“Come on, Pentium computers, let them think for me.” In 1999, when Pu Shu sang this lyric in “New Boy,” x86 architecture chips were undergoing a magnificent transformation, with the Wintel combination bringing personal computers into the homes of ordinary people. By 2021, when the band “Landlord’s Cat” covered this song, computers were no longer the primary window for people to glimpse the world, and x86 architecture faced a fateful rival: Arm. This article is the tenth in the “Domestic Replacement” series, focusing on the domestic replacement of CPUs. In this article, you will learn about: mainstream CPU architectures and features, the development history of mainstream CPU architectures, and the wave of entrepreneurship and financing in domestic CPUs along with the thoughts behind it.Fu Bin | AuthorLi Tuo | EditorGuokel Hard Technology | Planning

The CPU is the most important digital chip. Over the past decade, Arm (Advanced RISC Machine) architecture CPUs have swept the smartphone market and are gradually encroaching on the traditional desktop computer market, also making significant inroads into the server computing market. Today, the potential of the Arm instruction set in the chip localization movement has attracted substantial capital, making this round of semiconductor feasting increasingly vigorous.

x86 and Arm, Sharing the World

As the indispensable brain of all modern computing systems, today’s single CPU can have multiple processing cores and hundreds of billions of transistors, with the best workload type being serial computation. Its strong versatility can also command the overall computation, control and allocate all computer hardware resources, interpret computer instructions, and process data in computer software[1]. Therefore, it can handle everything from system booting, productivity applications, to advanced workloads like cryptography and artificial intelligence[2].

CPUs are categorized into different factions based on their instruction sets (also known as architectures or ISAs). An instruction set refers to a set of standard specifications for software and hardware, around which CPU chips and software applications are designed. It can be understood as a hard program that optimizes CPU computation guidance. Instruction sets are generally divided into two major architectures: Complex Instruction Set Computer (CISC) and Reduced Instruction Set Computer (RISC). The beginning of instruction sets can be traced back to Intel. Since Intel launched the first commercially available microprocessor, the 4004, fully integrated into a single chip in 1971, the development of CPUs and instruction sets has spanned nearly 50 years.

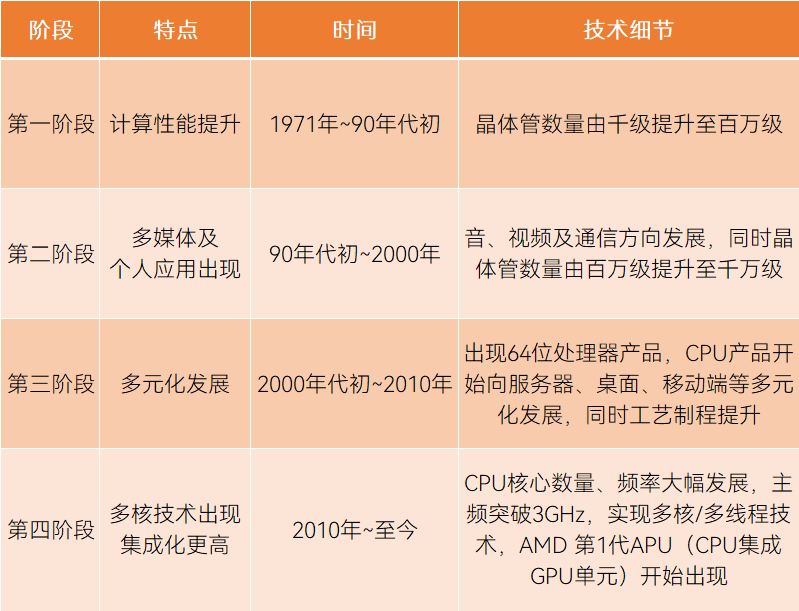

Over the 50-year history of CPUs, four stages have been experienced, table compiled by Guokel Hard TechnologySource: CSTC[3]

Over the 50-year history of CPUs, four stages have been experienced, table compiled by Guokel Hard TechnologySource: CSTC[3]

Over the past 50 years, many instruction sets have emerged, but some participants have either declined from prosperity or are still new and cannot bear heavy responsibilities. The performance requirements for CPUs in desktops, mobile devices, and servers are high. Currently, the market is dominated by the x86 instruction set, represented by Intel and AMD (Advanced Micro Devices), which occupies the majority of the market share, while the Arm instruction set holds a smaller portion.

Note: The origin of x86 – Early Intel processors ended with 86, including Intel 8086, 80186, 80286, 80386, and 80486, hence the name x86. Current mainstream instruction set situation, table compiled by Guokel Hard Technology

Current mainstream instruction set situation, table compiled by Guokel Hard Technology

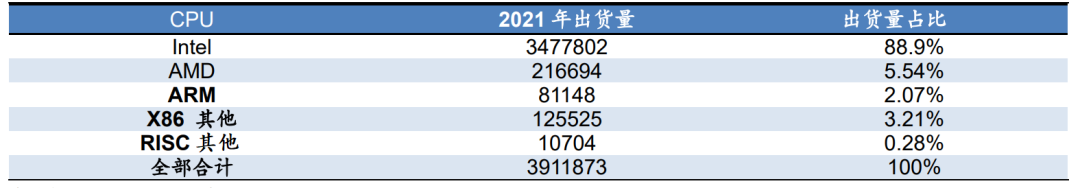

Domestic CPUs rely on imports, with the highest demand for CPU performance and quantity coming from servers, where Intel and AMD accounted for over 94% of CPU shipments in China in 2021.

2021 China server CPU market shipment situation, source: Huashan Securities[4]

2021 China server CPU market shipment situation, source: Huashan Securities[4]

Arm, the Rising Star

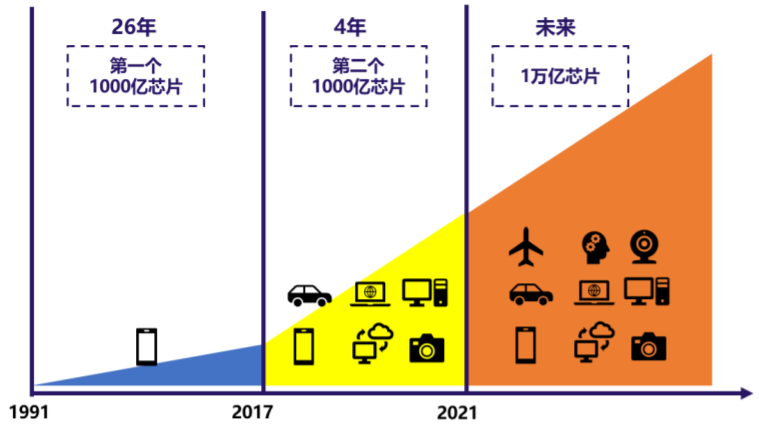

Initially, Arm was only used in mobile phones, but later, due to its low power consumption advantages, it occupied the embedded and automotive fields. Today, the ubiquitous Arm chips have shipped over 225 billion units[5]. In recent years, Arm, originally active in mobile and embedded fields, has made significant inroads into desktop, mobile, and server CPUs. The driving force behind this growing trend is Apple and Amazon.

The Arm architecture ecosystem is growing larger, source: Pacific Securities[6]

The Arm architecture ecosystem is growing larger, source: Pacific Securities[6]

Apple has the ability to lead industry trends. Its several changes in instruction sets have disrupted the desktop and mobile PC markets.

-

In 1994, Apple transitioned the Mac from Motorola 68000 to PowerPC, an instruction set founded by Apple, IBM, and Motorola, which achieved great success for a time, with Sony’s PlayStation 3, Nintendo’s Wii and Wii U, and Microsoft’s Xbox 360 all using PowerPC processors;[7]

-

In 2005, Apple switched to Intel’s x86 processors, as Jobs wanted to compete for more market share with other computer OEMs by using the same instruction set as competitors, allowing users to install competitors’ operating systems to “dig the wall.” Of course, if he did not recognize x86, Jobs would not have chosen it;[8]

-

In 2020, the trend changed again, as Apple abandoned x86 and switched to its self-developed Arm SoC (System on Chip, which includes CPU, GPU, ISP, NPU, etc.), leading the industry and media to believe that Apple might lead a new decade of trends.[9]

Since Apple abandoned x86 and launched the M1, it has propelled Arm to great heights, filling the market with competition, making x86 “unpopular.” Geekbench 5 test scores show that the 2020 13-inch MacBook Pro ([email protected] GHz) is 70% faster in single-core performance and 50% faster in multi-core performance compared to the 2019 15-inch MacBook Pro ([email protected] GHz), despite the M1 having only 8 threads while the i7-9750H has 12 threads[10]. Coincidentally, PassMark benchmark tests show that the M1 chip’s single-core performance even surpasses some 11th generation Core i9 (i9-11900K, i9-11900F, etc.) and 12th generation Core (i7-12700T, i5-12500T, etc.)[11]. Some different test results show that Cinebench R23 tests indicate that Intel CPUs have stronger single-core performance than the M1, but multi-core performance still lags behind the M1[12]. After the M1 product was launched, Intel hurriedly shared a set of data to prove that its products had greater advantages (i7-1185G7), but it did not stir up much response at the time.[13] Subsequently, Apple launched M1 Pro, M1 Max, and M1 Ultra, further intensifying the momentum of Arm chips. During the 2022 WWDC, Apple introduced the M2 chip, utilizing TSMC’s second-generation 5nm process, integrating over 20 billion transistors, and achieving an 18% increase in CPU speed compared to the M1. The key to Apple’s successful design and production of such chips is Arm.[14] Although there are increasing voices in the industry criticizing Apple’s hype, and although Apple’s data may indeed be exaggerated, it must be said that the actual performance of Apple chips is quite good, solidifying Arm’s capabilities in desktop and mobile PCs.

As a staunch Arm supporter, Amazon has been promoting Arm chips in the server field. Since 2018, it has launched the AWS (Amazon Web Services) Graviton cloud processor based on Arm, showcasing the advantages of Arm IP in the cloud computing market. Additionally, major companies like Google and Microsoft have also developed their own Arm cloud processors. Ampere, a company focusing on Arm architecture server CPUs, has previously stated that x86 has been around for a long time and has been applied in the market for decades, with its original design intent and application scenarios being non-cloud business, which is also x86’s biggest disadvantage. In the past decade or two, due to the lack of better options in the market, x86 has also been used in cloud business, but in the future, Arm’s position in data centers will continue to rise. This “rising” position of Arm is reflected in various CPU fields, which is also the logic behind the domestic forces making significant inroads into the Arm market. Consequently, various capital has entered the fray, ushering in an era of abundant funding for domestic Arm architecture CPU companies.

Wave of Financing for Domestic Arm Architecture CPUs

For many years, CPUs in the Chinese market have relied on imports, which not only pose security risks such as backdoors, vulnerabilities, and trojans but may also be subject to eavesdropping and control. After incidents like “Stuxnet,” “Prism,” and various sanctions, the only path for domestic CPUs is to develop independently and controllably.[15] However, as the “pinnacle of human-made objects,” creating CPUs is challenging. A successful CPU requires not only high investment but also involves an entire chain: on one hand, high-performance CPUs are complex and are typical talent-, capital-, and technology-intensive industries; on the other hand, producing a chip does not mean the end; a complete industrial ecosystem must be established, as a chip without supporting hardware and software is useless. To create a CPU, one must first have an instruction set, and domestic manufacturers face three paths:

-

Obtain IP (Intellectual Property) core licensing: equivalent to buying a semi-finished product, purchasing already designed circuits or physical layouts, and then designing the backend based on the semi-finished product. This has a low entry barrier and guaranteed performance, but hard IP requires using designated foundries and processes, while soft IP, apart from configuration options, does not allow any design changes. More importantly, both types of IP lack independent controllability;[16]

-

Obtain instruction set licensing or use open-source instruction sets: only purchasing instruction set licensing and independently designing corresponding specification CPUs based on this. In this model, there is only a licensing agreement, and CPU design relies entirely on oneself, which has a certain degree of independent controllability, but the instruction set itself also carries sanction risks; or use open-source instruction sets like RISC-V to independently design CPUs, which has high controllability, but if some patented modules are needed, licensing will also be involved;

-

Independently develop an instruction set: creating an instruction set that does not exist in the world, not relying on any other instruction set, which has a very high technical threshold but is highly independently controllable. There are also some semi-independently developed situations in China, where new instruction sets are developed based on licensed instruction sets.

Through these three paths, the current domestic CPU market has formed three major instruction set camps:

-

In the x86 camp, Tianjin Haiguang and Shanghai Zhaoxin’s IP licensing comes from AMD (Advanced Micro Devices) and VIA (VIA Technologies) respectively, with high performance, good compatibility, and a complete ecosystem, but doubts remain about independent controllability;

-

In the Arm camp, Kunpeng, Feiteng, etc., are all instruction set licensed, with a certain degree of independent controllability, but compatibility and ecosystem depend on the Arm instruction set itself;

-

In the self-developed camp, Loongson was previously based on MIPS licensing but later abandoned MIPS for complete independent development, while Shenwei is based on Alpha licensing for self-development, with very high independent controllability, but performance lags behind foreign counterparts, and compatibility and ecosystem need further development.

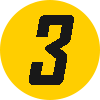

Situation of major domestic CPU manufacturers, table compiled by Guokel Hard Technology

Situation of major domestic CPU manufacturers, table compiled by Guokel Hard Technology

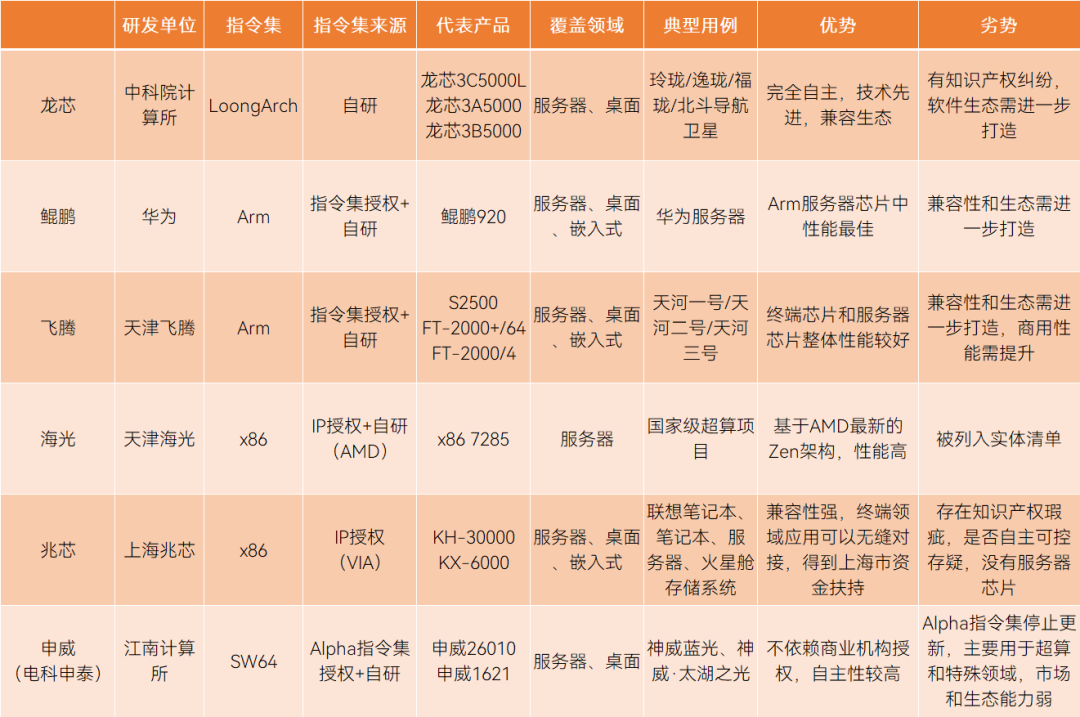

As a fundamental infrastructure, CPUs will inevitably attract new players, supported by capital. Creating CPUs is costly, and the financing amounts related to CPU companies continue to rise, with some companies able to secure hundreds of millions in financing even in the Pre-A round, with valuations exceeding 4 billion yuan at times. In this trend, while some manufacturers choose the open-source RISC-V to design CPUs with strong independent controllability, most manufacturers still opt for the more mature Arm to produce high-performance CPUs.

Situation of major financing stage enterprises in China, table compiled by Guokel Hard Technology

Situation of major financing stage enterprises in China, table compiled by Guokel Hard Technology

Cold Reflections Behind the Financing Wave

So, what challenges will domestic manufacturers face as they make significant inroads into high-performance Arm CPUs?

x86 Will Still Dominate the Market

Although Arm’s momentum is strong, x86 will not relinquish its scepter. In practical applications, both sides have their victories and defeats, stemming from the different mechanisms and product characteristics of x86 and Arm in CPU design:

-

The widely accepted conclusion in the industry is that x86 is based on a complex instruction set (CISC), processing instructions over multiple clock cycles, while Arm is based on a reduced instruction set (RISC), executing one instruction per clock cycle. Therefore, Arm is superior in power consumption, but in terms of performance, Arm is weaker than x86;

-

x86 implements more work through hardware, while Arm delegates some work to the compiler, thereby reducing hardware complexity;[17]

-

As a RISC instruction set, Arm can use instructions per cycle (IPC) to measure CPU running speed, but as a CISC instruction set, x86 is not suitable for IPC to reflect running speed because a single x86 instruction requires the CPU to perform a lot of work, while a single Arm instruction usually corresponds to one function or operation;[18]

-

x86 instruction sets have a long development history, and the PC field ecosystem is significantly more mature than Arm’s, and previously deeply bound to Windows, dubbed Wintel (Windows + Intel). Currently, the operating systems, languages, cloud-native, databases, CI (Continuous Integration)/CD (Continuous Deployment) supported by Arm are increasing, but the ecosystem is still not as mature as x86;

-

From the beginning, the Arm instruction set has operated on an authorization model, and Arm itself does not rely on its own design and manufacturing or selling CPU chips. Due to open licensing, it is more active in development, but the x86 instruction set is almost closed, only authorizing a very small range of companies. It was only this February that it began to loosen its licensing of soft and hard cores for the x86 instruction set, allowing customers to mix different CPU IP cores like x86, Arm, and RISC-V in custom-designed chips manufactured by Intel.[19]

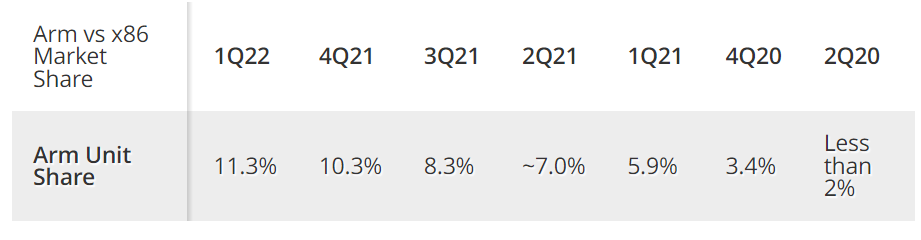

Some experts have also warned the industry that arguing about instruction sets is meaningless. This is because the technical skills related to CPU performance improvement are completely independent of instruction sets, including pipelining, out-of-order execution, branch predictors, multi-level caches, and many other techniques that can be implemented in any instruction set, including x86, Arm, and RISC-V. Arm and x86 are merely languages for communication with CPUs; ultimately, performance relies on chip design.[20] In simple terms, the instruction set is just a hammer; how the chip is shaped depends on the user. Even with a mature Arm instruction set, how far domestic manufacturers can go still depends on their CPU design capabilities. Moreover, although Arm has made significant progress in high-performance CPUs and has strong backing from giants, it must be said that x86 still holds absolute advantages in performance and ecosystem, making it difficult to completely take over x86’s market share in the short term. Arm has great potential but still needs time to develop. In 2020, x86 accounted for nearly 98% of the total CPU market. According to Tom’s Hardware data, in Q2 2020, Arm CPUs accounted for less than 2% of the overall market share, while in Q1 2022, Arm CPUs accounted for 11.3% of the total share.[21] According to Khaveen Investments, it is predicted that the Arm CPU market could reach $16.92 billion TAM (Total Addressable Market) by 2025, with its market share increasing to 19.5%.

Changes in Arm CPU market share from Q2 2020 to Q1 2022, source: Tom’s Hardware[21]

Changes in Arm CPU market share from Q2 2020 to Q1 2022, source: Tom’s Hardware[21]

High Arm Licensing Fees

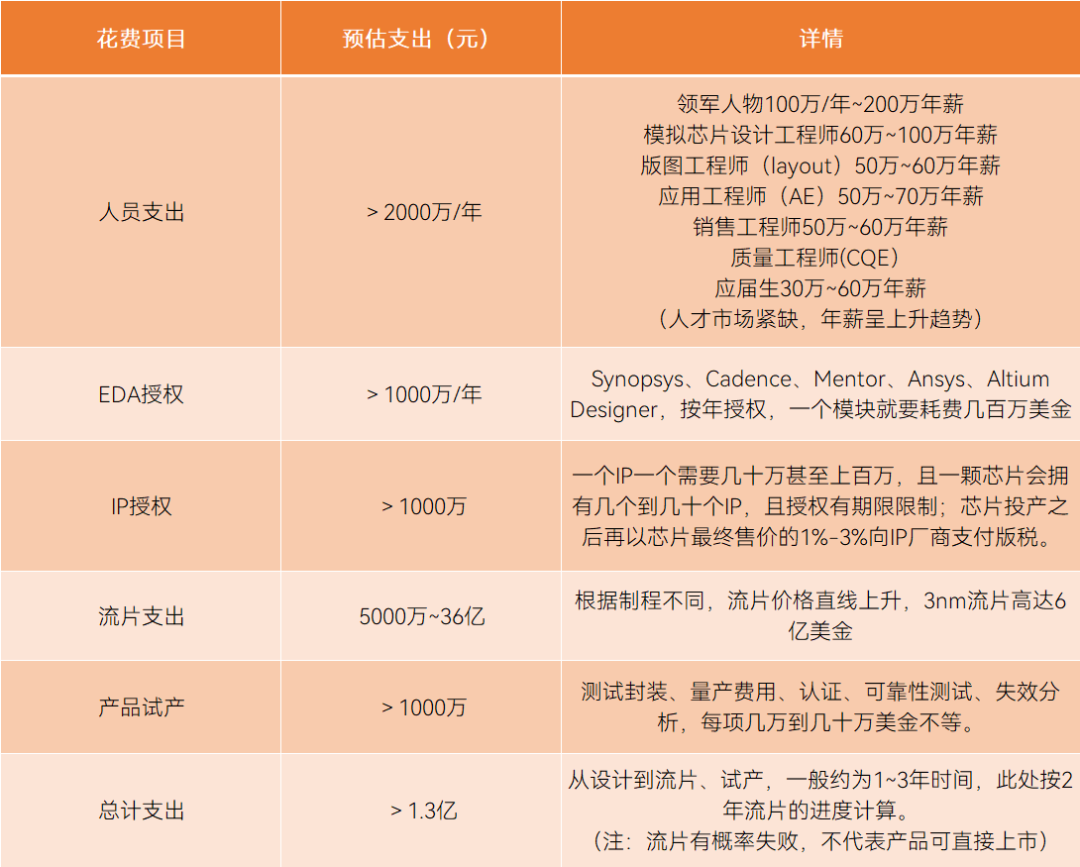

Creating CPUs is very costly, especially for a company like Arm that relies solely on licensing, which incurs high fees. Arm’s charges include upfront licensing fees, royalties, and technical consulting service fees.[23] The upfront licensing fee is a fixed cost charged by Arm, and the licensing model includes architecture licensing, traditional IP licensing, and Arm Flexible Access. Currently, the licensing fees for mid-to-low-end Arm chips are relatively low, but for high-performance desktop, mobile, and server CPUs, which belong to cutting-edge fields, the licensing costs are high. The upfront licensing fee is estimated to reach $1 million to $10 million, and the more IPs used, the more expensive it becomes.[24] We can feel Arm’s licensing costs through a number: although Nvidia did not successfully acquire Arm, it had previously paid Arm $750 million for Arm IP in the initial transaction.[25] Royalties are Arm’s cut after the chip is shipped. Royalties are the main profit point for most semiconductor IP design companies, and Arm’s royalties are generally about 1% to 3% of the final chip price. It is worth noting that in addition to licensing fees, making CPUs involves many costly projects, and if not careful, the financing money can be burned out. Currently, there is a talent shortage, and personnel costs will only increase, not decrease; without experienced design personnel, good CPUs cannot be produced; without EDA software, there are no basic tools for CPUs, and EDA also requires licensing; high-performance CPUs are generally advanced processes, which can quickly enhance CPU performance, but the more advanced the process, the higher the tape-out costs, and if the tape-out fails, high losses must be borne; during the product trial production phase, there are many testing projects, and unstable CPU products will inevitably be eliminated. According to our rough calculations, the total expenditure for a CPU product, from labor costs to licensing to successful tape-out and trial production, exceeds 130 million yuan, and if we reserve costs for tape-out failures, the total expenditure will be even higher.

Costs required for chip startups, table compiled by Guokel Hard TechnologyNote: This table is only a rough calculation and should not be used as investment reference; market fluctuations are severe, please refer to actual conditions.

Costs required for chip startups, table compiled by Guokel Hard TechnologyNote: This table is only a rough calculation and should not be used as investment reference; market fluctuations are severe, please refer to actual conditions.

Risks That Cannot Be Ignored

Although the original intention of domestic manufacturers is to produce CPUs with independent controllability, externally, with the clash of major powers, the Arm instruction set itself also carries certain risks; internally, the Arm company, which holds the Arm instruction set, is also in a period of turmoil, partly due to SoftBank’s pressure for an IPO and partly due to unresolved issues with its Chinese subsidiary. Furthermore, due to Arm’s critical importance in the semiconductor industry, its IPO has raised concerns about the company’s future ownership and neutrality, with many international giants vying to plan acquisitions. Since Nvidia’s acquisition failed, it seems that a single company cannot swallow Arm, and subsequently, Intel, SK Hynix, Qualcomm, and other companies are eager to try to form a consortium to acquire it. However, if the acquirers are all American companies, it would mean that Arm’s control would effectively fall into American hands. Although domestic companies can also purchase permanent licenses for the current version of Arm, Arm itself is also evolving, and if sanctions are imposed, they will not be able to obtain subsequent new versions. In other words, the risks of using Arm always exist. Therefore, the industry holds a skeptical attitude towards this wave of investment in Arm CPU startups. The intention of creating Arm CPUs is to escape the predicament of x86, but will the result turn out to be jumping from one pit to another? Additionally, at this stage, investors are flocking to invest in Arm CPU projects, riding the wave without considering the serious homogenization of the situation or whether valuations are too high, and how subsequent projects will exit. Can the secondary market handle it? For now, there is no time to think about that; just get on board.

References:

[1] Intel: CPU vs GPU: What’s the Difference. https://www.intel.co.uk/content/www/uk/en/products/docs/processors/cpu-vs-gpu.html

[2] Intel: Architecture – Intel® Technology Innovation. https://www.intel.co.uk/content/www/uk/en/silicon-innovations/6-pillars/architecture.html

[3] China Evaluation: CPU Technology and Industry White Paper (2021). 2021.9. https://www.cstc.org.cn/CPUjishuyuchanyebaipishu.pdf

[4] Huashan Securities: Loongson Zhongke to be listed on the Sci-Tech Innovation Board, focusing on domestic CPU investment opportunities. 2021.6.14. https://pdf.dfcfw.com/pdf/H3_AP202206141572028208_1.pdf?1655200996000.pdf

[5] Arm Community: Arm’s FY2021 Revenue and Profit Hit Record Highs. 2022.5.13. https://mp.weixin.qq.com/s/TOEKNaN–fFcQ2Zjhn-cpQ

[6] Pacific Securities: Currently optimistic about the ARM industry chain led by China Great Wall. 2021.8.8. http://qccdata.qichacha.com/ReportData/PDF/ce1f92c12d42f8883bdf356e06b7f9ea.pdf

[7] Semiconductor Industry Observation: The Bitter History of PowerPC. 2020.7.8. https://mp.weixin.qq.com/s/PyNYOQoi1MSk4eozSIcPHg

[8] Apple: Apple to Use Intel Microprocessors Beginning in 2006. 2005.6.6. https://www.apple.com/newsroom/2005/06/06Apple-to-Use-Intel-Microprocessors-Beginning-in-2006/

[9] Apple: Apple announces Mac transition to Apple silicon. 2020.6.22. https://www.apple.com/newsroom/2020/06/apple-announces-mac-transition-to-apple-silicon/

[10] Geekbench: MacBook Pro (13-inch Late 2020) Benchmarks. https://browser.geekbench.com/macs/macbook-pro-13-inch-late-2020

[11] PassMark: Single Thread Performance. https://www.cpubenchmark.net/singleThread.html

[12] WccfTech: Intel And AMD x86 Mobility CPUs Destroy Apple’s M1 In Cinebench R23 Benchmark Results. 2020.11.17. https://wccftech.com/intel-and-amd-x86-mobility-cpus-destroy-apples-m1-in-cinebench-r23-benchmark-results/

[13] IT168: Is Apple’s M1 Really Powerful? Intel: Look at this set of comparisons before concluding. 2021.3.16. https://mp.weixin.qq.com/s/v491r3_2l5txhxlpvF1XfA

[14] Apple: Apple unveils M2, taking the breakthrough performance and capabilities of M1 even further. 2022.6.6. https://www.apple.com.cn/newsroom/2022/06/apple-unveils-m2-with-breakthrough-performance-and-capabilities/

[15] Ma Wei, Yao Jingbo, Chang Yongsheng, Xie Weiqi. The Current Situation and Prospects of Domestic CPU Development [J]. Integrated Circuit Applications

[16] Zhu Bin, Xing Yanning, Yao Lin, Sun Jiaxing. Discussion on China’s CPU Development Strategy [J]. China Integrated Circuit, 2011, 20(09): 13-20.

[17] SHEN J P, LIPASTI M H. Modern Processor Design: Fundamentals of Superscalar Processors [M]. Waveland Press, 2013.

[18] WANG W. An improved instruction-level power and energy model for RISC microprocessors [D]. Southampton: University of Southampton, 2017.

[19] ExtremeTech: Intel Plans to License Hybrid Chips That Combine ARM, RISC-V, and x86. 2022.2.16. https://www.extremetech.com/computing/331740-intel-plans-to-license-cores-that-combine-arm-risc-v-and-x86

[20] SeekingAlpha: Overhyped Apple Silicon: Arm Vs. X86 Is Irrelevant. 2021.8.10. https://seekingalpha.com/article/4447703-overhyped-apple-silicon-arm-vs-x86-is-irrelevant

[21] Tom’s Hardware: AMD Gains CPU Share Amid Biggest Desktop PC Quarterly Decline In History. 2022.5.11. https://www.tomshardware.com/news/amd-share-skyrockets-amid-biggest-quarterly-desktop-pc-decline-in-history

[22] SeekingAlpha: Qualcomm: Arm CPU Market Presents $3.8 Bln Opportunity. 2022.2.28. https://seekingalpha.com/article/4491550-qualcomm-arm-cpu-market-presents-3-8-bln-opportunity

[23] AnandTech: Arm Flexible Access: Design the SoC Before Spending Money. 2019.7.16. https://www.anandtech.com/show/14644/arm-flexible-access-design-the-soc-before-spending-money

[24] Strategyzer: Business Model Example-Arm. https://www.strategyzer.com/business-model-examples/arm-business-model

[25] Barron’s: SoftBank Deal to Sell Arm Has $1.25 Billion Breakup Clause. Nvidia Pays $750 Million Licensing Fee. 2020.9.18.

For investors, startup team members, or researchers interested in the offline closed-door meetings or other scientific innovation service activities organized by Guokel Hard Technology, please scan the QR code below, or reply “Corporate WeChat” in the WeChat public account to add our event service assistant. We will organize activities through this channel.

“Are Fuel Cells Stuck in Cost… ?”

“Are Fuel Cells Stuck in Cost… ?” “Supercritical is Hot, but I Suggest You Stay Calm”

“Supercritical is Hot, but I Suggest You Stay Calm” “Where is the Bottleneck in the Localization of Industrial Robots?”

“Where is the Bottleneck in the Localization of Industrial Robots?”