Recently, the 176th meeting of the 18th Issuance Review Committee of the China Securities Regulatory Commission was held, and Fuzhou Rockchip’s initial public offering (IPO) was approved. Previously, Rockchip had failed multiple times in its IPO attempts, primarily due to its insufficient strength. Even now, there are still some flaws in Rockchip’s documentation, and this approval may give investors a shock. However, the Chinese stock market itself is quite unpredictable, with many pitfalls, so one more or one less does not make much difference.

Rockchip’s Heavy Reliance on Government Subsidies in Recent Years

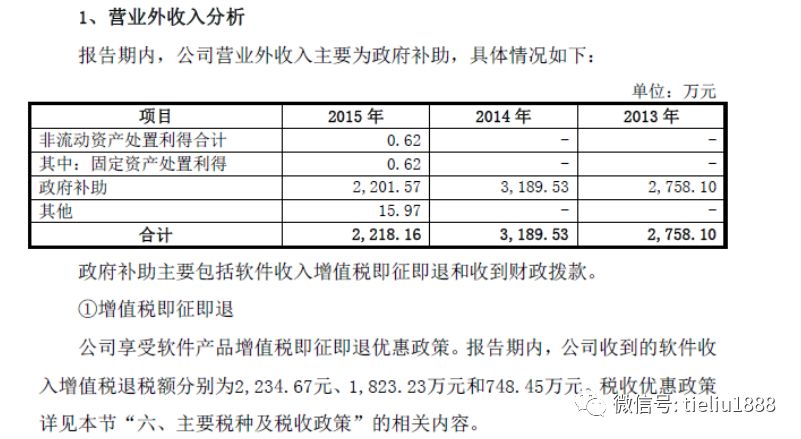

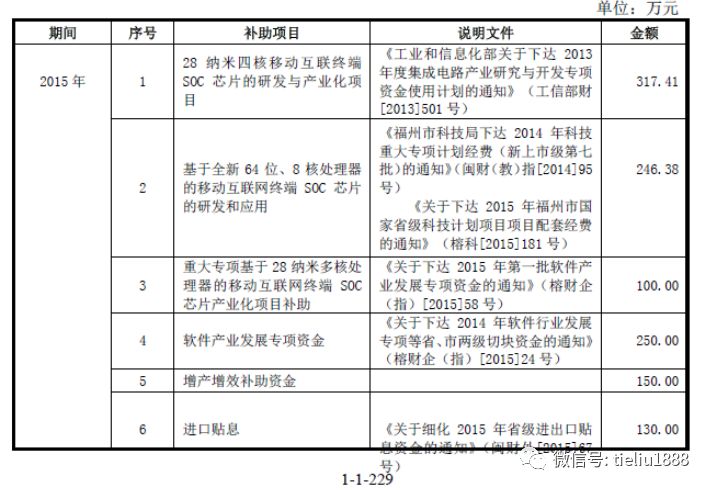

From 2013 to 2015, Rockchip received a total of 81.6579 million yuan in government subsidies, and it is unclear whether it received any subsidies prior to that. The following screenshots are from Rockchip’s IPO documentation.

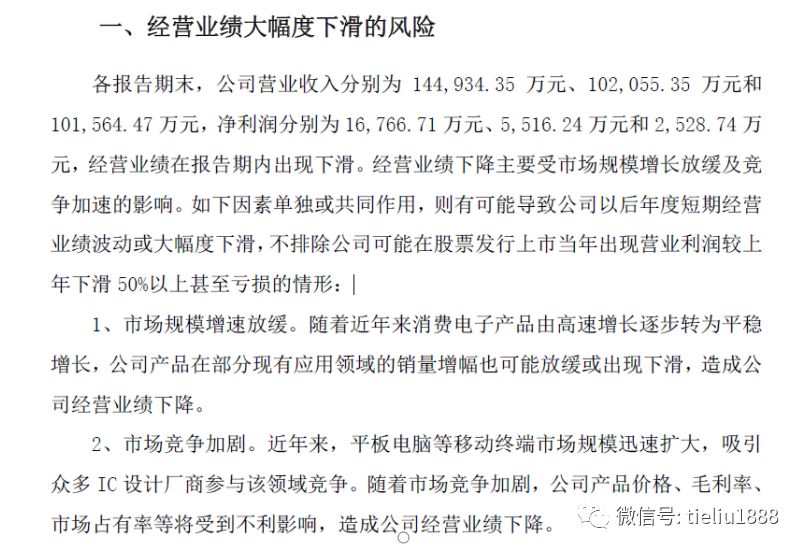

Moreover, from a business perspective, Rockchip has not been successful. Whether a company is successful or has market competitiveness is not determined by mere words but is directly reflected in its performance. According to Rockchip’s IPO application documents, its performance dropped significantly from 1.4 billion yuan in 2013 to 1 billion yuan in 2015, with profits plummeting from 160 million yuan in 2013 to just 25 million yuan in 2015. Even disregarding the substantial decline in both revenue and profit, a company with 1 billion yuan in revenue should not have a mere 25 million yuan in profit. This profit was only achieved with the help of a 22.1816 million yuan government subsidy in 2015, which raises some intriguing implications.

(Screenshots from Rockchip’s IPO documentation)

To compare, we can look at Allwinner, which has a similar business model, technology route, and scale as Rockchip. During the tablet era, Allwinner and Rockchip were on equal footing, with very close market shares. Allwinner Technology had a revenue of 1.65 billion yuan in 2013 and a profit of 419 million yuan. Although there was a decline in 2015, its revenue still exceeded Rockchip’s at 1.209 billion yuan, and its profit was five times that of Rockchip at 109 million yuan. Furthermore, Allwinner’s annual report for 2016 showed an increase in revenue to 1.252 billion yuan and profit to 132 million yuan. It is evident that, with similar revenue figures, Allwinner’s profit is about five times that of Rockchip. Additionally, if we exclude the 22.1816 million yuan subsidy in 2015, Rockchip’s actual profit for that year was only 3.1058 million yuan.

Rockchip’s Marketing Tactics Are Questionable

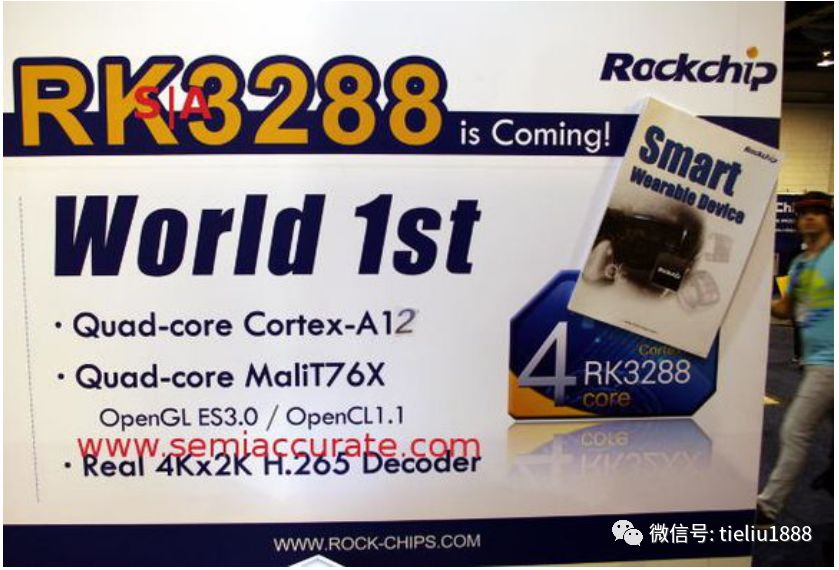

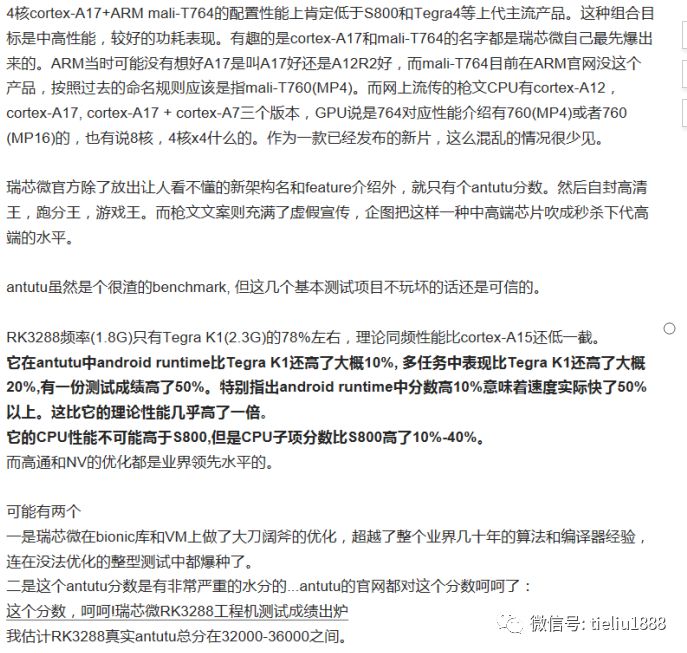

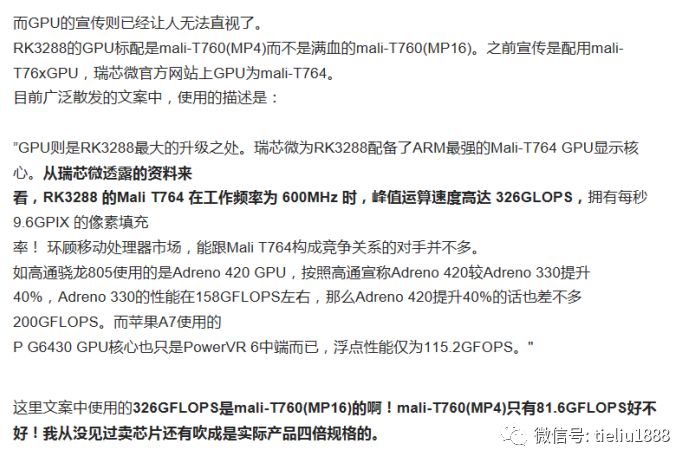

Some of Rockchip’s marketing tactics are rather questionable. Due to a series of failures with the RK29 and RK30 series and a string of fraud scandals, Rockchip’s credibility has severely declined, leading to widespread criticism in the user market. To restore its image, Rockchip heavily promoted the upcoming release of the RK3288 based on Cortex A12 at the end of 2013 and the beginning of 2014. There are still many promotional articles online from that time claiming it was based on Cortex A12.

However, this A12 core processor suddenly transformed into Cortex A17 at the CES exhibition in the United States, with all promotional materials changing instantly. To this day, Rockchip still pretends not to see the vast amount of promotional content from that time claiming RK3288 was Cortex A12, insisting that RK3288 is indeed Cortex A12. Although A17 and A12 are very close in performance, this kind of misleading behavior is quite debatable.

A photo from the exhibition is quite telling. During the setup, Rockchip’s promotion claimed RK3288 was the world’s first A17 processor, but soon after, doubts began to arise domestically, questioning why the previously promoted A12 suddenly became A17. The incident quickly escalated in China and began to spread abroad. A few days later, when the exhibition officially started, the image below appeared, showing the A17 being covered by a sticker with the number 2 written on it.

Moreover, MTK clearly stated that the MT6595 was the first chip to integrate Cortex A17, and it is impossible for both MTK’s statement and Rockchip’s promotion to be true. So, who is lying, MTK or Rockchip?

The following is a screenshot of the discussion thread questioning the A12 to A17 transformation:

RK3288 has continued to employ questionable tactics in both its promotion and benchmarking, such as the controversial A12 to A17 transformation, the substitution of GPU specifications between mali-T760MP4 and mali-T760MP16, and more covert cheating methods regarding AnTuTu and AnTuTu X benchmarks.

If we follow Rockchip’s promotional parameters, the specifications of RK3288 should far surpass the A7 processor used in the iPad at that time, yet users of tablet products equipped with this processor have a profound impression of its inability to compare with the iPad. At one point, a popular term emerged similar to the “high frequency, low performance” phrase associated with Intel Pentium 4 processors, called “domestic PPT processor.” The following are screenshots from related posts.

Rockchip Has Let Down the Zhejiang University Technical Team

Rockchip was never a dominant player during the PMP era; the true leader was Actions Semiconductor. Even though Actions has since declined, the saying that “history is written by the victors” does not mean Rockchip can distort the truth. In fact, to this day, Rockchip’s video decoding remains a shortcoming, with better performance still seen in products from Amlogic and Allwinner, the latter of which has a technical team for video decoding that comes from Actions.

In fact, Rockchip’s most successful products were the RK2606/2608 series of repeaters, and if we delve into the history of the RK2606/2608 series, it reveals a dark past—former deputy factory director of BuBuGao Educational Electronics, and chairman of Dongguan Smart Technology, He Xiangyang, published a lengthy documentary novel titled “The First Person in Chinese Chips—Li Min’s Rise to Fame” on his Sina blog, which fully disclosed the unsavory history of Rockchip’s CEO Li Min.

Subsequently, this documentary novel was deleted from Sina Weibo, and only fragments remain online. Then, a shocking incident occurred where Huang Xu, a representative of the Fuzhou People’s Congress and chairman of the well-known Chinese chip brand Rockchip, physically assaulted He Xiangyang and his brother-in-law at the Fuzhou High-tech Software Park, resulting in injuries to He Xiangyang’s brother-in-law’s hand…

A senior engineer who participated in national key projects stated that when he was a graduate student, he was taken by his boss to work for Rockchip, and Huang let down the Zhejiang University technical team.

Over 1 Billion in Bank Deposits Yet Seeking Nearly 500 Million in IPO Funds

In July 2017, Rockchip’s attempt to go public on the Growth Enterprise Market with the sponsorship of Guosen Securities was rejected. In November, Rockchip submitted its counseling filing materials to the Fujian Regulatory Bureau of the CSRC again, this time changing its sponsor to Industrial Securities. On November 12, 2018, Rockchip’s IPO was accepted by the CSRC.

Rockchip plans to raise 488 million yuan for four fundraising projects, including the construction of a research and development center, the development of next-generation high-resolution image and video processing technology and related application processor chip upgrades, the development and industrialization of AI series SoC chips for voice or visual processing, and the upgrade of PMU power management new products.

According to the prospectus, by the end of 2018, Rockchip’s cash balance reached 1.037 billion yuan, of which 1.035 billion yuan was unrestricted bank deposits, more than double the amount it plans to raise this time.

Moreover, according to Rockchip’s prospectus submitted in November 2018, all four fundraising projects had already received approval for filing. During that year, with 1 billion in deposits, Rockchip did not start construction on the fundraising projects in advance, raising questions about the necessity of these projects and the motivation behind Rockchip’s insistence on going public despite not being short on funds.

Rockchip’s Chip Design Capabilities Are Limited

The prospectus states that Rockchip’s “design process is at a relatively high level in the industry,” which may be debatable.

From Rockchip’s past products, the chip’s IP is basically purchased from foreign companies like ARM, with the CPU and GPU core source code written by foreign companies like ARM. Rockchip’s role is merely SoC design. The performance iteration of its products relies on purchasing better IP from foreign companies, lacking the ability for independent technological upgrades. Rockchip is essentially a product of integrating ARM IP, essentially a laborer for ARM in China, with core technologies constrained by others. It can only be said to be a Chinese chip brand, but it cannot be called “Made in China.”

Lenovo once used Rockchip’s chips, such as the A10 tablet equipped with Rockchip processors, but later stopped using them for unknown reasons (which may be known to many users).

And this is not an isolated case for Lenovo; similar situations have occurred with many others. HP, after launching the Selate7 with RK3066, immediately switched to a non-Rockchip processor in the Selate7 3G version. ASUS, despite exposing tablet prototypes using Rockchip processors, ultimately did not launch them.

Rockchip once collaborated with Intel on the SoFia chip, but as a partner, Intel’s evaluation of Rockchip is quite telling. Intel categorized Rockchip’s products as part of the X3 series and explicitly stated in official documents that the X3 series is the lowest-end and cheapest series. Considering Intel’s absolute authority in CPU technology, this behavior by Intel vividly illustrates Rockchip’s chip design capabilities.