Recently, the China Semiconductor Industry Association released a notice regarding the “Rules for the Identification of the ‘Country of Origin’ of Semiconductor Products,” stating that according to the relevant provisions on non-preferential origin rules, the origin of “integrated circuits” is determined based on the four-digit tariff number change principle, meaning that the wafer fabrication site is recognized as the country of origin. In this regard, the China Semiconductor Industry Association recommends that the origin of “integrated circuits,” whether packaged or unpackaged, should be declared based on the location of the “wafer fabrication plant” for import customs clearance.

Recently, due to China’s increased tariffs on imported products from the U.S., this means that under the new rules, chips fabricated in U.S. wafer fabs will incur additional tariffs when imported into the domestic market. Jiemian Network has compiled a list of wafer fabs located in the United States for industry reference.

According to statistics, there are four foundries with wafer fabs in the U.S., including TSMC (2), GlobalFoundries (3), Tower Semiconductor (2), and X-Fab (1). There are also six IDM companies with wafer fabs in the U.S., namely Intel (4), Texas Instruments (5), ADI (3), Micron Technology (3), NXP (4), Infineon (6), and Samsung (2).

TSMC

TSMC is the world’s leading foundry, headquartered in Taiwan, China, with the largest market share in chip manufacturing, providing foundry services for well-known companies such as MediaTek, Apple, and NVIDIA.

Currently, TSMC has two wafer fabs in the U.S., located in Arizona, the 12-inch wafer fab—TSMC Arizona Corporation, and the 8-inch wafer fab in Washington—TSMC Washington, LLC and Wafer Fab 11.

(TSMC Arizona Wafer Fab—TSMC Arizona Corporation)

Texas Instruments

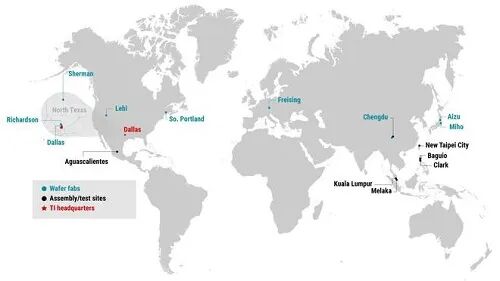

Texas Instruments has a long history of internal manufacturing operations, with a global presence and regional diversification. Among its 15 manufacturing bases worldwide, there are several wafer fabrication plants, packaging and testing plants, as well as bump and probe plants. Currently, Texas Instruments has five wafer fabs in the U.S., mainly located in Texas, Utah, and Oregon. In terms of capacity share, approximately 90% of TI’s wafer manufacturing is completed by its own factories, which are primarily concentrated in the U.S.

(Texas Instruments Global Manufacturing Base Distribution)

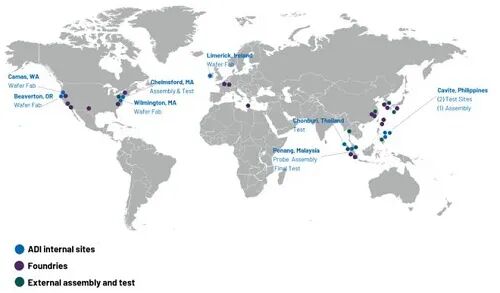

ADI

ADI has three wafer fabs in the U.S., located in Massachusetts, Washington, and Oregon. The company is expanding its manufacturing capacity both internally and externally, with internal investments expected to double its production capacity in the U.S. and Europe by the end of 2025. Approximately 30%-40% of ADI’s wafer capacity comes from its own factories in the U.S., while the rest relies on external foundries (such as TSMC, UMC) and overseas owned factories (such as Limerick, Ireland).

Intel

Intel is not only a leading IDM company globally but also provides foundry services. The company has three operational manufacturing plants in the U.S., located in Arizona, New Mexico, and Oregon, and plans to build a new wafer fab in Ohio. Approximately 20%-30% of Intel’s wafer capacity comes from its own factories in the U.S., while the rest relies on external foundries (such as TSMC, UMC) and overseas owned factories (such as Fab 34 in Ireland, Fab 28 in Israel).

(Intel Global Manufacturing Base Distribution)

Micron Technology

Micron Technology has over 30 offices worldwide, 11 manufacturing bases, and 13 customer labs. Currently, it has three manufacturing bases in the U.S., located in Virginia, Idaho, and New York. Approximately 10%-15% of Micron’s wafer capacity comes from its own factories in the U.S., while the rest relies on external foundries (such as TSMC, UMC) and overseas owned factories (such as Japan and Taiwan).

(Micron Global Company Distribution)

NXP

NXP operates four wafer manufacturing plants in the U.S., two of which are located in Austin, Texas, and the other two in Chandler, Arizona. The representative products of the wafer fabs include MCUs, MPUs, power management chips, RF transceivers, amplifiers, sensors, and RF GaN products. Approximately 30%-40% of NXP’s wafer capacity is satisfied by its own wafer fabs in the U.S., which are mainly focused on automotive and industrial semiconductors.

(NXP Chandler RF GaN Wafer Fab)

GlobalFoundries

GlobalFoundries is a semiconductor wafer foundry company headquartered in California, USA. The company originally spun off from AMD’s manufacturing division and produces not only AMD products but also collaborates with companies such as IBM, ARM, Broadcom, NVIDIA, and Qualcomm.

The company currently has three wafer fabs in the U.S., located in Malta, New York (Fab 8, primarily 14nm), East Fishkill, New York (Fab 10, primarily 22nm), and Vermont (Fab 9, primarily 90nm).

(GlobalFoundries Global Company Distribution)

Samsung

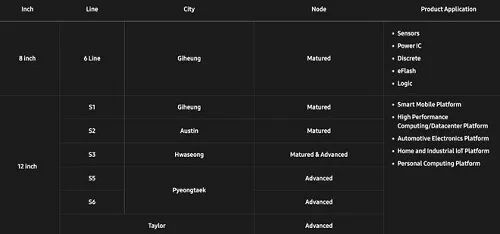

Samsung has two wafer fabs in the U.S., located in Austin and Taylor, Texas. The largest wafer fab in the U.S. is located in Austin, providing wafer manufacturing from 65nm to 14nm processes. The newly built 500,000 square meter wafer fab in Taylor further expands service and production capacity.

(Samsung Wafer Fabs in the U.S. and Korea)

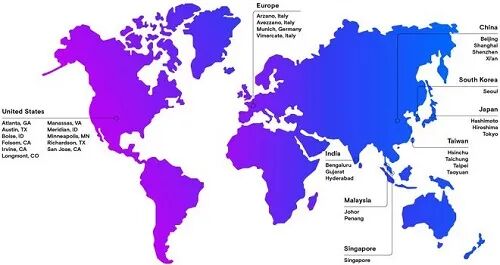

Infineon

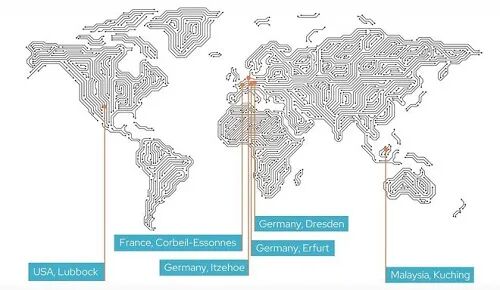

Infineon, headquartered in Germany, primarily provides semiconductor system solutions and has six production bases in the U.S., including manufacturing, assembly, and production, located in Washington, California, Arizona, Colorado, Texas, and Massachusetts. Approximately 20%-30% of Infineon’s wafer capacity comes from its own factories in the U.S., while the rest relies on external foundries (such as TSMC, UMC) and overseas owned factories (such as Dresden, Germany, and Kulim, Malaysia).

(Infineon Production Base Distribution in the U.S.)

Tower Semiconductor

Tower Semiconductor is an Israeli semiconductor foundry specializing in providing customized analog solutions for differentiated products, offering cutting-edge process technologies.

The company has two wafer fabs in the U.S. (Newport Beach, California, and San Antonio, Texas) and can utilize Intel’s New Mexico plant’s 300mm capacity corridor, mainly producing CMOS, CIS, RF analog, MEMS, power, etc.

(Tower Semiconductor’s Three Foundries)

X-Fab

X-FAB is one of the world’s leading analog/mixed-signal semiconductor technology foundry groups, focusing on automotive, industrial, and medical applications, headquartered in Germany. The company currently has one foundry in the U.S., primarily producing CMOS mixed-signal chips and a range of SiC products.

(X-FAB Global Foundry Distribution)

Source | Aijimei

Recommended Reading——Will GlobalFoundries merge with UMC? UMC respondsRecord high! GlobalFoundries receives $1.5 billion subsidy from the U.S. government to expand semiconductor productionImec and GlobalFoundries announce the application of deep neural network computing for IoT edge devicesTrump’s chip tariffs are approaching, rumored TSMC’s advanced process prices will rise by more than 15% in 2025So tragic! $38 billion wafer foundry project has failed!Another investment boom! 115 wafer fabs/facility investment plans exposedSK Telecom merges with Rebellions: creating a $740 million AI chip giant to challenge NVIDIA ☞ Business Cooperation: ☏ Please call 010-82306118 / ✐ Or send an email to [email protected]

☞ Business Cooperation: ☏ Please call 010-82306118 / ✐ Or send an email to [email protected]