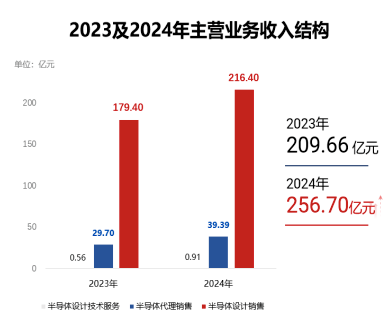

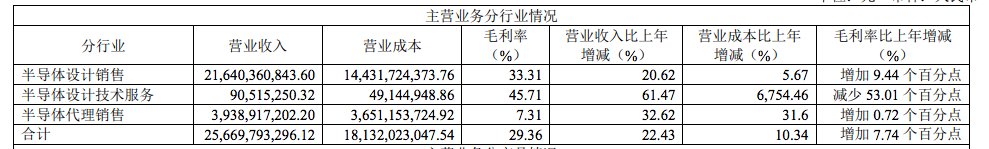

Recently, China’s leading semiconductor design company Weir Shares (603501) has delivered an impressive performance report. Driven by the continuous introduction of products in the high-end smartphone market and the accelerated penetration of automotive intelligence, the company’s performance has seen significant growth, with operating revenue reaching a historical high and net profit increasing substantially!According to the company’s disclosed 2024 financial report, the main business revenue for 2024 is 25.670 billion yuan, an increase of 22.43% compared to the main business revenue of 2023; the net profit attributable to shareholders of the parent company is 3.323 billion yuan, an increase of 498.11% compared to 2023.The gross margin of semiconductor chip design has significantly improvedWeir Shares mainly covers three major business segments, including semiconductor design, semiconductor design technology services, and semiconductor agency sales. The semiconductor design business accounts for the largest proportion of total business, exceeding 80%.In terms of business revenue, the semiconductor design business, which has the highest proportion (84%), achieved product sales revenue of 21.640 billion yuan, an increase of 20.62% compared to the previous year; the semiconductor agency sales business, which ranks second (15%), achieved revenue of 3.939 billion yuan, an increase of 32.62% compared to the previous year. In terms of gross margin, the semiconductor design sales business has shown significant growth, reaching9.44%; the gross margin of semiconductor agency sales has slightly increased to 0.72%; while the gross margin of semiconductor design technology services has significantly declined to-53.01.

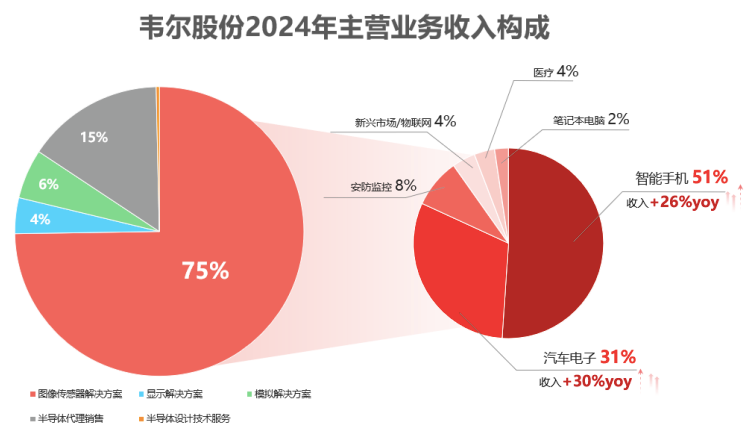

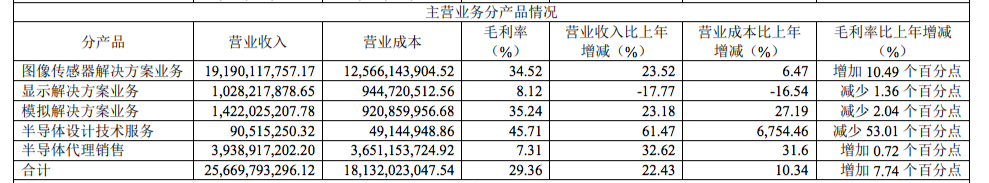

In terms of gross margin, the semiconductor design sales business has shown significant growth, reaching9.44%; the gross margin of semiconductor agency sales has slightly increased to 0.72%; while the gross margin of semiconductor design technology services has significantly declined to-53.01. Multi-field Drives Growth in CIS and Analog Chip IndustriesThe semiconductor design business of Weir Shares mainly consists of image sensor solutions, display solutions, and analog solutions, forming three major product systems. Among them, image sensor (CIS) solutions account for the highest proportion of total business revenue, reaching 75%; display solutions and analog solutions account for 4% and 6% of total business, respectively.

Multi-field Drives Growth in CIS and Analog Chip IndustriesThe semiconductor design business of Weir Shares mainly consists of image sensor solutions, display solutions, and analog solutions, forming three major product systems. Among them, image sensor (CIS) solutions account for the highest proportion of total business revenue, reaching 75%; display solutions and analog solutions account for 4% and 6% of total business, respectively. In 2024, the company’s image sensor solutions and analog solutions both achieved revenue growth, increasing by 23.52% and 23.18% respectively. However, revenue from the display solutions business declined, decreasing by 17.77% compared to the previous year.Image sensor revenue surged by 24%, driven by smartphones and automotive applications The image sensor solutions business, which accounts for the largest proportion of total business, achieved operating revenue of 19.190 billion yuan in 2024, an increase of 23.52% compared to the previous year. The growth was mainly due to a significant increase in operating revenue from image sensors in the smartphone and automotive markets.

In 2024, the company’s image sensor solutions and analog solutions both achieved revenue growth, increasing by 23.52% and 23.18% respectively. However, revenue from the display solutions business declined, decreasing by 17.77% compared to the previous year.Image sensor revenue surged by 24%, driven by smartphones and automotive applications The image sensor solutions business, which accounts for the largest proportion of total business, achieved operating revenue of 19.190 billion yuan in 2024, an increase of 23.52% compared to the previous year. The growth was mainly due to a significant increase in operating revenue from image sensors in the smartphone and automotive markets. Looking at the image sensor market by segment:

Looking at the image sensor market by segment:

- High-end products in the smartphone market are selling strongly: Revenue from the smartphone market reached approximately 9.802 billion yuan, an increase of 26.01% compared to the same period last year.

- Accelerated penetration of automotive intelligent driving: Revenue from the automotive market for image sensors reached approximately 5.905 billion yuan, an increase of 29.85% compared to the same period last year, with market share continuing to rise.

- Weak recovery in the security market: Revenue from the security market for image sensors reached approximately 1.603 billion yuan, a decrease of 6.92% compared to the same period last year. (Currently, the traditional security monitoring market is still in a weak recovery phase, with demand for consumer security, especially for export security products, gradually recovering, and demand from the traditional security market for image sensors is gradually being released.)

- Recovery in the medical market: Revenue from the medical market for image sensors reached approximately 668 million yuan, an increase of 59.35% compared to the same period last year. (The inventory destocking cycle in the medical imaging field has come to an end, and global downstream related demand is gradually recovering, with customers entering a new inventory stocking cycle.)

- AR/VR applications are accelerating penetration across multiple scenarios, with the machine vision market gearing up for expansion: Revenue from emerging markets/IoT for image sensors reached approximately 760 million yuan, an increase of 42.37% compared to the same period last year.

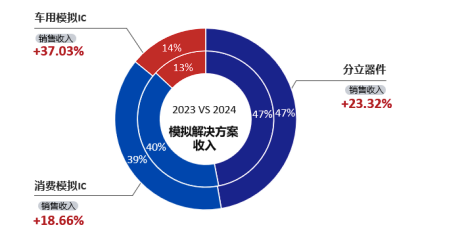

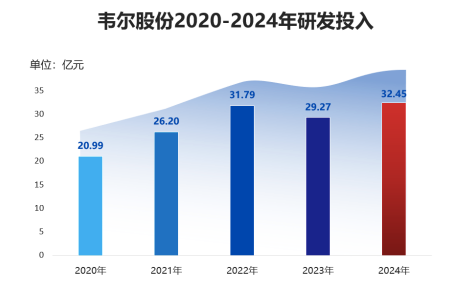

Analog solutions revenue increased by 37%: Automotive analog ICs become a new growth point Weir Shares’ analog solutions mainly include analog ICs and discrete devices. As inventory destocking in industries such as consumer electronics is completed, demand has significantly rebounded. The company’s analog solutions business achieved operating revenue of 1.422 billion yuan, an increase of 23.18% compared to the same period last year. Weir Shares continues to advance its product layout in automotive analog chips, promoting the validation and introduction of multiple products such as CAN/LIN, SerDes, PMIC, and SBC, contributing new growth points for analog solutions, with automotive analog ICs increasing by 37.03% year-on-year.  Display solutions: Price pressure leads to significant revenue decline Weir Shares’ display solutions cover various products including LCD-TDDI, OLED DDIC, and TED (Tcon Embedded Driver), currently mainly applied in the smartphone market. Affected by the imbalance in industry supply and demand, the average price of the company’s LCD-TDDI products continues to be under pressure, and the display solutions business achieved operating revenue of 1.028 billion yuan, a decrease of 17.77% compared to the same period last year. Continuing to increase R&D investment, with a 10% annual increase Weir Shares continues to steadily increase R&D investment across various product areas, providing sufficient support for product upgrades and new product development, steadily enhancing product competitiveness. In 2024, the company’s R&D investment in semiconductor design sales business is approximately 3.245 billion yuan, accounting for 15.00% of the company’s semiconductor design sales revenue, an increase of 10.89% compared to the previous year.

Display solutions: Price pressure leads to significant revenue decline Weir Shares’ display solutions cover various products including LCD-TDDI, OLED DDIC, and TED (Tcon Embedded Driver), currently mainly applied in the smartphone market. Affected by the imbalance in industry supply and demand, the average price of the company’s LCD-TDDI products continues to be under pressure, and the display solutions business achieved operating revenue of 1.028 billion yuan, a decrease of 17.77% compared to the same period last year. Continuing to increase R&D investment, with a 10% annual increase Weir Shares continues to steadily increase R&D investment across various product areas, providing sufficient support for product upgrades and new product development, steadily enhancing product competitiveness. In 2024, the company’s R&D investment in semiconductor design sales business is approximately 3.245 billion yuan, accounting for 15.00% of the company’s semiconductor design sales revenue, an increase of 10.89% compared to the previous year. Conclusion As one of the top 10 chip design companies globally, this significant performance increase and continued R&D investment will allow Weir Shares to maintain its leading position in image sensors (CIS). Furthermore, under the impact of the US tariff policy, the global semiconductor supply chain is facing significant uncertainty. The domestic semiconductor replacement is ushering in more opportunities, especially in the analog chip sector, where the domestic replacement rate is currently low, and companies like Weir Shares have significant space and opportunities to replace foreign brands.Let us wait and see, looking forward to further breakthroughs from domestic chip companies!Previous HighlightsFailed to reach an agreement! Onsemi cancels 6.9 billion acquisition planDomestic power chip company: one business increased by 1402% year-on-year!Faced with “roadblocks”! Yageo’s acquisition of Shibaura Electronics faces uncertaintiesStorage giant: Additional fees related to tariffs imposed!In the first quarter of 2025, China’s integrated circuit exports increased by 12% year-on-year!China Semiconductor Industry Association urgent notice! Concerning the “origin” identification rules2.5 billion USD! Infineon acquires Marvell’s automotive businessPassive component giant price increase notice, effective June 1Storage giant Samsung: Seeking a 5% price increase

Conclusion As one of the top 10 chip design companies globally, this significant performance increase and continued R&D investment will allow Weir Shares to maintain its leading position in image sensors (CIS). Furthermore, under the impact of the US tariff policy, the global semiconductor supply chain is facing significant uncertainty. The domestic semiconductor replacement is ushering in more opportunities, especially in the analog chip sector, where the domestic replacement rate is currently low, and companies like Weir Shares have significant space and opportunities to replace foreign brands.Let us wait and see, looking forward to further breakthroughs from domestic chip companies!Previous HighlightsFailed to reach an agreement! Onsemi cancels 6.9 billion acquisition planDomestic power chip company: one business increased by 1402% year-on-year!Faced with “roadblocks”! Yageo’s acquisition of Shibaura Electronics faces uncertaintiesStorage giant: Additional fees related to tariffs imposed!In the first quarter of 2025, China’s integrated circuit exports increased by 12% year-on-year!China Semiconductor Industry Association urgent notice! Concerning the “origin” identification rules2.5 billion USD! Infineon acquires Marvell’s automotive businessPassive component giant price increase notice, effective June 1Storage giant Samsung: Seeking a 5% price increase Scan to follow Chip Affairs Stay updated on the latest chip industry trends

Scan to follow Chip Affairs Stay updated on the latest chip industry trends

#Weir Shares #Semiconductor #Image Sensor #Analog Chip #Financial Report Data