Trading is a process that combines both strategy and technique, and it is also a form of practice.Both technology and skill are indispensable.!Value is limited, growth is guided, and cycles have their principles, while themes are boundless!In the stock market, one must act in accordance with the trend, combining strategy and technique, managing positions, investing in value, and achieving unity of knowledge and action! High growth, low valuation, good buying points; understanding the principles and applying the techniques, this world will one day belong to us!

According to Statista data, the global analog chip market size reached 77.3 billion USD in 2023, accounting for about 19% of the global semiconductor market size. China is the largest market for analog chips, but the self-sufficiency rate in 2023 is only 15%. Foreign leading manufacturers’ revenues in China far exceed those of local manufacturers, and this contradiction may change under the trend of de-globalization. Furthermore, the competition landscape in the analog chip industry is fragmented, with a CR5 of about 50% in 2023, which also provides opportunities for domestic manufacturers to enter the market.

Since 2000, the semiconductor industry has experienced four cycles. It can be said that in every corner that has been digitized, there are traces of analog chips. The cycles of the analog industry are strongly correlated with the technology cycles of downstream applications. The certification process for analog chips is more complex and longer, and the iteration process is less affected by Moore’s Law, resulting in a longer product cycle. Analog chips typically do not need to pursue advanced processes because analog transistors need to be larger to ensure good load, power distribution, and signal fidelity in applications. At the same time, due to the differences in downstream applications and product designs, there is a diversity of chip types in the analog industry. In 2022, ADI had over 75,000 part numbers, with about 80% of its revenue coming from products that contribute less than 0.1% of total revenue.

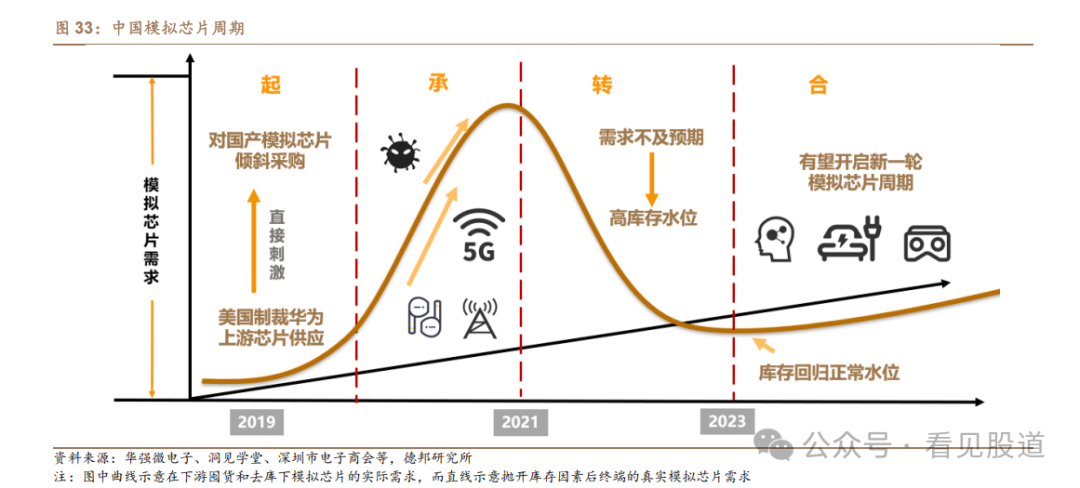

The current cycle of domestic analog chips can be summarized as follows:

Start (2019 year): The U.S. restricted local manufacturers from supplying chips to terminal manufacturers like Huawei, directly stimulating domestic terminal manufacturers to preferentially procure domestic chips, allowing domestic analog chip manufacturers to gradually enter the consumer sector.

Continuation (2019-2021 years): Technological innovations such as 5G and AIOT drove a rapid increase in demand for consumer electronics, while the pandemic impacted the supply chain. Therefore, downstream manufacturers adopted conservative inventory strategies, which boosted the demand for analog chips.

Transition (2021-2023 years): Due to demand falling short of expectations and previous inventory strategies leading to high channel and terminal stock, competition in the industry intensified, resulting in a downward cycle for the analog chip industry.

Conclusion (2024 and beyond): Currently, the consumer sector has recovered, and we expect that as automotive and industrial inventories gradually decrease, the demand and market size for analog chips will steadily increase under the trends of AI and automotive intelligence.

Where does the analog chip industry stand now?

In the short term, looking at inventory: The inventory cycle is nearing its end, with consumer electronics recovering first; in the medium term, looking at the landscape: The new “Nine National Policies” and “Eight Science Policies” are working together to accelerate industry resource integration, and the competitive situation is expected to improve; in the long term, looking at demand: The trends of AI and automotive electrification will contribute to growth, with ample space for domestic substitution.

Catalysts: The U.S.-China tariff war and changes in the rules for determining the “country of origin” for semiconductor products have directly cut off the source of price wars, causing short-term supply disruptions and accelerating domestic substitution!

Recommended to pay attention to: Yachuang Electronics, Naxin Micro, SIRUI, and Shengbang Co., Ltd.

Join the Stock Market Circle for Free! The public account updates three times a week at most!Value Growth:

Quantitative Trading: Value Growth Edition!

Quantitative Trading: Indicator Zone!

Quantitative Trading: Technical Edition!

Quantitative Trading: Dilemma Reversal Edition!