As of April 30, Allwinner Technology, Jinghe Integrated, Rockchip, Zhiwei Intelligent, Weir Shares, Qizhong Technology, China Resources Micro, Fuman Micro, Mingwei Electronics, Beijing Junzheng, Tiande Yu, New Xiangwei, Ge Kewei, Zhongying Electronics, Lixin Micro, Huicheng Shares, Longxun Shares, and Goodix Technology have successively released their Q1 2025 financial reports. Below is a summary of the performance of these 20 companies in Q1 2025 (some previously introduced companies are not listed again; please refer to past articles).

Among the 20 companies summarized, five companies, including Weir Shares, Jinghe Integrated, China Resources Micro, Ge Kewei, and Goodix Technology, reported revenues exceeding 1 billion yuan. Compared to the same period last year, the vast majority showed year-on-year growth, with 16 companies increasing and only 4 companies declining. Among them, Rockchip, Tiande Yu, Allwinner Technology, and New Xiangwei had growth rates exceeding 49%.

Four companies reported net losses attributable to shareholders, with losses ranging from 1K to 6K. Companies with profits exceeding 100 million yuan included Weir Shares, Rockchip, Goodix Technology, and Jinghe Integrated. Compared to the same period last year, 8 companies showed a year-on-year increase, while 12 companies reported growth, with Zhiwei Intelligent, Rockchip, China Resources Micro, New Xiangwei, and Tiande Yu exceeding 100% growth. Eleven companies experienced increases in both revenue and net profit, while only one company saw declines in both. Overall, the performance was good, but profitability needs improvement.

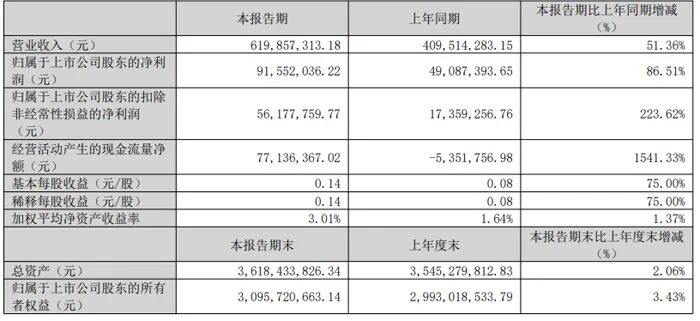

Allwinner Technology: Revenue of 620 million yuan, a year-on-year increase of 51.36%

In Q1 2025, Allwinner Technology achieved operating revenue of 620 million yuan, an increase of 51.36% compared to 410 million yuan in the same period last year. The net profit attributable to shareholders was 91.55 million yuan, up 86.51% from 49.09 million yuan in the same period last year. The net profit excluding non-recurring items was 56.18 million yuan, compared to 17.36 million yuan in the same period last year, an increase of 223.62%.

In 2024, Allwinner Technology successfully launched high-end octa-core smart chips A537 and A733, complementing the A527 octa-core products to achieve complete coverage of various high, medium, and low-end application needs, such as tablets, laptops, cloud computers, commercial displays, and cash registers. The company will continue to expand and improve software and hardware solutions, strengthen cooperation with leading customers in various sub-product fields, and expand the application group to achieve steady growth in the consumer sector.

In 2025, Allwinner Technology will focus on in-vehicle and intelligent cockpit applications. The company’s automotive chip T527V has passed the automotive AEC-Q100 certification and has achieved good layout in the automotive front-end. The company will continue to deepen cooperation with leading automotive customers around intelligent cockpit scenarios, promote mass production around designated projects, and continuously expand brand solutions to achieve broader product coverage.

In 2025, Allwinner Technology will expand its coverage in the family video and visual market. In 2024, the company’s first-generation smart projection product H713 received high recognition from the market and customers. The second-generation smart projection dedicated chip has completed verification and is about to enter mass production, which will provide better picture quality experience for products and customers. The company will continue to leverage product advantages to accelerate the mass production and iteration of new products, gaining higher market recognition. In the security market, the company continues to improve the market and customer layout of the V series products V851 and V821, and expand the mass production of new technologies such as AI-ISP and AOV, while improving the delivery and application of various AI algorithms.

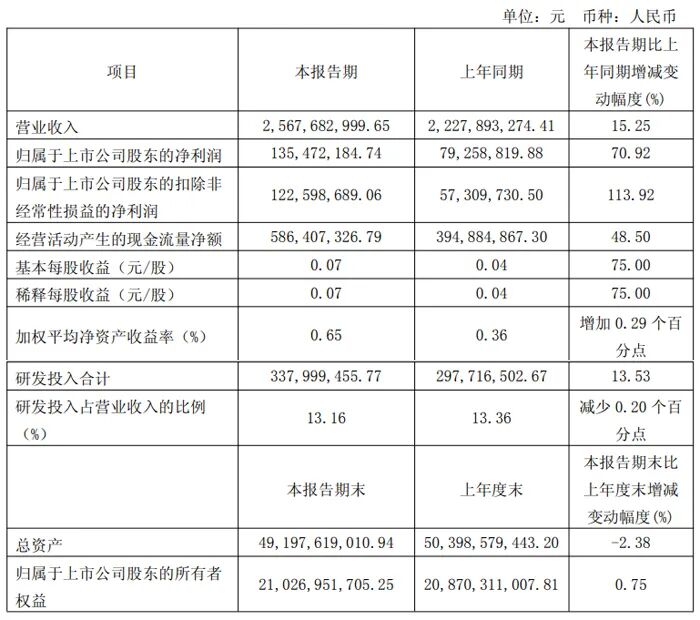

Jinghe Integrated: Revenue of 2.568 billion yuan, a year-on-year increase of 15.25%

In Q1 2025, Jinghe Integrated achieved operating revenue of 2.568 billion yuan, a year-on-year increase of 15.25%; the net profit attributable to shareholders was 135 million yuan, a year-on-year increase of 70.92%; the net profit excluding non-recurring items was 123 million yuan, a year-on-year increase of 113.92%. The net cash flow from operating activities was 590 million yuan. During the reporting period, total R&D investment was 338 million yuan, a year-on-year increase of 13.53%, accounting for 13.16% of operating revenue.

The industry is in a recovery phase, and Jinghe Integrated preliminarily judges that overall prices will remain stable in 2025. The main factors affecting the gross profit margin of the company’s products are price and utilization rate.

For the development strategy in 2025, Jinghe Integrated will focus on the two core products of DDIC and CIS, actively engage in the strategic layout of OLED display driver chip foundry, and vigorously promote CIS products to move towards mid-to-high-end applications to strengthen core business competitiveness. At the same time, the company will closely monitor market dynamics and actively carry out related technology research and development for the rapidly growing automotive chip, power management chip markets, and emerging application fields such as AR/VR, promoting diversified product applications and continuously optimizing product structure to adapt to the ever-changing market demands.

In 2025, the company will integrate resources, actively explore overseas markets, achieve market diversification, strive to acquire more international new customers, and enhance the company’s market share in the wafer foundry field, providing new growth points for the company’s sustainable development.

It is worth mentioning that Jinghe Integrated’s 55nm automotive display driver chip has already entered mass production, and the development of other automotive chips is progressing smoothly. Currently, the company’s 40nm OLED display driver chip has entered mass production, and the acquisition and planning of subsequent orders will be dynamically adjusted and arranged based on actual market demand. The 28nm OLED driver chip is expected to enter the risk mass production stage in 2025.

Rockchip: Revenue of 885 million yuan, a year-on-year increase of 62.95%

In the Q1 2025 report, Rockchip achieved operating revenue of 885 million yuan, an increase of 62.95% compared to 543 million yuan in the same period last year. The net profit attributable to shareholders was 209 million yuan, up 209.65% from 67.65 million yuan in the same period last year. The net profit excluding non-recurring items was 208 million yuan, up 215.00% from 66.01 million yuan in the same period last year. Basic earnings per share were 0.50 yuan/share, up 212.50% from 0.16 yuan/share in the same period last year. The net cash flow from operating activities was 312 million yuan, an increase of 47.26% from 212 million yuan in the same period last year.

In Q1 2025, the AIoT market grew rapidly, with emerging applications such as automotive electronics, industrial vision, industrial inspection, and various robots experiencing rapid growth. The open-source of domestic AI large model technology represented by Deepseek has brought new opportunities for the rapid development of AIoT at the edge and end side.

During the reporting period, the company made efforts to resolve supply chain packaging obstacles caused by the US-China tensions. The company leveraged the advantages of its AIoT platform layout, with flagship chip RK3588 leading all AIoT product lines to maintain rapid growth, achieving operating revenue of 885 million yuan, a year-on-year increase of 62.95%; while continuously optimizing product structure, the gross profit margin increased to 40.95%; the company achieved a net profit of 209 million yuan, a year-on-year increase of 209.65%.

Recently, the international situation has been changing rapidly. It has been observed that most AIoT applications are in China. Rockchip relies on its core technologies, product combinations, and scenario applications in AIoT to establish a clear growth trend; at the same time, the company’s important new products are landing as expected. We are confident about future growth.

Zhiwei Intelligent: Revenue of 852 million yuan, a year-on-year increase of 19.35%

Zhiwei Intelligent achieved operating revenue of 852 million yuan in Q1 2025, a year-on-year increase of 19.35%; the net profit attributable to shareholders was 42.12 million yuan, a year-on-year increase of 226.89%. The net profit excluding non-recurring items was 36.07 million yuan, a year-on-year increase of 354.16%; basic earnings per share were 0.17 yuan. The weighted average return on net assets was 1.99%.

In early 2025, the company continued to strengthen the management of accounts receivable and inventory comprehensively. In Q1 2025, the company reversed credit impairment losses of 21 million yuan, and accounts receivable decreased by about 45.2 million yuan (-51.82%) compared to the end of 2024, leading to a reversal of credit impairment losses due to increased customer repayments. The company will further strengthen the management of customer repayments to reduce the provision for credit impairment losses. In Q1 2025, the company made a provision for inventory depreciation of 16 million yuan and reversed 16 million yuan.

In 2025, Zhiwei Intelligent’s overseas business will enter a new development stage. In terms of business layout, the ODM/OEM business will continue to exert efforts to further increase the market share of leading customers in overseas markets. The channel brand business will further expand the marketing and service network around three core areas: education, commercial display, and audio-visual solutions. The company will focus on promoting products such as AI PCs, OPS computers, and digital signage in the global market, enhancing brand awareness and market share locally through localized marketing and services.

Zhiwei Intelligent seizes the development opportunities of the AI era, rapidly achieving localized deployment of open-source large models across all end-side products, including all-in-one machines, MINI PCs, AI edges, workstations, and Xinchuang, covering the most comprehensive product line, with platforms including Intel, AMD, NVIDIA, Rockchip, Loongson, Feiteng, Haiguang, and Zhaoxin. Deployments range from small parameter versions to ultra-large parameter versions, meeting the needs for computing resources and performance in different user scenarios, achieving flexible applications of locally deployed open-source models, reducing reliance on cloud servers, enhancing the security of local private data, and providing one-stop AI solutions for document processing, data analysis, and content creation.

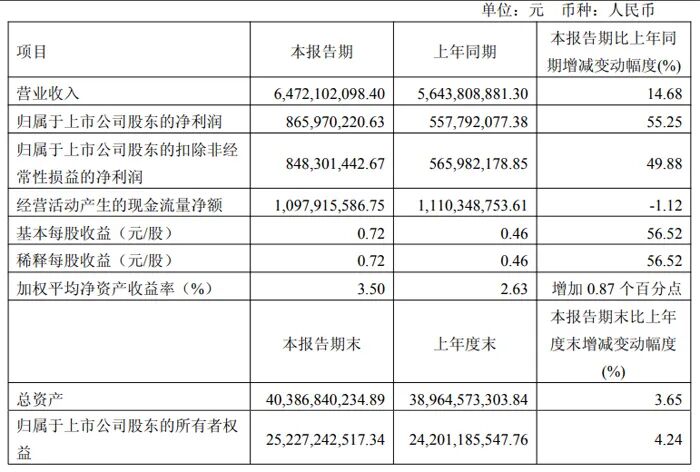

Weir Shares: Revenue of 6.472 billion yuan, a year-on-year increase of 14.68%

During the reporting period, Weir Shares achieved operating revenue of 6.472 billion yuan, an increase of 14.68% compared to 5.644 billion yuan in the same period last year. The net profit attributable to shareholders was 866 million yuan, up 55.25% from 558 million yuan in the same period last year. The net profit excluding non-recurring items was 848 million yuan, up 49.88% from 566 million yuan in the same period last year. Basic earnings per share were 0.72 yuan/share, up 56.52% from 0.46 yuan/share in the same period last year. The net cash flow from operating activities was 1.098 billion yuan, a slight decrease of 1.12% from 1.110 billion yuan in the same period last year. R&D expenses were 654 million yuan, an increase of 5.0% from 623 million yuan in the same period last year.

The significant year-on-year increase in net profit is mainly due to: (1) the company seizing market opportunities, with continuous product introduction in the high-end smartphone market and accelerated penetration of automotive intelligence driving significant revenue growth, achieving operating revenue of 6.472 billion yuan, a year-on-year increase of 14.68%; (2) the company improving gross profit margin through structural optimization of products and supply chain efficiency, with a comprehensive gross profit margin of 31.03%, an increase of 3.14 percentage points year-on-year and 2.05 percentage points quarter-on-quarter.

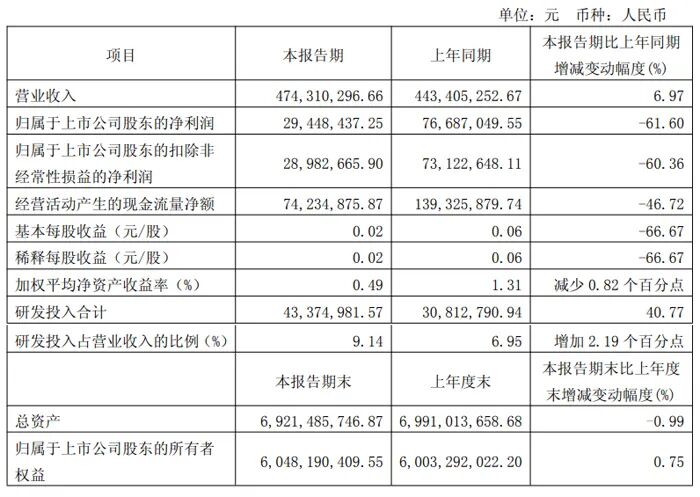

Qizhong Technology: Revenue of 474 million yuan, a year-on-year increase of 6.97%

In Q1 2025, Qizhong Technology achieved operating revenue of 474 million yuan, a year-on-year increase of 6.97%; the net profit attributable to shareholders was 29.44 million yuan, a year-on-year decrease of 61.60%; the net profit excluding non-recurring items was 28.98 million yuan, a year-on-year decrease of 60.36%; the decline in net profit was mainly due to increased costs such as equipment depreciation, equity incentives, and labor compensation.

During the reporting period, basic earnings per share were 0.02 yuan. The weighted average return on net assets was 0.49%. The net cash flow from operating activities was 74.23 million yuan, a year-on-year decrease of 46.72%, mainly due to increased cash payments for purchasing goods and accepting services.

In Q1 2025, the company’s display business revenue accounted for about 94%, while non-display business revenue accounted for about 6%. Among them, AMOLED revenue accounted for about 19%.

In Q1 2025, the company invested 43.38 million yuan in R&D, a year-on-year increase of 40.77%, accounting for 9.14% of revenue.

The Hefei plant focuses on display business, mainly packaging and testing of 12-inch wafers, with the first phase of capacity planning for BP and CP at about 20,000 pieces/month, COF at about 30 million pieces/month, and COG at about 30 million pieces/month. Since production began in 2024, the project has been delayed to some extent due to equipment procurement from abroad and supplier capacity issues, as well as a long customer certification cycle. Currently, the company is actively shortening the capacity ramp-up period, accelerating mass production in various process segments to effectively resolve capacity bottlenecks and further enhance the company’s profitability.

Regarding the outlook for Q2 2025 for the display chip packaging and testing business, Qizhong Technology stated that the transfer effect of the display industry continues to ferment, coupled with the impact of national subsidies, the demand for large-size COF and TDDI COG remains strong in the off-season, while the demand for small-size TDDI maintenance and brand expectations has increased. The penetration rate of AMOLED continues to rise, maintaining a cautiously optimistic outlook overall.

The impact of the recent US tariff increase on the company is relatively limited, as the proportion of revenue from exports to the US is very low. However, given the interconnected global economy, the macroeconomic climate is subject to fluctuations in trade policies, which may lead to changes in global semiconductor market demand that need further observation. In addition, the company will closely monitor changes in international trade policies and respond actively.

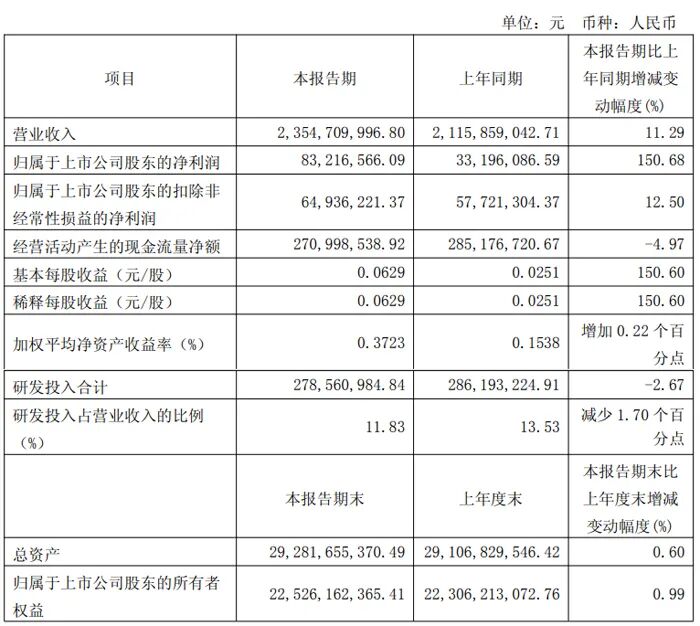

China Resources Micro: Revenue of 2.355 billion yuan, a year-on-year increase of 11.29%

China Resources Micro achieved operating revenue of 2.355 billion yuan in Q1 2025, a year-on-year increase of 11.29%; the net profit attributable to shareholders was 83.22 million yuan, a year-on-year increase of 150.68%. Revenue shows an upward trend. Behind the performance is China Resources Micro’s precise efforts in power semiconductors, analog-digital mixed, smart sensors, and intelligent control across multiple channels.

From the perspective of product and solution segments, the market share situation in 2024 and Q1 2025 is basically similar, with the shares being 21% for automotive electronics, 20% for new energy, 18% for home appliances, 16% for industrial equipment, 9% for communication equipment, 5% for computers, 4% for lighting, and 7% for smart wearables, medical, and others.

The overall market scale of the company’s MOSFET products continues to grow steadily. The company expects to achieve about 15% growth this year, leveraging its advantages in 6, 8, and 12-inch capacity, as well as competitive advantages in categories, performance, and cost. Orders for IGBT products in industrial control, automotive, and consumer sectors have significantly increased year-on-year, while accelerating product structure upgrades, with the 8-inch and 12-inch production lines ramping up, expecting to achieve about 50% growth this year.

The company’s gross profit margin in Q1 was 25.29%, a year-on-year decrease of 1.1 percentage points. The decline in gross profit margin is mainly due to the significant increase in monthly depreciation caused by the production of high-end mask factories, coupled with a decrease in prices of IC products. However, the gross profit margins of power devices and packaging testing businesses are better than the same period last year.

In 2025, capital expenditures are expected to be 2 billion yuan, of which equipment expenditures are 1.9 billion yuan, mainly for the capacity ramp-up of packaging and testing bases, as well as investments to fill gaps. Equity investments have uncertainties and are not included.

It is worth mentioning that the company relies on the layout of “two rivers and three regions” to efficiently and qualitatively promote key projects such as the 12-inch wafer manufacturing production line in Chongqing, the 12-inch integrated circuit production line in Shenzhen, the advanced packaging and testing base in Chongqing, and high-end masks.

China Resources Micro stated that the utilization rate of the Chongqing 12-inch production line is currently around 70%, striving to achieve full production by the end of the year, focusing on breakthroughs in key areas such as automotive, high-end industrial control, and computing power markets this year. The Shenzhen 12-inch production line will be in the capacity ramp-up phase in the next two years, with multiple products on the 90nm platform ramping up, and successful introduction and platform synchronization verification of 55/40nm products, covering high-performance power supplies and MCU and other high-end specialty process products as well as display drivers, Bluetooth, and other product categories.

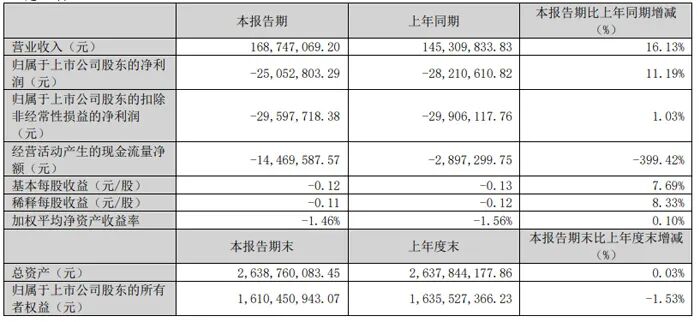

Fuman Micro: Revenue of 169 million yuan, a year-on-year increase of 16.13%

In the Q1 2025 report, Fuman Micro achieved operating revenue of 169 million yuan, a year-on-year increase of 16.13%; the net profit attributable to shareholders was -25.05 million yuan, a year-on-year increase of 11.19%; the net profit excluding non-recurring items was -29.60 million yuan, a year-on-year increase of 1.03%. During the reporting period, Fuman Micro’s basic earnings per share were -0.12 yuan, and the weighted average return on net assets was -1.46%.

In 2025, Fuman Micro will resolutely focus on its main business, continuously enhancing profitability through accelerated new product development, mature product technology iteration, process improvements, product structure optimization, cost reduction, and increased marketing efforts, laying a solid foundation for the company’s long-term development. Based on solid technical capabilities, the company will actively create a new business pattern, seeking profit improvement in its original advantageous sectors and achieving steady growth in scale; while incubating new applications.

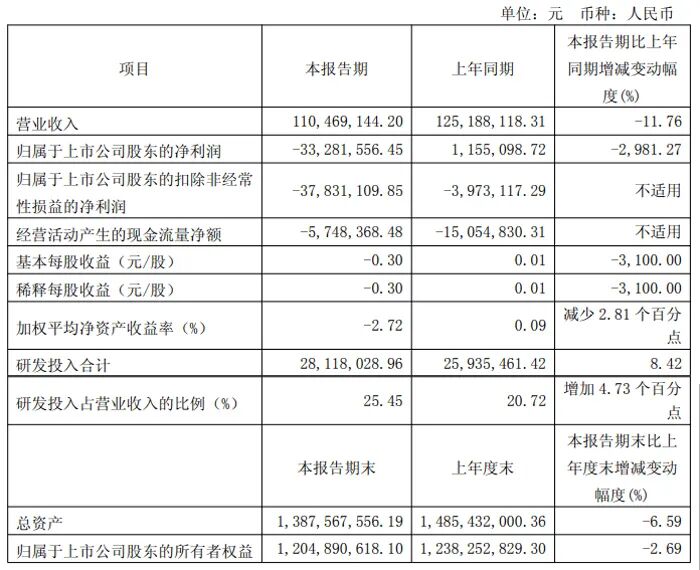

Mingwei Electronics: Revenue of 110 million yuan, increased R&D investment

In the Q1 2025 report, Mingwei Electronics achieved operating revenue of 110 million yuan, a year-on-year decrease of 11.8%; the net profit attributable to shareholders was a loss of 33.28 million yuan, a year-on-year decrease of 2981.3%; the net profit excluding non-recurring items expanded from a loss of 3.97 million yuan in the same period last year to a loss of 37.83 million yuan.

The revenue decline is mainly due to intense competition in the downstream market during the reporting period, which put pressure on product prices, leading to a decrease in the unit price of some products. Additionally, due to the decline in sales prices, the cost of some products in inventory exceeded the sales price, resulting in significant inventory impairment losses.

During the reporting period, the company’s net cash flow from operations was -5.75 million yuan, an increase of 61.8% year-on-year. As of the end of Q1, the company’s total assets were 1.388 billion yuan, a decrease of 6.6% compared to the end of the previous year; the net assets attributable to shareholders were 1.205 billion yuan, a decrease of 2.7% compared to the end of the previous year.

Mingwei Electronics continues to invest in R&D, with total R&D investment reaching 28.12 million yuan in Q1 2025, accounting for 25.45% of operating revenue, an increase of 4.73 percentage points compared to the same period last year, demonstrating the company’s emphasis on technological innovation.

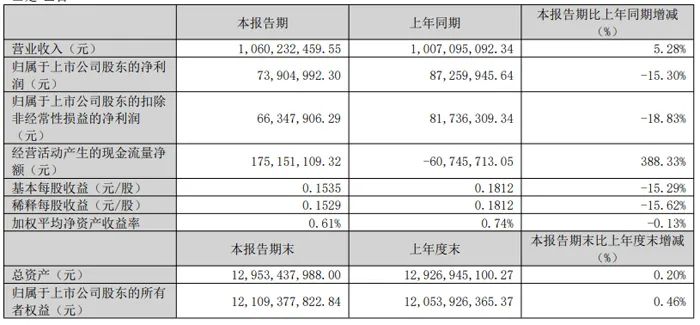

Beijing Junzheng: Revenue of 1.060 billion yuan, a year-on-year increase of 5.28%

In the Q1 2025 report, Beijing Junzheng achieved operating revenue of 1.060 billion yuan, an increase of 5.28% compared to 1.007 billion yuan in the same period last year. The net profit attributable to shareholders was 73.90 million yuan, a year-on-year decrease of 15.30%; the net profit excluding non-recurring items was 66.35 million yuan, a year-on-year decrease of 18.83%. Basic earnings per share were 0.1535 yuan/share, and the weighted average return on net assets was 0.61%. The net cash flow from operating activities was 175.15 million yuan, an increase of 388.33% compared to -60.74 million yuan in the same period last year. The management expenses for this reporting period were 57.76 million yuan, an increase of 34.07% compared to the same period last year, mainly due to increased equity incentive expenses.

During the reporting period, the automotive, industrial medical, and communication markets showed some recovery, driving the market sales of the company’s chip products aimed at these industries. The sales revenue of the company’s storage chips, analog and interconnect chips all achieved year-on-year growth; benefiting from the company’s rich product line layout in computing chips, the sales revenue of computing chips also achieved certain year-on-year growth, leading to an overall increase in the company’s operating revenue. Due to the implementation of the restricted stock incentive plan, the company incurred an additional equity incentive expense of 11.89 million yuan year-on-year, while the overall gross profit margin fluctuated, resulting in a certain decline in net profit.

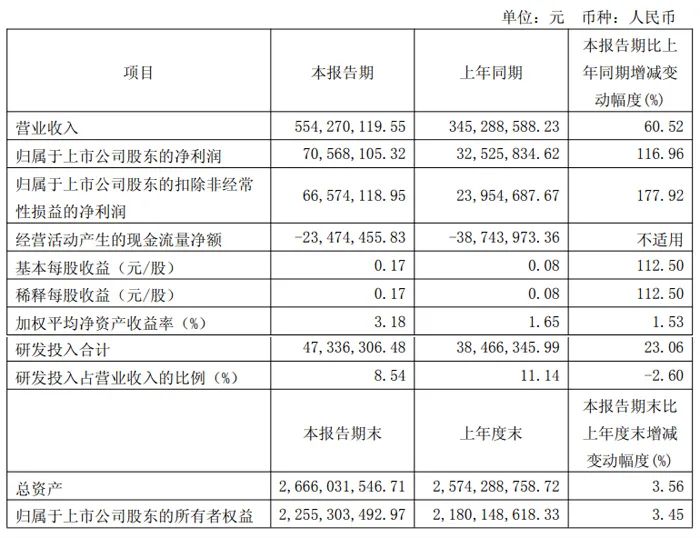

Tiande Yu: Revenue of 554 million yuan, a year-on-year increase of 60.52%

In the Q1 2025 report, Tiande Yu achieved operating revenue of 554 million yuan, a year-on-year increase of 60.52%; the net profit attributable to shareholders was 70.57 million yuan, a year-on-year increase of 116.96%; the net profit excluding non-recurring items was 66.57 million yuan, a year-on-year increase of 177.92%; basic earnings per share were 0.17 yuan, a year-on-year increase of 112.50%, and the weighted average return on net assets was 3.18%. During the reporting period, total R&D investment was 47.34 million yuan, a year-on-year increase of 23.06%.

Since its establishment, Tiande Yu has focused on key chips and overall solutions in the fields of mobile intelligent terminals and smart IoT. The company is positioned around human-computer interaction, including vision, touch, and perception, using artificial intelligence combined with IoT technology to provide a beautiful vision for smart living. After more than a decade of development, the company has widely laid out mainstream scenarios such as smartphones, smart wearables, smart tablets, and smart speakers in the mobile intelligent terminal field, aiming to become an innovator of display touch chips, camera motor drive chips, and fast charging chips and solutions. In the smart IoT field, the company has widely laid out applications in smart homes, smart supermarkets, smart medical care, smart transportation, smart logistics, and energy-saving and carbon-reduction products, aiming to become a leader in electronic price tags and artificial intelligence chips in the smart IoT field.

In the future, Tiande Yu will actively seize downstream industry development opportunities, strengthen innovative technology research and development, actively explore new product areas based on upgrading and improving existing product technologies, enrich product layout, and further deepen business cooperation with key customers, leveraging the huge development space and market opportunities of mobile intelligent terminals to implement differentiated competition strategies, increase market share and competitiveness, and strengthen efforts to expand both domestic and international markets.

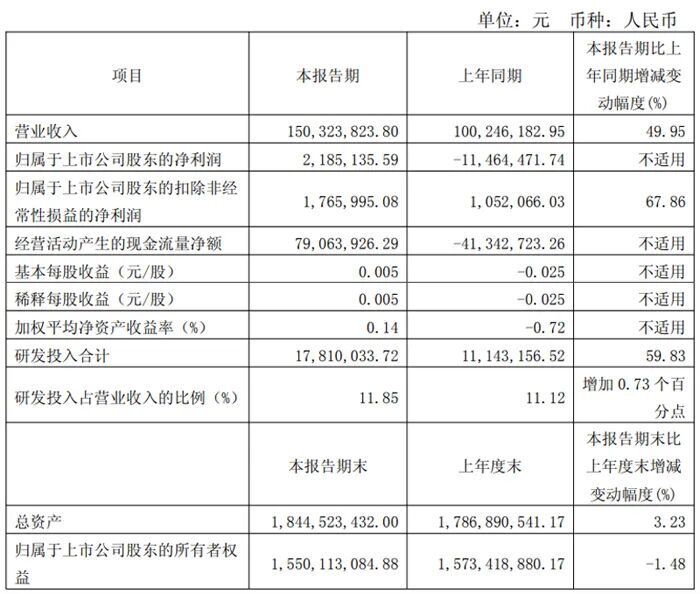

New Xiangwei: Revenue of 150 million yuan, a year-on-year increase of 49.95%

In the Q1 2025 report, New Xiangwei achieved operating revenue of 150 million yuan, compared to 100 million yuan in the same period last year, a year-on-year increase of 49.95%. The net profit attributable to shareholders was 2.1851 million yuan, compared to a loss of 11.4645 million yuan in the same period last year, successfully turning a loss into a profit. The net profit excluding non-recurring items was 1.766 million yuan, compared to 1.051 million yuan in the same period last year, a year-on-year increase of 67.86%.

Each share’s net assets were 3.37 yuan, a year-on-year decrease of 1.92%, with operating cash flow per share of 0.17 yuan, a year-on-year increase of 291.24%, and earnings per share of 0.01 yuan, a year-on-year increase of 120.0%.

During the reporting period, total R&D investment reached 17.81 million yuan, a year-on-year increase of 59.83%. The total of sales, management, and financial expenses was 6.6405 million yuan, accounting for 4.42% of revenue, a year-on-year increase of 82.4%. The gross profit margin was 14.44%, a year-on-year increase of 7.58%, and the net profit margin was 1.02%, a year-on-year increase of 108.73%.

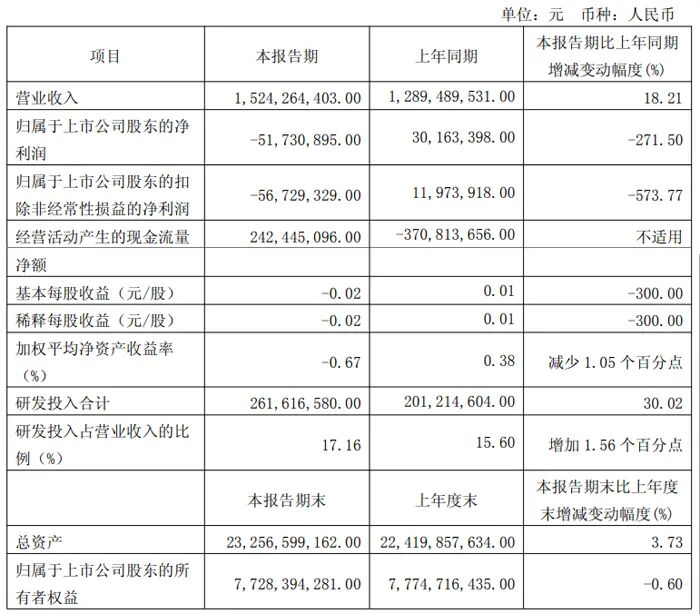

Ge Kewei: Revenue of 1.524 billion yuan, a year-on-year increase of 18.21%

In the Q1 2025 report, Ge Kewei achieved operating revenue of 1.524 billion yuan, an increase of 18.21% compared to 1.289 billion yuan in the same period last year. The net profit attributable to shareholders was a loss of 517.309 million yuan, a decline of 271.50% compared to a profit of 301.634 million yuan in the same period last year. The net profit excluding non-recurring items was a loss of 567.293 million yuan, a decline of 573.77% compared to a profit of 119.739 million yuan in the same period last year. The decline in net profit is mainly due to: (1) intense market competition leading to reduced selling prices and lower gross profit margins; (2) continuous increases in R&D investment for high-resolution products leading to profit declines, with total R&D investment of 262 million yuan during the reporting period, an increase of 30.02% compared to 201 million yuan in the same period last year.

The net cash flow from operating activities was 242 million yuan, compared to -371 million yuan in the same period last year, mainly due to the revenue from products with 1,300 million pixels and above exceeding 400 million yuan, a significant growth compared to the same period last year, especially the increase in the proportion of self-produced products from the Lingang factory, which boosted cash inflow from operating activities.

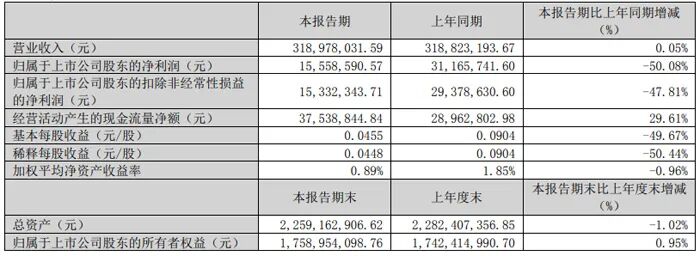

Zhongying Electronics: Revenue of 319 million yuan, basically flat year-on-year

During the reporting period, Zhongying Electronics achieved operating revenue of 319 million yuan, basically flat year-on-year, with a slight increase of 0.05%; the net profit attributable to shareholders was 15.56 million yuan, a year-on-year decrease of 50.08%. The decrease in net profit was mainly due to a reduction in the amount of VAT deductions, an increase in depreciation and expenses after the completion of the second headquarters building in Hefei, and a gross profit margin of 32.09% (a year-on-year decrease of 1.77%). The company maintains its R&D investment intensity, with R&D expenses of 77.76 million yuan, accounting for 24.4% of revenue, a year-on-year increase of 3.57%.

In Q1 2025, the company’s period expenses were 93.67 million yuan, an increase of 4.87 million yuan compared to the same period last year; the period expense ratio was 29.37%, an increase of 1.51 percentage points compared to the same period last year. Among them, sales expenses decreased by 16.00% year-on-year, while management expenses increased by 15.32%, and financial expenses increased by 42.75%.

The fluctuating US tariff policy affects the global supply chain order, leading to a short-term wait-and-see sentiment in global trade. Facing downstream manufacturers in non-US markets, more are recognizing that using US chips will cause supply chain insecurity or increased costs, actively seeking domestic alternatives. Customers who previously purchased chips from US manufacturers have been inquiring about more cooperation with the company, mainly for lithium battery management chips and some white goods MCU chip customers.

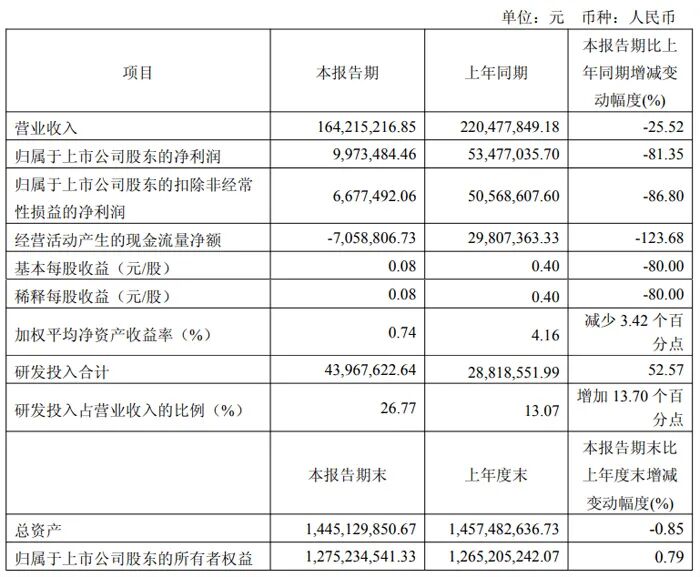

Lixin Micro: Revenue of 164 million yuan, a year-on-year decrease of 25.52%

During the reporting period, Lixin Micro achieved operating revenue of 164 million yuan, a year-on-year decrease of 25.52%; the net profit attributable to shareholders was 9.9735 million yuan, a year-on-year decrease of 81.35%; the net profit excluding non-recurring items was 6.6775 million yuan, a year-on-year decrease of 86.80%; basic earnings per share were 0.08 yuan. The weighted average return on net assets was 0.74%.

The significant year-on-year decrease in net profit is mainly due to: first, external market demand weakness, fluctuations in supply chain costs, and intensified industry competition affecting the company’s sales and gross profit margin; second, increased R&D investment compared to the previous year. In summary, this led to a significant decrease in profits during the reporting period.

During this period, the company continued to increase R&D investment, with personnel salaries, R&D materials, and IP cooperation costs increasing year-on-year. During the reporting period, R&D investment was 43.97 million yuan, a year-on-year increase of 52.57%. R&D investment accounted for 26.77% of operating revenue, an increase of 13.70 percentage points.

The net cash flow from operating activities was -7.06 million yuan, a year-on-year decrease of 123.68%, mainly due to the decline in sales scale year-on-year, resulting in a corresponding decrease in cash receipts; second, team building was strengthened, leading to increased salary costs.

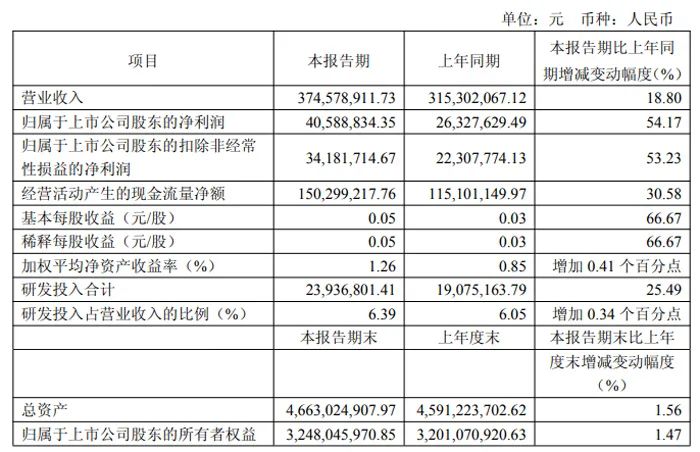

Huicheng Shares: Revenue of 375 million yuan, a year-on-year increase of 18.80%

In Q1 2025, Huicheng Shares achieved operating revenue of 375 million yuan, a year-on-year increase of 18.80%; the net profit attributable to shareholders was 40.59 million yuan, a year-on-year increase of 54.17%; the net profit excluding non-recurring items was 34.18 million yuan, a year-on-year increase of 53.23%; basic earnings per share were 0.05 yuan. The weighted average return on net assets was 1.26%.

During the reporting period, benefiting from the warming of consumer electronics and the company’s capacity expansion, the order volume continued to grow; coupled with product structure improvement, high-end product orders continued to be introduced, the company’s revenue scale and gross profit margin levels increased year-on-year, and net profit improved significantly, with a year-on-year increase of over 50%. In Q1 2025, the company’s gross profit margin was 23.96%, an increase of 4.77 percentage points year-on-year, and the net profit margin was 10.84%, an increase of 2.49 percentage points compared to the same period last year.

The net cash flow from operating activities was 150 million yuan, a year-on-year increase of 30.58%, mainly due to the increase in revenue scale and cash received from sales of goods.

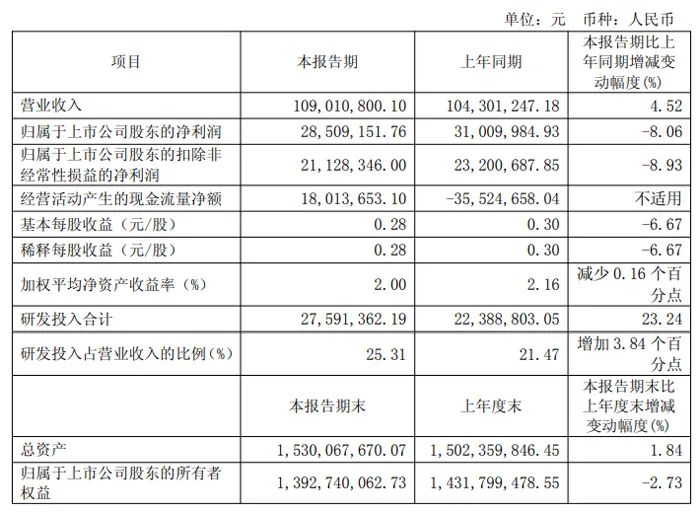

Longxun Shares: Revenue of 109 million yuan, a year-on-year increase of 4.52%

In Q1 2025, Longxun Shares achieved total operating revenue of 109 million yuan, a year-on-year increase of 4.52%; the net profit attributable to shareholders was 28.51 million yuan, a year-on-year decrease of 8.06%; the net profit excluding non-recurring items was 21.13 million yuan, a year-on-year decrease of 8.93%; the decline in net profit was mainly due to increased period expenses, including R&D and management expenses.

During the reporting period, the net cash flow from operating activities was 18.01 million yuan, compared to -35.52 million yuan in the same period last year, mainly due to the large amount of inventory purchased and services accepted in the previous year.

During the reporting period, Longxun Shares invested 27.59 million yuan in R&D, accounting for 25.31% of operating revenue, a year-on-year increase of 23.24%.

Goodix Technology: Revenue of 1.064 billion yuan, net profit increased by 20.29%

In Q1 2025, Goodix Technology achieved operating revenue of 1.064 billion yuan, a decrease of 12.64% compared to 1.218 billion yuan in the same period last year. The net profit attributable to shareholders was 195 million yuan, an increase of 20.29% compared to 162 million yuan in the same period last year. The net profit excluding non-recurring items was 132 million yuan, a decrease of 10.61% compared to 148 million yuan in the same period last year. The net cash flow from operating activities was 183 million yuan, a decrease of 16.94% compared to 221 million yuan in the same period last year.

Fingerprint and touch control are the main sources of revenue for the company, maintaining a leading position in the market for a long time. In 2025, the company will continue to iterate products, improve performance, optimize costs, maintain core advantages, and explore more commercial opportunities in various scenarios. The new generation of under-screen light sensors and NFC/eSE security products will also achieve large-scale commercial use with leading smartphone customers in the fourth quarter, and the company will continue to strengthen promotion efforts, introducing more customers and projects, becoming a new driving force for the company’s growth.

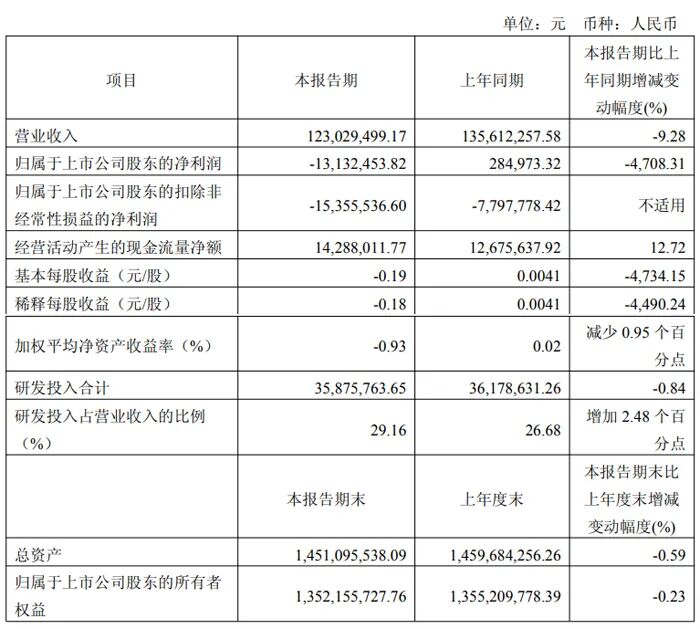

Beiyi Micro: Revenue of 123 million yuan, a year-on-year decrease of 9.3%

In Q1 2025, Beiyi Micro achieved operating revenue of 123 million yuan, a year-on-year decrease of 9.3%; the net profit attributable to shareholders was a loss of 13.13 million yuan, a year-on-year decrease of 4708.3%; the net profit excluding non-recurring items expanded from a loss of 7.80 million yuan in the same period last year to a loss of 15.36 million yuan. The net cash flow from operating activities was 14.29 million yuan, a year-on-year increase of 12.7%.

During the reporting period, the company actively adjusted its product structure, expanding the market share of new products, with revenues from products such as motor drives, DC-DC, and linear regulators increasing by 61.29%, and the overall gross profit margin improved to 29.13% year-on-year. Due to the company’s various forms of employee incentives, such as restricted stock and stock ownership plans, the share-based payment expenses increased by 90.89% year-on-year, affecting current profits.

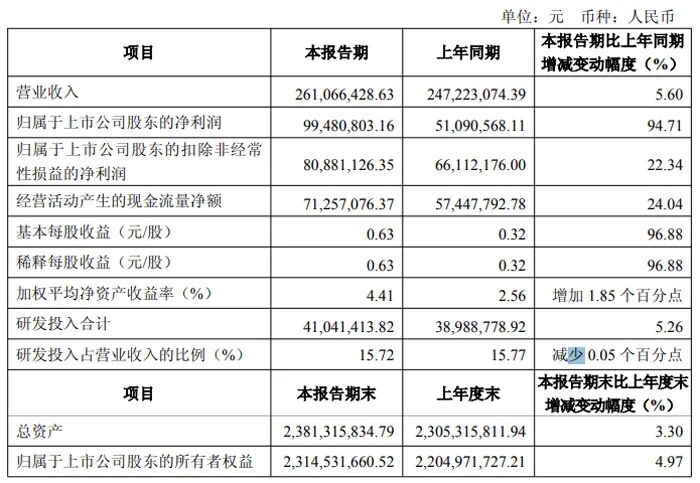

Jucheng Shares: Revenue of 261 million yuan, net profit increased by 94.71%

In Q1 2025, Jucheng Shares achieved operating revenue of 261 million yuan, with net cash flow from operating activities of 71.26 million yuan, both increasing by 5.60% and 24.04% year-on-year, achieving the best historical performance for the same period. As the company’s products sold in high-value markets such as DDR5 memory modules, automotive electronics, and industrial control increased, the company’s overall gross profit margin increased by 5.67 percentage points compared to the same period last year, achieving a net profit of 80.88 million yuan, a year-on-year increase of 22.34%.

Additionally, the company holds some shares of Huahong Company, and the gains from the reduction in holdings and changes in fair value during the reporting period increased significantly compared to the same period last year. Under the comprehensive influence of the above factors, the company achieved a net profit attributable to shareholders of 99.48 million yuan in the first quarter, a year-on-year increase of 94.71%, setting a new historical high for net profit attributable to shareholders and net profit excluding non-recurring items.