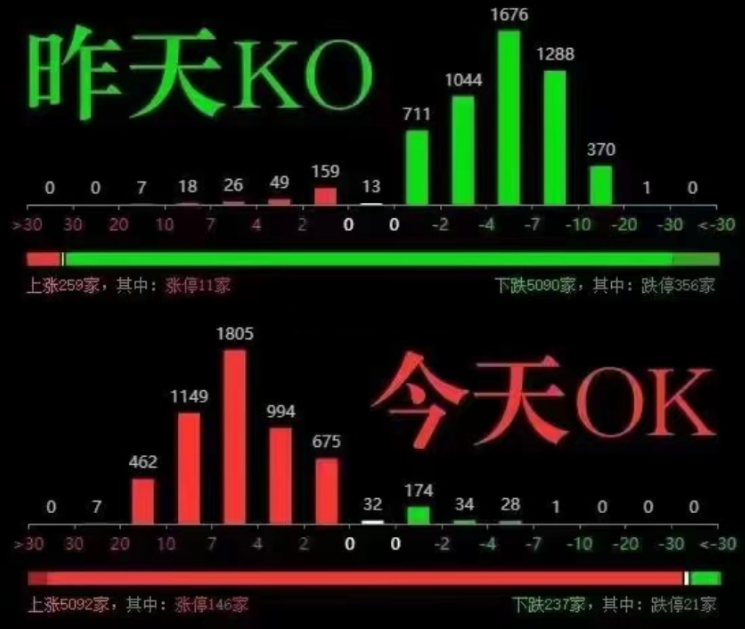

First, I would like to report to all the teachers that after issuing the explanation of the “Nine National Policies” overnight in the village, the micro-cap stocks finally stopped their free fall, and many oversold stocks have rebounded strongly. My cousin has already won back the money lost yesterday.(The losses from Monday have not been recovered yet.)

The A-shares are like a madman; yesterday they were in the ICU, and today they are happily bouncing around in a KTV.

It’s too frustrating to be beaten up and then given a candy.

The index has surged with a medium bullish line, and the micro-cap stock index has crazily hit the limit up, but unfortunately, the trading volume has not increased.

In the background, a female fan praised my cousin, saying: “The rebound is here, my cousin is really accurate.”

This girl is flattering me; my cousin is not as good as she says. After so many days of continuous decline, the oversold rebound after a low opening in the morning is quite normal, but this does not mean that micro-cap stocks will turn around from here; there will not be a general rise starting tomorrow.

The micro-cap stocks that were wrongly punished will continue to rise, but those that cannot rise should be watched carefully.

Micro-cap stocks have their good and bad sides, but many of the micro-cap stocks that have been rising for three consecutive years, with poor performance and money-raising schemes, may face a long decline next year.

Micro-cap stocks are supported by quantitative funds, and the leadership has decided to shift the blame to quantitative funds while continuously suppressing the scale of these funds.

The A-shares are becoming more like Hong Kong stocks, which is definitely the final destination for the bad micro-cap stocks.

—————

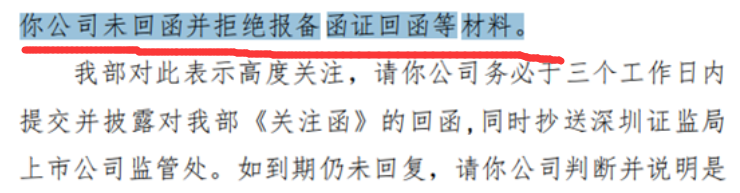

1: ST Meishang directly refused to respond to the exchange.

This stock has already fallen below the par value of 1 yuan, currently priced at 0.61 yuan. If it does not rise back to 1 yuan within 20 days, it will be directly delisted.

The exchange routinely inquired why it was below 1 yuan, but unexpectedly, the company chose to “read without replying”, leaving the exchange confused.

If my cousin is going to be fired tomorrow, and tonight the boss wants me to accompany a big client for drinks, would you say I would go?

Perhaps this company has this kind of mentality; it is suggested to respond properly to maintain good relations, as it might be possible to reverse the situation in the future.

2: The New York Times states: It did not mention the significant contributions of WuXi AppTec to the U.S. biotechnology and pharmaceutical industry and patients.

The report found, after reviewing hundreds of pages of records from around the world, that WuXi plays an important role in the U.S. pharmaceutical industry, providing part or all of the main ingredients for drugs widely used to treat certain types of leukemia, lymphoma, and other cancers, as well as obesity and AIDS.

My cousin checked and found that there are 323 drugs in short supply in the U.S. in the first three months of 2024. Is this a sign of relaxation in the biopharmaceutical sector?

Today, the index rebounded significantly, and the continuously declining biopharmaceutical sector also rebounded a little, but from the K-line perspective, these stocks are still in a state of deep decline with weak rebounds. WuXi is a good company, but the management’s continuous reduction of holdings has deeply hurt the confidence of institutions and retail investors.

There are some readers here who are deeply trapped by WuXi, and I have no good solutions for them. The stock trading model of stubbornly holding on without understanding when to enter or exit will only have a chance to recover in the U.S. stock market.

3: Train tickets for the first day of the May Day holiday sold out in seconds.

The difficulty in buying train tickets is related to certain apps; you have to pay extra to get the so-called “successful ticket grab.” Of course, the May Day holiday is also a traditional good season for tourism, and readers holding tourism stocks have also welcomed a rebound after the recent drop.

My cousin believes that the current round of speculation in tourism stocks is not over yet, but it is basically nearing the end of the tail, and more of it is in the stage of rebound arbitrage, so it is advisable to exit early before and after the holiday.

4: A certain financial institution suggests overweighting Japanese stocks.

Bro, bro, can you stop doing this all the time?

4: Offshore RMB at 7.25

————–

Tomorrow’s observations:

The index has rebounded, micro-cap stocks have surged, but the trading volume has not increased. Many retail investors who cut losses yesterday and this morning are scared and do not dare to enter the market even when they see the index rising and individual stocks rebounding.

Now it is mid-April, with two weeks left until the end of the month when the annual reports are released. My cousin estimates that tomorrow will still see more rebounds, but after a morning surge, there may be a pullback in the afternoon, and a general rise will not occur again.

Tomorrow will reveal whether the stocks in your hands are good or bad. If they continue to rise tomorrow, it indicates that they are quality micro-cap stocks that were wrongly punished; if they stagnate or even fall, you need to consider carefully.

Friday is the delivery day for stock index futures,and usually, the market on this day is quite “pushed up.”

However, my cousin still firmly believes that it is not difficult for the index to hit 3100 points. It is highly likely that May will be a relatively profitable month.

Trend Arbitrage Model: Chip Sector: Severely Pressured Military Industry Sector: Weak and Uninspired Liquor Sector: Drowning Sorrows in Alcohol Innovative Drugs: Policy Support Lithium Battery Sector: Oversold Rebound Photovoltaic Sector: Dull and Dim Real Estate Sector: Resurrecting from the Dead Tourism and Hospitality: Downgraded Consumption Artificial Intelligence: Late Night, Ghosts on the Road Coal Sector: Coal Madness Non-ferrous Metals: Rising and Pulling Back Special Valuation: Halo Support Securities Sector: Financially Obsessed

PS: Today, the large Citic Bank hit the limit up, and when I asked around in the fund group, everyone looked confused. Recently, there has been a strict crackdown on small essays, and many people in the fund group are afraid to write.

Recently, Fitch downgraded the rating outlook for major banks, and with the banks rising like this, it is likely to increase dividend payouts, perhaps even twice a year, which could stimulate the market.

In the past, brokerages were the leaders in bull markets, but now it has changed to banks. My cousin bought Agricultural Bank at 2.5 yuan two years ago, just for fun to make some daily price differences, and later sold it because it became boring.

Unexpectedly, Agricultural Bank’s stock price has doubled quietly over the past two years. My cousin does not intentionally recommend banks, as I do not buy them myself; I find it quite a waste of time.

Short-term traders do not need to keep an eye on those speculative stocks that are always hitting the boards; if you make money, it is your luck, but how you made it will eventually lead to losses.

Unless you use the “Dragon Empty Dragon” technique to avoid significant capital drawdowns during the adjustment period. (Definition: The Dragon Empty Dragon technique involves heavily investing in popular leading stocks during good market conditions and maintaining a cash position during adjustments, resisting temptation to avoid significant capital drawdowns.)

PPS: My cousin does not like to trade speculative stocks; he prefers stable trend stocks, but some readers enjoy trading exciting stocks, which is reasonable. My cousin will not criticize that.

But remember, 99.99% of speculative stocks are just hot air; make your profits and do not be fooled into becoming long-term shareholders.

Remember, do not forget!

PPPS: The Israeli military collectively supports a hard response against Iran, and after the Americans’ persuasion failed, they chose silence. The Israeli military stated: They will retaliate against Iran at their chosen time, place, and in their own way…

Iran is also confused: Bro, I was already looking for a way out, why are you still slapping me?

Dear readers, if a larger-scale conflict breaks out in the Middle East, which sectors would benefit?

Military, gold, copper mines, oil, artificial intelligence?