The chilling frost wind enters the night, countless stars shine in the sky, the pipa plays a rapid tune of golden spears, and the heavenly sounds are accompanied by the drums…

As the pipa plays, behind the night curtain, an unprecedented battle in the Internet of Things begins!

Wireless communication technology has rapidly developed for over 20 years. After connecting people, the Internet of Things provides continuous development momentum for the wireless industry. Due to the relatively low difficulty of LPWAN (Low Power Wide Area Network) technology, various technologies have emerged one after another, creating a landscape where many flags are planted.

Among the most notable are NB-IoT and LTE-M, which use licensed spectrum and are primarily invested in by operators and telecom equipment manufacturers led by 3GPP; and technologies such as LoRaWAN, Sigfox, Weightless, HaLow, and RPMA (Random Phase Multiple Access) that use unlicensed spectrum, most of which are invested in non-telecom sectors.

LPWAN, Low-Power Wide-Area Network, captures two key words: low power and wide coverage. Simply put, it is a wireless technology that achieves long-distance communication while being very power-efficient.

The common point of this technology is that its long-distance communication capability supports large-scale IoT deployments, and low power consumption avoids frequent battery replacements, reducing maintenance costs.

The most typical applications of LPWAN are smart cities, including city streetlights, smart meters, sewer water level detection, smart traffic, etc. Long-distance wireless communication can avoid the need for wired pipelines, and low power consumption ensures that batteries do not need to be replaced for years, saving hassle and costs, making it an ideal choice for large-scale smart city construction.

1 NB-IoT vs. LTE-M, Market Fragmentation?

NB-IoT is gaining momentum. In 2016, 3GPP realized that the LPWAN opportunity had arrived and quickly launched the R13 NB-IoT standard in June.

Although it arrived a bit late, it has attracted much attention. Led by 3GPP, supported by several telecom equipment manufacturers, and with over 300 operators globally completing 90% coverage of mobile networks, its unparalleled ecosystem has made other LPWAN technologies feel threatened.

• Supports upgrades to existing networks, allowing for rapid market capture.

• Carrier-grade security and quality assurance.

• Standards continue to evolve and improve. In the 3GPP R14 standard, NB-IoT will add features such as positioning, multicast, enhanced non-anchored PRB, mobility and service continuity, new power levels, and reduced power consumption and latency, making NB-IoT more competitive.

Because NB-IoT uses licensed spectrum, it can avoid wireless interference and provides carrier-grade security and quality assurance, making it appear more high-end compared to other LPWAN technologies.

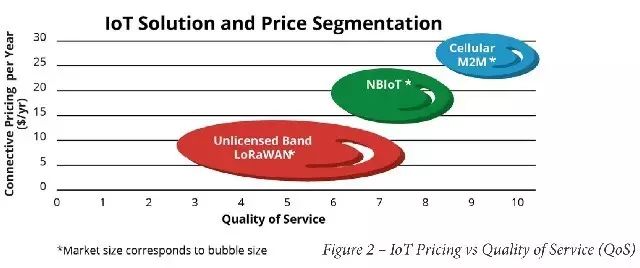

However, this comes at a cost; when considering spectrum auction prices, the deployment cost of NB-IoT is actually higher than that of some other LPWAN technologies. According to a report on NB-IoT vs LoRa technology, the deployment cost of NB-IoT is higher than that of LoRa (as shown below).

This is akin to courier services; some small courier companies offer lower prices but cannot guarantee speed, and might even lose your inflatable doll, while NB-IoT is like the express courier service.

Therefore, for applications that require high reliability and low latency, NB-IoT is irreplaceable.

Since the R13 standard was frozen, NB-IoT has been rapidly capturing the market. According to incomplete statistics, countries such as China, Germany, Spain, and the Netherlands have announced plans for commercial use of NB-IoT.

• China Telecom plans to commercially launch the first nationwide NB-IoT network in June 2017.

• Deutsche Telekom plans to commercially launch the NB-IoT network in the second quarter of 2017, using LTE 800MHz and 900MHz bands, initially applied to smart meters, smart parking, and asset tracking management.

• The Netherlands plans to complete the national-level NB-IoT network construction by the end of 2017.

• In Spain, Vodafone first deployed NB-IoT in Valencia and Madrid, and expanded to Barcelona, Bilbao, and Malaga by the end of March, with over 1,000 base stations supporting NB-IoT.

…

However, we must not overlook another force from 3GPP—LTE-M. At the beginning of 2017, LTE-M is also rapidly spreading.

On February 27, 2017, at MWC 2017, AT&T (USA and Mexico), KPN (Netherlands), KDDI (Japan), NTT DOCOMO (Japan), Orange (Europe, Middle East, and Africa), Telefonica (Europe), Telstra (Australia), TELUS (Canada), and Verizon (USA) jointly announced support for global deployment of LTE-M.

• KPN has completed LTE-M testing in the Netherlands, using Ericsson and Qualcomm equipment.

• AT&T deployed an LTE-M network pilot project in San Francisco as early as 2016, and in February 2017, announced plans to complete the first national LTE-M network deployment in the USA in the second quarter of 2017.

• This is not to be underestimated; rival Verizon is not satisfied. Just a few days ago, on March 31, 2017, Verizon announced that it would be the first in the USA to launch a nationwide LTE-M network, stating that it is accelerating construction, implying that it doesn’t matter when AT&T completes its network, it just wants to be the first.

3GPP introduced two versions of IoT in the R13 version: LTE-M and NB-IoT. Frankly, this is the result of compromise; 3GPP has muddied the waters, leading to market fragmentation and confusion.

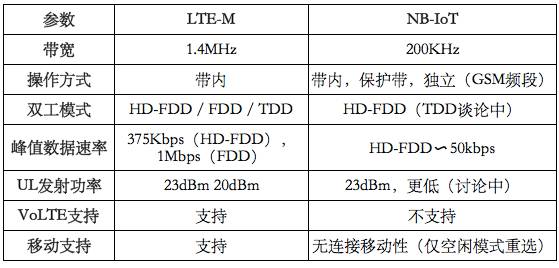

Let’s compare the two technologies:

At a glance, NB-IoT is more flexible in terms of spectrum, supporting three deployment modes. LTE-M has a higher rate.

However, this is not enough; the key to IoT is performance, cost, and power consumption, so let’s compare these three aspects below.

1) Performance

Due to the lower bit rate of NB-IoT, the link budget is better, and it is generally believed that NB-IoT has a larger coverage area than LTE-M.

However, I recently saw an article abroad that refuted this. I just act as a transporter; let’s discuss.

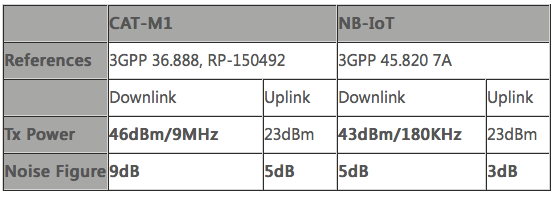

The maximum coupling loss (MCL) is the maximum total channel loss between the UE and the eNodeB antenna port when transmitting data. The higher the MCL, the stronger the link. According to 3GPP, the MCL for CAT-M1 is 155.7dB, while for NB-IoT it is 164dB, showing an 8dB difference. On the surface, NB-IoT appears to have an advantage. However, according to Shannon’s theorem, when the signal-to-noise ratio (SNR) is very low and the noise is white noise, the approximate channel capacity is independent of bandwidth.

Based on the above reasoning, we can draw the following conclusions:

• When the transmission power is the same, the coverage area in the uplink direction is the same for both technologies,

• In the downlink direction, the coverage area of CAT-M1 is 6 times that of NB-IoT (~8dB), because the signal bandwidth emitted from the node (eNB) is 6 times that of NB-IoT.

In fact, if we carefully look at the parameters set in the reference scenarios used to calculate MCL in the 3GPP standards, the parameter settings of the two standards are different, such as transmission power, noise factor, and target throughput, making such comparisons unfair, as shown in the table below:

If we use the same assumptions (same transmission power, same noise factor, and same target throughput), we can see that the previous conclusions hold, namely: the uplink coverage area of both standards is the same, while the downlink coverage area of CAT-M1 is optimized by ~8dB compared to NB-IoT.

2) Cost

In terms of module cost, NB-IoT is undoubtedly lower than LTE-M. LTE-M has a bandwidth of 1.4MHz, while NB-IoT processes bandwidth of 200KHz. The baseband part is smaller, and the RF front-end and digital processing for 200K bandwidth is much simpler than the 1.4MHz LTE resource block. Additionally, the NB-IoT waveform is simpler, while LTE-M processes OFDM, which is more complex.

3) Power Consumption

Since most IoT devices are “asleep” most of the time, power consumption comparisons mainly focus on the power consumption during device activation. It is generally believed that because NB-IoT has a lower rate and simpler waveform processing, it consumes less power.

However, I have seen another explanation that says that because LTE-M has a higher throughput than NB-IoT, if the amount of data received is the same, LTE-M takes less time than NB-IoT, which means it is more power-efficient.

&%&&**%¥#¥…. I really can’t stand these tech nerds!!!!

In summary, if we must draw a line, the two major operators in the USA support LTE-M, while China and Europe lean more towards NB-IoT. Of course, the key is still for operators to deploy according to their actual situations; what is most beneficial to themselves is what matters.

2 Sigfox, Seizing Territory

In 2017, while NB-IoT has not yet stabilized, Sigfox is frantically seizing territory, attempting to create distance in the shortest time possible.

This is understandable; technologies like Sigfox, LoRaWAN, and RPMA are inherently more mature than NB-IoT by a year or two. In fact, by 2017, they had already taken the lead in commercialization; if they do not accelerate now, when will they?

Sigfox from France is well aware that one of its biggest weaknesses in competing with NB-IoT is network coverage, as NB-IoT has an existing network and can be deployed quickly, while Sigfox needs to build new base stations. Therefore, their current goal is to build networks, rapidly.

According to statistics, as of January 2017, the Sigfox network had covered 29 countries and regions, 1.7 million square kilometers, and 470 million people, with plans to expand the network to 60 countries by 2018.

Additionally, although Sigfox does not attract as much attention as NB-IoT, its ecological deployment cannot be overlooked. Sigfox employs a free patent licensing strategy, attracting many partners to join its ecosystem. Currently, Sigfox has 71 device manufacturers, 49 IoT platform providers, 8 chip manufacturers, 15 module manufacturers, and 30 software and design service providers among its partners. These include chip suppliers such as Texas Instruments (TI), STMicroelectronics (ST), Silicon Labs, ON Semiconductor, NXP, Ethertronics, Microchip, and M2Comm.

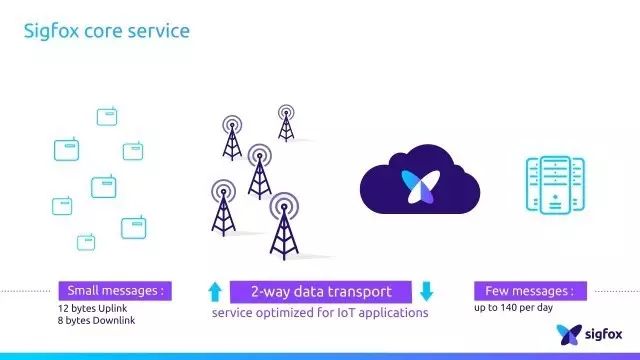

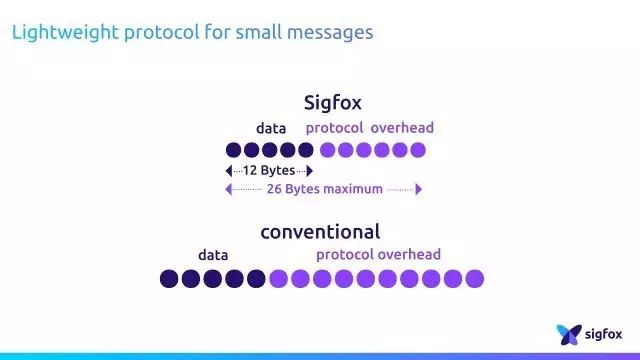

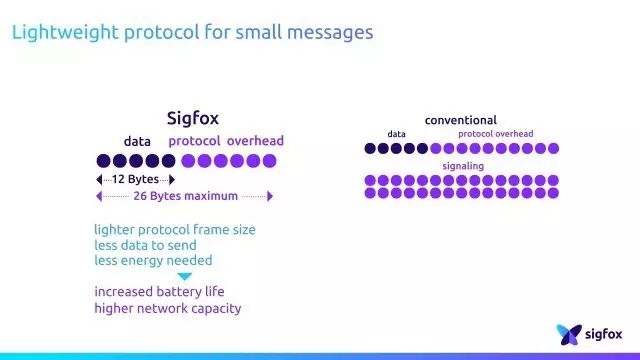

Sigfox operates in the 868MHz and 902MHz ISM bands, consuming very narrow bandwidth or power, and its transmission rate is only 100 bits/s, with a maximum message length of 12 bytes, and a node can send a maximum of 140 messages per day. When transmitting a 12-byte message, the packet size is only 26 bytes. Therefore, due to its narrow bandwidth and short message characteristics, along with its 162dB link budget, Sigfox also has significant advantages in long-distance transmission.

▲ Sigfox messages can be sent with 12 bytes up and 8 bytes down; a maximum of 140 messages can be sent per day; it can connect to IoT devices using the Sigfox Cloud platform through a computer

▲ In the case of transmitting a 12-byte message, the Sigfox packet capacity is only 26 bytes, smaller than other communication protocols

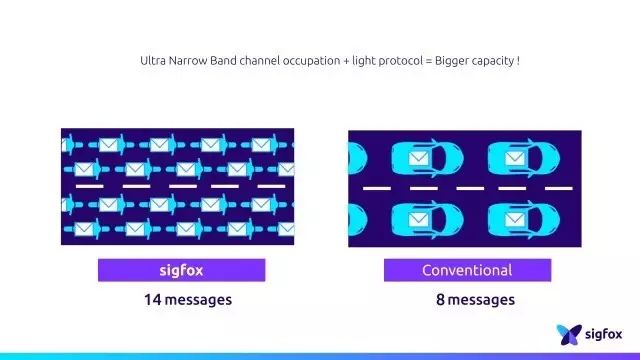

Moreover, Sigfox has another characteristic: it does not require transmission signaling; terminals only need to use the SigFox Radio Protocol to emit signals, and the base station will autonomously receive the information, thus saving signaling load, reducing the total transmission data, and further lowering power consumption.

▲ The Sigfox protocol does not require the transmission of signaling signals, saving more bandwidth

However, there are pros and cons. Sigfox has low speed and wide coverage but limited daily data uploads, making it unsuitable for applications with high data transfer frequency.

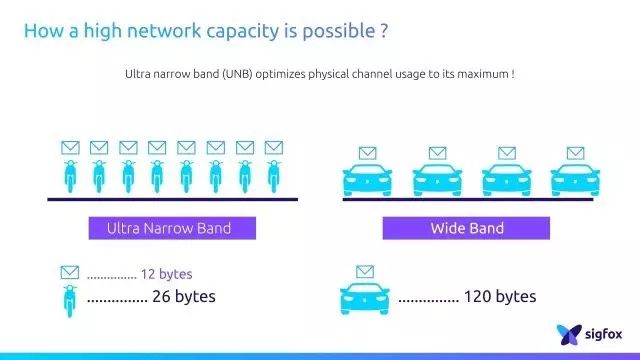

So, there is an apt metaphor: if the LPWAN technology with a message length of 120 bytes is a car, then Sigfox is a motorcycle.

▲ Sigfox’s transmission method is like using a motorcycle to transport a small amount of goods

Of course, the benefit is that it can increase the number of connections…

3 LoRa, The Mighty Army

LoRa, short for Long Range, dreams of long distances; if a gateway or base station can cover an entire city, that would be wonderful.

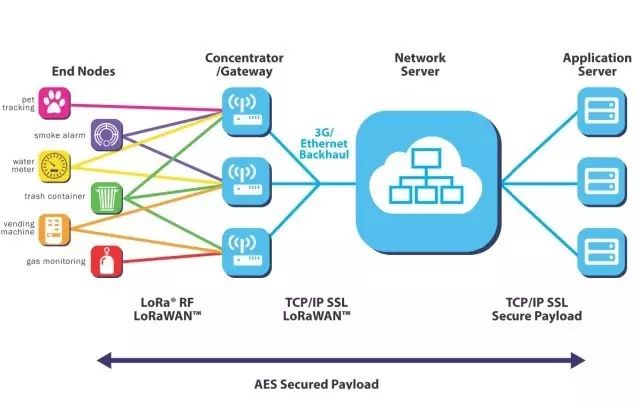

In a LoRa network, all terminals first connect to a gateway, and gateways are interconnected to the network server. In this architecture, even if two terminals are located in different areas and connect to different gateways, they can still transmit data to each other, further expanding the range of data transmission.

▲ LoRa network structure diagram

Currently, most networks adopt a mesh topology; however, in this type of network topology, nodes often act as relays for transmission, leading to convoluted routing, which increases overall network complexity and power consumption.

LoRa takes a different approach by adopting a star topology, allowing all nodes to connect directly to the gateway, which then connects to the network server. If communication is needed with other terminal nodes, it is also transmitted via the gateway. This way, although terminal nodes must be installed at specific locations, the gateway installation points are flexible, allowing them to be placed near wired networks or power sources without worrying about the power consumption of the gateway. Thus, terminal nodes can offload some power-consuming tasks to the gateway to improve their battery life.

LoRa supports bidirectional transmission, and the transmission method is divided into three different classes: Class A, Class B, and Class C.

Class A is the most power-efficient; terminal devices usually turn off data transmission functions, and after uploading data, they briefly perform two receiving actions before turning transmission off again. While this method can significantly save power, it cannot receive commands or transmit data from the network server in real-time, resulting in longer delays.

Class B consumes more power, allowing for scheduled download functions to receive data, thus reducing transmission delays.

Class C, on the other hand, keeps the download function continuously open outside of upload times, which significantly reduces delay but further increases power consumption.

The LoRa army, led by IBM and Cisco, is also quite formidable. The LoRa Alliance has 17 sponsoring members, including operators like SK Telecom from Korea and Orange from France.

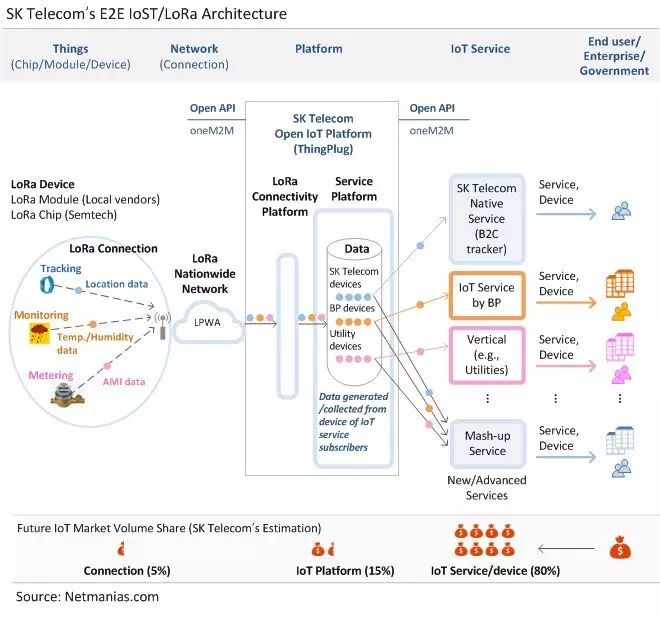

For example, SK Telecom announced in 2016 that it would commercialize the first national-level IoT network based on LoRa.

▲ SK Telecom’s end-to-end LoRa network architecture diagram

LoRa stated as early as 2016 that 17 countries had announced network construction plans, with more than 120 cities already having operational networks. The LoRa Alliance has over 400 members, with a complete industrial chain, making it one of the most attractive LPWAN technologies for telecom operators besides NB-IoT.

Although LoRa’s transmission distance is not as far as Sigfox, it can still ensure coverage over several kilometers, and its wider frequency band makes construction cost-effective and less difficult, especially suitable for collecting various data such as temperature, water, gas, and production data in industrial areas. Of course, if combined with mature large networks like NB-IoT or LTE-M, it would be significant to connect widely distributed industrial zones and transmit data to the cloud for analysis.

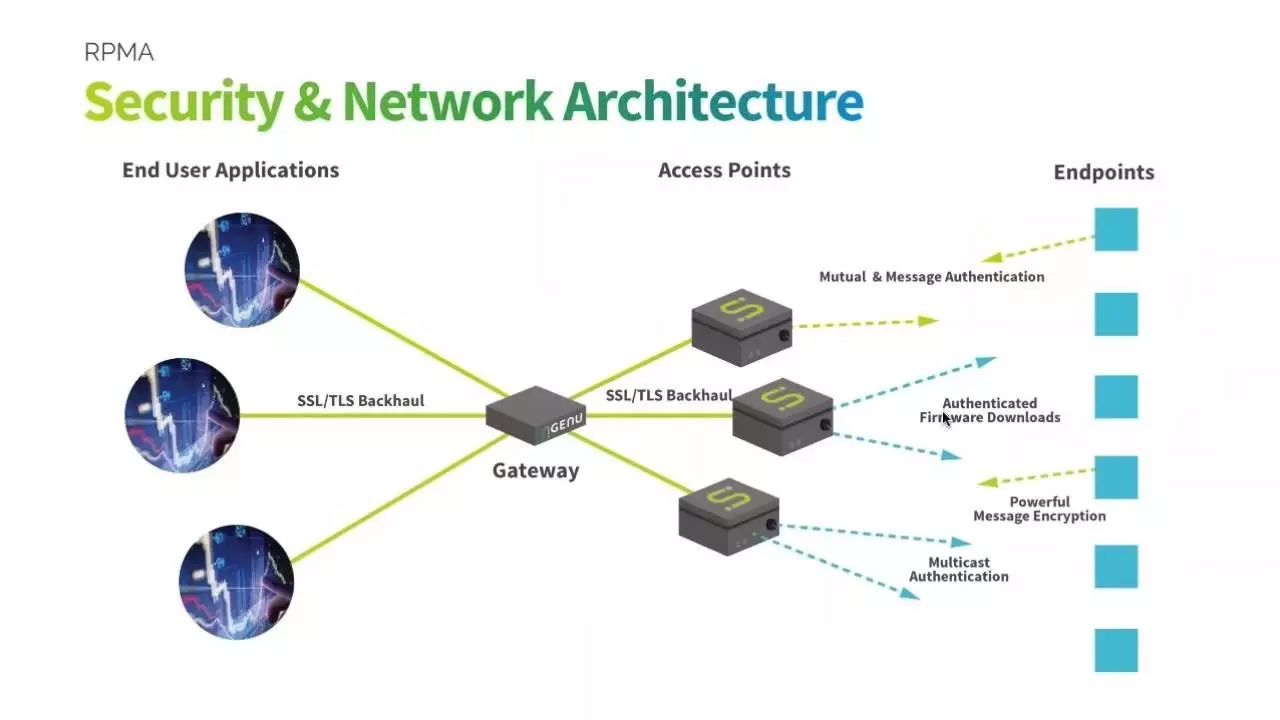

4 RPMA, The Dark Horse of LPWAN

RPMA is somewhat unique; while other LPWAN technologies mostly use frequency bands below 1GHz, the PRMA led by Ingenu uses the 2.4GHz band, which some people call the dark horse of the LPWAN world.

RPMA has strong coverage capabilities; it is said that only 619 base stations are needed to cover the entire USA, while LoRa would require 10,830 base stations for the same coverage. RPMA also has a large capacity; for example, if each device transmits 100 bytes of information per hour, RPMA can connect 249,232 devices, while LoRa and Sigfox can only connect 2,673 and 9,706 devices, respectively.

To quickly capture the low LPWAN market, Ingenu has stated that it has deployed 2.4GHz RPMA in over 45 countries and regions worldwide, reportedly establishing 600 base stations in 30 cities in the USA by the end of 2016, covering 70% of the US territory.

Ingenu is also actively establishing partnerships with chip, module, and system suppliers to expand its ecosystem and promote market applications.

5 Weightless, Seemingly Calm

Weightless has three different architectures: Weightless-N, Weightless-P, and Weightless-W. Weightless-N is a low-cost version for unidirectional communication; Weightless-P is for bidirectional communication; and if local TV white space is available, Weightless-W can be chosen.

Weightless has reached a cooperation agreement with the European Telecommunications Standards Institute (ETSI), and this technology may emulate Wi-Fi in the future to establish a unified standard and certification system, standardizing and industrializing technology and products. According to the goals of Weightless SIG, the cost of a Weightless-connected terminal is hoped to be under $2, and the material cost of a Weightless base station is expected to be under $3,000.

Weightless-P uses GMSK and offset-QPSK modulation to provide optimal power amplifier efficiency. The offset-QPSK modulation itself has interference immunity and uses spread spectrum technology to enhance network connection quality. With a low transmission power of 17dBm, terminals can be powered by button batteries. The adaptive data rate also allows nodes to establish a new signal channel to the base station with minimal transmission power, thus extending battery life. In standby mode, Weightless-P consumes less than 100uW.

6 HaLow, The Dream of Bringing Wi-Fi Outdoors

Wi-Fi has achieved great success indoors and has always wanted to go outdoors. With the arrival of the Internet of Things, it is time to make another attempt. In September 2016, the 802.11ah standard led by IEEE completed its Draft 9.0 version. In December, it completed the standard committee approval process, and it is expected to commercialize in 2018 under the name HaLow, using the unlicensed 900MHz band, with a transmission distance of up to 1 kilometer and a transmission rate of 150kbps to 347Mbps.

IEEE also plans to use the 802.11af technology in the TV white channel frequency band of 54 to 790MHz, hoping to provide lower power consumption and longer transmission distances.

However, from HaLow’s specifications, the transmission distance still lags behind other LPWAN technologies that can reach dozens of kilometers, although it can be extended to several kilometers through multi-point relaying. Due to its late start, the industrial chain is weak. The advantage is that building a Wi-Fi network is not difficult; it can be done simply through device upgrades.

Currently, it can only be positioned as a supplement to NB-IoT; achieving wide-area network connectivity still relies on NB-IoT.

Surrounded by threats, as the pipa plays, the battle of the Internet of Things has begun…

Network optimization mercenary submission email: [email protected]

Long press the QR code to follow

On the road of communication, let’s walk together!