In the digital age, every electronic device relies on the heartbeat of power management integrated circuits (PMIC). They are the heart of the power supply for electronic devices, responsible for managing and controlling the power system to ensure stable operation and efficient energy management. Join us as we delve into the latest research and market dynamics of the PMIC industry.

Overview of PMIC

Power management integrated circuits (PMICs) integrate multiple functions, responsible for managing and controlling the power system of electronic devices. With the rapid development of technology, the demand for power management in electronic devices has become increasingly complex and diverse. PMICs are widely used not only in consumer electronics but also play a key role in emerging fields such as automotive electronics, industrial control, and communication base stations. Their efficient power management capabilities can significantly enhance device performance, extend battery life, and reduce energy consumption, thus having important implications for energy conservation and environmental protection.

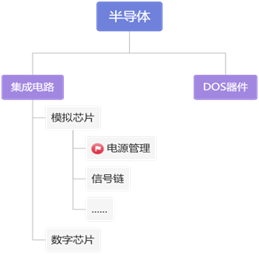

Basic Classification and Functions of PMIC

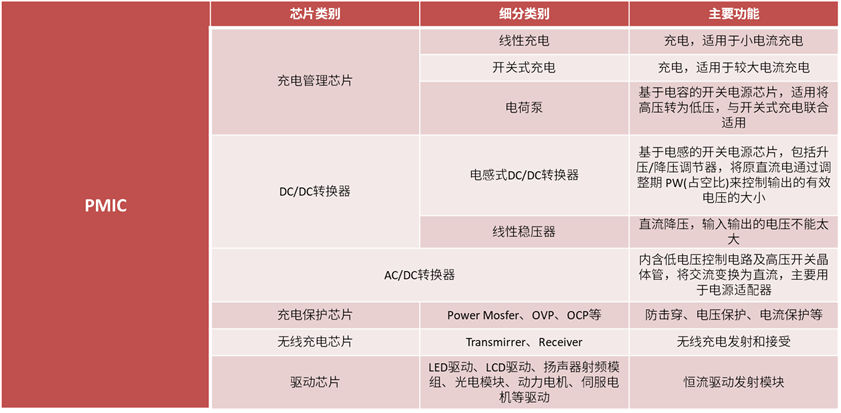

PMIC chips come in various categories, including charging management chips, DC/DC converters, AC/DC converters, charging protection chips, wireless charging chips, and driver chips. These chips not only provide basic power management functions but also integrate advanced features such as overload protection, overvoltage protection, and sequencing.

Figure: Categories of PMIC Chips, compiled by Qicheng

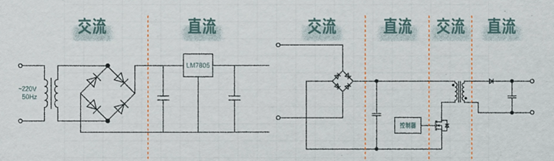

Technical Classification: Comparison of Linear and Switching (AC-DC) PMICs

Linear PMICs achieve voltage step-down conversion through resistive voltage division, while switching PMICs use PWM waves for voltage conversion, offering higher conversion efficiency and lower energy consumption. With technological advancements, switching PMICs have gradually become the mainstream in the market due to their efficiency and multifunctionality.

For applications requiring high efficiency and adjustable output voltage, buck converters are typically chosen. Buck conversion is a type of DC-DC converter whose primary purpose is to convert a higher input voltage to a lower output voltage. This conversion is very common in power supply design for several reasons:

-

Adapt to Load Requirements: Many electronic devices require voltages lower than what the power supply provides, and buck converters can lower the voltage to the required level.

-

Improve Efficiency: By using buck conversion, energy loss can be minimized, as current flowing at lower voltages reduces power loss according to the power formula P=IV.

-

Voltage Stability: Buck converters can provide stable output voltage even when input voltage or load current changes.

-

Energy Distribution: In distributed power systems, buck converters can allocate power to different subsystems, each with its own buck converter to meet specific voltage requirements.

As for the low conversion efficiency of resistive voltage division, it is mainly due to:

-

Power Loss: Resistor voltage dividers reduce voltage through resistors, generating heat and power loss. According to Joule’s law P=I²R, energy is consumed as current flows through the resistor, dissipating as heat rather than performing work.

-

Non-adjustability: The output voltage of a resistor voltage divider is fixed, determined by the resistor values, making it unsuitable for applications requiring variable output voltage.

-

Slow Response Speed: Resistor voltage dividers respond slowly to load changes, as their output voltage is significantly influenced by load current.

-

Unsuitable for High Current Applications: In high current applications, resistor voltage dividers need low resistance values to minimize power loss, which decreases the voltage division ratio, resulting in insufficient low output voltage.

-

Unsuitable for High Voltage Applications: In high voltage applications, resistor voltage dividers require high resistance values to minimize power loss, which increases the physical size and cost of the resistors.

Therefore, for applications that require high efficiency and adjustable output voltage, buck converters are typically chosen over resistor voltage dividers.

Figure: Comparison of Linear and Switching PMICs, compiled by Qicheng

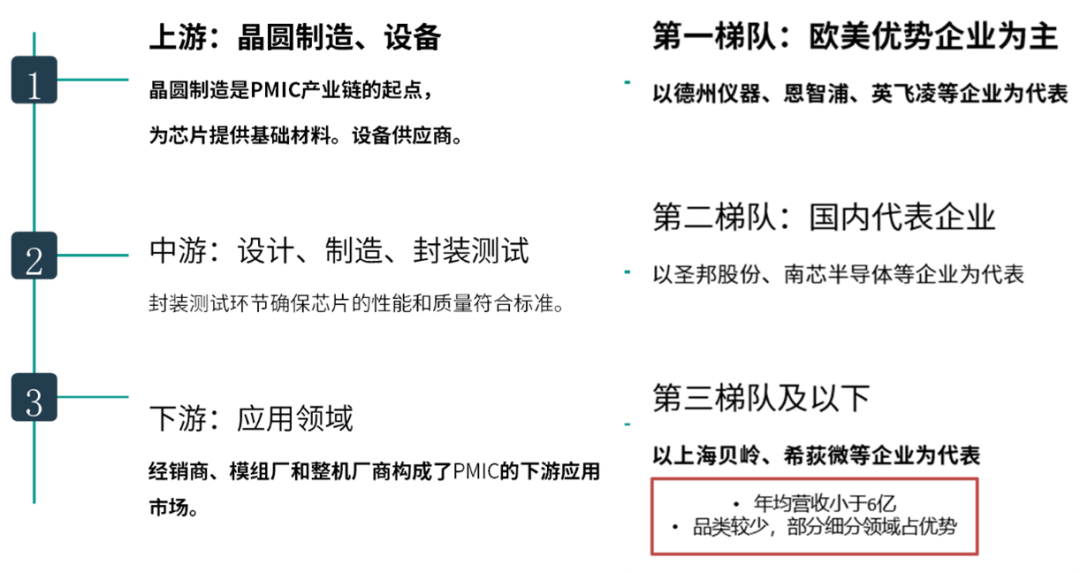

PMIC Industry Chain Overview

The PMIC industry chain consists of upstream wafer manufacturing and equipment supply, midstream design, manufacturing, packaging, and testing, as well as downstream application fields.

The PMIC market is highly competitive, making it difficult for leading manufacturers to achieve monopoly advantages. Companies in Europe and America, such as Texas Instruments, NXP, and Infineon, occupy the first tier, while domestic companies like Singatron and Nanchip Semiconductor follow closely.

Figure: PMIC Industry Chain, compiled by Qicheng

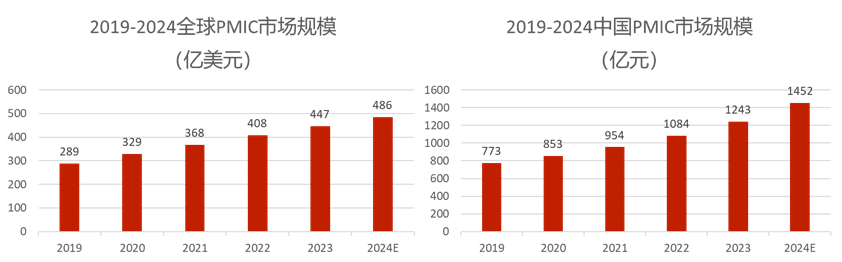

PMIC Market Size

Power management chips are one of the largest sub-segments in the analog chip market, with a global market size reaching $44.7 billion in 2023, accounting for 47% of the analog chip market.

The global PMIC market size continues to grow, expected to reach $56.5 billion by 2026. The Chinese market is also showing rapid growth, with an average annual compound growth rate of about 8.6%, reaching a market size of 124.3 billion yuan in 2023.

Figure: Global PMIC Market Size, compiled by Qicheng

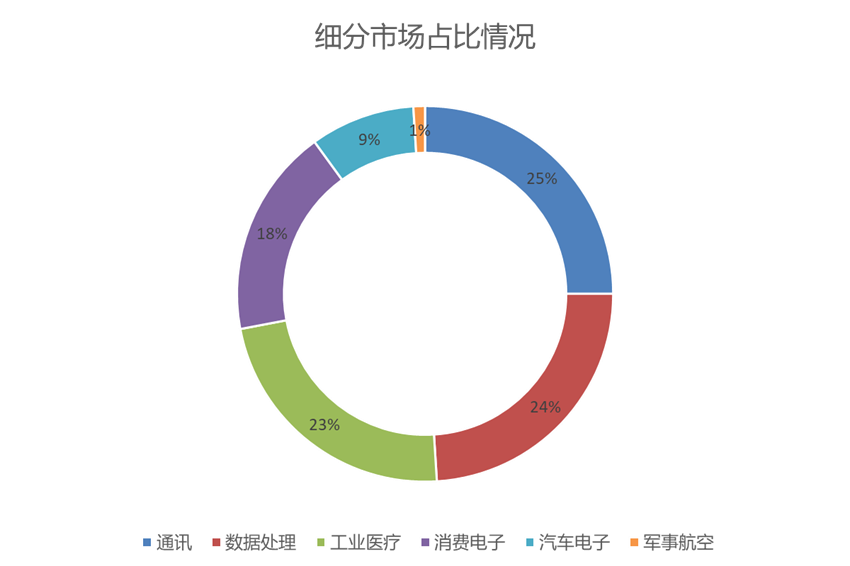

Downstream Applications and Market Share of PMIC

Power management chips are primarily used in communications, data processing, industrial medical fields, with consumer electronics accounting for 18%, while automotive electronics and military aviation are below 10%.

Figure: PMIC Downstream Applications

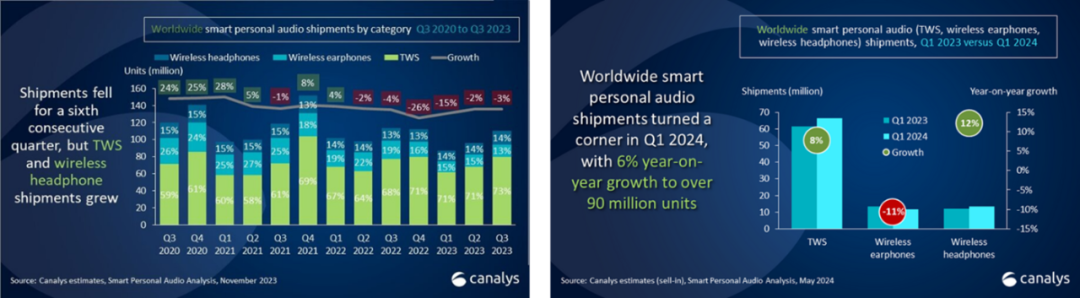

Emerging Sub-segment Expansion of PMIC: Application in TWS Headphones

TWS headphones place higher demands on PMIC for miniaturization, low power consumption, and multifunction integration. With the rapid growth of the TWS market, the application of PMIC in this field is also increasing. In 2023, the global shipment of TWS headphones is approximately 295 million units, with a market size of around 1 billion yuan. The robust growth of the TWS market brings new opportunities for the PMIC market.

Figure: TWS Market Size, compiled by Qicheng

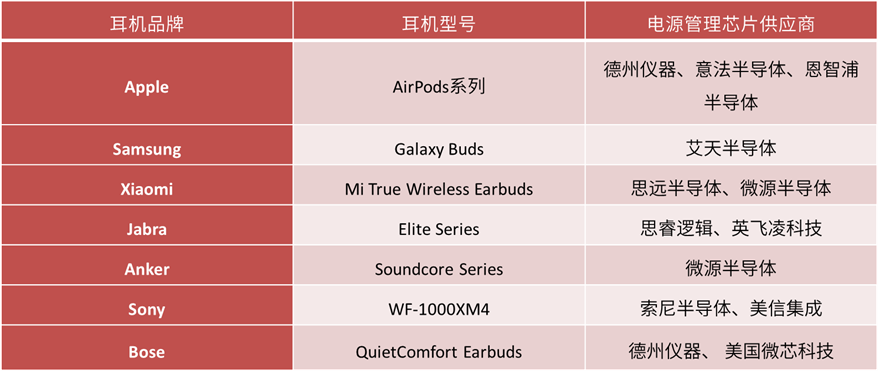

TWS PMIC Competitive Landscape

The market for TWS headphone PMIC chips is highly competitive, with brands like Apple, Samsung, and Xiaomi all having their suppliers. The demand for high-performance PMICs is increasing.

Figure 13: TWS PMIC Competitive Landscape, compiled by Qicheng

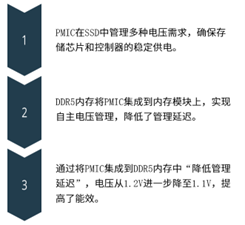

PMIC Sub-segments: Application in the Storage Market

With the development of the digital economy, the shipment of SSDs continues to grow. With the promotion and application of DDR5 technology, the demand for power management has also increased, driving the application of PMIC in the storage market. Integrated power management solutions will become the market mainstream, and the storage market will be a new growth market for PMIC.

PMIC plays a key role in SSDs, including:

-

Power Management: PMIC is responsible for regulating and managing power in SSDs to ensure optimal energy consumption and maximize battery life.

-

Improve Efficiency: As SSDs demand higher energy efficiency, PMIC helps SSDs achieve better performance and lower power consumption by providing efficient power management solutions.

-

Support Miniaturization: As electronic devices continue to shrink, efficient power management by PMIC is crucial for ensuring devices operate effectively.

Benefiting from the digital economy, SSD shipments have surpassed HDDs, and prices have soared:

-

Compared to traditional HDDs, SSDs have significant performance advantages, leading to continuous growth in SSD shipments. With the ongoing scale deployment of 5G, big data, IoT, and vehicle networking applications, the demand for high-performance storage from digital enterprises has become prominent, driving the expansion of the SSD market.

-

Global tech giants are ramping up their investments in data centers, significantly increasing demand for related storage devices. To meet market demand, Samsung Electronics is considering increasing the production of commercial SSDs. According to media reports, Samsung has decided to raise the prices of its commercial SSDs by 25% in the second quarter. Prices for consumer-grade SSDs are also expected to rise again, with an increase of 10% to 15% anticipated.

Currently, SSD power management chips primarily use discrete solutions, with integrated solutions as a supplement, but integrated solutions are expected to become the market mainstream:

-

Integrated power management solutions: Use a single integrated circuit (IC) to handle all power management functions. These integrated circuits typically include multiple voltage controllers, protection circuits, and power monitoring functions, offering advantages of space savings, simplified design, and lower costs.

-

Discrete power management solutions: Use multiple separate components to manage different power management functions. For example, separate voltage regulators, current protectors, and power monitoring circuits. The advantage is flexibility for combination and easier thermal management.

Figure: PMIC Applications in the Storage Market

Storage Market Size Continues to Expand

The growth in global SSD shipments and the semiconductor industry’s recovery cycle bring new growth opportunities to the storage market. It is expected that the storage market size will reach a new high in 2024-2025.

Conclusion: As a core component of electronic devices, the market size and application fields of PMIC are continuously expanding. With the rapid development of emerging markets such as AI, new energy, and TWS headphones, the PMIC industry will face more opportunities and challenges. Let’s look forward to the future of the PMIC industry together~