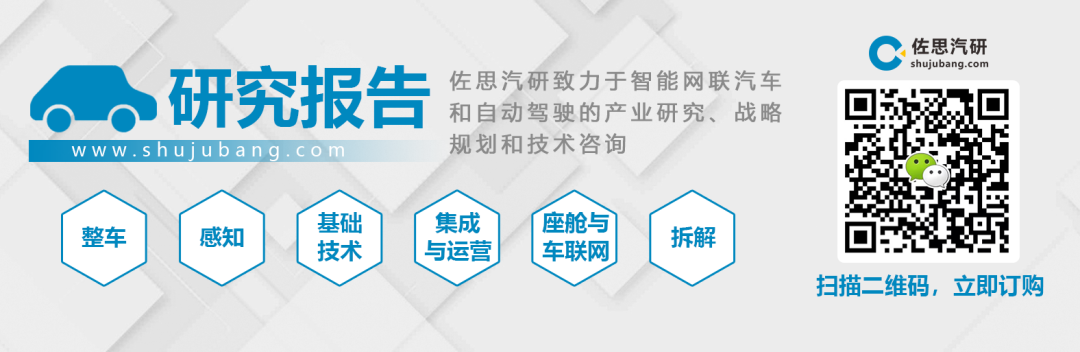

PMIC Device Classification

Source: Zuosi Automotive Research, 2023 Automotive Power Management Chip Industry Research Report

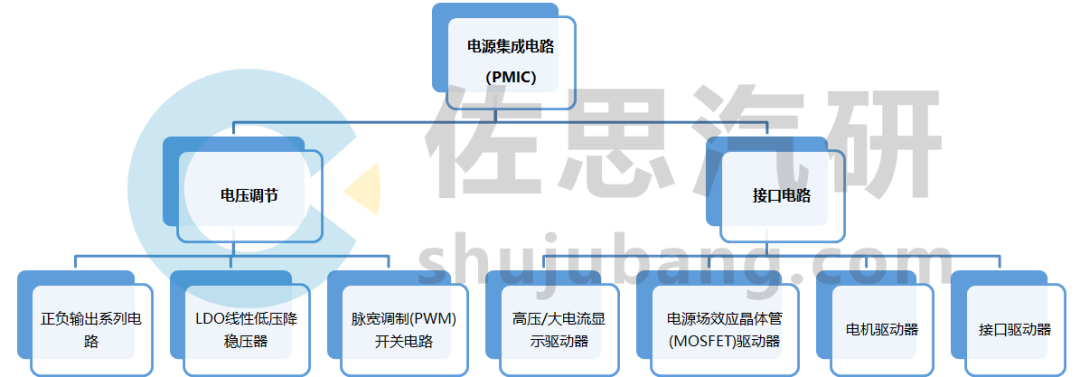

There Is a Huge Supply Gap for Automotive AFE Chips, Strong Demand for Domestic Substitution

AFE Chip Working Principle

Source: Jiewahte

1) Demand Side for Automotive AFE Chips: Development from 400V Platform to 800V Platform, Doubling Demand for AFE Chips

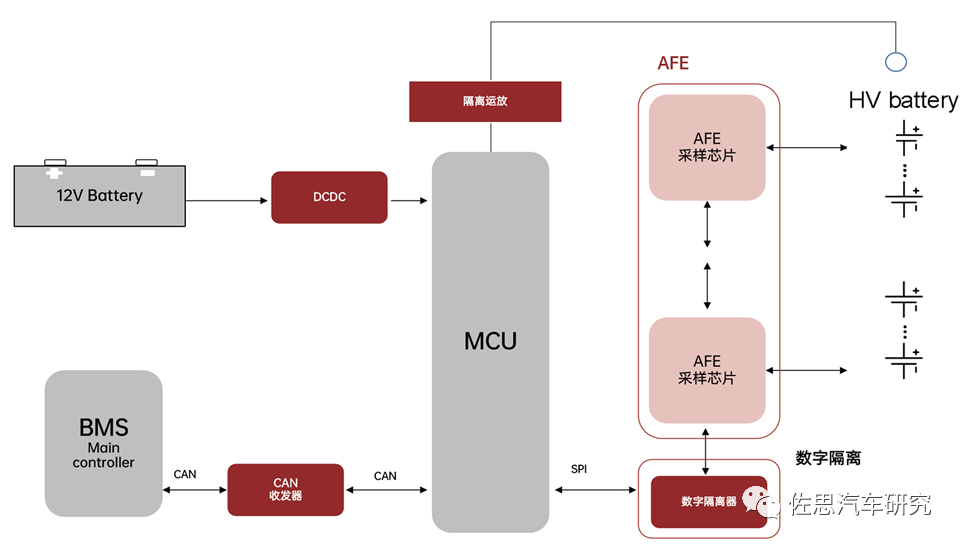

Global Automotive AFE Chip Market Size Forecast

Source: Zuosi Automotive Research, 2023 Automotive Power Management Chip Industry Research Report

2) Supply Side for Automotive AFE Chips: Domestic Market Relies on Imports, Significant Market Gap, Urgent Need for Domestic Alternatives

Domestic Layout of Automotive-grade AFE Chips

Source: Zuosi Automotive Research, 2023 Automotive Power Management Chip Industry Research Report

NXP DNB1168 Chip Battery Monitoring Unit

Source: Electronic Engineering World

Automotive-grade DC/DC Chips Will Enter the Domestic Substitution Cycle

Domestic Layout of Automotive-grade DC/DC Chips

Source: Zuosi Automotive Research, 2023 Automotive Power Management Chip Industry Research Report

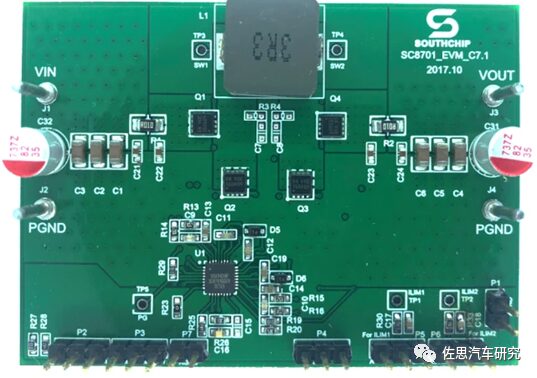

Nanxin Semiconductor Automotive-grade SC8701Q Chip

Source: Charging Head Network

Domestic Wafer Fab BCD Process Breakthrough, “Chip Shortage Crisis” Accelerates the Domestic Substitution Process of Automotive PMIC

Development Status of Domestic Wafer Foundry BCD Process Platforms

Source: Zuosi Automotive Research, 2023 Automotive Power Management Chip Industry Research Report

Table of Contents for the 2023 Automotive Power Management Chip Industry Research Report

01

Overview of Automotive Power Management Chips

1.1 Overview of Analog Chips

1.1.1 Analog chips: divided into power management chips and signal chain chips

1.1.2 Global market competition pattern for analog chips

1.1.3 Global market size for analog chips

1.1.4 Competition pattern of the Chinese analog chip market: gradual emergence of domestic substitution

1.1.5 Market size of the Chinese analog chip market

1.1.6 Main factors accelerating the development of domestic analog chips

1.1.7 Revenue composition and comparison of domestic analog chip manufacturers

1.1.8 Applications of analog chips in automotive electronics

1.2 Automotive Power Management Chips

1.2.1 What is power management?

1.2.2 Classification of power management chips

1.2.3 Global competition pattern for power management chips

1.2.4 Evolution of domestic power management chip substitution paths

1.2.5 Some domestic power management chip manufacturers

1.2.6 Application scenarios of power management chips in automotive electronics

1.2.7 Automotive-grade power management chips have higher performance requirements

1.2.8 Mass production process of automotive-grade power management chips

1.2.9 Domestic power management IC companies accelerating entry into the vehicle supply chain

1.2.10 Intensive listing period for domestic power management IC companies

1.2.11 Business layout of domestic power management IC companies in the automotive sector

1.3 Relevant Policies and Certification Standards for Domestic Automotive-grade Chips

1.3.1 Current policy status and guidance for standardization of automotive chips in China

1.3.2 Interpretation of automotive-grade chip requirements

1.3.3 Certification standards for automotive-grade power management chips in China

1.3.4 Functional safety standards for automotive-grade power management chips – ISO26262

1.3.5 Certification testing standards for automotive-grade power management chips – AEC-Q100

1.3.6 Production testing of automotive-grade power management chips

1.4 Application Scenarios of Power Management Chips in Automobiles

1.4.1 Application scenarios of power management chips in automotive electronics

1.4.2 Application scenario one for on-board power management chips: Intelligent Cockpit

1.4.3 Application solutions for power management chip manufacturers in the intelligent cockpit

1.4.4 Intelligent cockpit PMIC application solution: Yutai Semiconductor assists Tesla’s on-board wireless microphone

1.4.5 Application scenario two for on-board power management chips: Motor Controller

1.4.6 Motor controller PMIC application solutions (1)

1.4.7 Motor controller PMIC application solutions (2)

1.4.8 Application scenario three for on-board power management chips: On-board Charger

1.4.9 Application scenario four for on-board power management chips: Domain Controller

1.4.10 Application solutions for power management chip manufacturers in the domain controller

1.4.11 Power management IC solutions for autonomous driving domain (1)

1.4.12 Power management IC solutions for autonomous driving domain (2)

1.4.13 Power management IC solutions for autonomous driving domain (3)

1.4.14 Power management IC solutions for autonomous driving domain (4)

1.4.15 Application scenario five for on-board power management chips: Tail Lights and Ambient Lights

1.4.16 Application solutions for power management chip manufacturers in automotive lighting

1.4.17 Automotive lighting power management IC solutions: Microchip automotive LED lighting solutions

1.4.18 Application scenario six for on-board power management chips: On-board Charger

1.4.19 Development history of on-board wired charging

1.4.20 Development history of on-board wireless charging

02

Automotive Power Management Chip Manufacturing Process

2.1 Automotive Power Management Chip Industry Operating Models

2.1.1 Development history of semiconductor industry production models

2.1.2 Power management chip production operating models

2.1.3 Domestic power management chips becoming IDM

2.1.4 Streamlining of IDM factories to Fab-lite models

2.1.5 Transition of IDM manufacturers to Fab-lite strategies (1)

2.1.6 Transition of IDM manufacturers to Fab-lite strategies (2)

2.1.7 Some Fabless companies layout Fab-lite

2.1.8 Virtual IDM models: possessing proprietary process technology and process platforms

2.1.9 Comparison of IDM, Fabless, and virtual IDM models

2.1.10 Development path of domestic power management chip manufacturers’ operating models

2.2 Manufacturing Steps of Automotive Power Management Chips

2.2.1 Manufacturing steps for automotive power management chips: chip design, wafer foundry, packaging testing

2.2.2 IC design of automotive power management chips

2.2.2.1 Development of domestic automotive-grade power management chip IC design industry

2.2.2.2 Development of domestic power management chip IC design industry: Most domestic companies are in small batch supply and R&D state

2.2.2.3 Comparison of foreign automotive power management chip manufacturers (1)

2.2.2.4 Comparison of foreign automotive power management chip manufacturers (2)

2.2.2.5 Comparison of domestic automotive power management chip manufacturers (1)

2.2.2.6 Comparison of domestic automotive power management chip manufacturers (2)

2.2.2.7 Automotive power management chip supply system: Upstream chip manufacturers’ bargaining power is increasing

2.2.2.8 Reconstruction of the domestic automotive PMIC chip industry chain: From “vehicle manufacturers leading” to “enterprises mastering key technology leading”

2.2.3.1 Eight major manufacturing processes for automotive power management chips

2.2.3.2 Evolution of the process platform for analog chips

2.2.3.3 Mainstream production processes for automotive power management chips: BCD process

2.2.3.4 Development direction of BCD process technology: high voltage, high power, high density

2.2.3.5 BCD process isolation technology

2.2.3.6 Current development status of global BCD process platforms (1): Wafer foundry BCD process evolution diagram

2.2.3.7 Current development status of global BCD process platforms (2): TSMC, UMC, etc. belong to the first tier of BCD processes in the wafer foundry field

2.2.3.8 Current development status of global BCD process platforms (3): Domestic wafer foundries achieve breakthroughs in 55nm BCD process

2.2.3.9 Development status of domestic wafer foundry BCD process platforms

2.2.3.10 Process nodes for automotive power management chips: mainstream based on 8-inch production lines 0.18-0.11μm mature processes

2.2.3.11 Automotive power management chip wafer foundry: 12-inch production lines are the future trend

2.2.3.12 Layout status of 12-inch production lines for power management chip manufacturers and foundries

2.2.3.13 Gross profit margin and net profit margin of major wafer foundries

2.2.4 Packaging Testing of Automotive Power Management Chips

2.2.4.1 Chip packaging testing process flow

2.2.4.2 Packaging types for power management chips: mainly BGA, QFP, SO, DIP

2.2.4.3 Layout of domestic power management IC companies in the packaging and testing field: Fabless + testing/packaging

03

Analysis of Automotive Power Management Chip Products (By Type)

3.1 Classification and Corresponding Functions of Power Management Chips

3.2 Market Size of Power Management Chips (By Type)

3.3 AC/DC Chips

3.3.1 AC/DC chips: structure and working principle

3.3.2 AC/DC chips: classified by isolation

3.3.3 Competition pattern of automotive-grade AC/DC chips

3.3.4 Applications of AC/DC in automotive electronics: charging piles

3.3.5 AC/DC chips: AC slow charging

3.3.6 AC/DC chips: DC fast charging

3.3.7 New energy vehicle charging piles

3.3.8 Downstream customer groups for new energy vehicle AC/DC converters

3.4 DC/DC Chips

3.4.1 DC/DC converters

3.4.2 Main application types of DC/DC converters in electric vehicles

3.4.3 Classification of DC/DC direct current conversion chips

3.4.4 Main matching modes for new energy vehicle DC/DC converters

3.4.5 Downstream customer groups for on-board DC/DC chips (1)

3.4.6 Downstream customer groups for on-board DC/DC chips (2)

3.4.7 Key performance indicators of DC/DC chips

3.4.8 How to select DC/DC chips

3.4.9 DC/DC chips: mainstream switching regulators Buck, Boost, Buck-Boost

3.4.10 Layout of domestic automotive power management DC/DC chip manufacturers (1)

3.4.11 Layout of domestic automotive power management DC/DC chip manufacturers (2)

3.4.12 DC/DC chips: LDO linear voltage regulators

3.4.13 Selection of automotive-grade LDO linear voltage regulators

3.4.14 Layout of domestic automotive LDO linear voltage chip manufacturers

3.5 Battery Management Chips (BMIC)

3.5.1 Battery management system (BMS)

3.5.2 Working principle of automotive BMS

3.5.3 Comparison of new energy vehicle BMS solutions

3.5.4 BMS architecture: BMS architecture evolving towards domain controllers

3.5.5 Structure of battery management chips (BMIC)

3.5.6 Battery management chips (BMIC)

3.5.7 Wired BMS chip solutions (1): Tesla BMS design

3.5.8 Wired BMS chip solutions (2): Tesla BMS design

3.5.9 Wired BMS chip solutions (3): Tesla BMS design

3.5.10 Wired BMS chip solutions (4): Summary

3.5.11 Wireless BMS chip solutions (1): General Motors wBMS

3.5.12 Wireless BMS chip solutions (2): General Motors wBMS

3.5.13 Wireless BMS chip solutions (3): LG Innotek plans to start mass production of wireless BMS in 2024

3.5.14 BMS power management IC solutions (1): PI’s 12V emergency power supply solution

3.5.15 BMS power management IC solutions (2)

3.5.16 BMS power management IC solutions (3)

3.5.17 SBC chip applications in BMS: Main functions of SBC chips

3.5.18 Advantages of SBC chip applications in BMS

3.5.19 Defect cases of SBC chip applications in BMS

3.5.20 AFE chips in BMIC: working principle

3.5.21 AFE chips in BMIC: Mainstream automotive companies’ layout of 800V high-voltage platform drives AFE chip demand growth

3.5.22 AFE chips in BMIC: Global market size and single vehicle ASP calculation

3.5.23 AFE chips in BMIC: Major foreign suppliers and product selection (1)

3.5.24 AFE chips in BMIC: Major foreign suppliers and product selection (2)

3.5.25 AFE chips in BMIC: Representative foreign automotive AFE chip products (1)

3.5.26 AFE chips in BMIC: Representative foreign automotive AFE chip products (2)

3.5.27 Development of domestic automotive BMIC: in the initial layout stage

3.5.28 Development of domestic automotive BMIC: Deployment and mass production cases of domestic automotive-grade BMIC manufacturers (1)

3.5.29 Development of domestic automotive BMIC: Deployment and mass production cases of domestic automotive-grade BMIC manufacturers (2)

3.5.30 AFE chip solutions: NXP Semiconductors (DNS) launches automotive-grade electric vehicle single-cell monitoring chip

3.5.31 AFE chip solutions (1)

3.5.32 AFE chip solutions (2)

3.5.33 Development of domestic automotive BMIC: Development bottlenecks faced by domestic automotive-grade BMIC

3.5.34 Domestic BMIC downstream customers: Top 10 companies in BMS installation in China

3.6 Driver Chips

3.6.1 Driver chips: classified by application field

3.6.2 Working principle of motor driver chips

3.6.3 Driver chips for motor driving: Types and applications of DC motors in automobiles

3.6.4 Main application scenarios for DC motors (1): Intelligent Chassis

3.6.5 Main application scenarios for DC motors (2): Body Control

3.6.6 Evolution of motor driving methods: Relay driving → Chip driving

3.6.7 Automotive-grade motor driver chips: Strong customer stickiness

3.6.8 Major downstream customers of automotive-grade motor driver chips (1)

3.6.9 Major downstream customers of automotive-grade motor driver chips (2)

3.6.10 Automotive-grade motor driver chips: Major foreign suppliers and product selection

3.6.11 Automotive-grade motor driver chips: Domestic development and major suppliers

3.6.12 Motor driver chip solution (1)

3.6.13 Motor driver chip solution (2)

04

Analysis of Key Issues in Automotive Power Management Chips

4.1 Supply Interruption and Chip Shortage Issues

4.1.1 Factors affecting the shortage and price increase of automotive power management chips: capacity squeeze, increased demand

4.1.2 Impact of chip shortages on the automotive industry: production cuts, price increases, extended delivery cycles

4.1.3 Capacity utilization during the “chip shortage”

4.1.4 Capacity utilization of major wafer foundries

4.1.5 Expansion under the “chip shortage”: New capacity to be gradually released in 2024

4.1.6 Wafer factory expansion and new production line status (1)

4.1.7 Wafer factory expansion and new production line status (2)

4.1.8 Wafer factory expansion and new production line status (3)

4.1.9 Capacity forecast: Global wafer capacity and growth rate forecast from 2021 to 2025

4.1.10 Limitations on wafer factory capacity expansion: silicon wafers, equipment

4.1.11 Under the supply interruption of power management chips: domestic manufacturers accelerate substitution

4.1.12 Future supply situation of automotive power management chips

4.2 Development Direction of Automotive-grade Power Management IC Technology

4.2.1 Technology one: High and low voltage circuit integration technology

4.2.2 Technology two: Ultra-low current burst mode technology

4.2.3 Technology three: High-brightness LED technology

4.2.4 Technology four: Low EMI (Electromagnetic Interference)

4.2.5 Methods to reduce EMI: Use of filters or reducing switching slew rate

4.2.6 Low EMI solutions: TI low EMI innovative solutions

05

Research on Foreign Automotive-grade Power Management Chip Suppliers

5.1 Texas Instruments

5.1.1 Introduction to Texas Instruments (TI)

5.1.2 TI’s layout of power management chips

5.1.3 TI’s layout of automotive-grade BMIC

5.1.4 TI’s capacity expansion: Accelerating deployment in automotive electronics

5.1.5 New breakthroughs in TI’s power management products in the low static power consumption field (1)

5.1.6 New breakthroughs in TI’s power management products in the low static power consumption field (2)

5.2 Infineon

5.2.1 Introduction to Infineon

5.2.2 Infineon’s global factory distribution

5.2.3 Infineon’s downstream customer distribution

5.2.4 Infineon’s BMS solutions: Highly integrated system solutions

5.2.5 Some new automotive-grade power management chip products from Infineon

5.3 ADI

5.3.1 Introduction to ADI

5.3.2 ADI’s layout in automotive power management chips

5.3.3 ADI’s automotive power management chip application scenario solutions

5.4 MPS

5.4.1 Introduction to MPS

5.4.2 MPS’s specialty process BCD Plus and packaging technology Mesh Connect

5.4.3 MPS’s development history

5.4.4 MPS’s automotive power management chip product tree

5.4.5 MPS’s layout of automotive-grade power management chips

5.4.6 Integration of MPS power management chips

5.5 STMicroelectronics

5.5.1 Introduction to STMicroelectronics

5.5.2 STMicroelectronics’ business layout

5.5.3 Core R&D technologies of STMicroelectronics

5.5.4 STMicroelectronics’ BCD process flowchart

5.5.5 STMicroelectronics’ automotive-grade power management IC products

5.5.6 STMicroelectronics’ product roadmap for automotive-grade linear voltage regulators

5.6 ON Semiconductor

5.6.1 Introduction to ON Semiconductor

5.6.2 Expansion path of ON Semiconductor: Layout of SiC devices in the electric drive field

5.6.3 ON Semiconductor’s layout in automotive electronics

5.6.4 Power packaging technology for ON Semiconductor’s main driving modules

5.6.5 Information on some new automotive-grade power management chip products from ON Semiconductor

5.7 Renesas

5.7.1 Introduction to Renesas

5.7.2 Renesas’ product layout in the automotive electronics field

5.7.3 Renesas’ automotive BMS product layout

5.7.4 Renesas launches an in-vehicle camera solution that meets ASIL B standards

06

Research on Domestic Automotive-grade Power Management Chip Suppliers

6.1 Jiewahte

6.1.1 Introduction to Jiewahte

6.1.2 Development history of Jiewahte’s products

6.1.3 Jiewahte’s virtual IDM operating model

6.1.4 Jiewahte’s three major process platforms

6.1.5 Iteration history of Jiewahte’s 7-55V low and medium voltage BCD process platform

6.1.6 Iteration history of Jiewahte’s 10-200V high voltage BCD process platform

6.1.7 Iteration history of Jiewahte’s 10-700V ultra-high voltage BCD process platform

6.1.8 Revenue share of Jiewahte’s various process platforms from 2019 to 2021

6.1.9 Overall product layout of Jiewahte’s power management chips

6.1.10 Jiewahte’s automotive power management chip application layout

6.1.11 Jiewahte’s automotive-grade chip development process

6.1.12 Jiewahte’s products through automotive-grade certification

6.1.13 Jiewahte’s automotive-grade DCDC chip product: JWQ5103

6.1.14 Average selling price of Jiewahte’s major products

6.1.15 Main application technologies of Jiewahte in automotive electronics

6.2 Xidi Microelectronics

6.2.1 Introduction to Xidi Microelectronics

6.2.2 Supply chain model of Xidi Microelectronics: Fabless model

6.2.3 Stable supply chain structure of Xidi Microelectronics

6.2.4 Gross margin of Xidi Microelectronics’ products

6.2.5 Major product line layout of Xidi Microelectronics’ power management chips

6.2.6 Xidi Microelectronics’ layout in automotive electronics

6.2.7 Power management application block diagram for automotive information entertainment systems by Xidi Microelectronics

6.2.8 On-board DC/DC conversion chip of Xidi Microelectronics: HL7509 FNQ

6.2.9 Proposed R&D projects for automotive power management by Xidi Microelectronics

6.3 Yachuang Electronics

6.3.1 Introduction to Yachuang Electronics

6.3.2 Supply chain model of Yachuang Electronics’ power management ICs

6.3.3 Layout of Yachuang Electronics’ automotive-grade power management IC products

6.4 Shengbang Microelectronics

6.4.1 Introduction to Shengbang Microelectronics

6.4.2 Product layout of Shengbang Microelectronics’ analog chips

6.4.3 Operating model of Shengbang Microelectronics

6.4.4 Production process of Shengbang’s major products

6.4.5 Shengbang Microelectronics power management chip products (1)

6.4.6 Shengbang Microelectronics power management chip products (2)

6.4.7 Automotive-grade voltage reference chip from Shengbang Microelectronics

6.5 Sirepu Technology

6.5.1 Introduction to Sirepu Technology

6.5.2 Supply chain model of Sirepu Technology: Fabless model

6.5.3 Layout of Sirepu Technology’s power management chips

6.5.4 Layout of Sirepu Technology’s automotive-grade products: First convert old products, then develop new products

6.5.5 Application of Sirepu automotive-grade products in the smallest basic systems

6.5.6 Application scenarios of Sirepu automotive PMIC solutions (1)

6.5.7 Application scenarios of Sirepu automotive power management chip solutions (2)

6.5.8 Automotive-grade power management chips from Sirepu Technology

6.6 Xinzhu Technology

6.6.1 Introduction to Xinzhu Technology

6.6.2 Four major product lines in Xinzhu Technology’s power management chip field

6.6.3 Layout of Xinzhu Technology’s automotive-grade power management chips

6.6.4 Application solutions for Xinzhu Technology’s power management IC products in automotive smart rearview mirrors

6.7 Silergy Corp

6.7.1 Introduction to Silergy Corp

6.7.2 Application scenarios of Silergy Corp automotive power management ICs (1)

6.7.3 Application scenarios of Silergy Corp automotive power management ICs (2)

6.7.4 Some automotive-grade power management chip products from Silergy Corp

6.7.5 Silergy Corp: Ultra-small PMIC automotive camera solutions

6.8 Aiwei Electronics

6.8.1 Introduction to Aiwei Electronics

6.8.2 Layout of Aiwei’s automotive electronics products

6.8.3 Production model of Aiwei’s power management ICs

6.8.4 Aiwei Electronics’ self-built three-temperature CP (Chip Prober Wafer Testing) production line

6.9 Yutai Semiconductor

6.9.1 Company introduction

6.9.2 Technology development and product evolution of Yutai Semiconductor

6.9.3 Operating model of Yutai Semiconductor: Fabless

6.9.4 Major product unit costs of Yutai Semiconductor

6.9.5 Layout of Yutai Semiconductor’s automotive-grade power management chip products

6.9.6 R&D projects for automotive electronic power management products

More Research Reports from Zuosi

Zuoyan Jun: 18600021096 (same as WeChat)

Zuosi 2023 Research Report Writing Plan

Panorama of the Intelligent Connected Vehicle Industry Chain (February 2023 Edition)

| Independent Brand OEMs Autonomous Driving | Automotive Vision (Domestic) | High-Precision Maps |

| Joint Venture Brand OEMs Autonomous Driving | Automotive Vision (Foreign) | High-Precision Positioning |

| ADAS and Autonomous Driving Tier 1 – Domestic | Automotive Vision Algorithms | Automotive Gateways |

| ADAS and Autonomous Driving Tier 1 – Foreign | Surround View Market Research (Local Edition) | Data Closed Loop Research |

| Key Components of ADAS Domain Controllers | Surround View Market Research (Joint Venture Edition) | Automotive Information Security Hardware |

| Autonomous Driving and Cockpit Domain Controllers | Infrared Night Vision | Automotive Information Security Software |

| Multi-Domain Computing and Regional Controllers | Autonomous Driving Simulation (Foreign) | OEM Information Security |

| Passenger Vehicle Chassis Domain Control | Autonomous Driving Simulation (Domestic) | Wireless Communication Modules |

| Domain Controller Ranking Analysis | Laser Radar – Domestic Edition | Automotive 5G Integration |

| E/E Architecture | Laser Radar – Foreign Edition | 800V High Voltage Platform |

| L4 Autonomous Driving | Core Components of Laser Radar | Fuel Cells |

| L2/L2+ Autonomous Driving | Millimeter Wave Radar | Integrated Battery |

| Passenger Vehicle Camera Quarterly Report | Automotive Ultrasonic Radar | Integrated Die Casting |

| ADAS Data Annual Report | Radar Disassembly | Automotive Operating Systems |

| Joint Venture Brand Vehicle Networking | Ranking of Laser and Millimeter Wave Radar | Chassis Control |

| On-Board Information Service Systems and Entertainment Ecosystems | Autonomous Driving Heavy Trucks | Electric Control Suspension |

| Commercial Vehicle ADAS | Unmanned Shuttle | Steering Systems |

| Commercial Vehicle Smart Cockpit | Unmanned Delivery Vehicles | Brake-by-Wire Research |

| Commercial Vehicle Vehicle Networking | Unmanned Retail Vehicles | Charging and Swapping Infrastructure |

| Commercial Vehicle Smart Chassis | Agricultural Machinery Autonomous Driving | Automotive Motor Controllers |

| Automotive Intelligent Cockpit | Port Autonomous Driving | Hybrid Power Report |

| Intelligent Cockpit Tier 1 | Modular Report | Automotive PCB Research |

| Cockpit Multi-Screen and Linked Screens | V2X and Vehicle Road Coordination | IGBT and SiC Research |

| Intelligent Cockpit Design | Roadside Intelligent Perception | Automotive Power Electronics |

| Instrument and Central Control Display | Roadside Edge Computing | Electric Drive and Power Domain |

| Smart Rearview Mirror | Automotive eCall System | Automotive Wiring Harness |

| Driving Recorder | Automotive EDR Research | Automotive Digital Key |

| Automotive UWB Research | Automotive Personalization | Automotive Sound Systems |

| HUD Industry Research | Vehicle Voice | Automotive Lighting |

| Human-Machine Interaction | Vehicle Antennas | Automotive Magnesium Alloy Die Casting |

| Vehicle DMS | TSP Manufacturers and Products | New Four Modernizations of Automotive Electronics |

| OTA Research | Autonomous Driving Regulations | New Forces in Vehicle Manufacturing – NIO |

| Automotive Cloud Service Research | Autonomous Driving Standards and Certification | NIO ET5/ET7 Intelligent Function Disassembly |

| Automotive Functional Safety | Intelligent Connected Testing Base | New Forces in Vehicle Manufacturing – XPeng |

| AUTOSAR Research | PBV and Automotive Robots | XPeng G9 Function Disassembly |

| Software Defined Vehicles | Flying Cars | New Forces in Vehicle Manufacturing – Li Auto |

| Software Suppliers | Integrated Driving and Parking Research | Li Auto L8/L9 Function Disassembly |

| Passenger Vehicle T-Box | Smart Parking Research | Autonomous Driving Chips |

| Commercial Vehicle T-Box | Automotive Shared Leasing | Chassis VCU Research |

| T-Box Ranking Analysis | Vehicle Enterprise Digital Transformation | Automotive MCU Research |

| Model Supplier Research | Vehicle Enterprises Digital Transformation | DJI Dual Vision and Tida Laser Radar Disassembly |

| NIO and Toyota Great Wall Vehicle Machine and Cockpit Domain Control Disassembly | Autonomous Driving Fusion Algorithms | Sensor Chips |

| Intelligent Surfaces | Automotive CIS Research |