business models to restart.