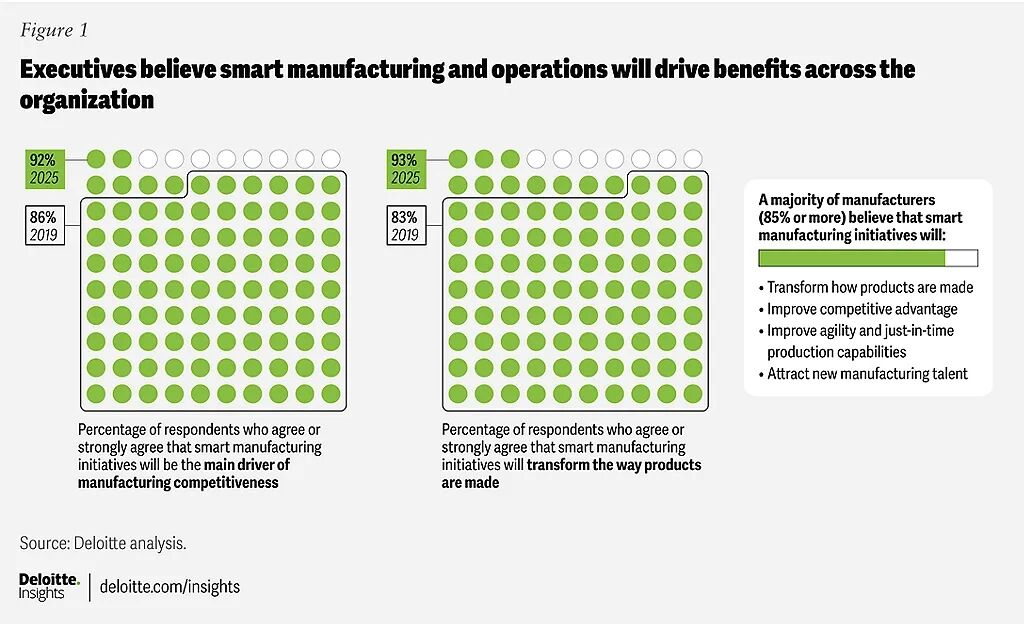

Respondents view smart manufacturing as a key driver for enhancing competitiveness in the next three years, believing it will reshape production processes, improve corporate agility, and attract top talent in the industry.

[Qiming Additive Manufacturing]Deloitte’s 2025 Smart Manufacturing Survey conducted between August and September 2024 shows that smart manufacturing is rapidly becoming a strategic focus for industrial leaders in the United States. The survey covered 600 senior executives from large manufacturing companies. The results indicate that 92% of respondents see smart manufacturing as a key driver for enhancing competitiveness in the next three years, an increase of 6 percentage points compared to 2019. Additionally, approximately 85% of respondents believe that smart manufacturing will reshape production processes, improve corporate agility, and attract top talent in the industry.

01

Performance Growth Drives Investment Interest

The report indicates that companies that have implemented smart manufacturing have achieved significant performance improvements. On average, manufacturers report an output increase of 10% to 20%, employee productivity improvements of 7% to 20%, and capacity release of up to 15%. Nearly half of executives believe operational efficiency is the primary reason for adopting these measures, while 44% emphasize financial benefits. 78% of respondents stated they would allocate over 20% of their improvement budget to smart manufacturing, and 88% expect their investments in the coming year to remain stable or increase, reflecting this optimistic outlook. Manufacturers are focusing on process and physical automation, as well as synchronizing factory operations to drive these improvements.

Modernization initiatives in factories include significant investments in automation equipment, sensors, and vision systems. Cloud computing, data analytics, and the Industrial Internet of Things (IIoT) are widely adopted, with 57% of companies using cloud solutions and 46% deploying IIoT. The adoption of unified data models and common architectural standards is increasing, helping companies manage data more effectively and respond quickly to operational demands.

Nevertheless, the report shows that many manufacturers are still developing artificial intelligence (AI) capabilities. Only 29% of manufacturers have adopted AI at scale, while 24% have begun using generative AI. Some pilot projects are underway, indicating that manufacturers’ interest in applying AI to decision-making processes is cautious but growing.

Executives participating in the survey unanimously believe that smart manufacturing will enhance competitiveness and drive production transformation.

02

Addressing Risks and Workforce Demands

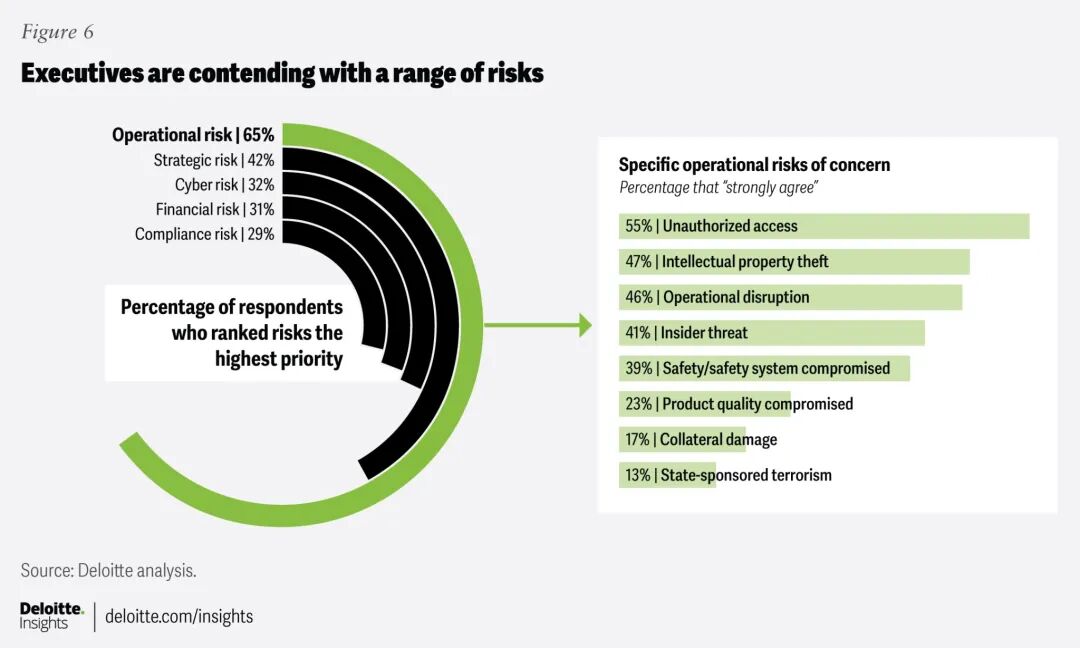

While the benefits are evident, scaling smart manufacturing also faces challenges. 65% of executives list operational risks as a primary concern, including potential financial losses from business interruptions and project failures. Cybersecurity is also an urgent challenge. According to Deloitte’s 2024 Global Cyber Future Survey, 91% of manufacturers reported at least one cybersecurity breach in the past year. Meanwhile, the talent shortage is becoming increasingly severe, with an estimated need for 3.8 million new employees in the industry by 2033. To address this, 48% of companies have launched smart manufacturing training programs, but Deloitte’s survey shows that human capital remains the least developed area.

The talent gap is not limited to the factory floor; many companies struggle to fill vacancies in information technology (IT), operational technology, and data science. As a result, about 70% of manufacturers are seeking third-party vendors to meet cybersecurity and data needs.

Executives list operational risks and data threats as primary concerns.

Within manufacturing companies, measures to address the transformation to smart manufacturing are continuously evolving. More than half of respondents have formed dedicated teams to advance smart manufacturing initiatives, while 45% focus on establishing communication processes to assist employees and customers in adapting to these changes.

The leadership of these initiatives often involves cross-departmental collaboration, with about half of respondents noting that operational leaders, including Chief Operating Officers (COOs), are leading these efforts. In approximately 38% of cases, technology leaders such as Chief Technology Officers (CTOs) play a key role.

Deloitte’s report concludes that the ambitious vision proposed in 2017 has now transformed into a practical roadmap for enhancing competitiveness. Smart manufacturing is no longer just a pursuit of the latest technological trends but requires targeted investments in data, core systems, and workforce development to unlock operational and financial value.

Overall, Deloitte’s survey results resonate with the adoption of 3D printing and digital factory solutions, which bring agility and resilience to modern manufacturing.

References[1] 2025 Smart Manufacturing and Operations Survey: Navigating challenges to implementation. Deloitte (2025)Content InformationCover:DeloitteThis content is provided solely for the purpose of industry information dissemination and sharing. Users are advised toconsider and independently assess any viewpoints, opinions, and conclusions presented in the article.Contributions are welcome! If you have any questions, please contact us:18067519625(WeChat), [email protected].