Understanding chips means understanding cars better.

Author| Wang RuiEditor| Xi Zi

There is a domestic chip company that has shipped over 8 million automotive-grade chips, covering more than 100 mainstream models, with leading domestic and international car manufacturers such as Li Auto, Chery, Geely, Changan, SAIC, and Nissan as its clients.

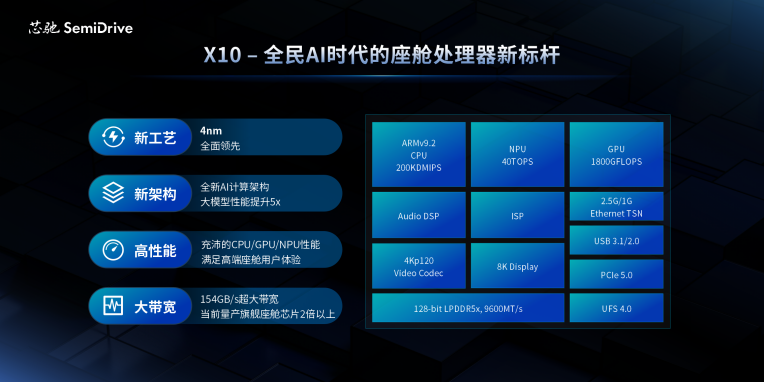

It is Xinchip Technology. At this year’s Shanghai Auto Show, Xinchip officially launched the next-generation AI cabin chip X10 series, as well as the high-end intelligent control MCU product E3 series aimed at regional controllers, electric drive, power domain control, and advanced driver assistance.

In a subsequent interview, Xinchip stated to media such as “Smart Car Planet” that the goal of the X10 is to usher in the era of “AI cabins for all”, making it affordable for mainstream models priced between 100,000 to 200,000 yuan.

The X10 uses a 4nm process, supports 7B parameter large model deployment on the edge, with a system memory bandwidth of 154GB/s, which is more than twice that of the current mass-produced flagship cabin chips, allowing for the deployment of multiple small models while running large models.

According to Xinchip, the X10 series chips are expected to go into mass production in 2026, and they are already in deep communication with several car manufacturers.

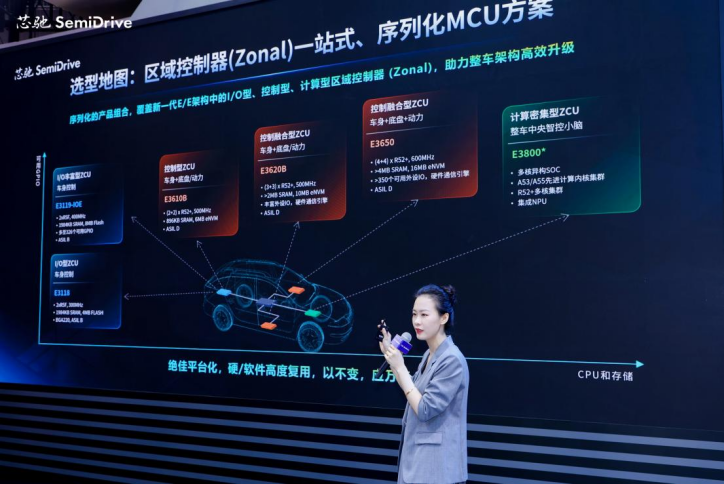

The other product line, the E3 series, fills the gap in the “domestic high-end MCU” market, with updates at this auto show focusing on products for regional controllers, electric drive, power systems, as well as advanced driver assistance and cabin-driving integration applications.

According to Zhang Xitong, General Manager of Xinchip’s MCU product line: “The products we make are in high demand in these high-end fields, and there has previously been a lack of strong domestic suppliers. Currently, there are almost none.” Chinese car manufacturers are already very advanced in many aspects, so they urgently need suppliers to provide equally high-value, high-performance components.

How did they achieve a large shipment of automotive-grade chips in a short time and gain a leading market position?

Xinchip’s answer is: Understanding chips means understanding cars better.

△ Xinchip Technology CEO Cheng Taiyi

How do you view the development of intelligent cabins and the demand for chips? What advantages does Xinchip have compared to overseas companies? After establishing a foothold in the intelligent cabin field, does Xinchip have plans to develop towards intelligent driving?

During the auto show, Xinchip Technology’s CTO Sun Mingle, Vice President Chen Shujie, and General Manager of the MCU product line Zhang Xitong were interviewed by the media and answered these questions one by one.

The following is the edited and adjusted transcript of the interview:

AICabin Chips: “Good Enough”

Media: In the past two years, the industry has begun to focus on integratingAIcapabilities into chips. From your observation, what is the current industry landscape for AI cabin chips?

Sun Mingle:Currently, most of the chips used in the market, except for those designed for specific early needs, are mainly reused from mobile phone or tablet platforms. Although these chips have AI capabilities, they were not deeply optimized for cabin scenarios, especially for large model applications, at the design stage, as chip design cycles are long and it is difficult to foresee the current forms and demands of large models.

With the release of Qualcomm’s next-generation platform and products from MTK and NVIDIA, AI is gradually becoming a very important core selling point, and the landscape of AI cabin chips will become clearer.

Media: From the perspective of car manufacturers, what specific requirements do they have forAIcabin chips?

Sun Mingle:A very strong demand is for “local deployment of AI large models”, that is, “edge deployment”. Many car manufacturers have already tried deploying large models in the cloud, and some high-end models have also begun to deploy 1.5B edge models, but the feedback is generally that the level of intelligence is not sufficient.

The current clear trend is to hope to support larger model sizes on the edge. We have also observed that some car manufacturers are looking for external AI acceleration unit solutions to run large models, but this is usually not the optimal solution.

△ Xinchip Technology CTO Sun Mingle

Media: Why is edge deployment so important? Previously, many processes were handled in the cloud?

Sun Mingle:There are several issues with cloud deployment. If large models are processed in the cloud, when users issue commands, the data is uploaded to the cloud, and the model processes it before returning results. This process has network latency. Even if the network latency itself is not large, during network congestion or when servers are busy, response times can slow down, affecting the consistency of the experience. Edge deployment can ensure deterministic response times, providing a stable and consistent user experience.

Secondly, there is a demand for multimodal interaction. Pure voice interaction has a small data volume, but future AI cabins need to combine images (such as perceiving driver status, judging interaction objects based on gaze direction), sounds, and other multimodal information. If all data is uploaded to the cloud for processing, the data transmission volume will be very large, placing higher demands on network bandwidth and processing capabilities.

Finally, there are privacy issues. Continuously uploading all information about the in-car user’s voice, actions, etc., to the cloud can raise privacy concerns for users.

Media: What is the current size of models deployed on the edge in the industry?

Sun Mingle:Currently, the large models that are actually deployed and running on mass-produced vehicles are generally around 1.5B. Larger models are limited by chip computing power, especially memory bandwidth, making it difficult to run smoothly. However, with the launch of the new generation of AI cabin chips, the model sizes supported on the edge will definitely exceed 1.5B and develop towards larger sizes.

Media: Does a higher model parameter mean a better chip? Or what dimensions are used to evaluateAIcabin chips?

Sun Mingle:It is not necessarily the case that higher parameters are better; the key is that “good enough” is sufficient.

Just like when purchasing a mobile phone, some people pursue extreme gaming performance or photography, but for most people, a balanced, reasonably priced phone (for example, in the 3000 yuan range) may be more suitable. A price that is too low may sacrifice experience, while a price that is too high may exceed actual needs.

Car manufacturers are currently in fierce competition, but ultimately it will return to commercial logic: the added features need to be something users are willing to pay for, not just for advertising purposes. For example, a chip that can run a 13B model may perform better in benchmark tests, but it is necessary to assess whether it truly provides users with a significantly different and valuable intelligent experience compared to a 7B model.

Based on our discussions with industry experts, it is generally believed that the improvement from 1.5B to 3B is not significant, while there is a considerable improvement from 3B to 7B, and the perceived improvement from 7B to 13B is relatively limited.

Media: Are there any other specific requirements? For example, is the integration of intelligent driving and cabin (intelligent cabin integration) a factor they consider?

Sun Mingle:Once it is determined to support specific model sizes and performance targets, specific hardware requirements naturally arise. For example, to support smooth operation of a 7B model, approximately 30-40 TOPS of AI computing power and 80-100 GB/s of memory bandwidth are needed.

Car manufacturers are now evaluating chips more rationally. After experiencing a phase of purely pursuing high TOPS computing power in the intelligent driving field, everyone has realized that “actual effects” are more important.

Now they not only look at how large a model you claim to run and how much computing power you have, but will also inquire deeply about specific performance metrics: what is the rate under specific conditions? What is the latency? They may even care about how you achieve these performances through technology.

As for intelligent cabin integration, using a single chip to handle both intelligent driving and intelligent cabin functions is indeed one of the directions being discussed in the industry.

Media: What is the reason behind car manufacturers’ shift from focusing on parameters to focusing on implementation methods and actual effects?

Sun Mingle:Ultimately, it comes from user feedback. Car manufacturers have promoted high parameters, but if users find the experience poor or do not see a significant advantage compared to lower-parameter competitors, they will reflect on the meaning of the parameters themselves.

This prompts them to focus more on: first, whether the chip’s performance is fully utilized; second, whether, even if the performance is utilized, it truly meets user needs and provides a good user experience.

Media: Last year, many car manufacturers integrated various applications into their cabins, and at the beginning of this year, they began to accessChatGPTlike cloud-basedlarge models. So, what are the main differences between vehicles equipped with dedicatedAIcabin chips and the current solutions?

Sun Mingle:The main difference is that the models running on the edge are larger, more capable, and more versatile. Edge large models can be understood as a local “encyclopedia”. Although current cloud models have extensive knowledge, there is still a perceivable delay during interaction.

More complex tasks, such as “help me restore the seat and air conditioning settings from when I drove this car two days ago”, require the model to understand context, retrieve historical data, and generate a series of execution instructions. Such tasks are relatively difficult for the current 1.x B edge models. Dedicated AI cabin chips can handle these complex, personalized tasks better.

Of course, not all AI tasks are suitable for or must be completed on the edge. For example, chatting, storytelling, etc., can be completely processed in the cloud; if implemented on the edge, it may instead increase unnecessary hardware costs.

Media: What changes have occurred in car manufacturers’ demand forMCUs? Are there new requirements in terms ofcomputing power, latency, integration, etc.?

Zhang Xitong:Currently, the strongest demand for AI computing power is still concentrated in the central computing layer, such as intelligent driving and intelligent cabins. For the actuator level (such as power, chassis, body control), the core demand remains high reliability, high real-time performance, and certain cost-effectiveness.

At this stage, the control algorithms at these actuator levels, including some computations that need acceleration, can usually be met by high-performance CPUs. For example, our newly released E3650 has a CPU computing power that is already quite strong, sufficient to cover most algorithm acceleration needs in body control.

△ Xinchip Technology MCU Product Line General Manager Zhang Xitong

Media: Some foreign manufacturers emphasize thatMCUproducts support service-oriented architecture (SOA). How does Xinchip’s MCU products consider this aspect?

Zhang Xitong:SOA is indeed an industry trend, but the specific tasks it implements at different levels are different.

In the central computing layer, SOA may involve complex service dynamic orchestration and scheduling, requiring strong computing power support.

In the regional controller or actuator MCU layer, SOA is more reflected in the standardization of signal or service interfaces, conversion, and publish-subscribe. For these tasks, the current mainstream MCU’s CPU capability is usually sufficient.

When designing the E3650, we specifically reserved a large amount of computing power and storage resources, considering that some leading OEM customers hope to achieve more SOA functions and more complex logic at the regional controller level.

“We do not pursue absolute lowest cost”

Media: What is the market positioning of the Xinchip X10 chip? Which models is it mainly aimed at?

Sun Mingle:We position it as the “cabin chip for the AI era for all”. “For all” means it is not just an expensive product for high-end models, but aims to make it accessible for mainstream models, such as cars priced between 100,000 to 200,000 yuan.

Media: “For all AI” means the price needs to go down. How will Xinchip further reduce costs in the future?

Sun Mingle:Cost considerations have been included from the initial design stage of the chip. Once the product design is completed, some cost reductions can be achieved through supply chain optimization (such as improving yield, reducing testing costs, and lowering supplier costs), but the core lies in the positioning of the product at the project initiation stage, which needs to choose a technology and cost range that can remain competitive for a period of time in the future.

The key to balancing cost and performance lies in “optimization based on scenario needs”. We need to clarify what the target scenario is, what tasks need to be accomplished in that scenario, and what hardware resources are required for those tasks, and define chip specifications based on this analysis.

We do not pursue absolute lowest cost, but rather cost optimization that meets specific scenario needs.

Media: After the release of the X10 chip, what feedback have you received from car manufacturers or partners?

Sun Mingle:The feedback has been very positive. The general expectation is “make it quickly, we are waiting to use it”, and we have already scheduled in-depth technical discussions with many customers.

Media: What advantages does Xinchip have compared to some foreign competitors?

Chen Shujie:Firstly, we are closer to the local supply chain and customers in China, with a very fast response speed. All of our core R&D teams are rooted in China, eliminating time differences or communication costs, allowing us to respond to customer needs as quickly as possible.

If a car manufacturer encounters an urgent problem, we can arrive at the customer’s site within a few hours to assist in resolving it immediately.

When customers evaluate costs, they do not only look at the procurement cost of the chip itself but also consider the overall BOM cost and R&D investment brought by using this chip. For example, how to help car manufacturers complete development work faster and more efficiently, shortening the entire product development and market launch cycle.

Media: Players from different backgrounds entering theAIcabin chip field, such as those from mobile backgrounds or automotive backgrounds, what differences will there be in their approaches?

Sun Mingle:Every enterprise has its own genes and inherent advantages. Some have entered the automotive market using their accumulation in the mobile sector, which was an effective strategy in the early stages, especially after the Android ecosystem became mainstream in car machines, as their chips could quickly introduce a wealth of mobile applications, significantly changing the cabin experience at that time.

However, automotive applications are ultimately different from mobile applications. As automotive intelligence deepens, especially in the AI cabin era, demands begin to diverge. For example, the demand for AI computing, requirements for functional safety and reliability, constraints on power consumption and heat dissipation, etc., are all different from mobile phones, so manufacturers will also begin to launch more specialized automotive-grade chips.

For Xinchip, we pay more attention to insights into the specific needs and changing trends of the automotive market, and plan products based on this. We do not necessarily pursue the highest performance parameters, but focus on how to provide reliable, compliant, differentiated, and cost-appropriate solutions in our target market.

Media: Why do car manufacturers rarely develop cabin chips on their own?

Sun Mingle:There are usually several driving factors for car manufacturers to develop chips on their own:

Firstly, cost; if external procurement costs are too high and the internal usage is large, self-development may be more economical in the long run;

Secondly, differentiation advantage; self-development can achieve unique functions and build a moat;

Finally, ensuring the security of core technology supply and R&D rhythm, without being constrained by external suppliers.

For intelligent driving chips, these three factors may be relatively strong.

However, for cabin chips, the cabin SoC system is complex, IP licensing costs are high, and the volume of self-developed chips is usually insufficient to dilute R&D costs, which may not be cheaper than purchasing externally;

Currently, in the cabin field, there is relatively limited space for achieving disruptive differentiation through self-developed chips, and there are already multiple suppliers offering products at different levels;

There are many options for cabin chip suppliers, and even if a particular supplier’s new product is delayed, there are alternative solutions or the previous generation products can be used, making the risk relatively controllable. Moreover, cabin functions are not in a stage of rapid technological iteration and intense competition like intelligent driving.

Therefore, most car manufacturers believe that the necessity of self-developing cabin chips is not strong. Of course, it does not rule out that some manufacturers may attempt this for long-term strategic considerations.

Media: The development paths of domesticMCUmanufacturers seem to have two types: one is to expand into MCUs like some analog chip manufacturers, or to start from simple body MCUs and gradually move up; the other is to directly target high-end like Xinchip. How should this high-end MCU be developed to make our domestic brand known globally?

Zhang Xitong:The first path you described, starting from the low end and moving up, may see others’ products and create a functionally similar, lower-priced product.

The products we make are in high demand in these high-end fields, and there has previously been a lack of strong domestic suppliers. Currently, there are almost none.

How to ensure that this forward-looking product definition aimed at high-end is accurate? Collaboration with car manufacturers and upstream and downstream ecosystem partners is crucial. We need to work closely with them while having a very deep understanding of the entire vehicle architecture.

Xinchip internally requires the team to have leading system capabilities from Tier 1 and car manufacturers; we are even studying the electronic and electrical architecture of the entire vehicle and may build virtual vehicle models for research. We need to have a profound understanding of the system.

Chen Shujie:I believe this is related to Xinchip’s team background. Many manufacturers that develop from the bottom up may have previously been in consumer electronics or simple industrial control, and developing towards automotive-grade, especially high-end automotive-grade MCUs, indeed requires gradual accumulation.

However, Xinchip is somewhat like a “dimensionality reduction strike”. Our core team comes from the SoC field, starting from more complex system-on-chip design experience to work on the MCU part.

The current transformation of the electronic and electrical architecture brought about by the electrification and intelligence of automobiles has created huge opportunities and new demands. These new demands need to be discovered and met; it does not necessarily have to be that foreign manufacturers lead first and we follow.

Currently, our car manufacturers are already very advanced in many aspects, and they urgently need us to provide equally high-value, high-performance components.

I believe that these products do not necessarily have to be strictly called “high-end”; more accurately, they are aimed at future needs. Only by capturing these forward-looking demands can we have the opportunity to create products with technological barriers, leading capabilities, and reasonable profits.

Now, the competition in China’s chip industry is also very fierce, and everyone’s profit pressure is quite large. We must ensure sustainable development through such strategic positioning.

Media: In markets like Japan, their automotive chip industry chain is very mature, with strong local manufacturers like Renesas, and many products may compete with Xinchip. I would like to ask, what kind of “moat” does Xinchip have in the Japanese market or in broader overseas markets?

Sun Mingle:I think it may be a bit early to talk about “moats”; we are still in a relatively early stage of expansion in overseas markets. However, from an advantage perspective, I believe there are several points:

The entire Chinese automotive industry is developing in terms of new energy and intelligence much faster than many foreign markets. Many of our new products have first been validated and applied by numerous car manufacturers in the Chinese market, and after use, they have become mature products in mass production.

When overseas companies communicate with us, they will find that our solutions may be more advanced than those in their existing supply chain systems, while also being a verified, stable, and reliable choice. This may be faster and more attractive for them than developing a new solution from scratch within their original supply chain system.

Our arrangements to establish offices in Europe, Japan, and other places are not merely decisions; we have already conducted very in-depth communications with many local customers to confirm that they indeed have such needs.

The demand and technology route for intelligent driving are still unstable

Media: The X9 series includes the X9SP, which recently released a demo for integrated cabin and parking functions through a single chip. I see that the X10 seems to mainly focus onAIcabins. What is Xinchip’s strategic consideration for not focusing on the intelligent driving field at the moment?

Sun Mingle:The main positioning of our X10 product is the AI cabin.

First, we believe that the deployment of large AI models in the car will be a stronger market demand than cabin-driving integration for at least the next six months to a year. Integration mainly addresses cost issues, while deploying large AI models in the car can bring new user experiences and opportunities for industrial transformation, spawning more innovative applications.

Second, intelligent driving itself is changing very rapidly. Looking back over the past year, the positioning of intelligent driving functions by car manufacturers has undergone significant changes, and user demands are also evolving. At the same time, the technology route planning of leading car manufacturers has a huge impact on the entire industry. In such an unstable demand and technology route, it is not a good choice for us to rashly integrate.

Chen Shujie:For a chip hardware company, doing well in intelligent driving also requires a huge investment of manpower and resources for software development, etc. We need to consider our positioning from the perspective of the overall market landscape; it is not about seeing what everyone else is doing and feeling we must do the same.

On the contrary, Xinchip has been following its own path, solidly making the cabin top-notch. In the cabin field, we currently have over fifty mass-produced models on the market, which is leading in the industry.

For high-end automotive-grade MCUs, we have not participated in the price war in the low-end market but have directly positioned ourselves in the high-end market with very high technical requirements, ensuring our technological leadership and reasonable profit margins.

We believe that this solid, practical development path based on actual shipment volumes and customer choices is more important than merely telling grand stories.

Media: You just mentioned that in the intelligent driving field, both demand and hardware are still rapidly changing; in the cabin field, you mentioned that deploying large models in the car is currently a pressing demand. Are there any other obvious changes and trends in the cabin field besides large AI models? Can you talk about it?

Sun Mingle: In the cabin field, another obvious change in demand we see is the impact of intelligent driving systems on cabin functions. As the penetration rate of advanced intelligent driving functions increases, cabin systems need to render the surrounding environmental information perceived by the intelligent driving system in real-time and realistically, displaying it on the dashboard, central control screen, or HUD.

This rendering task is usually completed in the cabin domain, leading to higher demands on the CPU, especially GPU computing power and graphics processing performance of the cabin SoC, which will be much higher than the previous simple infotainment system requirements.

Media: Regarding the integrated cabin-driving solution, some OEMs seem to have concerns, such as worrying that although hardware costs are saved in the early stage, the need for overall replacement during later maintenance will increase maintenance costs. How do you view this issue?

Sun Mingle:OEMs are indeed actively exploring the direction of cabin-driving integration. From a system design perspective, if OEMs can properly handle integration issues, it can theoretically simplify the system.

However, challenges still exist in practice. For example, the complexity of R&D integration. Merging the originally relatively independent cabin and intelligent driving systems will exponentially increase the workload of system integration, testing, and verification, significantly increasing the difficulty and cost of engineering R&D.

From a cost perspective, theoretically, integration can save a set of structural components, reducing material costs. However, at the current stage, high R&D investment and the lack of scale effects make the R&D costs allocated to each component very high. OEMs need to weigh the upfront R&D costs against potential material savings later.

Moreover, there has not yet been a clear revolutionary improvement in user experience or functional differences brought about by cabin-driving integration. If integration can bring significant functional innovation, its value will be greater.

Finally, the iteration speed and path of intelligent driving technology do not completely synchronize with intelligent cabins. Intelligent driving algorithms and sensor configurations are still rapidly evolving, with significant differences among various solutions. Forcing the two to be bound may limit the flexibility of rapid updates and iterations of each technology. Therefore, the current volume of this solution is still small.

Follow “Smart Car Planet” on WeChat

The most sincere reporting on smart cars

The most sincere reporting on smart cars