In today’s world, where the wave of artificial intelligence is sweeping through global data center architectures, a once relatively obscure yet crucial component—Digital Signal Processor (DSP)—is quietly reshaping the future landscape of optical communication. The DSP discussed here is not the traditional voice signal processing DSP, but rather DSP chips specifically designed for high-speed optical interconnects. As data centers upgrade from 100G to 400G, 800G, and even 1.6T bandwidths, the importance of DSP becomes increasingly prominent. Especially in AI-driven hyperscale data centers, low-power, high-performance interconnect solutions have become a necessity.

Currently, the optical communication DSP market has formed a triopoly dominated by three core players: Marvell, Broadcom, and Credo, with competition among the giants becoming increasingly fierce. However, new player Alphawave Semi is emerging with a full-stack layout, and Retym is breaking through with a clear technical architecture and aggressive strategy. The clash of old and new forces is stirring the market landscape.

Why is DSP Important?

Optical communication DSP (Digital Signal Processor) is a key component in modern fiber optic networks. It converts analog signals into digital signals and encodes digital data into various optical signals, utilizing complex modulation techniques (such as PAM4 and coherent modulation) to achieve high-speed, efficient data transmission.

The explosive growth of AI has given rise to a new paradigm for interconnecting hyperscale data centers. In AI data centers, transmitting data from GPU to GPU, the modulation method, bit error rate control capability, and power consumption performance of a DSP directly affect the latency and cost of model training. In the future, optical communication DSP will no longer be a behind-the-scenes hero but a key infrastructure determining how far AI can go.

Currently, optical communication DSPs are mainly divided into two categories:

PAM4 DSP: Suitable for short-range optical modules and active electrical cables (AEC), covering interconnects within data centers or over distances of several kilometers. With advantages of low cost and low power consumption, PAM4 DSPs are widely used in 800G and 1.6T modules, becoming the current market mainstream.

Coherent DSP: Enhances signal quality through advanced modulation and coherent detection techniques, suitable for long-distance transmission ranging from 10 kilometers to several thousand kilometers, making it the preferred choice for high-performance, long-distance networks. In recent years, the concept of ‘coherent-lite’ has emerged, filling the gap for mid-range scenarios of 2-20 kilometers, receiving significant attention from manufacturers.

According to the latest “PAM4 and Coherent DSP Market Report” released by LightCounting, the construction of AI infrastructure is driving a significant increase in PAM4 DSP shipments. “Bob Wheeler, a senior analyst at LightCounting, stated, ‘By 2028, as the next-generation 102T switching systems transition to 200G SerDes, 1.6T optical modules will consume over $1 billion worth of PAM4 DSP chips. The total market size for PAM4 and coherent DSPs will exceed $4 billion, with a strong compound annual growth rate (CAGR).’

The Dominance of Three Giants

Marvell is a dual champion in the PAM4 and coherent DSP fields, with a product line covering a wide range of application scenarios from short to long distances. Marvell’s dominant position in the DSP field is largely due to its strategic acquisition of Inphi, which is still regarded as one of the most iconic consolidation cases in the industry.

On October 29, 2020, Marvell announced its acquisition of Inphi for cash and stock, and the transaction was officially completed in April 2021, with a total amount of approximately $10 billion. This acquisition significantly expanded Marvell’s product landscape in the high-speed connectivity field, extending its capabilities from traditional copper interconnects to next-generation optical communication systems.

Inphi possesses an industry-leading high-speed data interconnect platform, covering unique silicon photonics technology and DSP architecture, particularly leading in 400G data center optical modules, precisely matching the ongoing demand for higher bandwidth and lower power consumption in future cloud computing data centers and global backbone networks. Its high-speed electro-optical products are widely used in cloud service providers and wired and wireless operator networks, serving as a key pillar of next-generation connectivity infrastructure.

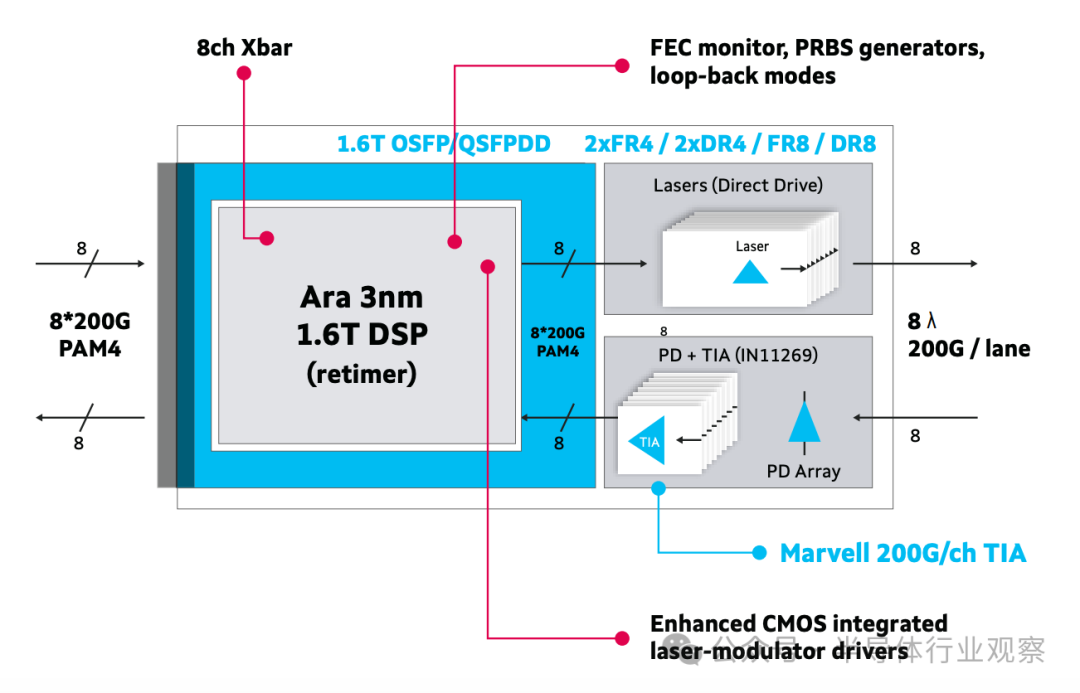

In the PAM4 DSP field, Marvell has formed a complete product matrix from 100G, 200G, 400G, 800G to 1.6T, including the Spica series, Nova series, and Ara series, among others. In December 2024, Marvell launched the industry’s first 3nm 1.6 Tbps PAM4 interconnect platform, Ara, featuring 200 Gbps electrical and optical interfaces. Compared to the previous generation Nova 2 DSP (the industry’s first 5nm 1.6 Tbps PAM4 DSP with 200 Gbps electrical and optical interfaces), Ara can reduce the power consumption of 1.6 Tbps optical modules by over 20%. Ara marks another first for Marvell in PAM4 DSP.

Ara System Block Diagram (Source: Marvell)

In the coherent DSP and coherent-lite DSP fields, Marvell has launched the Aquila O-Band Coherent-Lite DSP (model MV-CD242), a low-power, low-latency coherent-lite DSP aimed at 800G/1.6T optical modules. This chip is optimized for O-band fixed-wavelength lasers, supporting mid-range transmission from 2 to 20 kilometers, suitable for interconnects within data centers and campus-level AI cluster interconnects, becoming an important component for connecting future AI infrastructure.

Broadcom has a very strong market position in the PAM4 DSP field. Broadcom’s advantage lies in its complete ecosystem support, including deep integration with the Tomahawk series switching chips and close collaboration with optical module manufacturers (such as Eoptolink).

Broadcom’s DSPs are known for their low power consumption and high performance, especially in AI clusters and hyperscale data centers.

On March 25 of this year, Broadcom launched its latest Sian3 DSP, using a 3nm process and supporting 200G/channel PAM4 modulation. Broadcom claims it can provide the industry’s lowest power consumption for 800G and 1.6T optical transceivers using single-mode fiber (SMF), similar to Marvell’s Ara, also achieving over 20% power reduction for 1.6T optical modules.

Along with Sian3, Broadcom also launched the Sian2M DSP, which provides a specially optimized solution for 800G and 1.6T short-range MMF links within AI clusters. By integrating VCSEL drivers and leveraging Broadcom’s proven 200G VCSEL technology, Sian2M brings new levels of performance and efficiency to short-range connections. This technology is based on Broadcom’s existing achievements in optical interconnects, having successfully deployed over 50 million 100G VCSEL channels in AI networks.

Founded in 2008, Credo is a manufacturer known for its SerDes IP and energy-efficient connectivity technology, and it went public on NASDAQ in 2022. In the optical DSP field, Credo is renowned for its low-power and cost-effective PAM4 DSPs, covering 50G to 1.6T, supporting optical modules and active electrical cables (AEC).

On April 1, 2025, Credo launched its ultra-low power Lark optical DSP series. The Lark series includes two innovative optical DSP products. Lark 800 is a high-performance, highly reliable, low-power DSP designed to support the next generation of fully retimed 800G transceivers, which will be deployed in the world’s largest and densest AI data centers under challenging power and cooling environments. Lark 850 is designed for 800G linear receive optics (LRO) with a power consumption of less than 10W.

What sets Credo apart is its focus on industrial temperature ranges (-40°C to +85°C), giving it a competitive advantage in 5G front-haul/mid-haul and enterprise data centers. Although Credo may not have the technical depth of Broadcom and Marvell, it performs exceptionally well among small to medium-sized customers and emerging markets.

The Rise of New Forces: Alphawave and Retym

Alphawave Semi: Transitioning from IP to Silicon

Alphawave Semi was originally known for its high-speed SerDes IP and transitioned to a silicon product supplier in 2023, marking its ambition with the establishment of its Connectivity Products Group. Leveraging its WidEye architecture and EyeQ diagnostic technology, Alphawave is entering the high-speed PAM4 and coherent ‘coherent-lite’ DSP branches.

Alphawave’s first products are based on a 3nm process, utilizing the power and performance advantages of 3nm technology to challenge traditional giants. The products include:

-

Cu-Wave: A PAM4 DSP suitable for active electrical cables (AEC) up to 3 meters long, with a data rate of up to 1.6Tbit/s, or 8 x 200G. The product AW200-C can equalize losses of up to 40dB (measured bump-to-bump) at both the host and line side interfaces. AW200-C is manufactured using a 3nm CMOS technology node and is provided in the form of known good die (KGD). Alphawave Semi provides a complete reference design for 1.6T AEC.

-

O-Wave: A 200G PAM4 DSP for optical retimers and transceivers, with the same specifications, supporting optical fiber links up to 2 kilometers.

-

Co-Wave: A coherent-lite DSP for optical transceivers. AW400-O uses DP-QAM16 modulation, supporting 800G/1.6T modules over distances of 20 kilometers across campuses, and includes an integrated, configurable NIST-certified security engine for encrypting all links connecting a data center to adjacent data centers on campus.

Alphawave CEO Tony Pialis stated, “From IP to custom silicon to standard products, Alphawave can meet the diverse needs of hyperscale customers (such as North American hyperscalers).” This transformation strategy has earned Alphawave collaboration opportunities with leading hyperscale customers in North America, demonstrating its ‘closed-loop leap’ from IP technology to silicon system capabilities.

Retym: A Rising Star in Coherent DSP

Retym, pronounced “Re-Time,” was founded in 2021 and has recently emerged rapidly with $180 million in multiple rounds of financing. Retym specializes in providing programmable coherent digital signal processor (DSP) solutions for cloud and AI infrastructure.

Its first coherent DSP chip, designed using TSMC’s 5nm process, will be intended for data transmission over distances ranging from 10 kilometers to 120 kilometers, but optimized for ranges of 30 kilometers to 40 kilometers, focusing on the data center interconnect market. Reports indicate that its chip is currently in the testing and validation phase.

Retym’s founders, Sachin Gandhi and Roni El-Bahar, have extensive industry experience, and their vision is to break the monopoly of traditional vendors through an open ecosystem. They mentioned in an article that some DSP suppliers even compete directly with their own customers, causing friction and stifling innovation.

Retym co-founder and CTO Roni El-Bahar stated, “In the past, coherent optics were used for ultra-long distances. Now, we want to bring it into campuses and make it affordable.” Notably, Dr. Roni El-Bahar previously served as the CTO of Huawei’s Israel Research Center.

Retym’s innovation lies in its mixed-signal design, combining high-performance DAC/ADC with intelligent DSP algorithms, significantly reducing power consumption and costs. El-Bahar pointed out that as coherent optics penetrate from long distances to short distances, Retym’s solutions will fill market gaps, especially in AI infrastructure.

Several Trends and Observations

In the AI-driven computing architecture, “whoever controls the connectivity controls the performance ceiling of the system.” Traditionally, attention has been focused on computing chips like GPUs and NPUs, but in reality, connectivity bottlenecks have become the core limiting factor of AI systems. The importance of DSP will become increasingly prominent. The development of DSP and market demand also suggest the following trends:

Technological Route Differentiation: The optical communication DSP market is at a crossroads of technology and application. Whether it is the short-range dominance of PAM4 or the mid-range rise of coherent-lite, both are inevitable products of market demand.

Energy Consumption Optimization as a Key Threshold: As DSP chips operate around the clock, high-speed SerDes integration, and high-order modulation support become standard, the balance point between power consumption and performance depends on the advancement of process nodes: 3nm DSPs (such as Marvell Ara, Broadcom Sian3, Alphawave series) have demonstrated significant power advantages in 800G/1.6T modules; SerDes supporting 200G/channel requires extreme high-speed analog design and process support; the leading process nodes not only affect single-chip performance but also manifest as a multiplicative effect on TCO differences after large-scale deployment.

Platformization Trend: Future DSP products will certainly be integrated platforms of “high-speed SerDes + DSP logic + some security module + status diagnostics + AI-assisted algorithms,” while traditional analog discrete solutions will gradually become marginalized.

Ecological Competition: Traditional players (such as Marvell and Broadcom) often create complex relationships of “both cooperation and competition” with customers due to their strong product coverage capabilities, spanning switching chips, optical modules, and DSP products. New players (Retym/Alphawave) emphasize “open cooperation” and “not competing with customers,” making this strategy more appealing to hyperscalers.

Profit Structure Restructuring: Which is more profitable, chip manufacturers or module manufacturers? From an industrial value perspective, optical module manufacturers are facing profit squeeze and homogenization risks, while high-end DSP chips remain a profit stronghold.

The Next Variable? The Chinese market may achieve breakthroughs in low-power DSP through self-research. As AI infrastructure rapidly expands domestically, companies with capabilities in analog signal and SerDes R&D may enter this strategic high ground, breaking the existing technological monopoly of overseas manufacturers.

The war over optical communication DSP is essentially a war over the infrastructure of computing interconnects. Regardless, the overall situation of DSP remains undecided.

END

*Disclaimer: This article is an original work by the author. The content reflects the author’s personal views, and the reprint by Luko Verification is solely to convey a different perspective, not representing Luko Verification’s endorsement or support of this viewpoint. If there are any objections, please feel free to contact Luko Verification.