leo/20250620

As NVIDIA GPUs dominate 67% of the global AI chip market, an antitrust revolution is underway. Tech giants like Google, Amazon, and Microsoft are developing their own ASIC chips, or Application-Specific Integrated Circuits, targeting cost-performance efficiency.

These chips, customized for specific tasks, are akin to special forces, executing a single mission with speeds up to 10 times faster than GPUs, reducing energy consumption by 50%, and costing only one-third of their competitors. This report will dissect the logic of the ASIC industry, opportunities in the supply chain, and key players.

The report consists of 27 pages, and below is a simplified interpretation of this report

1. Cost-Performance Ratio

1. Born for AI

• Advantages in compute-intensive scenarios: ASICs eliminate redundant designs and focus on AI computation. For example, Google’s TPU v6 chip has improved inference performance by 4 times compared to the previous generation, and training large models is 3 times faster.• Energy consumption beats competitors: The energy consumption per unit of compute for ASICs is only 1/100 of CPUs and 1/5 of GPUs. Microsoft’s self-developed Maia 100 chip has a power consumption 40% lower than NVIDIA’s H100 at the same compute level.

2. Inference Market

• Cost plummets: In 2023, the inference cost for GPT-4 is $36 per million tokens, dropping to $4 for GPT-40 in 2024, an 89% decrease, stimulating a surge in demand.• China’s share of inference servers will reach 73% as ASICs become the preferred choice due to low latency and low cost.

In 2024, the global AI chip market share of ASICs has soared from 10% in 2017 to 40%

(McKinsey data).

2. Who is Sharing the Pie?

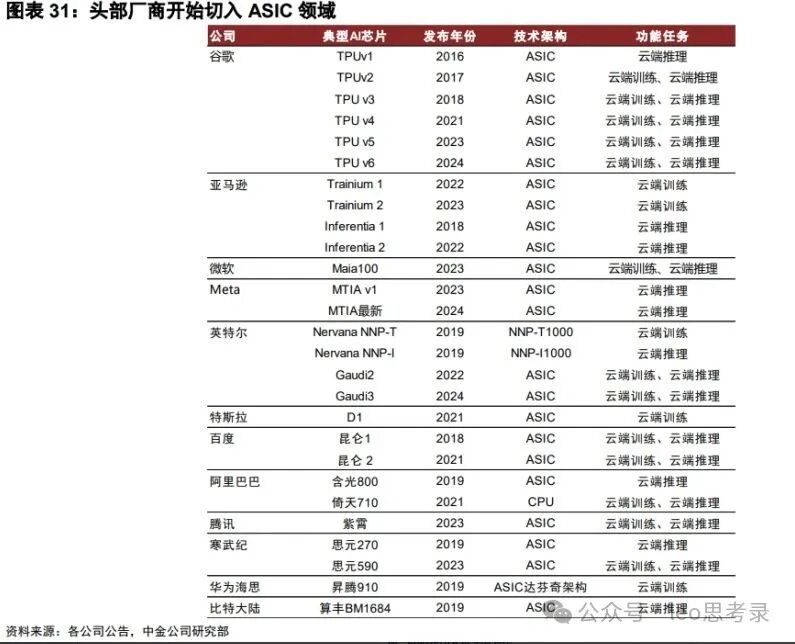

1. Cloud Giants Developing ASICs is a Trend

• Escaping NVIDIA’s high price tax: NVIDIA’s gross margin is as high as 73%, and cloud vendors can save 30-40% by developing their own chips.• The four giants’ layouts:○ Google: TPU has iterated to the seventh generation Ironwood, with a single cluster compute power of 42.5 Exaflops, 24 times that of the world’s strongest supercomputer.○ Amazon: Trainium 2 training chip performance has improved 4 times, with clients including Adobe and Apple Siri.○ Microsoft: Maia 100 is linked to OpenAI, with the next generation being manufactured by TSMC using 3nm technology.○ Meta: MTIA v2 focuses on recommendation systems, with an HBM version to be launched in 2026.

2. The Breakthrough Path of Domestic ASICs

• Huawei Ascend 910B: 7nm process, FP16 compute power of 376 TFLOPS, supports 8-card interconnection, a benchmark for domestic alternatives.• Cambricon MLU590: 7nm process, 314 TFLOPS compute power, targeting the training and inference market.• Tencent/Alibaba: Zixiao and Hanguang 800 chips have been used in cloud gaming, smart city brain, and other scenarios.

In 2024, the global ASIC market size is expected to reach $45.1 billion, a year-on-year increase of 17%; China’s accelerated server market is expected to reach $22.1 billion, a year-on-year increase of 134%.

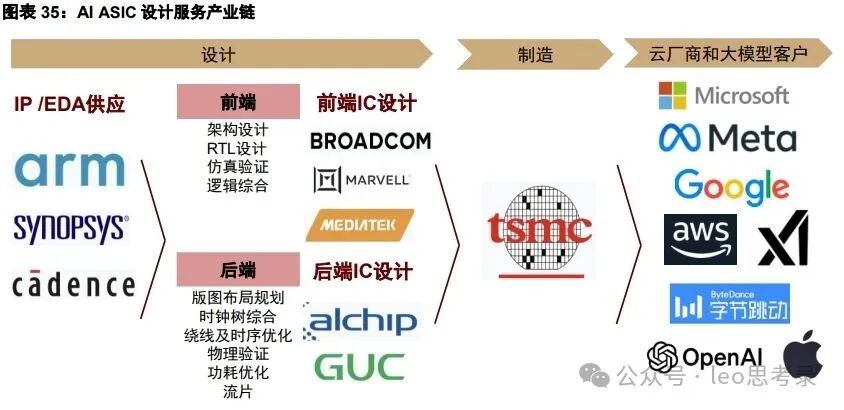

3. The Shovel Sellers

The ASIC industry chain is divided into design, manufacturing, and packaging/testing, withdesign service providers being the core beneficiaries:

1. International Leaders: Broadcom, Marvell

• Broadcom: Binds with Google TPU for manufacturing, with shipments of XPU chips expected to exceed 1 million units in 2026.• Marvell: Provides 3nm design for Amazon’s Trainium 2, with AI revenue expected to double by 2027.

2. Taiwan’s Dual Giants: ChipMOS, MediaTek

• ChipMOS: Focuses on backend design, securing orders for Amazon’s Inferentia, but with lower gross margins (IP relies on external purchases).• MediaTek: Holds shares in TSMC, mastering 3nm packaging technology, manufacturing for Microsoft’s Maia v2.

3. Domestic Design Service Providers: Chipone, Aowei Technology

• Chipone: 5nm design capability,in 2024GPU/NPU IP licensing revenue is expected to reach 740 million yuan, with clients including Google and Intel.• Aowei Technology: Chip customization business revenue of 340 million yuan, securing orders from OPPO and Xiaomi.

Light asset design service providers > Manufacturing/testing companies

4. Three Certain Directions

1. Inference chip explosion: By 2028, ASICs will account for 70% of edge computing (McKinsey forecast).2. Chiplet technology: Huawei/Chipone are laying out chiplet architecture to break through process limitations.3. Increase in domestic production rate: Driven by policy, the share of Chinese ASIC design companies is expected to increase from 10% to 30%.

Conclusion

As NVIDIA dominates general-purpose computing with GPUs, ASICs are launching a counterattack in vertical fields, surrounding cities from the countryside. Investment opportunities lie not in chip manufacturing, but in the design of chips. Companies like Broadcom, Marvell, and Chipone, the shovel sellers in the industry chain, will become the invisible champions in the computing power arms race.