In the smartphone chip sector, there is currently a competition among four major giants: Apple’s iOS devices use their self-developed A-series chips, Qualcomm has launched its flagship Snapdragon series, MediaTek boasts the Dimensity series, and Huawei represents the domestically developed Kirin chips.

Contrast Between Brand Popularity and Shipment Volume

In terms of brand popularity, Huawei’s Kirin chips are undoubtedly the most talked about. Yu Chengdong, a Huawei executive director, famously stated that they are “far ahead,” which propelled the Kirin chips to new heights; subsequently, the slogan “No matter how you fold it, it looks good” further elevated Huawei’s marketing to new levels, even becoming a popular phrase among elementary school students!

However, the situation is quite different when it comes to the latest flagship chip shipments. According to a well-known digital blogger, among the four SOC manufacturers in the Chinese market, Apple’s A18 firmly holds the top spot, followed by Qualcomm’s Snapdragon Supreme version in second place, MediaTek’s Dimensity 9400 in third, while Huawei’s Kirin 9020 unfortunately ranks last, which is indeed surprising.

What is even more intriguing is that despite many complaints about the iOS system being unfriendly and its application ecosystem being closed, with users stating they would not choose an iPhone, the reality always contradicts these statements when sales data is released—Apple phones still dominate the shipment volume.

Overview of Shipment Volumes of the Four Major Manufacturers

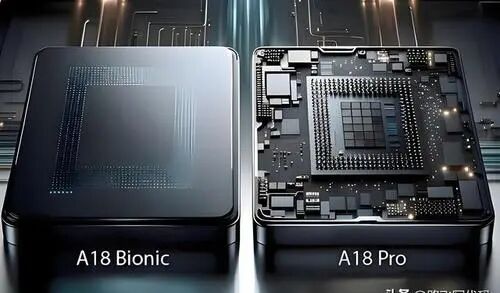

As of mid-April, the activation number of Apple’s A18 series chips is approximately 20.8 million units, with the iPhone 16 Pro Max alone activating over 8.8 million units domestically, while the iPhone 16 Pro reached about 6.9 million units. Considering the high prices of these two models, it is evident how strong the loyalty of Apple users is.

For Qualcomm in the U.S., the Chinese Android camp is its main market, with brands like Xiaomi, OPPO, and vivo heavily adopting its products. Notably, the Xiaomi 15, which debuted with the Qualcomm Snapdragon 8 Supreme processor, achieved a shipment volume of about 8 million units in the domestic market, aided by the Xiaomi brand.

As for MediaTek’s Dimensity 9400, some consumers have long held reservations about it, generally believing that only smartphones equipped with Qualcomm Snapdragon or Apple A-series chips can be considered true flagship devices. This perception has led to the Dimensity 9400’s shipment volume being only about 4.5 million units, significantly lower than the first two.

Finally, looking at Huawei’s Kirin 9020, this chip, which debuted with the Mate 70 Pro, uses Huawei’s self-developed Taishan V3 architecture and Maliang 920 GPU architecture, with performance comparable to Qualcomm’s Snapdragon 8 Supreme version. However, its shipment volume is only about 3 million units, placing it at the bottom.

Analysis of the Two Main Factors Behind the Low Shipment Volume of Huawei Kirin 9020

The author analyzes that there are two main reasons for this phenomenon: On one hand, Huawei faces severe capacity constraints, especially with low yield rates in chip manufacturing processes. Additionally, with the country’s emphasis on AI computing power development, Huawei needs to allocate some resources to produce Ascend 910B and 920 chips, further squeezing the supply space for Kirin 9020; On the other hand, the high pricing of smartphones equipped with Kirin 9020 is also a significant factor. Faced with high price tags, many potential buyers, although willing to support domestic products, ultimately give up purchasing due to economic constraints. If Huawei can appropriately adjust its pricing strategy and resolve capacity bottlenecks in the future, it is believed that capturing the top market share will be just around the corner.