Recently, Wuhan Guangju Microelectronics Co., Ltd., a filter IDM company that just completed a 189 million yuan B+ round of financing, published a letter to all employees. The letter pointed out that under the complex and changing global economic landscape, the company faces multiple challenges including intense industry competition, difficulty in maintaining orders, low-price competition from peers, sharp revenue declines, rising raw material prices due to tariffs, and high labor costs. As of the first quarter of 2025, the company has accumulated losses of 600 million yuan and will undergo business transformation and organizational restructuring starting April 18. This event has sparked widespread market attention on the intense competition within the RF front-end chip industry, particularly regarding the performance losses of RF front-end chip companies.

In fact, the performance losses of domestic RF front-end chip manufacturers are no longer a new topic. As a crowded track accommodating hundreds of local companies, over 85% of the market share is still firmly held by foreign companies such as Broadcom, Qualcomm, Skyworks, Qorvo, and Murata. In the high-end market represented by highly integrated 5G modules, foreign companies’ market share exceeds 95%. Whether it is PA, filters, or RF switches, the level of competition in the entire industry has reached a well-known extent.

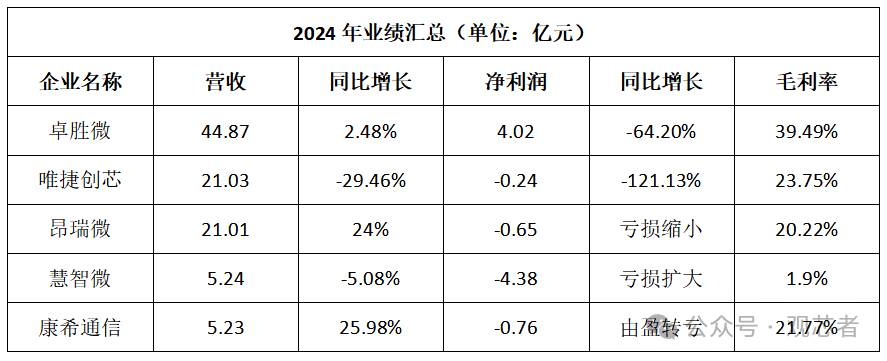

Guanxin has compiled the performance data for A-share listed companies such as Zhaosheng Micro, Weijie Chuangxin, Huizhiwei, and Kangxi Communication, as well as Angrui Micro, which is currently pushing for an IPO on the Sci-Tech Innovation Board. The analysis of these leading RF front-end chip manufacturers for 2024 shows that, in terms of revenue, Zhaosheng Micro remains the leader in the domestic RF front-end chip market with a revenue of 4.487 billion yuan. Weijie Chuangxin, which achieved a revenue of 2.982 billion yuan in 2023, is severely affected by intensified market competition and industry price wars, leading to a significant decline in revenue for 2024, falling short of Zhaosheng Micro’s revenue by less than half.

From the above table, it can be seen that only Kangxi Communication, Angrui Micro, and Zhaosheng Micro are expected to achieve revenue growth in 2024. However, the growth in performance for Zhaosheng Micro and Kangxi Communication is accompanied by deteriorating profit levels and declining gross margins, while Angrui Micro has also failed to escape a state of continuous losses.

From the perspective of gross margin, despite being in a continuous decline, Zhaosheng Micro still leads among many domestic RF front-end manufacturers with a gross margin of 39.49%. However, compared to international RF companies like Broadcom, Qualcomm, Skyworks, and Qorvo, which maintain gross margins above 40%, it clearly faces greater downward price pressure.

Weijie Chuangxin, Angrui Micro, and Kangxi Communication have gross margins between 20% and 24%. The low gross margins limit their ability to generate profits, making them more susceptible to expanding losses under external pressures such as intensified market competition and rising costs.

Huizhiwei has a gross margin of only 1.9%, which is extremely low. Such a low gross margin leaves almost no profit buffer for the company. Any slight adverse changes in the market environment, such as intensified competition or fluctuations in raw material prices, can easily lead to expanded losses. The performance in 2024, with losses expanding to 4.38 million, confirms this point.

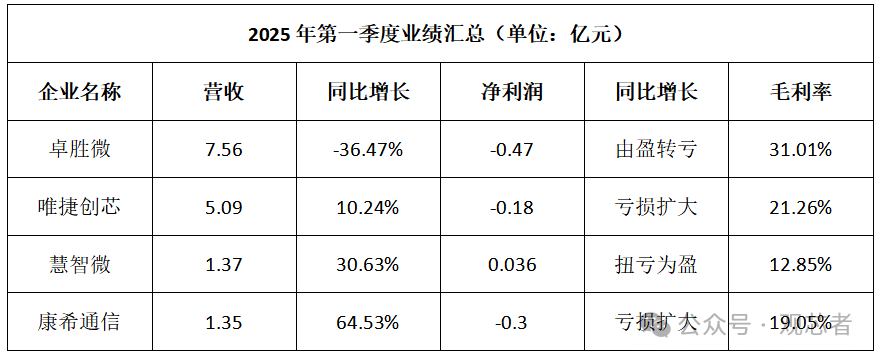

Entering the first quarter of 2025, the situation of intense competition in the industry has escalated. Zhaosheng Micro’s revenue is 756 million yuan, a year-on-year decrease of 36.47%, with net profit turning from profit to loss, resulting in a loss of 47 million yuan and a gross margin dropping to 31.01%, indicating significant performance fluctuations. Weijie Chuangxin’s revenue is 509 million yuan, showing a growth of 10.24%, but losses continue to expand. Huizhiwei’s revenue is 137 million yuan, a year-on-year increase of 30.63%, achieving a turnaround with a net profit of 3.6 million yuan and a gross margin of 12.85%. Kangxi Communication’s revenue is 135 million yuan, a year-on-year increase of 64.53%, but losses are also expanding.

The root cause of this situation lies in the extremely complex design and manufacturing processes in the RF front-end field, which have high barriers to entry. There are simply too many domestic companies entering the market, while foreign companies firmly control the high-end market with their long-accumulated technological advantages and patent barriers, making it difficult for domestic manufacturers to break through in the short term.

The mid-to-low-end market is also caught in a heated price war due to the influx of numerous companies. Major manufacturers continuously lower prices to compete for limited market shares, further compressing profit margins, leading to generally weak profitability and even expanding losses. In this situation, companies’ R&D investments are limited, and the pace of technological upgrades is slow, creating a vicious cycle.

In summary, the fluctuations of Wuhan Guangju and the performance ups and downs of A-share listed RF front-end chip manufacturers reflect the thorns and fog on the development path of the domestic RF chip industry. The technological barriers in the high-end market and the price wars in the mid-to-low-end sectors continuously test the survival wisdom and innovative resilience of enterprises.

In this uncertain industry wave, should companies continue to struggle in the red ocean of homogenized competition, or should they open new avenues for technological innovation? Should they stick to the existing domestic market or bravely break through the blockade of international giants and move towards the global market? Each company is searching for its own answer. The future of the industry may be hidden in every technological breakthrough, every strategic adjustment, and every resource integration, waiting for the disruptors to write a new chapter.

—— END ——