The global semiconductor manufacturing industry, the invisible engine driving the digital age, is undergoing a profound transformation. The significant signs of this transformation are reflected in the sharp increase in demand for artificial intelligence (AI), intense competition among processor architectures, and the collaborative efforts of various countries to reshape complex international supply chains.Although established companies still hold significant positions, the market landscape is being deeply influenced by agile new entrants and government policies aimed at promoting domestic production and reducing geopolitical risks.Recent data indicates that the previously strong growth trend in the industry has moderated due to regional differences and strategic adjustments across the entire value chain.

As Arm Dominates, RISC-V Begins to Emerge

The design of processor architectures dominates production and market share. Currently, the industry is witnessing a compelling three-way competition.Arm architecture chips dominate the mobile and embedded sectors due to their power efficiency advantages and extensive licensing model, with annual shipments reaching hundreds of billions, widely used in consumer electronics.The x86 architecture, led by Intel and AMD, has long been the mainstream choice for personal computers and servers, holding about 55% of the processor market share.However, the market share of x86 processors is gradually being eroded by Arm architecture CPUs. Apple’s Mac computers and some laptops have adopted Arm architecture CPUs, and more cloud computing and AI servers in large data centers are using custom chips.Meanwhile, the RISC-V architecture is rapidly rising. Despite starting from a smaller base, shipments exceeded 10 billion units in 2022, mostly for cores or simple controllers.According to The SHD Group’s forecast, shipments of RISC-V system-on-chips (SoCs) are expected to reach 16.2 billion units per year by 2030. Its open standard provides flexibility, customization, and the advantage of not having to pay royalties, driving this growth.Although RISC-V’s global processor market share is still smaller than that of x86 and Arm, an analysis of the $27.7 billion computer microchip market for 2024 shows that RISC-V’s share is 13.2%. This difference highlights the impact of market definition, indicating that RISC-V is gaining significant momentum in specific niche markets such as low-cost microcontrollers and dedicated embedded processors.

TSMC’s Dominance Faces Challenges from Reshoring Trends Chip manufacturing is primarily handled by foundries, with TSMC (Taiwan Semiconductor Manufacturing Company) holding a dominant position. In the fourth quarter of 2024, it accounted for about 67% of the global wafer foundry market revenue, highlighting its critical role in the semiconductor supply chain. Samsung Electronics’ foundry services rank second with about 11% market share, while GlobalFoundries, UMC, and SMIC each hold about 5%. Recently, TSMC reported a 42% revenue growth for the first quarter of 2025, reaching $25 billion.TSMC’s dominance in advanced logic manufacturing has raised geopolitical concerns, as its manufacturing capabilities span from mature technologies to cutting-edge 3-nanometer process nodes. The company is now transitioning to 2-nanometer (Gate-All-Around Field-Effect Transistor, or GAA FET) technology and is leading in advanced packaging solutions (such as CoWoS), which are crucial for integrating high-performance computing and AI chips with high-bandwidth memory. To address the risk of over-concentration of capacity in Taiwan, TSMC has made significant investments in the U.S. and Japan, with plans to expand into Europe to achieve strategic diversification of its geographical layout.Intel, as a traditional integrated device manufacturer (IDM), is transforming by expanding its Intel Foundry Services (IFS) to compete with TSMC and Samsung. IFS commits to supporting chip designs for the three mainstream instruction set architectures: x86, Arm, and RISC-V, and has launched a $1 billion IFS Innovation Fund, most of which is aimed at promoting the development of the RISC-V ecosystem. This indicates Intel’s recognition of RISC-V’s increasingly important position in the semiconductor field.

AI and Automotive Sectors Drive Innovation in Wafer FoundriesDemand from different market sectors largely determines the priority development directions of foundry companies.In the high-performance computing (HPC) and artificial intelligence (AI) sectors, the endless demand for computing power drives the market’s need for the most advanced process nodes and complex packaging technologies supplied by TSMC, Samsung, and Intel Foundry Services (IFS). For example, NVIDIA’s Blackwell GPU utilizes TSMC’s advanced CoWoS-L packaging technology.In contrast, the automotive semiconductor market faces different challenges and opportunities due to its strict reliability requirements (AEC-Q100) and long-term supply demands.Foundries such as TSMC, Samsung, GlobalFoundries, and UMC offer dedicated automotive platforms, with certified processes that meet the advanced chip demands of ADAS and infotainment systems, while also incorporating mature nodes for microcontrollers and power management integrated circuits. Additionally, RISC-V is gaining attention in the automotive sector and is expected to become a rapidly developing application direction.

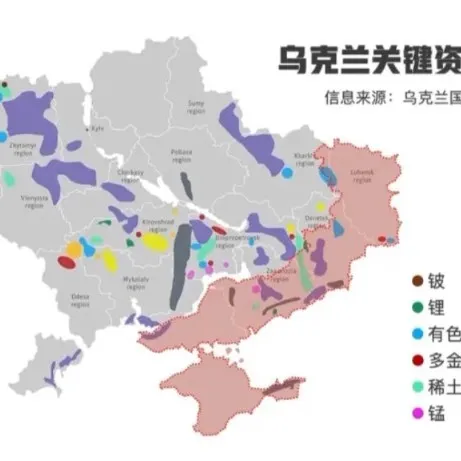

Countries Strive to Increase Supply Chain ResilienceThe over-concentration of the semiconductor supply chain, especially the dominance of Taiwan and South Korea in advanced manufacturing, has raised significant concerns about geopolitical risks. Furthermore, reliance on critical equipment (such as ASML’s EUV lithography machines) and global procurement of raw materials has further increased the vulnerability of the supply chain.In response, governments around the world are implementing ambitious industrial policies. The U.S. CHIPS and Science Act allocates hundreds of billions of dollars to incentivize domestic semiconductor manufacturing and R&D, bringing the production of advanced logic chips back to the U.S. Similarly, the European Chips Act aims to enhance Europe’s semiconductor value chain and increase its global market share. These efforts are prompting major chip manufacturers and foundries to make significant investments outside East Asia, reflecting a long-term effort towards supply chain resilience and geographical diversification.

The Semiconductor Industry is in a Period of TransformationThe semiconductor manufacturing industry is at a critical juncture. The continuous advancement of AI innovation has generated unprecedented demand for advanced chips, while the RISC-V architecture, with its open and customizable features, is challenging the existing dominance of x86 and Arm. Moreover, the industry’s high dependence on TSMC is changing, as Samsung and Intel actively advance their advanced manufacturing capabilities, and geopolitical factors are making geographical diversification an urgent priority, leading to a strategic shift in the foundry industry landscape.This article is translated from the sister platform EETimes of International Electronic Business, original title:Shifting Sands in Silicon by Global Supply ChainsEditor: Clover Li

Hot News

The U.S. and Ukraine to Sign Mineral Agreement: Can Ukraine’s 8,000 Mineral Deposits Fill 70% of the U.S. Supply Chain Gap?

2025-04-18

Konka’s Performance Collapses, Chip Investment Plummets by 95%

2025-04-17

STMicroelectronics Reveals Global Plan Details, Launches “Voluntary Departure” Program

2025-04-17

The U.S. Fully Blocks! AI Chips from NVIDIA, AMD, and Intel Prohibited from Being Sold to China

2025-04-17

Intel’s New CEO Chen Lifeng Takes First Action! Sells 51% Stake in Altera

2025-04-15