On April 2, Arm’s Senior Vice President of Infrastructure, Mohamed Awad, stated in an interview with Reuters that Arm aims to increase its share of the global data center CPU market from the current 15% to 50% by the end of 2025.

Currently, most servers run on Intel Xeon processors or AMD EPYC processors based on the x86 instruction set architecture, primarily due to the extensive x86 data center-level software ecosystem that has been built up over the years. However, with Arm continuously launching competitive Neoverse series IP core products in the data center market, along with the transformation brought about by the AI era to the traditional data center ecosystem, Arm is experiencing rapid growth in its market share across the data center sector.

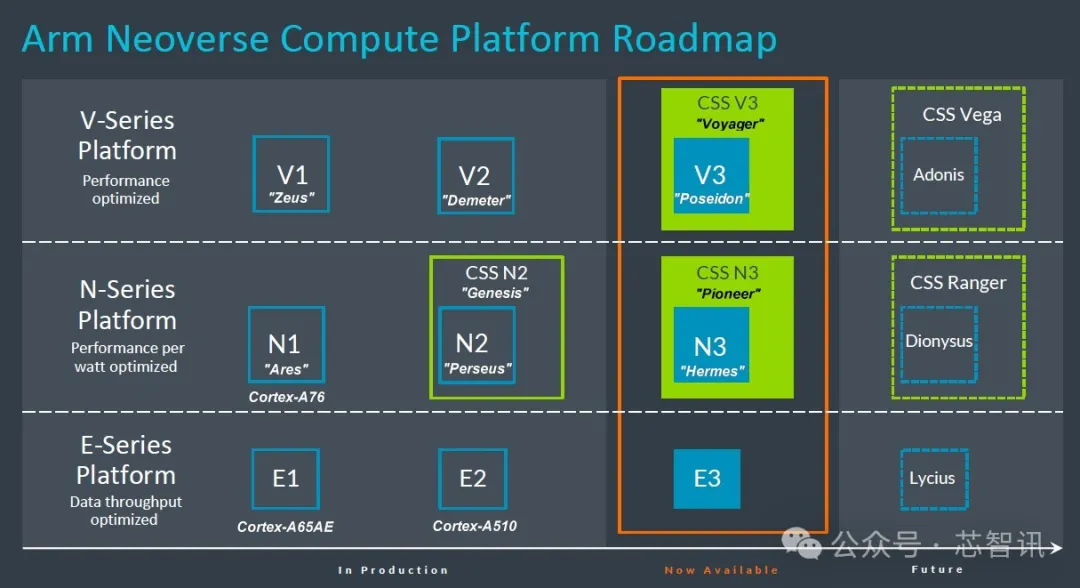

Specifically, since 2018, Arm has successively launched multiple series of Neoverse N/V/E IP core products, which have begun to catch up with x86 server CPUs in performance while offering advantages in energy efficiency and cost. This aligns with the trend of cloud service providers developing their own Arm server CPUs.

△ Arm Neoverse Product Roadmap

“Arm technology typically has lower power consumption compared to competitors’ server CPUs like Intel and AMD, which is particularly important for large cloud service providers focused on energy consumption and cost,” said Mohamed Awad.

We can see that several years ago, Amazon Web Services (AWS) launched the Graviton series server CPUs based on Arm Neoverse series core IP, which have undergone multiple iterations and are now used in many of its instances. AWS stated last December that the Arm-based Graviton CPUs currently in use account for more than half of the total increase in server CPUs over the past two years.

Leading cloud service providers such as Alibaba Cloud (Yitian series), Google (Axion series), and Microsoft (Cobalt 100) have also launched Arm-based server CPUs for their cloud services.

Additionally, there are chip design companies that specifically provide Arm server CPUs to customers, such as Ampere Computing, Huawei, and Phytium.

To support Arm server CPU manufacturers’ designs, Arm integrated resources from leading industry companies, including special application IC (ASIC) design firms, IP suppliers, electronic design automation (EDA) tool providers, foundries, and firmware developers, to launch the “Arm Total Design” initiative in October 2023. This aims to accelerate and simplify the development of Neoverse CSS architecture systems, assist various parties in innovation, speed up product time-to-market, and reduce the costs and barriers associated with creating customized chips, enriching the Arm server processor ecosystem.

As of October 2024, the number of companies participating in Arm Total Design has rapidly grown to over 30, and they have begun accelerating the development of test chips and small chip products based on the Neoverse N series or V series CSS.

Rumors suggest that MediaTek and Qualcomm will also launch Arm-based server CPUs. In June 2024, MediaTek announced its participation in the Arm Total Design ecosystem project to expand the influence of Arm Neoverse CSS in cloud AI and computing infrastructure applications.

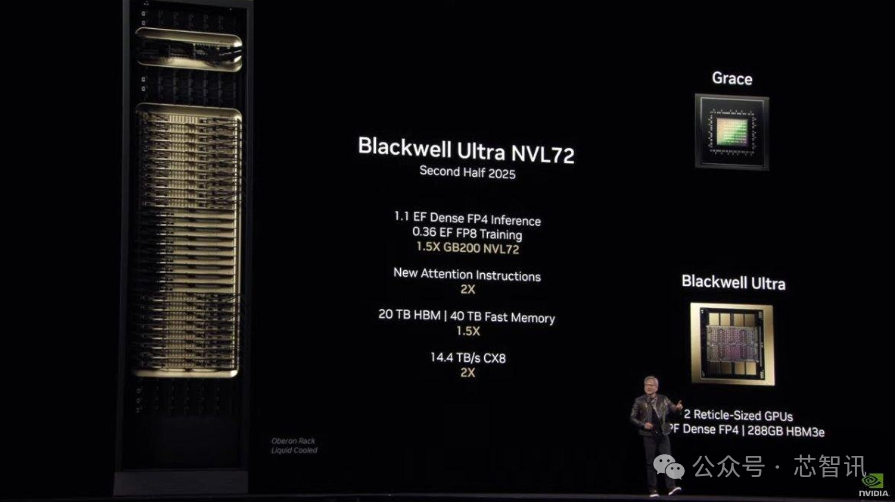

More critically, with the rise of generative AI, NVIDIA has quickly dominated the AI data center market with its powerful GPU chips. In NVIDIA’s advanced AI systems, the self-developed 144-core Arm Neoverse V2 core Grace CPU is used, such as in the NVIDIA DGX GB200 NVL72 rack system, which includes 36 Grace CPUs and 72 Blackwell GPUs, without the need for additional x86 CPUs for support. Currently, NVIDIA’s GB200 and GB300 series AI servers are highly favored by leading cloud service providers and AI technology companies, which will inevitably accelerate the increase of Arm architecture server CPUs’ market share in the overall server CPU market.

△Blackwell Ultra NV72 Server

△Blackwell Ultra NV72 Server

It is particularly noteworthy that Arm seems to be developing its own server CPUs for large cloud service providers like Meta. If Meta deploys them in bulk, it will inevitably control a significant portion of the server CPU market, as Meta is one of the major procurement customers globally.

Recently, SoftBank Group announced its acquisition of Ampere for $6.5 billion, and SoftBank is also the majority shareholder of Arm. This acquisition is seen as a move to help Arm better expand into the server market. Recent rumors about Arm planning to acquire SerDes giant Alphawave follow the same reasoning.

According to a report released by market research firm Counterpoint at the beginning of 2023, in 2022, AWS and Ampere, two Arm server CPU manufacturers, accounted for 4.68% of the global server CPU market by revenue. Additionally, according to Gartner, the global Arm server shipment share in the first quarter of 2023 was 7%.

Another research firm, Bernstein Research, predicts that in 2023, nearly 10% of servers globally will use Arm server CPUs, with half of them deployed by AWS, which has over 2 million self-developed Graviton chips in its cloud.

According to the latest interview with Arm’s Senior Vice President of Infrastructure, Mohamed Awad, Arm’s share of the global server CPU market has already increased to 15% in 2024.

Mohamed Awad stated that in many cases, Arm’s server CPUs consume less power and are more cost-effective than x86 architecture server CPUs made by competitors like Intel or AMD. Given that AI data centers consume a significant amount of electricity, presenting substantial energy and cost challenges, Arm’s chips are becoming increasingly popular in the cloud service market.

“Now, some server programs are developed first for Arm-based processors and then ported to x86 platforms. We have reached that point,” said Mohamed Awad.

With major global cloud service providers increasingly developing and adopting Arm architecture server CPUs, and more third-party chip design companies beginning to invest in Arm server CPU research and development, along with NVIDIA’s advanced AI systems being accepted by more AI data center customers, and Arm starting to customize server CPUs for leading clients, Mohamed Awad believes that this year, the market share of Arm server CPUs in the global server CPU market will significantly increase to 50%.

Mohamed Awad explained that Arm’s confidence stems mainly from the booming AI trend and the significant advantages of its architecture. “In this era of AI transformation, we see an insatiable demand for computing power, and AI servers are expected to grow over 300% in the coming years.”

“To achieve scalability, energy efficiency is no longer a competitive advantage but a basic industry requirement. This is where the Arm Neoverse computing platform clearly leads, and it is the preferred computing platform for industry-leading partners, including AWS, Google, Microsoft, and NVIDIA,” Mohamed Awad further stated.

Regarding Arm’s prediction of capturing 50% of the data center CPU market by 2025, some analysts disagree. Manoj Sukumaran from market research firm Omdia believes that by 2025, Arm-based CPUs may only account for 20%-23% of the global data center market, rather than the 50% claimed by Arm.

Nevertheless, it is evident that in the data center CPU market, which has been dominated by x86 for many years, Arm’s influence and market share are continuously expanding, posing an increasing threat to x86.

Editor: Chip Intelligence – Wandering Sword

Previous Exciting ArticlesRumors of Arm and Qualcomm competing to acquire SerDes giant, with the latter’s stock price soaring 21%!Intel CEO Pat Gelsinger: Divesting non-core businesses to establish a world-class foundry!The world’s first! Ruisi Zhixin GESP integrated visual sensor ALPIX-Pizol is launched!2024 European Patent Application Rankings: Samsung first, Huawei second!Infineon Executive Interview: Detailed explanation of GaN/SiC/AI/robotics layout and localization development in China!2024 Q4 Global Smartphone AP Market: Unisoc’s share rises to 14%, Huawei’s share drops to 3%!Gao Lun Electronics plans to acquire Ruicheng Semiconductor to leverage EDA and IP synergy!New Kailai releases 31 semiconductor devices across 6 categories (with product information attached)Following Sandisk and Yangtze Memory, Micron also announces price increases!The US has added 54 Chinese companies, including Inspur, Ningbo Chang, and Zhongke Keke, to the entity list!The first 350nm lithography machine in Russia will be produced in MoscowNorth Huachuang enters the ion implantation equipment market!Chinese Academy of Sciences successfully develops all-solid-state DUV light source technology!

For industry communication and cooperation, please add WeChat: icsmart01Chip Intelligence Official Group: 221807116