Today, I want to talk about LoRa.

In the past six months, I have repeatedly mentioned “Internet of Things“.

When discussing the Internet of Things, the term I have used the most is “NB-IoT“.

[Reference Reading] Previous articles about NB-IoT:

I’ve heard that this NB thing is going to take over…

What can NB-IoT actually do?

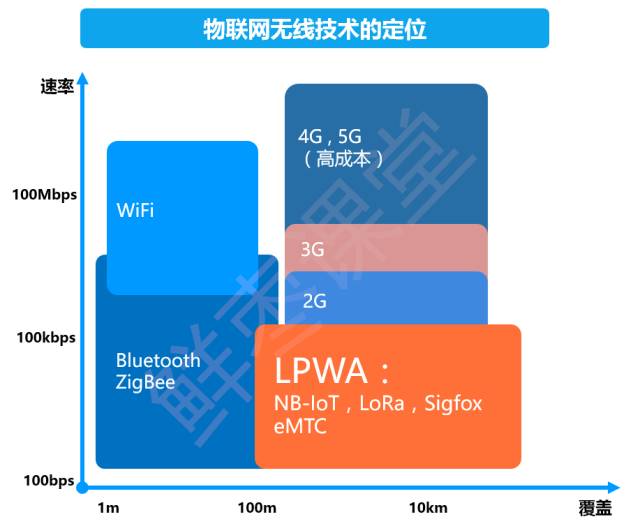

In fact, for the complex application scenarios of the Internet of Things, there are many factors to consider, including cost, speed, lifespan, mobility, and coverage, etc. No single technology standard can dominate.

“LoRa“ is a LPWAN technology that fiercely competes with NB-IoT.

LPWAN

(Low Power Wide Area Network)

What is LoRa?

LoRa is a long-range wireless transmission scheme based on spread spectrum technology and is one of the communication technologies for the Internet of Things.

Its name comes from the abbreviation of “Long Range“, and its biggest feature is its long distance.

Although LoRa’s momentum is not as grand as that of NB-IoT, in terms of seniority, NB-IoT still has to call LoRa “brother”.

In August 2013, Semtech Corporation in the United States released a new type of chip for ultra-long distance low-power data transmission technology based on frequencies below 1GHz, which is our LoRa chip.

Once LoRa was launched, it gained widespread attention due to its remarkable sensitivity (-148dbm), strong anti-interference capability, and excellent system capacity.

In simple terms, LoRa has changed the balance between transmission power consumption and transmission distance, fundamentally altering the landscape of embedded wireless communications. It presents a new communication technology that can achieve long distances, long battery life, large system capacity, and low hardware costs, which is exactly what the Internet of Things (IoT) needs.

Source: Global IoT Observation

With its treasure in hand, Semtech has certainly spared no effort in promoting LoRa technology.

In 2015, Semtech took the lead in establishing the LoRa Alliance. Founding members include heavyweight industry giants like IBM and Cisco, as well as well-known semiconductor manufacturers like MicroChip. Additionally, the alliance has attracted numerous telecom operators such as Singapore Telecom SingTel, KPN of the Netherlands, Swisscom, and Belgium’s telecom operator Belgacom.

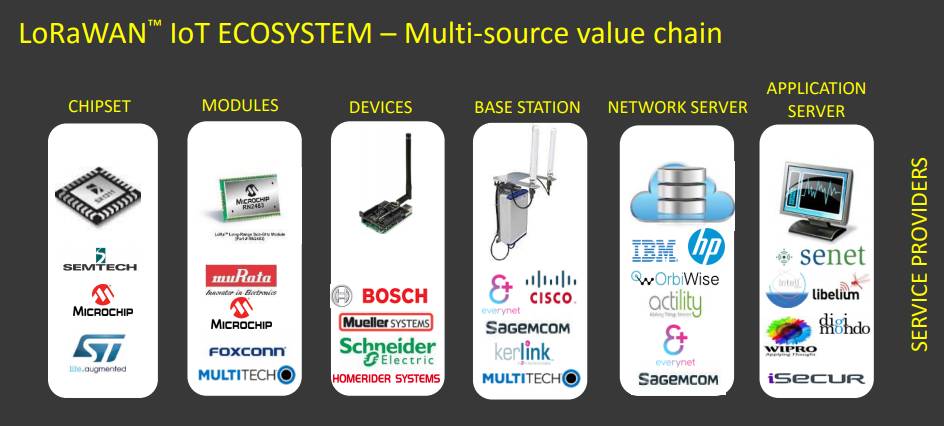

As we all know, whether a technology can thrive mainly depends on the strength of its ecosystem.

From the very beginning, the LoRa Alliance has placed special emphasis on ecosystem development. Under the alliance’s promotion, the LoRa industry chain has become quite mature, with relevant manufacturers covering everything from underlying chips and modules to equipment manufacturing and system integration.

Source: LoRa Alliance Official Website

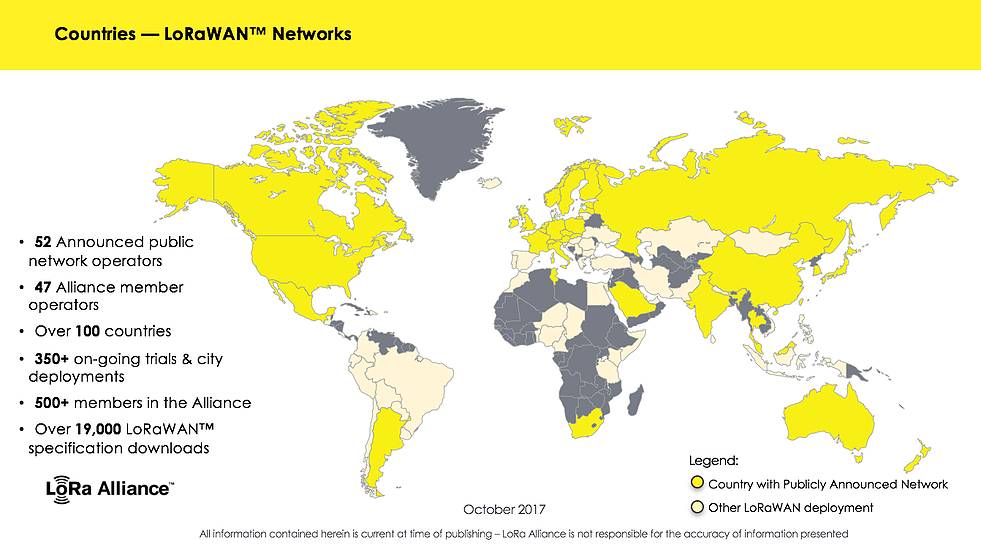

LoRa’s development internationally has been much more explosive than domestically.

Source: LoRa Alliance Official Website

According to the latest published data, the number of members of the LoRa Alliance has grown to over 500, with 52 operators worldwide deploying LoRa networks, and over 100 countries and regions starting pilot projects, such as the USA, France, Germany, Australia, and India. KPN Telecom in the Netherlands and SK Telecom in South Korea deployed a nationwide LoRa network as early as the first half of 2016, providing IoT services based on LoRa.

The competition between LoRa and NB-IoT can be seen as a contest between ZTE and Huawei.

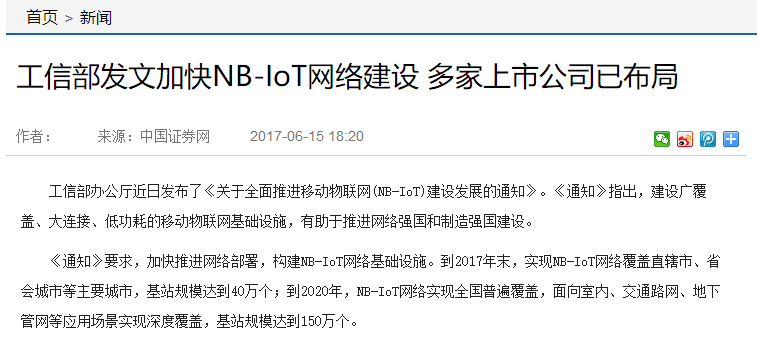

Since the standard for NB-IoT was frozen in June 2016, it has continuously attracted public attention.

This year, all three major telecom operators are vigorously promoting NB-IoT, with related news emerging almost daily.

Even the Ministry of Industry and Information Technology has issued documents to support it, and for a time, people seem to know “only NB, not LR”.

In fact, LoRa has not admitted defeat; on the contrary, it is continuously fighting back.

“Sailing on two boats” OFO

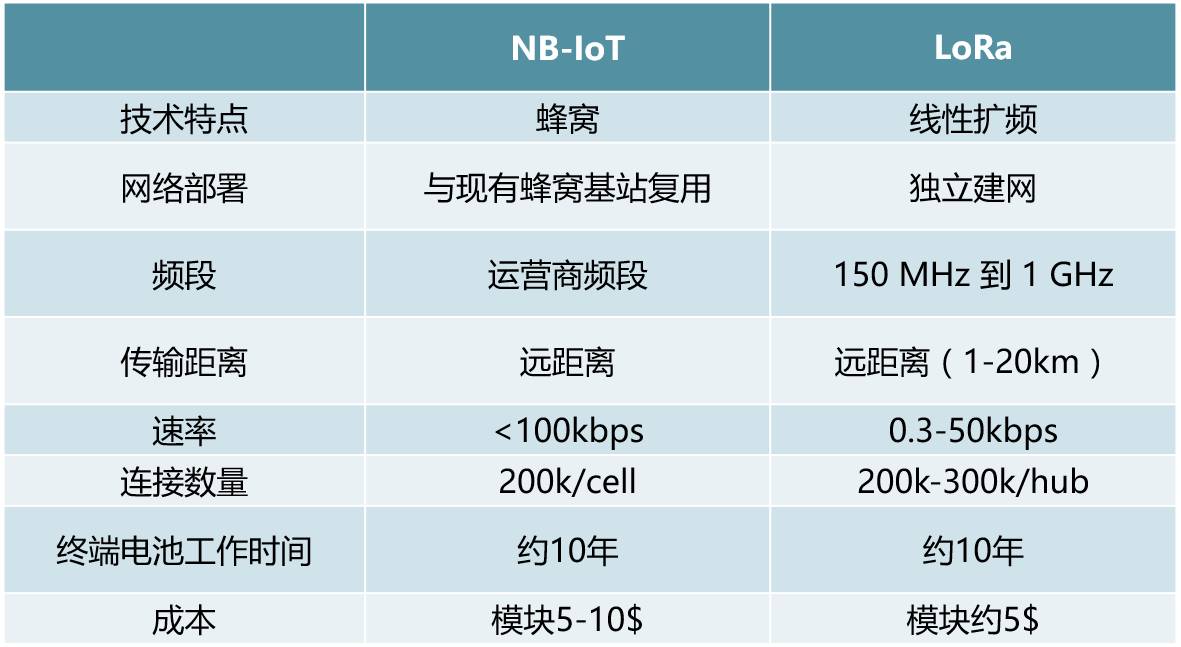

In terms of technical performance, LoRa and NB-IoT are actually evenly matched.

Source: Global IoT Observation

Their application scopes and service targets are also basically consistent.

The main difference between the two is — spectrum.

NB-IoT operates on licensed spectrum, which is a specifically allocated frequency band.

LoRa operates on unlicensed spectrum, meaning it can only work on certain designated free frequency bands.

Furthermore, NB-IoT must be provided by operators and must use the operator’s network.

This is why the three major operators in China only promote NB-IoT technology.

In fact, LoRa has advantages over NB-IoT in some aspects:

-

In terms of flexibility

For customers, using NB-IoT mainly relies on the operator’s basic network infrastructure, which is not fully covered in many harsh conditions. On the other hand, LoRa is a more flexible autonomous network that can be deployed anywhere needed, allowing enterprises (and even individuals) to become “operators”.

-

In terms of security

NB-IoT is an operator network, so data is first transmitted to the operator, and many enterprises are reluctant to share their data with others (even operators), so they will choose to deploy their own private LoRa networks.

-

In terms of frequency bands

LoRa operates in unlicensed frequency bands below 1GHz (mainly using 470-518MHz in China), allowing network construction without application, so there are no additional communication costs during application, which has become a major selling point for related enterprises.

Huawei, as the backing of NB-IoT, has been continuously promoting NB. Naturally, ZTE, as Huawei’s rival, has been tirelessly pushing for LoRa.

In January 2016, with the support of the LoRa Alliance, ZTE, together with nearly twenty partner manufacturers, initiated the establishment of the China LoRa Application Alliance (CLAA). The aim is to promote the application and development of the LoRa industry chain in China, especially through a nationwide cloud-based core network and shared access, gradually forming a nationwide operational virtual LoRa network.

Semtech CEO Maheshwaran and ZTE Senior Vice President Xu Huijun

In simple terms, what CLAA aims to do is to have all alliance members establish base stations nationwide according to common standards, utilizing a large number of scattered LoRa networks to establish a national backbone network (somewhat like gathering sand to form a tower).

With ZTE’s efforts, the number of CLAA members has surpassed that of the international LoRa Alliance. Currently, the number of CLAA members exceeds 850 and is still accelerating, with the number expected to reach 1000 by the end of 2017.

For LoRa, ZTE is also putting in a lot of effort, even establishing a subsidiary (ZTE Kela Technology Co., Ltd.) to find partners and sign cooperation agreements…

Just a few days ago, on October 19, ZTE hosted the 9th General Assembly of the International LoRa Alliance (and the 2017 China LoRa IoT International Summit).

In summary, NB-IoT and LoRa are currently in a heated competition stage, and it is still too early to say that NB-IoT has secured victory. Communication technology is evolving rapidly, and market developments are changing swiftly; anything can happen. Moreover, “mixing and matching” has always been a characteristic of communication technology development; after all, 2G is still hanging on…

(End of Full Text)