Due to increased demand from SSDs and servers, the price of NAND Flash memory has risen for the first time in 16 months. However, the market anticipates that this increase may be temporary, with a potential decline as early as next year.

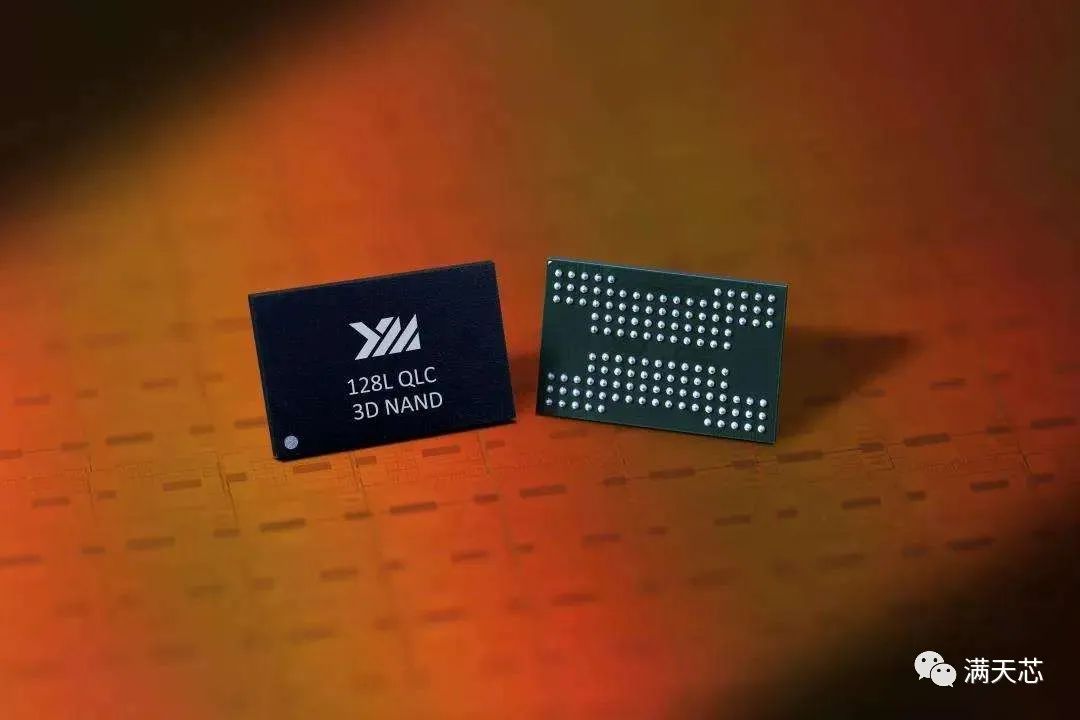

According to a report by Nikkei News on the 23rd, the wholesale price of NAND Flash rose for the first time in 16 months in July 2021, with the price of the benchmark product TLC 256Gb at approximately $3.35 each, an increase of 3% from the previous month. The report indicates that the rise in NAND Flash prices is primarily due to increased demand for PC SSDs (which use NAND Flash as a core component) and a surge in orders from data center servers. Since early spring this year, the supply and demand for NAND Flash has begun to tighten. The market generally expects that the price increase of NAND Flash may be temporary, as Samsung and Kioxia plan to increase production in the second half of this year, and semiconductor trading companies suggest that a decline may occur as early as next year. Kioxia announced on August 12 that its financial report for the last quarter (April-June 2021) showed that due to improved supply and demand balance in the NAND Flash market, prices increased by over 10%, marking the first rise in four quarters, leading to a 23% year-on-year increase in consolidated revenue to 329.5 billion yen; the consolidated operating profit, which reflects the profitability of its core business, surged by 139% to 35.1 billion yen, marking the first profit in three quarters; and the consolidated net profit skyrocketed sixfold (an increase of 624%) to 12.3 billion yen, also marking the first profit in three quarters. Regarding market trends and future outlook, Kioxia pointed out that with the prevalence of remote work and online education, overall demand for NAND Flash will remain high. Although there are concerns about production adjustments due to component shortages, it is expected that the supply and demand situation for NAND Flash will continue to stabilize in the second half of this year, and the long-term growth trend in the NAND Flash market remains largely unchanged.

☆ END ☆ 【Previous Hot Articles】【1】The Most Comprehensive Overview of the Semiconductor Industry Chain!【2】TWS Bluetooth Headphone Supply Chain + Mainstream Solution Comparison!【3】Essential! Component Packaging Query Chart (Extremely Comprehensive)【4】Major Global MLCC Manufacturers and Production Processes in 2020【5】Over 100 Global Connector Manufacturers! Including Selection Guide

【Previous Hot Articles】【1】The Most Comprehensive Overview of the Semiconductor Industry Chain!【2】TWS Bluetooth Headphone Supply Chain + Mainstream Solution Comparison!【3】Essential! Component Packaging Query Chart (Extremely Comprehensive)【4】Major Global MLCC Manufacturers and Production Processes in 2020【5】Over 100 Global Connector Manufacturers! Including Selection Guide