This article is compiled by Semiconductor Industry Insight (ID: CVIEWS)Unisoc continues to expand its market share in the mid-to-low-end segment.

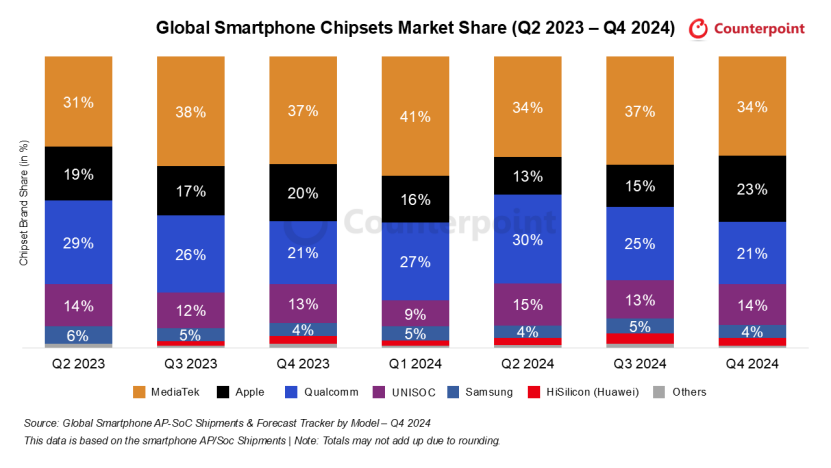

This article is compiled by Semiconductor Industry Insight (ID: CVIEWS)Unisoc continues to expand its market share in the mid-to-low-end segment. According to the latest market share ranking of global smartphone application processors (AP-SoC) for Q4 2024 released by Counterpoint Research, MediaTek (34%), Apple (23%), Qualcomm (21%), Unisoc (14%), Samsung (4%), and Huawei HiSilicon (3%) occupy the top six positions.

According to the latest market share ranking of global smartphone application processors (AP-SoC) for Q4 2024 released by Counterpoint Research, MediaTek (34%), Apple (23%), Qualcomm (21%), Unisoc (14%), Samsung (4%), and Huawei HiSilicon (3%) occupy the top six positions.

Counterpoint points out that MediaTek experienced overall shipment growth in Q4 2024. The shipment of LTE chips remained stable, while the shipment of 5G chips increased. Driven by the launch of the Dimensity 9400, high-end chip shipments are expected to grow. Additionally, MediaTek introduced four new chips in the mid-range market—Dimensity 8400, Dimensity 8350, Helio G50, and Helio G92.However, in terms of shipment market share, MediaTek’s share decreased from 37% in the previous quarter to 34%.

The second-ranked Apple benefited from the large shipment of new iPhone models in Q4 2024, driving a rapid increase in shipments of Apple A-series processors, with its market share rising from 15% in Q3 to 23%.

Qualcomm’s chip shipments in Q4 2024 saw a slight decline compared to the previous quarter, but growth in the high-end market drove revenue growth.

Counterpoint states that due to the adoption of Unisoc LTE chips by several leading manufacturers, the company’s shipments increased in Q4 2024. With the support of its LTE product portfolio, Unisoc continues to expand its share in the low-end market (under $99). This has also led to an increase in its overall shipment share from 13% in the previous quarter and the same period last year to 14%, ranking fourth.

Samsung maintained stable Exynos shipments in Q4 2024. With the launch of the Samsung Galaxy S24 FE, Exynos 2400 shipments increased. Additionally, due to high shipments of the Samsung Galaxy A55 and A16 5G, shipments of Exynos 1480 and Exynos 1330 also increased.

Huawei HiSilicon ranked sixth with a share of 3%. Despite Huawei launching the Mate 70 series flagship phone on November 26, 2024, the actual sales time in Q4 2024 was only a little over a month, leading to a 1 percentage point decrease in shipment share. The release of the Mate 70 series marks Huawei’s strong return to the smartphone market, with the technical strength of Kirin chips and Huawei’s deep accumulation in the communications field still providing strong support for HiSilicon in market competition. As Huawei’s smartphone business gradually recovers and develops, HiSilicon’s market share is expected to further increase.

Recently, Huawei quietly released its 2024 annual report on its official website, achieving global sales revenue of 862.1 billion RMB, with a net profit of 62.6 billion RMB. In 2024, R&D investment reached 179.7 billion RMB, accounting for approximately 20.8% of total annual revenue, with cumulative R&D expenses exceeding 1.249 trillion RMB over the past decade.

Specifically, in 2024, Huawei’s ICT infrastructure business, terminal business, cloud computing business, digital energy business, smart automotive solutions business, and other businesses achieved revenues of 369.9 billion RMB, 339 billion RMB, 38.5 billion RMB, 68.7 billion RMB, 26.4 billion RMB, and 19.6 billion RMB, respectively, with year-on-year growth of 4.9%, 38.3%, 8.5%, 24.4%, 474.4%, and 79%, resulting in a total revenue growth of 22.4%. It can be seen that all five major business segments achieved year-on-year growth. Among them, the automotive business revenue grew 4.7 times and achieved profitability in its first year, while terminal business revenue approached the ICT baseline.

Unisoc: Continuing to Expand Market Share in the Mid-to-Low-End Segment

Unisoc: Continuing to Expand Market Share in the Mid-to-Low-End Segment

Unisoc leverages the differentiated advantages of its 4G LTE chips, gaining adoption from several major smartphone manufacturers, continuously expanding its share in the mid-to-low-end market and driving shipment growth.

SC9832E features the highest level of global integration, supporting512MB of memory, smoothly running the Android Go system, and combined with 28nm HPC+ technology, reduces standby power consumption by 50%, enhancing heavy usage battery life by 40%, making it particularly suitable for the cost-performance demands of emerging markets.

SC9863A is Unisoc’s first 4G SoC platform supporting artificial intelligence applications, utilizing an 8-core 1.6 GHz Arm Cortex-A55 processor architecture, improving performance by 20% and AI processing capability by 6 times, enhancing the intelligent experience of mobile terminals.

T60 adopts a 12nm process and DynamIQ architecture, balancing performance and power consumption through a combination of two A75 big cores and six A55 small cores, meeting daily multitasking needs.

Others T7280, T7255, T7250, T7255, T7200 also utilize a big.LITTLE core combination and are manufactured using a 12nm process, suitable for high-performance scenarios in the mid-to-low-end market.

The Nokia C2 series uses the SC9832E chip, which adapts to entry-level market demands with high integration and low power consumption characteristics.

Nubia V70 Max is equipped with Unisoc’s T606 processor, manufactured using a 12nm process, featuring two Arm Cortex-A75 CPUs with a frequency of 1.6GHz and six Arm Cortex-A55 processors, achieving a balance between performance and energy consumption.

vivo Y19e debuted in overseas markets, using Unisoc’s T7225 processor, equipped with 4GB RAM + 64GB storage specifications, priced at only 7999 Indian Rupees (approximately 671 RMB).

ZTE Axon 60 and Axon 60 Lite entry-level models are powered by Unisoc’s T616 processor, showcasing exceptional cost-performance, driving brand sales growth in Southeast Asia and Latin America.

*Disclaimer: This article is the original author’s creation. The content reflects their personal views, and our reposting is solely for sharing and discussion, not representing our endorsement or agreement. If there are any objections, please contact us.