(Source: nextplatform)Thanks to the booming development of GenAI, artificial intelligence has experienced explosive growth in just three years, now accounting for half of global system revenue. Therefore, it is reasonable to expect that the custom ASIC design business and AI-related networking business will ultimately dominate Broadcom’s semiconductor operations. In the second quarter of fiscal year 2025, ending in early May, Broadcom’s AI-related semiconductor share exceeded 50% of sales for the second consecutive time. We now have reason to suspect that, given the focus on high-end networking and the increasing prevalence of Ethernet switching in AI workloads, this share may soon break 75%—not only for horizontally scaling networks connecting cluster nodes but also for vertically scaling networks connecting XPUs.Specifically, Broadcom’s sales for the May quarter were slightly above $15 billion, a year-on-year increase of 20.2%. Operating profit nearly doubled to $5.83 billion, primarily due to cost reductions in its VMware software division, with over 8,700 of its 10,000 largest VMware customers adopting its restructured and streamlined VCF product line. The scale of Broadcom’s Infrastructure Software Group (including VMware, CA, and Symantec product lines) is smaller than its semiconductor solutions chip business, but in the past two quarters, its operating profit margin has reached 76%, while the chip business’s operating profit margin has been 57%, with the chip business being one-third the size of Broadcom’s overall operations.

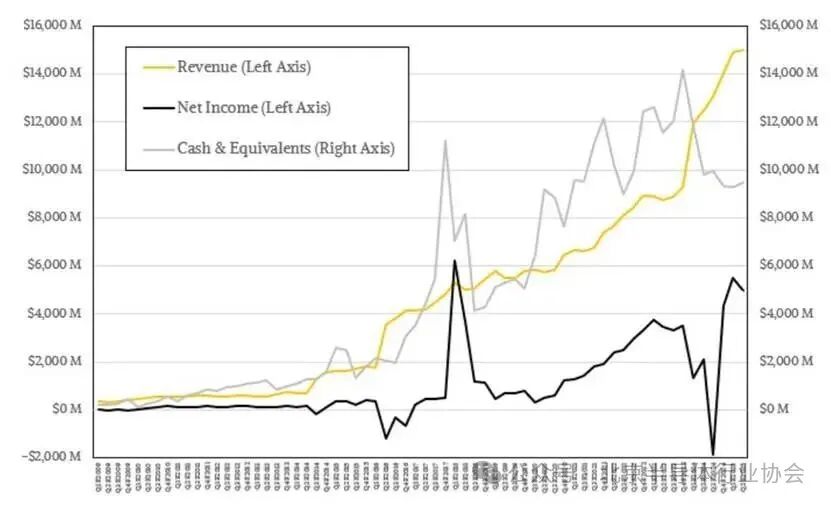

In the second quarter of fiscal year 2025, ending in early May, Broadcom’s AI-related semiconductor share exceeded 50% of sales for the second consecutive time. We now have reason to suspect that, given the focus on high-end networking and the increasing prevalence of Ethernet switching in AI workloads, this share may soon break 75%—not only for horizontally scaling networks connecting cluster nodes but also for vertically scaling networks connecting XPUs.Specifically, Broadcom’s sales for the May quarter were slightly above $15 billion, a year-on-year increase of 20.2%. Operating profit nearly doubled to $5.83 billion, primarily due to cost reductions in its VMware software division, with over 8,700 of its 10,000 largest VMware customers adopting its restructured and streamlined VCF product line. The scale of Broadcom’s Infrastructure Software Group (including VMware, CA, and Symantec product lines) is smaller than its semiconductor solutions chip business, but in the past two quarters, its operating profit margin has reached 76%, while the chip business’s operating profit margin has been 57%, with the chip business being one-third the size of Broadcom’s overall operations. Broadcom’s traditional software business, accumulated over decades, has somewhat alleviated the pressure on its chip business, which has been under significant strain. By collaborating with hyperscale computing vendors and cloud service providers to manufacture its own host CPUs and AI XPUs, Broadcom can benefit from the risk diversification and cost savings pursued by these tech giants, as they can create and install their own designed computing engines without directly competing with Nvidia, AMD, and Intel.It is hard to imagine anyone better managing the company than Broadcom CEO Hock Tan. From a technical standpoint, Broadcom’s operational mix may seem somewhat odd, but from a financial perspective, it operates well. For example, net profit increased 2.3 times to $4.97 billion, accounting for 33.1% of revenue. Today, the proportion of net profit to sales is nearly at the level before Hock Tan’s decision in May 2023 to acquire VMware for $61 billion and restructure it to create more profit.Since the first quarter of fiscal year 2024 (ending February 2024), VMware has been included in Broadcom’s accounts. We estimate that this server virtualization giant has contributed $21.71 billion in revenue to Broadcom, along with $14.59 billion in interim profit. This is roughly equivalent to half of Broadcom’s chip business revenue and operating profit. At this rate, VMware has already recouped about one-fifth of its $61 billion cost in operating profit within just six quarters. VMware is expected to recover the cost of this deal within three years at Broadcom.

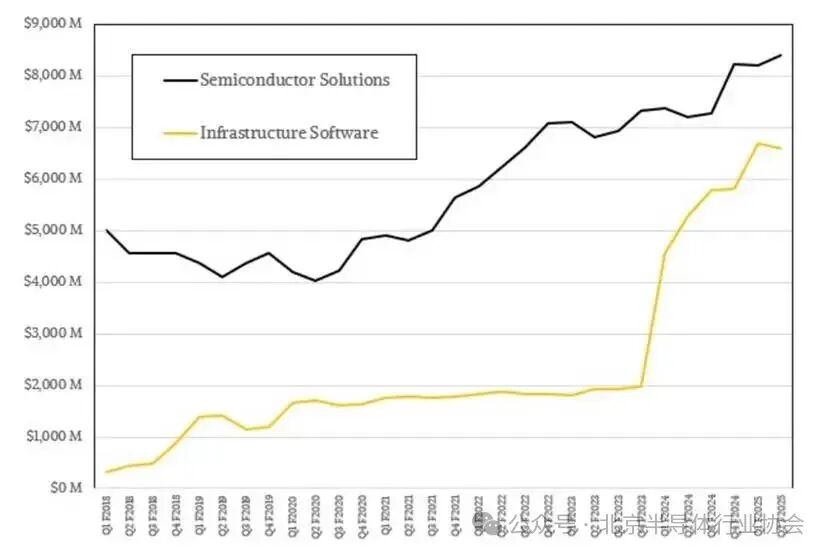

Broadcom’s traditional software business, accumulated over decades, has somewhat alleviated the pressure on its chip business, which has been under significant strain. By collaborating with hyperscale computing vendors and cloud service providers to manufacture its own host CPUs and AI XPUs, Broadcom can benefit from the risk diversification and cost savings pursued by these tech giants, as they can create and install their own designed computing engines without directly competing with Nvidia, AMD, and Intel.It is hard to imagine anyone better managing the company than Broadcom CEO Hock Tan. From a technical standpoint, Broadcom’s operational mix may seem somewhat odd, but from a financial perspective, it operates well. For example, net profit increased 2.3 times to $4.97 billion, accounting for 33.1% of revenue. Today, the proportion of net profit to sales is nearly at the level before Hock Tan’s decision in May 2023 to acquire VMware for $61 billion and restructure it to create more profit.Since the first quarter of fiscal year 2024 (ending February 2024), VMware has been included in Broadcom’s accounts. We estimate that this server virtualization giant has contributed $21.71 billion in revenue to Broadcom, along with $14.59 billion in interim profit. This is roughly equivalent to half of Broadcom’s chip business revenue and operating profit. At this rate, VMware has already recouped about one-fifth of its $61 billion cost in operating profit within just six quarters. VMware is expected to recover the cost of this deal within three years at Broadcom. Broadcom’s Infrastructure Software Division sales for the May quarter were $6.6 billion, a year-on-year increase of 24.8%, but a quarter-on-quarter decrease of 1.6%. Operating profit increased by 58.7% year-on-year to $5.03 billion, but decreased by 1.4% quarter-on-quarter.For The Next Platform, Broadcom’s semiconductor solutions division is more important, as Broadcom is responsible for producing and selling networking and storage chips to third parties. The sales of this chip business were $8.41 billion, a year-on-year increase of 16.7%, and even showed slight growth compared to the first quarter of fiscal year 2025.In terms of chip business, our model shows that Broadcom’s AI chip revenue (including switch ASICs, XPU ASIC designs, packaging, chip support for hyperscale computing platforms and cloud service providers, and other chip businesses) grew by 46.7% to $4.42 billion, while other chip sales declined by 4.8% to $3.99 billion. Broadcom has three custom computing engine customers—Google is the first, but now Meta Platforms and OpenAI are collaborating with Broadcom to develop chips—along with four potential customers, which we believe include Apple, ByteDance, and two others, who are seeking to have Broadcom as a supporter for XPUs.

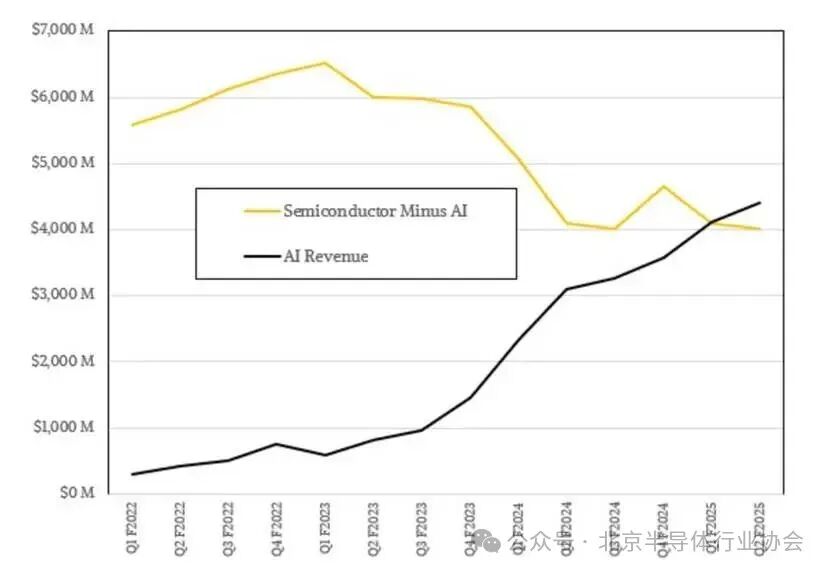

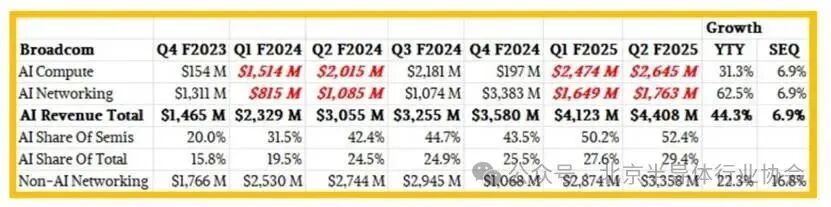

Broadcom’s Infrastructure Software Division sales for the May quarter were $6.6 billion, a year-on-year increase of 24.8%, but a quarter-on-quarter decrease of 1.6%. Operating profit increased by 58.7% year-on-year to $5.03 billion, but decreased by 1.4% quarter-on-quarter.For The Next Platform, Broadcom’s semiconductor solutions division is more important, as Broadcom is responsible for producing and selling networking and storage chips to third parties. The sales of this chip business were $8.41 billion, a year-on-year increase of 16.7%, and even showed slight growth compared to the first quarter of fiscal year 2025.In terms of chip business, our model shows that Broadcom’s AI chip revenue (including switch ASICs, XPU ASIC designs, packaging, chip support for hyperscale computing platforms and cloud service providers, and other chip businesses) grew by 46.7% to $4.42 billion, while other chip sales declined by 4.8% to $3.99 billion. Broadcom has three custom computing engine customers—Google is the first, but now Meta Platforms and OpenAI are collaborating with Broadcom to develop chips—along with four potential customers, which we believe include Apple, ByteDance, and two others, who are seeking to have Broadcom as a supporter for XPUs. In terms of AI sales, according to comments from Tan & Co during a conference call with Wall Street analysts, we believe Broadcom’s AI computing sales were $2.65 billion, a year-on-year increase of 34.5%, and a quarter-on-quarter increase of 7.2%.AI networking is just beginning to take off, with sales growing by 67.7% to $1.77 billion, driven by Jericho-3AI and the current Tomahawk 6 switch ASIC, which increased by 7.1% compared to the previous quarter.

In terms of AI sales, according to comments from Tan & Co during a conference call with Wall Street analysts, we believe Broadcom’s AI computing sales were $2.65 billion, a year-on-year increase of 34.5%, and a quarter-on-quarter increase of 7.2%.AI networking is just beginning to take off, with sales growing by 67.7% to $1.77 billion, driven by Jericho-3AI and the current Tomahawk 6 switch ASIC, which increased by 7.1% compared to the previous quarter. As we reported earlier, Broadcom’s AI chip sales for fiscal year 2023 were $3.8 billion, and this figure is expected to grow 3.2 times to $12.2 billion in fiscal year 2024.Broadcom has not disclosed many details about the sales performance of its various departments, but we believe the situation is as follows:

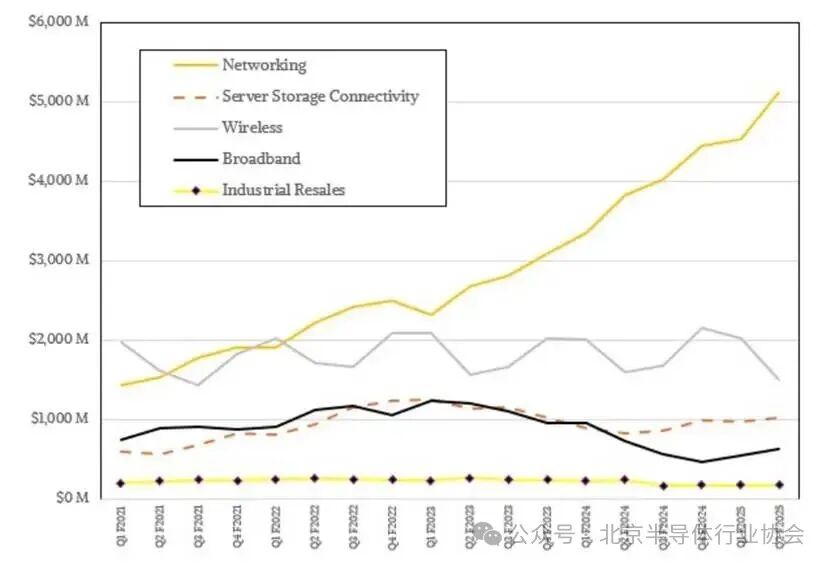

As we reported earlier, Broadcom’s AI chip sales for fiscal year 2023 were $3.8 billion, and this figure is expected to grow 3.2 times to $12.2 billion in fiscal year 2024.Broadcom has not disclosed many details about the sales performance of its various departments, but we believe the situation is as follows: In our Broadcom model, networking sales grew by $33.7 billion to $51.21 billion, while server storage connection sales grew by 22.6% to $10.1 billion.Looking ahead to the third fiscal quarter ending in early August, Broadcom expects sales to reach $15.8 billion, an increase of about 21%. Chip sales are expected to reach approximately $9.1 billion, a growth of 25%. A closer analysis of Broadcom’s semiconductor division’s AI and non-AI business forecasts indicates that AI computing business is expected to grow by about 42% to approximately $3.1 billion, while AI networking business is expected to nearly double to approximately $2.1 billion. This means that Broadcom’s total AI revenue for the third fiscal quarter will reach $5.16 billion, and the total AI revenue for fiscal year 2025 is expected to reach approximately $19 billion, or even higher. Hock Tan stated that Broadcom expects to grow this business by about 60% in fiscal year 2026, reaching approximately $30 billion.Interestingly, tech giants are actively developing their own AI training ASICs and AI inference ASICs—not just for training but increasingly for inference as well. Tan explained during the conference call with Wall Street analysts:“I believe there is no difference between using commercial accelerators and custom accelerators for training and inference. I think the entire premise of moving to custom accelerators still exists, and it is not just a cost issue. As custom accelerators are used and developed on any specific hyperscale computing platform, they will go through a learning curve to learn how to optimize the writing of large language model algorithms and the way chips are bound.This capability has tremendous added value in creating algorithms that can drive continuous improvements in LLM performance, far beyond simply separating hardware and software. As they embark on this journey, you are effectively combining end-to-end hardware and software. It is a journey. They cannot learn this in a year. It takes several cycles of practice to become increasingly proficient. That is where the value lies—compared to using third-party commercial chips, the fundamental value of creating your own hardware is that you can optimize software for the hardware, ultimately achieving performance far beyond other methods. We see this happening.”The question is: when will this phenomenon of custom chips surpass commercial chips occur in the switch ASICs that Broadcom is so eager to sell?

In our Broadcom model, networking sales grew by $33.7 billion to $51.21 billion, while server storage connection sales grew by 22.6% to $10.1 billion.Looking ahead to the third fiscal quarter ending in early August, Broadcom expects sales to reach $15.8 billion, an increase of about 21%. Chip sales are expected to reach approximately $9.1 billion, a growth of 25%. A closer analysis of Broadcom’s semiconductor division’s AI and non-AI business forecasts indicates that AI computing business is expected to grow by about 42% to approximately $3.1 billion, while AI networking business is expected to nearly double to approximately $2.1 billion. This means that Broadcom’s total AI revenue for the third fiscal quarter will reach $5.16 billion, and the total AI revenue for fiscal year 2025 is expected to reach approximately $19 billion, or even higher. Hock Tan stated that Broadcom expects to grow this business by about 60% in fiscal year 2026, reaching approximately $30 billion.Interestingly, tech giants are actively developing their own AI training ASICs and AI inference ASICs—not just for training but increasingly for inference as well. Tan explained during the conference call with Wall Street analysts:“I believe there is no difference between using commercial accelerators and custom accelerators for training and inference. I think the entire premise of moving to custom accelerators still exists, and it is not just a cost issue. As custom accelerators are used and developed on any specific hyperscale computing platform, they will go through a learning curve to learn how to optimize the writing of large language model algorithms and the way chips are bound.This capability has tremendous added value in creating algorithms that can drive continuous improvements in LLM performance, far beyond simply separating hardware and software. As they embark on this journey, you are effectively combining end-to-end hardware and software. It is a journey. They cannot learn this in a year. It takes several cycles of practice to become increasingly proficient. That is where the value lies—compared to using third-party commercial chips, the fundamental value of creating your own hardware is that you can optimize software for the hardware, ultimately achieving performance far beyond other methods. We see this happening.”The question is: when will this phenomenon of custom chips surpass commercial chips occur in the switch ASICs that Broadcom is so eager to sell?