In mid-May, a notice circulated regarding a major MCU manufacturer criticizing agents and sales for violating regulations by selling at high prices in the open market.

MCU, short for Microcontroller Unit, is a microcomputer.

It is small, with an ordinary MCU being about the size of a fifty-cent coin; it is inexpensive, with prices ranging from a few cents to several tens of yuan; it is not scarce, as in 2020, the global production of MCUs exceeded 36 billion units;

and it is not special, as it can be found in remote controls, cars, various smart appliances, shared bicycles, and even in the electric toothbrushes we use daily.

However,this small component has unknowingly choked many electronic terminal companies in the current “chip shortage” wave, since last September when ST microcontrollers announced a “price increase of several times, faster than the rise in housing prices in Shenzhen,” MCUs have consistently dominated the chip hot search rankings.

From the historical market performance of MCUs, the market situation has roughly gone through the following changes:

→Price increases of several times, higher than housing prices in Shenzhen

→Automobiles halting production due to MCU shortages

→Foreign MCU manufacturers raising prices, domestic MCUs rising to replace them

→Domestic MCUs following the price increases

→Increase, increase, increase increase increase increase increase

→Some small and medium-sized enterprises unable to bear the high costs are tending to “lie flat”

→MCU prices have slightly retreated but remain high

The chip shortage issue is complex, why has the price of MCUs soared and remained high, consistently topping the hot chip rankings? What are the reasons for small and medium-sized enterprises to “lie flat” due to the chip shortage?After reading this article, you can roughly find answers to the following questions:

- Surging prices of several times, the current situation of rampant counterfeits and refurbished goods in MCUs

- How is the logic behind the surge in MCU prices formed?

- After the chaos, what changes have occurred in the MCU market?

01

The chaotic landscape of MCUs: Long-term dominance of hot material rankings

Rampant counterfeits and refurbished goods

MCU chips are the abbreviation for Microcontroller Units, also known as microcontrollers. They integrate the central processing unit, memory, counters, serial ports, and other peripheral interfaces into a single chip, forming a chip-level computer for different control functions in various applications.

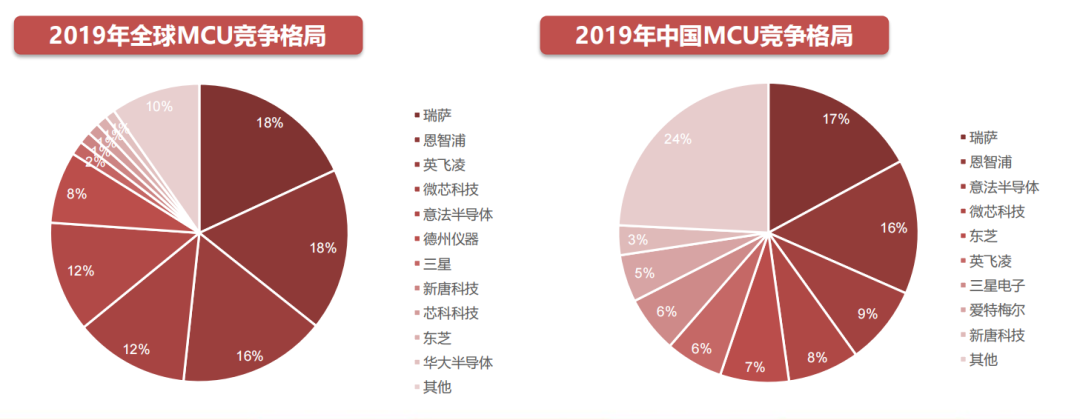

The MCU industry has a high concentration, but domestic manufacturers have a low market share.

Global MCU suppliers are mainly foreign manufacturers, with a relatively high industry concentration: Renesas Electronics (Japan), NXP (Netherlands), Infineon (Germany), Microchip Technology (USA), STMicroelectronics, etc., with the top 7 companies holding over 80% market share.

Chinese MCUs are catching up and gradually expanding their market share: domestic MCU chip manufacturers have strong competitiveness in the mid-to-low-end market. Companies like GigaDevice, Huada Semiconductor, Zhongying Electronics, Neusoft Carrier, Beijing Junzheng, Taiwanese company Nuvoton Technology, and Jihai Semiconductor are steadily increasing their market share.

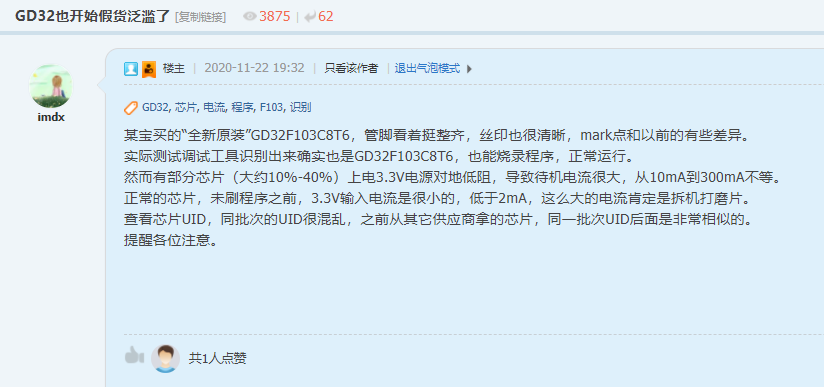

In this round of shortage and price increase, the MCU has been known for its “ST microcontroller price increase of several times,” and has remained at the top of the hot material rankings, later gaining attention due to automobile production halting due to MCU shortages, making it a “evergreen tree,” “fighter,” and “best financial product” in the chip shortage and price increase wave. At the same time, the MCU, with its wealth halo and mysterious aura, has also attracted attention due to rampant counterfeits and refurbished goods. For details on the GD32 counterfeit and refurbished goods incident, please refer to the recommended reading at the end of the article.How severe is the price increase of MCUs? Here is a set of price changes to feel it:

For details on the GD32 counterfeit and refurbished goods incident, please refer to the recommended reading at the end of the article.How severe is the price increase of MCUs? Here is a set of price changes to feel it:

-

GD32F103C8T6 normally costs around5 yuan, the current market price is35 yuan; (domestic GD)

-

N76E003AT20 normally costs around1 yuan, the current market price is8 yuan; (Taiwanese Nuvoton)

-

STM32F103C8T6 normally costs around6 yuan, the highest price reached65 yuan, the current market price is 55 yuan; (the “ancestor” of MCU price increases, ST)

-

FS32K144HAT0MLHT normally costs around20 yuan, the market price peaked at585 yuan, the current price is500 yuan; (automotive MCU)

From the current MCU market performance, whether foreign MCUs, Taiwanese MCUs, or domestic MCUs, all have experienced varying degrees of price increases, with increases ranging from several times to several tens of times, some even reaching dozens of times. This growth rate has left stock and fund investors in tears, leading to comments in the market that “MCUs are the best financial product of the year.”There are also rumors that in this unprecedented chip shortage and price increase wave, many ST big shots have achieved financial freedom and are now enjoying self-driving tours.

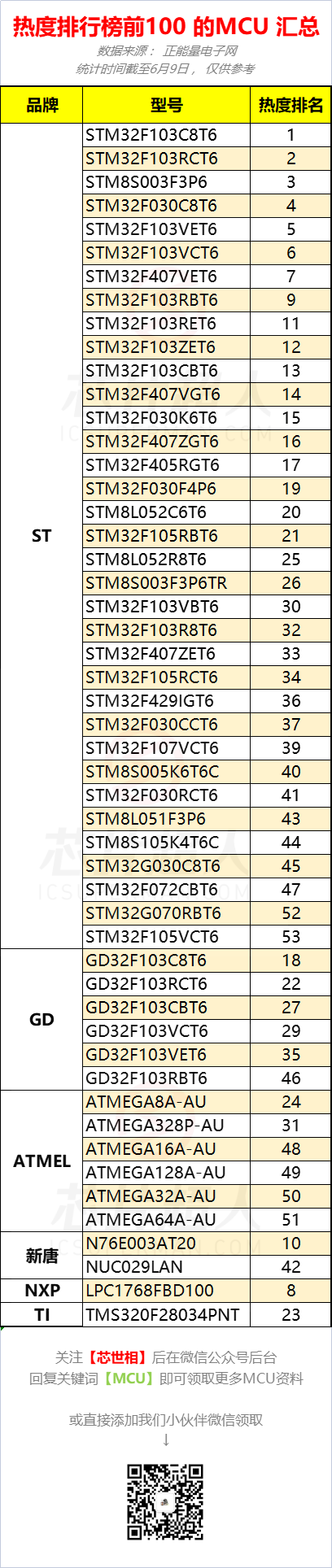

So, in this rapidly changing market, which MCUs are particularly popular? The following is a summary analysis of the MCU models in the top 100 hot material rankings from the Chip World and Positive Energy Electronics Network:

- In the Top 100 chip hot search rankings, there are a total of 51 MCU models, including 35 from ST, 6 from GD, 6 from ATMEL, 2 from Nuvoton, and 1 each from NXP and TI;

- ST brand MCUs are mainly 32-bit MCUs, with 29 out of 36 MCUs being 32-bit;

- The STM32F series products account for the most, reaching 29, with 10 models of STM32F103, 6 models of STM32F030, 4 models of STM32F407, and 3 models of STM32F105; among them, 103 is the mainstream entry-level, 030 is entry-level, 303 is an upgrade of 103, featuring DSP and analog peripherals, while 407 is high-performance, equipped with DSP and FPU.

02

How is the logic behind the surge in MCU prices formed?The direct reason for the surge in MCU prices by several times in the market is that there are customers willing to pay high prices.So, who are these customers?They are large clients, those with high product added value, such as automotive clients and industrial control users, because these clients have advantages in terms of funding and risk tolerance, making it easier for decision-makers to accept price increases when weighing the overall goals.For example, in the automotive sector, in December last year, the topic of automotive “chip shortage” was rapidly ignited, with automotive manufacturers halting or reducing production becoming the main theme. Tracing back, the indirect reason for the halting of production by Volkswagen in the north and south was the shortage of the main control chip (MCU) for producing the corresponding ECU.According to Chip World, the price increase of automotive chips began in October last year, and most automotive suppliers had already stockpiled in the market in advance. By December, the “chip shortage” crisis had highlighted that the shortage of related chips had developed to a serious state affecting production.Automobiles have high integration and high costs, with about 30,000 components needed for a complete vehicle; missing even one component can halt production.Prices have risen, and they are expensive; will they stop buying? Automotive suppliers can hesitate, but complete vehicle manufacturers cannot afford to wait. Everything is ready, and they cannot be stuck due to a few chips, leading to many complete vehicle manufacturers helping their suppliers buy chips or directly going to the market to purchase chips.The scarce MCUs, in an atmosphere of high buying and selling, have solidified their reputation for surging prices, which is an important factor for the long-term rise of MCUs.Looking further back, how is the surge of several times formed? Here, we might borrow the “water tank theory” we previously used in analyzing the MLCC market. Since ST’s MCU price increase is the most severe, we will take ST’s MCU as an example. Here, we can invoke the “water tank theory” we previously used in analyzing the MLCC market: Assume that ST MCU is a water tank of infinite volume, with upstream being the original factory and downstream being the terminal. In this tank, new MCUs are continuously injected, while MCUs also flow out. If the inflow of MCUs decreases while the demand for the water tank depth increases, the outflow of MCUs must decrease significantly.And these increasingly scarce MCUs are the chips that drive the price of MCUs in the tank. In the ST MCU tank, it is rumored that market big shots and speculative funds are locking up stocks, leading to a continuous decrease in the MCUs flowing into the market, and when demand increases, prices naturally inflate.In addition, we believe that apart from the common factors of wafer production capacity shortages, panic stockpiling by manufacturers, and double or triple orders in the shortage market, there are several other factors:

Here, we can invoke the “water tank theory” we previously used in analyzing the MLCC market: Assume that ST MCU is a water tank of infinite volume, with upstream being the original factory and downstream being the terminal. In this tank, new MCUs are continuously injected, while MCUs also flow out. If the inflow of MCUs decreases while the demand for the water tank depth increases, the outflow of MCUs must decrease significantly.And these increasingly scarce MCUs are the chips that drive the price of MCUs in the tank. In the ST MCU tank, it is rumored that market big shots and speculative funds are locking up stocks, leading to a continuous decrease in the MCUs flowing into the market, and when demand increases, prices naturally inflate.In addition, we believe that apart from the common factors of wafer production capacity shortages, panic stockpiling by manufacturers, and double or triple orders in the shortage market, there are several other factors:

- The contradiction between production capacity and demand under the pandemic;

MCUs mainly rely on 8-inch wafer production capacity, and the shortage of 8-inch wafer capacity has been ongoing since August last year. The probability of a contradiction arising between the tight production capacity and the recovery of demand and new demand growth has greatly increased;

- Panic anxiety caused by chip shortages halting production;

The automotive industry has gained attention due to halting production due to MCU shortages, and widespread reporting on social media has led to a consensus among audiences: MCUs are indeed scarce.

- Price increases triggered by raw material costs;

Against the backdrop of rising costs of raw materials, wafer foundry, and packaging testing, with supply not meeting demand, many MCU manufacturers, including Renesas, NXP, ST, GD, Songhan, Nuvoton, and Shengqu, have issued price increase notices, and the official announcements from chip manufacturers have, to some extent, fueled the frenzy of MCU prices in the market.

03

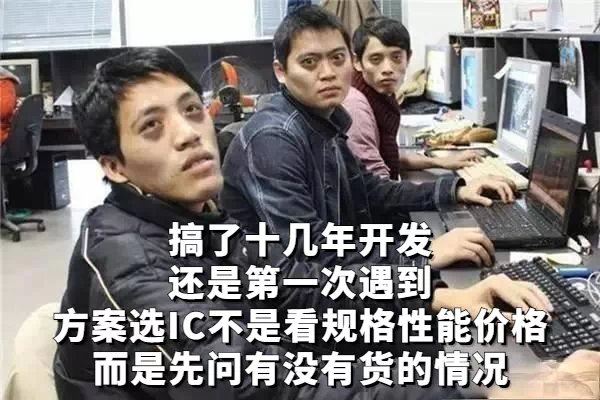

“Can’t afford it, can’t buy it”After the chaos, what changes have occurred in the MCU market?High-priced MCUs are still acceptable for large enterprises and high-value-added products, as they have advantages in terms of cost and original factory support. However, for small and medium-sized enterprises, the “can’t afford it, can’t buy it” chips are a nightmare concerning survival, and some manufacturers have even resorted to the helpless strategy of “more production leads to more losses, directly halting production.”“Previously, we used ST’s 8-bit microcontroller, which cost just over 1 yuan, then we started using Taiwanese ones, which cost over 1 yuan, and now Taiwanese ones have risen to 8 or 9 yuan, and we can’t buy them or afford them. Our previous solution only cost over 20 yuan.” This is what Mr. Fan, who mainly works on smart clothes drying control systems at Jiangsu Kejia Smart Home Co., Ltd., lamented over the phone about the “chip shortage.”“Customers are unwilling to bear the increased costs; it is not scientific to lose money on every set produced.”Faced with the unavailability of chips, Mr. Fan mentioned that he had considered alternatives. Since the beginning of the year, he has tried several solutions using available chips to adjust the design, spending two months from design to testing, but the products often encounter issues. “Troubleshooting feels like playing Minesweeper, one after another, and engineers rarely have time to think about how to improve production performance; all their time is spent on after-sales service.”The exhaustion of both chips and morale probably best summarizes Mr. Fan’s state of mind this year. He admitted, “When I see some peers lying flat due to unbearable cost pressures, I have thought about lying flat too, but I always think that if the new solution stabilizes, there might be a glimmer of hope.” However, Mr. Fan seems less anxious now than at the beginning of the chip shortage; he is now focusing more on customers who are less sensitive to price and willing to bear the rising costs of chips.In this round of shortage, Mr. Fan’s biggest realization is the need for more alternative solutions. “In the past, we wouldn’t consider replacements, mainly using ST MCUs because of their performance, stability, and price being comparable to Taiwanese and domestic options. When ST MCUs were in short supply in 2017, we switched to Nuvoton, thinking the supply would be more stable, but now we can’t buy them either.”Mr. Fan’s predicament is a common challenge faced by many solution providers and engineers today. In the chip shortage wave, “the solution is no longer about specifications, performance, and price, but first asking if there is stock” has become the norm. Some have replaced their MCUs, some have chosen to “lie flat,” and some, like Mr. Fan, are continuously trying new solutions, waiting for a glimmer of hope. Currently, all types of MCUs are in a state of skyrocketing prices and unavailability. Although the prices of ST MCUs have slightly retreated recently, they remain high, generally in a state of “available at a price but no market.”Friends in the chip spot market have raised a question: When will ST MCUs collapse? However, in May, ST announced another message that “starting June 1, all products will increase in price,” as we can see, the high-priced MCUs and their popularity are still there, remaining unchanged.So, when will ST collapse?We believe that the inflated MCUs are like balloons floating in the air, with various brands rising, and they cannot be suppressed or controlled. As long as there are still buyers, the soaring prices will not come down. Conversely, if production capacity continues to be released and high-priced MCUs go unsold, the collapse of MCUs will not be far off.Finally, let’s have a little interaction.If you have any other thoughts, feel free to add Moer WeChat for communication, and you can also receive a valuable MCU resource package ↓↓↓

Currently, all types of MCUs are in a state of skyrocketing prices and unavailability. Although the prices of ST MCUs have slightly retreated recently, they remain high, generally in a state of “available at a price but no market.”Friends in the chip spot market have raised a question: When will ST MCUs collapse? However, in May, ST announced another message that “starting June 1, all products will increase in price,” as we can see, the high-priced MCUs and their popularity are still there, remaining unchanged.So, when will ST collapse?We believe that the inflated MCUs are like balloons floating in the air, with various brands rising, and they cannot be suppressed or controlled. As long as there are still buyers, the soaring prices will not come down. Conversely, if production capacity continues to be released and high-priced MCUs go unsold, the collapse of MCUs will not be far off.Finally, let’s have a little interaction.If you have any other thoughts, feel free to add Moer WeChat for communication, and you can also receive a valuable MCU resource package ↓↓↓

Aiming for profitable opportunities

Wealth hotline scan to get it

Recommended Reading:

▶ GigaDevice Innovation? Has GD32 also started to see rampant counterfeits and refurbished goods?

▶ Wafer production capacity has been tight for nearly a year; the struggles of chip people, you don’t understand!

▶ “Iron-clad shortages, flowing IC price increase notices” | Latest price increase notice collection summary

▶ Seg Electronics building closure, merchants moving goods overnight, chips and mining machines are even scarcer

▶ Current situation of chip shortages in Zhongshan lighting companies: some orders cannot be accepted, some can afford to buy, but it is difficult!

▶ Water shortages, power shortages, and the spread of the pandemic threaten the production of TSMC, UMC, and other factories

▶ Even Toyota can’t hold on! Two factories in Japan plan to halt production in June

▶ ST price increase notices are flooding! All lines will increase in price starting in June! (Including price increase notice collection)

Click to view past content

↓↓↓