Welcome to follow the public account belowAbao1990, this account focuses on autonomous driving and smart cockpits, providing you with daily automotive insights. We started with cars but are not limited to them.

Introduction

✦

PMIC is about to experience explosive growth, and domestic power management chip manufacturers will also have a golden opportunity if they seize it.

✦

✦

PMIC, or Power Management Integrated Circuit, is a chip responsible for the conversion, distribution, detection, and other management duties of electrical energy in electronic device systems. It is mainly applied in various fields, including automotive, industrial, communication, consumer electronics, and computing. According to the latest data, in the coming years, the communication market will occupy the largest market share, and the large-scale deployment of 5G infrastructure and the wave of 5G smartphone upgrades will further increase the demand for power management chips in the communication field. At the same time, the electrification of vehicles and the upgrade of Industry 4.0 will also become a driving force for power management chips.

Why is this PMIC Dominant?

According to the latest data from bom2buy (as of June 5, 2022), the most popular device in the power management chip category is NXP’s MMPF0100F0AEP, a highly programmable/configurable PMIC that integrates a wealth of power devices. It can achieve up to 6 sets of buck converters and 6 sets of linear regulators, providing RTC power and enabling the charging of coin cell batteries, thus requiring only a few external components to implement a power supply circuit system. The MMPF0100F0AEP is widely used in e-readers, IPTV, medical monitoring, and home/factory automation.

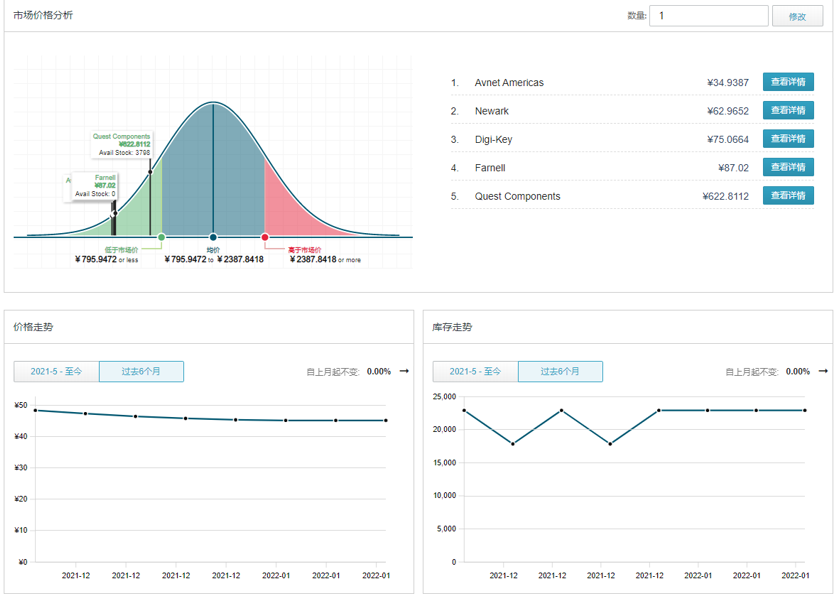

According to information from distributors such as Avnet Americas, Newark, Digi-Key, Farnell, and Quest Components, the market average price of the NXP MMPF0100F0AEP power management chip is around 44.78 RMB, with a total market inventory of about 3,798 units. Currently, this component is in a normal supply situation, with no supply chain risks.

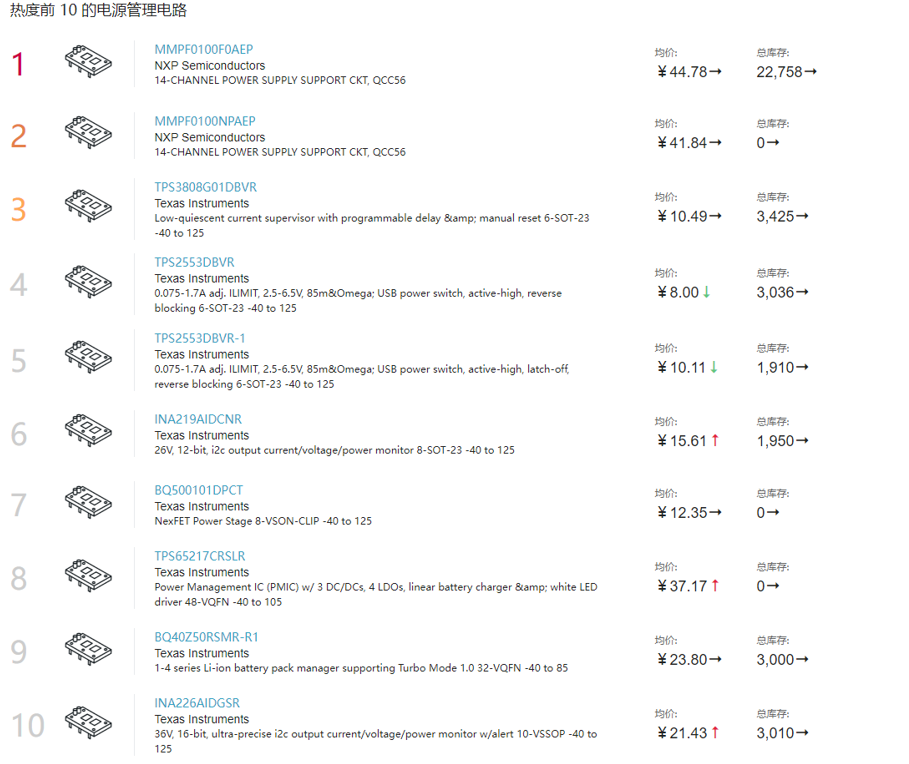

PMIC Popularity Ranking TOP10

PMIC Popularity Ranking TOP10

Source: bom2buy

In the past 6 months, the price trend of MMPF0100F0AEP has remained stable, and inventory trends have leveled off, maintaining a high level. However, prior to December of last year, the inventory of this component remained low, which was related to the previous shortage of power management chips. Currently, the sluggishness of various electronic consumer markets has led to a rebound in inventory, which may also be directly related to the repeated domestic pandemic in the first quarter, slow product development progress, and weak expansion in the electronic consumer market.

PMIC Inventory/Price Trends

Source: bom2buy

As a member of NXP’s power management chips, why is the MMPF0100F0AEP so popular? This involves its features and applications.

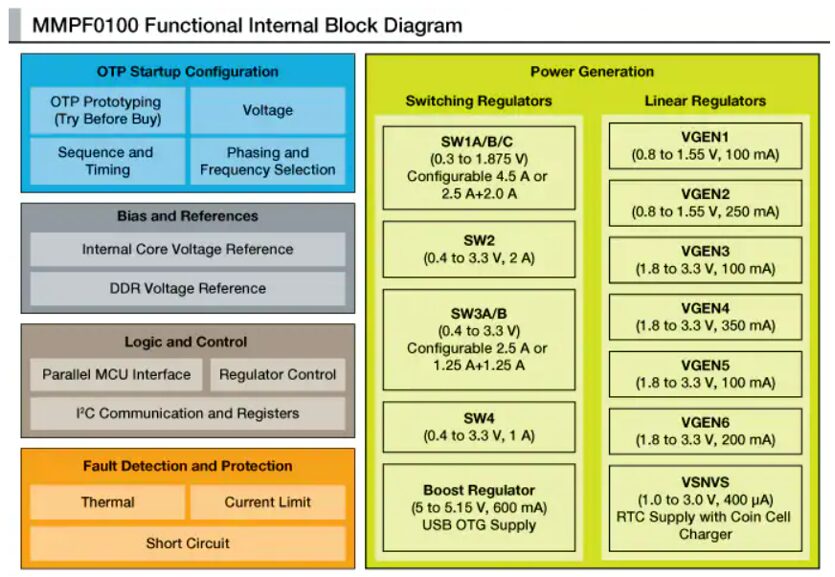

As mentioned earlier, the MMPF0100F0AEP has unprecedented integration, not only with 6 sets of buck converters and 6 sets of LDO but also capable of flexible configuration. The specific hardware functional block diagram is shown below.

MMPF0100F0AEP Internal Hardware Functional Block Diagram

Source: NXP Official Website

Some of the main features of the MMPF0100F0AEP include:

4-6 buck converters, depending on configuration (single-phase/dual-phase/parallel options, DDR terminal tracking mode options)

Boost regulator to 5.0 V output

6 general-purpose linear regulators

Programmable output voltage, sequencing, and timing

OTP (One-Time Programmable) memory for device configuration

Coin battery charger and RTC power

DDR terminal reference voltage

Power control logic with processor interface and event detection

I2C control

Individually programmable on, off, and standby modes

The MMPF0100 is the first product of NXP’s PF series PMIC. Its configurable and programmable architecture can support various output current levels, providing power for core processors, memory, and various peripherals. Meanwhile, the comprehensive system-level power management functions significantly simplify system design for engineers.

From the perspective of application matching, the popularity of this PMIC is directly related to the one-stop solution provided by NXP (see the figure below). The NXP i.MX 6 series processors are very popular application processors, including i.MX 6SoloX, i.MX 6SoloLite, i.MX 6Solo, i.MX 6DualLite, i.MX 6Dual, i.MX 6Quad, i.MX 6DualPlus, and i.MX 6QuadPlus, applicable in automotive, industrial, communication, consumer electronics, and computing fields. The recommended power management chip to go with it is precisely the MMPF0100, whose optimized performance architecture brings efficient, advanced functions to consumer electronics, industrial control, and automotive applications. This one-stop reference design solution provides users with a streamlined product development process, reducing engineers’ selection time and accelerating the product launch speed in actual design.

MMPF0100F0AEP and i.MX 6X Matching Solution

Source: NXP Official Website

PMIC, An Indispensable Component in the Electronics Industry

Various electronic devices rely on power, thus requiring a wide and more segmented range of power management chips. Taking NXP’s MMPF0100 series PMIC as an example, the research and development of power management chips are closely tied to the actual product application needs. The development in automotive, industrial, communication, consumer electronics, and computing fields provides power management chip manufacturers with broader and more competitive space. Which fields will further drive PMIC upgrades in 2022?

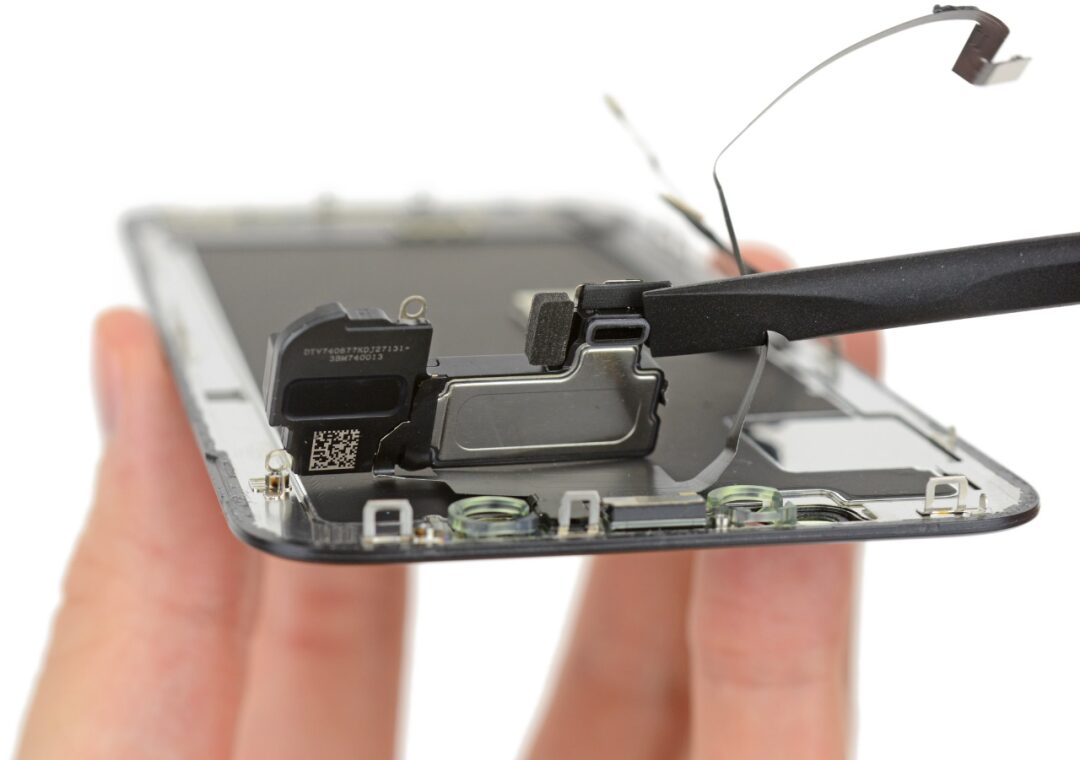

Refined Consumer Electronics

Image Source | iDownloadBlog

The rapid popularization of consumer electronics, IoT applications, and wearable devices is inseparable from the updates and iterations of power management technology. Battery-powered devices that are small and portable often have compact sizes and limited battery capacity, while requiring long standby times and quick responses, which places high demands on the power system and the low power consumption and stability of the components themselves. Therefore, PMICs in these fields not only need to have multiple power supply topologies but are also extremely strict on their own losses, promoting manufacturers to further upgrade PMICs.

The Most Stylish – New Energy Vehicles

New energy vehicles may be the most stylish in 2022. Electrification, intelligence, and automation are the three major trends in the development of new energy vehicles, with electrification being the key focus of industry development at this stage. PMICs are essential core components of new energy vehicles, as automotive power systems, in-vehicle electronic devices, and advanced driver-assistance systems all rely on PMICs, which are like the heart of new energy vehicles. Due to the strict requirements for automotive-grade products and slow expansion, power management chips have become one of the most scarce chips. Moreover, domestic new energy vehicle companies are overly reliant on overseas chip manufacturers, making the domestic replacement of PMICs crucial under this backdrop.

5G Communication That Will Eventually Gain Momentum

The rich networking architecture and layout methods of 5G bring more power supply methods and combinations, including AC direct power supply, -48V power supply, high-voltage DC power supply, etc. Since 5G construction will need to be compatible with existing 3G and 4G communications for a long time, most will adopt the method of transforming and upgrading existing base stations and central offices, which means that communication power supplies need to simultaneously power 3G/4G and 5G communication devices, raising new demands on the output power, power density, and reliability of communication power supplies. The power requirements for base station power supplies after adding 5G communication have increased by 68%, which means that the demand for power efficiency in communication power supplies is higher, requiring more efficient power management technology to reduce communication operating costs.

Unavoidable Traditional Fields

The continuous upgrading and innovation in traditional fields are also promoting the development of PMICs, such as home appliances and industry. Due to their strong universality, power management chips can be considered a versatile solution. As shown in a white paper released by TI in 2020, we should pay more attention to the 5 transformative trends of power management chips themselves, which are power density, low Iq, low EMI, low noise, and high precision, isolation.

Leading Domestic PMIC Manufacturers

According to statistics from the China Semiconductor Industry Association, the sales revenue of China’s integrated circuit industry in 2021 reached 1,045.83 billion yuan, a year-on-year increase of 18.2%. China’s integrated circuit industry has also broken the trillion yuan mark for the first time. Driven by the good macroeconomic performance in the country, the domestic integrated circuit industry continues to maintain rapid and stable growth. With the continuous increase in consumer electronics categories and the development of new energy vehicles, the proportion of power management chips used in consumer electronics and automotive fields is expected to continue to rise. However, due to the repeated global pandemic, global semiconductor manufacturers have been significantly impacted. To alleviate the current supply chain shortage, manufacturers urgently need to prepare multiple backup plans. We have compiled the latest developments from several domestic PMIC manufacturers, which are worth paying attention to (not ranked).

Saint Semiconductor

In 2021, a batch of new products with world-leading levels was added, including high-voltage, high-precision low-noise instrumentation amplifiers, charge pump mode AMOLED screen power supply chips, efficient power-limiting hot-swappable controllers, integrated adjustable negative voltage regulators for negative voltage charge pumps, 35nA ultra-low static current system timers with watchdog functions, 140dB large dynamic logarithmic current-voltage converters, high-voltage DC-DC buck power supply converters with adjustable frequency up to 2MHz and 1.5A output, DDR terminal voltage regulators, and high-speed, high-precision 24-bit Sigma-Delta ADCs with integrated PGA.

Shanghai Belling

In 2021, increased investment in the research and development of new power management products, and strengthened the upgrade of existing products. In response to the domestic automotive chip supply shortage, completed the research and development of two automotive electronic products, one of which is an LED driver chip that has been recognized by customers and is continuously sold. Another LDO product that passed automotive certification in 2020 has achieved mass shipment. Meanwhile, the company has several automotive-grade power management products under development, which will continue to strengthen in the automotive electronics market.

The company’s power management chip product performance and quality are comparable to world-class analog manufacturers, with some key performance indicators surpassing similar domestic and foreign products. For example, the company launched an industry-leading ultra-low noise LDO, which is used in the communication market to power various analog/RF designs. It also launched ultra-low noise and high PSRR LDO for IoT applications. Successfully developed a fast transient response high-current DDR terminal voltage regulator specifically for memory power supply. Developed a high-current boost DC-DC for mobile power applications. For the PD power fast charging market, it launched an ACDC product with a voltage rating of 80V and output power exceeding 60W.

Fuman Electronics

A domestic large-scale power management chip manufacturer engaged in the design, research and development, packaging, testing, and sales of high-performance analog and mixed-signal integrated circuits. Currently, it has over 400 types of IC products involving power management, LED driving, MOSFET, etc., covering a series of products such as AC-DC, DC-DC, LDO, and PD protocols.

Xinpeng Microelectronics

Currently, there are more than 1200 effective power management chip models, with three major application series including household appliances, standard power supplies, and industrial control power. They are widely used in household appliances, chargers for mobile phones and tablets, adapters for set-top boxes and laptops, car chargers, smart meters, industrial control equipment, and many other fields.

Image Source | Internet

In addition to the companies mentioned above, there are also listed companies such as Srypu, Xidiwei, Jingfeng Mingyuan, Lixinwei, Angbao Electronics, Weier Co., Ltd., and Silergy that are involved in power management chip business, as well as a number of unlisted companies such as Nanxin Semiconductor, Weiyuan Semiconductor, Jishengyang, Botong Micro, and Xinzhao Micro that also have power management chip products. Driven by downstream markets such as 5G communication, new energy vehicles, and IoT, the number and variety of electronic devices continue to grow, making the management of energy application efficiency for these devices increasingly important, thus driving the growth in demand for power management chips. It is expected that PMICs will experience a wave of explosive growth, and if these domestic power management chip manufacturers can seize the opportunity, they will also usher in a golden period.