Chinese consumer electronics have indeed been exempted, applicable under the latest exemption terms. (Products manufactured within China are also exempted)

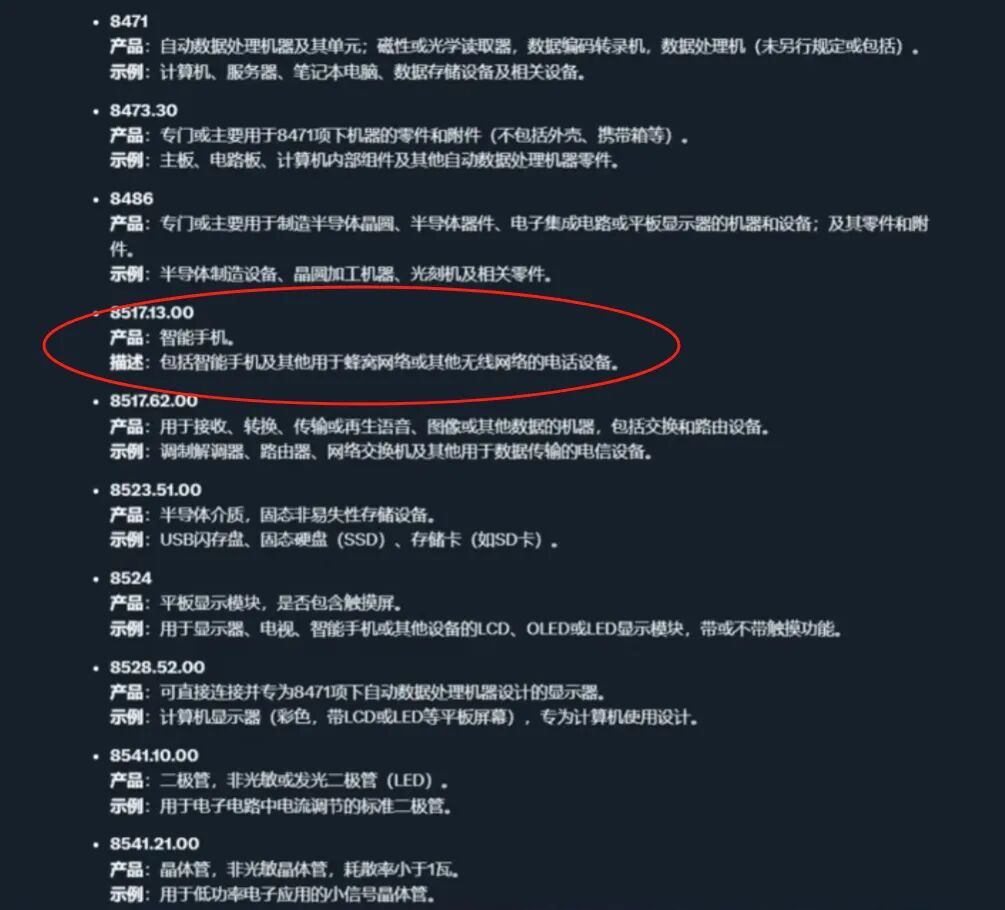

The exempt tariff codes 8517.13.00, 8471, 8517.62.00 cover Apple products manufactured in China, including smartphones, laptops, headphones, glasses, and watches.

This means that all products produced by Apple in China and exported to the United States will enjoy the latest tariff exemptions, avoiding the new round of 125% tariffs imposed by the U.S.

Previously, consumer electronics represented by Apple’s supply chain were the most affected in this round of tariff wars, and now with the latest complete exemption, it is beneficial for the industry’s expected recovery.

Conclusion: The second round of tariff exemptions is indeed favorable for Apple’s supply chain, NVIDIA’s supply chain, and laptop OEMs. A significant rebound is likely on Monday, further recovery is expected!

A-shares: Goertek, Luxshare Precision, Will Semiconductor, GigaDevice, Risen Energy etc.

On Friday, the viewpoint on consumer electronics was very direct; currently, the extent of damage to consumer electronics is overestimated, and after company buybacks, the opportunity at this position outweighs the risks. The downside is limited unless there is a significant rise; otherwise, holding stocks is advisable.

Additionally, on the 16th of next week, Huawei’s W smart glasses will be released, and the Huawei Aito U8 will be launched. On the 17th, Xiaomi’s YU7 and Xiaomi AI glasses will be released. This may further boost consumer electronics!

Direction

Semiconductor Chips: (Analog Chips)

What are analog chips? After a significant rise on Friday, will they continue next week? How favorable is the level of benefits?

From a broad perspective, chips can be divided into digital chips and analog chips. Digital chips are easy to understand, such as quantifiable numbers like 0, 1, 2, 3, which are convenient for calculation and processing. However, in the real world, many signals like sound, light, and temperature are continuous functions, which we cannot directly apply; we need corresponding chips to process them. Therefore, analog chips are also known as the bridge connecting the real world and the digital world.

Analog chips can be categorized by function into power management and signal chain chips. Power management chips primarily function to achieve voltage conversion, charge and discharge management, power distribution, detection, and driving, and can be further divided into DC/DC converters, AC/DC converters, charging products, battery management, and general power management products. Signal chain chips mainly process and transmit analog signals, converting information such as light, magnetic fields, temperature, and sound into digital signals, and can be further divided into amplifiers, comparators, analog-to-digital/digital-to-analog converters, and various interface products.

The chip industry chain mainly includes integrated circuit design, wafer manufacturing, packaging, and testing, and can be classified into three business models based on the participation of enterprises in these processes.

A-shares: NXP Semiconductors, Zhaoxin Microelectronics, Shengbang Technology, Silicon Motion

Rockchip Technology, Beijing Junzheng, etc…

On Monday, pure analog chips are likely to rise again. This is because the replacement space is indeed substantial!

Additionally, it is favorable for wafer manufacturers, such as SMIC and Hua Hong Semiconductor. Due to the certification of wafer manufacturing locations, the high prices of chip manufacturing in the U.S. may lead to mature processes being manufactured domestically.

From the weekend news perspective (consumer electronics and semiconductors are likely to remain hot, so there is no need to worry), pay attention to the sectors that are likely to rebound the latest; when the rebound in consumer electronics ends, it will be time to be cautious!

The above content is purely personal opinion and should not be used as a basis for trading.

Click the card below to follow this public account for daily updates, direction guidance, and risk alerts.