Click the blue text above to follow 21st Century Economic Report~

Entering into all aspects of economic life

Introduction:The importance of chips in today’s technology industry is akin to that of steam engines and internal combustion engines during the first and second industrial revolutions, or even greater. Whether it is the smartphones and computers commonly used by people, or the data centers and industrial robots used by enterprises, they all rely on chips.

The U.S. ban on ZTE has revealed a “soft spot” in China’s technology industry: China’s chip production is insufficient, heavily reliant on imports, and there is a gap of 2-5 generations compared to leading international players from the U.S. and South Korea.

How Should China Play the Chip Game?

Source: 21st Century Economic Report (ID: jjbd21)

Reporters: Zhai Shaohui, Zhou Zhiyu, Tao Li, Intern Qin Yuanshun

International Chip Landscape:

Top Five Semiconductor Players Hold Nearly Half the Market Share

In recent years, the global technology industry has been thriving: technologies such as 5G communication, artificial intelligence, autonomous driving, augmented reality, and virtual reality have transitioned from ideals to reality, and the call for the fourth industrial revolution is gradually emerging. Chinese technology companies have also made continuous breakthroughs in recent years, leading in certain fields on the international stage.

However, the lack of “chips” remains a “pain point” for China’s technology industry. Han Xiaomin, general manager of the Integrated Circuit Industry Research Center at the China Center for Information Industry Development, recently stated to the media that the backwardness of China’s chip industry is “comprehensive and systemic”; even domestic leading enterprises still lag behind international mainstream manufacturers, let alone top manufacturers.

Sravan Kundojjala, deputy director of mobile component technology services at Strategy Analytics, stated in an interview with 21st Century Economic Report that most Chinese semiconductor companies are still “in a backward state” in the chip field.

Global Semiconductor Industry Geographic Layout: U.S. and South Korean Companies Hold Strong Positions

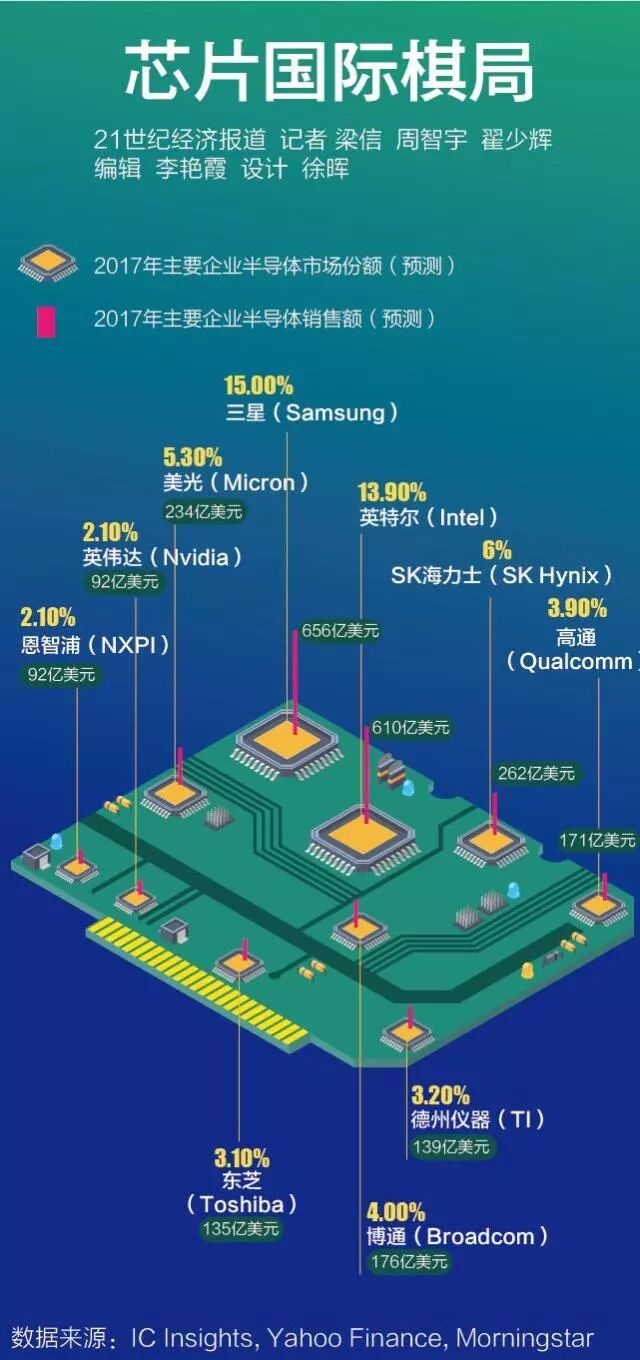

According to a forecast updated by semiconductor industry analysis firm IC Insights in November 2017, excluding wafer foundries, U.S. and South Korean companies held 5 and 2 positions respectively among the top ten semiconductor companies in 2017 based on market share (at the time of the report, Broadcom’s headquarters was still in Singapore), while Japan, Singapore, and the Netherlands each had one company in the rankings. In 2016, U.S. and South Korean companies had 4 and 2 companies in the rankings, with the remaining 4 from Singapore, Japan, the Netherlands, and Taiwan, China.

By selecting data from the years 1993, 2000, 2006, 2016, and 2017 (predicted), Intel ranked first in market share in all years except for 2017, where it fell to second place; Samsung from South Korea ranked 7th, 4th, 2nd, and 2nd in the first four selected years, and climbed to the top in 2017. Samsung’s rapid growth in recent years is mainly due to the global price increases of DRAM and NAND memory chips, which have also benefited South Korea’s SK Hynix and U.S. Micron.

Overall, the advantages of semiconductor giants are continuously expanding. According to data updated by IC Insights in April 2018, the global integrated circuit market (excluding wafer foundries) reached $444.7 billion in 2017, with sales from the top five semiconductor companies accounting for 43% of the total market, compared to just 33% ten years ago in 2007.

Additionally, looking horizontally, the market shares of the top 10, 25, and 50 semiconductor companies globally in 2017 were 57%, 77%, and 88% respectively; in 2007, these figures were 46%, 67%, and 76%. In the increasingly competitive semiconductor industry, the space for new players is shrinking. How to break through in an industry that has entered a mature phase remains a challenge for Chinese companies.

Chinese IC Design Market Share Reaches 11%

However, emerging market semiconductor manufacturers are not without opportunities. IC Insights data shows that from 1990 to 2017, Japan’s integrated circuit industry (excluding wafer foundries) saw its market share drop from 49% to 7%, with companies like NEC, Hitachi, Panasonic, and Mitsubishi exiting the market.

During the same period, companies in the Asia-Pacific region experienced astonishing growth, increasing from 4% to 37%. Among them, the rising South Korean integrated circuit suppliers, especially in the memory chip sector, played a significant role in this shift. Additionally, aside from stagnant European companies, North American companies increased their share from 37% to 49%, replacing Japanese companies as the leading group.

However, it is worth noting that this growth in the Asia-Pacific region is not solely due to business growth; financial operations and mergers and acquisitions have also played a role. For example, Broadcom, which was once headquartered in Singapore, has stirred the industry landscape with several “acquisition frenzy” moves.

In 2016, Avago, headquartered in Singapore, completed the acquisition of Broadcom Corp., which was based in the U.S., and subsequently integrated to form the new Broadcom Limited. In November 2017, Broadcom made a cash and stock offer of $130 billion to Qualcomm, and after being rejected, initiated a hostile takeover. Just days before the initial offer, Broadcom CEO Hock Tan expressed plans to relocate the headquarters back to the U.S. at the White House.

In March 2018, just before the “decisive battle” at Qualcomm’s shareholder meeting, the U.S. Committee on Foreign Investment (CFIUS) intervened urgently, requiring Qualcomm to postpone the shareholder meeting and the deadline for shareholder voting. A week later, U.S. President Trump signed an executive order blocking the acquisition on the grounds of “national security” concerns, and Broadcom subsequently announced it would formally abandon the acquisition of Qualcomm and stated it would continue with its original plan to relocate its headquarters. On April 4, Broadcom announced that its U.S. headquarters in San Jose, California, would now serve as its global headquarters, making it an American company once again.

A private equity investor with over $10 billion invested in the semiconductor field pointed out to 21st Century Economic Report that the integrated circuit industry has a “smile curve,” where the profit margins are high at both ends and low in the middle, with IC design being one of the high-margin segments.

Data updated by IC Insights in March this year shows that if only counting the “lucrative” IC design segment, these companies achieved integrated circuit sales of $101.4 billion in 2017, with U.S. companies accounting for 53%, not including the 16% market share of Broadcom, which was still headquartered in Singapore in 2017.

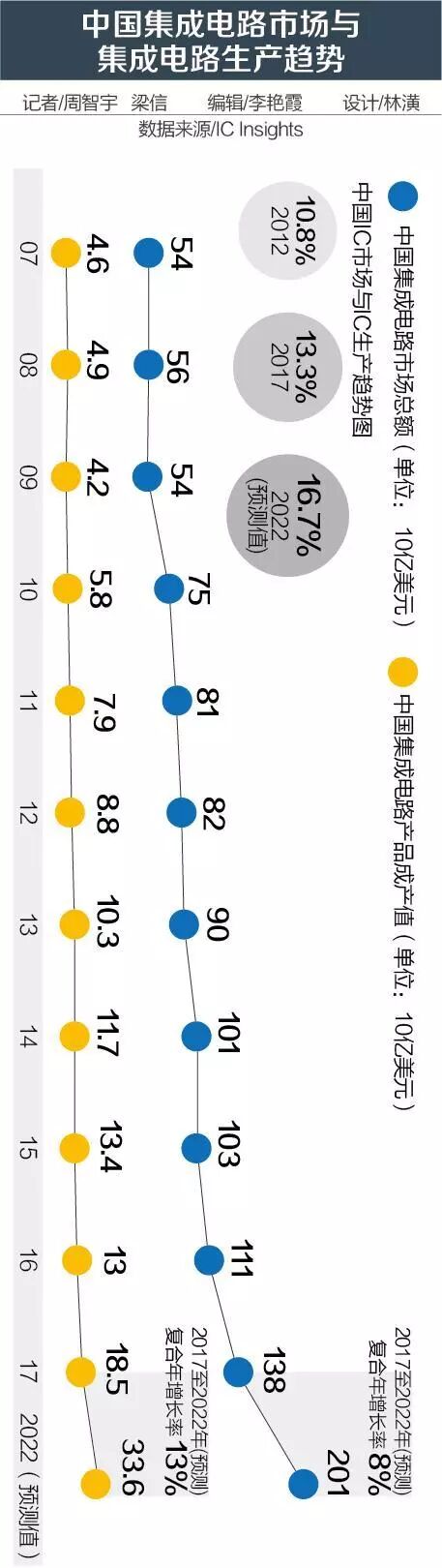

However, Chinese companies have also made significant progress in IC design, becoming the fastest-growing segment in global IC design market share since 2010. In 2010, the market share of Chinese companies was only 5%, but by 2017 it had grown to 11%. In 2009, only HiSilicon Semiconductor was among the top 50 IC design companies, while by 2017, there were 10 Chinese companies, including HiSilicon, ZTE, and Unisoc, in the top 50.

Annual Import Amount of Approximately $260.1 Billion, China’s Semiconductor “Insufficient”

Despite being the world’s manufacturing hub for electronic products, China’s production capacity in chips appears insufficient.

China is a major consumer of semiconductors globally, but its export capacity has remained low. According to data from the General Administration of Customs of China, the annual import amount of integrated circuits in China was approximately $260.1 billion in 2017, exceeding the total amount of oil imports, while exports were only $66.9 billion.

In contrast, in previous years, from 2014 to 2016, China’s annual integrated circuit imports were $217.6 billion, $229.9 billion, and $227 billion, showing an upward trend. Meanwhile, China’s annual integrated circuit exports during the same period were $60.9 billion, $69.1 billion, and $61 billion. The export-to-import ratio has been declining since 2015.

Additionally, according to data from the China Center for Information Industry Development, the value of semiconductors consumed in China each year accounts for about 33% of the global shipment volume, with the integrated circuit market size accounting for about 81% of the entire semiconductor industry, while China’s integrated circuit industry size accounts for about 7%-10% of the global integrated circuit industry size. This data indicates that China consumes one-third of the world’s semiconductors each year, but its production capacity can only provide one-tenth of the global supply.

“Chinese semiconductor companies have indeed made significant progress over the past decade,” Sravan Kundojjala from Strategy Analytics stated to 21st Century Economic Report, especially in components related to smartphones, such as baseband processors, application processors, connectivity chips, and fingerprint sensors.

However, due to the concentration of semiconductor companies in mainland China in the high-performance, low-cost market, these companies are unable to advance their technology roadmaps compared to global leaders like Qualcomm. Kundojjala believes that from this perspective, there is a significant technological gap between semiconductor companies in mainland China and companies like Qualcomm and Broadcom.

Kundojjala cited that Chinese semiconductors have made “limited” progress in the LTE mobile baseband field. Companies like HiSilicon Semiconductor Co., Ltd. (hereinafter referred to as “HiSilicon”) have made good progress in LTE and 5G basebands, as have Spreadtrum, Rockchip, and RDA Microelectronics. However, HiSilicon’s LTE Cat7 downlink speed reaches 300 Mbps, while Qualcomm’s integrated baseband supports a maximum downlink speed of 2 Gbps.

At the same time, the integration capabilities of semiconductor companies in mainland China are far behind Qualcomm. For example, Qualcomm’s LTE baseband also integrates CPU, GPU, DSP, ISP, etc. Kundojjala stated that in the baseband field, HiSilicon is the only Chinese company that can compete with Qualcomm.

Overall Gaps, Some Areas Achieve Breakthroughs

Guo Gaohang, a semiconductor industry analyst at TrendForce, pointed out to 21st Century Economic Report that nearly 90% of design companies in China are small and micro startups, and many of these companies have overlapping development directions.

Data from the China Semiconductor Industry Association shows that in 2017, there were approximately 1,380 integrated circuit chip design companies in mainland China, most of which are small in scale and have weak R&D capabilities. Among them, only over 500 companies are profitable. Most design companies in the Internet of Things, automotive electronics, and consumer electronics sectors are startup teams with fewer than 10 people, which shows a significant gap in competition with giant companies like Qualcomm.

While the number of design companies in mainland China has surged, international design companies are experiencing a trend of consolidation and resource optimization. Qualcomm’s attempt to acquire NXP is a representative case.

A report from the Integrated Circuit Research Institute of the China Center for Information Industry Development indicates that if Qualcomm successfully acquires NXP, it would essentially block the high-end development path of integrated circuits in mainland China in fields such as the Internet of Things, wearables, automotive networking, autonomous driving, drones, industrial applications, and consumer electronics, leaving Chinese design companies limited to niche segments such as Beidou navigation, military, special fields, and agricultural development.

Furthermore, Guo Gaohang believes that although there are significant breakthroughs in some chip products in mainland China, the IP cores still rely on international leaders like ARM, and the EDA tools used in the design process are entirely dependent on vendors like Synopsys, Cadence, and Mentor for licensing.

Guo Gaohang analyzed to 21st Century Economic Report that while there are breakthroughs in processors, with companies like HiSilicon and Spreadtrum making progress, they still tend to focus on mobile terminal fields, and HiSilicon’s processor chips are not supplied externally, while Spreadtrum remains in the mid-to-low-end market, leaving mainland Chinese manufacturers without a voice in PC and server applications.

A visible fact is that there are still no manufacturers from mainland China among the top 20 semiconductor companies globally. Guo Gaohang believes this is mainly due to the current lack of innovation capability among Chinese manufacturers, significant technological gaps, and the need for improvement in industrial support and atmosphere.

In the memory sector, Guo Gaohang stated that Chinese companies have entered the global mainstream supplier array in the area of NOR Flash products.

According to TrendForce data, in 2016, GigaDevice’s NOR Flash global market share was about 7%, and it has successfully entered the supply chain of Samsung smartphones. However, mainstream memory chips like DRAM and NAND still heavily rely on imports, and the initial mass production plans for three domestic memory wafer manufacturing lines are scheduled for the second half of 2018, with a technological gap of about 2 generations compared to international leading manufacturers in both 3D-NAND and DRAM.

Kundojjala also pointed out that in terms of advanced process technology, Chinese foundries like SMIC are still lagging behind Samsung.

Kundojjala believes that foundry technology is crucial for flagship chips related to new technologies like 5G and AI.

Following Samsung, Intel, Hynix, and others are also planning to spin off their foundry businesses, and Guo Gaohang pointed out that competition in the manufacturing sector of the global semiconductor industry will become even more intense.

In the testing and packaging sector, while manufacturers in mainland China can be said to have entered the global leading ranks, the driving force for revenue growth from mature packaging technologies will gradually weaken.

Alibaba Enters the Chip Field

Aiming for “Self-Control” in Domestic Chips

On April 20, Alibaba confirmed to 21st Century Economic Report that the company has fully acquired Hangzhou Zhongtian Micro Systems Co., Ltd. (hereinafter referred to as “Zhongtian Micro”), with the investment amount not disclosed.

The partnership was not accidental; as early as January 2016, Alibaba invested in Zhongtian Micro, becoming its largest shareholder. In June 2017, Alibaba injected 500 million yuan into Zhongtian Micro, officially entering the chip infrastructure design field.

The acquisition of Zhongtian Micro is an important part of Alibaba’s chip layout.Alibaba’s CTO Zhang Jianfeng stated, IP Core is the core of basic chip capabilities, and entering the IP Core field is the foundation for achieving “self-control” in Chinese chips.

Image Source / Xinhua News Agency

Alibaba’s determination to enter the chip field is significant. On April 19, Alibaba’s DAMO Academy announced the self-developed neural network chip Ali-NPU. It is reported that this chip will be used for image and video analysis, machine learning, and other AI computing, with a cost-performance ratio 40 times that of similar products currently on the market.

In 2017, Alibaba invested 100 billion yuan as the startup fund for DAMO Academy, focusing on research in quantum computing, machine learning, basic algorithms, network security, visual computing, natural language processing, next-generation human-computer interaction, chip technology, sensor technology, and embedded systems.

In addition to Alibaba, giants like Baidu and Tencent have also established varying degrees of cooperation with related companies in the chip field. Industry insiders believe that chip research and development requires continuous investment and cannot be achieved overnight. It typically takes at least three to five years to see results, but with sufficient resources and continuous investment from internet giants, the situation of domestic chips may change.

Alibaba Accelerates Its Layout

The “2017 China Integrated Circuit Industry Analysis Report” shows that the current market share of domestic chips in core integrated circuits in China is low, with nearly zero market share in chips for computers and mobile communication terminals.In 2017, China imported chips worth $230 billion from abroad, which is twice the amount of oil imports.

In light of this situation, Alibaba has begun to accelerate its layout.On one hand, it is rushing to develop its own chips, and on the other hand, it is continuously increasing its investment. Public information shows that Hangzhou Zhongtian Micro Systems Co., Ltd. was established in 2001, focusing on the research and large-scale application of 32-bit embedded CPU IP. As of now, it has shipped over 700 million chips globally for various IoT fields such as multimedia, security, home, transportation, and smart cities.

Zhongtian Micro has a CPU business line targeting various embedded application scenarios and has developed 7 embedded CPUs covering high, medium, and low embedded applications, which can be used in multiple fields such as IoT, digital audio and video, information security, networking and communication, industrial control, and automotive electronics.

The CEO of Zhongtian Micro, Qi Xiaoning, has stated that the company’s founding purpose is to establish domestic CPU independent research and innovation capabilities. “We hope to leverage Alibaba’s strong platform and data center system to achieve large-scale commercial applications of independently developed chips, contributing to the research and mass production of true ‘Chinese chips.'”

It is worth noting that in addition to the full acquisition of Zhongtian Micro, Alibaba has also invested in five chip companies including Cambricon, Barefoot Networks, Deep Insight, Kneron, and ASR in 2017. Regarding rumors that Alibaba has acquired the IoT chip company Espressif Technology (Shanghai) Co., Ltd., Alibaba representatives stated in an interview with 21st Century Economic Report that they are unaware of where this news originated. “We have not invested in this company.”

“Chips are the core of connection, control, and computation. Alibaba aims to form an integrated capability from edge to cloud, providing solutions from cloud to edge for various vertical industries, making the layout of the chip field significant for us,” the representative further stated, In recent years, the self-sufficiency rate of chips in China’s communication industry has been continuously improving. However, in some areas with higher stability and reliability requirements, domestic chips still have significant room for improvement. In this regard, Alibaba will further achieve breakthroughs in core technologies such as chip research and development.

Industry Actively Prepares

Image Source / Tuchong Creative

As early as November 2016, Alibaba and Tencent led a $23 million Series C financing for programmable chip company Barefoot Networks. Barefoot Networks developed the world’s first programmable chip, named Tofino, which can process network data packets at a speed of 6.5 terabits per second, faster than any other chip on the market.

Subsequently, Alibaba invested in five chip companies, each with different application scenarios and unique features. Cambricon focuses on mobile chips, Deep Insight mainly targets security, and Kneron is involved in smart home and smart security.

Compared to Alibaba’s focus on AI chips, Baidu’s attention is directed towards a broader field.

In March 2017, Baidu released the DuerOS smart chip and established strategic cooperation with Unisoc, ARM, and Shanghai Hanfeng. This chip is equipped with a conversational AI operating system, enabling devices to have conversational capabilities, and can be widely used in various devices such as smart toys, Bluetooth speakers, and smart homes. In August 2017, Baidu also released the XPU in collaboration with Xilinx, a 256-core cloud computing acceleration chip based on FPGA.

However, the investment from technology companies is still just a trial compared to national investments. The National Integrated Circuit Industry Investment Fund, established earlier, raised 138.7 billion yuan in its first phase, with the second phase expected to reach 200 billion yuan; by 2017, local governments announced the establishment of semiconductor funds totaling about 500 billion yuan; this is expected to drive social investment of 700 billion yuan.

Ye Weigang, founder and managing partner of Datang Capital, stated in an interview with 21st Century Economic Report that from a global trend perspective, each industry should have clear divisions of labor, and large companies should focus on their main businesses. However, the ZTE incident has alerted these technology companies that they must have their own technology and product reserves to avoid being constrained. “It can be said that Alibaba is more doing preparatory work, not aiming to replace any chip company, but to avoid being constrained. The approach taken by Huawei in developing its own chips is also correct.”

Currently, Alibaba’s DAMO Academy has assembled a technical team of over 400 people in just six months. 21st Century Economic Report has learned that Alibaba has recently increased its hiring efforts in the U.S. to attract technical talent in the chip industry to support its research in the chip field.

(Editor: Li Yanxia, Bao Fangming)

21st Century Economic Report

What do you think, friends?

Millions of readers are watching…

ZTE holds a press conference! Chairman: The U.S. sanctions have put the company in a state of shock, and we firmly oppose it! U.S. Commerce Department officials: The ban has no room for reversal or negotiation.

Did the “ban” on ZTE mistakenly hit the leading security company? Hong Kong capital buys into Hikvision, net buying 1.292 billion yuan in two days, setting a historical high!

Big data reveals six truths about cancer in China! Why are more and more young people getting cancer?

This issue’s editor: Liu Xiang

21st Century Economic Report

Friends, please give 21st Century Economic Report a thumbs up before you leave~