Last night, U.S. stocks plummeted, leading to a triple whammy for stocks, currencies, and bonds.The crisis involving the U.S. dollar and bonds is actually unrelated to the A-shares.However, it is necessary to mention that:If there are any insiders on the other side, they should be aware that the pitfalls of U.S. bonds are currently significant, a mess left by the previous administration. The 90-day tariff suspension by the current administration is partly due to the U.S. bond yield. Once the yield rises, the federal government has to pay back a lot more money, and most importantly, it could trigger a U.S. bond crisis, leading to widespread sell-offs and shaking the dollar’s status.On April 9, the yield on U.S. bonds briefly rose to nearly 5%Under pressure, the current administration announced a 90-day tariff suspensionand the yield came down(as shown in the figure below) However, last night it was clearly still unable to be suppressed, and the yield rose again.The simultaneous decline of the dollar, U.S. bonds, and stocks is a rare occurrence.The core issue lies with U.S. bonds.This is the biggest soft spot for the other side.The market’s risk aversion is primarily focused on the G-tax, and the core of selling U.S. bonds is also related to the G-tax.Under pressure, the current administration today released a mild signaland has actively proposed to negotiate.

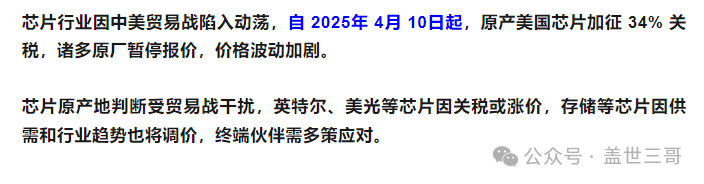

However, last night it was clearly still unable to be suppressed, and the yield rose again.The simultaneous decline of the dollar, U.S. bonds, and stocks is a rare occurrence.The core issue lies with U.S. bonds.This is the biggest soft spot for the other side.The market’s risk aversion is primarily focused on the G-tax, and the core of selling U.S. bonds is also related to the G-tax.Under pressure, the current administration today released a mild signaland has actively proposed to negotiate. Here, should we choose to believe the current administration?Of course not, those who are forced are never worth trusting.Because once they are no longer forced, they will immediately revert to their original state.From today’s performance of A-shares, it can be seen that they were not significantly affected by last night’s decline in U.S. stocks, which itself reflects an attitude of being primarily “internal”.Today, the strongest market segment is still semiconductor chips.The news should have been seen, regarding countermeasures against U.S. semiconductor chips.This is considered a relatively precise and targeted countermeasure.

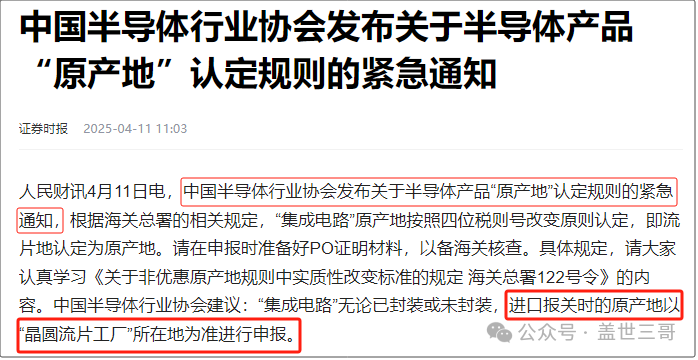

Here, should we choose to believe the current administration?Of course not, those who are forced are never worth trusting.Because once they are no longer forced, they will immediately revert to their original state.From today’s performance of A-shares, it can be seen that they were not significantly affected by last night’s decline in U.S. stocks, which itself reflects an attitude of being primarily “internal”.Today, the strongest market segment is still semiconductor chips.The news should have been seen, regarding countermeasures against U.S. semiconductor chips.This is considered a relatively precise and targeted countermeasure. The core point is to confirm the origin of the wafers through wafer fabrication.What does wafer fabrication mean?It is the step where the chip design is completed and the data is sent to the wafer foundry for actual manufacturing, in other words, it is “trial production”. If trial production goes well, then mass production can occur, which may be outsourced.The above-mentioned ZC confirms the origin based on wafer fabrication, aiming to avoid tariffs by outsourcing production, for example, U.S. chip manufacturers outsourcing overseas, where the export customs declaration does not reflect the original manufacturing location, thus avoiding tariff issues. It was reported yesterday that chip manufacturers have stopped quoting.

The core point is to confirm the origin of the wafers through wafer fabrication.What does wafer fabrication mean?It is the step where the chip design is completed and the data is sent to the wafer foundry for actual manufacturing, in other words, it is “trial production”. If trial production goes well, then mass production can occur, which may be outsourced.The above-mentioned ZC confirms the origin based on wafer fabrication, aiming to avoid tariffs by outsourcing production, for example, U.S. chip manufacturers outsourcing overseas, where the export customs declaration does not reflect the original manufacturing location, thus avoiding tariff issues. It was reported yesterday that chip manufacturers have stopped quoting. The news came out todayThe countermeasure effect is still very obvious, and today semiconductors surged.This is considered a very effective countermeasure.

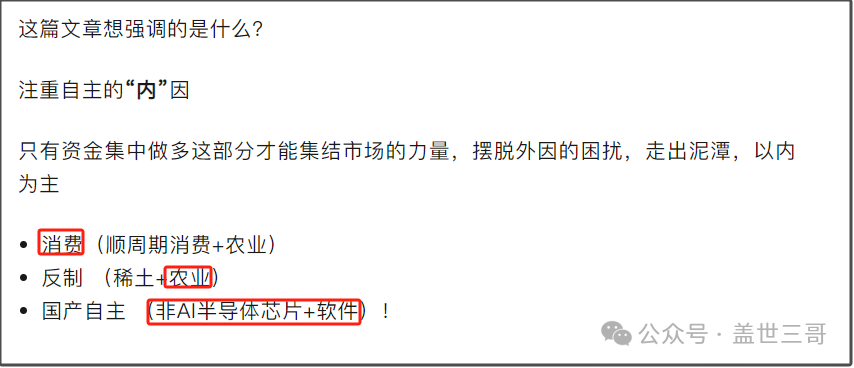

The news came out todayThe countermeasure effect is still very obvious, and today semiconductors surged.This is considered a very effective countermeasure. As mentioned in previous articles, looking at the direction of autonomy, chips are worth watching, but they must be non-AI directions. The strongest segments that rose today are mostly unrelated to AI and are focused on autonomy.In the article from April 8, I listed the sub-segments:

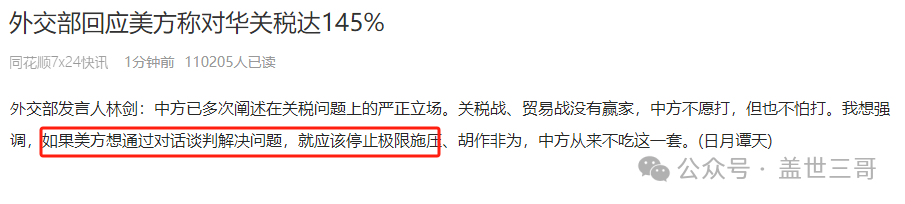

As mentioned in previous articles, looking at the direction of autonomy, chips are worth watching, but they must be non-AI directions. The strongest segments that rose today are mostly unrelated to AI and are focused on autonomy.In the article from April 8, I listed the sub-segments: Currently, the sectors that have realized gains include cyclical consumption and agriculture,and today it has reached semiconductor chips.The article from Wednesday, along with this chart, is gaining more and more value.You may wonder if semiconductors can sustain this growth?The core lies in the Sci-Tech Innovation Board, where most advanced semiconductor manufacturing companies are listed with 688 as the prefix.Whether speculating on trends or countermeasures, it depends on whether core technologies continue to rise!Various news will definitely emerge over the weekend.The current administration’s stance cannot be described as weakness; it is more of a forced situation.We have also clearly stated that if negotiations are to be held, it is not impossible, but the premise is to show sincerity, first acknowledge the passive environment, and then negotiate, rather than engaging in petty actions while being arrogant. This kind of behavior will definitely not be accepted.

Currently, the sectors that have realized gains include cyclical consumption and agriculture,and today it has reached semiconductor chips.The article from Wednesday, along with this chart, is gaining more and more value.You may wonder if semiconductors can sustain this growth?The core lies in the Sci-Tech Innovation Board, where most advanced semiconductor manufacturing companies are listed with 688 as the prefix.Whether speculating on trends or countermeasures, it depends on whether core technologies continue to rise!Various news will definitely emerge over the weekend.The current administration’s stance cannot be described as weakness; it is more of a forced situation.We have also clearly stated that if negotiations are to be held, it is not impossible, but the premise is to show sincerity, first acknowledge the passive environment, and then negotiate, rather than engaging in petty actions while being arrogant. This kind of behavior will definitely not be accepted. We are optimistic that the market will gradually detach from external factors and enter a desensitization phase, while focusing on internal factors to perform well.Consumption, the Belt and Road Initiative, ASEAN + EU (or there may still be variables), and the still unappreciated countermeasures still have opportunities (those that have already risen should not be considered, such as agriculture).In the current market, both internal and external factors must be understood and integrated. External factors indicate risks, while internal factors indicate opportunities. Missing either will lead to blind spots in market observation.As long as any one aspect is not tracked properlyin the recent market trends, it will feel chaotic.It is particularly difficult to operate,and opportunities often arise in crises (this time is a typical example).If you do not track or think, you may avoid risks, but at the same time, you will miss opportunities.Everyone should ponder this.That’s about it, have a great weekend everyone!

We are optimistic that the market will gradually detach from external factors and enter a desensitization phase, while focusing on internal factors to perform well.Consumption, the Belt and Road Initiative, ASEAN + EU (or there may still be variables), and the still unappreciated countermeasures still have opportunities (those that have already risen should not be considered, such as agriculture).In the current market, both internal and external factors must be understood and integrated. External factors indicate risks, while internal factors indicate opportunities. Missing either will lead to blind spots in market observation.As long as any one aspect is not tracked properlyin the recent market trends, it will feel chaotic.It is particularly difficult to operate,and opportunities often arise in crises (this time is a typical example).If you do not track or think, you may avoid risks, but at the same time, you will miss opportunities.Everyone should ponder this.That’s about it, have a great weekend everyone!