In recent years, there has been a surge of new hardware combining smart wearables and AI, such as AI glasses and AR headsets. While these new products are quite innovative, they have not translated into substantial commercial demand, resulting in a limited market space.

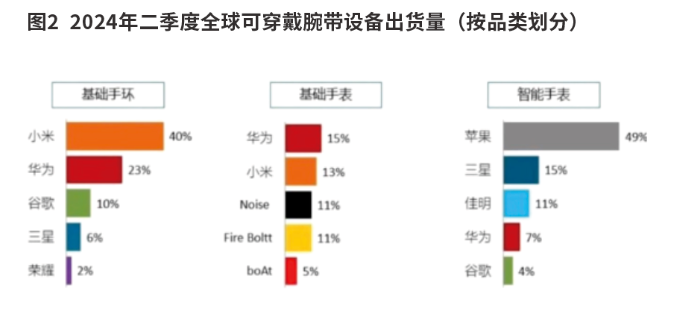

Among smart wearable hardware, smartwatches remain the largest category.

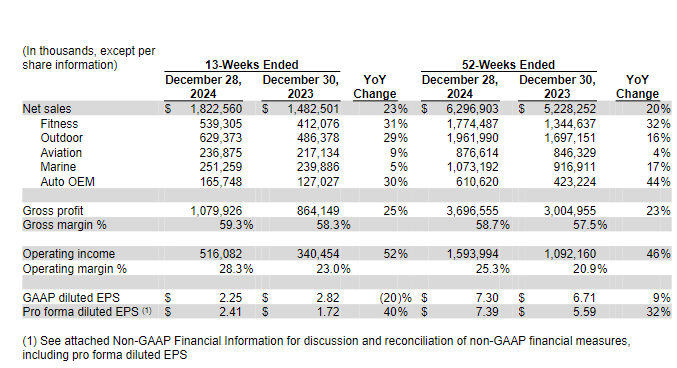

A company specializing in sports smartwatches, Garmin, has disclosed very optimistic financial results, projecting a 20% increase in revenue and a 46% increase in profit for 2024. Surprisingly, there is still a high growth category within consumer electronics, indicating a thriving smartwatch industry.

However, upon closer inspection, the industry is dominated by original smartphone giants such as Apple, Huawei, Xiaomi, and Samsung. As a non-internet smart device company, Garmin’s scale and software capabilities are not on par with these leading competitors, yet it has managed to carve out a niche.

It is indeed somewhat unbelievable that Garmin, a navigation information giant that started with GPS systems, has now become a representative stock in the smartwatch sector. What has the company done right?

1. Uneven Growth

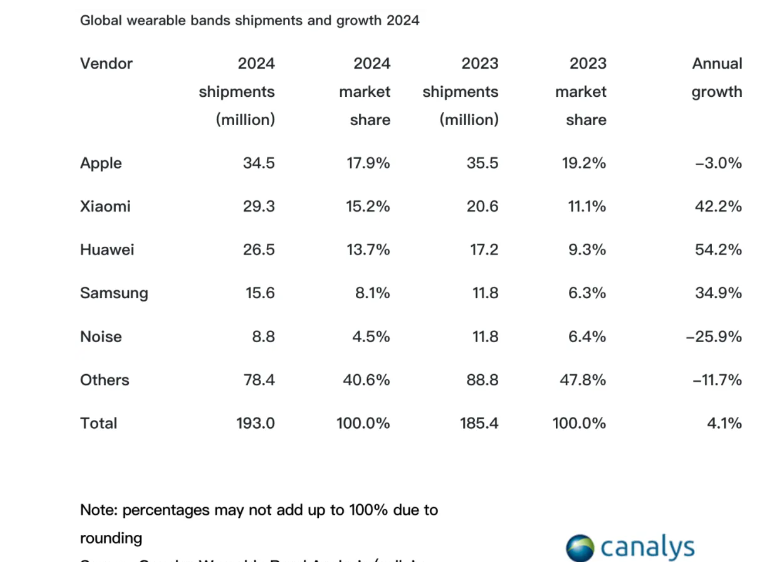

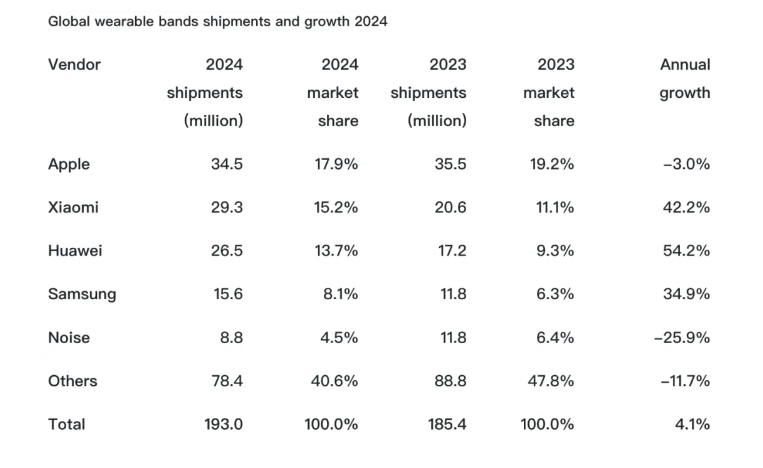

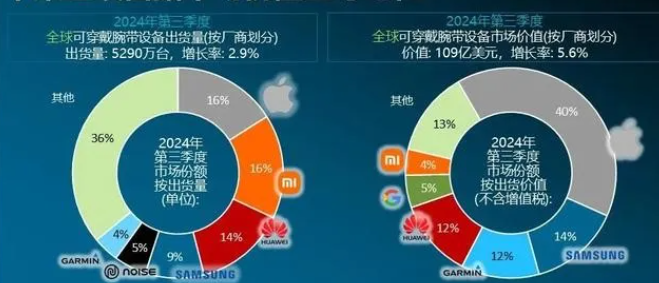

The outlook for smartwatches in 2024 is not particularly bright; only a few companies, such as Xiaomi, Huawei, and Samsung, are experiencing growth, with these Android-based companies showing high growth rates, while Apple’s shipments have slightly declined.

Apple, the first to launch smartwatches, is also facing competition from latecomers, with Garmin being one of the high-growth players.

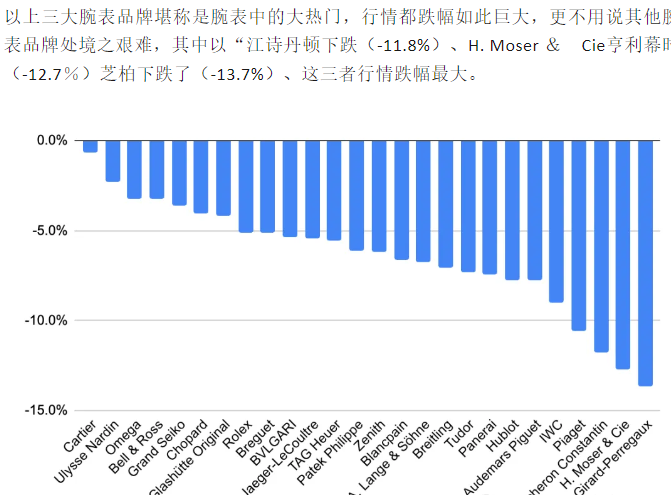

Currently, it is evident that consumers are continuously shifting away from traditional mechanical watches. The Swiss watch industry is also performing poorly in 2024, with exports to China plummeting by 20%. Additionally, prices of major watch brands have significantly dropped, with many attributing the decline to the poor state of the Chinese economy. However, in the era of smart technology, as watches become more functional, user dependency increases. The selling points of luxury, design, and brand narrative remain, but the core functions of traditional mechanical watches have not changed, leading to an increasing functional gap. The value of mechanical watches is shifting from everyday wear to special occasions, which undoubtedly diminishes the desire for purchase and collection.

Returning to the industry itself, smartwatches from Android camp companies like Xiaomi, Huawei, and Samsung, which are lower in price and not lacking in performance, are experiencing the fastest growth in the industry. Currently, a few thousand yuan for an Apple Watch is relatively inexpensive compared to mechanical watches, but it is still too expensive compared to other competitors. Smartwatches are evaluated based on performance, unlike luxury mechanical watches that are marketed based on craftsmanship and storytelling.

Thus, it appears that smartwatches are overall capturing the market share of mechanical watches, with Xiaomi, Huawei, and Samsung encroaching on Apple’s market.

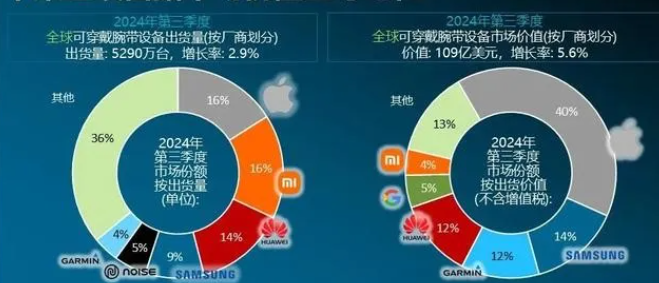

Currently, Garmin’s position in the industry, based on shipment volume, is not large, with a market share of less than 4.5%, below Noise. However, its revenue share in the industry is quite high, only trailing behind Apple and Samsung.

From the financial report, it can be inferred that Garmin’s smartwatch revenue is close to $3.8 billion, while Xiaomi’s revenue from its fitness bands is only around $1 billion. After all, the price of one Garmin smartwatch is roughly equivalent to ten Xiaomi or Huawei fitness bands.

Additionally, it is important to note that the growth in industry value is outpacing the growth in shipment volume, reflecting an increase in the average price of products. Many consumers are also increasingly inclined to upgrade their smart wearable devices. The growth of Xiaomi, Huawei, and Samsung is not merely a case of increasing volume at the expense of price; rather, their average selling prices for smartwatches have also risen.

The smartwatch industry does not have the luxury narrative segmentation of traditional mechanical watches, but performance disparities still create significant pricing differences. For example, a few hundred yuan can only buy a basic fitness band that meets essential functions, while smartwatches that integrate navigation, motion sensing, and health data monitoring, which contain numerous sensors and chips, naturally cost several thousand yuan.

So why is Garmin’s financial report so good? One reason is that within the high-end smartwatch segment, Garmin is experiencing significant growth, outperforming Apple. It is worth noting that the revenue for Apple’s smartwatch business line is declining in 2024, while Garmin is growing at 20%.

This also indicates the company’s unique competitive advantage in this niche market. High-end products lead the industry in technology, and excelling in the high-end segment carries more value than in the mid-to-low-end segments, which solidifies the company’s future position in the industry.

Additionally, the company’s stock performance has been quite good. With revenue growth, the company’s profit margin has also improved significantly, increasing the operating profit margin from 20.9% to 25.3%. The valuation has risen from 20 to 30 times earnings, representing a classic double-up scenario.

However, the market’s favor also hinges on a key point: the company is a rare IoT device company. After all, the smartwatch businesses of Apple, Xiaomi, and Samsung are not standalone; these businesses are peripheral within their parent companies and do not have a significant financial impact, regardless of their growth rates.

Even if one is optimistic about the future of Xiaomi and Apple smartwatch products, suitable stocks cannot be purchased. In contrast, Garmin, which primarily focuses on smartwatches, has a pure business model, making it reasonable for its valuation to receive a premium.

2. A Strong Moat, Rising Again

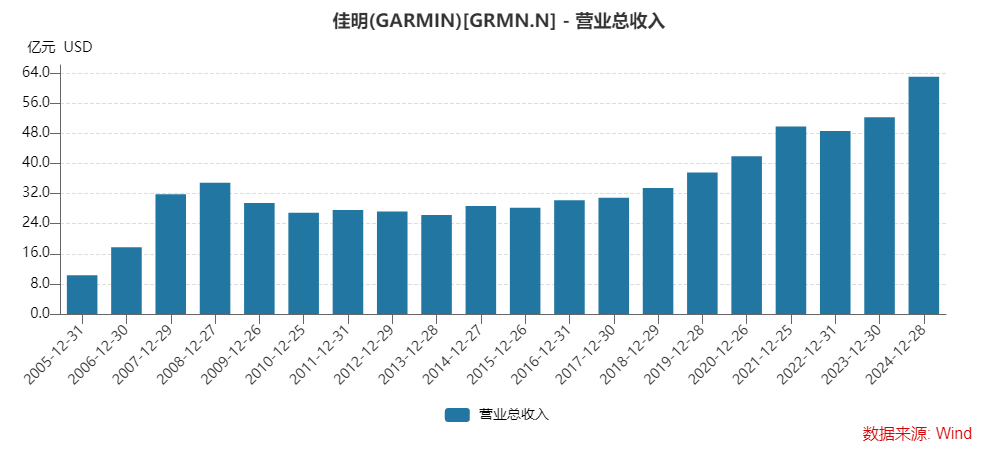

Garmin’s development trajectory has not been smooth; it can even be described as tumultuous.

The company was founded in the 1980s, initially providing civilian GPS services, primarily targeting aviation, marine, and automotive navigation products. The early GPS products could not be integrated into mobile phones and looked like this.

At that time, Garmin was a B2B specialized equipment company, with its core business spanning land, sea, and air, eventually becoming the largest automotive navigation device company, integrating maps and entertainment functions into automotive GPS devices, which accounted for 72% of the company’s sales at that time. Navigation devices were still scarce, similar to the historical tears of companies like China’s Kailide.

However, today we see that automotive navigation accounts for only about 10% of Garmin’s revenue, indicating that the company has undergone significant changes. Observing the financial reports, we can also find that in 2007, when navigation devices were the main source of income, the company’s revenue was $3 billion. By 2017, the company’s revenue had only returned to $3 billion. The company was once defeated by internet giants.

After 2008, smartphones rapidly evolved into multifunctional integrated terminals. Car navigation devices? It is better to open Google Maps on a phone.

Professional navigation devices still have a market, but the demand for many products that fall between specialized and civilian has significantly declined. As revenue declined, the company’s stock price naturally plummeted.

Many navigation device companies essentially went bankrupt and disappeared after that, but Garmin, as the industry leader, still managed to tap into potential from existing products. As early as 2003, the company launched its watch product line, which, while not considered smartwatches, theoretically served as a terminal for navigation functions. It was unlikely to be completely replaced by mobile phones.

After stabilizing its commercial marine and aerospace business, the company shifted its focus to wearable products, expanding into civilian applications. Building on its strong GPS navigation capabilities, it also added core technological functions for consumer use, such as precise sensing during sports and fitness. To this day, the functionality of the Apple Watch in professional running is still not as rich as Garmin’s.

In many niche areas of sports, Garmin’s products are highly regarded. For instance, in cycling, in addition to cycling instruments, Garmin also offers many sensor products for professional training enhancement and safety awareness.

Of course, Garmin’s watch software interaction and collaboration with mobile phones have gaps compared to smartphone giants, but in terms of many sports sensing capabilities and algorithm accumulation, Garmin still holds an advantage. By appropriately reducing the level of intelligence, Garmin has also achieved good battery life. The smartwatches from mobile giants often adopt a fast-moving consumer electronics approach, requiring frequent charging and emphasizing computing power over power consumption and battery life. This may be acceptable in urban settings, but in extreme environments, during sports, or in emergencies, it poses challenges.

The invention of watches is to check the time without external interference, especially during emergencies. Many mechanical watches also emphasize this point, lasting for decades without failure. Therefore, although Garmin’s products are also smartwatches, user perception differs. Combining its past experience in specialized equipment for land, sea, and air, Garmin has carved out a unique product positioning style in this sector. This is somewhat similar to Lululemon, which binds professional communities, operates communities, and relies on product strength to become a champion in niche products.

Currently, the global watch market is valued at $80-90 billion, with smartwatches accounting for half. Garmin’s total market share is around 4%, and looking ahead, there is still ample room for growth. Although there are many giants in the industry, Garmin can withstand competition from Apple. Of course, Xiaomi, Huawei, and Samsung are growing faster than Garmin, but the competitive relationship with Garmin is not very pronounced, as their main products do not directly compete.

However, if we look at all the companies in the industry, there are actually only a few, and the competition is not as fierce as in the smartphone market. Oppo and Vivo have not entered the smartwatch sector, and compared to the diverse positioning of various mechanical watch brands in the past, the competitive landscape is much improved.

Conclusion

Garmin’s future looks promising, confirming that being a champion in a specialized market segment is a good model. This smartwatch company has a market value comparable to that of Ford, which sells cars. In recent years, many professional sports equipment brands, such as Garmin and Yingshi, have also been rapidly growing. Large companies often struggle to deeply understand consumer needs in niche markets, which presents opportunities.

Currently, Garmin’s valuation appears slightly high at 30 times earnings, primarily due to the current market backdrop of declining consumer spending. Other new consumer leaders, such as ELF, DECK, and Lululemon, are facing even worse situations, with their valuations dropping to around 20 times earnings. In comparison, Garmin’s valuation is higher. However, if it were not for the pressure on consumer spending in the US stock market, Garmin, as a standard double-up consumer stock, would have outperformed Apple, and its valuation would not be limited to the current level. If the US stock market rebounds, it may not be the companies that have fallen the most that rebound the most, but rather those with the most significant improvements in fundamentals that will have the greatest elasticity.