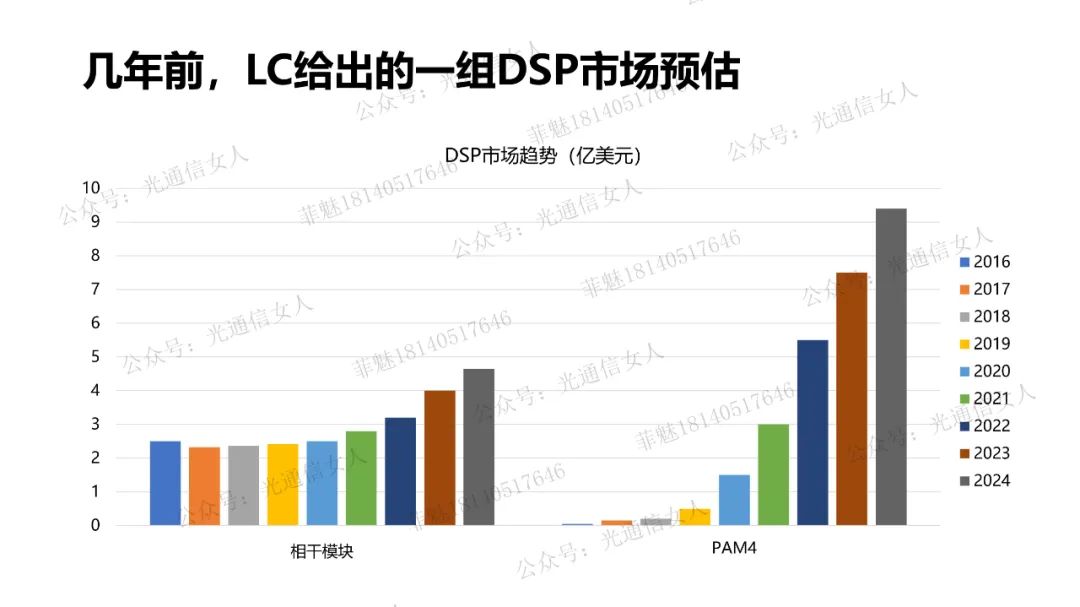

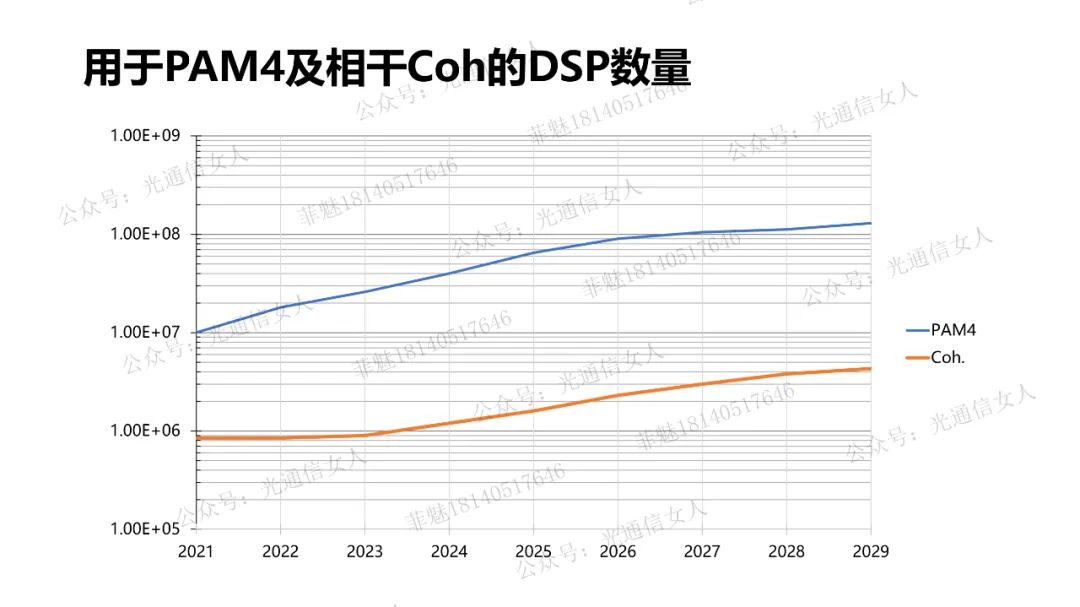

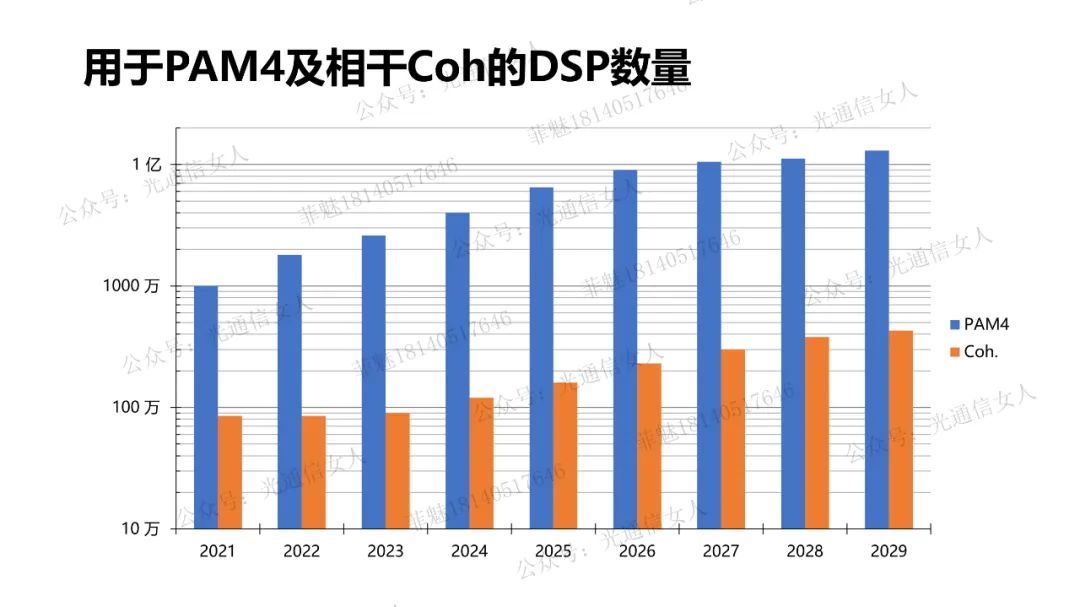

A few days ago, Lightcounting released a table regarding the trends in DSP chips. To provide some context, a few years ago, when 200G optical modules were just starting to ramp up, the DSP market, which emerged alongside PAM4, began to grow rapidly. In contrast to the slower growth of the coherent module market, the PAM4 DSP used in high-speed Ethernet optical modules for data communication has been increasing exponentially.

It’s important to note that the vertical axis in the chart below is still a linear scale, and these two markets are at least an order of magnitude apart.

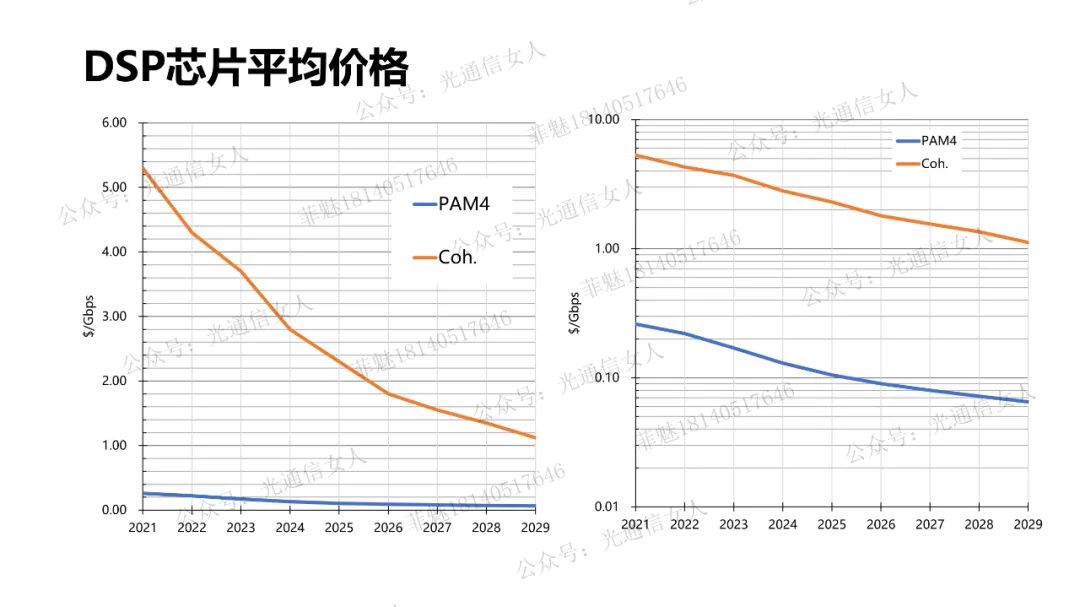

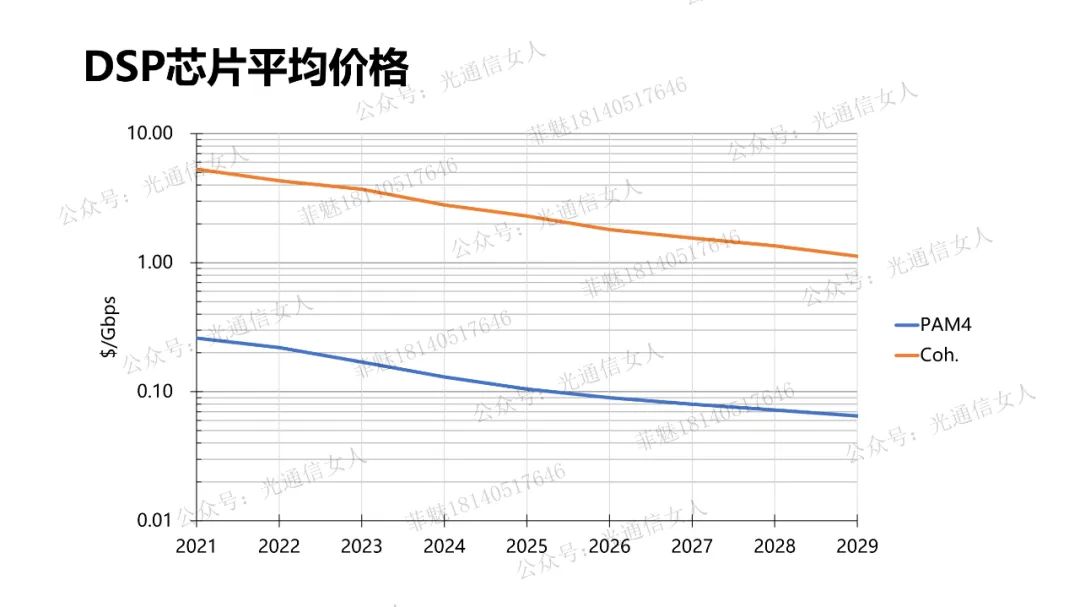

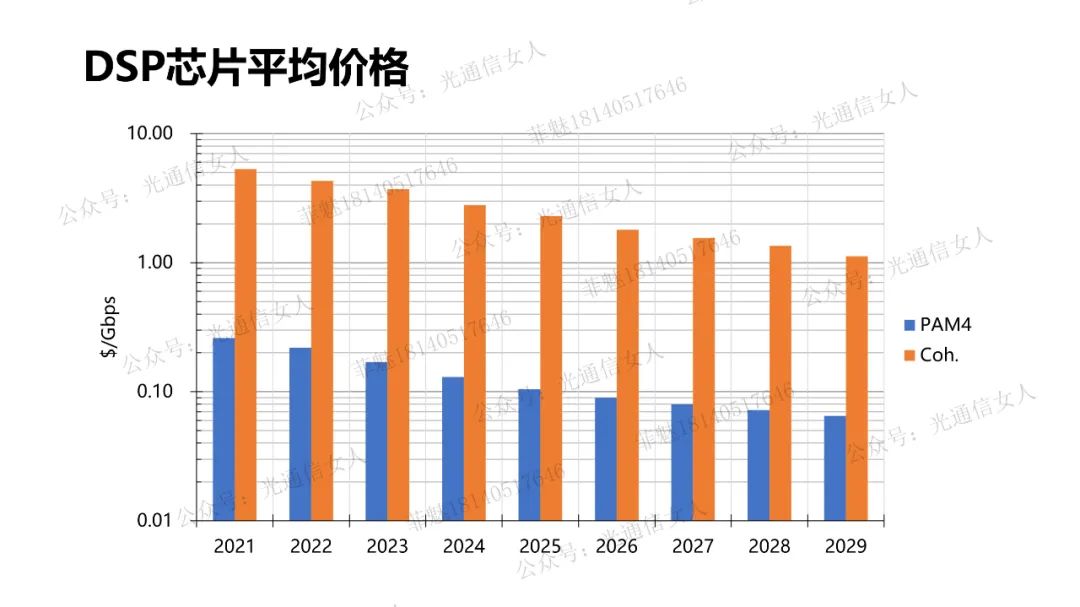

Subsequently, the prices of PAM4 DSP chips have decreased significantly, and their quantities have increased. This year, Lightcounting provided new data that analyzes the same set of data using a logarithmic scale, highlighting the differences between absolute and logarithmic values on the axes.

The price of DSPs used for coherent applications is an order of magnitude higher than that of PAM4.

The number of DSPs used for PAM4 is an order of magnitude higher than that for coherent applications.

I adjusted the zero point on this axis; the expected number of DSPs for PAM4 this year is around 30 million, while for coherent modules, it is about 1.2 million.

The uncertainty lies in the fact that many standard details for 800G and 1.6T have not yet been finalized. Y10T64 mentioned the timeline for the 800G standard.

The opportunities for PAM4 DSP arise from the growth of the data communication market, especially due to the rapid increase in module numbers driven by the fat-tree non-convergent topology of new AI data centers.

The risks in the PAM4 DSP market stem from the degree of industrial implementation of new technologies at three levels: LPO, CPO, and coherent downscaling. If any one of these technologies makes a breakthrough, it could quickly capture DSP’s market share in optical modules.

The opportunities for coherent DSP come from the growth of existing markets and the exploration of new coherent downscaling fields.