The global MCU market is dominated by five manufacturers: Infineon, NXP, Renesas Electronics, STMicroelectronics, and Microchip Technology, with Infineon and Renesas Electronics performing particularly well in 2024. NXP maintains a leading position in automotive electronics and security chips, while Microchip holds a significant position in the 8-bit microcontroller market. The company’s product line covers a wide range, from 8-bit to 64-bit MCUs, meeting the needs of various application scenarios. With the development of smart driving, the Internet of Things (IoT), and industrial automation, the MCU market will continue to grow, with foreign manufacturers dominating this field.

NXP Semiconductors

- Main ProductsNXP focuses on automotive electronics, security chips, IoT solutions, and ARM architecture-based MCUs. Its product line includes Cortex-M series MCUs, security chips, RFID chips, smart card solutions, and more.

- Market PositioningNXP has a significant advantage in automotive electronics and security chips, especially in the in-vehicle MCU market. Its products are widely used in intelligent transportation, payment systems, industrial control, and other fields.

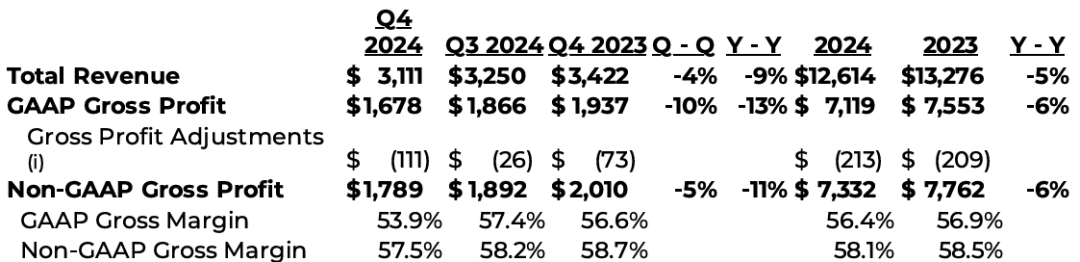

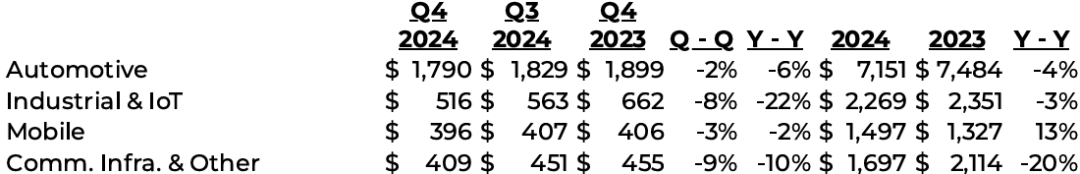

- NXP’s total revenue for 2024 was $12.614 billion, a decrease of 5% from $13.276 billion in 2023. This decline was mainly influenced by weakness in end markets such as automotive, industrial IoT, and communication infrastructure. The annual operating profit was $3.417 billion, down 7% from $3.661 billion in 2023. The decline in operating profit was attributed to increased restructuring costs and a slight rise in the proportion of selling, general, and administrative expenses relative to revenue.

- Product InnovationNXP launched several innovative products in 2024, including the S32J series high-performance automotive Ethernet switches and network controllers, the Trimension® NCJ29Dx ultra-wideband product series, and the i.MX 94 series application processors.

- Acquisition ActivitiesNXP announced the acquisition of Aviva Links and TT Tech Auto to expand its in-vehicle network product portfolio and accelerate the development of the CoreRide platform.

- Collaboration and StrategyNXP is collaborating with ZF Friedrichshafen AG to develop next-generation SiC-based traction inverter solutions and with Honeywell International Semiconductor Corp. to optimize energy awareness and security control in commercial buildings.

Renesas Electronics

- Main ProductsRenesas’ product line covers 8-bit, 16-bit, and 32-bit MCUs, including RX series, RL78 series, and RZ series MPUs. Its products are widely used in automotive electronics, industrial control, smart appliances, IoT, and more. In 2024, Renesas further expanded its partner network to support more off-the-shelf component solutions.

- Market PositioningRenesas holds about 30% of the MCU market share, making it one of the largest MCU suppliers globally. Its products are known for high performance, low power consumption, and high integration, especially in automotive electronics and industrial control.

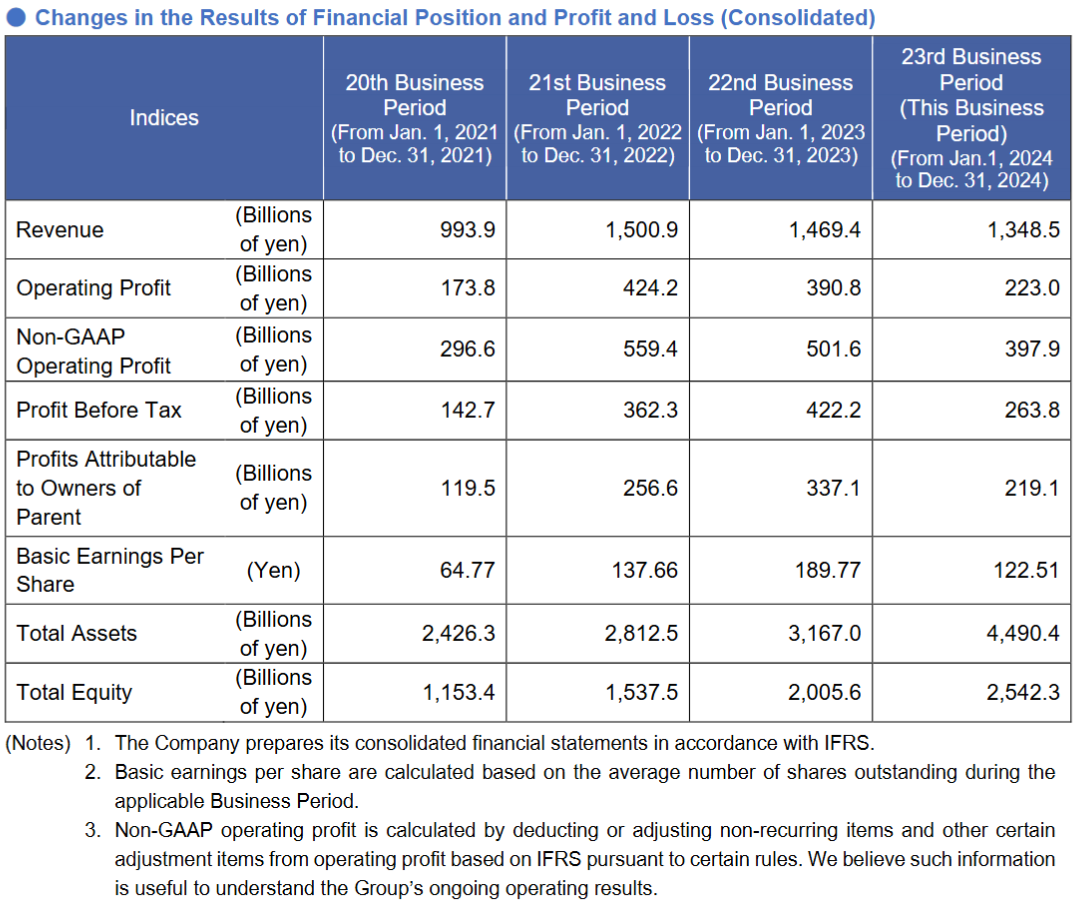

- In the fiscal year 2024, Renesas’ total revenue was 134.85 billion yen, a decrease of 8.2% from the previous year. This decline was mainly due to weak demand in industrial, infrastructure, and IoT businesses.

- Gross profit for the year was 74.98 billion yen, down about 0.3 percentage points from the previous year. This was mainly due to revenue decline, reduced factory utilization, and adverse changes in product mix. Operating profit for the year was 22.30 billion yen, down 16.78 billion yen from the previous year. Nevertheless, the company maintained a good profit level.

- Automotive BusinessDespite challenges, the automotive business achieved growth in the fiscal year 2024. This was mainly due to the depreciation of the yen and the expansion of channel inventory. Additionally, Renesas launched the first device in the fifth generation R-Car series and the high-performance automotive SoC R-Car X5H with advanced 3nm process technology, as well as the MPU RZ/V2H with integrated AI accelerators.

- Industrial, Infrastructure, and IoT BusinessThese business segments performed weakly, mainly affected by soft demand and inventory adjustments. For example, the gross margin and operating profit margin of the industrial, infrastructure, and IoT business declined in the second quarter.

Microchip Technology

- Main ProductsMicrochip primarily focuses on 8-bit and 32-bit MCUs, with product lines including PIC series, PIC32 series, and ARM architecture-based Kinetis series. Additionally, Microchip provides development tools (such as MPLAB integrated development environment) and peripheral devices.

- Market PositioningMicrochip leads the 8-bit microcontroller market, with its products widely used in consumer electronics, industrial control, IoT devices, and more. Microchip’s strategy is to attract small and medium-sized customers through high cost-performance and broad compatibility.

Infineon

- In 2024, Infineon continued to expand its market share in automotive electronics and industrial control, particularly increasing investment in smart driving and vehicle-to-everything (V2X) technology.

NXP Semiconductors

The Current Status and Product Layout of NXP’s Automotive Business

NXP has a comprehensive and highly competitive product portfolio in the automotive sector.

● In automotive processors, its S32 series processors offer outstanding performance, with the S32N serving as a solution for vehicle computers, utilizing a 5nm process, featuring secure real-time processing, hardware isolation and virtualization technology, as well as AI/ML acceleration capabilities.

It enables cross-domain super integration, meeting the complex architecture requirements of software-defined vehicles (SDV), providing strong computational support for core vehicle functions such as propulsion and power, body and comfort, and vehicle management.

● In the automotive networking field, NXP is a leader in in-vehicle networking, ensuring efficient and stable data transmission between various electronic control units (ECUs) in vehicles, meeting the stringent requirements of evolving automotive electronic and electrical architectures, and supporting the transition from traditional architectures to domain-centralized and regional architectures.

● Automotive radar systems are also a core advantage of NXP, providing various types of radar solutions from edge radar to imaging radar, featuring a unique scalable architecture.

By integrating advanced sensor technologies and signal processing algorithms, it can accurately detect the surrounding environment of the vehicle, providing critical perception data for advanced driver assistance systems (ADAS) and autonomous driving functions, enhancing driving safety and comfort, and achieving high recognition and market share.

● NXP’s product portfolio in the automotive sector covers multiple key technology areas:

◎ S32 series processors: including the latest S32N series, providing strong computing and security support for SDV. They integrate hardware isolation technology, virtualization capabilities, and AI/ML accelerators, making them an ideal choice for the future vehicle computing core.

◎ In-vehicle radar solutions: offering a multi-layer platform from edge radar to imaging radar, with a single vehicle value of $60 to $90, demonstrating the high growth potential in this field.

◎ Battery management systems (BMS): providing highly optimized battery monitoring and management solutions for electric vehicles through analog front-end and integrated power management chips, with single vehicle material costs ranging from $70 to $100.

◎ In-vehicle networking and security: NXP maintains a leading position in in-vehicle Ethernet, CAN/LIN protocols, and security chips, laying a solid foundation for the networking and security functions of software-defined vehicles.

Market Position

According to data from 2024, NXP is a market leader in several fields:

◎ Automotive processors: first in market share,

◎ In-vehicle radar: leading global market share,

◎ Secure vehicle networking: a top supplier including vehicle key and access systems.

Outlook and Detailed Analysis of NXP’s Automotive Business

NXP continues to deepen its R&D in automotive technology.

● In the autonomous driving field, it continuously optimizes its radar and processor technologies to enhance target detection accuracy and processing speed.

● In terms of processors, it is developing heterogeneous multi-core architectures tailored to the computing needs of autonomous driving, integrating more AI processing units to improve the operational efficiency of autonomous driving algorithms, reduce latency, and enable vehicles to make faster and more accurate decisions.

● In collaboration with automotive manufacturers,NXP has established close strategic partnerships.

◎ In collaboration with Hyundai, it provides core chip technology to support Hyundai’s transition to software-defined vehicles, helping Hyundai enhance vehicle intelligence and user experience, thus winning the 2022 Global Supplier Award from Hyundai, reflecting NXP’s important position and technical recognition in the automotive manufacturer’s supply chain.

◎ In collaboration with LEAPMOTOR, NXP’s S32 automotive processing technology assists LEAPMOTOR’s clover architecture in achieving centralized vehicle functions and optimizing wiring length, improving the overall integration and performance of the vehicle, while also providing practical application scenarios and market validation opportunities for NXP’s products, promoting collaborative development in technology R&D and market promotion.

NXP simplifies the entire vehicle computing system integration process from development to production through its CoreRide platform.

● This platform provides highly optimized hardware and software solutions through a modular and scalable architecture:

◎ Centralized computing architecture: supports collaboration between core computing nodes and regional controllers, achieving comprehensive integration of vehicle functions.

◎ Open middleware: combines hypervisor, operating systems, and NXP’s unique functional safety software to accelerate customer development cycles.

NXP has established extensive collaborations with major automotive companies (such as Hyundai, Ford) and suppliers (such as Foxconn).

◎ Through joint laboratories and technology platforms, it promotes the rapid development of electrified and intelligent vehicles,

◎ Through joint ventures with TSMC and Vanguard, NXP ensures stable production capacity for future key semiconductor nodes (such as 5nm and 40nm).

● In electrification, NXP’s products cover battery management, inverters, and charging systems, particularly being highly competitive in the 800V high-voltage platform.

● In the autonomous driving field,NXP’s radar platform and ADAS solutions are driving the increase in penetration rates of L2 to L3 driving functions, with expectations that by 2030, the penetration rate of ADAS systems will exceed 60%.