Author: Michael McGuiness

Thanks to Justin Drake for inspiring many ideas in this article and for reading the draft.

For years, I have believed that Bitcoin has the most asymmetric risk-reward profile of our lifetime. Its unique properties make it the best way to store value in the world. Its hard-to-replicate network effects make it unlikely that any other cryptocurrency will replace it.

By September 2020, Bitcoin was the only cryptocurrency I held. Its Total Addressable Market (TAM) as a store of value was so enormous that allocating capital anywhere else made little sense. The broad market for value storage could be as high as $400 trillion, and what shocked me was how likely Bitcoin was to gain a significant portion of the “currency premium” from:

-

Gold ($10 trillion)

-

Bonds ($100 trillion)

-

Stocks ($30 trillion)

-

Real Estate ($200 trillion)

-

Broad Money ($100 trillion)

-

Art, Wine, Collectibles ($20 trillion)

I used to think, what could possibly compete with this advantage? Moreover, most other cryptocurrencies are scams, and the few legitimate projects seem not to have found product-market fit.

Then, at the urging of a friend, I reluctantly started buying some ETH. Don’t get me wrong; smart contracts and decentralized applications (Dapps) are cool. But at the time, it seemed to me that Bitcoin would win the use case for store of value, which was the expected outcome and the ultimate reward. I was also unsure how Ethereum’s native asset (ETH) would appreciate.

Months ago, my view began to change. Almost everyone in the crypto space can attest that once you own something, you pay more attention to it (Ethereum) has two developments that caught my attention: 1) Ethereum’s transition to Proof of Stake (PoS); 2) the changes in the protocol’s monetary policy. I quickly realized that these changes would have a huge impact on the monetary properties of ETH and could even make it a better store of value than BTC.

Of course, I was initially skeptical. After all, Bitcoin has such a huge lead. It is a household name, and it is the most secure in terms of network hash rate, with large institutions like Tesla, MicroStrategy, and MassMutual beginning to adopt it as a reserve asset. Can Ethereum really catch up?

But the more I read and thought, the more I believed that the likelihood of ETH as a store of value was increasing. I soon converted most of my BTC into ETH and decided to write this article to clarify my thoughts.

In my view, Ethereum will win the store of value battle for four main reasons:

-

More Scarce

-

More Secure

-

Organic Demand

-

Real Yield

I realize that such a suggestion may be seen as blasphemy by Bitcoin maximalists. I support these maximalists in many ways, such as the demand for a new asset that allows people to preserve their wealth over time. However, I am not so dogmatic about how to achieve that. I will ultimately support the asset I believe is most likely to succeed. To borrow the words of Paul Tudor Jones, Ethereum now looks like the fastest horse.

01. More Scarce

In my previous article, Why Bitcoin Makes Sense [1], I wrote extensively about what constitutes a good store of value, so I won’t spend too much time discussing the definition here.

The basic premise is that money is simply a technology that allows us to consume our wealth today at a later date. Therefore, over time, the “best” money will provide the greatest purchasing power to its holders. Several factors affect the suitability of a monetary commodity as a store of value, but the most important factor is supply growth or scarcity.

Have you ever wondered why gold has been the primary store of value for humanity throughout history? Why not silver, copper, or one of the other 118 elements? The main reason is scarcity. The annual growth rate of gold supply has historically hovered around 2%. Only silver’s annual growth rate can reach 5-10%, and it currently stands at around 20%. The extremely low supply growth rate allows gold to maintain its purchasing power better than anything else over time, and the world ultimately recognized gold as a store of value.

For thousands of years, gold has been the best (store of value) we could use because it is a limited-supply monetary commodity that can maintain its value over time. However, the invention of Bitcoin created the first truly scarce form of currency in history. Bitcoin has a precise supply cap of 21 million coins, and anyone can audit this with their home computer. Bitcoin takes what gold has done better than anything else and makes an order of magnitude improvement on it. However, Ethereum may also do the same to Bitcoin by transitioning to Proof of Stake (PoS) and upcoming changes to its gas management.

2. Ethereum’s Monetary Policy & EIP-1559

Currently, Ethereum’s annual network issuance (i.e., inflation rate) is about 4.5%, with 2 ETH per block and an additional reward of 1.75 ETH per uncle block (plus fees) for miners. Ethereum does not have a fixed supply because a fixed supply also means a fixed network security budget. Rather than arbitrarily fixing Ethereum’s security, its monetary policy is best described as “minimum issuance to ensure network security.”

Bitcoiners hate this ambiguity because they believe the underlying financial system should be stable. The development of Bitcoin has been intentionally cautious and slow, with a total issuance cap of 21 million coins.

But the Ethereum community believes in sacrificing short-term (issuance) stability for long-term network security, and the fact is that Ethereum has a history of reducing issuance to an estimated minimum level. Furthermore, the transition to PoS will significantly reduce ETH issuance while maintaining the same level of network security. I will elaborate on this later, but Vitalik has a great article[2] explaining how PoS can provide more security at the same cost.

According to the current Eth 2.0 specifications, as part of PoS, Ethereum’s issuance rate will be significantly reduced. New ETH issuance will be generated by validators who have staked ETH by processing transactions and achieving consensus on the state of the network, rather than being given to miners, and there will be a floating ratio between the total staked ETH and the annual yield of stakers. The current specifications will produce the following annual rates and inflation rates based on network ETH staking totals:

Basically, we can expect that after the PoS transition, the annual network issuance (i.e., inflation rate) will drop from today’s ~4.5% to less than 1%. The following chart highlights this massive decline:

But this (inflation rate) is still higher than Bitcoin, which has a cap of 21 million coins and a long-term inflation rate of 0%. So, how will Ethereum become more scarce? Well, there’s more. With the release of Ethereum Improvement Proposal EIP-1559, Ethereum has begun to address many concerns regarding its monetary policy, which is referred to as the “scarcity engine of Ethereum” or “ETH burning mechanism.”

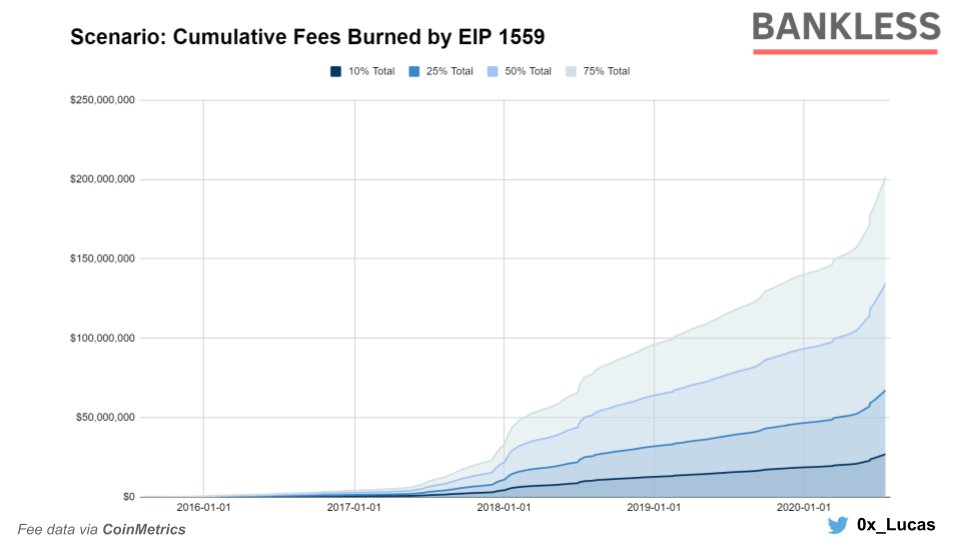

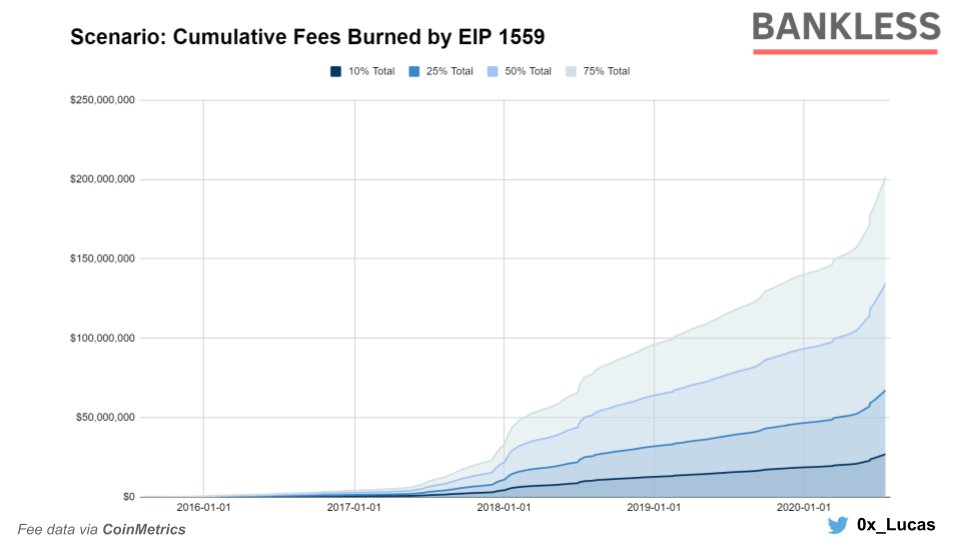

EIP-1559 will be implemented this July as part of Ethereum’s upcoming London hard fork. Delving into the details of this proposal goes beyond the scope of this article, but a key aspect to note is that in addition to improving the user experience of Ethereum gas fees, EIP-1559 will burn (destroy) a portion of ETH transaction fees. This will permanently remove a portion of ETH supply from circulation and reduce the net daily issuance of ETH.

A year-long analysis of network transactions showed that EIP-1559 would burn nearly 1 million ETH within 365 days, which is almost equivalent to 1% of the entire circulating supply of the network. With the growing demand for Ethereum transactions, many expect this number to increase over time. Thus, when combined with the lower issuance rate brought by PoS (below 1%), Ethereum will actually have a deflationary monetary policy.

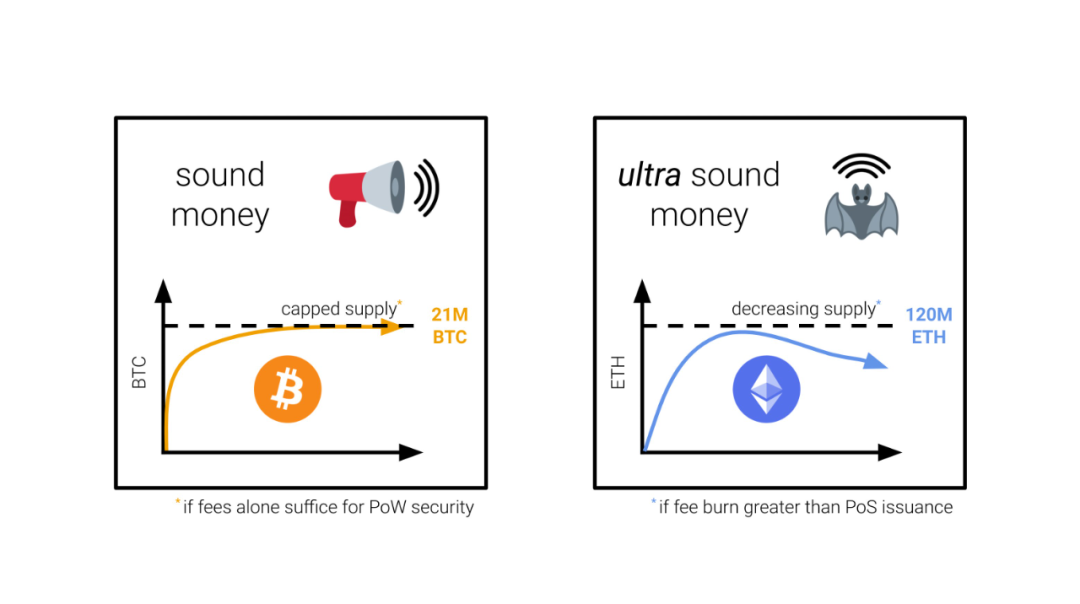

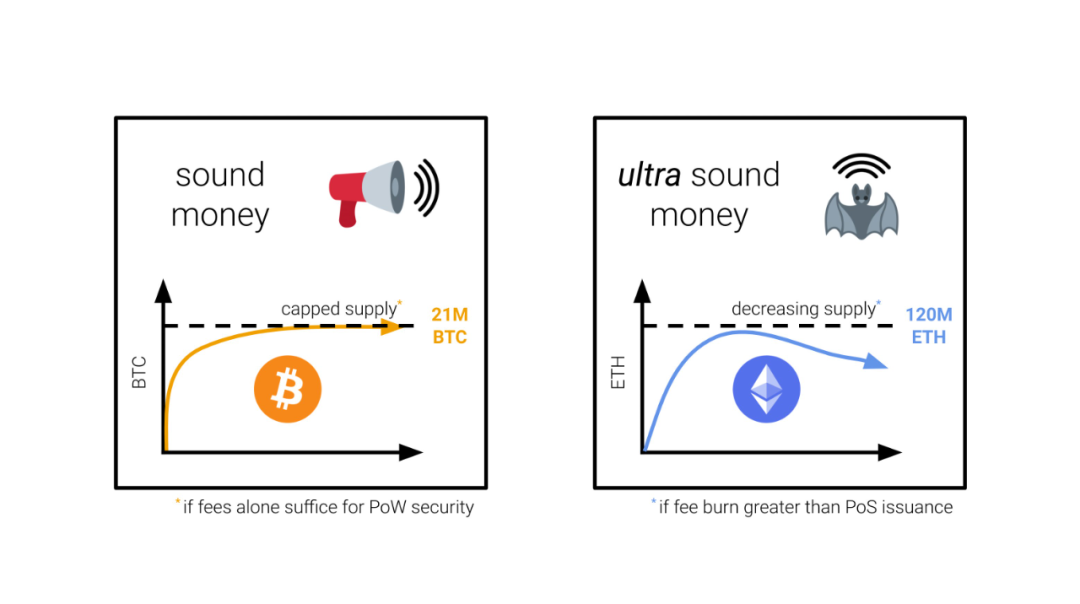

This has led to the recent emergence of the term “ultrasound money” (ultra-sound money) meme within the Ethereum community, coined by Ethereum researcher Justin Drake. The term is a bit silly, but Drake’s point is that if Bitcoin is considered “sound money” due to its capped supply of 21 million, then a cryptocurrency with a gradually decreasing supply should be even better, hence the term “ultrasound money.”

In the long run, Ethereum will be a more scarce asset. However, I may be more optimistic in the short term. With the removal of PoW, ETH issuance will drop by about 90%. According to estimates, this will have an impact on miner sell pressure equivalent to three Bitcoin “halvings.”

3. Stock-Flow Ratio & Transition to PoS

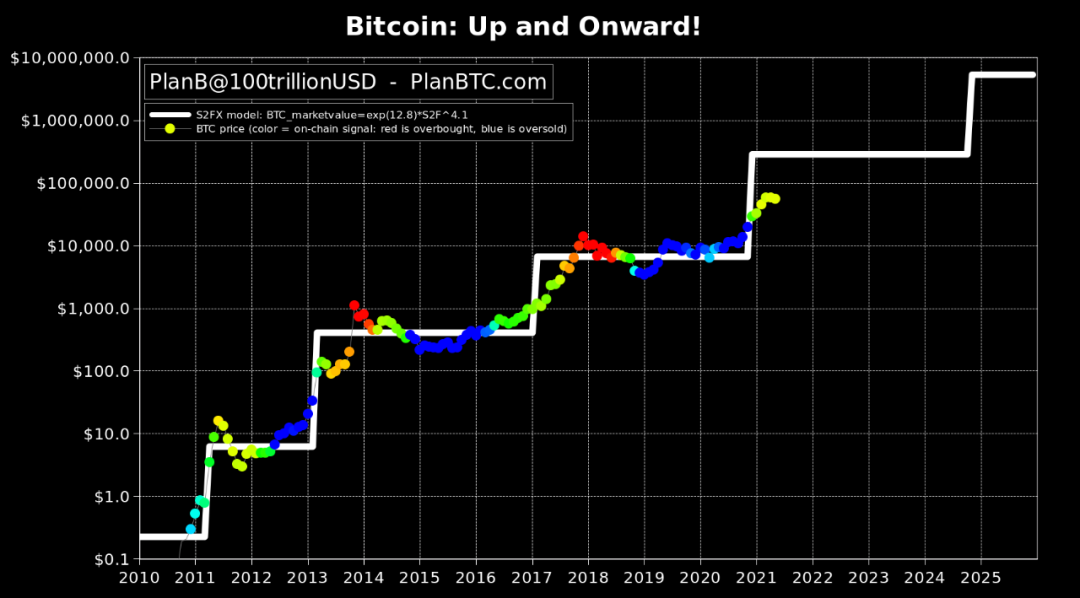

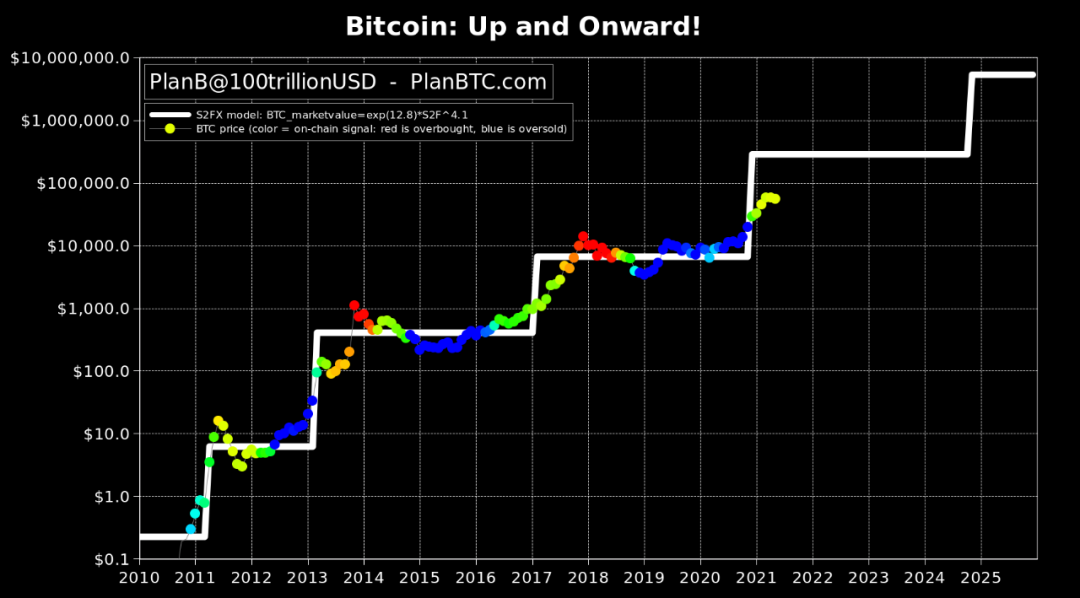

To quantify Bitcoin’s scarcity and apply it to Bitcoin’s value modeling, the best attempt comes from PlanB’s stock-to-flow model [3]. Essentially, PlanB believes that scarcity (defined as the supply growth rate) directly drives value; the scarcer an asset is (i.e., the lower the supply growth rate), the more valuable it becomes. Below is the chart he created to prove his point (where “SF” stands for “stock-to-flow,” calculated inversely to the supply growth rate):

Note: SF = Stock / Flow; Supply Growth = Flow / Stock. The stock of an asset refers to the total number of that asset currently circulating in the market; flow refers to the amount of that asset newly added to circulation each year..

It is shocking that this SF model has held up very well for the two years since its publication. In the chart below, the white line represents the predicted price of BTC, while the multicolored dots represent Bitcoin’s price performance as of May 2021.

As we can see, based on this model, Bitcoin’s value jumps significantly every four years. This is because the block rewards paid to Bitcoin miners are halved every 210,000 blocks (approximately every four years). Since block rewards are the only way to mint new Bitcoins, Bitcoin’s supply growth is halved every four years.

As PlanB has elucidated (and quantified) in his article, the decline in Bitcoin’s supply growth (i.e., halving) is highly correlated with the skyrocketing price of Bitcoin. This may be because the halving directly reduces the miners’ sell pressure by half. Because Bitcoin uses a resource-intensive PoW consensus mechanism, miners must sell Bitcoin to cover their hardware and electricity costs. Therefore, when Bitcoin’s block reward halved from 12.5 BTC to 6.25 BTC in May 2020, the miners’ sell pressure dropped from 1,800 BTC per day to 900 BTC per day. This means that the annual reduction in BTC sold by miners is equivalent to about 1.6% of Bitcoin’s market value (approximately $18 billion at today’s prices). Under such a huge supply shock (decrease), we naturally see the BTC price skyrocket until a new equilibrium is reached based on this reduced inflation rate.

Ethereum is currently also using the PoW consensus mechanism. However, when it fully transitions to PoS, the current annual issuance of about 4.5% of ETH will drop to less than 1%. This is equivalent to more than 3.5% of the market value of Ethereum being sold by miners annually (over $15 billion at today’s prices). Additionally, I expect the sell pressure to be smaller because block rewards will be allocated to stakers (validators) who have very low hardware and electricity costs and do not need to be forced to sell (ETH). However, to be fair, most stakers will still have to sell some ETH to pay taxes on their rewards, so the new ETH market supply will not go to zero.

Of course, in addition to scarcity, there are many other factors driving the value of an asset. The degree of acceptance by others is one such factor. However, scarcity (at least for now) seems to be the most crucial factor affecting the value of commodity money because it influences the sales of the commodity over time. On the other hand, security is also a critical factor. Just as gold does not corrode, decay, or undergo other types of degradation, cryptocurrencies must have proper incentive design to endure. After all, an asset that will not exist decades from now cannot serve as a store of value.

02. More Secure

When holding gold, you don’t have to worry about security issues. From non-duplicability to non-double spending, the laws of physics apply to it. However, with cryptocurrencies, you must constantly pay costs (i.e., block rewards to miners/validators) to ensure network security.

Take the Bitcoin network, for example; a new block is created every 10 minutes. Each block contains newly minted BTC (i.e., “block subsidy,” currently 6.25 BTC per block) and transaction fees, which together constitute the “block reward.” According to Bitcoin’s hard-coded monetary policy, the amount of newly minted BTC per block decreases over time (halving every four years), ultimately reaching 0% by 2140. When this happens, with no new Bitcoins being issued, the only compensation for miners will be transaction fees.

Many Bitcoiners believe this will not be a problem because when the block subsidy runs out, the dollar value of transaction fees will be very high, making (the Bitcoin network’s) security spending sufficient to secure the network. Bitcoin supporter Dan Held wrote in his article, Bitcoin’s Security is Fine [4]:

“I suspect that several hundred billion dollars in present value should be enough for a security budget, because it would be hard for a government to justify such an expense just to attack the Bitcoin blockchain. They would also have to publicly respond to such an attack since their citizens (taxpayers), businesses, and banks would all be invested in Bitcoin.”

He then addresses some concerns often raised about relying solely on transaction fees for (Bitcoin) network security in that article. I agree with many of Held’s points and understand why Satoshi designed Bitcoin this way. Because PoW mechanisms are used, there is always a trade-off between inflation (block subsidy) and security. Bitcoin has made specific trade-offs, and it will continue to pay increasingly less to its consensus engine (i.e., reducing block subsidies) to maintain scarcity and limit the number of Bitcoins to 21 million.

However, I disagree with Held’s view that such dollar-denominated security spending is important and support Vitalik Buterin’s recent post[5] on reddit, which stated:

“The security demand of a thing must be proportional to its size, because as a thing gets bigger, its enemies will also get bigger, and their motivations will be stronger. If BTC (market cap) were 100 times what it is today, then the value (cost) to destroy it would increase 100 times, and those who wish to destroy it would become larger and more formidable. This is also why the military sizes of all countries are roughly proportional to their GDP. So, in reality, the correct data to measure is the attack cost divided by market cap. In the long run, PoW, which ultimately will not issue (new coins), looks less favorable.”

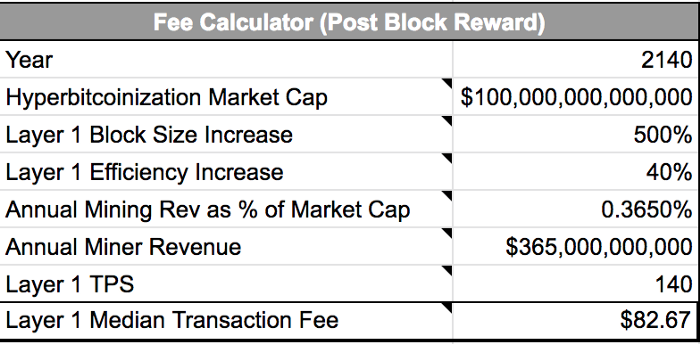

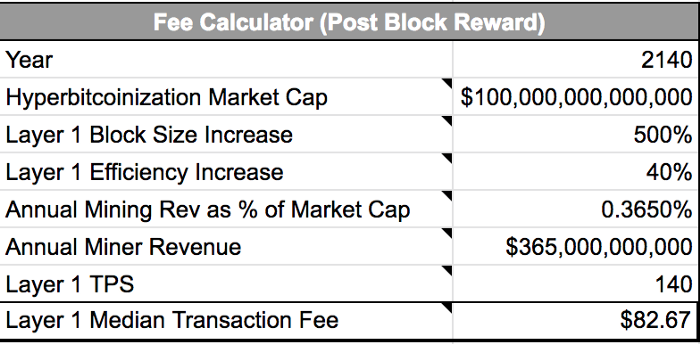

So let’s look at Held’s most optimistic assumption: that Bitcoin “survives and thrives, and its market share continues to grow exponentially, just as it has over the past decade.” In this hypothetical scenario, Bitcoin’s market cap in 2140 would be $100 trillion, and (users) would generate $365 billion in transaction fee income for miners due to demand for Bitcoin block space (this would be the security spending for Bitcoin at that time). See the chart below:

Is $365 billion in security spending really enough to protect the Bitcoin network from attack? Maybe. I’m really not sure, nor do I know what the world will look like in 2140.However, I am very sure that we can do better. In the above hypothetical scenario, Bitcoin’s PoW consensus mechanism would yield a value-to-security ratio (the ratio of Bitcoin’s market cap to its annual security spending) of approximately 273 to 1. In contrast, under Ethereum’s PoS consensus mechanism, we can expect a value-to-security ratio of about 10 to 1. If Ethereum’s market cap were to match Held’s predicted Bitcoin market cap, the cost of launching a 51% attack on the Ethereum network would be roughly equivalent to about $10 trillion, which is over 27 times higher than the $365 billion cost predicted for Bitcoin by Held. The only assumption here is that about 10% of ETH is staked, which seems reasonable; meanwhile, Held’s prediction assumes a 500% increase in Bitcoin block size, a 40% increase in efficiency, and enormous transaction demand for Bitcoin block space.

In addition to the much lower value/security ratio (Note: the lower the value/security ratio, the higher the attack cost), Ethereum has a major advantage in how it responds to attacks. After suffering a 51% attack, the only option for the Bitcoin network is to transition from its current Double SHA-256 ASICs to a new PoW system. This new system would have to be based on commercially available mining hardware, such as GPUs or CPUs, because there would not be enough time to manufacture hardware for another ASIC PoW system. Then the attacker could only launch the same 51% attack on regular hardware.Vitalik calls this a “spawn camping attack”, where a miner alliance that initiates a 51% attack will continuously attack, rendering the chain useless.In PoW systems, there is no way to destroy (or punish) the attacker’s mining capability.

Ethereum (and broader PoS) is less susceptible to this type of attack. This is because the Ethereum network can “slash” or penalize attackers. If an attacker does something wrong, the network will punish them by confiscating their staked ETH. This is akin to Bitcoin destroying the attacker’s mining equipment, but this is something the protocol clearly cannot do.

Ethereum actually has two slashing mechanisms. The first can be called “Layer 1” slashing, which is triggered if you (the validator) do something obviously wrong in the protocol (such as submitting two conflicting proofs), in which case, the Ethereum network will automatically slash at least one-third of your staked ETH. This will address most potential attacks and redistribute ETH from dishonest nodes to honest nodes, making the system somewhat antifragile. If you view this from the perspective of game theory, the Ethereum system becomes stronger each time it is attacked.

Let’s assume the attacker wants to attack again. They must acquire more ETH, attack again, and then be slashed again. Each time an attack occurs, the amount of ETH in circulation decreases, so the actual number of times the system can be attacked is limited. For example, if there are currently 100 million ETH, with 10% staked, for each attack, the attacker would have to purchase at least 10 million ETH, and each time they are slashed, they would have to re-acquire another 10 million ETH. In the worst-case scenario, the attacker can only attack the system 9 times. Furthermore, the cost of each attack will increase because the price of ETH in the open market is likely to rise as the supply decreases.

This antifragility is also present at the level of single-instance games. If you want to attack the Ethereum network, you must acquire 10 million ETH (using simplified numbers in the above example). Due to simple supply and demand, the more ETH you want to buy, the more expensive ETH will become as the available ETH for sale decreases, creating a diseconomy of scale (diseconomies of scale) where the cost of buying 1% of the ETH supply the second time is much higher than the first time, as there is less ETH available for sale after you have purchased 1% of the ETH supply the first time.

To alleviate the fear of miners or mining pools gaining 51% hash power, a common argument (hypothetical) is: even if they gain 51% hash power, why would they want to attack? After all, attacking the network would destroy the “golden goose” that lays the eggs, which is not in their interest.But in reality, we cannot assume this; this argument not only assumes rationality but also assumes the absence of outside incentives (outside incentives). The entire point of having a high level of security is to prevent those with outside incentives from compromising the chain. This is why Vitalik’s approach to thinking about PoS security is “If they (the attackers) have X billion dollars, how many times can they attack this chain before all their funds are slashed?” This is not an assumption of rationality but merely assumes that malicious actors have limited economic resources.

Perhaps the best argument I have heard for PoW security is that its hardware-driven nature (mining machines) adds resistance for those with ample capital to attack: you have to wait a year for this hardware to be manufactured, which inherently involves many people, and the risk of being discovered during this process (i.e., while gradually increasing your hash power) is very high. This is the true advantage of PoW. That said, physical hardware also has a key drawback: it is challenging to conduct large-scale mining without detection, while PoS is more censorship-resistant.

In terms of security, participating in Ethereum staking does not leave any “footprint,” which is a huge advantage: to become an Ethereum validator, all you need is ETH, a Raspberry Pi, an SSD, and an internet connection. This stands in stark contrast to Bitcoin mining, where becoming a miner leaves a significant “footprint”: miners need to consume vast amounts of energy and use huge warehouses to store mining equipment. Such a “footprint” allows governments to relatively easily discover and shut down mining activities. However, with Ethereum, you (the validator) can be located anywhere in the world (perhaps after using the Tor network, you can even hide your IP address). Even if a country could find and confiscate your physical equipment validating Ethereum, that equipment does not store your staked ETH: ETH exists only in the digital realm and can only be confiscated by forcing the owner to hand over their private keys.

People sometimes forget that when Satoshi Nakamoto created Bitcoin over a decade ago, it was the first successful attempt to create digital scarcity and incentive design for a PoW consensus system. While the name “Satoshi” is clever, this person (or team) is human and could not reasonably be expected to foresee all potential issues arising from Bitcoin’s incentive design. Since then, the blockchain space has undergone over 12 years of research and development in network security and scalability.

In my view, Ethereum seems to be a more secure network in the long run.

03. Organic Demand

In 1944, the Bretton Woods Agreement laid the groundwork for a near-global lock on the US currency system. However, merely a decade later, the Bretton Woods system began to unravel. The US began to experience massive fiscal deficits, inflation levels rose moderately, first due to domestic projects in the late 1960s (the post-war US economy was heavily developed) and then due to the Vietnam War. Soon, the US’s gold reserves began to dwindle as other countries began to doubt the dollar’s backing and exchanged dollars for gold. The continued decrease in gold reserves ultimately forced Richard Nixon to end the dollar’s convertibility to gold in 1971.

After the collapse of the Bretton Woods system, every currency became fiat. This was the first time in human history that all currencies in the world were transformed into paper money without any backing. These currencies themselves have no intrinsic value. Their value comes from the government declaring them valuable and forcing their use as a medium of exchange and unit of account by mandating that all taxes be paid only in that currency or by enacting other laws that increase the barriers to the use of other media of exchange and units of account (or in some cases, completely prohibiting them).

However, outside of the US, foreign businesses and governments had little reason to accept (dollar) paper currency because these currencies could be printed endlessly and had no solid backing. But it turned out that the US created a sustained international demand for the dollar through the petrodollar system, forcing global adoption of the dollar.

In 1974, the US and Saudi Arabia reached an agreement. Saudi Arabia (and other OPEC member countries) would only sell oil in dollars in exchange for US protection and cooperation. For example, even if Germany wanted to buy oil from Saudi Arabia, they could only do so with dollars. Since then, any country wanting oil had to use dollars to pay. As a result, non-oil-producing countries began to sell many of their exports in dollars so that they could acquire the dollars they needed to purchase oil from oil-producing countries. All these countries would hold excess dollars as foreign exchange reserves.

Over time, this system has strengthened. As Lyn Alden wrote in her excellent article, The Fraying of The US Global Currency Reserve System [6]:

“Initially, countries needed dollars to obtain oil. Decades later, as so much international financing was conducted in dollars, countries now need dollars to repay dollar-denominated debt. Therefore, the dollar is supported by oil and dollar-denominated debt, creating a very powerful self-reinforcing network effect. Importantly, most of this debt is not owed to the US (even though it is dollar-denominated), but to other countries. For instance, China provides many dollar-based loans to developing countries, as do Europe and Japan.”

It is this “self-reinforcing network effect” that has led everyone in the world to accept the paper issued by the US government in exchange for tangible goods and services. This is undoubtedly the fundamental reason for the dollar becoming the global reserve asset. Why is this important? I believe that a similar system—and a virtuous cycle—is beginning to form around the Ethereum network.

Over the past decade, the demand side of most crypto networks has been dominated by speculation. This is understandable. Speculation has funded the construction of the supply side (infrastructure, applications, etc.) of these networks.But this is changing. You need to use ETH to do things on the Ethereum network, and people are doing a lot of things in this network: they are buying domain names, trading tokens, lending, issuing bonds, using prediction markets, making payments, buying insurance, purchasing art, gaming, buying virtual land in the metaverse, horse racing, and more.All these activities require using ETH to pay transaction fees.

As applications built on Ethereum become increasingly complex and intuitive for users over time, demand for Ethereum will grow. Of the top 100 crypto projects, 94 are built on Ethereum, with over 3,000 Dapps and 200,000 ERC-20 tokens running on Ethereum. The total transaction volume on Ethereum reaches historical highs daily, and the average transaction value on Ethereum is over twice that of Bitcoin.

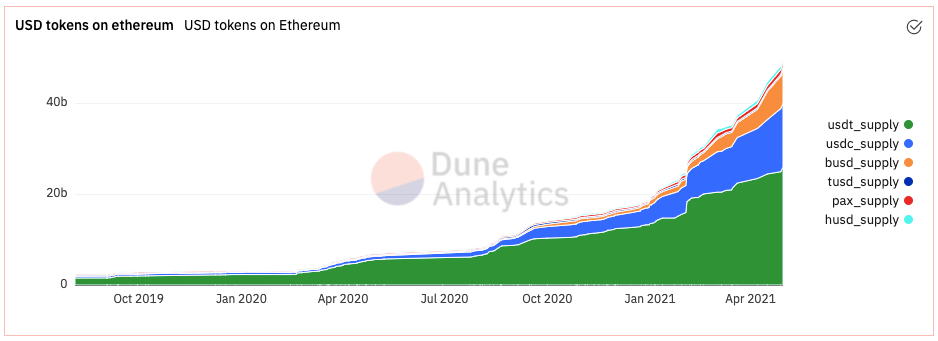

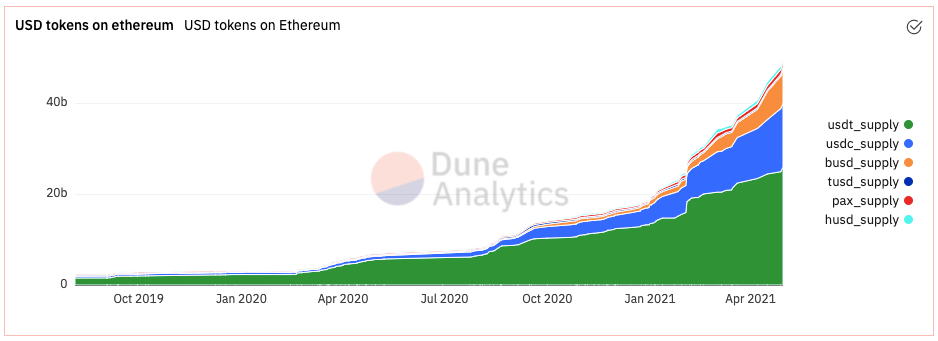

Some of these numbers are indeed staggering. (At the time of writing) over $80 billion in ETH is locked in DeFi applications, up from $16 billion in January. In the past 12 months, decentralized exchanges (DEX) like Uniswap and Sushiswap have reached $432 billion in trading volume on Ethereum, as these automated market makers (AMM) have made token trading easier than ever. The supply of stablecoins on Ethereum has grown from $19.5 billion in January to over $48 billion today.

Above: The growth of various types of stablecoins supplied on Ethereum.

Ethereum is not only the settlement layer for almost all leading Dapps but also the settlement layer for almost the entire digital dollar (i.e., dollar-pegged stablecoin) ecosystem. Even traditional financial services companies like Visa are allowing transactions to be settled using USDC on Ethereum, indicating that stablecoins have now far exceeded the use cases of traditional cryptocurrencies. Just weeks ago, the EU’s investment department used Ethereum to issue €100 million (approximately $121 million) in two-year digital notes for the first time.

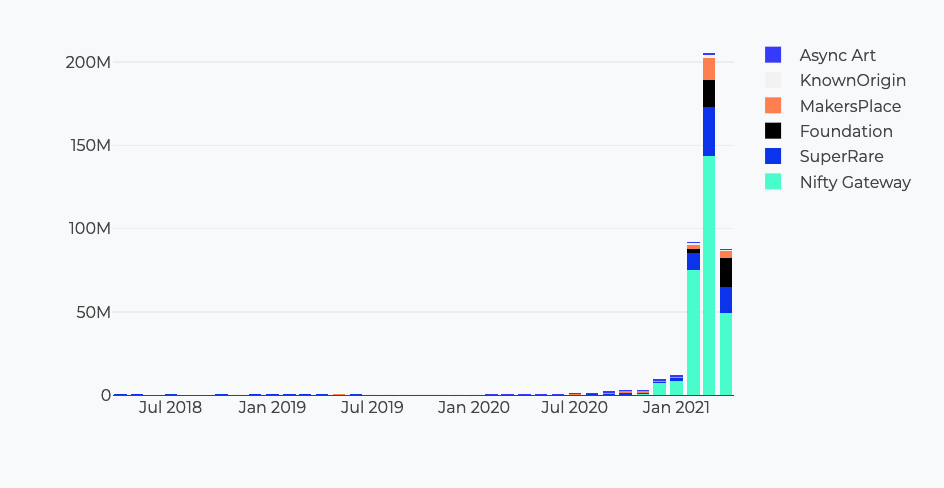

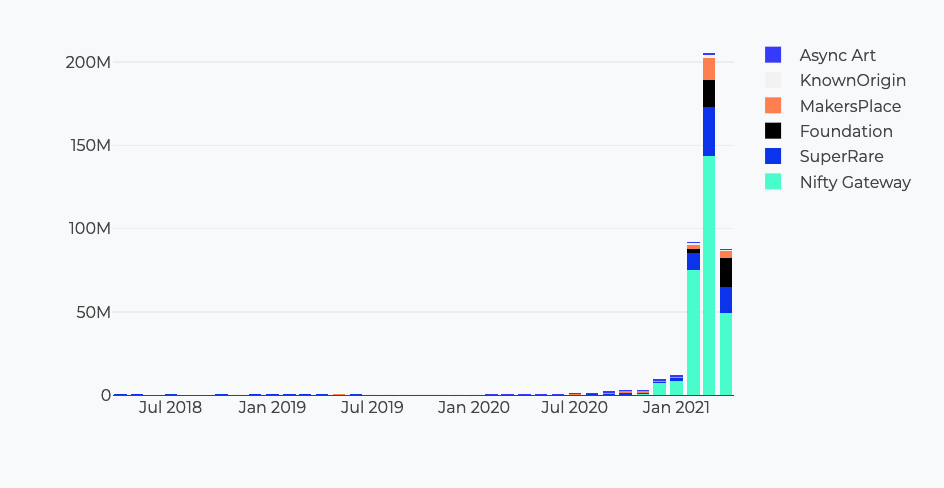

Additionally, sales of NFTs (non-fungible tokens) on Ethereum have exceeded $600 million, with 13 NFTs selling for over $1 million each. The use cases for NFTs are exploding.

Above: The growth of various types of stablecoins supplied on Ethereum.

Ethereum is not only the settlement layer for almost all leading Dapps but also the settlement layer for almost the entire digital dollar (i.e., dollar-pegged stablecoin) ecosystem. Even traditional financial services companies like Visa are allowing transactions to be settled using USDC on Ethereum, indicating that stablecoins have now far exceeded the use cases of traditional cryptocurrencies. Just weeks ago, the EU’s investment department used Ethereum to issue €100 million (approximately $121 million) in two-year digital notes for the first time.

Additionally, sales of NFTs (non-fungible tokens) on Ethereum have exceeded $600 million, with 13 NFTs selling for over $1 million each. The use cases for NFTs are exploding.

Similarly, if you want to interact with any of the use cases mentioned above on the Ethereum network, you must pay fees to the miners/validators processing your transactions. Ethereum is essentially a decentralized computer that requires payment for computational power. These fees are referred to as “Gas,” and the similarities to oil are striking.

The more useful the applications built on Ethereum are, the greater the demand for ETH will be. It is estimated that just using cumulative revenue as a metric, the TAM (Total Addressable Market) of DeFi reaches $2.7 trillion (2%-3% of global GDP). Understanding this, it is easy to see how a system similar to the petrodollar could develop around the Ethereum network. Let’s modify Lyn Alden’s words above:

Initially, everyone needed ETH to use this global decentralized computer. Decades later, as so much international financing is conducted in ETH, people now need ETH to repay debt denominated in ETH. Therefore, ETH is supported by both computational demand and debt denominated in ETH, creating a very powerful self-reinforcing network effect.

Comparing the demand for ETH to the demand for oil may seem a bit far-fetched, but if the world’s financial infrastructure is based on Ethereum, would it still be far-fetched? In my view, ETH increasingly seems likely to benefit from this self-reinforcing network effect, similar to what made the dollar the global reserve currency.

Overall, Ethereum mimics Bitcoin in many ways but significantly expands potential use cases by creating a virtual decentralized computer, providing a substantial improvement.These use cases provide organic, sustainable, and growing demand for Ethereum block space. As these use cases flourish and are more widely adopted, demand will only increase.

Because the “best” money will provide the greatest purchasing power to its holders, this organic demand further increases the probability of ETH winning the store of value battle.

04. Real Yield

Wall Street financial mogul George Soros may be the greatest forex trader in history. In his book The Alchemy of Finance, he reveals much about his decision-making process. The third chapter is titled “Reflexivity in the Currency Market,” which describes the vicious and virtuous cycles in currency markets. In this chapter, Soros argues that there are complementary factors in traditional currency markets that cause significant fluctuations characterized by exchange rates, interest rates, inflation, and/or levels of economic activity. This chapter is highly technical, but let’s focus on the key drivers of speculative capital: rising exchange rates and interest rates.

We focus on speculative capital because it is one of the three main drivers of exchange rate changes (the other two being trade and the flow of non-speculative capital). In fact, “fundamentals” (the “more scarce” and “organic demand” factors we discussed earlier are also fundamentals for ETH) are also influenced by market participants’ expectations of future exchange rate trends (i.e., the two influence each other).

(Note: the two influence each other)

This is just one example of Soros’s “reflexivity” concept, which is easily observable in Ethereum: speculation drives many investors and developers to invest their time and money in building network infrastructure and applications on it. In fact, speculative capital is crucial to the fundamentals.

“Speculative capital seeks the highest total returns. (The factors influencing) total returns are three: interest rate differentials, exchange rate differentials, and appreciation of the local currency. Since the third factor varies by situation, we can propose the following general rule: speculative capital is attracted by rising exchange rates and interest rates. Among these two factors, the exchange rate is the most important. A currency’s exchange rate does not need to fall too much for total returns to be negative. Similarly, when a currency that appreciates also has an interest rate advantage, total returns exceed any expectations of financial asset holders under normal circumstances.”

Let’s analyze this. The exchange rate is the most important factor. This makes sense. If I stake ETH at an 8.5% interest rate but the price drops by 10%, I lose money. Therefore, we really shouldn’t focus on interest rates until we can determine that exchange rates will rise. This is why most altcoins with annual returns exceeding 1000% are poor bets, while Bitcoin has been such a great bet over the past 12 years. This is also why I focused on the key factors driving ETH prices up in the first three sections of this article.

Let’s assume Bitcoin and Ethereum have similarly appealing monetary properties, and the market expects both assets to appreciate 100% this year. In this case, rational investors should not have a strong preference for either of the two assets. However, if you let the same investor earn a return of 6% by staking ETH on Coinbase (or let them run a validator node themselves to earn 8%+ returns), the situation starts to change. Although the expected return of 100% for (BTC) and 106% for (ETH) does not seem significantly different, over the long term, this will make a huge difference. As speculation in cryptocurrencies decreases, the market becomes more efficient, and the expected appreciation of assets will drop to more reasonable levels, especially true.Over time, this additional 6% staking yield could take up an increasingly large proportion of ETH’s expected total return.

By staking ETH, you can earn an additional risk-free yield of over 6%, which will incentivize some investors to shift capital from Bitcoin to Ethereum. This is how the market works. For example, since 2008, foreign investment in the US has reached about $8.5 trillion, most of which has increased since 2011, as investors sought higher returns in the form of arbitrage (the yield on US bonds was higher than the zero or negative yields in Europe and Japan).Speculative capital naturally flows to the asset with the highest expected real yield.

Ethereum’s virtuous cycle will create a vicious cycle for Bitcoin. As more speculative capital flows from Bitcoin to Ethereum in search of higher real yields, the expected exchange rate between the two currencies will also change.This will not happen overnight, but over time, I expect the market’s expectations for Ethereum’s price appreciation to exceed those of Bitcoin. When this happens, Bitcoin’s situation could be dire. As Soros wrote:

“The longer a virtuous cycle lasts, the more attractive financial assets holding appreciating currencies become, and the more important exchange rates become in calculating total returns. Those who tend to fight against the trend will gradually be eliminated, and ultimately only trend followers will survive as active participants. As speculation becomes increasingly important, other factors lose their influence. The market itself, which is dominated by trend followers, is the only consideration guiding speculators. These considerations explain how the dollar can continue to appreciate in the face of expanding trade deficits.”

I love Bitcoin and everything it represents, but this scenario seems increasingly likely to unfold. I wonder what would happen if Ethereum’s market cap surpassed Bitcoin’s for a period of time. If Bitcoin is not the most liquid asset in cryptocurrencies, what asset would that be?

Another aspect I won’t delve into too deeply is that for most large ETH holders, using (ETH for) staking and yield farming in DeFi is sufficient to provide passive daily income. They no longer need or want to sell ETH because they can earn passive income of 8%+ from staking rewards and even higher yield farming rewards. This will further enhance Ethereum’s scarcity and future expected price increases.

05. Risks & Concerns

In summary, these four factors (more scarcity, more security, organic demand, real yield) are the main reasons I believe Ethereum will ultimately win the store of value battle. Of course, my conclusions above are not deterministic, and this article would be incomplete if it did not discuss some of the risks present. Because this article is already lengthy, I will briefly comment on each risk.

1. Scalability Challenges

Currently, when the (Ethereum) network is busy, transaction speeds are affected, resulting in poor user experience for certain types of Dapps. As the network becomes busy, gas prices also rise as transaction senders bid against each other. This makes using Ethereum very expensive. A few months ago, the gas price for completing a simple transaction reached as high as $100-200, but prices have decreased with the Berlin upgrade, coinciding with ETH reaching a new all-time high.

This could be Ethereum’s most critical risk, as it opens the door for competing projects, such as Solana, which are doing interesting things in this space. But ultimately, Ethereum has many options to improve the speed, efficiency, and scalability of the network.Layer 2 solutions and sharding are perhaps the most noteworthy. However, they are not without technical risks, and they are urgently needed.

2. Other Layer 1 Solutions

I can’t help but wonder if Ethereum will eventually be replaced by a cryptocurrency that learns from Ethereum’s experiments and improves on certain fundamentals. Many “Ethereum killers” are trying to take advantage of Ethereum’s weaknesses to become the dominant player, including Polkadot, Solana, Cosmos, Cardano, and others.

As Peter Thiel (billionaire venture capitalist) explained in his Stanford entrepreneurship lecture, “People often talk about ‘first mover advantage.’ But focusing on this can be problematic; you can be first and then slowly fade away. More important than being first is the one who comes later. You must have staying power.”

Two years before Amazon (Amazon) was born, there was Book Stacks Unlimited (an online bookstore). Four years before Google, Yahoo! (Yahoo) created the initial global search engine. Before Facebook, MySpace dominated social media. There are countless examples like this. In the history of technology, there are countless such examples: the first mover becomes interested in a concept or product, and the later mover takes advantage of the opportunity to improve the existing product.

But Ethereum has strong protections against this risk of being replaced. It has many of the same network effects as Bitcoin, and the Ethereum community and protocol are innovation-friendly, which may be equally important. The meme that “Bitcoin will absorb all innovation” has never come to fruition. In reality, Ethereum has the opportunity to do so, largely because they have “functional escape velocity” at the EVM level.

While I acknowledge that constant adaptation to new developments and risks in this field is necessary, Ethereum currently looks like the best option.

3. Stability of Monetary Policy

Bitcoin may be the most immutable crypto system ever created. Bitcoiners believe this is where Bitcoin’s true value lies. It is a reliable neutral system based on code (not humans) that you can rely on for decades.

Ethereum’s human-managed hard forks and relatively centralized development team introduce risks. How can we trust that Ethereum’s monetary policy won’t change again? How can we ensure that an adverse (protocol) change won’t occur? Even if the Ethereum community agrees that it will never change and respects that, it will always lag behind the trust built by Bitcoin over 12 years.

If Ethereum is to become a global store of value, this is an important question, but as mentioned above, I believe Ethereum is sacrificing short-term (monetary issuance) stability for long-term security. Ethereum is already quite decentralized, and its relatively centralized aspects allow them (Ethereum development team) to innovate in terms of security, monetary policy, and effectiveness.

As is almost always the case in (protocol) design, the transition from PoW to PoS involves trade-offs. The first is complexity. Bitcoin’s PoW system is very simple; you can write pseudocode for it in just a few lines. But Ethereum’s PoS is much more complex. The state transition mechanism of the beacon chain may require about 1000 lines of code, so we will see the complexity increase by about 100 times. This is a very real trade-off—complexity leaves room for bugs and may lead to scalability issues and other problems. The good news is that Ethereum has handled this complexity well, proving that it can overcome this complexity with four production-grade (client) implementations protecting the beacon chain.

Some believe that Bitcoin is “monopolistic in fairness” because when it launched, no one knew what it would become. They believe this is something that cannot be replicated and gives Bitcoin some of its best properties. Anything with a presale cannot be considered fair. Furthermore, Bitcoin’s PoW system provides a great enforcement mechanism for the distribution of BTC because miners must sell Bitcoin to cover their hardware and electricity costs. PoS does not have this property. Ethereum’s stakers will simply accumulate more ETH and will not be forced to sell ETH because PoS is highly efficient, with very low hardware and electricity costs. Thus, Bitcoiners believe that PoS will establish a permanent oligarchy.

However, as previously mentioned, this is a misunderstanding because income tax (around 50% in many jurisdictions) will play an economic enforcement role. Additionally, Ethereum has been using the PoW system for nearly six years, and many Ethereum supporters believe this has resulted in a good distribution of ETH.

Furthermore, do most market participants really care whether the network is fair? I would argue that most of them act out of self-interest, buying any asset they believe will make them the most money. And who can decide what a fair distribution looks like and what doesn’t?

Note: This article solely represents the author’s views, and the translation has been slightly abridged. For the original English text, see:

https://michaelmcguiness.com/essays/why-eth-will-win-store-of-value

Links mentioned in the text:

[1]:https://michaelmcguiness.com/essays/why-bitcoin-makes-sense

[2]:https://vitalik.ca/general/2020/11/06/pos2020.html

[3]:https://medium.com/@100trillionUSD/modeling-bitcoins-value-with-scarcity-91fa0fc03e25

[4]:https://danhedl.medium.com/bitcoins-security-is-fine-93391d9b61a8

[5]:https://www.reddit.com/r/ethereum/comments/mf31ia/a_brain_dump_on_pos_vs_pow_arguments

[6]:https://www.lynalden.com/fraying-petrodollar-system/

-END- <strong>Article copyright belongs to the original author, and its content and views do not represent Unitimes' stance. All images appearing on this WeChat platform are collected from the internet, and copyright belongs to the copyright owner. If the copyright holder believes that their work should not be made available for browsing or should not be used free of charge, please add WeChat unitimes2018 to contact us, and we will immediately correct it.</strong>