Since the IoT market has become vibrant, software and hardware manufacturers from various industries have continuously entered the market. As the fragmented nature of the market has become clear, products and solutions tailored to specific application scenarios have also become mainstream. Furthermore, to ensure that products/solutions meet customer needs while allowing manufacturers to gain control and more profits, self-developed technologies have become a significant trend, especially in non-cellular communication technologies, which once saw a hundred flowers blooming in the market.

In the realm of small wireless communication, there are technologies such as Bluetooth, Wi-Fi, Zigbee, Z-Wave, and Thread; in the low-power wide-area network (LPWAN) sector, there are also distinctive technologies like Sigfox, LoRa, ZETA, WIoTa, and Turmass.

This article will provide a brief summary of the current development status of the aforementioned technologies and analyze them from three aspects: application innovation, market planning, and industry chain changes, discussing the current state and future trends of the IoT communication market.

Small Wireless Communication, Scenario Expansion, and Technology Interconnection

Currently, various small wireless communication technologies are still undergoing continuous iteration, and the changes in functionality, performance, and applicable scenarios of these technologies actually provide certain insights into market trends. At present, there is a phenomenon of To C technology becoming To B in scenario exploration, and in terms of technology interconnection, besides the implementation of the Matter protocol, there have been other advancements in cross-technology interconnection.

Bluetooth

Bluetooth 5.4 Released – Enhancing Electronic Shelf Label Applications

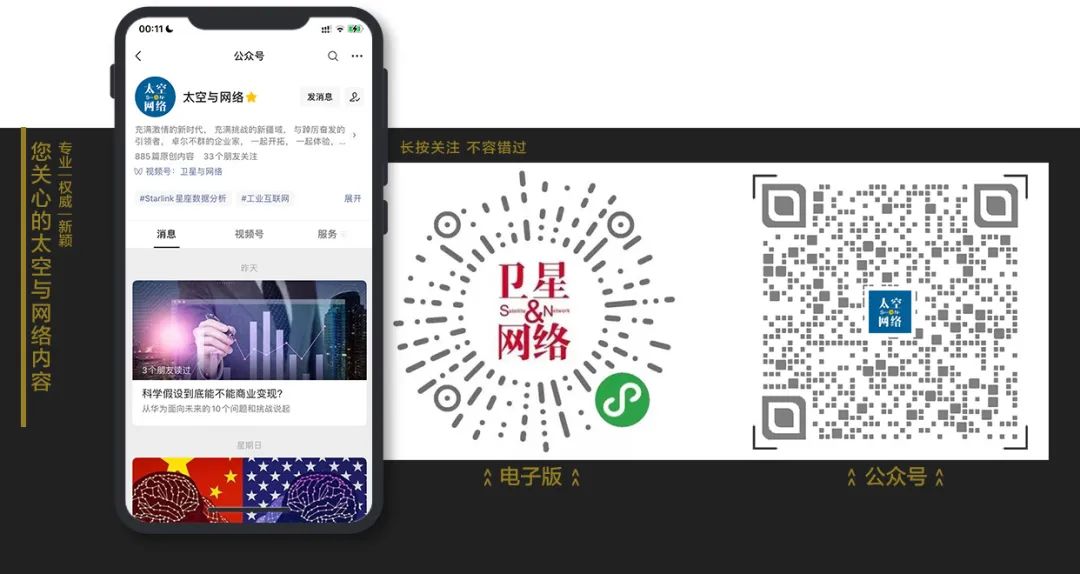

According to the “Bluetooth Core Specification Version 5.4”, ESL (Electronic Shelf Label) uses a device addressing scheme consisting of an 8-bit ESL ID and a 7-bit group ID (binary). Moreover, the ESL ID is unique across different groups. Therefore, an ESL device network can contain up to 128 groups, with each group containing a maximum of 255 unique ESL devices belonging to that group. In simple terms, if Bluetooth 5.4 is used for networking in electronic shelf label applications, a total of 32,640 ESL devices may exist in one network, with each label controllable from a single access point.

Bluetooth 5.4 One-to-Many Communication

(Image source: “Bluetooth Core Specification Version 5.4”)

Wi-Fi

Scenario Expansion to Smart Locks and More

In addition to wearable devices and smart speakers, smart home products such as doorbells, thermostats, alarm clocks, coffee machines, and light bulbs have also connected to Wi-Fi networks. Moreover, smart locks are expected to connect to Wi-Fi networks to provide more services. Wi-Fi 6 is improving data throughput while reducing power consumption by enhancing network efficiency and increasing bandwidth.

Image source: “Harnessing the Power of Wi-Fi 6 in the New Age of IoT”

Wi-Fi Positioning is Gaining Momentum

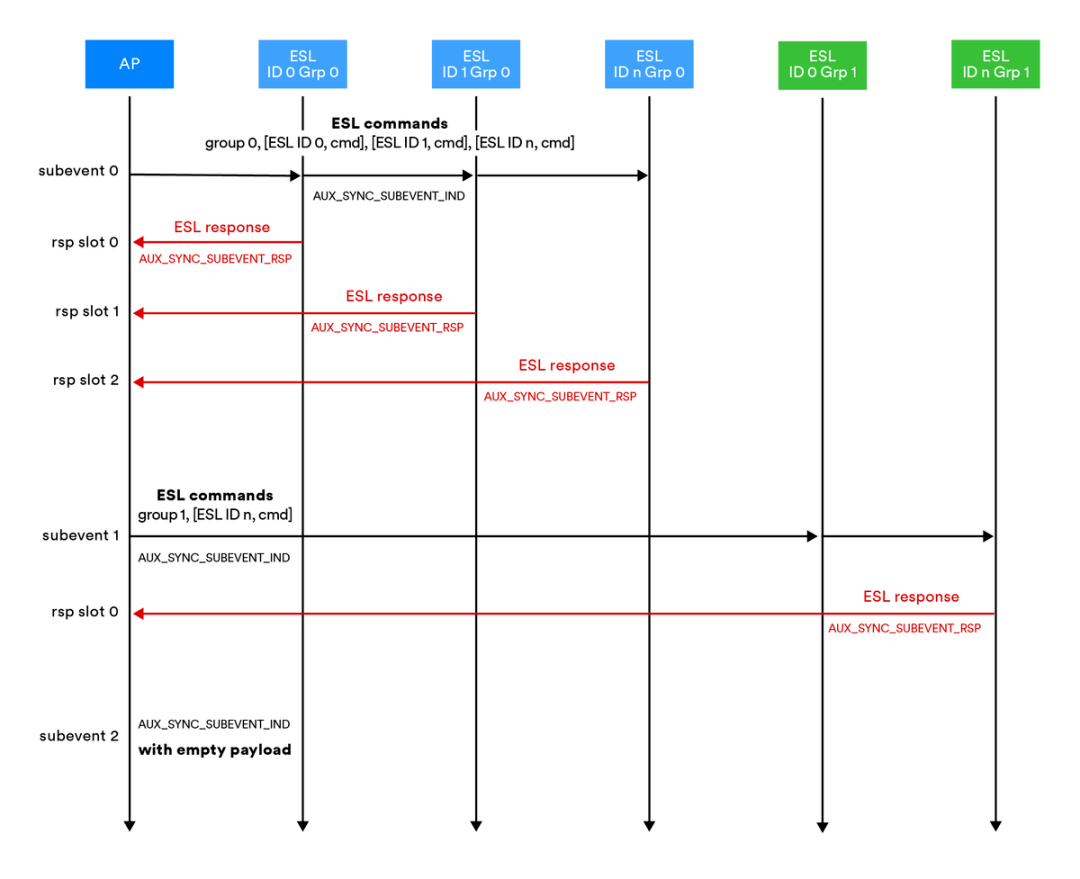

Currently, the accuracy of Wi-Fi positioning can reach 1-2 meters, and the third and fourth generation standards based on Wi-Fi location services are under development. The new LBS technology will significantly improve its accuracy, widely serving consumers, industries, and enterprises. Dorothy Stanley, standard architect at Aruba Networks and chair of the IEEE 802.11 working group, stated that the new and improved LBS technology will bring Wi-Fi positioning to within 0.1 meters.

Image source: Wi-Fi NOW interview “New LBS Wi-Fi standards are ‘calls to innovate'”

Zigbee

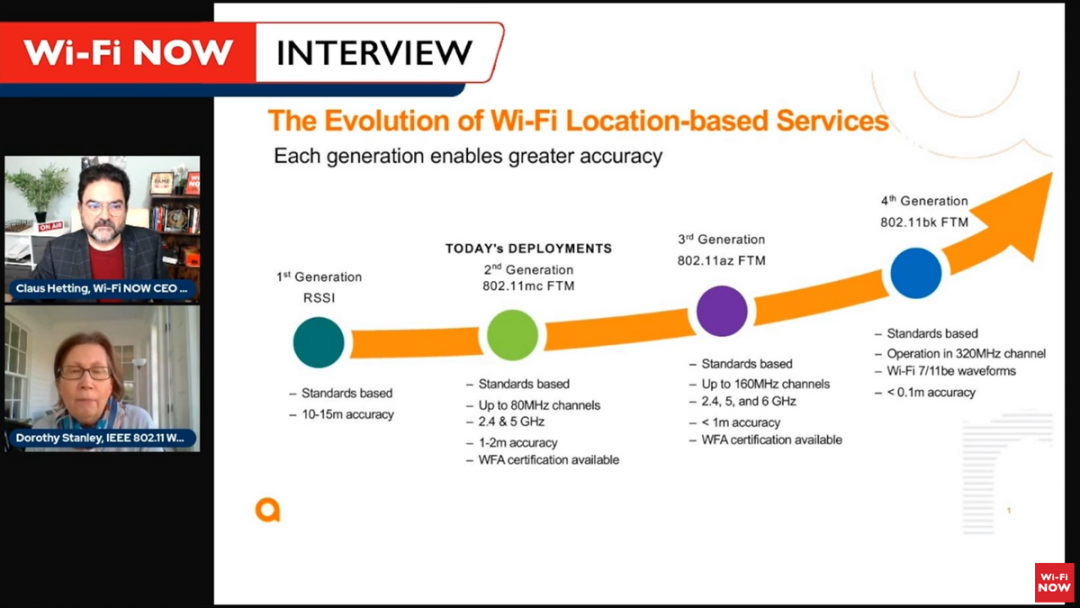

Release of Zigbee Direct, Integrating Bluetooth for Direct Mobile Connection

Image source: Zigbee official website

Targeting consumers, Zigbee Direct provides a new interaction mode by integrating Bluetooth, allowing Bluetooth devices to access devices in the Zigbee network without the need for cloud or hub. In this scenario, the Zigbee network can connect directly to mobile phones via Bluetooth, enabling mobile phones to control devices within the Zigbee network.

Release of Zigbee PRO 2023 Enhancing Device Security

Zigbee PRO 2023 expands its security architecture and promotes the standardization of hub-centric operations by “working with all hubs”. This feature enhances the resilience of hub-centric networks by helping devices identify the most suitable parent node for secure joining and rejoining of the network. Additionally, support for sub-gigahertz frequencies in Europe (800 MHz) and North America (900 MHz) has been added, providing higher signal strength and range to support more use cases.

From the above information, two conclusions can be drawn: first, the direction of communication technology iteration is gradually shifting from performance enhancement to meeting application scenario needs, providing new product ideas for industry chain partners; second, besides the Matter protocol breaking down interconnection “barriers”, various technologies are also engaging in bidirectional interconnection.

Of course, small wireless communication, as a local area network, is only a part of IoT communication, and the continuously vibrant LPWAN technology is also receiving significant attention.

LPWAN, Industry Chain Operation Upgrade, and Broad Overseas Market Space

From the early days of the technology’s emergence and popularization to today’s pursuit of application innovation to capture more markets, the direction of technology iteration is undergoing a remarkable transformation. It is understood that, in addition to small wireless communication technologies, there have also been many developments in the LPWAN market in recent years.

LoRa

Semtech Acquires Sierra Wireless

As the creator of LoRa technology, Semtech, after acquiring Sierra Wireless, a company primarily focused on cellular communication modules, will integrate LoRa wireless modulation technology into Sierra Wireless’s cellular modules, merging the products of both companies. Customers will be able to access an IoT cloud platform that will handle multiple tasks, including device management, network management, and security.

6 Million Gateways, 300 Million End Nodes

Image source: LoRa 10th Anniversary Celebration

It is worth mentioning that, based on different regulations in various countries, LoRa’s development direction differs domestically and internationally. Domestically, it is moving towards “regional networking”, while internationally, large-scale wide-area networks are still being constructed. It is understood that the Helium platform abroad, based on a digital asset reward and consumption mechanism, has provided significant support for LoRa’s gateway coverage. As of the end of 2022, more than 180 countries and regions have begun deploying gateways for the Helium platform, with a cumulative deployment of over 980,000 gateways. Its operators in North America include Actility, Senet, and X-TELIA.

Sigfox

Multi-Technology Integration and Collaboration

Since the acquisition of Sigfox by Singapore IoT company UnaBiz last year, the latter has adjusted the former’s operational methods, especially in terms of technology integration. Currently, Sigfox is integrating with other LPWA technologies and small wireless communication technologies for service. Recently, UnaBiz has facilitated the collaboration between Sigfox and LoRa.

Image source: UnaBiz official website – “Actility and UnaBiz Integrate LoRaWAN® and Sigfox Technologies”

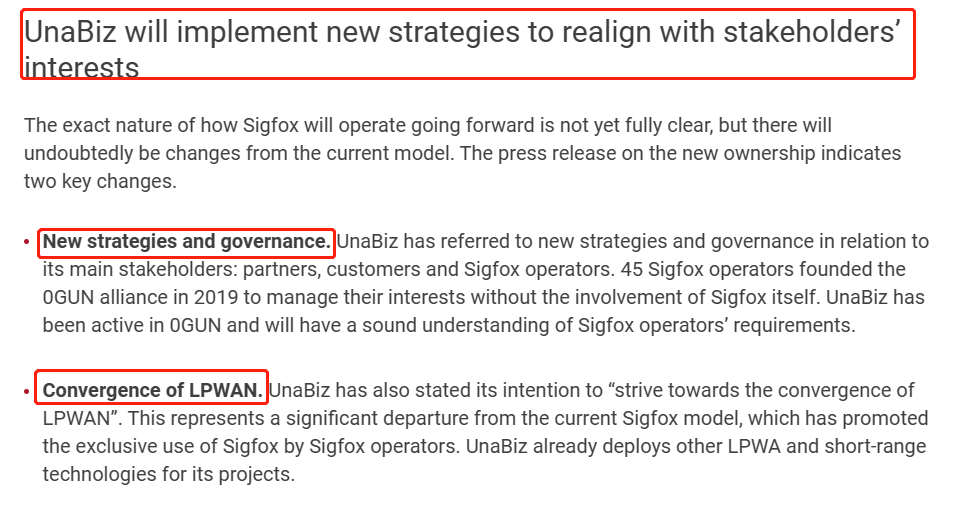

Business Model Transformation

UnaBiz has re-established Sigfox’s operational strategy and business model. In the past, Sigfox’s strategy was to develop a global capability that meets various needs, positioning itself as an operator. However, due to its strict control over the technology ecosystem, requiring partners based on the Sigfox network to share a large portion of service revenue, many companies in the industry chain felt disheartened. Now, UnaBiz is not only focusing on network operations but also concentrating on providing services to key industries, adjusting the operational strategies of major stakeholders (partners, customers, and Sigfox operators). By the end of 2022, Sigfox’s losses had significantly decreased by two-thirds compared to the end of 2021.

Source: analysys mason

ZETA

Open Ecosystem, Collaborative Development of the Industry Chain

Unlike LoRa, where 95% of chips are produced by Semtech, ZETA’s chip and module industry has more participants, including foreign companies like STMicroelectronics, Silicon Labs, and Socionext, as well as domestic semiconductor manufacturers like GigaDevice, Huapu Micro, and Zhipu Micro. Additionally, ZETA collaborates with manufacturers like Socionext, Huapu Micro, Zhipu Micro, and Dayou Semiconductor, and the chips are not limited to ZETA module applications; they can also license IP to various application manufacturers in the industry, forming a relatively open underlying ecosystem.

Development of ZETA PaaS Platform

Through the ZETA PaaS platform, developers can create solutions for more scenarios; technology suppliers can collaborate with IoT PaaS to reach a broader customer base; manufacturers can connect to the market more quickly, reducing overall costs. Furthermore, through the PaaS platform, various ZETA devices can break through category and scenario limitations to interconnect, thereby uncovering more data application value.

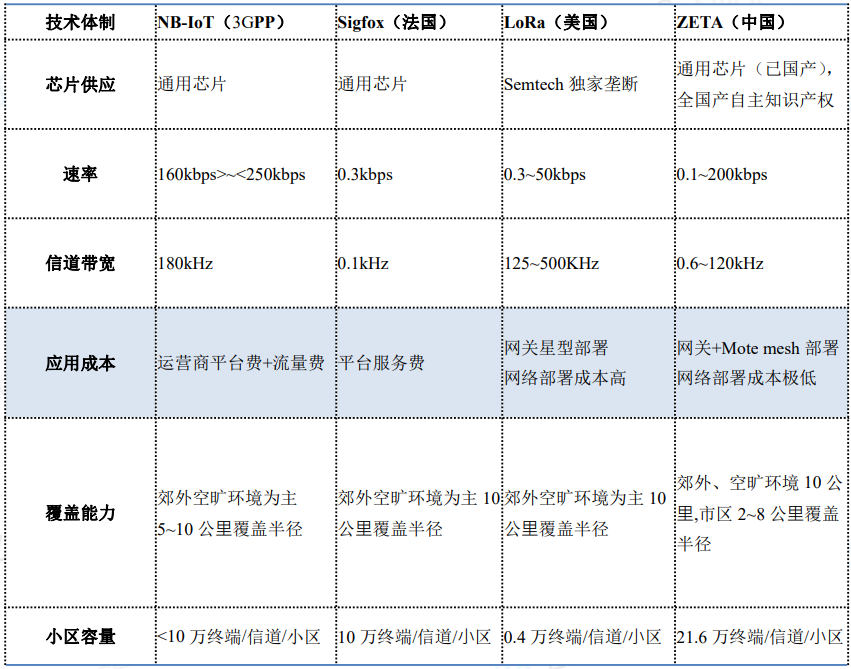

LPWAN Technology Comparison Table (Source: ZETA Ecosystem White Paper)

Through the development of LPWAN technology, especially the “revival” of Sigfox, it can be seen that for IoT communication technology to achieve more connections, it requires collaborative development with industry chain partners, enhancing the participation and benefits of stakeholders. At the same time, it can also be observed that other technologies like LoRa and ZETA are actively developing their ecosystems.

Conclusion

In summary, compared to previous years when communication technologies were constantly emerging and each technology holder operated independently, a significant trend in recent years is the move towards integration, including the complementarity of small wireless communication technologies in functionality and performance, and the complementarity of LPWAN technologies in terms of applicability.

On the other hand, elements that were once emphasized in technology iteration, such as data throughput and latency, have now become basic requirements. The current focus of technology iteration is more on scenario expansion and services. The shift in iteration direction actually signifies that the number of participants in the industry is increasing, and the ecosystem is improving. As the foundational communication technology for IoT connectivity, the future will not be limited to the “old adage” of connectivity, but will also bring more innovations.

>End>>> This article is reproduced from “IoT Media”, author: Wutong, original title: “Zigbee Direct Connection to Mobile Phones? Sigfox’s Revival? An Overview of Non-Cellular Communication Technologies”.To share cutting-edge information and valuable insights, the Space and Network WeChat public account has reproduced this article and edited it.Support the protection of intellectual property rights, please indicate the original source and author when reprinting.Some images could not find the original source, so they are not marked in the text. If your rights are infringed, please contact us immediately.HISTORY/Previous Recommendations

Disney Spreads Happiness, Beautiful Planet Lights Up Dreams

Why is it so difficult for commercial launch vehicles?

Mixed Ownership Model: The Logical Evolution and Practical Path of the New National System in the Development of Commercial Space (Part One)

Mixed Ownership Model: An Important Way to Promote the New National System in the Field of Commercial Space

>>>

A passionate new era,

A challenging new domain,

With the vigorous leaders,

Outstanding entrepreneurs,

Let’s explore together,

Experience together,

Perceive together,

Build better quality together,

Achieve higher value together,

Witness greater leaps in commercial space!

—— “Satellite and Network”, observe, record, disseminate, and lead.

>>>

·Special Advisor of “Satellite and Network”:Wang Zhaoyao

·Editorial Committee of “Satellite and Network”

Senior Advisors:Wang Guoyu, Liu Cheng, Tong Xudong, Xiang Zhenhua, Wang Zhiyi, Yang Lie

· Founder of “Satellite and Network”:Liu Yufei

· Vice President of “Satellite and Network”:Yuan Hongyi, Wang Junfeng, Zhou Lei

· WeChat Public Account (ID: satnetdy) TeamEditor:Yan Ling、Ha Mei, Zhou YongMain Reporters:Li Gang, Wei Xing, Zhang Xuesong、Huo Jian, Le Yu、Daozi, Zhao DongPlanning Department:Yang YanVisual Director:Dong NingProfessional Photography:Feng Xiaojing, Song WeiDesign Department:Gu Meng, Pan Xiheng, Yang XiaomingAdministrative Department:Jiang He, Lin ZiBusiness Department:Wang Jinxin, Jin YiFor original article reprint authorization, infringement of reprinted articles, submissions, etc., please add WeChat: 18600881613For business cooperation; exhibition hall design, corporate VI/CI and interior design, corporate culture construction and brand promotion; corporate reputation communication and overall marketing communication, please add WeChat: 13811260603For magazine subscriptions, please add WeChat: wangxiaoyu9960· Satellite and Network Branches:Chengdu Branch Head: Shen HuaiChangsha Branch Head: Bin HongpuXian Branch Head: Guo ZhaohuiQingdao Branch Head: Jiang Wei· Satellite and Network Headquarters Head:Nong Yan· Conference and Event DepartmentHead:Qiao Haoyi· Investment and Strategic Cooperation:Liu Yufei· This platform’s contracted design company:Yihua Kaitian (Beijing) Cultural Creative Design Co., Ltd.· Aerospace Plus (Shenzhen) Equity Investment Fund Management Head: Yang Yan