Recently, China Telecom announced the launch of large-scale outdoor testing of NB-IoT in 12 cities across seven provinces, with plans to complete NB-IoT trial commercialization by June.

This targets the weaknesses of its two major competitors, creating a rapid and decisive advantage. After all, China Mobile does not yet have an FDD license, and Unicom’s 1800M NB-IoT industrial chain is not mature enough.

As NB-IoT is poised for launch, I am reminded of Bill Gates’ old saying: We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten.

The nascent NB-IoT is not as optimistic as it seems.

Just a Software Upgrade? Not That Simple

When discussing NB-IoT, people often quote the phrase “just a base station software upgrade,” but communication engineers are anxious; the reality is far more complex.

Let’s look at the situation…

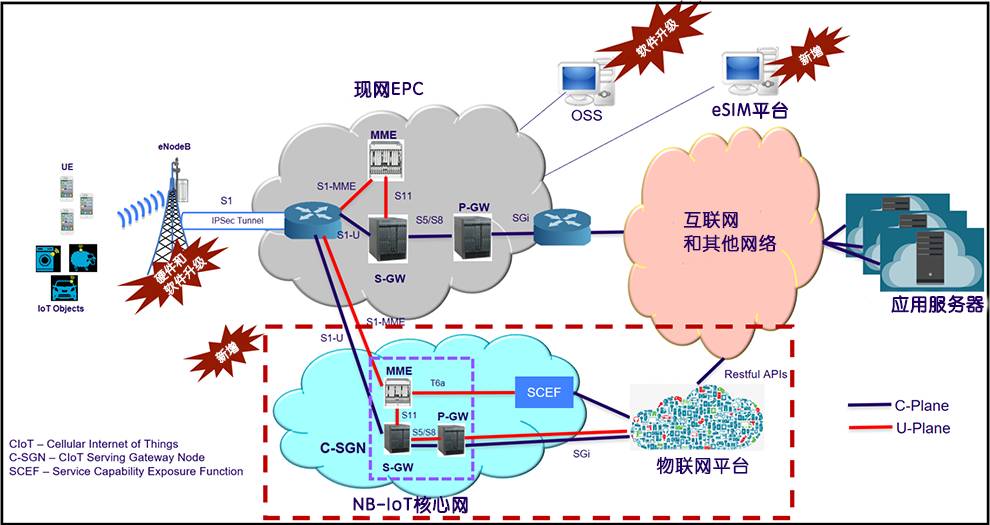

The ultimate deployment of NB-IoT requires not only the software and hardware upgrades of base station eNB, OSS upgrades, but also the addition of NB-IoT core networks, IoT platforms, and eSIM platforms. It must also integrate existing network subsystems such as PCRF (Policy and Charging Rules Function), DPI, BSS, and upgrade HSS. All of this is very complex work!

More Than Just Connectivity

“Connectivity” is the advantage of cellular IoT, given the ubiquitous network coverage accumulated over more than 20 years. However, this advantage appears too thin in the realm of IoT technology.

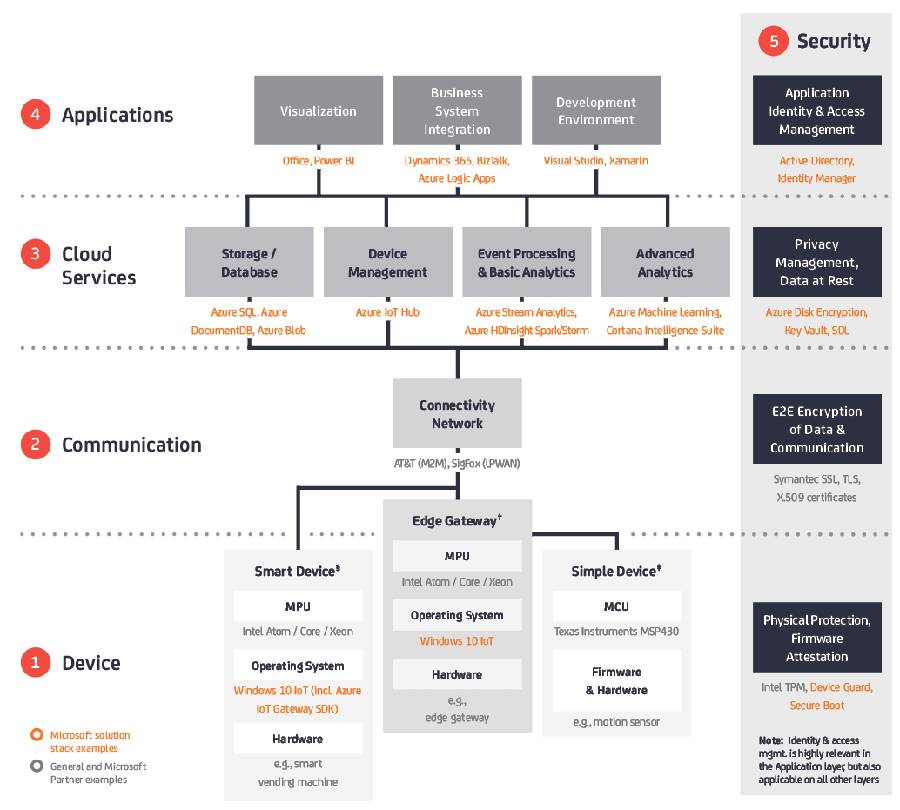

Referencing a summary from IoT Analytics, here’s a diagram of the five-layer structure of end-to-end IoT solutions…

IoT solutions are divided into five layers: terminal devices, connectivity, cloud services, applications, and security. Apart from connectivity and security, operators’ cellular IoT does not hold a dominant advantage in cloud services, applications, or even terminals.

This is merely a technical issue; the real challenge lies in the transformation of business models under this IoT framework, which will force companies to undergo a transformation in organizational structure and culture.

Transformation is precisely the concern of some manufacturers. When the appliances, cars, and other products you sell are all connected to the network, the sales model and customer relationship management will face unprecedented changes.

Operators must not only adapt to these changes in related industries but also need to change themselves. This is not like selling SIM cards on the street; the revenue from IoT traffic is pitifully low, and due to the impact of other LPWAN technologies, the fees for IoT data traffic continue to decline. Only new business models can offer a way out.

However, can operators, constrained by the system, adapt to change?

Module Cost Competition

In the 2G era, RF modules only supported two frequency bands, and chip costs were low; a GPRS module was about $7. In the 3G and 4G eras, as traffic demand increased, the number of supported frequency bands grew, leading to increasingly complex chips. Despite benefiting from Moore’s Law, prices remained high—approximately $20 for 3G modules and $35 for 4G modules.

Although NB-IoT was born for low costs, the different frequency bands deployed by each operator may affect the ecological scalability, resulting in chip costs not declining as expected.

Additionally, since cellular IoT has two versions: Cat-M1 and Cat-NB1, will supporting both versions on a single chip lead to increased development costs?

Furthermore, will patent barriers occur in cellular IoT similar to those in 3G/4G? Could this lead to ecological imbalances, preventing cellular IoT chips from being integrated into various devices at scale like WiFi and Bluetooth?

Of course, raising so many questions does not indicate a loss of confidence in cellular IoT. Returning to the saying mentioned at the beginning: We always overestimate the changes that will occur in the next two years and underestimate those in the next ten.

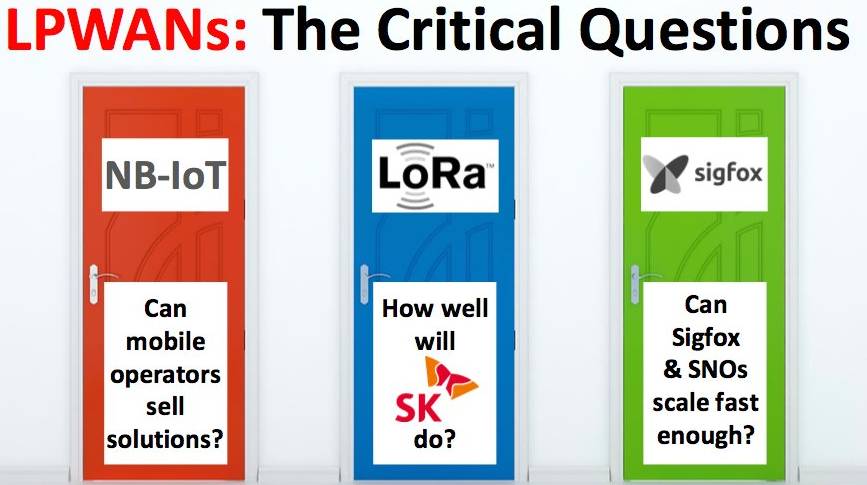

Compared to other LPWAN technologies, NB-IoT is relatively late to the market. In its initial phase, it will inevitably face fierce resistance from other LPWAN technologies. Moreover, for NB-IoT to mature, it requires time to accumulate, and this process also provides other LPWAN technologies the opportunity to develop cloud computing, big data, and other IoT-related services, thereby securing a foothold in the market.

In the short term, NB-IoT will undoubtedly face a brutal challenge.

However, cellular IoT relies on a strong 3GPP industry chain, and with the continuous evolution of standards and market maturity, it will inevitably expand its market under scale effects. After all, the 3GPP standard is not to be underestimated. But how long will it take?

Network Optimization Freelancers Submission Email: [email protected]

Long press the QR code to follow

On the Road of Communication, Let’s Walk Together!