Source: Jiang Dongwen ChannelID: zscy006Author: Jiang Dongwen272.8 billion yuan, the largest semiconductor acquisition in history. On September 14, NVIDIA and SoftBank announced a final agreement for NVIDIA to acquire ARM from SoftBank for $40 billion.

Source: Jiang Dongwen ChannelID: zscy006Author: Jiang Dongwen272.8 billion yuan, the largest semiconductor acquisition in history. On September 14, NVIDIA and SoftBank announced a final agreement for NVIDIA to acquire ARM from SoftBank for $40 billion.

The most combative man in Silicon Valley, Jensen Huang, has bought the British chip design giant from Japan’s richest man, which is akin to dropping a heavy bomb in the global chip industry, and it carries a hint of horror. Due to ARM’s unique position, most semiconductor companies globally are its customers, with over 95% of smartphone chips using its architecture, including Apple, Samsung, and Huawei. If ARM is successfully acquired by NVIDIA and becomes an American company, it poses a significant threat to Huawei’s HiSilicon and the global semiconductor industry!

Given the complexity of NVIDIA’s acquisition of ARM, it requires analysis of many events. First, let’s look at why this unprecedented acquisition occurred. This can be traced back to a $100 billion “gamble.” In July 2016, SoftBank offered $31 billion to acquire ARM from the British, marking SoftBank’s largest acquisition ever, highlighting Masayoshi Son’s fondness for ARM. At that time, Son was at his peak; his early investment in Alibaba saw it go public in the U.S. in 2014, yielding over 1000 times returns, skyrocketing his net worth to the top of the world, earning him the title of investment god. After acquiring ARM, Son attempted to replicate this success. In 2017, he gathered Middle Eastern royalty, Apple, Qualcomm, Foxconn, and other investors to launch the SoftBank Vision Fund, which reached a staggering $100 billion, claiming to be the largest and most powerful globally. The grand scale was intended to invest heavily and create another Alibaba. However, Son not only failed to find the next Alibaba but also suffered significant losses. SoftBank’s 2019 financial report showed that many projects in the Vision Fund were losing money, with the most notable ones being WeWork, OYO, and Uber, all of which were money pits. Many projects went bankrupt after the pandemic broke out. These disastrous projects plunged SoftBank into a debt abyss: by the end of 2019, SoftBank Group had debts of $173 billion (approximately 1.2 trillion yuan), with daily interest alone exceeding 100 million yuan…

At that time, Son was at his peak; his early investment in Alibaba saw it go public in the U.S. in 2014, yielding over 1000 times returns, skyrocketing his net worth to the top of the world, earning him the title of investment god. After acquiring ARM, Son attempted to replicate this success. In 2017, he gathered Middle Eastern royalty, Apple, Qualcomm, Foxconn, and other investors to launch the SoftBank Vision Fund, which reached a staggering $100 billion, claiming to be the largest and most powerful globally. The grand scale was intended to invest heavily and create another Alibaba. However, Son not only failed to find the next Alibaba but also suffered significant losses. SoftBank’s 2019 financial report showed that many projects in the Vision Fund were losing money, with the most notable ones being WeWork, OYO, and Uber, all of which were money pits. Many projects went bankrupt after the pandemic broke out. These disastrous projects plunged SoftBank into a debt abyss: by the end of 2019, SoftBank Group had debts of $173 billion (approximately 1.2 trillion yuan), with daily interest alone exceeding 100 million yuan…

To quickly repay debts, in March of this year, SoftBank announced it would sell off 4.5 trillion yen (approximately $410 billion) in assets. As of August this year, 95% of the selling plan had been completed, with everything sellable being sold, including some Alibaba shares and Son’s beloved ARM. Here, we introduce the importance of ARM; it is a British chip design giant, and although its scale is not as large as Intel or NVIDIA, its strategic position is extraordinary. As mentioned, in the chip industry today, apart from giants like Intel and Samsung that handle design, manufacturing, and packaging, others have clear divisions of labor. Apple, Qualcomm, and Huawei’s HiSilicon focus on design, while foundries like TSMC and SMIC handle manufacturing, with downstream companies specializing in chip packaging. ARM is unique in that it only does design, specifically the initial core architecture and instruction set of chip design, which is then licensed to chip designers for further development. As a chip architecture giant, ARM perfectly capitalized on the mobile internet boom, monopolizing 95% of the global mobile chip architecture, with Apple, Samsung, and Huawei all relying on it.

In the long run, ARM’s prospects are very promising. For instance, in the computer processor sector, Intel’s X86 architecture has long been dominant, and both Apple and Microsoft systems have relied on Intel chips. However, Intel has always had a problem with high costs, so in June of this year, Apple suddenly announced that future Mac computers would abandon Intel processors. If not Intel, then who? They will use self-developed chips based on ARM architecture, and Microsoft is also considering this and has already started preparations.ARM is already the absolute leader in mobile chip architecture, and if it opens up the computer processor market, its valuation could at least double. The saying goes, “The wind rises at the end of the green plums;” often, significant changes in the era are initiated inadvertently.

Of course, distant water cannot quench immediate thirst; no matter how great ARM’s prospects are, that is a future matter, while SoftBank is currently mired in a debt crisis, and selling off assets to repay debts is the top priority. In a panic, Son has cheapened another rising star in the chip industry—NVIDIA.  NVIDIA was founded by the most combative man in Silicon Valley, Jensen Huang, who has a strong temper and a great obsession with technology. Under his leadership, NVIDIA spent six years in seclusion and successfully produced the GeForce 256 graphics card in 1999, introducing the concept of the GPU (Graphics Processing Unit), which redefined modern computer graphics technology.

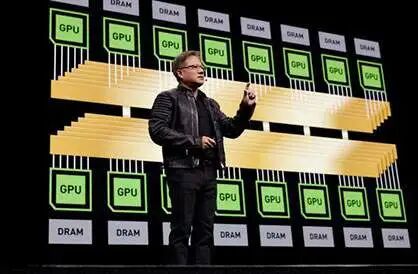

NVIDIA was founded by the most combative man in Silicon Valley, Jensen Huang, who has a strong temper and a great obsession with technology. Under his leadership, NVIDIA spent six years in seclusion and successfully produced the GeForce 256 graphics card in 1999, introducing the concept of the GPU (Graphics Processing Unit), which redefined modern computer graphics technology.

I previously provided a detailed introduction on the differences between CPU and GPU: Intel’s X86 architecture CPU is known for speed and performance, but when data and image demands increase, such as when gaming or conducting scientific calculations, it becomes inadequate. NVIDIA’s GPU perfectly fills this gap because it operates on more efficient parallel computing, capable of handling thousands of threads simultaneously, significantly enhancing a computer’s graphics processing performance. In simple terms, the CPU is the king of speed, while the GPU is the king of storage and computation. Why is NVIDIA considered a rising star? The GPU primarily focuses on graphics processing, but 20 years ago, the demand for computers was primarily for speed; aside from gamers, no one cared about the quality of the graphics card, which is often referred to as being born at the wrong time… After more than a decade of struggle, with the arrival of the data explosion era, demands for gaming, high-definition video, and AI chips surged, traditional CPUs began to seem inadequate, and NVIDIA finally launched its comeback.

Since 2015, NVIDIA and Intel have been rivals, with NVIDIA’s GPU performance increasing by 25 times, and net profits soaring from $631 million to $4.141 billion. Meanwhile, Intel has long departed from Moore’s Law, and its slow innovation speed has been criticized; in July this year, it announced a delay in the launch of its 7nm chips, causing its stock price to plummet. Thus, the capital market has given NVIDIA significant recognition, achieving a staggering 30-fold increase in five years, and in August this year, NVIDIA’s market value surpassed $300 billion, overtaking Intel to become the world’s largest chip giant by market value. Huang’s computing era has officially begun.One is the GPU giant overshadowing Intel, and the other is the global king of mobile chip architecture; what will happen when NVIDIA and ARM combine? For NVIDIA, it is undoubtedly a huge benefit. The ARM architecture currently dominates the smartphone and IoT sectors, and with Apple and Microsoft’s trend of moving away from Intel CPUs, it has also made breakthroughs in CPU architecture in recent years.

If NVIDIA can successfully integrate the ARM ecosystem, its future layout will involve smartphones, PC processors, autonomous driving, AI robots, IoT, and more, creating a comprehensive AI computing empire. However, for others, the merger would be a disaster.The current shipment volume of ARM-based chips has reached 160 billion units, with most semiconductor companies globally, including Apple, Samsung, Qualcomm, and Huawei, operating within this vast ecosystem. However, NVIDIA is an American company, and if it were to acquire ARM, it would mean the U.S. gains another powerful tool. Given the current behavior of the U.S., it is not impossible for ARM to raise patent licensing fees for those chip designers when necessary. Due to these interests, semiconductor companies in various countries will certainly strongly oppose this acquisition and even prepare alternatives. For instance, a source from the South Korean chip industry stated: “In the long run, ARM’s customers may try to find alternatives.” Huawei’s HiSilicon is particularly affected; although it has designed high-end smartphone chips in the Kirin series, the Kirin is also based on ARM architecture. The U.S. ban on Huawei has already taken effect, and Huawei’s use of American technology, software design, and semiconductor manufacturing will face severe restrictions. Chip giants like TSMC, MediaTek, Qualcomm, Samsung, SK Hynix, and Micron have already indicated that it will be difficult to supply Huawei in the future. If ARM becomes American, then not only manufacturing but even the design of Kirin will become problematic. From this perspective, this acquisition is nothing short of a disaster.

Fortunately, this acquisition has not yet been fully successful, as it involves too many parties and requires regulatory approvals from the UK, China, the U.S., and the EU, so there is still a chance for a turnaround. Would the Americans agree to tighten their grip on the semiconductor industry of various countries? Conclusion: Huawei has already been cut off from supplies, Yu Chengdong said no one can extinguish the stars in the sky, and no one knows how Huawei will reverse this crisis or how long it will take. But one thing is certain: after this, the determination for domestic substitution will only grow stronger, and the steps will only become more resolute. Because this time, there are no illusions; apart from victory, we have no retreat.— 【 THE END 】—The author of this article is Jiang Dongwen, first published on the WeChat public account “Jiang Dongwen Channel” (ID: zscy006), serving as a disseminator of value.This content is reprinted with authorization and does not represent the views of TechWeb.Review of previous exciting articles:

| “Buy Apple, get fired; buy Huawei, get subsidies,” the reasons this company supports domestic phones surprised me!

| Apple iOS 14 officially released! A wave of new features launched collectively, must upgrade!