Acceleration of Domestic AI Chip Localization: Technological Breakthroughs and Investment Opportunities

Content Overview

With the investment boom triggered by Huawei’s Ascend chips in the A-share market, the domestic AI chip industry has entered a phase of accelerated development. This article provides an in-depth analysis of the technological breakthroughs and market landscape of domestic AI chips, comparing the gaps and advantages between domestic chips and international manufacturers like NVIDIA, and exploring investment opportunities along the industry chain, offering investors a comprehensive industry perspective and investment ideas.

1. Background and Market Drivers of Domestic AI Chip Development

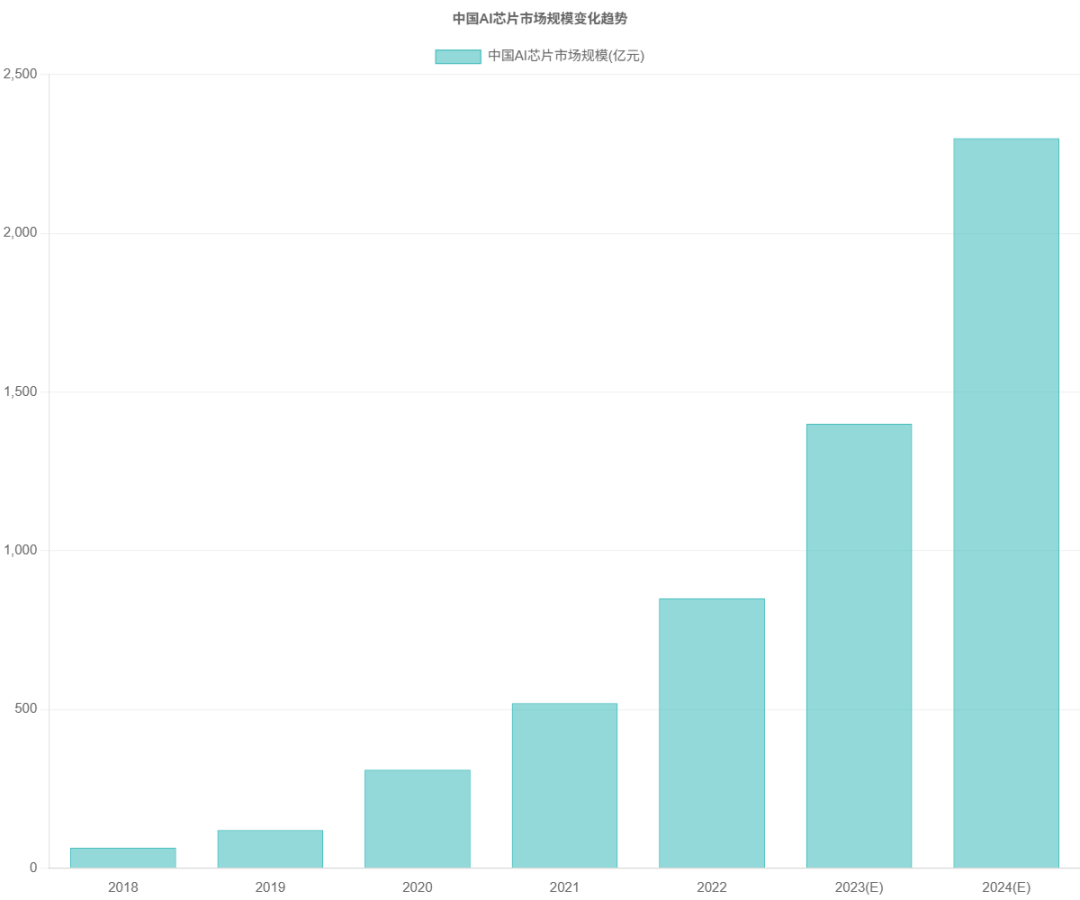

Recently, a series of developments regarding Huawei’s Ascend chips have activated a technology investment boom in the A-share market, making domestic AI chips the focus of the capital market. Indeed, against the backdrop of the global acceleration of AI technology deployment, the importance of AI chips, as a core component of AI infrastructure, is becoming increasingly prominent. The Chinese AI chip market has rapidly grown from 6.4 billion yuan in 2018 to 85 billion yuan in 2022, and it is expected that the market size will exceed 230 billion yuan by 2024, showing explosive growth.

1. Market Driving Factors

Demand-Side Drivers

- • Explosive growth in AI computing demand, especially with the rise of large models like ChatGPT

- • Continuous increase in demand for AI chips due to the digital transformation of traditional industries

- • 5G and IoT technologies driving the expansion of edge computing and cloud computing scenarios

Supply-Side Drivers

- • The U.S. continues to intensify AI computing power restrictions, accelerating domestic substitution

- • The Chinese government is increasing policy support and improving computing power infrastructure

- • The domestic semiconductor industry chain is maturing, enhancing collaborative development capabilities

2. Market Size and Growth Forecast

Data Source: Industry Research Report Compilation

2. Analysis of Mainstream Domestic AI Chip Technologies

Huawei Ascend: The Rapidly Rising New Benchmark for Domestic Computing Power

As a representative enterprise of domestic AI chips, Huawei’s Ascend series chips have recently attracted widespread market attention. The product line of Huawei Ascend chips has formed a comprehensive layout from training to inference, from cloud to edge.

Ascend 910B/910C

Expected to ship over 800,000 units in 2024, it has become the main choice for domestic AI servers

Ascend 910D

The goal is to surpass NVIDIA’s H100, with the first batch of samples expected to be delivered by the end of May, further enhancing domestic computing power levels

CloudMatrix384 Super Node

Improves the efficiency and flexibility of AI infrastructure construction, with plans to achieve tens of thousands of deployments in the first half of 2025

The rapid iteration of Huawei Ascend chips has activated the technology investment boom in the A-share market, with several Huawei ecosystem partners benefiting significantly. For example, Changshan Beiming, as a Huawei ecosystem partner, saw its stock price rise by 5.14% to 21.49 yuan on April 18, with a transaction volume of 3.22 billion yuan.

Cambricon: A Pioneer in AI Chips with a Full Product Line

As one of the first companies in China focused on AI chip research and development, Cambricon has formed a complete product line covering cloud, edge, and terminal, with independently developed third-generation intelligent processor architecture.

| Product Series | Main Products | Technical Specifications | Main Applications |

| Cloud Chips | SiYuan 290/370 | 7nm process, peak performance of 1024 TOPS (4-bit) | Cloud servers, data centers, AI processing |

| Edge Chips | SiYuan 220 Series | High energy efficiency, low power design | Smart manufacturing, smart cities, intelligent driving |

| Terminal IP | Cambricon 1M | 7nm process, efficiency ratio of 5 TOPS/W | Smartphones, smart cameras, IoT |

Cambricon also focuses on software ecosystem development, launching the Cambricon NeuWare software platform, supporting integrated cloud-edge-terminal and training-inference architectures, providing users with comprehensive hardware-software collaborative solutions.

Birun Technology: A New Star in Domestic High-Performance GPUs

Birun Technology focuses on the research and development of high-performance general-purpose GPUs, with its BR100 GPU standing out among domestic AI chips.

BR100 GPU Technical Features

- • Peak computing power exceeds three times that of NVIDIA’s A100 GPU

- • 7nm process and Chiplet packaging technology, with 77 billion transistors

- • Can be paired with 64GB HBM 2E memory, with over 300MB of on-chip cache

- • Supports PCIe 5.0 interface, facilitating system integration

- • Completed compatibility testing with Baidu PaddlePaddle, performing excellently in NLP, CV, and other fields

Birun Technology’s BR100 has collaborated with Inspur Technology to launch the OAM server “Hai Xuan,” providing high energy efficiency and low TCO solutions for data center clusters, applied in multiple fields.

3. Comparative Analysis of Domestic AI Chips and NVIDIA

1. Technical Parameter Comparison

| Parameter | Huawei Ascend 910C | Cambricon SiYuan 370 | Birun BR100 | NVIDIA H100 (SXM) | NVIDIA A100 |

| Process | 7nm | 7nm | 7nm | 4nm | 7nm |

| Transistor Count | Not disclosed | Not disclosed | 77 billion | 80 billion | 54.5 billion |

| FP32 Performance | ~45 TFLOPS | ~40 TFLOPS | ~50 TFLOPS | 60 TFLOPS | 19.5 TFLOPS |

| FP16/BF16 Performance | ~90 TFLOPS | ~80 TFLOPS | ~100 TFLOPS | 2000 TFLOPS* | 312 TFLOPS* |

| Memory | 32GB HBM2e | 48GB HBM2e | 64GB HBM2e | 80GB HBM3 | 40GB HBM2 |

| TDP | ~350W | ~350W | ~400W | 700W | 400W |

*Using sparse technology display, actual performance is about half of the marked value

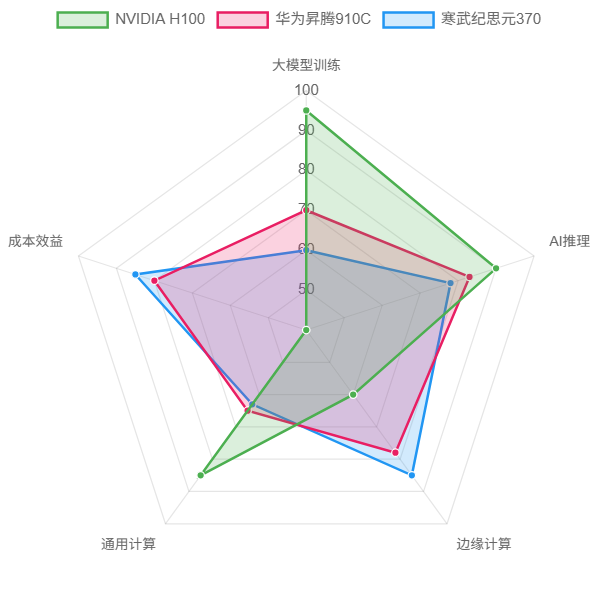

2. Application Scenario Adaptability Analysis

Comparative Analysis

Large Model Training Scenarios

NVIDIA’s H100 is optimized for large-scale AI training, and there is still a generational gap between domestic chips and NVIDIA, but Huawei Ascend and Birun BR100 can meet domestic training needs in specific scenarios.

AI Inference Scenarios

Domestic chips have cost-performance advantages and localized support advantages, making them particularly suitable for inference optimization of domestic models; NVIDIA, on the other hand, has a more comprehensive software ecosystem and model support.

Edge Scenarios

Cambricon and Huawei are highly competitive in edge inference scenarios due to their energy efficiency advantages and full-stack domestic capabilities; NVIDIA’s high energy consumption limits its edge applications.

3. Cost and Availability Analysis

| Factor | Domestic AI Chips | NVIDIA AI Chips |

| Procurement Cost | Lower (about 50-70% of comparable NVIDIA products) | High, and facing a trend of price increases |

| Supply Chain Stability | Domestic supply chain, relatively stable | High-end products are difficult to obtain due to U.S. export controls |

| Technical Support | Localized support, fast response | Mature global support system but local response may be limited |

| Software Ecosystem | Rapidly developing but still incomplete | High maturity, wide application range |

| Updates and Iterations | Fast iteration speed, strong targeting | Globally unified iteration, relatively fixed time |

4. Summary of Advantages and Disadvantages

Advantages of Domestic AI Chips

- • High cost-performance ratio, significant cost advantage

- • Secure and stable supply chain, less affected by geopolitical factors

- • Fast localized support and service response

- • Adaptation to mainstream domestic application scenarios and models

- • Rapid development speed, short technology iteration cycles

- • High energy efficiency, suitable for edge computing scenarios

Challenges Faced by Domestic AI Chips

- • Significant generational gap in high-end training chips compared to NVIDIA

- • Insufficient maturity of the software ecosystem, high development threshold

- • Process technology lagging behind international leading levels

- • Lack of experience in optimizing and accelerating large models

- • Need to enhance the supporting capabilities of the industry chain

- • Relatively few international recognitions and application cases

4. Industry Chain and Investment Opportunities

1. Overview of the AI Chip Industry Chain

Five major links in the AI chip industry chain

Upstream

- • Design: Cambricon, Birun Technology

- • Manufacturing and Materials: SMIC, Yuhuan New Materials

- • Packaging and Testing: Changdian Technology, Tongfu Microelectronics

Midstream

- • System Integration: Inspur Information, Zhongke Shuguang

- • AI Computing Power Infrastructure: Changshan Beiming, Unisoc

Downstream

- • Application Ecosystem: Haiguang Information, iFlytek

- • Industry Solutions: Inspur Information, China Great Wall

2. Potential Investment Targets Screening

1. Inspur Information (000977)

Core Advantages

The largest server manufacturer in China, a core supplier of domestic computing power infrastructure

Relation with Huawei

Both a partner of Huawei Cloud and an alternative solution, a win-win strategy

Performance

2023 revenue of 110.6 billion yuan, net profit of 1.78 billion yuan, with the proportion of AI server revenue continuously increasing

2. Zhongke Shuguang (603019)

Core Advantages

A leading provider of high-performance computing solutions in China, with complete independent intellectual property rights

Relation with Huawei

Strategic cooperation in multiple fields, complementary advantages in computing power infrastructure

Performance

2023 revenue of 11.9 billion yuan, net profit of 670 million yuan, with stable gross margin

3. Changshan Beiming (000158)

Core Advantages

An important partner in the Huawei ecosystem, strong capability in integrated hardware and software solutions

Relation with Huawei

Deeply bound to the Huawei Ascend ecosystem, with expanding cooperation areas

Performance

Stock price has continued to rise due to Huawei Ascend’s progress, with significant transaction volume

4. Unisoc (002049)

Core Advantages

A leading domestic memory supplier, a key link in the integration of AI chips and storage

Relation with Huawei

Jointly building a domestic storage-computing integration system

Performance

2023 revenue of 6.58 billion yuan, net profit of 1.74 billion yuan, with an increasing proportion of high-margin business

5. Investment Risks and Recommendations

1. Major Risk Factors

Technology Iteration Risk

AI chip technology updates rapidly, and companies need to continuously invest in R&D to maintain competitiveness

Overseas Competition Risk

International giants like NVIDIA are technologically advanced and may launch lower-spec products to capture the Chinese market

Industry Cycle Risk

The semiconductor industry has strong cyclicality and may face periodic overcapacity

Valuation Risk

Some targets have already reflected many expectations, with high valuation levels

2. Investment Strategy Recommendations

Focus on Leaders

Select leading companies with core competitiveness in various sub-sectors

Pay Attention to Cost-Performance Ratio

Look for relatively reasonably valued targets in high-prosperity industries

Industry Chain Layout

Appropriately diversify investments across the upstream, midstream, and downstream of the AI chip industry chain

Long-Term Perspective

The domestic AI chip substitution is a long-term trend, suggesting a long-term hold of core assets

6. Conclusion and Outlook

Domestic AI chips are in a phase of accelerated catch-up, forming comparative advantages in inference and edge computing in specific scenarios. Continuous breakthroughs by companies like Huawei Ascend, Cambricon, and Birun Technology are narrowing the gap with international giants. With policy support, market demand, and capital assistance, the domestic AI chip industry chain is expected to usher in a sustained high prosperity cycle.

Investors should focus on core enterprises in the industry chain such as Inspur Information, Zhongke Shuguang, Changshan Beiming, and Unisoc to share in the investment dividends of the rise of domestic AI computing power. At the same time, they should be wary of the valuation risks brought by the industry’s high prosperity and maintain a rational investment mindset.

With the launch of new generation chips like Huawei Ascend 910D, domestic AI chips are expected to welcome a new round of technological breakthroughs and market expansion, further accelerating the process of domestic substitution.