Introduction

MIR DATABANK

This article aims to provide a systematic review and analysis of the PLC market from 2021 to Q1 2025, along with professional forecasts for market trends from 2025 to 2027. The data is primarily sourced from publicly available industrial data from the National Bureau of Statistics, and the relevant analysis and forecasts are strictly based on publicly available PLC sales data. Sales data from confidential sectors such as military and defense are not discussed in this article. This article employs a combination of industry data models and in-depth analysis of typical project cases to accurately present the true state of the market.

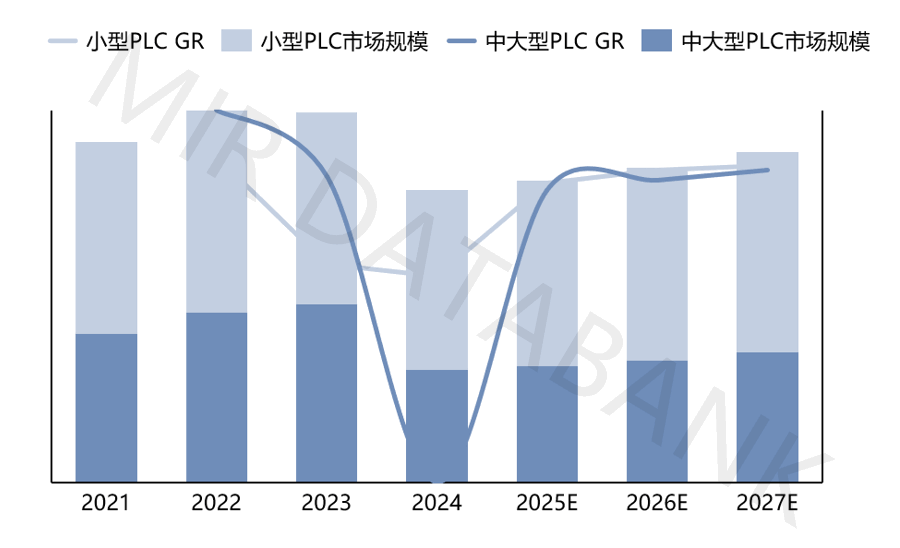

Overall PLC Market Size and Forecast from 2021 to 2027E

Data Source: MIR Rui Industrial “2025 PLC Market Standard Report”

Market Review from 2021 to Q1 2025

1

2021-2022: Steady Growth Amid Demand Recovery

From 2021 to 2022, the global economy gradually emerged from the trough, and the automation industry entered a rapid development phase, with PLC sales data showing a steady upward trend. Market data for 2022 indicates that the small PLC market grew by approximately 5% year-on-year, while the medium and large PLC market grew by approximately 9% year-on-year. Against the backdrop of sustained economic recovery, the domestic PLC market demonstrated robust development momentum.

2

2023: Structural Differentiation Under Stable Demand

In 2023, the market was affected by macroeconomic fluctuations, with the overall PLC market size in China remaining roughly flat compared to 2022, but significant structural adjustments occurred within the market. The medium and large PLC market continued to grow, showing year-on-year growth compared to 2022, while small PLC sales experienced a year-on-year decline, reflecting structural changes in market demand.

3

2024: Real Market Reassessment During Adjustment Period

Data indicates that the overall PLC market size declined in 2024, with both small PLCs and medium and large PLCs experiencing a drop in sales, although the reasons for the decline differ fundamentally.

1. Reasons for Decline in Small PLC Sales Data – Demand Differentiation

1) Imbalance in Demand Structure

In the demand side for small PLCs, industry differentiation characteristics are evident. The photovoltaic industry holds a significant share in traditional demand, and as the market becomes increasingly saturated, its growth rate sharply declines, dragging down the overall market demand for 2024. Although the 3C/semiconductor sector is experiencing rapid demand growth, its pull effect is limited, ultimately leading to a net decline in small PLC market demand.

2) Intensified Competition on the Supply Side

Domestic manufacturers are expanding their competitive model of “low-price strategy + overall solutions” in sectors such as electronics, photovoltaics, textiles, packaging, and logistics, intensifying market competition. In this context, some European foreign brands have lowered product prices to maintain market share.

2. Reasons for Significant Decline in Medium and Large PLC Sales Data – High Inventory Levels Among Distributors and Domestic Substitution

1) High Inventory Levels Among Foreign Brand Distributors

Some foreign brand distributors have high inventory levels, leading to reduced ordering enthusiasm, with some industry demand being met by distributor inventory products rather than converting into actual sales for manufacturers.

2) Adjustments in Demand from Certain Industries

The saturation of production capacity and increasingly fierce competition in the new energy sectors such as photovoltaics and lithium batteries have posed certain impacts on PLC manufacturers. At the same time, foreign brands are affected by price competition from domestic manufacturers, which has impacted the market space for medium and large PLC products to some extent.

3) Domestic Manufacturers Breaking Through Against the Trend

In recent years, the demand for domestic substitution of PLCs, especially medium and large PLCs, in major infrastructure sectors such as power, petrochemicals, and water conservancy has become increasingly urgent. As domestic medium and large PLC manufacturers continue to establish benchmark projects, their technical levels are maturing, and brand reputation is continuously improving, they have entered the stage of large-scale promotion in multiple industries, rapidly increasing market share. The rapid rise of domestic medium and large PLC manufacturers has significantly impacted foreign manufacturers that hold advantageous positions in project-based industries, forcing European and American manufacturers to lower the actual transaction prices of medium and large PLCs, leading to significant fluctuations in market data due to price reductions.

4

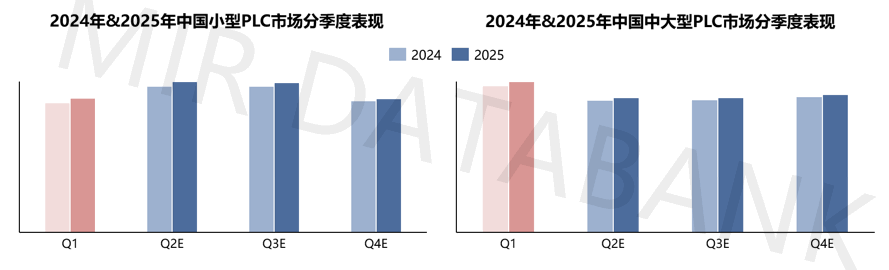

Q1 2025: Demand Recovery and Supply Side Repair

Quarterly Performance of the Chinese PLC Market in 2024 & 2025

Data Source: MIR Rui Industrial “2025 PLC Market Standard Report”

In Q1 2025, signs of recovery appeared in the PLC market, with clear trends of demand recovery and supply side repair.

1. Improvement on the Demand Side

Multiple industries are showing strong growth momentum. Benefiting from increased global equipment investment budgets in the lithium battery industry and the pull of export orders in the food and beverage industry, the PLC market growth rate is gradually beginning to recover. At the same time, the expansion of AI server capacity has driven demand for small PLCs. The rapid development of these industries has injected new vitality into the PLC market, becoming an important support for market recovery.

2. Optimization on the Supply Side

Market competition is gradually becoming rational, with price competition easing and the extent of price reductions by foreign brands narrowing. At the same time, distributor inventory management has been optimized, with inventory turnover days returning to normal levels, which has increased the enthusiasm of distributors to place orders, stabilizing the market supply system.

Market Forecast from 2025 to 2027

1

Overall Market: Stable Growth Coupled with Accelerated Domestic Substitution

Looking ahead to 2025-2027, the overall PLC market is expected to maintain stable growth, accompanied by accelerated domestic substitution.

From the perspective of demand support, industries such as new energy, municipal engineering, and water conservancy will continue to play an important role.In the new energy sector, the strong growth momentum of lithium equipment exports will bring broad international market space for the PLC market;in municipal engineering, the demand for domestic equipment in projects such as sewage treatment is continuously increasing, with a localization target set at 60%, which will strongly promote the application of domestic PLC products;in the water conservancy sector, the “14th Five-Year Plan” investment reaches 1.8 trillion yuan, with a large number of infrastructure construction projects directly driving demand for PLCs. Considering these factors,it is expected that by 2027, the PLC market size will maintain positive growth.

The dual drive of policy and technology will also provide strong momentum for market development. The Ministry of Industry and Information Technology has proposed a target of increasing the localization rate of key industrial control equipment to 40% by 2027, which encourages domestic manufacturers to increase R&D investment and enhance technical strength. At the same time, domestic manufacturers, leveraging their rapid response service advantages (such as a 72-hour rapid response mechanism), can better meet customer needs and gradually occupy a more favorable position in market competition.

2

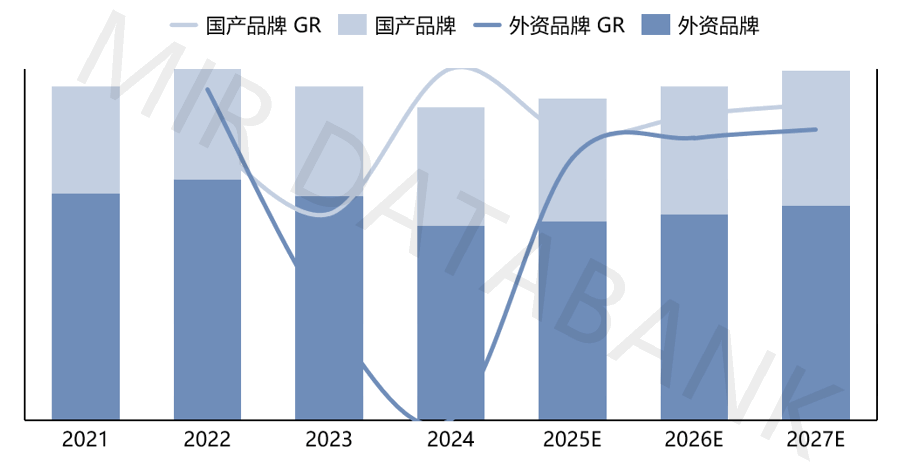

Small PLCs: Upgrading from Price Competition to Value Competition

Analysis of the Proportion Change Between Domestic and Foreign Brands in the Overall Small PLC Market in China

(2021-2027)

Data Source: MIR Rui Industrial “2025 PLC Market Standard Report”

Market Size:Starting in 2025, the small PLC market will recover with slight positive growth: at the beginning of 2025, the state will implement various specific subsidies and support policies to support the development of the domestic industry, stabilize economic performance, and further drive the growth of automation product demand.

Path to Deepening Localization:Leading brands such as Inovance and Xinjie are actively launching “PLC + Industrial Internet Platform” solutions to meet the growing demand for programming compatibility across various industries.By enhancing the comprehensive value of products, they not only meet customer needs for programming convenience and equipment interconnectivity but also increase the added value of products;cross-industry manufacturers such as Leadshine and Hechuan are expanding their PLC product lines based on their advantages in motion control technology.They perform well in industries such as food packaging and electronics, further consolidating the position of domestic small PLCs in niche markets, and are expected to drive an increase in the localization rate of small PLC products.

3

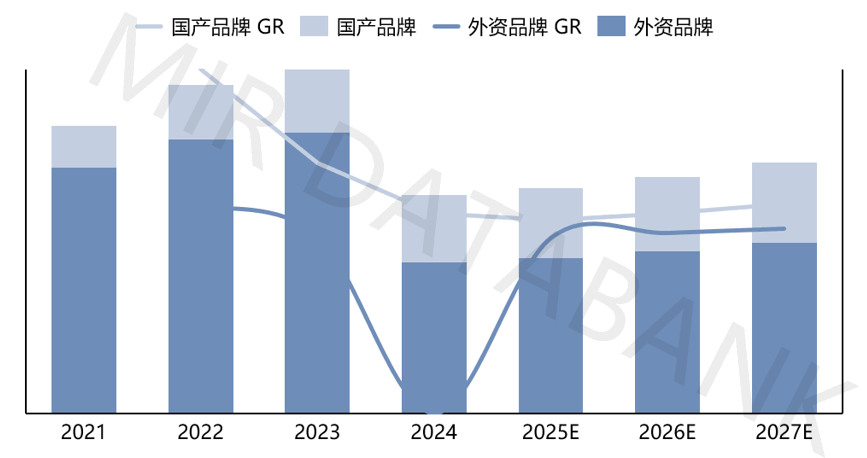

Medium and Large PLCs: Strategic Breakthrough in the “Bottleneck” Period

Analysis of the Proportion Change Between Domestic and Foreign Brands in the Overall Medium and Large PLC Market in China

(2021-2027)

Data Source: MIR Rui Industrial “2025 PLC Market Standard Report”

Currently, the localization rate of the medium and large PLC market is relatively low, but there is significant potential for growth, and it is rapidly expanding. In key sectors such as power, petrochemicals, steel metallurgy, and military industry, there is a heightened emphasis on supply chain security, making the demand for domestic substitution extremely urgent.As domestic manufacturers enhance their technical capabilities and successfully implement benchmark projects, the certification cycle for domestic medium and large PLCs is gradually shortening. It is expected that by 2027, the localization rate of medium and large PLCs will steadily increase.

Analyzing application scenarios and user distribution, compared to small PLCs, the users of medium and large PLCs are mostly concentrated in military, major equipment, and critical infrastructure sectors such as power, water conservancy, transportation, metallurgy, shipping, municipal, and petrochemicals, with a more urgent demand for domestic substitution and addressing “bottleneck” issues. However, due to the critical nature of their application scenarios, users are more cautious about the localization of core control systems, including medium and large PLCs, and have higher requirements for successful application cases of benchmark projects within the industry, pushing for more comprehensive product technology validation and on-site trial operation cycles. Therefore, the domestic market for medium and large PLCs has a more urgent demand for substitution compared to small PLCs, and it is expected that the localization rate will be higher than that of small PLCs in the further future, with a broader market space.

In recent years, companies such as Aotuo Technology, Zhongkong Technology, and Holley have broken through the monopoly of foreign brands in multiple fields such as water conservancy, shipping, rail transit, and petrochemicals, thanks to long-term technical accumulation and favorable policies for domestic substitution, achieving a leap from small-scale applications to large-scale promotion in certain industries.Looking to the future, domestic medium and large PLCs will achieve strategic expansion from non-existence to small-scale applications and from small-scale applications to large-scale promotion in various fields such as metallurgy, municipal, tap water, sewage, gas, wind power, nuclear power, and building control, and the monopoly position of foreign brands in the Chinese medium and large PLC market will be irreversibly broken.

In summary,in the next three to five years, the Chinese PLC market will enter a phase of sustained and stable growth, with both the market share and sales of domestic PLCs increasing, while the performance of domestic medium and large PLCs will be even more remarkable, becoming the main driving force for the overall market scale expansion and rapid increase in localization rates.

*Log in toMIR DATABANK Manufacturing Industry Professional Data Platform for more manufacturing data information, company information, and research reports! https://www.mirdatabank.comContact UsMIR DATABANK – Beijing HeadquartersYan Xuehui +86-18600855341[email protected]Shen Xia +86-13683509940[email protected]MIR DATABANK – Shanghai BranchLi Yujie +86-18221802598[email protected]Li Xuejiao +86-15921636781[email protected]MIR DATABANK – Wuhan BranchLi Xuejiao +86-15921636781[email protected]

*Log in toMIR DATABANK Manufacturing Industry Professional Data Platform for more manufacturing data information, company information, and research reports! https://www.mirdatabank.comContact UsMIR DATABANK – Beijing HeadquartersYan Xuehui +86-18600855341[email protected]Shen Xia +86-13683509940[email protected]MIR DATABANK – Shanghai BranchLi Yujie +86-18221802598[email protected]Li Xuejiao +86-15921636781[email protected]MIR DATABANK – Wuhan BranchLi Xuejiao +86-15921636781[email protected] Click here to read the original text

Click here to read the original text