Click to Follow ▲ Ai Qi SEM

Knowledge | Experience | Information | Resources Four Major Sections

From SEM to Integrated Internet Marketing

Author: Bai Dongli, CEO of Re Yun Data

WeChat Official Account: Re Yun Data

This article is part of a series aimed at providing a deeper understanding of “user acquisition” through real big data.

Recently, I spent two weeks traveling across the country, engaging in many discussions (mainly over drinks) with friends in user acquisition from Chengdu, Shanghai, Guangzhou, Shenzhen, Xiamen, and Beijing. In addition to in-depth conversations with many experienced user acquisition veterans, I also interacted with several new teams just entering the user acquisition field. In this article, I hope to continue discussing the topic of user acquisition, with content that is suitable for both veterans and newcomers, and I hope it will be helpful to both.

This content includes:

1. An in-depth analysis of advertising channel data to understand why you can’t afford users!

2. The arrival of wealthy players, with blockbuster campaigns about to unfold!

3. A discussion on cheating!

01

An In-Depth Analysis of Advertising Channel Data: Understanding Why You Can’t Afford Users!

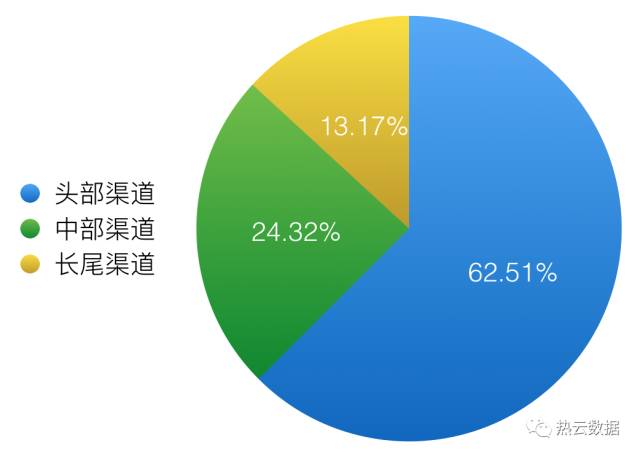

Everyone knows that both Android and iOS are facing the issue of increasingly expensive users. Let’s analyze this from the data of advertising channels. First, let’s look at a dataset where I selected the top 386 advertising channels and platforms from the last month (with a cumulative app activation number greater than 500). Among them, the top five channels accounted for 62.51% of the total activation volume, 31 middle channels accounted for 24.32%, and 350 long-tail channels accounted for 13.17%.

From the data, we can see that the top channels are currently the most competitive in user acquisition. The top channels include Toutiao, Guangdiantong, Zhihuitui (including Zhihuitui external links), UC Toutiao, and WeChat MP. Experienced users can navigate these platforms, while those with less experience must first learn how to acquire users on these channels.

Then the questions arise: Why is the conversion rate on Toutiao low? Why is Zhihuitui unaffordable? Why is WeChat MP too expensive? How much does it cost to maintain an account? Another piece of data shows that among all advertisers who have run ads in the last month, over 50% have advertised on Toutiao, 39% on Zhihuitui (including external links), 32% on UC Toutiao, 28% on Guangdiantong, and 10% on WeChat MP.

The reason so many advertisers prioritize top channels is that they have a large user base, good conversion rates, and considerable returns. Each platform supports audience targeting, but we currently find that advertisers’ products are severely homogenized, and the materials are also homogenized (high-conversion materials are easily copied), leading to users being cycled through the platforms, resulting in user fatigue.

When we look at the issue of material homogenization, it extends to the problem of raising user expectations and managing user expectations regarding advertising returns, which involves costs and the relationship between ad CTR, clicks to landing pages, downloads, installations, activations, and returns.

To increase ad CTR, can we just raise the bid? No, raising the bid can only increase exposure; to increase CTR, we must focus on audience targeting and materials.

Assuming audience targeting is fixed, whether the material can attract users depends on the creativity of the ad designers (I personally believe that the scenarios for programmatic creativity are limited and have specific significance for certain industries, such as e-commerce). The direct metric is CTR.

Many advertisers will go to great lengths to improve CTR, often leading to a problem of raising user expectations. For example, if the material shows a high-definition Maserati, but the download reveals a second-hand bicycle, the feedback from the data shows poor retention and returns, so raising user expectations should not go overboard.

Next, platforms like Zhihuitui require landing pages, and the design of landing pages will also affect further user conversion. Whether to further raise user expectations or deepen the product impression through the landing page can be explored through A/B Testing.

User drop-off when transitioning to the App Store or application center is also related to the app size; minimizing the app size can also improve conversion rates. In summary, the process from clicking on an ad to activating a paid user is a process of managing user expectations, and each step of conversion requires careful data analysis.

I have elaborated on the issue of managing user expectations in advertising. Returning to the main topic, why are users becoming increasingly unaffordable? From Q3 2016 to the end of Q1 2017, we monitored data showing that the number of advertisers in mobile performance advertising increased by over 40% compared to Q3 last year, while the actual growth of new unique users was less than 20%. The increase in advertisers and historical advertisers acquiring users came from the top channels, with over 62% sourced from them. Therefore, the issues everyone must face now are:

1. The users are still the same, but there are nearly twice as many advertisers competing for these users. The painful part is that these new advertisers are all very wealthy, driving up bids.

2. Core users are being cycled through, product homogenization is severe, and user conversion is gradually deteriorating.

3. In the near future, competition for top channels will become even more intense, as more large companies and wealthy players enter the market. Advertisers with limited funds or no clearly differentiated products will face greater challenges.

4. Finding more quality media and channels will be a significant test for the media managers in the advertising team.

So, the question arises: after discussing the top channels, what about the remaining 40% of middle and long-tail channels? Why are they also unaffordable? Here, we can roughly categorize the remaining channels into traditional four major portals, Hero Apps, and third-party advertising platforms:

For the four major portals (Sina, Netease, SOHU, wait, why are there only three major portals?), my conclusion is uniformly about KPI pressure (facepalm), as many of the three major portals sell on a CPM basis, and some premium positions are even monopolized, resulting in limited volume available. Many advertisers find that after comparison, they are not cheaper than top channels. Of course, the conversion and returns are not bad; it’s just a matter of balancing CAC and ROI, which is quite frustrating.

For some Hero Apps, the main issue I analyzed is user matching. Most Hero Apps do not fully understand their user attributes, especially in performance advertising monetization. Fully understanding their users is the foundation for maximizing traffic value, along with user habits. For example, I check the weather app every morning to see if there’s smog; if there is, I immediately close the app, and if there isn’t, it’s a Sunshine Day… I also close the app immediately…

As for performance-based third-party advertising platforms, most connect with BAT and various media ADXs or package some media, but they mostly sell long-tail volume that others cannot sell. This poses a significant challenge for user tagging capabilities and acquiring quality media. High-conversion, large-volume third-party advertising platforms are rare.

Once the top channels are secured, how to establish a foothold in middle channels is an advanced capability for the advertising team. If you cannot manage it yourself, I recommend finding a reliable agency. If you have this need, you can contact our BD colleagues. Of course, there are many other ways to acquire traffic, such as video apps, WAP sites, and genuine CPA channels. A graduating advertising team typically manages over 30 channels for a single product simultaneously (the main goal is to bypass fraudulent traffic).

In summary, the price of users on top channels will continue to rise, while the middle and long-tail channels still hold potential for exploration. Although it is already a red ocean, I believe the domestic user acquisition market is still in its early stages, and everyone needs to hone their basic skills to survive until the end.

02

A Blockbuster Year Ahead

After experiencing last year’s “small skirmishes” and testing the waters, reliable sources indicate that this year, several major companies and various hidden wealthy players will enter the market with over 50 million RMB in marketing expenses for each product to compete for users. Recently in Guangzhou and Shenzhen, I encountered a wealthy player ready to invest 150 million RMB in a SLG product, which reminded me of the page game era a few years ago, where companies like Kunlun and Efun released products in Taiwan with a blitzkrieg approach, using the best-looking products to capture all core users in the shortest time.

Additionally, some first-tier companies relying on user acquisition are aggressively acquiring users at any cost (one company raised CPC to 25 RMB, just to give you a sense of the situation), and CPA costs have soared to over 100 RMB (let the common folks tremble). In my previous article, I mentioned that first-tier companies can consistently add over 500,000 new users per week for a single product, which has narrowed the survival space for B+ products that could have survived. Apple is now very strict about cutting Apple Pay, removing apps one by one, which has left some user acquisition teams that were previously able to maintain a profit margin of over 15% in a difficult position.

Ultimately, domestic user acquisition will be a blockbuster showdown among the wealthy, with top channel user acquisition being the primary battlefield. To secure a place, one must rely not only on an experienced user acquisition team, reliable products, and sufficient funds but also on courage and strategy; otherwise, they will only become cannon fodder or pioneers. From the perspective of healthy industry development, it will be interesting to see if second-tier platforms can realize the value of performance-based traffic and whether advertisers can tap into second-tier users. Re Yun Data will soon release a product aimed at balancing overlapping users between top channels and second-tier platforms to reduce user acquisition costs, so stay tuned.

03

Discussing Cheating Again

I previously spent considerable time discussing how some advertising platforms cheat by inflating clicks or reporting impressions as clicks to steal attribution and natural volume. However, some still seem to understand only partially, so I will take some time to elaborate again.

If you find an advertising platform that settles with you on a CPA basis without disclosing where the ads will be displayed, and you notice that the “click” data is very high but the activation rate is only a fraction of a percent, you need to be cautious, as you may be encountering a fraudulent CPA channel.

Regarding the Last Click attribution model, you can refer to my previous articles. The platforms mentioned above exploit the loopholes in the Last Click model by inflating clicks or reporting impressions as clicks, leading to cheating. If such cheating occurs, your ads will either have no exposure and rely solely on machine clicks or have no clicks, only impressions.

Cheating through machine clicks requires the cheating platform to accumulate a sufficient number of real device IDs (usually starting from tens of millions) and then simulate clicks by sending device IDs to the advertiser or third-party monitoring platform in a certain pattern (some have no pattern at all). Since what the advertiser or third-party monitoring platform receives is just an HTTP request, it is difficult to assess whether it is a real click. There is a certain probability that these users will download the app from the App Store, at which point the cheating platform will “steal” a user. If the advertiser is running ads on multiple platforms, there is also a probability that users from other platforms will be stolen by the cheating platform.

Cheating by reporting impressions as clicks means that the advertising platform reports ad impressions as clicks. This leads to two main issues: first, it is absolutely unfair for everyone using click attribution, and second, it also leads to stealing from other platforms and natural volume.

Therefore, I recommend that everyone carefully distinguish between genuine and fraudulent CPA channels. Do not think you are getting a bargain; we have found that a significant portion of advertising teams are still trapped in this trap.

The previous article in this series:“Data on User Acquisition” | Uncovering the Real Data of Information Flow/DSP User Acquisition in the Mobile Game Industry!

Click Tag Cloud

Learn More

Understand DSP Advertising | DSP Mainstream Platform Evaluation Report | Game APP Promotion Experience | DSP Material Quality | Mobile DSP Strategy | What is Mobile DSP | DSP Strategy Experience Sharing | Baidu Mobile DSP | Splash Ads | UC Toutiao | Toutiao Advertising Mechanism and Optimization Suggestions | Toutiao Advertising Strategy | Toutiao E-commerce Industry Case Report | How to Become a Toutiao Advertising Expert | Toutiao Backend Operation Instructions | Fan Communication Optimization Practical Case | This is How You Use Fan Communication | Fan Communication Promotion Effect Analysis | Information Flow Advertising Data Analysis Logic System | Fan Communication Operation Experience | Youdao Smart Selection | Toutiao Advertising Creative Optimization Skills | Becoming a DSP Optimizer