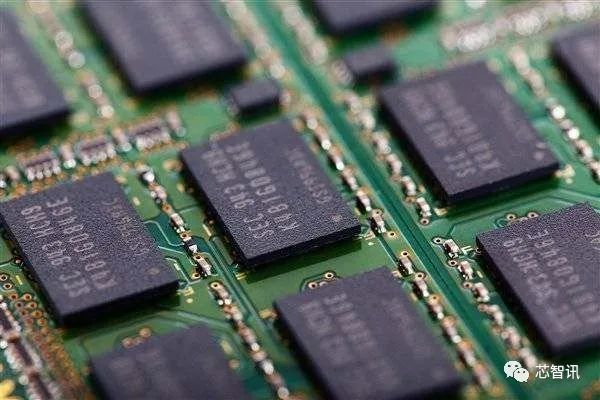

On December 11, it was reported that amid the ongoing production cuts by leading memory chip manufacturers such as Samsung, SK Hynix, and Micron, the price of NAND Flash wafers increased by over 25% in November. The reduction in supply due to factory cuts, combined with proactive price hikes from manufacturers, has forced some storage module manufacturers to accept these price increases, especially under the expectation that “manufacturers will continue to raise prices.” This has led to a rush for goods among storage module manufacturers, further driving up prices in December.

As a leading manufacturer of NAND Flash, Samsung has been continuously reducing its NAND Flash production since the second quarter, with a further cut in September to 50% of total capacity, primarily focusing on products with fewer than 128 layers. This has established confidence in price increases across the entire NAND Flash market.

The unexpected extent of production cuts by memory chip manufacturers, coupled with generally low client inventories, has driven the continuous rise in NAND Flash prices. However, in the second half of this year, both Mobile DRAM and NAND Flash (eMMC, UFS) have seen demand surge due to the traditional peak season, with the Huawei Mate 60 series stimulating other Chinese smartphone brands to expand production targets, leading to a short-term influx of demand and pushing up contract prices for the fourth quarter.

The most significant price increase in this round has been in NAND Flash wafer prices. According to the latest research results from TrendForce, the current industry situation shows that NAND module manufacturers’ inventories have rapidly depleted due to client orders, prompting module manufacturers to request increased supply from manufacturers. However, manufacturers continue to maintain their production cut strategies, leading to a strong rebound in NAND Flash wafer prices due to supply shortages. TrendForce’s data indicates that the price of NAND Flash wafers increased by over 25% in November alone.

Industry insiders reveal that under the current limited supply and significantly increased demand, module manufacturers can only accept the strong price increases from manufacturers. The expectation that manufacturers will continue to raise prices has led to a situation where “everyone is just scrambling for goods.”

From the current market situation, TrendForce believes that in December, with tight supply, NAND Flash prices will continue to rise. However, whether prices will continue to rise significantly in the first quarter will still depend on manufacturers’ production cut strategies and market demand conditions.

It is reported that some manufacturers are considering increasing production capacity due to the hot demand from downstream clients. If manufacturers increase production early, coupled with no significant improvement in demand, the extent of price increases will be significantly limited.

Editor: Lin Zi, Chip Intelligence

Previous Exciting Articles

Domestic production rate only 3%? Under restrictions from the US, Japan, and the Netherlands, this Korean testing equipment company is making a fortune in China!

A well-known brand’s unreleased prototype was leaked, and the Songshan Lake police successfully solved the case! Possibly related to Mate 60!

Intel IEDM 2023: 3D stacking/back power/back contact/DrGaN helps advance Moore’s Law

Huahong Group takes over Chengdu GlobalFoundries wafer factory: registered capital of 22.8 billion yuan, planning monthly production capacity of 30,000 wafers!

Tesla opens Cybertruck 48V system design data! Ford CEO: Thank you very much!

AMD’s strongest AI chip released: performance is 1.3 times that of H100! Also, the Ryzen 8040 series aimed at AI PCs

Rumors of Ruijun Microelectronics dissolving, unable to pay salaries and compensation? Internal executives respond

Huawei and Xiaomi’s actual controllers arrested!

The semiconductor equipment market in mainland China surged by 42%, but domestic manufacturers’ market share is only 5%?

After completing a $61 billion acquisition, Broadcom plans to lay off 1,267 employees!

Samsung CIS prices rise by 30%, providing opportunities for domestic CIS manufacturers!

Faced with numerous difficulties, Apple may abandon its self-developed 5G baseband chip?

For industry communication and cooperation, please add WeChat: icsmart01Chip Intelligence official group: 221807116