According to reports from Taiwanese media, Infineon, Renesas, Texas Instruments, and Rapidus have all initiated plans to build new wafer fabs for automotive chips, with industry estimates suggesting that the four companies’ investment in expansion could reach $25 billion.Reports indicate that the primary goal of IDM manufacturers intensively expanding production is to shorten the delivery process and cycle for automotive chips and to curb the trend of automakers directly collaborating with wafer foundries.However, a closer examination of the expansion plans of these major automotive chip manufacturers reveals that it will significantly impact the current supply situation of automotive chips, shortening the window of opportunity for domestic automotive chip manufacturers.

One Good News

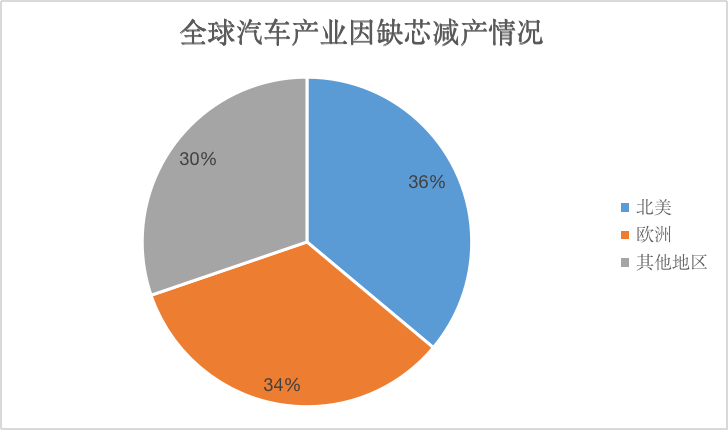

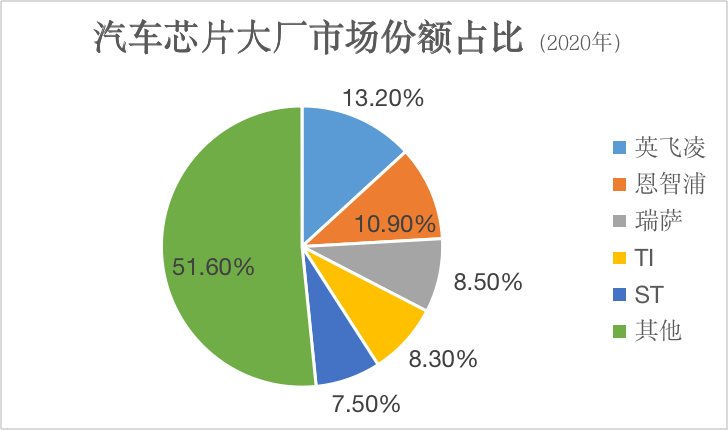

For the global automotive manufacturing supply chain, the expansion of production by mainstream automotive chip manufacturers is certainly welcome news. Over the past two to three years, the global automotive supply chain has suffered from a chip shortage, leading even the world’s leading car manufacturer, Toyota, to announce multiple rounds of production halts due to chip shortages.According to analysis data from automotive industry forecasting company AutoForecast Solutions, by the end of November 2022, the global automotive industry had reduced production by 4.1176 million vehicles due to chip shortages, with an estimated total affected production capacity of about 4.4853 million vehicles for the year. The North American market has been hit hardest, with brands like General Motors and Ford reducing production by 1.4857 million vehicles due to chip shortages by the end of November 2022, followed by a reduction of 1.3867 million vehicles in the European market. Delving into the reasons behind this, one is that the global automotive chip supply gap was still significant in 2022, and the other is that the demand for chips in smart vehicles is increasing. Taking automotive MCUs, which have been in the most severe shortage, as an example, the supply gap reached as high as 90% at the beginning of 2022, with product delivery times generally reaching 5-6 months. Although the supply tightness of automotive MCUs has eased somewhat, a complete resolution is not expected until the end of 2023 or 2024. Furthermore, according to relevant analysis reports, the demand for chips in smart vehicles is growing, with some high-end vehicles using over 2000 chips, while traditional vehicles use between 300-500 chips, indicating a several-fold demand gap. However, the penetration rate of smart vehicles is rapidly increasing, with projections suggesting that by 2030, the penetration rate of smart vehicles in China will exceed 70%.Thus, the good news is that mainstream automotive chip suppliers are expanding production. According to relevant statistics, by the end of 2020, the top five automotive chip manufacturers globally were Infineon, NXP, Renesas, TI (Texas Instruments), and ST (STMicroelectronics), with Infineon ranking first with a market share of 13.2% after acquiring Cypress, followed by NXP, Renesas, TI, and ST with market shares of 10.9%, 8.5%, 8.3%, and 7.5%, respectively.

Delving into the reasons behind this, one is that the global automotive chip supply gap was still significant in 2022, and the other is that the demand for chips in smart vehicles is increasing. Taking automotive MCUs, which have been in the most severe shortage, as an example, the supply gap reached as high as 90% at the beginning of 2022, with product delivery times generally reaching 5-6 months. Although the supply tightness of automotive MCUs has eased somewhat, a complete resolution is not expected until the end of 2023 or 2024. Furthermore, according to relevant analysis reports, the demand for chips in smart vehicles is growing, with some high-end vehicles using over 2000 chips, while traditional vehicles use between 300-500 chips, indicating a several-fold demand gap. However, the penetration rate of smart vehicles is rapidly increasing, with projections suggesting that by 2030, the penetration rate of smart vehicles in China will exceed 70%.Thus, the good news is that mainstream automotive chip suppliers are expanding production. According to relevant statistics, by the end of 2020, the top five automotive chip manufacturers globally were Infineon, NXP, Renesas, TI (Texas Instruments), and ST (STMicroelectronics), with Infineon ranking first with a market share of 13.2% after acquiring Cypress, followed by NXP, Renesas, TI, and ST with market shares of 10.9%, 8.5%, 8.3%, and 7.5%, respectively. It is evident that these leading automotive chip manufacturers have been deeply engaged in this field for decades, with a wide range of product categories that are difficult for automotive chip teams to match. In addition to automotive MCUs, automotive chips also include power devices such as AMP, IGBT, MOSFET, sensors, and discrete devices. Moreover, automotive-grade chips not only come in various types but also have high technical barriers, with lengthy certification cycles deterring many manufacturers.Therefore, compared to automakers developing their own chips and collaborating with wafer foundries, the direct expansion of traditional IDM manufacturers will yield more significant results. Analysis institutions predict that by 2023, global automotive chip shipments are expected to exceed 63 billion units, compared to 40.4 billion units in 2020.It is noteworthy that in addition to the major automotive chip manufacturers, the expansion news also mentioned Rapidus. This company is quite remarkable; Rapidus is a state-owned chip enterprise in Japan, supported by the Japanese government, with joint investors including Toyota, Sony, NTT, NEC, Denso, SoftBank, Kioxia, and Mitsubishi UFJ Bank. Previously, the company’s mission was considered to address Japan’s lag in advanced processes, and Rapidus has already partnered with IBM to develop 2nm technology. However, it now appears that entering the automotive chip sector is also one of the company’s goals. According to previous reports from Tokyo TV, Rapidus is considering building a chip factory in Hokkaido, northern Japan, which is likely to be used for expanding automotive chip production, especially since TSMC’s 2nm factory has just been approved, while Rapidus still has a funding gap of $54 billion for its 2nm factory.

It is evident that these leading automotive chip manufacturers have been deeply engaged in this field for decades, with a wide range of product categories that are difficult for automotive chip teams to match. In addition to automotive MCUs, automotive chips also include power devices such as AMP, IGBT, MOSFET, sensors, and discrete devices. Moreover, automotive-grade chips not only come in various types but also have high technical barriers, with lengthy certification cycles deterring many manufacturers.Therefore, compared to automakers developing their own chips and collaborating with wafer foundries, the direct expansion of traditional IDM manufacturers will yield more significant results. Analysis institutions predict that by 2023, global automotive chip shipments are expected to exceed 63 billion units, compared to 40.4 billion units in 2020.It is noteworthy that in addition to the major automotive chip manufacturers, the expansion news also mentioned Rapidus. This company is quite remarkable; Rapidus is a state-owned chip enterprise in Japan, supported by the Japanese government, with joint investors including Toyota, Sony, NTT, NEC, Denso, SoftBank, Kioxia, and Mitsubishi UFJ Bank. Previously, the company’s mission was considered to address Japan’s lag in advanced processes, and Rapidus has already partnered with IBM to develop 2nm technology. However, it now appears that entering the automotive chip sector is also one of the company’s goals. According to previous reports from Tokyo TV, Rapidus is considering building a chip factory in Hokkaido, northern Japan, which is likely to be used for expanding automotive chip production, especially since TSMC’s 2nm factory has just been approved, while Rapidus still has a funding gap of $54 billion for its 2nm factory.

Two Bad News

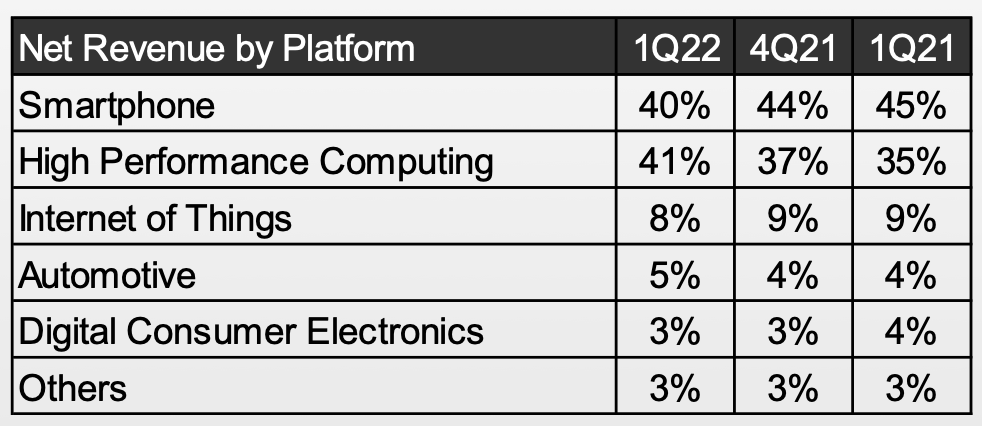

Everything has two sides; the expansion of automotive chip manufacturers like Infineon, Renesas, Texas Instruments, and Rapidus is good news for the automotive industry, but it is not so good for wafer foundries and domestic automotive chip manufacturers.First, looking at the wafer foundry side, recently, automakers have been eager to develop chips, and some have already begun collaborating with wafer foundries to produce chips. For example, General Motors and GlobalFoundries have signed a long-term chip supply agreement, under which GlobalFoundries will produce chips for General Motors at its advanced semiconductor facility in upstate New York. However, previously, there was a long supply chain between automakers and wafer foundries, with little direct communication between them.With the expansion of mainstream automotive chip IDM manufacturers, automakers will reassess the value of their original supply chains, as developing their own chips is highly challenging, especially automotive chips. Consequently, it will be much more difficult for wafer foundries to secure such orders in the future.At the same time, this is a process of mutual gain and loss. IDM expansion will inevitably bring more production back to their own factories, reducing outsourcing orders, which may affect the order intake of foundries like TSMC and UMC.For instance, TSMC had secured about 70% of automotive chip IDM orders in the first quarter of 2022, resulting in automotive chips accounting for 5% of TSMC’s business, with a 26% quarter-on-quarter revenue increase. However, if IDM manufacturers have their own production capacity, wafer foundries may lose some orders.

TSMC’s revenue share by business in Q1 2022, source: TSMC financial reportFor domestic automotive chips, this is also bad news. It is well known that the recent surge in domestic automotive chips was primarily due to the shortage of automotive chips, allowing some domestic chip manufacturers to secure orders in areas such as body and cockpit, with some orders being fulfilled with industrial-grade chips. Therefore, it has been said that the orders that international IDM cannot fulfill are opportunities for domestic automotive chip manufacturers, which is referred to as the window period.Previously, supply chain insiders generally believed that the window period for the development of domestic automotive chips would close in 2025, as global automotive chip supply would return to normal by the end of 2024. Thus, industry insiders believe that during this approximately three-year period, domestic automotive chip manufacturers need to do two things: one is to quickly enhance their technological competitiveness, and the other is to establish deep ties with automotive manufacturers. Now, the $25 billion investment is a significant variable, potentially resolving the automotive chip supply tightness issue ahead of schedule, making it difficult for domestic automotive chips that have not yet entered the market to find opportunities. After all, compared to the concept of domestic substitution, automotive manufacturers place more emphasis on the long-term market validation of products from international IDM. The underlying reason is that safety and reliability are paramount for automobiles.Therefore, in the author’s view, the expansion of IDM is also bad news for the development of domestic automotive chips.

Final Thoughts

In the next 2-3 years, the automotive chip market will continue to be a high-growth market, with demand for automotive chips increasing year by year as the penetration rate of smart vehicles rises. Both international giants and domestic manufacturers undoubtedly do not want to miss this market opportunity.However, the supply-demand relationship is a dynamic balance, constantly changing between oversupply and undersupply. When this trend reaches the oversupply stage, latecomer domestic automotive chip startups will find it challenging to seize opportunities and may be blocked by the high walls of the automotive market.

Disclaimer: This article is originally from Electronic Enthusiasts. Please cite the source above. For group discussions, please add WeChat elecfans999. For submission inquiries, please email [email protected].

More Hot Articles to Read

- Apple to Mass Produce the Market’s First Micro LED Wearable Product, These Supply Chain Companies Will Benefit First

- GlobalFoundries and General Motors Reach Long-Term Direct Supply Agreement, Impacting More Than Just Intermediaries

- The First Electric Vehicle Sold Less Than Six Months After Launch at a Discount, Does Toyota’s Failure Expose the Decline of Japanese Automakers?

- Microsoft Releases ChatGPT Version of Bing! Google and Baidu Join the Fray, Ushering in a New Era for Search Engines!

- NIO Faces Power Theft from BYD and Tesla, “One Car, One Pile” Boosts the Charging Pile Industry Chain